Reports

Reports

Analysts’ Viewpoint on Market Scenario

Increase in concerns regarding climate change and rise in focus on reducing carbon emissions are projected to propel the next-generation solar cell market size in the next few years. Many countries and organizations are setting ambitious carbon emission targets and renewable energy goals to achieve their sustainability goals, which are projected to boost adoption of solar energy.

Advancements in solar cell technologies are likely to offer lucrative opportunities to vendors in the global next-generation solar cell industry. These advancements are focused on making solar energy more economically viable and attractive to a broader range of consumers and industries. Vendors are investing in the R&D of high-efficiency perovskite solar cells to expand their product portfolio and increase their next-generation solar cell market share.

Solar cells, also known as photovoltaic (PV) cells, are semiconductor devices that convert sunlight directly into electricity through the photovoltaic effect. When sunlight (photons) strikes the surface of a solar cell, it excites electrons in the semiconductor material, creating an electric current. This electrical energy can be used to power various devices or be fed into the electrical grid.

Solar cells are the fundamental building blocks of solar panels, which are commonly used to capture and harness solar energy for residential, commercial, and industrial applications. Multiple solar cells are interconnected to form a solar module or panel. These panels can be combined to create larger solar arrays. Next-generation solar cells are developed to overcome limitations and improve the efficiency, performance, and cost-effectiveness of traditional solar cells.

Rise in transition toward clean and renewable energy sources is prompting improvement in the performance and cost-effectiveness of third-generation solar cells. As solar energy becomes a mainstream energy source, cost competitiveness becomes crucial for its widespread adoption. Improving the efficiency and reducing the manufacturing costs of solar cells helps make solar energy more economically viable and competitive with conventional energy sources. Thus, surge in demand for high-efficiency and economically viable thin-film solar cells is propelling the next-generation solar cell market value.

Researchers and next-generation solar cell companies across the globe are continuously striving to push the boundaries of solar cell efficiency, making use of novel materials and advanced manufacturing techniques. Oxford PV, an Oxford University spin-off company in the field of perovskite photovoltaics and solar cells, is focusing on the commercial release of its perovskite-on-silicon tandem cell. The company anticipates achieving an impressive conversion efficiency of 27% and an energy yield of 24%. This is a significant improvement compared to the energy yield of approximately 20%-22% offered by most silicon panels currently available in the market. Hence, adoption of novel materials and advanced manufacturing techniques is estimated to spur the next-generation solar cell market growth in the next few years.

Governments and organizations worldwide are setting higher renewable energy targets and prioritizing the transition to cleaner energy sources. Solar technologies that can generate more electricity from sunlight, improve overall efficiency, and reduce the cost per watt can help meet these ambitious renewable energy goals. Hence, governments and organizations worldwide are investing in renewable energy technologies. This, in turn, is fueling the next-generation solar cell market expansion.

Availability of new funding mechanisms is further supporting the growth in adoption of next-generation solar cells. These funding options provide financial incentives, stability, and reduced risk for investors and project developers, making it easier to secure financing for research, manufacturing, and deployment of advanced solar technologies.

In 2022, the U.S. introduced the Inflation Reduction Act (IRA), which included substantial new funding for solar photovoltaic (PV) projects. The act introduced investment and production tax credits, providing a substantial boost to the expansion of PV capacity and the supply chain in the country. These incentives are expected to augment investment in solar PV projects and help increase the next-generation solar cell market revenue in the U.S.

Perovskite PV cells are poised to generate new opportunities in the next-generation solar cell market. Perovskite solar cells have garnered significant interest in recent years due to their exceptional light-absorbing properties and potential for high conversion efficiencies. These cells can be processed using low-temperature techniques, reducing manufacturing costs compared to silicon-based cells. This cost advantage opens up opportunities for affordable solar power solutions, making renewable energy more accessible to a broader range of consumers.

Perovskite solar cells can be combined with other solar cell materials, such as silicon, to form tandem solar cells. This tandem approach allows for improved light absorption and energy conversion, leading to higher overall efficiency. Perovskite solar cells can be fabricated using earth-abundant materials, making them environmentally friendly compared to some other solar cell technologies.

