Reports

Reports

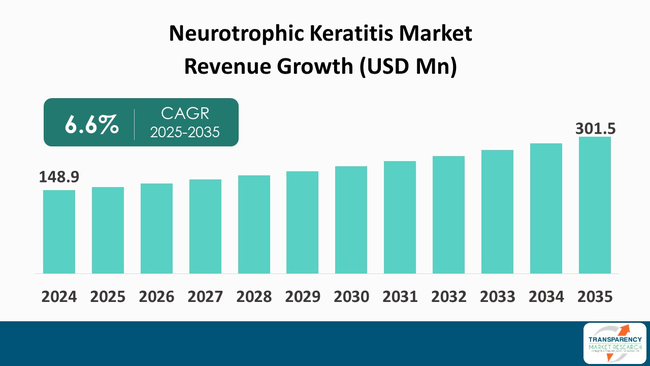

The global specimen collection cards market size was valued at US$ 148.9 million in 2024 and is projected to reach US$ 301.5 million by 2035, expanding at a CAGR of 6.6 % from 2025 to 2035. A major element contributing to this development is the heightened awareness of rare eye disorders, along with the progress made in regenerative ophthalmology and the increased use of innovative biologic therapies such as recombinant nerve growth factors.

The global neurotrophic keratitis industry will continue to grow over the forecast period due to growing comprehension of rare ocular diseases, the progress of diagnostic technologies, and the accessibility of novel treatment modalities. Among the other factors, the rising research collaborations, the designations of orphan drugs, and the available supportive regulatory paths are leading the innovations in the field to grow.

The treatment paradigms will be changed by the continued regenerative ophthalmology advancements as well as the development of recombinant human nerve growth factor therapies. It is expected that the product innovation will be fastened up by the biotech firms and academic institutions through their strategic collaborations. Moreover, the market penetration is expected to be increased due to higher disease awareness and early diagnosis resulting from campaigns and initiatives in the next ten years.

However, the market expansion is disrupted by the expensive treatment and the scarcity of the advancement of therapies in developing regions. Increased healthcare spending and the implementation of regulations favorable to the industry are major factors that have contributed to the positive market atmosphere. The area is additionally being pointed out by experts as a major growth contributor for the coming years. They see rising healthcare infrastructure and patient reach as key factors that will result in an upsurge of demand for healthcare services and products in these countries.

Neurotrophic keratitis (NK) is an uncommon, gradually debilitating corneal disorder that results in the loss of corneal sensitivity. The disease may lead to continuous epithelial defects, corneal ulcers, and even loss of vision if the treatment is delayed.

The rising awareness, improvements in ophthalmology, and a range of new treatment methods, mainly the use of biologics and regenerative therapies, have made it easier for the medical community to recognize this neglected therapeutic area. The global neurotrophic keratitis market is gradually meeting the needs of healthcare staff, patients, and drug companies concentrating their efforts on better diagnosis, increased treatment accessibility, and solving the large unmet medical needs related to this condition.

For instance, the U.S. Food and Drug Administration announced its approval of Oxervate as the first biologic therapy for the treatment of neurotrophic keratitis, in addition to giving several orphan drug designation grants to investigational drugs such as BRM424 and REC 0559 aimed at providing resources to facilitate the creation of novel therapies.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The neurotrophic keratitis market is being driven largely by the increasing prevalence of underlying health conditions. The increasing number of diabetes cases has a significant impact on corneal nerve damage and impaired healing, and alongside that are herpes simplex and herpes zoster infections. Besides, the neurological disorders that influence the innervation of the trigeminal nerve are the cause of the patients' susceptibility to this rare but severe corneal disease has been a major impact on health.

As per the World Health Organization, in 2022, 14% of adults aged 18 years and older were battling diabetes, an increase from 7% in 1990. More than half (59%) of adults aged 30 years and over living with diabetes were not opting for medication for their diabetes in 2022. It further states that diabetes treatment coverage was lowest in low- and middle-income countries.

