Reports

Reports

Analysts’ Viewpoint on Nasal Dressings Market Scenario

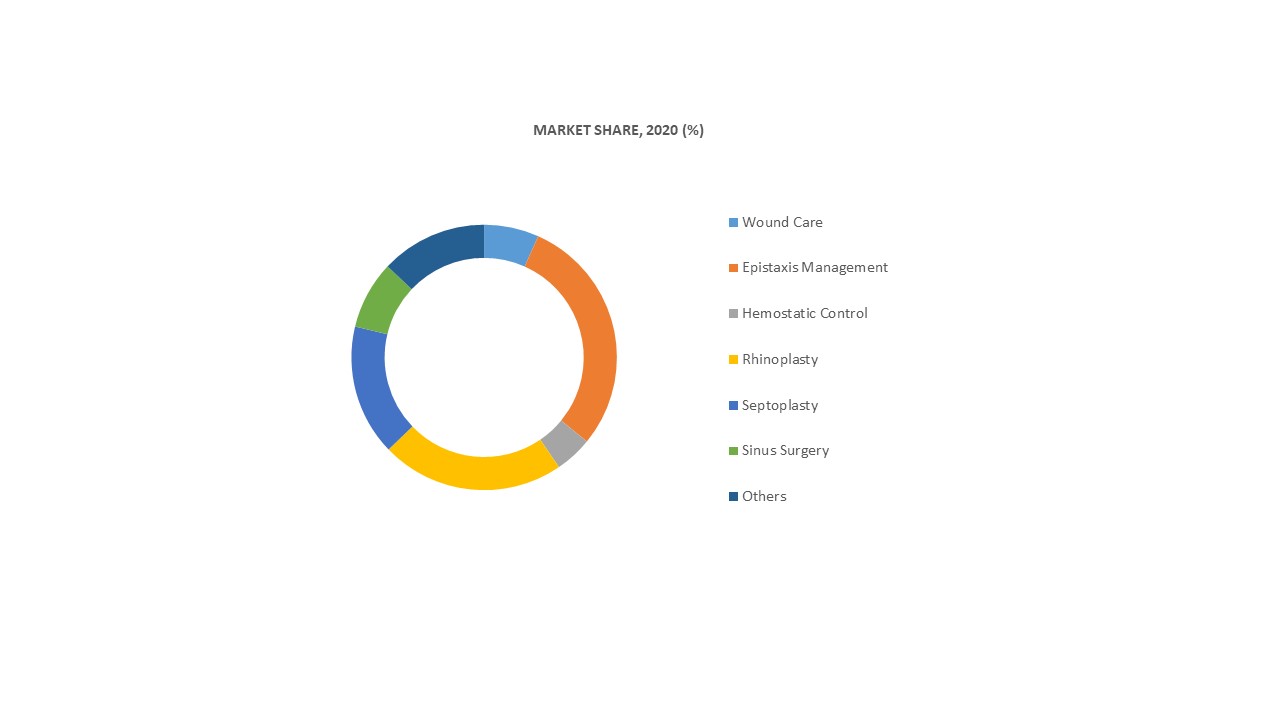

The global nasal dressings market is expected to be driven by increase in nasal injuries due to accidental damage, surge in nasal & cosmetic surgeries, and novel technological advancements in nasal surgeries. Nasal dressings are mostly used post-functional endoscopic sinus surgery (FESS) in order to prevent ongoing bleeding and manage the wound healing process. Nasal dressing assists in maximizing absorbance as well as wicking away of fluid, which helps in minimizing pain and chances of re-bleed upon removal. Nasal dressings have major applications in epistaxis management, sinus surgery, and wound care. These dressings are used to apply pressure to nasal septum. Nasal packing is a safe and effective method of treating anterior and posterior epistaxis. Nasal dressing packs are designed for use in various nasal surgeries, including septoplasty, turbinectomy, and rhinoplasty. Nasal pack dressings fill and support nasal cavities during surgery, enabling smooth septum ventilation to ensure patient comfort. Nasal packing devices apply constant local pressure to the nasal septum. Nasal packing works through direct pressure; consequent reduction of mucosal irritation, which decreases bleeding and clot formation surrounding the foreign body that increases pressure.