Inorganics, such as crystalline silicon, polycrystalline silicon (poly-Si), cadmium telluride, and copper indium germanium selenide, boasting power conversion efficiencies (PCE) in the range of 15–20%, are widely employed in the production of solar energy. Third-generation cells represent "emerging" technologies that are not as commercially advanced yet. These include organic photovoltaics (OPVs), copper zinc tin sulfide (CZTS), perovskite solar cells, dye-sensitized solar cells (DSSCs), and quantum dot solar cells.

According to the latest next-generation solar cell market forecast, Asia Pacific is projected to hold largest share from 2023 to 2031. Rise in population and the subsequent increase in energy demand are boosting the market dynamics of the region. China, South Korea, and Taiwan are major manufacturing hubs for solar panels.

China has outlined its intentions to accelerate the commercialization of various next-generation silicon solar cells, including TOPCon, heterojunction (HJT), and IBC, as well as perovskite and tandem solar cells. The plan aims to fast-track the development and deployment of advanced solar cell technologies in the country. Such initiatives are expected to drive market statistics in Asia Pacific in the next few years.

Implementation of renewable energy goals and policies is propelling market progress in North America. Surge in adoption of Building-integrated Photovoltaics (BIPV) to improve energy efficiency in buildings is fueling the market trajectory in Europe. Flexible and lightweight next-generation solar cells can be integrated into building materials, providing new architectural opportunities.

Next-generation solar cell manufacturers are adopting various strategies to strengthen their position in the industry. They are expanding their manufacturing capabilities to cater to a larger customer base and maintain a competitive edge in the market. Vendors are subcontracting and forming strategic partnerships with other companies to outsource certain aspects of their operations in order to enhance their efficiency, reduce costs, and access specialized expertise.

Canadian Solar, Greatcell Energy, JA Solar, JinkoSolar Holding Co., Ltd., Jolywood, LONGi, Oxford PV, Renshine Solar, Saule Technologies, SunPower Corporation, Trina Solar, Panasonic Holdings Corporation, and ReNew Energy Global Plc are key entities operating in this industry.

Each of these players has been profiled in the next-generation solar cell market report based on factors such as financial overview, company overview, business strategies, business segments, application portfolio, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.4 Bn |

|

Market Forecast Value in 2031 |

US$ 14.2 Bn |

|

Growth Rate (CAGR) |

21.7% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and GW for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

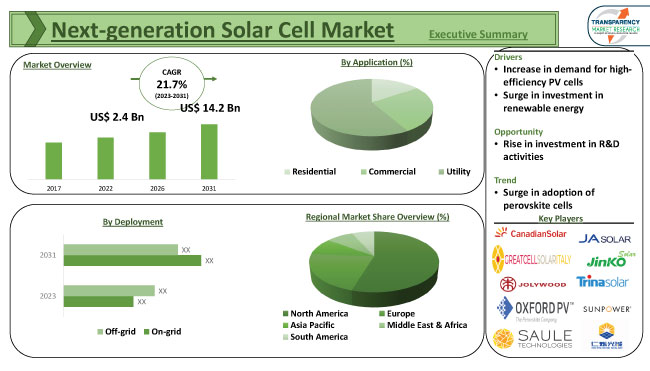

It was valued at US$ 2.4 Bn in 2022

It is projected to advance at a CAGR of 21.7% from 2023 to 2031

It is anticipated to reach US$ 14.2 Bn by the end of 2031

Increase in demand for high-efficiency PV cells and surge in investment in renewable energy

Asia Pacific is projected to record the highest demand during the forecast period

Canadian Solar, Greatcell Energy, JA Solar, JinkoSolar Holding Co., Ltd., Jolywood, LONGi, Oxford PV, Renshine Solar, Saule Technologies, SunPower Corporation, Trina Solar, Panasonic Holdings Corporation, and ReNew Energy Global Plc

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Next-generation Solar Cell Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Solar Energy Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

