Reports

Reports

Analysts’ Viewpoint on Market Scenario

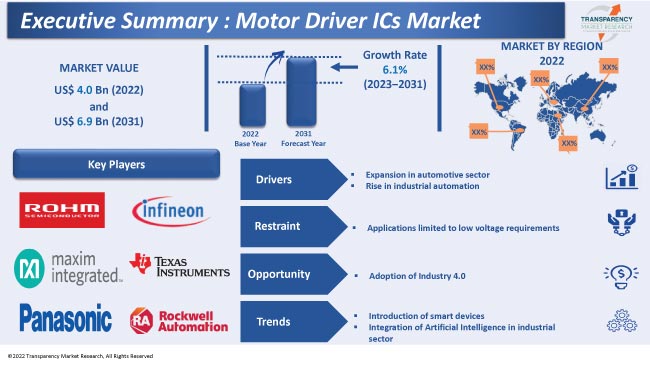

The market for motor driver ICs is driven by increase in demand for automation across various industries. Motor driver ICs are used in manufacturing equipment, such as conveyor belts, assembly lines, and robotic arms, as well as in home appliances, such as washing machines and refrigerators.

Rise in adoption of electric and hybrid vehicles is also expected to boost the motor driver ICs market value during the forecast period. Motor driver ICs are an essential component in controlling the electric motors that power these vehicles.

Motor driver IC manufacturers are offering advanced products with an extensive voltage range and current ratings. Asia Pacific is the most lucrative market for motor driver ICs, as the region is home to some of the world's largest automotive manufacturers.

Motor driver integrated circuit (IC) is an electronic device that is specifically designed to drive and control the operation of electric motors. It contains electronic circuits that provide the necessary signals to drive and control the speed, direction, and torque of the motor.

Motor driver ICs assist in various functions such as choosing the motor's backward or forward rotation, preventing overload, and controlling the motor speed. These ICs are widely employed in various electrical and electronics products including pumps, electric power steering, power sliding doors, refrigerators, water heaters, gaming consoles, surveillance cameras, and HVAC systems.

Increase in vehicle production and growth in demand for safety and comfort features in vehicles are boosting the demand for motor driver ICs in the automotive sector. Governments across the globe are implementing stringent regulations to curb carbon emissions and promote the adoption of electric vehicles (EVs). This is anticipated to drive the usage of microcontrollers and motor driver ICs in EVs.

According to the India Brand Equity Foundation, vehicle exports from India are projected to grow by five times from 2016 to 2026. Thus, rise in adoption of automobiles is estimated to spur the motor driver ICs market growth in the near future.

Electric power steering systems use motor driver ICs to control the steering wheel's movement, providing a more efficient and responsive steering system. Surge in demand for fuel-efficient cars has also led to the widespread adoption of electric power steering systems, augmenting adoption of motor driver ICs in the automotive sector.

Similarly, automatic sliding doors employ motor driver ICs to control the movement of the door, making them more efficient and reliable than manual doors. They are widely utilized in commercial buildings, hospitals, airports, and public transportation systems. Therefore, rise in usage of electric power steering and automatic sliding doors in various applications is likely to boost the motor driver ICs market expansion in the next few years.

Businesses across the globe are investing in automation to boost their production capabilities and reduce their operational costs. Motor driver ICs play a crucial role in the control of electric motors in industrial automation applications. They provide the necessary signals to drive and control the speed, direction, and torque of the motor, ensuring precise and reliable operation of the machines and equipment. Thus, growth in adoption of automation is fueling market progress.

According to the latest motor driver ICs market trends, the brushless DC motor segment held major share of 43.9% in 2022. The segment is projected to maintain its dominance and expand at a CAGR of 6.2% during the forecast period. Brushless DC motors are widely employed in various equipment and devices including computer fans, EVs, and drones. Rise in adoption of EVs is boosting the demand for brushless DC motors.

According to the latest motor driver ICs market analysis, the consumer electronics end-use industry segment accounted for largest share of 39.0% in 2022. The segment is projected to dominate the industry and rise at a CAGR of 6.2% from 2023 to 2031. Expansion in the consumer electronics sector is driving the segment.

