Reports

Reports

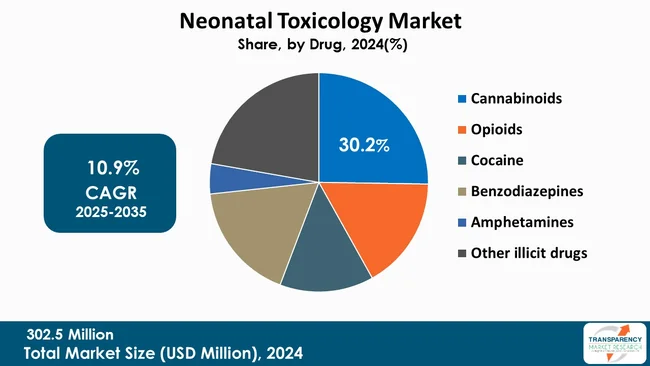

The global neonatal toxicology market size was valued at US$ 302.5 million in 2024 and is projected to reach US$ 931.7 million by 2035, expanding at a CAGR of 10.9 % from 2025 to 2035. The market is primarily influenced by the increasing number of prenatal substance exposure and the uptrend in cases of drug-related complications in newborns. The escalating consumption of prescription drugs, illicit drugs, and pollutants by pregnant women has expedited the demand for first detection and follow-up.

The global neonatal toxicology market is likely to experience a major expansion over the next several years. This is mainly attributed to the increasing awareness of in-utero substance, rising incidences of neonatal drug exposure, and the improvement of diagnostic technologies. The demand for a prompt and precise initial detection of toxins and drugs in neonates has resulted in the increased use of advanced testing techniques such as mass spectrometry and non-invasive sample analysis from meconium or umbilical cord tissue.

While the robust healthcare infrastructure and regulatory initiatives have helped North America to maintain its lead over the rest of the world in the market, the Asia-Pacific is progressively becoming a significant market with its expanding healthcare systems and increasing investments in maternal and child health.

Nevertheless, factors such as restricted availability of state-of-the-art diagnostic instruments in low- and middle-income countries, elevated costs, and the requirement for uniform testing procedures are still creating obstacles for the maximum potential of the market to be realized. The neonatal toxicology market has robust growth prospects as a result of a trend where healthcare providers, diagnostic companies, and policymakers are putting more emphasis on neonatal safety and early intervention in cases of substance exposure.

The neonate toxicology market revolves around identifying and analyzing poisons, drugs, and the other harmful agents in babies to make sure they are healthy and safe. The market is rapidly growing due to the rising consciousness of the effects of the mother's drug use, pollutants, and the general surroundings on the infant's health.

Confirmatory tests in this domain are generally conducted through the examination of biological specimens such as meconium, the umbilical cord tissue, urine, or blood to pinpoint any toxics that the body might have been exposed to. Recent improvements in technology, sensitive analytical techniques such as mass spectrometry, and immunoassays are crucial factors in making these tests more accurate and faster, which, therefore, leads to earlier intervention and better clinical outcomes.

The market is influenced by various factors such as the increased cases of substance exposure in neonates, the intensified focus on maternal and child healthcare, and the development of healthcare facilities worldwide. However, the situation is still characterized by a few obstacles such as expensive testing, limited access to testing in the regions of the world that are less developed, and the necessity for the standardization of testing protocols. According to Centers for Disease Control and Prevention (CDC) approximately 13% of all cases reported to child welfare services are associated with neonatal substance exposure. Study also noted a significant increase child welfare involvement in substance-exposed newborns, rising from 3.79 to 12.90 per 1,000 births.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increase in maternal substance abuse has become one of the major causes of concern for the health of newborn babies. This is due to the fact that the spiraling consumption of opioids and the other drugs by pregnant women is the main factor that impels a rise in the cases of neonatal abstinence syndrome (NAS) as well as the other complications associated with it. According to the CDC, opioids consumption by a pregnant woman can result in NAS to the baby, which is a condition of withdrawal symptoms in newborns due to drugs exposure in the uterus. Withdrawal signs generally start within 72 hours of life and can comprise trembling, being irritable, and difficulty in feeding.

The exposure to these substances while still in the womb may result in consequences like child born with a low birth weight, infants exhibiting withdrawal symptoms, and even premature birth, along with developmental issues that get into the child's later years. As an outcome of this trend, there is now a greater need for identification and ongoing surveillance through neonatal toxicology tests, which does make it possible for medical practitioners to act without delay and offer the essential support.

Moreover, it highlights the necessity of health measures for the general public, which should primarily aim at preventing substance use, educating mothers, and ensuring access to the programs of treatment in order to protect both - the mother and the infant. According to NBS Scotland figures, more than 1,500 infants have been born with NAS between 2017 and 2024, with the majority of cases resulting from the mother's drug or alcohol use during the pregnancy. The largest volume of new cases was in NHS Lothian, then in NHS Greater Glasgow and NHS Grampian.