5. Global Next-generation Solar Cell Market Analysis, by Material Type

5.1. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

5.1.1. Second-generation

5.1.1.1. Amorphous Silicon (a-Si)

5.1.1.2. Microcrystalline Silicon (μc-Si)

5.1.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

5.1.1.4. Copper Indium Gallium Selenide (CIGS)

5.1.2. Third-generation

5.1.2.1. DSSC PV

5.1.2.2. Organic Photovoltaic (OPV)

5.1.2.3. Quantum Dot (QD) PV

5.1.2.4. Perovskite PV

5.1.2.5. GaAs/GaInP

5.1.2.6. Inorganics-in-Organics

5.1.2.7. Tandem Solar Cells

5.2. Market Attractiveness Analysis, By Material Type

6. Global Next-generation Solar Cell Market Analysis, by Deployment

6.1. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

6.1.1. On-grid

6.1.2. Off-grid

6.2. Market Attractiveness Analysis, By Deployment

7. Global Next-generation Solar Cell Market Analysis, by Application

7.1. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

7.1.1. Residential

7.1.2. Commercial

7.1.3. Utility

7.2. Market Attractiveness Analysis, By Application

8. Global Next-generation Solar Cell Market Analysis and Forecast by Region

8.1. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Region, 2017-2031

8.1.1. North America

8.1.2. Europe

8.1.3. Asia Pacific

8.1.4. Middle East & Africa

8.1.5. South America

8.2. Market Attractiveness Analysis, By Region

9. North America Next-generation Solar Cell Market Analysis and Forecast

9.1. Market Snapshot

9.2. Drivers and Restraints: Impact Analysis

9.3. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

9.3.1. Second-generation

9.3.1.1. Amorphous Silicon (a-Si)

9.3.1.2. Microcrystalline Silicon (μc-Si)

9.3.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

9.3.1.4. Copper Indium Gallium Selenide (CIGS)

9.3.2. Third-generation

9.3.2.1. DSSC PV

9.3.2.2. Organic Photovoltaic (OPV)

9.3.2.3. Quantum Dot (QD) PV

9.3.2.4. Perovskite PV

9.3.2.5. GaAs/GaInP

9.3.2.6. Inorganics-in-Organics

9.3.2.7. Tandem Solar Cells

9.4. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

9.4.1. On-grid

9.4.2. Off-grid

9.5. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

9.5.1. Residential

9.5.2. Commercial

9.5.3. Utility

9.6. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Country and Sub-region, 2017-2031

9.6.1. U.S.

9.6.2. Canada

9.6.3. Rest of North America

9.7. Market Attractiveness Analysis

9.7.1. By Material Type

9.7.2. By Deployment

9.7.3. By Application

9.7.4. By Country/Sub-region

10. Europe Next-generation Solar Cell Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

10.3.1. Second-generation

10.3.1.1. Amorphous Silicon (a-Si)

10.3.1.2. Microcrystalline Silicon (μc-Si)

10.3.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

10.3.1.4. Copper Indium Gallium Selenide (CIGS)

10.3.2. Third-generation

10.3.2.1. DSSC PV

10.3.2.2. Organic Photovoltaic (OPV)

10.3.2.3. Quantum Dot (QD) PV

10.3.2.4. Perovskite PV

10.3.2.5. GaAs/GaInP

10.3.2.6. Inorganics-in-Organics

10.3.2.7. Tandem Solar Cells

10.4. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

10.4.1. On-grid

10.4.2. Off-grid

10.5. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

10.5.1. Residential

10.5.2. Commercial

10.5.3. Utility

10.6. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Country and Sub-region, 2017-2031

10.6.1. U.K.

10.6.2. Germany

10.6.3. France

10.6.4. Rest of Europe

10.7. Market Attractiveness Analysis

10.7.1. By Material Type

10.7.2. By Deployment

10.7.3. By Application

10.7.4. By Country/Sub-region

11. Asia Pacific Next-generation Solar Cell Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

11.3.1. Second-generation

11.3.1.1. Amorphous Silicon (a-Si)

11.3.1.2. Microcrystalline Silicon (μc-Si)

11.3.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

11.3.1.4. Copper Indium Gallium Selenide (CIGS)

11.3.2. Third-generation

11.3.2.1. DSSC PV

11.3.2.2. Organic Photovoltaic (OPV)

11.3.2.3. Quantum Dot (QD) PV

11.3.2.4. Perovskite PV

11.3.2.5. GaAs/GaInP

11.3.2.6. Inorganics-in-Organics

11.3.2.7. Tandem Solar Cells

11.4. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

11.4.1. On-grid

11.4.2. Off-grid

11.5. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

11.5.1. Residential

11.5.2. Commercial

11.5.3. Utility

11.6. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Country and Sub-region, 2017-2031