Motor driver ICs are widely used in consumer electronics, where they play a critical role in the control of electric motors. Consumer electronics refers to a wide range of electronic devices designed for personal and home use, including appliances, personal computers, smartphones, and gaming consoles.

Asia Pacific is anticipated to hold largest share during the forecast period. The region held prominent share of 38.6% in 2022. Growth in the consumer electronics sector and the presence of major electronics manufacturers are augmenting market statistics in the region.

China, India, Japan, South Korea, and ASEAN are lucrative countries for these manufacturers due to the availability of low-cost labor and favorable government schemes. In February 2021, the Government of India launched Production Linked Incentive (PLI) scheme to boost domestic manufacturing.

North America and Europe held 28.8% and 23.6% share, respectively, in 2022. Surge in adoption of EVs to reduce carbon emissions and comply with the Paris Agreement on climate change is fueling market revenue in these regions.

The global industry is highly fragmented, with established players having a strong hold on the market. Allegro MicroSystems, Inc., Infineon Technologies AG, Maxim Integrated, Microchip Technology Inc., NXP Semiconductors, Panasonic Corporation, Rockwell Automation, Inc, STMicroelectronics, Texas Instruments Inc, Toshiba Corporation, Dialog Semiconductor, Power Integrations, Powerchip Semiconductor Manufacturing Corp, ROHM Semiconductor, and Diodes Incorporated are key entities operating in this industry.

Key players have been profiled in the motor driver ICs market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments. Manufacturers are constantly striving to innovate and develop new products that meet the changing needs of the industry. They are investing heavily in research and development to introduce new products and increase their motor driver ICs market share.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 4.0 Bn |

|

Market Forecast Value in 2031 |

US$ 6.9 Bn |

|

Growth Rate (CAGR) |

6.1% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 4.0 Bn in 2022.

It is expected to be 6.1% from 2023 to 2031.

Expansion in automotive sector and rise in industrial automation.

The brushless DC motor segment accounted for major share of 43.9% in 2022.

The consumer electronics segment accounted for major share of 39.0% in 2022.

Asia Pacific was a more attractive region for vendors and held 38.6% share in 2022.

The industry in China was valued at US$ 565.9 Mn in 2022.

Allegro MicroSystems, Inc., Infineon Technologies AG, Maxim Integrated, Microchip Technology Inc., NXP Semiconductors, Panasonic Corporation, Rockwell Automation, Inc, STMicroelectronics, Texas Instruments Inc, Toshiba Corporation, Dialog Semiconductor, Power Integrations, Powerchip Semiconductor Manufacturing Corp, ROHM Semiconductor, and Diodes Incorporated.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Motor Driver ICs Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Integrated Circuit Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap

4.5. Industry SWOT Analysis

4.6. Porter’s Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Motor Driver ICs Market Analysis, by Motor Type

5.1. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

5.1.1. Brushed DC Motor

5.1.2. Brushless DC Motor

5.1.3. Stepper Motor

5.2. Market Attractiveness Analysis, by Motor Type

6. Global Motor Driver ICs Market Analysis, by Material

6.1. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

6.1.1. Si (Silicon)

6.1.2. SiC (Silicon Carbide)

6.1.3. GaN (Gallium Arsenide)

6.2. Market Attractiveness Analysis, by Material

7. Global Motor Driver ICs Market Analysis, by Technology

7.1. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

7.1.1. MOSFET

7.1.2. IGBT

7.2. Market Attractiveness Analysis, by Technology

8. Global Motor Driver ICs Market Analysis, by Voltage Range

8.1. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

8.1.1. 3 V - 5 V

8.1.2. 5 V - 24 V

8.1.3. 5 V - 24 V

8.1.4. 48 V - 240 V

8.1.5. 240 V and Above

8.2. Market Attractiveness Analysis, by Voltage Range

9. Global Motor Driver ICs Market Analysis, by End-use Industry

9.1. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

9.1.1. Automotive

9.1.2. Consumer Electronics

9.1.3. Industrial

9.1.4. Medical

9.1.5. Others (Construction, Aerospace & Defense, etc.)

9.2. Market Attractiveness Analysis, by End-use Industry

10. Global Motor Driver ICs Market Analysis and Forecast, by Region

10.1. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Market Attractiveness Analysis, by Region