Nasal dressings are commonly used as an intranasal device that applies constant local pressure to the nasal septum, which prevents ongoing bleeding and promotes wound healing. Breakthrough innovations in the nasal dressings market such as the introduction of biodegradable nasal dressings are translating into revenue opportunities for manufacturers. They are innovating in biodegradable nasal dressings that are now extensively being used post nasal and sinus surgeries.

The revenue of nasal dressings market is projected to rise with robust biodegradable nasal dressings that are fragmentable dressings which biodegrade with regular irrigation of nasal cavity. This helps to eliminate the need to remove them, whilst reducing the risk of damaging the post-operative structures. Biodegradable nasal dressings provide a scaffold for better and faster wound healing, reduce the risk of adhesions, and promote local hemostasis.

Companies in the nasal dressings market are taking data-drive decisions before investing in new manufacturing and material technologies for nasal pack dressings. They are ensuring business continuity by maintaining robust supply chains for hospitals, ambulatory surgery centers, and for home care settings. The remote monitoring of patients in home care settings is driving market demand for nasal dressings.

Manufacturers are adopting contingency planning to tide over disruptions in customer demand, supply of materials, and availability of logistics services. They are increasing their local production capabilities to reduce dependence on other countries for raw materials. As such, reopening of country borders is helping to resolve transport and logistic issues.

Since conventional nasal dressing packs are associated with disadvantages such as excessive bleeding due to mucosal disturbance, headache, and nasal airway obstruction, manufacturers are innovating in biodegradable nasal dressings. Nevertheless, manufacturers are diversifying their production in polyvinyl alcohol (PVA), polyvinyl acetate (PVAc), & polyethylene glycol (PEG) nasal packing to generate revenue streams. These nasal packing are emerging as key market segments in nasal dressings product portfolio.

Manufacturers in the nasal dressings market are adhering to ISO standards to boost their credibility in the production of PVA nasal dressings. Different nasal surgeries, including rhinoplasty, septoplasty and turbinectomy are contributing to nasal dressings market expansion. These nasal packing devices help to fill and support nasal cavities during surgery, allowing smooth septum ventilation to ensure patient comfort.

The largest opportunity for nasal dressings is in bioresorbable nasal dressings. Manufacturers in the nasal dressings market are increasing the production of bioresorbable nasal packing devices for post sinus surgery applications to enable efficient epistaxis management. These novel nasal dressing packs provide a support to separate tissue and structure at the surgical site.

Companies are manufacturing bioresorbable nasal dressings that help in the prevention of adhesions between mucosal surfaces and assist in healing. In addition, these nasal packing dissolve gradually and cleared naturally, thus eliminating the need for painful nasal packing removal.

The Functional Endoscopic Sinus Surgery (FESS) has become the international standard for the treatment of refractory chronic rhinosinusitis. Such findings are increasing the market demand for nasal dressings in post-FESS procedures.

The most common complication encountered after FESS is the lateralization of the middle turbinate and the adhesion formation (synechia) that results in the occlusion of the sinus drainage pathway. This can lead to recurrent symptoms and subsequent surgical failure, as adhesions form when two opposing mucosal surfaces touch. This is leading to an increase in the revenue of nasal dressings market, since nasal dressing packs have a space-filling ability (bulking) to physically separate mucosal tissues such that adhesions are prevented from forming during the initial healing period of the tissue.

Assistive technologies such as nasal dressing holders are storming the nasal dressings market. These holders are replacing adhesive tapes to hold nasal dressings in place following nose bleeds, rhinoplasty, facial trauma, septoplasty, and sinus surgery. Manufacturers are innovating in clear plastic dressing holders that are secured by ear loops. Hook & loop fastener tabs can be infinitely adjusted to fit any patient comfortably. Such innovations are improving patient quality of life.