11.6.1. China

11.6.2. Japan

11.6.3. India

11.6.4. South Korea

11.6.5. ASEAN

11.6.6. Rest of Asia Pacific

11.7. Market Attractiveness Analysis

11.7.1. By Material Type

11.7.2. By Deployment

11.7.3. By Application

11.7.4. By Country/Sub-region

12. Middle East & Africa Next-generation Solar Cell Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

12.3.1. Second-generation

12.3.1.1. Amorphous Silicon (a-Si)

12.3.1.2. Microcrystalline Silicon (μc-Si)

12.3.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

12.3.1.4. Copper Indium Gallium Selenide (CIGS)

12.3.2. Third-generation

12.3.2.1. DSSC PV

12.3.2.2. Organic Photovoltaic (OPV)

12.3.2.3. Quantum Dot (QD) PV

12.3.2.4. Perovskite PV

12.3.2.5. GaAs/GaInP

12.3.2.6. Inorganics-in-Organics

12.3.2.7. Tandem Solar Cells

12.4. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

12.4.1. On-grid

12.4.2. Off-grid

12.5. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

12.5.1. Residential

12.5.2. Commercial

12.5.3. Utility

12.6. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Country and Sub-region, 2017-2031

12.6.1. GCC

12.6.2. South Africa

12.6.3. Rest of Middle East & Africa

12.7. Market Attractiveness Analysis

12.7.1. By Material Type

12.7.2. By Deployment

12.7.3. By Application

12.7.4. By Country/Sub-region

13. South America Next-generation Solar Cell Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Material Type, 2017-2031

13.3.1. Second-generation

13.3.1.1. Amorphous Silicon (a-Si)

13.3.1.2. Microcrystalline Silicon (μc-Si)

13.3.1.3. Cadmium Telluride/Cadmium Sulfide (CdTe/CdS)

13.3.1.4. Copper Indium Gallium Selenide (CIGS)

13.3.2. Third-generation

13.3.2.1. DSSC PV

13.3.2.2. Organic Photovoltaic (OPV)

13.3.2.3. Quantum Dot (QD) PV

13.3.2.4. Perovskite PV

13.3.2.5. GaAs/GaInP

13.3.2.6. Inorganics-in-Organics

13.3.2.7. Tandem Solar Cells

13.4. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Deployment, 2017-2031

13.4.1. On-grid

13.4.2. Off-grid

13.5. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Application, 2017-2031

13.5.1. Residential

13.5.2. Commercial

13.5.3. Utility

13.6. Next-generation Solar Cell Market Value (US$ Bn) and Volume (GW) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.6.1. Brazil