11. North America Motor Driver ICs Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

11.3.1. Brushed DC Motor

11.3.2. Brushless DC Motor

11.3.3. Stepper Motor

11.4. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

11.4.1. Si (Silicon)

11.4.2. SiC (Silicon Carbide)

11.4.3. GaN (Gallium Arsenide)

11.5. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

11.5.1. MOSFET

11.5.2. IGBT

11.6. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

11.6.1. 3 V - 5 V

11.6.2. 5 V - 24 V

11.6.3. 5 V - 24 V

11.6.4. 48 V - 240 V

11.6.5. 240 V and Above

11.7. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

11.7.1. Automotive

11.7.2. Consumer Electronics

11.7.3. Industrial

11.7.4. Medical

11.7.5. Others (Construction, Aerospace & Defense, etc.)

11.8. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.8.1. U.S.

11.8.2. Canada

11.8.3. Rest of North America

11.9. Market Attractiveness Analysis

11.9.1. by Motor Type

11.9.2. by Material

11.9.3. by Technology

11.9.4. by Voltage Range

11.9.5. by End-use Industry

11.9.6. by Country/Sub-region

12. Europe Pacific Motor Driver ICs Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

12.3.1. Brushed DC Motor

12.3.2. Brushless DC Motor

12.3.3. Stepper Motor

12.4. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

12.4.1. Si (Silicon)

12.4.2. SiC (Silicon Carbide)

12.4.3. GaN (Gallium Arsenide)

12.5. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

12.5.1. MOSFET

12.5.2. IGBT

12.6. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

12.6.1. 3 V - 5 V

12.6.2. 5 V - 24 V

12.6.3. 5 V - 24 V

12.6.4. 48 V - 240 V

12.6.5. 240 V and Above

12.7. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

12.7.1. Automotive

12.7.2. Consumer Electronics

12.7.3. Industrial

12.7.4. Medical

12.7.5. Others (Construction, Aerospace & Defense, etc.)

12.8. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.8.1. U.K.

