Reports

Reports

Analysts’ Viewpoint

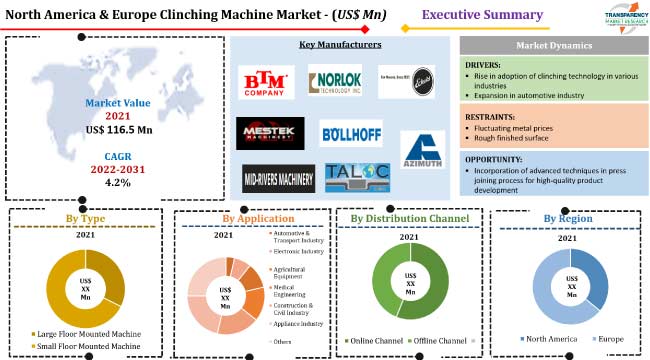

Rise in adoption of clinching technology in various industries is driving the North America & Europe clinching machine market size. Clinching machines are used to join metalwork pieces by deforming two metal substrates. Portable clinching machines are gaining traction, as they can clinch three layers and offer fast operation with lateral sliding. Furthermore, they can be easily transported.

Increase in usage of metal clinchers in the automotive sector is expected to augment market statistics during the forecast period. Prominent companies in the clinching machine industry are investing significantly in R&D activities to facilitate the assembly of large-scale sheet metal parts and multi-material combination sheets.

Clinching is a process of assembling metal sheets without welding or fasteners. Clinching machine is an interlocking of two or more metal layers. Clinching can be employed to join painted or coated metal sheets without damaging the surface. Large floor mounted machines and small floor mounted machines are the two types of clinching machines available in the market in North America and Europe. Small floor mounted machines are compact, cost-effective, and offer high mobility.

Dyes and punches are various tools used in clinching. The intensity of pressure coupled with the shape of the clinching tool helps determine the mechanical interlock of materials. Clinching does not require electricity or cooling of electrodes, which is commonly associated with spot welding. Clinching machines can be used to join different materials including metals, polymers, wood, and composite materials.

Rise in Adoption of Clinching Technology in Various Industries Augmenting North America & Europe Clinching Machine Market Progress

Clinching is a better method than welding. It does not require electricity or electrode cooling, akin to welding. The method can be used on a wide range of materials. No smoke or sparks are produced, which highlights safety. Joints are not affected by changes in environmental factors. Riveted interlocks have a higher fatigue life than other systems such as welding and bonding. Clinching is an instant and time-saving process.

Clinching is energy efficient and requires no additional components to perform the process. It offers high margins due to little or no material waste, low initial cost of clinching machines, and quick payback. Thus, the technology plays a vital role in the development of machinery in various industries. This is expected to boost North America & Europe clinching machine market development during the forecast period.

Clinching is practiced in the automotive industry by OEMs and component suppliers. It is widely used to bond metal sheet parts where high strength of a joint is not required. It is employed to join thin-walled structures in the production of motor vehicles.

Automotive manufacturers are focusing on minimizing fuel consumption of vehicles. In line with this objective, manufacturers use new vehicle body shapes and materials to fabricate vehicle bodies. Thus, increase in adoption of novel materials in the automotive sector is likely to augment the North America & Europe clinching machine market value in the near future.

Clinching is less expensive than other classic material bonding methods (fusion welding, pressure welding, and classic riveting). It costs 35% to 65% lower than spot welding. The usage of sheet metal clinching machines in vehicle assembly helps save time and eliminate the additional costs related to the preparation of parts for joining.

According to the latest North America & Europe clinching machine market trends, the automotive & transport application segment is expected to dominate the market during the forecast period. Companies are engaged in continuous R&D activities with respect to clinching, its tools, and the machines involved in the process.

Clinching machine manufacturers need to focus on incorporating advanced techniques in the press joining process for high-quality product development. Technological advancements in “C-frame” clinching equipment help in combining several parts in a single operation with a low degree of complication of product shapes.

Stationary presses are provided with additional jigs or multipurpose adapters and tools. They are used to form clinched joints. Parts with more complicated shapes are joined together on specialized presses.

Rise in usage of clinching technology in the automotive sector is anticipated to drive the automotive & transport segment in the North America & Europe clinching machine market during the forecast period. Major automobile manufacturers, such as Audi, Volkswagen (Polo – VW 240), Skoda (Roomster – SK 258), Mercedes Benz (C-class), Toyota (Lexus), and Shanghai GM (Cadillac CTS), are adopting the clinching technology.