13.6.2. Rest of South America

13.7. Market Attractiveness Analysis

13.7.1. By Material Type

13.7.2. By Deployment

13.7.3. By Application

13.7.4. By Country/Sub-region

14. Competition Assessment

14.1. Global Next-generation Solar Cell Market Competition Matrix - a Dashboard View

14.1.1. Global Next-generation Solar Cell Market Company Share Analysis, by Value (2022)

14.1.2. Technological Differentiator

15. Company Profiles (Global Manufacturers/Suppliers)

15.1. Canadian Solar

15.1.1. Overview

15.1.2. Product Portfolio

15.1.3. Sales Footprint

15.1.4. Key Subsidiaries or Distributors

15.1.5. Strategy and Recent Developments

15.1.6. Key Financials

15.2. Greatcell Energy

15.2.1. Overview

15.2.2. Product Portfolio

15.2.3. Sales Footprint

15.2.4. Key Subsidiaries or Distributors

15.2.5. Strategy and Recent Developments

15.2.6. Key Financials

15.3. JA Solar

15.3.1. Overview

15.3.2. Product Portfolio

15.3.3. Sales Footprint

15.3.4. Key Subsidiaries or Distributors

15.3.5. Strategy and Recent Developments

15.3.6. Key Financials

15.4. JinkoSolar Holding Co., Ltd.

15.4.1. Overview

15.4.2. Product Portfolio

15.4.3. Sales Footprint

15.4.4. Key Subsidiaries or Distributors

15.4.5. Strategy and Recent Developments

15.4.6. Key Financials

15.5. Jolywood

15.5.1. Overview

15.5.2. Product Portfolio

15.5.3. Sales Footprint

15.5.4. Key Subsidiaries or Distributors

15.5.5. Strategy and Recent Developments

15.5.6. Key Financials

15.6. LONGi

15.6.1. Overview

15.6.2. Product Portfolio

15.6.3. Sales Footprint

15.6.4. Key Subsidiaries or Distributors

15.6.5. Strategy and Recent Developments

15.6.6. Key Financials

15.7. Oxford PV

15.7.1. Overview

15.7.2. Product Portfolio

15.7.3. Sales Footprint

15.7.4. Key Subsidiaries or Distributors

15.7.5. Strategy and Recent Developments

15.7.6. Key Financials

15.8. Renshine Solar

15.8.1. Overview

15.8.2. Product Portfolio

15.8.3. Sales Footprint

15.8.4. Key Subsidiaries or Distributors

15.8.5. Strategy and Recent Developments

15.8.6. Key Financials

15.9. Saule Technologies

15.9.1. Overview

15.9.2. Product Portfolio

15.9.3. Sales Footprint

15.9.4. Key Subsidiaries or Distributors

15.9.5. Strategy and Recent Developments

15.9.6. Key Financials

15.10. SunPower Corporation

15.10.1. Overview

15.10.2. Product Portfolio

15.10.3. Sales Footprint

15.10.4. Key Subsidiaries or Distributors

15.10.5. Strategy and Recent Developments

15.10.6. Key Financials

15.11. Trina Solar

15.11.1. Overview

15.11.2. Product Portfolio

15.11.3. Sales Footprint

15.11.4. Key Subsidiaries or Distributors

15.11.5. Strategy and Recent Developments

15.11.6. Key Financials

15.12. Panasonic Holdings Corporation

15.12.1. Overview

15.12.2. Product Portfolio

15.12.3. Sales Footprint

15.12.4. Key Subsidiaries or Distributors

15.12.5. Strategy and Recent Developments

15.12.6. Key Financials

15.13. ReNew Energy Global Plc

15.13.1. Overview

15.13.2. Product Portfolio

15.13.3. Sales Footprint

15.13.4. Key Subsidiaries or Distributors

15.13.5. Strategy and Recent Developments

15.13.6. Key Financials

16. Recommendation

16.1. Identification of Potential Market Spaces

16.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 2: Global Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 3: Global Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 4: Global Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 5: Global Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 6: Global Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 7: Global Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 8: Global Next-generation Solar Cell Market Volume (GW) & Forecast, by Region, 2017-2031

Table 9: North America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 10: North America Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 11: North America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 12: North America Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 13: North America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 14: North America Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 15: North America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 16: North America Next-generation Solar Cell Market Volume (GW) & Forecast, by Country, 2017-2031

Table 17: Europe Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 18: Europe Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 19: Europe Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 20: Europe Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 21: Europe Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 22: Europe Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 23: Europe Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 24: Europe Next-generation Solar Cell Market Volume (GW) & Forecast, by Country, 2017-2031

Table 25: Asia Pacific Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 26: Asia Pacific Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 27: Asia Pacific Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 28: Asia Pacific Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 29: Asia Pacific Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 30: Asia Pacific Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 31: Asia Pacific Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 32: Asia Pacific Next-generation Solar Cell Market Volume (GW) & Forecast, by Country, 2017-2031

Table 33: Middle East & Africa Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 34: Middle East & Africa Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 35: Middle East & Africa Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 36: Middle East & Africa Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 37: Middle East & Africa Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 38: Middle East & Africa Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 39: Middle East & Africa Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 40: Middle East & Africa Next-generation Solar Cell Market Volume (GW) & Forecast, by Country, 2017-2031

