Reports

Reports

Analysts’ Viewpoint on Market Scenario

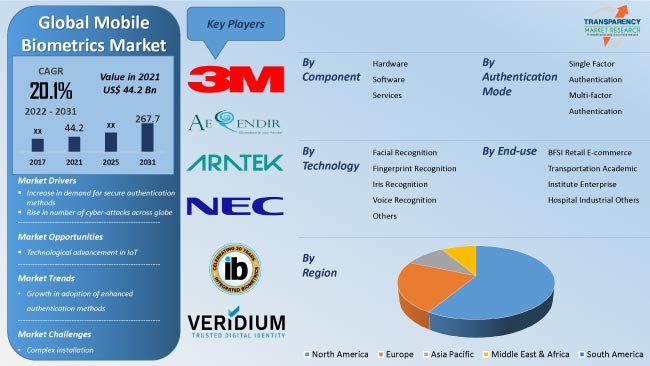

Companies in the market are focusing on high-growth industries such as BFSI, transportation, academic institutes, and enterprises in order to grow post the peak of the COVID-19 pandemic. Rise in demand for proper authentication methods and increase in number of cyber-attacks worldwide are fueling market statistics.

The Asia Pacific market is expected to grow significantly in the next few years, owing to the increase in number of vendors and growth in adoption of advanced biometrics systems in various industries, such as BFSI and retail, in the region. Top biometrics companies and manufacturers in the world are focusing on developing innovative biometric devices. End-use industries are opting for biometric fingerprint scanners rather than complex password authentication. The e-commerce sector is witnessing a rapid increase in demand for mobile biometric devices owing to an increase in number of small and medium-sized retail businesses across the world.

Mobile biometric authentication is used to detect and authenticate the identity of a user trying to access a mobile app. It can be accomplished in a number of ways, including fingerprint readers, facial recognition, and voice recognition. Mobile biometric authentication is most commonly used in banking and e-commerce sectors. In these sectors, customers can use facial recognition technology to authenticate transactions through their mobile applications. The global mobile biometrics market size is likely to increase during the forecast period, owing to the rapid growth in applications of biometric devices along with an increase in number of cyber-attacks across the globe.

Biometric security is gaining traction among individuals, organizations, and businesses to protect cyberspace from hackers and other malicious individuals. Surge in number of cyber-attacks around the world is one of the major factors driving mobile biometrics business growth.

According to PurpleSec, cybercrimes have increased by 600% due to the COVID-19 pandemic. Additionally, the annual number of enterprise security breaches increased by 27.4%. Businesses are investing heavily in two-factor authentication (2FA) or multi-factor authentication (MFA) to combat these cyber threats. According to Getapp data, in 2022, the majority (92 percent) of businesses in the U.S. used 2FA for at least some of their business applications. Therefore, rise in number of cyber-attacks is anticipated to fuel mobile biometrics market development in the next few years.

Rise in demand for appropriate authentication methods is driving the mobile biometrics industry growth. Authentication technology is constantly evolving. Businesses are shifting away from traditional password-based authentication. Popularity of advanced authentication technologies, such as facial recognition and fingerprint recognition, is increasingly due to their enhanced security. Attackers are not able to exploit passwords due to improved authentication methods and technologies, which helps prevent data breach.

Demand for various types of user authentication methods is rising for both online and offline systems. These authenticating methods are being employed in various organizations to secure their database and other resources.

According to the global mobile biometrics market report, the market has been segregated into hardware, software, and services, based on component. The software segment is likely to dominate during the forecast period. Rise in digitalization in developing economies is expected to drive the software segment during the forecast period.

Furthermore, growth of digital media and online content delivery has meant that traditional methods of authentication, such as signatures and text-based credentials, have become more difficult for users. Traditional authentication methods are highly vulnerable to cyber-attacks. Identity verification and management software can be used in healthcare, human resources, defense, and other industries. Biometric software enables users to own and control their identity while ensuring security and convenience. All these factors are contributing toward mobile biometrics market expansion.