Clinched joints are increasingly employed in modern vehicle construction, especially in components of less critical importance. These joints are also often applied to vehicle body parts that are important for passive safety. Surge in usage of advanced clinching techniques in the automotive industry is expected to offer lucrative opportunities for market expansion in the next few years.

Based on distribution channel, the offline channel segment is anticipated to account for the largest share of the North America & Europe clinching machine market during the forecast period. Growth of the segment can be ascribed to instant access to products and purchasing convenience in offline channels. Offline platforms allow customers to check the quality of products on the spot.

According to the latest North America & Europe clinching machine market forecast, Europe is expected to dominate the industry during 2022 to 2031. This can be ascribed to the expansion in automotive and construction industries in the region. Germany is a leading producer of automobiles in Europe. The country also has the largest concentration of OEM plants in the region. Thus, rise in production of automobiles in Germany is fueling market progress in Europe.

Most of the companies are investing significantly in comprehensive R&D activities, primarily to introduce innovative products. They are also adopting collaboration, partnership, and M&A strategies to expand their North America & Europe clinching machine market share. Manufacturers are introducing new technologies such as C-frame and stationery press and portable clinching machines to broaden their revenue streams.

Azimuth Machinery Ltd., Böllhoff Group, BTM Company, LLC., ECKOLD AG, Jurado Srls, LDP ITALIA S.r.l., Mestek Machinery, Mid-Rivers Machinery, Norlok Technology Inc., and Taloc USA are key entities operating in the market.

Detailed profiles of manufacturers are provided in the North America & Europe clinching machine market report to evaluate their financials, key product offerings, recent developments, and strategies.

|

Attribute |

Detail |

|

Market Value of Clinching machine in 2021 |

US$ 116.5 Mn |

|

Market Forecast Value in 2031 |

US$ 174.1 Mn |

|

Growth Rate (CAGR) |

4.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross-segment analysis at regional as well as country levels. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 116.5 Mn in 2021.

It is expected to reach US$ 174.1 Mn by 2031.

Rise in adoption of clinching technology in various industries and expansion in automotive industry.

The automotive & transport industry segment accounted for the largest share in 2021.

It dominated the consolidated industry in 2021.

Azimuth Machinery Ltd., Böllhoff Group, BTM Company, LLC., ECKOLD AG, Jurado Srls, LDP ITALIA S.r.l., Mestek Machinery, Mid-Rivers Machinery, Norlok Technology Inc., and Taloc USA.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Industry SWOT Analysis