12.8.2. Germany

12.8.3. France

12.8.4. Rest of Europe

12.9. Market Attractiveness Analysis

12.9.1. by Motor Type

12.9.2. by Material

12.9.3. by Technology

12.9.4. by Voltage Range

12.9.5. by End-use Industry

12.9.6. by Country/Sub-region

13. Asia Pacific Motor Driver ICs Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

13.3.1. Brushed DC Motor

13.3.2. Brushless DC Motor

13.3.3. Stepper Motor

13.4. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

13.4.1. Si (Silicon)

13.4.2. SiC (Silicon Carbide)

13.4.3. GaN (Gallium Arsenide)

13.5. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

13.5.1. MOSFET

13.5.2. IGBT

13.6. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

13.6.1. 3 V - 5 V

13.6.2. 5 V - 24 V

13.6.3. 5 V - 24 V

13.6.4. 48 V - 240 V

13.6.5. 240 V and Above

13.7. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

13.7.1. Automotive

13.7.2. Consumer Electronics

13.7.3. Industrial

13.7.4. Medical

13.7.5. Others (Construction, Aerospace & Defense, etc.)

13.8. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.8.1. China

13.8.2. Taiwan

13.8.3. Japan

13.8.4. South Korea

13.8.5. ASEAN

13.8.6. Rest of Asia Pacific

13.9. Market Attractiveness Analysis

13.9.1. by Motor Type

13.9.2. by Material

13.9.3. by Technology

13.9.4. by Voltage Range

13.9.5. by End-use Industry

13.9.6. by Country/Sub-region

14. Middle East & Africa Motor Driver ICs Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

14.3.1. Brushed DC Motor

14.3.2. Brushless DC Motor

14.3.3. Stepper Motor

14.4. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

14.4.1. Si (Silicon)

14.4.2. SiC (Silicon Carbide)

14.4.3. GaN (Gallium Arsenide)

14.5. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

14.5.1. MOSFET

14.5.2. IGBT

14.6. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

14.6.1. 3 V - 5 V

14.6.2. 5 V - 24 V

14.6.3. 5 V - 24 V

14.6.4. 48 V - 240 V

14.6.5. 240 V and Above

14.7. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

14.7.1. Automotive

14.7.2. Consumer Electronics

14.7.3. Industrial

14.7.4. Medical

14.7.5. Others (Construction, Aerospace & Defense, etc.)

14.8. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.8.1. GCC

14.8.2. South Africa

14.8.3. Rest of Middle East & Africa

14.9. Market Attractiveness Analysis

14.9.1. by Motor Type

14.9.2. by Material

14.9.3. by Technology

14.9.4. by Voltage Range

14.9.5. by End-use Industry

14.9.6. by Country/Sub-region

15. South America Motor Driver ICs Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Motor Type, 2017–2031

15.3.1. Brushed DC Motor

15.3.2. Brushless DC Motor

15.3.3. Stepper Motor

15.4. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Material, 2017–2031

15.4.1. Si (Silicon)

15.4.2. SiC (Silicon Carbide)

15.4.3. GaN (Gallium Arsenide)

15.5. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Technology, 2017–2031

15.5.1. MOSFET

15.5.2. IGBT

15.6. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by Voltage Range, 2017–2031