The increase in the number of specialized care units such as Neonatal Intensive Care Units (NICUs) and various pediatric toxicology centers have been significantly instrumental in the expansion of the neonatal toxicology market. These environments offer the specialized knowledge, essential structure, and advanced equipment for the precise identification and medical treatment of infants that have been exposed to harmful substances/medications before birth.

For instance, in Dar-es-Salaam, Tanzania, the Korea International Cooperation Agency (KOICA) signed a cooperation agreement with the Tanzanian Ministry of Health for assiting a 5-year initiative (2025-2029) aiming at the improvement of high-risk maternal and neonatal care services. As the project is concentrated on the three referral hospitals, it also constitutes the upgradation of maternity wards, facilitation of transport, procurement of medical devices, and the development of neonatal care.

Comprehensive care for the most vulnerable ones is made possible by an increasing number of NICUs and specialized centers that can provide a wide range of services. In addition, the presence of differentiated care promotes the use of advanced toxicology tests, eases research initiatives, and makes the implementation of neonatal care pathways more efficient, thereby contributing to the expansion of the market and the improvement of care for high-risk infants.

In addition, the evolution of these specially equipped centers is usually closely associated with expenditures on the education of medical professionals, thus ensuring that there will be qualified staff to deal with complicated cases. Such extension is also a source of support for local and worldwide initiatives that aim at unifying the standards of neonatal care by making the treatment of drug-exposed and other high-risk infants both safe and effective everywhere.

The neonatal toxicology market has been largely influenced by the rise of Cannabinoids segment with market share of 30.2%. This is mainly a result of the increase in prenatal cannabis exposure as well as the global trend of cannabis legalization and the expansion of its product availability. Facilities and units that take care of the youngest and most vulnerable patients have turned their attention more and more to screening for cannabinoids since such a screening is frequently a part of a newborn toxicology examination.

This segment is additionally supported by a wider testing adoption, better assay sensitivity, and more robust clinical guidelines advocating regular monitoring. With the continuous increase in cannabis consumption among pregnant individuals, the demand for cannabinoid testing will likely remain the highest in neonatal toxicology panels. Besides, laboratories are broadening the range of cannabinoid panels to cover more new synthetic variants, hence, the testing figures are going up as well. The ongoing changes in screening to which the demand for testing remains high, result in cannabinoids being the most common substances to be identified in neonatal toxicology.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Currently, the North American region is the major contributor to the global neonatal toxicology market with 47.2% market share. This is majorly due to the region's advanced healthcare infrastructure, the use of up-to-the-minute diagnostic technologies in a large number of cases, and the presence of a major supportive regulatory framework for neonatal screening programs.

The region is served by a great understanding of substance exposure in neonates and established procedures for recognizing and treating the first signs. For instance, newborn screening programs for genetic and the other congenital conditions have been mandated for infants born in the United States each year as it has seen dramatic changes over the past decade.

Moreover, these factors such as the presence of major market players, local research projects, and high healthcare expenditures add up to the region being the leader in the market. Analysis of Key Players in Neonatal Toxicology Market

Omega Laboratories, Inc., Laboratory Corporation of America Holdings, Clinical Reference Laboratory, Inc., Medpace, Cordant Health Solutions, ARUP Laboratories, Quest Diagnostics Incorporated, NMS Labs, Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., Charles River Laboratories, Eurofins Scientific, United States Drug Testing Laboratories, QuidelOrtho Corporation, Thermo Fisher Scientific, Inc. and others are some of the leading manufacturers operating in the global neonatal toxicology market.

Each of these companies has been profiled in the neonatal toxicology market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 302.5 Mn |

| Forecast Value in 2035 | More than US$ 931.7 Mn |

| CAGR | 10.9 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Specimen

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global neonatal toxicology market was valued at US$ 302.5 Mn in 2024

The global neonatal toxicology industry is projected to reach more than US$ 931.7 Mn by the end of 2035

Rising maternal substance abuse and expansion of specialized care are some of the factors driving the expansion of neonatal toxicology market.

The CAGR is anticipated to be 10.9 % from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Stryker, Smith+Nephew, Coloplast, B. Braun SE, Convatec Inc., Johnson & Johnson, 3M, URGO Medical, Medtronic, Medline Industries, LP., Advancis Medical, Cardinal Health, Integra LifeSciences Corporation, Zimmer Biomet, Mölnlycke AB. and other prominent players.