Biodegradable Nasal Dressings Segment to Lead Global Nasal Dressings Market

|

Attribute |

Detail |

|

Market Size Value in 2020 |

US$ 1.1 Bn |

|

Market Forecast Value in 2031 |

US$ 2.7 Bn |

|

Compound Annual Growth Rate (CAGR) |

9.01% |

|

Forecast Period |

2021–2031 |

|

Historical Data |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment and regional analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global nasal dressings market was valued at US$ 1.1 Bn in 2020 and is projected to cross US$ 2.7 Bn by 2031

The global market is expected to expand at a CAGR of 9.01% during the forecast period

Rise in nasal & cosmetic surgeries, increase in nasal injuries due to accidental damage, and technological advancements in nasal surgeries drive the global market

The market in Asia Pacific is anticipated to expand at the fastest CAGR during the forecast period

The biodegradable nasal dressings segment constituted the largest market share in 2020

Datt Mediproducts Private Limited, First Aid Bandage Company (FABCO), Lohmann & Rauscher GmbH & Co. KG, Anika Therapeutics, Inc., Medtronic plc, Stryker Corporation, and Summit Medical LLC are the prominent players in the global market

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Nasal Dressings Market

4. Market Overview

4.1. Introduction

4.1.1. Product Type Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Nasal Dressings Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Technological Advancements

5.2. Pricing Analysis

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

5.4. Regulatory scenario, by Region/Globally

5.5. Global Tenders for Nasal Dressing Market

6. Global Nasal Dressings Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Non-biodegradable (conventional) Nasal Dressings

6.3.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

6.4. Market Attractiveness Analysis, by Product Type

7. Global Nasal Dressings Market Analysis and Forecast, by Material

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Material, 2017–2031

7.3.1. Chitosan Lactate & Chitosan Hydrochloride

7.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

7.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

7.3.4. Hyaluronic Acid (HA)

7.3.5. Synthetic Polyurethane Foam (SPF)

7.4. Market Attractiveness Analysis, by Material

8. Global Nasal Dressings Market Analysis and Forecast, by Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Application, 2017–2031

8.3.1. Wound Care

8.3.2. Epistaxis Management

8.3.3. Hemostatic Control

8.3.4. Rhinoplasty

8.3.5. Septoplasty

8.3.6. Sinus Surgery

8.3.7. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Nasal Dressings Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Clinics

9.3.2. Ambulatory Surgery Centers

9.3.3. Home Care Settings

9.4. Market Attractiveness Analysis, by End-user

10. Global Nasal Dressings Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness Analysis, by Region

11. North America Nasal Dressings Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Non-biodegradable (conventional) Nasal Dressings

11.2.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

11.3. Market Value Forecast, by Material, 2017–2031

11.3.1. Chitosan Lactate & Chitosan Hydrochloride

11.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

11.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

11.3.4. Hyaluronic Acid (HA)

11.3.5. Synthetic Polyurethane Foam (SPF)

11.4. Market Value Forecast, by Application, 2017–2031

11.4.1. Wound Care

11.4.2. Epistaxis Management

11.4.3. Hemostatic Control

11.4.4. Rhinoplasty

11.4.5. Septoplasty

11.4.6. Sinus Surgery

11.4.7. Others

11.5. Market Value Forecast, by End-user, 2017–2031

11.5.1. Hospitals & Clinics

11.5.2. Ambulatory Surgery Centers

11.5.3. Home Care Settings

11.6. Market Value Forecast, by Country, 2017–2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product Type

11.7.2. By Material

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Nasal Dressings Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Non-biodegradable (conventional) Nasal Dressings