Furthermore, rise in adoption of IoT in authentication systems is anticipated to create lucrative mobile biometrics business opportunities in the near future.

In terms of technology, the mobile biometrics market segmentation comprises facial recognition, fingerprint recognition, iris recognition, voice recognition, and others (ear acoustic authentication, vein recognition, etc.). The fingerprint recognition segment held the highest mobile biometrics market share, i.e. nearly 35% of the global market, in 2021.

The identity of an individual can be recognized by automated fingerprint recognition technology, by comparing two fingerprints. It is one of the most common biometric methods that can be used for mobile and computerized system authentication. The popularity of fingerprint recognition technology is increasing rapidly due to the ease of acquisition and benefits associated with it as compared to other biometric solutions. This is likely to propel the mobile biometrics market size during the forecast period.

According to the mobile biometrics market research report, Asia Pacific is expected to be a rapidly expanding market for mobile biometrics during the forecast period. This can be ascribed to the lucrative presence of leading players in major economies such as Japan, South Korea, and China. Furthermore, increase in demand for smartphones, computers, and tablets is creating significant opportunities for manufacturers of mobile biometric solutions in the region. This is projected to augment market progress during the forecast period.

North America dominated the global market and accounted for 34% share in 2021. The North America mobile biometrics market share is expected to increase in the next few years, owing to the high concentration of mobile biometric solution vendors in the region. Furthermore, rise in demand for mobile biometrics in diverse industries, such as BFSI, retail, healthcare, and e-commerce, is projected to fuel market expansion in the region during the forecast period.

The global market is consolidated, with a few large-scale players controlling majority of the share. Expansion of product portfolios, partnerships, and acquisitions are some of the major strategies adopted by key players in the market.

3M, Aerendir, Aratek, Aware, Inc., BioEnable, Integrated Biometrics, iProov, NEC Corporation, Phonexia, secunet Security Networks AG, Stytch, Synaptics Incorporated, and Veridium are some of the best biometrics companies operating in the global market.

The global mobile biometrics market forecast report profiles these key players based on product portfolio, recent developments, financial overview, business segments, business strategies, and company overview.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 44.2 Bn |

|

Market Forecast Value in 2031 |

US$ 267.7 Bn |

|

Growth Rate (CAGR) |

20.1% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Bn for Value & Million Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It stood at US$ 44.2 Bn in 2021

It is expected to grow at a CAGR of 20.1% by 2031

It is likely to reach US$ 267.7 Bn in 2031

3M, Aerendir, Aratek, Aware, Inc., BioEnable, Integrated Biometrics, iProov, NEC Corporation, Phonexia, secunet Security Networks AG, Stytch, Synaptics Incorporated, and Veridium

The U.S. accounted for approximately 25.0% share in 2021

The fingerprint recognition segment held around 35.0% share in 2021

Increase in demand for secure authentication methods and rise in number of cyber-attacks across globe

North America is a more lucrative region for vendors

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Mobile Biometrics Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview – Global Authentication Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. Covid-19 Impact and Recovery Analysis