The globally increased comorbidities will likely result in the growth of neurotrophic keratitis-related burden, which points toward a higher demand for precise diagnostic tools and modern-day treatment options. Consequently, healthcare and pharmaceutical companies, along with medical professionals, are emphasizing the development of individualized treatment plans that will better address the growing patient volume.

According to the National Institute for Health Research, neurotrophic keratitis develops in around 6% of herpetic keratitis patients (prevalence of 149 per 100,000 population) and in 13% of herpes zoster keratitis patients (prevalence of 26 per 100,000 population). Moreover, 2.8% patients who underwent surgical procedures for trigeminal neuralgia (1.5 per 10,000 population) subsequently developed neurotrophic keratitis.

Better diagnostic abilities are the leading factor in successful management of neurotrophic keratitis. Progress in ocular surface imaging, corneal confocal microscopy, and various other revolutionary diagnostic tools are the main reasons ophthalmologists to find this disease in its early stages and with more precision. For instance, in case of artificial intelligence-enabled medical devices, the U.S. Food and Drug Administration (FDA) has broadened its model. To guarantee the security, transparency, and efficiency of AI-based diagnostic software, they have released concepts and criteria.

As a result, if identification takes place in the first stages, the possibilities for the patient to witness side-effects such as ulcers or losing sight will be as well lowered to a great extent. In addition, the first detection largely adds to successful therapy outcomes.

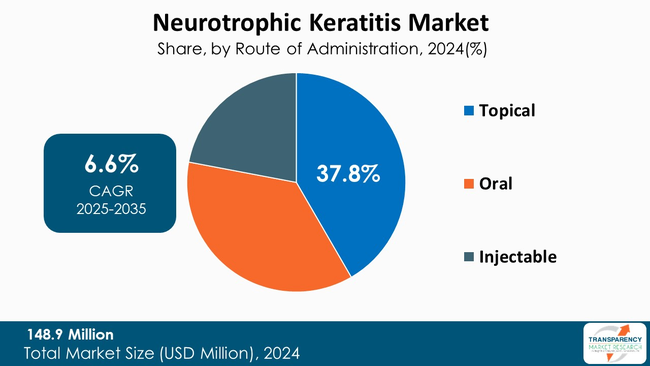

The topical segment leads the market for neurotrophic keratitis (37.8%) due to topical products' widespread availability and consumer preference for eye drops and topical biologics such as cenegermin (Oxervate). Topical therapies provide patients with a more convenient non-invasive treatment, which are visible directly on the eye surface. Therefore, such treatments are usually the first solution that doctors choose for most cases.

Due to continuous innovations in ophthalmic formulations, along with the consistent regulatory endorsements, the topical segment is estimated to keep its dominant position for the next couple of years.

| Attribute | Detail |

|---|---|

| Leading Region |

|

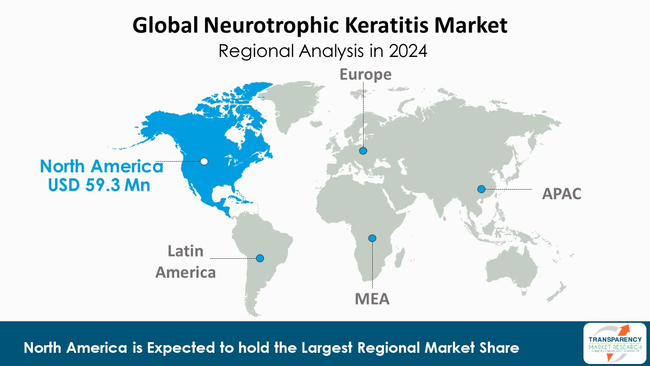

North America accounts for the highest market share of 39.9 % for global neurotrophic keratitis industry. Due to initial stage regulatory approvals such as by the U.S. Food and Drug administration (FDA) approval of cenegermin-bkbj, a recombinant human growth factor (NGF), the first medicinal product specifically for all stages of Neurotrophic keratitis, are some major aspects for acceleration in treatment and adoption leading to market growth.