12.2.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

12.3. Market Value Forecast, by Material, 2017–2031

12.3.1. Chitosan Lactate & Chitosan Hydrochloride

12.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

12.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

12.3.4. Hyaluronic Acid (HA)

12.3.5. Synthetic Polyurethane Foam (SPF)

12.4. Market Value Forecast, by Application, 2017–2031

12.4.1. Wound Care

12.4.2. Epistaxis Management

12.4.3. Hemostatic Control

12.4.4. Rhinoplasty

12.4.5. Septoplasty

12.4.6. Sinus Surgery

12.4.7. Others

12.5. Market Value Forecast, by End-user, 2017–2031

12.5.1. Hospitals & Clinics

12.5.2. Ambulatory Surgery Centers

12.5.3. Home Care Settings

12.6. Market Value Forecast, by Country/Sub-region, 2017–2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product Type

12.7.2. By Material

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Nasal Dressings Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Non-biodegradable (conventional) Nasal Dressings

13.2.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

13.3. Market Value Forecast, by Material, 2017–2031

13.3.1. Chitosan Lactate & Chitosan Hydrochloride

13.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

13.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

13.3.4. Hyaluronic Acid (HA)

13.3.5. Synthetic Polyurethane Foam (SPF)

13.4. Market Value Forecast, by Application, 2017–2031

13.4.1. Wound Care

13.4.2. Epistaxis Management

13.4.3. Hemostatic Control

13.4.4. Rhinoplasty

13.4.5. Septoplasty

13.4.6. Sinus Surgery

13.4.7. Others

13.5. Market Value Forecast, by End-user, 2017–2031

13.5.1. Hospitals & Clinics

13.5.2. Ambulatory Surgery Centers

13.5.3. Home Care Settings

13.6. Market Value Forecast, by Country/Sub-region, 2017–2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product Type

13.7.2. By Material

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Nasal Dressings Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Non-biodegradable (conventional) Nasal Dressings

14.2.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

14.3. Market Value Forecast, by Material, 2017–2031

14.3.1. Chitosan Lactate & Chitosan Hydrochloride

14.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

14.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

14.3.4. Hyaluronic Acid (HA)

14.3.5. Synthetic Polyurethane Foam (SPF)

14.4. Market Value Forecast, by Application, 2017–2031

14.4.1. Wound Care

14.4.2. Epistaxis Management

14.4.3. Hemostatic Control

14.4.4. Rhinoplasty

14.4.5. Septoplasty

14.4.6. Sinus Surgery

14.4.7. Others

14.5. Market Value Forecast, by End-user, 2017–2031

14.5.1. Hospitals & Clinics

14.5.2. Ambulatory Surgery Centers

14.5.3. Home Care Settings

14.6. Market Value Forecast, by Country/Sub-region, 2017–2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product Type

14.7.2. By Material

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Nasal Dressings Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Product Type, 2017–2031

15.2.1. Non-biodegradable (conventional) Nasal Dressings

15.2.2. Biodegradable (bioresorbable and biofragmentable) Nasal Dressings

15.3. Market Value Forecast, by Material, 2017–2031

15.3.1. Chitosan Lactate & Chitosan Hydrochloride

15.3.2. Polyvinyl Alcohol (PVA)/Polyvinyl Acetate (PVAc) & Polyethylene Glycol (PEG)

15.3.3. Cellulose & Carboxymethyl Cellulose (CMC)

15.3.4. Hyaluronic Acid (HA)

15.3.5. Synthetic Polyurethane Foam (SPF)

15.4. Market Value Forecast, by Application, 2017–2031

15.4.1. Wound Care

15.4.2. Epistaxis Management

15.4.3. Hemostatic Control

15.4.4. Rhinoplasty

15.4.5. Septoplasty

15.4.6. Sinus Surgery

15.4.7. Others

15.5. Market Value Forecast, by End-user, 2017–2031

15.5.1. Hospitals & Clinics

15.5.2. Ambulatory Surgery Centers

15.5.3. Home Care Settings

15.6. Market Value Forecast, by Country/Sub-region, 2017–2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product Type