5.6. Value Chain Analysis

5.7. COVID-19 Impact Analysis

5.8. Technological Overview

5.9. North America & Europe Clinching Machine Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projection (US$ Mn)

5.9.2. Market Volume Projection (Thousand Units)

6. North America & Europe Clinching Machine Market Analysis and Forecast, By Type

6.1. Clinching Machine Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

6.1.1. Large Floor Mounted Machine

6.1.2. Small Floor Mounted Machine

6.2. Incremental Opportunity, By Type

7. North America & Europe Clinching Machine Market Analysis and Forecast, By Application

7.1. Clinching Machine Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

7.1.1. Automotive & Transport Industry

7.1.2. Electronic Industry

7.1.3. Agricultural Equipment

7.1.4. Medical Engineering

7.1.5. Construction & Civil Industry

7.1.6. Appliance Industry

7.1.7. Others

7.2. Incremental Opportunity, By Application

8. North America & Europe Clinching Machine Market Analysis and Forecast, By Distribution Channel

8.1. Clinching Machine Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

8.1.1. Online Channel

8.1.2. Offline Channel

8.2. Incremental Opportunity, By Distribution Channel

9. North America & Europe Clinching Machine Market Analysis and Forecast, By Region

9.1. Clinching Machine Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

9.1.1. North America

9.1.2. Europe

9.2. Incremental Opportunity, By Region

10. North America Clinching Machine Market Analysis and Forecast

10.1. Region Snapshot

10.2. Price Trend Analysis

10.2.1. Weighted Average Price

10.3. Key Trends Analysis

10.3.1. Demand Side Analysis

10.3.2. Supply Side Analysis

10.4. Clinching Machine Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

10.4.1. Large Floor Mounted Machine

10.4.2. Small Floor Mounted Machine

10.5. Clinching Machine Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

10.5.1. Automotive & Transport Industry

10.5.2. Electronic Industry

10.5.3. Agricultural Equipment

10.5.4. Medical Engineering

10.5.5. Construction & Civil Industry

10.5.6. Appliance Industry

10.5.7. Others

10.6. Clinching Machine Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

10.6.1. Online Channel

10.6.2. Offline Channel

10.7. Clinching Machine Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

10.7.1. U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Incremental Opportunity Analysis

11. Europe Clinching Machine Market Analysis and Forecast

11.1. Region Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Price

11.3. Key Trends Analysis

11.3.1. Demand Side Analysis

11.3.2. Supply Side Analysis

11.4. Clinching Machine Market Size (US$ Mn and Thousand Units), By Type, 2017 - 2031

11.4.1. Large Floor Mounted Machine

11.4.2. Small Floor Mounted Machine

11.5. Clinching Machine Market Size (US$ Mn and Thousand Units), By Application, 2017 - 2031

11.5.1. Automotive & Transport Industry

11.5.2. Electronic Industry

11.5.3. Agricultural Equipment

11.5.4. Medical Engineering

11.5.5. Construction & Civil Industry

11.5.6. Appliance Industry

11.5.7. Others

11.6. Clinching Machine Market Size (US$ Mn and Thousand Units), By Distribution Channel, 2017 - 2031

11.6.1. Online Channel

11.6.2. Offline Channel

11.7. Clinching Machine Market Size (US$ Mn and Thousand Units), By Region, 2017 - 2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Incremental Opportunity Analysis

12. Competition Landscape

12.1. Market Player – Competition Dashboard

12.2. Market Share Analysis % (2021)

12.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

12.3.1. Azimuth Machinery Ltd.

12.3.1.1. Company Overview

12.3.1.2. Sales Area/Geographical Presence

12.3.1.3. Revenue

12.3.1.4. Strategy & Business Overview

12.3.1.5. Go-To-Market Strategy

12.3.2. Böllhoff Group

12.3.2.1. Company Overview

12.3.2.2. Sales Area/Geographical Presence

12.3.2.3. Revenue

12.3.2.4. Strategy & Business Overview

12.3.2.5. Go-To-Market Strategy

12.3.3. BTM Company, LLC.

12.3.3.1. Company Overview

12.3.3.2. Sales Area/Geographical Presence

12.3.3.3. Revenue

12.3.3.4. Strategy & Business Overview

12.3.3.5. Go-To-Market Strategy

12.3.4. ECKOLD AG

12.3.4.1. Company Overview

12.3.4.2. Sales Area/Geographical Presence

12.3.4.3. Revenue

12.3.4.4. Strategy & Business Overview

12.3.4.5. Go-To-Market Strategy

12.3.5. Jurado Srls

12.3.5.1. Company Overview

12.3.5.2. Sales Area/Geographical Presence

12.3.5.3. Revenue

12.3.5.4. Strategy & Business Overview

12.3.5.5. Go-To-Market Strategy

12.3.6. LDP ITALIA S.r.l.

12.3.6.1. Company Overview

12.3.6.2. Sales Area/Geographical Presence

12.3.6.3. Revenue

12.3.6.4. Strategy & Business Overview

12.3.6.5. Go-To-Market Strategy

12.3.7. Mestek Machinery

12.3.7.1. Company Overview

12.3.7.2. Sales Area/Geographical Presence

12.3.7.3. Revenue

12.3.7.4. Strategy & Business Overview

12.3.7.5. Go-To-Market Strategy

12.3.8. Mid-Rivers Machinery

12.3.8.1. Company Overview

12.3.8.2. Sales Area/Geographical Presence

12.3.8.3. Revenue

12.3.8.4. Strategy & Business Overview

12.3.8.5. Go-To-Market Strategy

12.3.9. Norlok Technology Inc.

12.3.9.1. Company Overview

12.3.9.2. Sales Area/Geographical Presence

12.3.9.3. Revenue

12.3.9.4. Strategy & Business Overview

12.3.9.5. Go-To-Market Strategy

12.3.10.Taloc USA

12.3.10.1. Company Overview

12.3.10.2. Sales Area/Geographical Presence

12.3.10.3. Revenue

12.3.10.4. Strategy & Business Overview

12.3.10.5. Go-To-Market Strategy

13. Key Takeaways

13.1. Identification of Potential Market Spaces

13.1.1. Type

13.1.2. Application

13.1.3. Distribution Channel

13.1.4. Region

13.2. Preferred Sales & Marketing Strategy

13.3. Prevailing Market Risks

List of Tables

Table 1: North America & Europe Clinching Machine Market, By Type, Thousand Units, 2017-2031

Table 2: North America & Europe Clinching Machine Market, By Type, US$ Mn, 2017-2031