Furthermore, in May 2024, the Centers for Disease Control and Prevention (CDC), a U.S. federal agency under the Department of Health and Human Services stated that over 3.4 Mn Americans aged 40 and older are visually impaired, a number expected to double by 2030.

In addition to that, the region has seen the outbreak of various diseases that lead to NK (ding herpetic keratitis, diabetes, and eye surgery). Such a situation brings a significant need for the effective treatment of those illnesses. For instance, the report from Ophthalmology shows that Neurotrophic keratopathy (NK) has a prevalence of 21.34 cases per 100,000 patients (0.021%) in the United States. The investigation also shows worse visual acuities in patients with NK are tied to several demographic characteristics, including a history of diabetes, corneal transplant, and herpetic keratitis.

AbbVie Inc., Dompé, Ocular Therapeutix, Inc., ReGenTree, LLC, Bausch Health Companies Inc., Laboratoires Théa, Santen Pharmaceutical Co., Ltd., Pfizer Inc., Neuroptika Inc., Johnson & Johnson, Viatris Inc., Grand Pharma (China) Co., Ltd., MimeTech Srl, Novartis AG, BRIM Biotechnology, Inc. are some of the leading manufacturers operating in the global neurotrophic keratitis market.

Each of these companies has been profiled in the neurotrophic keratitis market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 148.9 Mn |

| Forecast Value in 2035 | More than US$ 301.5 Mn |

| CAGR | 6.6 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Drugs

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global neurotrophic keratitis market was valued at US$ 148.9 Mn in 2024

The global neurotrophic keratitis industry is projected to reach more than US$ 301.5 Mn by the end of 2035

Rising number of diagnosed cases of neurotrophic keratitis and advanced ophthalmic diagnostics & imaging technologies are some of the factors driving the expansion of neurotrophic keratitis market.

The CAGR is anticipated to be 6.6 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

AbbVie Inc., Dompé, Ocular Therapeutix, Inc., ReGenTree, LLC, Bausch Health Companies Inc., Laboratoires Théa, Santen Pharmaceutical Co., Ltd., Pfizer Inc., Neuroptika Inc., Johnson & Johnson, Viatris Inc., Grand Pharma (China) Co., Ltd., MimeTech Srl, Novartis AG, BRIM Biotechnology, Inc. and other prominent players

Table 01: Global Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 02: Global Neurotrophic Keratitis Market Value (US$ Mn) Forecast, By Route of Administration, 2020 to 2035

Table 03: Global Neurotrophic Keratitis Market Value (US$ Mn) Forecast, By Stage, 2020 to 2035

Table 04: Global Neurotrophic Keratitis Market Value (US$ Mn) Forecast, By Distribution Channel, 2020 to 2035

Table 05: Global Neurotrophic Keratitis Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 06: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 07: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 08: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Route of Administration, 2020 to 2035

Table 09: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Stage, 2020 to 2035

Table 10: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 11: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 13: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Route of Administration, 2020 to 2035

Table 14: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Stage, 2020 to 2035

Table 15: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 16: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 18: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Route of Administration, 2020 to 2035

Table 19: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Stage, 2020 to 2035

Table 20: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 21: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 23: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Route of Administration, 2020 to 2035

Table 24: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Stage, 2020 to 2035

Table 25: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Table 26: Middle East and Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Drugs, 2020 to 2035

Table 28: Middle East and Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Route of Administration, 2020 to 2035

Table 29: Middle East and Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Stage, 2020 to 2035

Table 30: Middle East and Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, by Distribution Channel, 2020 to 2035

Figure 01: Global Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 02: Global Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 03: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Artificial Tears, 2020 to 2035

Figure 04: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Recombinant Human Nerve Growth Factors Eye Drop, 2020 to 2035

Figure 05: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Oral Antibiotics, 2020 to 2035

Figure 06: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 07: Global Neurotrophic Keratitis Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 08: Global Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 09: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Topical, 2020 to 2035

Figure 10: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Oral, 2020 to 2035

Figure 11: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Injectable, 2020 to 2035

Figure 12: Global Neurotrophic Keratitis Market Value Share Analysis, by Stage, 2024 and 2035