15.6.1. 3 V - 5 V

15.6.2. 5 V - 24 V

15.6.3. 5 V - 24 V

15.6.4. 48 V - 240 V

15.6.5. 240 V and Above

15.7. Motor Driver ICs Market Value (US$ Mn) Analysis & Forecast, by End-use Industry, 2017–2031

15.7.1. Automotive

15.7.2. Consumer Electronics

15.7.3. Industrial

15.7.4. Medical

15.7.5. Others (Construction, Aerospace & Defense, etc.)

15.8. Motor Driver ICs Market Value (US$ Mn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

15.8.1. Brazil

15.8.2. Rest of South America

15.9. Market Attractiveness Analysis

15.9.1. by Motor Type

15.9.2. by Material

15.9.3. by Technology

15.9.4. by Voltage Range

15.9.5. by End-use Industry

15.9.6. by Country/Sub-region

16. Competition Assessment

16.1. Global Motor Driver ICs Market Competition Matrix - a Dashboard View

16.1.1. Global Motor Driver ICs Market Company Share Analysis, by Value (2020)

16.1.2. Technological Differentiator

17. Company Profiles (Global Manufacturers/Suppliers)

17.1. Allegro MicroSystems, Inc.

17.1.1. Overview

17.1.2. Product Portfolio

17.1.3. Sales Footprint

17.1.4. Key Subsidiaries or Distributors

17.1.5. Strategy and Recent Developments

17.1.6. Financial Analysis

17.2. Infineon Technologies AG

17.2.1. Overview

17.2.2. Product Portfolio

17.2.3. Sales Footprint

17.2.4. Key Subsidiaries or Distributors

17.2.5. Strategy and Recent Developments

17.2.6. Financial Analysis

17.3. Maxim Integrated

17.3.1. Overview

17.3.2. Product Portfolio

17.3.3. Sales Footprint

17.3.4. Key Subsidiaries or Distributors

17.3.5. Strategy and Recent Developments

17.3.6. Financial Analysis

17.4. Microchip Technology Inc.

17.4.1. Overview

17.4.2. Product Portfolio

17.4.3. Sales Footprint

17.4.4. Key Subsidiaries or Distributors

17.4.5. Strategy and Recent Developments

17.4.6. Financial Analysis

17.5. NXP Semiconductors

17.5.1. Overview

17.5.2. Product Portfolio

17.5.3. Sales Footprint

17.5.4. Key Subsidiaries or Distributors

17.5.5. Strategy and Recent Developments

17.5.6. Financial Analysis

17.6. Panasonic Corporation

17.6.1. Overview

17.6.2. Product Portfolio

17.6.3. Sales Footprint

17.6.4. Key Subsidiaries or Distributors

17.6.5. Strategy and Recent Developments

17.6.6. Financial Analysis

17.7. Rockwell Automation, Inc.

17.7.1. Overview

17.7.2. Product Portfolio

17.7.3. Sales Footprint

17.7.4. Key Subsidiaries or Distributors

17.7.5. Strategy and Recent Developments

17.7.6. Financial Analysis

17.8. STMicroelectronics

17.8.1. Overview

17.8.2. Product Portfolio

17.8.3. Sales Footprint

17.8.4. Key Subsidiaries or Distributors

17.8.5. Strategy and Recent Developments

17.8.6. Financial Analysis

17.9. Texas Instruments Inc.

17.9.1. Overview

17.9.2. Product Portfolio

17.9.3. Sales Footprint

17.9.4. Key Subsidiaries or Distributors

17.9.5. Strategy and Recent Developments

17.9.6. Financial Analysis

17.10. Toshiba Corporation

17.10.1. Overview

17.10.2. Product Portfolio

17.10.3. Sales Footprint

17.10.4. Key Subsidiaries or Distributors

17.10.5. Strategy and Recent Developments

17.10.6. Financial Analysis

17.11. Dialog Semiconductor

17.11.1. Overview

17.11.2. Product Portfolio

17.11.3. Sales Footprint

17.11.4. Key Subsidiaries or Distributors

17.11.5. Strategy and Recent Developments

17.11.6. Financial Analysis

17.12. Power Integrations

17.12.1. Overview

17.12.2. Product Portfolio

17.12.3. Sales Footprint

17.12.4. Key Subsidiaries or Distributors

17.12.5. Strategy and Recent Developments

17.12.6. Financial Analysis

17.13. Powerchip Semiconductor Manufacturing Corp.

17.13.1. Overview

17.13.2. Product Portfolio

17.13.3. Sales Footprint

17.13.4. Key Subsidiaries or Distributors

17.13.5. Strategy and Recent Developments

17.13.6. Financial Analysis

17.14. ROHM Semiconductor

17.14.1. Overview

17.14.2. Product Portfolio

17.14.3. Sales Footprint

17.14.4. Key Subsidiaries or Distributors

17.14.5. Strategy and Recent Developments

17.14.6. Financial Analysis

17.15. Diodes Incorporated

17.15.1. Overview

17.15.2. Product Portfolio

17.15.3. Sales Footprint

17.15.4. Key Subsidiaries or Distributors

17.15.5. Strategy and Recent Developments

17.15.6. Financial Analysis

18. Recommendation

18.1. Opportunity Assessment

18.1.1. by Motor Type

18.1.2. by Material

18.1.3. by Technology

18.1.4. by Voltage Range

18.1.5. by End-use Industry

18.1.6. by Region

List of Tables

Table 1: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 2: Global Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 3: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 4: Global Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 5: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 6: Global Motor Driver ICs Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 7: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by Voltage Range, 2017‒2031

Table 8: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 9: Global Motor Driver ICs Market Value (US$ Mn) & Forecast, by Region, 2017‒2031

Table 10: Global Motor Driver ICs Market Volume (Million Units) & Forecast, by Region, 2017‒2031

Table 11: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 12: North America Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 13: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 14: North America Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 15: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 16: North America Motor Driver ICs Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 17: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Voltage Range, 2017‒2031

Table 18: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 19: North America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 20: North America Motor Driver ICs Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 21: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 22: Europe Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 23: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 24: Europe Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 25: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 26: Europe Motor Driver ICs Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 27: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by Voltage Range, 2017‒2031

Table 28: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 29: Europe Motor Driver ICs Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 30: Europe Motor Driver ICs Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 31: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 32: Asia Pacific Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 33: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 34: Asia Pacific Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 35: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 36: Asia Pacific Motor Driver ICs Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 37: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by Voltage Range, 2017‒2031