Table 3: North America & Europe Clinching Machine Market, By Application, Thousand Units, 2017-2031

Table 4: North America & Europe Clinching Machine Market, By Application, US$ Mn, 2017-2031

Table 5: North America & Europe Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Table 6: North America & Europe Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Table 7: North America & Europe Clinching Machine Market, By Region, Thousand Units, 2017-2031

Table 8: North America & Europe Clinching Machine Market, By Region, US$ Mn, 2017-2031

Table 9: North America Clinching Machine Market, By Type, Thousand Units, 2017-2031

Table 10: North America Clinching Machine Market, By Type, US$ Mn, 2017-2031

Table 11: North America Clinching Machine Market, By Application, Thousand Units, 2017-2031

Table 12: North America Clinching Machine Market, By Application, US$ Mn, 2017-2031

Table 13: North America Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Table 14: North America Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Table 15: North America Clinching Machine Market, By Country, Thousand Units, 2017-2031

Table 16: North America Clinching Machine Market, By Country, US$ Mn, 2017-2031

Table 17: Europe Clinching Machine Market, By Type, Thousand Units, 2017-2031

Table 18: Europe Clinching Machine Market, By Type, US$ Mn, 2017-2031

Table 19: Europe Clinching Machine Market, By Application, Thousand Units, 2017-2031

Table 20: Europe Clinching Machine Market, By Application, US$ Mn, 2017-2031

Table 21: Europe Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Table 22: Europe Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Table 23: Europe Clinching Machine Market, By Country, Thousand Units, 2017-2031

Table 24: Europe Clinching Machine Market, By Country, US$ Mn, 2017-2031

List of Figures

Figure 1: North America & Europe Clinching Machine Market, By Type, Thousand Units, 2017-2031

Figure 2: North America & Europe Clinching Machine Market, By Type, US$ Mn, 2017-2031

Figure 3: North America & Europe Clinching Machine Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 4: North America & Europe Clinching Machine Market, By Application, Thousand Units, 2017-2031

Figure 5: North America & Europe Clinching Machine Market, By Application, US$ Mn, 2017-2031

Figure 6: North America & Europe Clinching Machine Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 7: North America & Europe Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 8: North America & Europe Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 9: North America & Europe Clinching Machine Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 10: North America & Europe Clinching Machine Market, By Region, Thousand Units, 2017-2031

Figure 11: North America & Europe Clinching Machine Market, By Region, US$ Mn, 2017-2031

Figure 12: North America & Europe Clinching Machine Market Incremental Opportunity, By Region, US$ Mn, 2017-2031

Figure 13: North America Clinching Machine Market, By Type, Thousand Units, 2017-2031

Figure 14: North America Clinching Machine Market, By Type, US$ Mn, 2017-2031

Figure 15: North America Clinching Machine Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 16: North America Clinching Machine Market, By Application, Thousand Units, 2017-2031

Figure 17: North America Clinching Machine Market, By Application, US$ Mn, 2017-2031

Figure 18: North America Clinching Machine Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 19: North America Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 20: North America Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 21: North America Clinching Machine Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 22: North America Clinching Machine Market, By Country, Thousand Units, 2017-2031

Figure 23: North America Clinching Machine Market, By Country, US$ Mn, 2017-2031

Figure 24: North America Clinching Machine Market Incremental Opportunity, By Country, US$ Mn, 2017-2031

Figure 25: Europe Clinching Machine Market, By Type, Thousand Units, 2017-2031

Figure 26: Europe Clinching Machine Market, By Type, US$ Mn, 2017-2031

Figure 27: Europe Clinching Machine Market Incremental Opportunity, By Type, US$ Mn, 2017-2031

Figure 28: Europe Clinching Machine Market, By Application, Thousand Units, 2017-2031

Figure 29: Europe Clinching Machine Market, By Application, US$ Mn, 2017-2031

Figure 30: Europe Clinching Machine Market Incremental Opportunity, By Application, US$ Mn, 2017-2031

Figure 31: Europe Clinching Machine Market, By Distribution Channel, Thousand Units, 2017-2031

Figure 32: Europe Clinching Machine Market, By Distribution Channel, US$ Mn, 2017-2031

Figure 33: Europe Clinching Machine Market Incremental Opportunity, By Distribution Channel, US$ Mn, 2017-2031

Figure 34: Europe Clinching Machine Market, By Country, Thousand Units, 2017-2031

Figure 35: Europe Clinching Machine Market, By Country, US$ Mn, 2017-2031

Figure 36: Europe Clinching Machine Market Incremental Opportunity, By Country, US$ Mn, 2017-2031