5. Mobile Biometrics Market Analysis, by Component

5.1. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

5.1.1. Hardware

5.1.2. Software

5.1.3. Services

5.2. Market Attractiveness Analysis, By Component

6. Mobile Biometrics Market Analysis, by Authentication Mode

6.1. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

6.1.1. Single Factor Authentication

6.1.2. Multi-factor Authentication

6.2. Market Attractiveness Analysis, By Authentication Mode

7. Mobile Biometrics Market Analysis, by Technology

7.1. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

7.1.1. Facial Recognition

7.1.2. Fingerprint Recognition

7.1.3. Iris Recognition

7.1.4. Voice Recognition

7.1.5. Others

7.2. Market Attractiveness Analysis, By Technology

8. Mobile Biometrics Market Analysis, by End-use

8.1. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

8.1.1. BFSI

8.1.2. Retail

8.1.3. E-commerce

8.1.4. Transportation

8.1.5. Academic Institute

8.1.6. Enterprise

8.1.7. Hospital

8.1.8. Industrial

8.1.9. Others

8.2. Market Attractiveness Analysis, By End-use

9. Mobile Biometrics Market Analysis and Forecast, by Region

9.1. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Region, 2017–2031

9.1.1. North America

9.1.2. Europe

9.1.3. Asia Pacific

9.1.4. Middle East & Africa

9.1.5. South America

9.2. Market Attractiveness Analysis, By Region

10. North America Mobile Biometrics Market Analysis and Forecast

10.1. Market Snapshot

10.2. Drivers and Restraints: Impact Analysis

10.3. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

10.3.1. Hardware

10.3.2. Software

10.3.3. Services

10.4. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

10.4.1. Single Factor Authentication

10.4.2. Multi-factor Authentication

10.5. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

10.5.1. Facial Recognition

10.5.2. Fingerprint Recognition

10.5.3. Iris Recognition

10.5.4. Voice Recognition

10.5.5. Others

10.6. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

10.6.1. BFSI

10.6.2. Retail

10.6.3. E-commerce

10.6.4. Transportation

10.6.5. Academic Institute

10.6.6. Enterprise

10.6.7. Hospital

10.6.8. Industrial

10.6.9. Others

10.7. Mobile Biometrics Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

10.7.1. The U.S.

10.7.2. Canada

10.7.3. Rest of North America

10.8. Market Attractiveness Analysis

10.8.1. By Component

10.8.2. By Authentication Mode

10.8.3. By Technology

10.8.4. By End-use

10.8.5. By Country/Sub-region

11. Europe Mobile Biometrics Market Analysis and Forecast

11.1. Market Snapshot

11.2. Drivers and Restraints: Impact Analysis

11.3. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

11.3.1. Hardware

11.3.2. Software

11.3.3. Services

11.4. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

11.4.1. Single Factor Authentication

11.4.2. Multi-factor Authentication

11.5. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

11.5.1. Facial Recognition

11.5.2. Fingerprint Recognition

11.5.3. Iris Recognition

11.5.4. Voice Recognition

11.5.5. Others

11.6. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

11.6.1. BFSI

11.6.2. Retail

11.6.3. E-commerce

11.6.4. Transportation

11.6.5. Academic Institute

11.6.6. Enterprise

11.6.7. Hospital

11.6.8. Industrial

11.6.9. Others

11.7. Mobile Biometrics Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

11.7.1. U.K.

11.7.2. Germany