Table 38: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 39: Asia Pacific Motor Driver ICs Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 40: Asia Pacific Motor Driver ICs Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 41: Middle East & Africa Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 42: Middle East & Africa Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 43: Middle East & Africa Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 44: Middle East & Africa Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 45: Middle East & Africa Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 46: Middle East & Africa Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 47: Middle East & Africa Motor Driver ICs Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 48: Middle East & Africa Motor Driver ICs Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

Table 49: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Motor Type, 2017‒2031

Table 50: South America Motor Driver ICs Market Volume (Million Units) & Forecast, by Motor Type, 2017‒2031

Table 51: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Material, 2017‒2031

Table 52: South America Motor Driver ICs Market Volume (Million Units) & Forecast, by Material, 2017‒2031

Table 53: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Technology, 2017‒2031

Table 54: South America Motor Driver ICs Market Volume (Million Units) & Forecast, by Technology, 2017‒2031

Table 55: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Voltage Range, 2017‒2031

Table 56: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by End-use Industry, 2017‒2031

Table 57: South America Motor Driver ICs Market Value (US$ Mn) & Forecast, by Country and Sub-region, 2017‒2031

Table 58: South America Motor Driver ICs Market Volume (Million Units) & Forecast, by Country and Sub-region, 2017‒2031

List of Figures

Figure 01: Supply Chain Analysis - Global Motor Driver ICs Market

Figure 02: Porter Five Forces Analysis - Global Motor Driver ICs Market

Figure 03: Technology Road Map - Global Motor Driver ICs Market

Figure 04: Global Motor Driver ICs Market, Value (US$ Mn), 2017-2031

Figure 05: Global Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 06: Global Motor Driver ICs Market Projections by Motor Type, Value (US$ Mn), 2017‒2031

Figure 07: Global Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 08: Global Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 09: Global Motor Driver ICs Market Projections by Material, Value (US$ Mn), 2017‒2031

Figure 10: Global Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 11: Global Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 12: Global Motor Driver ICs Market Projections by Technology, Value (US$ Mn), 2017‒2031

Figure 13: Global Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 14: Global Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 15: Global Motor Driver ICs Market Projections by Voltage Range, Value (US$ Mn), 2017‒2031

Figure 16: Global Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 17: Global Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 18: Global Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 19: Global Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 20: Global Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 21: Global Motor Driver ICs Market Projections by Region, Value (US$ Mn), 2017‒2031

Figure 22: Global Motor Driver ICs Market, Incremental Opportunity, by Region, 2022‒2031

Figure 23: Global Motor Driver ICs Market Share Analysis, by Region, 2022 and 2031

Figure 24: North America Motor Driver ICs Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 25: North America Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 26: North America Motor Driver ICs Market Projections by Motor Type Value (US$ Mn), 2017‒2031

Figure 27: North America Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 28: North America Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 29: North America Motor Driver ICs Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 30: North America Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 31: North America Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 32: North America Motor Driver ICs Market Projections by Technology Value (US$ Mn), 2017‒2031

Figure 33: North America Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 34: North America Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 35: North America Motor Driver ICs Market Projections by Voltage Range Value (US$ Mn), 2017‒2031

Figure 36: North America Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 37: North America Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 38: North America Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 39: North America Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 40: North America Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 41: North America Motor Driver ICs Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 42: North America Motor Driver ICs Market, Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 43: North America Motor Driver ICs Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 44: Europe Motor Driver ICs Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 45: Europe Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 46: Europe Motor Driver ICs Market Projections by Motor Type Value (US$ Mn), 2017‒2031

Figure 47: Europe Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 48: Europe Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 49: Europe Motor Driver ICs Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 50: Europe Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 51: Europe Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 52: Europe Motor Driver ICs Market Projections by Technology Value (US$ Mn), 2017‒2031

Figure 53: Europe Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 54: Europe Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 55: Europe Motor Driver ICs Market Projections by Voltage Range Value (US$ Mn), 2017‒2031