Table 01: Global Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 02: Global Neonatal Toxicology Market Value (US$ Mn) Forecast, By Technology, 2020 to 2035

Table 03: Global Neonatal Toxicology Market Value (US$ Mn) Forecast, By Drug, 2020 to 2035

Table 04: Global Neonatal Toxicology Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 05: Global Neonatal Toxicology Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 06: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Country, 2020-2035

Table 07: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 08: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 09: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Drug, 2020 to 2035

Table 10: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 13: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 14: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, by Drug, 2020 to 2035

Table 15: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 18: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 19: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, by Drug, 2020 to 2035

Table 20: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 23: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 24: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, by Drug, 2020 to 2035

Table 25: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, by Specimen, 2020 to 2035

Table 28: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, by Technology, 2020 to 2035

Table 29: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, by Drug, 2020 to 2035

Table 30: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 02: Global Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 03: Global Neonatal Toxicology Market Revenue (US$ Mn), by Urine, 2020 to 2035

Figure 04: Global Neonatal Toxicology Market Revenue (US$ Mn), by Umbilical Cord, 2020 to 2035

Figure 05: Global Neonatal Toxicology Market Revenue (US$ Mn), by Meconium, 2020 to 2035

Figure 06: Global Neonatal Toxicology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 07: Global Neonatal Toxicology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 08: Global Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 09: Global Neonatal Toxicology Market Revenue (US$ Mn), by Mass Spectroscopy, 2020 to 2035

Figure 10: Global Neonatal Toxicology Market Revenue (US$ Mn), by Immunoassay, 2020 to 2035

Figure 11: Global Neonatal Toxicology Market Value Share Analysis, by Drug, 2024 and 2035

Figure 12: Global Neonatal Toxicology Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 13: Global Neonatal Toxicology Market Revenue (US$ Mn), by Cannabinoids, 2020 to 2035

Figure 14: Global Neonatal Toxicology Market Revenue (US$ Mn), by Opioids, 2020 to 2035

Figure 15: Global Neonatal Toxicology Market Revenue (US$ Mn), by Cocaine, 2020 to 2035

Figure 16: Global Neonatal Toxicology Market Revenue (US$ Mn), by Benzodiazepines, 2020 to 2035

Figure 17: Global Neonatal Toxicology Market Revenue (US$ Mn), by Amphetamines, 2020 to 2035

Figure 18: Global Neonatal Toxicology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 19: Global Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 20: Global Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 21: Global Neonatal Toxicology Market Revenue (US$ Mn), by Hospitals, 2025 to 2035

Figure 22: Global Neonatal Toxicology Market Revenue (US$ Mn), by Clinical Laboratories, 2020 to 2035

Figure 23: Global Neonatal Toxicology Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 24: Global Neonatal Toxicology Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Neonatal Toxicology Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Neonatal Toxicology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 27: North America Neonatal Toxicology Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Neonatal Toxicology Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 30: North America Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 31: North America Neonatal Toxicology Value Share Analysis, by Technology, 2025 to 2035

Figure 32: North America Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 33: North America Neonatal Toxicology Market Value Share Analysis, by Drug, 2025 to 2035

Figure 34: North America Neonatal Toxicology Market Attractiveness Analysis, by Drug, 2025 to 2035

Figure 35: North America Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 36: North America Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 37: Europe Neonatal Toxicology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 38: Europe Neonatal Toxicology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 39: Europe Neonatal Toxicology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 40: Europe Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 41: Europe Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 42: Europe Neonatal Toxicology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 43: Europe Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 44: Europe Neonatal Toxicology Market Value Share Analysis, By Drug, 2024 and 2035

Figure 45: Europe Neonatal Toxicology Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 46: Europe Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 47: Europe Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 48: Asia Pacific Neonatal Toxicology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 49: Asia Pacific Neonatal Toxicology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 50: Asia Pacific Neonatal Toxicology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 51: Asia Pacific Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 52: Asia Pacific Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 53: Asia Pacific Neonatal Toxicology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 54: Asia Pacific Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 55: Asia Pacific Neonatal Toxicology Market Value Share Analysis, By Drug, 2024 and 2035

Figure 56: Asia Pacific Neonatal Toxicology Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 57: Asia Pacific Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 58: Asia Pacific Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 59: Latin America Neonatal Toxicology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 60: Latin America Neonatal Toxicology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 61: Latin America Neonatal Toxicology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 62: Latin America Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 63: Latin America Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 64: Latin America Neonatal Toxicology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 65: Latin America Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 66: Latin America Neonatal Toxicology Market Value Share Analysis, By Drug, 2024 and 2035

Figure 67: Latin America Neonatal Toxicology Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 68: Latin America Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 69: Latin America Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 70: Middle East and Africa Neonatal Toxicology Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 71: Middle East and Africa Neonatal Toxicology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 72: Middle East and Africa Neonatal Toxicology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 73: Middle East and Africa Neonatal Toxicology Market Value Share Analysis, by Specimen, 2024 and 2035

Figure 74: Middle East and Africa Neonatal Toxicology Market Attractiveness Analysis, by Specimen, 2025 to 2035

Figure 75: Middle East and Africa Neonatal Toxicology Market Value Share Analysis, by Technology, 2024 and 2035

Figure 76: Middle East and Africa Neonatal Toxicology Market Attractiveness Analysis, by Technology, 2025 to 2035

Figure 77: Middle East and Africa Neonatal Toxicology Market Value Share Analysis, by Drug, 2024 and 2035

Figure 78: Middle East and Africa Neonatal Toxicology Market Attractiveness Analysis, By Drug, 2025 to 2035

Figure 79: Middle East and Africa Neonatal Toxicology Market Value Share Analysis, by End-user, 2024 and 2035

Figure 80: Middle East and Africa Neonatal Toxicology Market Attractiveness Analysis, by End-user, 2025 to 2035