Table 41: South America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Material Type, 2017-2031

Table 42: South America Next-generation Solar Cell Market Volume (GW) & Forecast, by Material Type, 2017-2031

Table 43: South America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Deployment , 2017-2031

Table 44: South America Next-generation Solar Cell Market Volume (GW) & Forecast, by Deployment , 2017-2031

Table 45: South America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Application , 2017-2031

Table 46: South America Next-generation Solar Cell Market Volume (GW) & Forecast, by Application , 2017-2031

Table 47: South America Next-generation Solar Cell Market Value (US$ Bn) & Forecast, by Country, 2017-2031

Table 48: South America Next-generation Solar Cell Market Volume (GW) & Forecast, by Country, 2017-2031

List of Figures

Figure 01: Global Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 02: Global Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 03: Global Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 04: Global Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 05: Global Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 06: Global Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 07: Global Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 08: Global Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 09: Global Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 10: Global Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 11: Global Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 12: Global Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 13: Global Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 14: Global Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 15: Global Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 16: Global Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 17: North America Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 18: North America Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 19: North America Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 20: North America Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 21: North America Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 22: North America Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 23: North America Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 24: North America Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 25: North America Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 26: North America Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 27: North America Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 28: North America Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 29: North America Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 30: North America Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 31: North America Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 32: North America Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 33: Europe Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 34: Europe Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 35: Europe Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 36: Europe Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 37: Europe Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 38: Europe Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 39: Europe Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 40: Europe Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 41: Europe Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 42: Europe Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 43: Europe Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 44: Europe Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 45: Europe Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 46: Europe Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 47: Europe Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 48: Europe Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 49: Asia Pacific Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 50: Asia Pacific Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 51: Asia Pacific Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 52: Asia Pacific Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 53: Asia Pacific Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 54: Asia Pacific Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 55: Asia Pacific Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 56: Asia Pacific Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 57: Asia Pacific Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 58: Asia Pacific Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 59: Asia Pacific Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 60: Asia Pacific Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 61: Asia Pacific Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 62: Asia Pacific Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 63: Asia Pacific Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 64: Asia Pacific Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 65: Middle East & Africa Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 66: Middle East & Africa Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 67: Middle East & Africa Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 68: Middle East & Africa Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 69: Middle East & Africa Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 70: Middle East & Africa Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 71: Middle East & Africa Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 72: Middle East & Africa Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 73: Middle East & Africa Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 74: Middle East & Africa Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 75: Middle East & Africa Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 76: Middle East & Africa Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 77: Middle East & Africa Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 78: Middle East & Africa Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 79: Middle East & Africa Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 80: Middle East & Africa Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031

Figure 81: South America Next-generation Solar Cell Market Value & Forecast, Value (US$ Bn), 2017-2031

Figure 82: South America Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 83: South America Next-generation Solar Cell Market Value & Forecast, Volume (GW), 2017-2031

Figure 84: South America Next-generation Solar Cell Market Value & Forecast, Y-O-Y, Volume (GW), 2017-2031

Figure 85: South America Next-generation Solar Cell Market Projections by Material Type, Value (US$ Bn), 2017-2031

Figure 86: South America Next-generation Solar Cell Market Share Analysis, by Material Type, 2021 and 2031

Figure 87: South America Next-generation Solar Cell Market, Incremental Opportunity, by Material Type, 2021-2031

Figure 88: South America Next-generation Solar Cell Market Projections by Deployment, Value (US$ Bn), 2017-2031

Figure 89: South America Next-generation Solar Cell Market Share Analysis, by Deployment, 2021 and 2031

Figure 90: South America Next-generation Solar Cell Market, Incremental Opportunity, by Deployment, 2021-2031

Figure 91: South America Next-generation Solar Cell Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 92: South America Next-generation Solar Cell Market Share Analysis, by Application, 2021 and 2031

Figure 93: South America Next-generation Solar Cell Market, Incremental Opportunity, by Application, 2021-2031

Figure 94: South America Next-generation Solar Cell Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 95: South America Next-generation Solar Cell Market Share Analysis, by Country and sub-region 2021 and 2031

Figure 96: South America Next-generation Solar Cell Market, Incremental Opportunity, by Country and sub-region, 2021-2031