15.7.2. By Material

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player - Competition Matrix (by tier and size of companies)

16.2. Market Share Analysis, by Region/Global

16.3. Company Profiles

16.3.1. Anika Therapeutics, Inc.

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. Datt Mediproducts Private Limited

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. SWOT Analysis

16.3.2.4. Strategic Overview

16.3.3. First Aid Bandage Company (FABCO)

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. SWOT Analysis

16.3.4. Lohmann & Rauscher GmbH & Co. KG

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. SWOT Analysis

16.3.5. Medtronic plc

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Olympus Corporation

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. Smith & Nephew plc

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Stryker Corporation

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Summit Medical LLC (Innovia Medical)

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. SWOT Analysis

List of Tables

Table 01: Global Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 03: Global Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Nasal Dressings Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Nasal Dressings Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 08: North America Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 09: North America Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Nasal Dressings Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 12: Europe Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 13: Europe Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 14: Europe Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 17: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 18: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 19: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, by Country/Sub Region, 2017–2031

Table 22: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 23: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 24: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, by Country/Sub Region, 2017–2031

Table 27: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 28: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, by Material, 2017–2031

Table 29: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 31: North America Nasal Dressings Market Share Analysis: Company Country Presence

Table 32: Europe Nasal Dressings Market Share Analysis: Company Country Presence (EU5)

Table 33: Asia Pacific Nasal Dressings Market Share Analysis: Company Country Presence (Australia)

List of Figures

Figure 01: Global Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 02: Global Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 03: Global Nasal Dressings Market (US$ Mn), by Non-biodegradable Nasal Dressings, 2017–2031

Figure 04: Global Nasal Dressings Market (US$ Mn), by Biodegradable Nasal Dressings, 2017–2031

Figure 05: Global Nasal Dressings Market, by Material, 2020 and 2031

Figure 06: Global Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 07: Global Nasal Dressings Market (US$ Mn), by Chitosan Lactate & Chitosan Hydrochloride, 2017–2031

Figure 08: Global Nasal Dressings Market (US$ Mn), by PVA/PVAc & PEG, 2017–2031

Figure 09: Global Nasal Dressings Market (US$ Mn), by Cellulose & Carboxymethyl Cellulose, 2017–2031

Figure 10: Global Nasal Dressings Market (US$ Mn), by Hyaluronic Acid, 2017–2031

Figure 11: Global Nasal Dressings Market (US$ Mn), by Synthetic Polyurethane Foam, 2017–2031

Figure 12: Global Nasal Dressings Market, by Application, 2020 and 2031

Figure 13: Global Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 14: Global Nasal Dressings Market (US$ Mn), by Wound Care, 2017–2031

Figure 15: Global Nasal Dressings Market (US$ Mn), by Epistaxis Management, 2017–2031

Figure 16: Global Nasal Dressings Market (US$ Mn), by Hemostatic Control, 2017–2031

Figure 17: Global Nasal Dressings Market (US$ Mn), by Rhinoplasty, 2017–2031

Figure 18: Global Nasal Dressings Market (US$ Mn), by Septoplasty, 2017–2031

Figure 19: Global Nasal Dressings Market (US$ Mn), by Sinus Surgery, 2017–2031

Figure 20: Global Nasal Dressings Market (US$ Mn), by Others, 2017–2031

Figure 21: Global Nasal Dressings Market, by End-user, 2020 and 2031

Figure 22: Global Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 23: Global Nasal Dressings Market (US$ Mn), by Hospitals & Clinics, 2017–2031

Figure 24: Global Nasal Dressings Market (US$ Mn), by Ambulatory Surgery Centers, 2017–2031

Figure 25: Global Nasal Dressings Market (US$ Mn), by Home Care Settings, 2017–2031

Figure 26: Global Nasal Dressings Market Value Share Analysis, by Region, 2020 and 2031