Figure 56: Europe Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 57: Europe Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 58: Europe Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 59: Europe Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 60: Europe Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 61: Europe Motor Driver ICs Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 62: Europe Motor Driver ICs Market, Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 63: Europe Motor Driver ICs Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 64: Asia Pacific Motor Driver ICs Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 65: Asia Pacific Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 66: Asia Pacific Motor Driver ICs Market Projections by Motor Type Value (US$ Mn), 2017‒2031

Figure 67: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 68: Asia Pacific Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 69: Asia Pacific Motor Driver ICs Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 70: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 71: Asia Pacific Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 72: Asia Pacific Motor Driver ICs Market Projections by Technology Value (US$ Mn), 2017‒2031

Figure 73: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 74: Asia Pacific Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 75: Asia Pacific Motor Driver ICs Market Projections by Voltage Range Value (US$ Mn), 2017‒2031

Figure 76: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 77: Asia Pacific Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 78: Asia Pacific Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 79: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 80: Asia Pacific Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 81: Asia Pacific Motor Driver ICs Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 82: Asia Pacific Motor Driver ICs Market, Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 83: Asia Pacific Motor Driver ICs Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 84: Middle East & Africa Motor Driver ICs Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 85: Middle East & Africa Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 86: Middle East & Africa Motor Driver ICs Market Projections by Motor Type Value (US$ Mn), 2017‒2031

Figure 87: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 88: Middle East & Africa Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 89: Middle East & Africa Motor Driver ICs Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 90: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 91: Middle East & Africa Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 92: Middle East & Africa Motor Driver ICs Market Projections by Technology Value (US$ Mn), 2017‒2031

Figure 93: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 94: Middle East & Africa Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 95: Middle East & Africa Motor Driver ICs Market Projections by Voltage Range Value (US$ Mn), 2017‒2031

Figure 96: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 97: Middle East & Africa Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 98: Middle East & Africa Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 99: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 100: Middle East & Africa Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 101: Middle East & Africa Motor Driver ICs Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 102: Middle East & Africa Motor Driver ICs Market, Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 103: Middle East & Africa Motor Driver ICs Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 104: South America Motor Driver ICs Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 105: South America Motor Driver ICs Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 106: South America Motor Driver ICs Market Projections by Motor Type Value (US$ Mn), 2017‒2031

Figure 107: South America Motor Driver ICs Market, Incremental Opportunity, by Motor Type, 2022‒2031

Figure 108: South America Motor Driver ICs Market Share Analysis, by Motor Type, 2022 and 2031

Figure 109: South America Motor Driver ICs Market Projections by Material Value (US$ Mn), 2017‒2031

Figure 110: South America Motor Driver ICs Market, Incremental Opportunity, by Material, 2022‒2031

Figure 111: South America Motor Driver ICs Market Share Analysis, by Material, 2022 and 2031

Figure 112: South America Motor Driver ICs Market Projections by Technology Value (US$ Mn), 2017‒2031

Figure 113: South America Motor Driver ICs Market, Incremental Opportunity, by Technology, 2022‒2031

Figure 114: South America Motor Driver ICs Market Share Analysis, by Technology, 2022 and 2031

Figure 115: South America Motor Driver ICs Market Projections by Voltage Range Value (US$ Mn), 2017‒2031

Figure 116: South America Motor Driver ICs Market, Incremental Opportunity, by Voltage Range, 2022‒2031

Figure 117: South America Motor Driver ICs Market Share Analysis, by Voltage Range, 2022 and 2031

Figure 118: South America Motor Driver ICs Market Projections by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 119: South America Motor Driver ICs Market, Incremental Opportunity, by End-use Industry, 2022‒2031

Figure 120: South America Motor Driver ICs Market Share Analysis, by End-use Industry, 2022 and 2031

Figure 121: South America Motor Driver ICs Market Projections by Country and Sub-region, Value (US$ Mn), 2017‒2031

Figure 122: South America Motor Driver ICs Market, Incremental Opportunity, by Country and Sub-region, 2022‒2031

Figure 123: South America Motor Driver ICs Market Share Analysis, by Country and Sub-region 2022 and 2031

Figure 124: Global Motor Driver ICs Market Competition

Figure 125: Global Motor Driver ICs Market Company Share Analysis