11.7.3. France

11.7.4. Rest of Europe

11.8. Market Attractiveness Analysis

11.8.1. By Component

11.8.2. By Authentication Mode

11.8.3. By Technology

11.8.4. By End-use

11.8.5. By Country/Sub-region

12. Asia Pacific Mobile Biometrics Market Analysis and Forecast

12.1. Market Snapshot

12.2. Drivers and Restraints: Impact Analysis

12.3. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

12.3.1. Hardware

12.3.2. Software

12.3.3. Services

12.4. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

12.4.1. Single Factor Authentication

12.4.2. Multi-factor Authentication

12.5. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

12.5.1. Facial Recognition

12.5.2. Fingerprint Recognition

12.5.3. Iris Recognition

12.5.4. Voice Recognition

12.5.5. Others

12.6. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

12.6.1. BFSI

12.6.2. Retail

12.6.3. E-commerce

12.6.4. Transportation

12.6.5. Academic Institute

12.6.6. Enterprise

12.6.7. Hospital

12.6.8. Industrial

12.6.9. Others

12.7. Mobile Biometrics Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

12.7.1. China

12.7.2. India

12.7.3. Japan

12.7.4. South Korea

12.7.5. ASEAN

12.7.6. Rest of Asia Pacific

12.8. Market Attractiveness Analysis

12.8.1. By Component

12.8.2. By Authentication Mode

12.8.3. By Technology

12.8.4. By End-use

12.8.5. By Country/Sub-region

13. Middle East & Africa Mobile Biometrics Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

13.3.1. Hardware

13.3.2. Software

13.3.3. Services

13.4. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

13.4.1. Single Factor Authentication

13.4.2. Multi-factor Authentication

13.5. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

13.5.1. Facial Recognition

13.5.2. Fingerprint Recognition

13.5.3. Iris Recognition

13.5.4. Voice Recognition

13.5.5. Others

13.6. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

13.6.1. BFSI

13.6.2. Retail

13.6.3. E-commerce

13.6.4. Transportation

13.6.5. Academic Institute

13.6.6. Enterprise

13.6.7. Hospital

13.6.8. Industrial

13.6.9. Others

13.7. Mobile Biometrics Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

13.7.1. GCC

13.7.2. South Africa

13.7.3. Rest of the Middle East & Africa

13.8. Market Attractiveness Analysis

13.8.1. By Component

13.8.2. By Authentication Mode

13.8.3. By Technology

13.8.4. By End-use

13.8.5. By Country/Sub-region

14. South America Mobile Biometrics Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Mobile Biometrics Market Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Component, 2017–2031

14.3.1. Hardware

14.3.2. Software

14.3.3. Services

14.4. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Authentication Mode, 2017–2031

14.4.1. Single Factor Authentication

14.4.2. Multi-factor Authentication

14.5. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by Technology, 2017–2031

14.5.1. Facial Recognition

14.5.2. Fingerprint Recognition

14.5.3. Iris Recognition

14.5.4. Voice Recognition

14.5.5. Others

14.6. Mobile Biometrics Market Value (US$ Bn) Analysis & Forecast, by End-use, 2017–2031

14.6.1. BFSI

14.6.2. Retail

14.6.3. E-commerce

14.6.4. Transportation

14.6.5. Academic Institute

14.6.6. Enterprise

14.6.7. Hospital

14.6.8. Industrial

14.6.9. Others

14.7. Mobile Biometrics Value (US$ Bn) and Volume (Million Units) Analysis & Forecast, by Country and Sub-region, 2017–2031