Figure 13: Global Neurotrophic Keratitis Market Attractiveness Analysis, by Stage, 2025 to 2035

Figure 14: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Stage I, 2020 to 2035

Figure 15: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Stage II, 2020 to 2035

Figure 16: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Stage III, 2020 to 2035

Figure 17: Global Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 18: Global Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2024 and 2035

Figure 19: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Hospital Pharmacies, 2025 to 2035

Figure 20: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Retail Pharmacies, 2020 to 2035

Figure 21: Global Neurotrophic Keratitis Market Revenue (US$ Mn), by Online Pharmacies, 2020 to 2035

Figure 22: Global Neurotrophic Keratitis Market Value Share Analysis, By Region, 2024 and 2035

Figure 23: Global Neurotrophic Keratitis Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 24: North America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 25: North America Neurotrophic Keratitis Market Value Share Analysis, by Country, 2024 and 2035

Figure 26: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 27: North America Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 28: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 29: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 30: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 31: North America Neurotrophic Keratitis Market Value Share Analysis, by Stage, 2024 and 2035

Figure 32: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Stage, 2025 to 2035

Figure 33: North America Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 34: North America Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 35: Europe Neurotrophic Keratitis Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 36: Europe Neurotrophic Keratitis Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 37: Europe Neurotrophic Keratitis Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 38: Europe Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 39: Europe Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 40: Europe Neurotrophic Keratitis Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 41: Europe Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 42: Europe Neurotrophic Keratitis Market Value Share Analysis, By Stage, 2024 and 2035

Figure 43: Europe Neurotrophic Keratitis Market Attractiveness Analysis, By Stage, 2025 to 2035

Figure 44: Europe Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 45: Europe Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 46: Asia Pacific Neurotrophic Keratitis Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 47: Asia Pacific Neurotrophic Keratitis Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 48: Asia Pacific Neurotrophic Keratitis Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 49: Asia Pacific Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 50: Asia Pacific Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 51: Asia Pacific Neurotrophic Keratitis Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 52: Asia Pacific Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 53: Asia Pacific Neurotrophic Keratitis Market Value Share Analysis, By Stage, 2024 and 2035

Figure 54: Asia Pacific Neurotrophic Keratitis Market Attractiveness Analysis, By Stage, 2025 to 2035

Figure 55: Asia Pacific Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 56: Asia Pacific Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 57: Latin America Neurotrophic Keratitis Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 58: Latin America Neurotrophic Keratitis Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 59: Latin America Neurotrophic Keratitis Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 60: Latin America Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 61: Latin America Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 62: Latin America Neurotrophic Keratitis Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 63: Latin America Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 64: Latin America Neurotrophic Keratitis Market Value Share Analysis, By Stage, 2024 and 2035

Figure 65: Latin America Neurotrophic Keratitis Market Attractiveness Analysis, By Stage, 2025 to 2035

Figure 66: Latin America Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 67: Latin America Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035

Figure 68: Middle East & Africa Neurotrophic Keratitis Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 69: Middle East & Africa Neurotrophic Keratitis Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 70: Middle East & Africa Neurotrophic Keratitis Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 71: Middle East and Africa Neurotrophic Keratitis Market Value Share Analysis, by Drugs, 2024 and 2035

Figure 72: Middle East and Africa Neurotrophic Keratitis Market Attractiveness Analysis, by Drugs, 2025 to 2035

Figure 73: Middle East and Africa Neurotrophic Keratitis Market Value Share Analysis, by Route of Administration, 2024 and 2035

Figure 74: Middle East and Africa Neurotrophic Keratitis Market Attractiveness Analysis, by Route of Administration, 2025 to 2035

Figure 75: Middle East and Africa Neurotrophic Keratitis Market Value Share Analysis, by Stage, 2024 and 2035

Figure 76: Middle East and Africa Neurotrophic Keratitis Market Attractiveness Analysis, By Stage, 2025 to 2035

Figure 77: Middle East and Africa Neurotrophic Keratitis Market Value Share Analysis, by Distribution Channel, 2024 and 2035

Figure 78: Middle East and Africa Neurotrophic Keratitis Market Attractiveness Analysis, by Distribution Channel, 2025 to 2035