Figure 27: Global Nasal Dressings Market Attractiveness Analysis, by Region, 2021–2031

Figure 28: North America Nasal Dressings Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: North America Nasal Dressings Market Value Share Analysis, by Country, 2020 and 2031

Figure 30: North America Nasal Dressings Market Attractiveness Analysis, by Country, 2021–2031

Figure 31: North America Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 32: North America Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 33: North America Nasal Dressings Market, by Material, 2020 and 2031

Figure 34: North America Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 35: North America Nasal Dressings Market, by Application, 2020 and 2031

Figure 36: North America Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 37: North America Nasal Dressings Market, by End-user, 2020 and 2031

Figure 38: North America Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 39: Europe Nasal Dressings Market Value (US$ Mn) Forecast, 2017–2031

Figure 40: Europe Nasal Dressings Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 41: Europe Nasal Dressings Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 42: Europe Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 43: Europe Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 44: Europe Nasal Dressings Market, by Material, 2020 and 2031

Figure 45: Europe Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 46: Europe Nasal Dressings Market, by Application, 2020 and 2031

Figure 47: Europe Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 48: Europe Nasal Dressings Market, by End-user, 2020 and 2031

Figure 49: Europe Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 50: Asia Pacific Nasal Dressings Market Value (US$ Mn) Forecast, 2017–2031

Figure 51: Asia Pacific Nasal Dressings Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 52: Asia Pacific Nasal Dressings Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 53: Asia Pacific Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 54: Asia Pacific Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 55: Asia Pacific Nasal Dressings Market, by Material, 2020 and 2031

Figure 56: Asia Pacific Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 57: Asia Pacific Nasal Dressings Market, by Application, 2020 and 2031

Figure 58: Asia Pacific Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 59: Asia Pacific Nasal Dressings Market, by End-user, 2020 and 2031

Figure 60: Asia Pacific Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 61: Latin America Nasal Dressings Market Value (US$ Mn) Forecast, 2017–2031

Figure 62: Latin America Nasal Dressings Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 63: Latin America Nasal Dressings Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 64: Latin America Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 65: Latin America Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 66: Latin America Nasal Dressings Market, by Material, 2020 and 2031

Figure 67: Latin America Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 68: Latin America Nasal Dressings Market, by Application, 2020 and 2031

Figure 69: Latin America Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 70: Latin America Nasal Dressings Market, by End-user, 2020 and 2031

Figure 71: Latin America Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 72: Middle East & Africa Nasal Dressings Market Value (US$ Mn) Forecast, 2017–2031

Figure 73: Middle East & Africa Nasal Dressings Market Value Share Analysis, by Country/Sub-region, 2020 and 2031

Figure 74: Middle East & Africa Nasal Dressings Market Attractiveness Analysis, by Country/Sub-region, 2021–2031

Figure 75: Middle East & Africa Nasal Dressings Market, by Product Type, 2020 and 2031

Figure 76: Middle East & Africa Nasal Dressings Market Attractiveness Analysis, by Product Type, 2021–2031

Figure 77: Middle East & Africa Nasal Dressings Market, by Material, 2020 and 2031

Figure 78: Middle East & Africa Nasal Dressings Market Attractiveness Analysis, by Material, 2021–2031

Figure 79: Middle East & Africa Nasal Dressings Market, by Application, 2020 and 2031

Figure 80: Middle East & Africa Nasal Dressings Market Attractiveness Analysis, by Application, 2021–2031

Figure 81: Middle East & Africa Nasal Dressings Market, by End-user, 2020 and 2031

Figure 82: Middle East & Africa Nasal Dressings Market Attractiveness Analysis, by End-user, 2021–2031

Figure 83: Global Nasal Dressings Market Share Analysis, by Company, 2020

Figure 84: North America Nasal Dressings Market Share Analysis, by Company, 2020

Figure 85: Europe Nasal Dressings Market Share Analysis, by Company, 2020

Figure 86: Asia Pacific Nasal Dressings Market Share Analysis, by Company, 2020