14.7.1. Brazil

14.7.2. Rest of South America

14.8. Market Attractiveness Analysis

14.8.1. By Component

14.8.2. By Authentication Mode

14.8.3. By Technology

14.8.4. By End-use

14.8.5. By Country/Sub-region

15. Competition Assessment

15.1. Global Mobile Biometrics Market Competition Matrix - a Dashboard View

15.1.1. Global Mobile Biometrics Market Company Share Analysis, by Value (2021)

15.1.2. Technological Differentiator

16. Company Profiles (Global Manufacturers/Suppliers)

16.1. 3M

16.1.1. Overview

16.1.2. Product Portfolio

16.1.3. Sales Footprint

16.1.4. Key Subsidiaries or Distributors

16.1.5. Strategy and Recent Developments

16.1.6. Key Financials

16.2. Aerendir

16.2.1. Overview

16.2.2. Product Portfolio

16.2.3. Sales Footprint

16.2.4. Key Subsidiaries or Distributors

16.2.5. Strategy and Recent Developments

16.2.6. Key Financials

16.3. Aratek

16.3.1. Overview

16.3.2. Product Portfolio

16.3.3. Sales Footprint

16.3.4. Key Subsidiaries or Distributors

16.3.5. Strategy and Recent Developments

16.3.6. Key Financials

16.4. Aware, Inc.

16.4.1. Overview

16.4.2. Product Portfolio

16.4.3. Sales Footprint

16.4.4. Key Subsidiaries or Distributors

16.4.5. Strategy and Recent Developments

16.4.6. Key Financials

16.5. BioEnable

16.5.1. Overview

16.5.2. Product Portfolio

16.5.3. Sales Footprint

16.5.4. Key Subsidiaries or Distributors

16.5.5. Strategy and Recent Developments

16.5.6. Key Financials

16.6. Integrated Biometrics

16.6.1. Overview

16.6.2. Product Portfolio

16.6.3. Sales Footprint

16.6.4. Key Subsidiaries or Distributors

16.6.5. Strategy and Recent Developments

16.6.6. Key Financials

16.7. iProov

16.7.1. Overview

16.7.2. Product Portfolio

16.7.3. Sales Footprint

16.7.4. Key Subsidiaries or Distributors

16.7.5. Strategy and Recent Developments

16.7.6. Key Financials

16.8. NEC Corporation

16.8.1. Overview

16.8.2. Product Portfolio

16.8.3. Sales Footprint

16.8.4. Key Subsidiaries or Distributors

16.8.5. Strategy and Recent Developments

16.8.6. Key Financials

16.9. Phonexia

16.9.1. Overview

16.9.2. Product Portfolio

16.9.3. Sales Footprint

16.9.4. Key Subsidiaries or Distributors

16.9.5. Strategy and Recent Developments

16.9.6. Key Financials

16.10. secunet Security Networks AG

16.10.1. Overview

16.10.2. Product Portfolio

16.10.3. Sales Footprint

16.10.4. Key Subsidiaries or Distributors

16.10.5. Strategy and Recent Developments

16.10.6. Key Financials

16.11. Stytch

16.11.1. Overview

16.11.2. Product Portfolio

16.11.3. Sales Footprint

16.11.4. Key Subsidiaries or Distributors

16.11.5. Strategy and Recent Developments

16.11.6. Key Financials

16.12. Synaptics Incorporated

16.12.1. Overview

16.12.2. Product Portfolio

16.12.3. Sales Footprint

16.12.4. Key Subsidiaries or Distributors

16.12.5. Strategy and Recent Developments

16.12.6. Key Financials

16.13. Veridium

16.13.1. Overview

16.13.2. Product Portfolio

16.13.3. Sales Footprint

16.13.4. Key Subsidiaries or Distributors

16.13.5. Strategy and Recent Developments

16.13.6. Key Financials

17. Recommendation

17.1. Opportunity Assessment

17.1.1. By Component

17.1.2. By Authentication Mode

17.1.3. By Technology

17.1.4. By End-use

17.1.5. By Region

List of Tables

Table 01: Global Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 02: Global Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 03: Global Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 04: Global Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 05: Global Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 06: Global Mobile Biometrics Market Size & Forecast, by Region, Value (US$ Bn), 2017-2031

Table 07: Global Mobile Biometrics Market Size & Forecast, by Region, Volume (Million Units), 2017-2031

Table 08: North America Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 09: North America Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 10: North America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 11: North America Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 12: North America Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 13: North America Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 14: North America Mobile Biometrics Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 15: Europe Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 16: Europe Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 17: Europe Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 18: Europe Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 19: Europe Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 20: Europe Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 21: Europe Mobile Biometrics Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 22: Asia Pacific Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 23: Asia Pacific Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 24: Asia Pacific Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 25: Asia Pacific Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 26: Asia Pacific Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 27: Asia Pacific Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 28: Asia Pacific Mobile Biometrics Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 29: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 30: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 31: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 32: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 33: Middle East & Africa Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 34: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 35: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

Table 36: South America Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2017-2031

Table 37: South America Mobile Biometrics Market Size & Forecast, by Component, Volume (Million Units), 2017-2031

Table 38: South America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2017-2031

Table 39: South America Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2017-2031

Table 40: South America Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2017-2031

Table 41: South America Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2017-2031

Table 42: South America Mobile Biometrics Market Size & Forecast, by Country, Volume (Million Units), 2017-2031

List of Figures

Figure 01: Global Mobile Biometrics Market Share Analysis, by Region

Figure 02: Global Mobile Biometrics Price Trend Analysis (Average Price, US$)

Figure 03: Global Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 04: Global Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 05: Global Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 06: Global Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 07: Global Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 08: Global Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 09: Global Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 10: Global Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 11: Global Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 12: Global Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 13: Global Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 14: Global Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 15: Global Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 16: Global Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 17: Global Mobile Biometrics Market Size & Forecast, by Region, Revenue (US$ Bn), 2017-2031

Figure 18: Global Mobile Biometrics Market Attractiveness, by Region, Value (US$ Bn), 2022-2031

Figure 19: Global Mobile Biometrics Market Size & Forecast, by Region, Value (US$ Bn), 2022-2031

Figure 20: North America Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 21: North America Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 22: North America Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 23: North America Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 24: North America Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 25: North America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 26: North America Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 27: North America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 28: North America Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 29: North America Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 30: North America Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 31: North America Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 32: North America Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 33: North America Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 34: North America Mobile Biometrics Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 35: North America Mobile Biometrics Market Attractiveness, by Country, Value (US$ Bn), 2022-2031

Figure 36: North America Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2022-2031

Figure 37: Europe Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 38: Europe Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 39: Europe Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 40: Europe Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 41: Europe Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 42: Europe Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 43: Europe Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 44: Europe Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 45: Europe Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 46: Europe Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 47: Europe Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 48: Europe Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 49: Europe Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 50: Europe Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 51: Europe Mobile Biometrics Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 52: Europe Mobile Biometrics Market Attractiveness, by Country, Value (US$ Bn), 2022-2031

Figure 53: Europe Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2022-2031

Figure 54: Asia Pacific Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 55: Asia Pacific Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 56: Asia Pacific Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 57: Asia Pacific Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 58: Asia Pacific Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 59: Asia Pacific Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 60: Asia Pacific Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 61: Asia Pacific Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 62: Asia Pacific Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 63: Asia Pacific Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 64: Asia Pacific Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 65: Asia Pacific Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 66: Asia Pacific Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 67: Asia Pacific Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 68: Asia Pacific Mobile Biometrics Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 69: Asia Pacific Mobile Biometrics Market Attractiveness, by Country, Value (US$ Bn), 2022-2031

Figure 70: Asia Pacific Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2022-2031

Figure 71: Middle East & Africa Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 72: Middle East & Africa Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 73: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 74: Middle East & Africa Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 75: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 76: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 77: Middle East & Africa Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 78: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 79: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 80: Middle East & Africa Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 81: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 82: Middle East & Africa Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 83: Middle East & Africa Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 84: Middle East & Africa Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 85: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 86: Middle East & Africa Mobile Biometrics Market Attractiveness, by Country, Value (US$ Bn), 2022-2031

Figure 87: Middle East & Africa Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2022-2031

Figure 88: South America Mobile Biometrics Market, Value (US$ Bn), 2017-2031

Figure 89: South America Mobile Biometrics Market, Volume (Million Units), 2017-2031

Figure 90: South America Mobile Biometrics Market Size & Forecast, by Component, Revenue (US$ Bn), 2017-2031

Figure 91: South America Mobile Biometrics Market Attractiveness, by Component, Value (US$ Bn), 2022-2031

Figure 92: South America Mobile Biometrics Market Size & Forecast, by Component, Value (US$ Bn), 2022-2031

Figure 93: South America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Revenue (US$ Bn), 2017-2031

Figure 94: South America Mobile Biometrics Market Attractiveness, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 95: South America Mobile Biometrics Market Size & Forecast, by Authentication Mode, Value (US$ Bn), 2022-2031

Figure 96: South America Mobile Biometrics Market Size & Forecast, by Technology, Revenue (US$ Bn), 2017-2031

Figure 97: South America Mobile Biometrics Market Attractiveness, by Technology, Value (US$ Bn), 2022-2031

Figure 98: South America Mobile Biometrics Market Size & Forecast, by Technology, Value (US$ Bn), 2022-2031

Figure 99: South America Mobile Biometrics Market Size & Forecast, by End-use, Revenue (US$ Bn), 2017-2031

Figure 100: South America Mobile Biometrics Market Attractiveness, by End-use, Value (US$ Bn), 2022-2031

Figure 101: South America Mobile Biometrics Market Size & Forecast, by End-use, Value (US$ Bn), 2022-2031

Figure 102: South America Mobile Biometrics Market Size & Forecast, by Country, Revenue (US$ Bn), 2017-2031

Figure 103: South America Mobile Biometrics Market Attractiveness, by Country, Value (US$ Bn), 2022-2031

Figure 104: South America Mobile Biometrics Market Size & Forecast, by Country, Value (US$ Bn), 2022-2031

Figure 105: Global Mobile Biometrics Market Share Analysis, by Company