Reports

Reports

The global microturbines market is gaining traction as distributed energy solutions are turning out to be necessary for efficiency, reliability, and sustainability. It will be a growth market primarily due to a strong push upwards in for the direction of combined heat and power (CHP) systems, which capture excess heat from producing electricity and thus improve fuel efficiency and reduce carbon emissions.

Microturbines are also utilized in oil & gas fields, in commercial buildings, and where a connection to the grid is limited or where or backup power generation is crucial. Microturbines can operate on more than one fuel, including natural gas, biogas and liquid fuels, which adds more flexibility and attractiveness for use in the move toward cleaner energy.

Key players are actively innovating to improve the efficiency of their turbine, lower emissions, and vary fuel sources, as well as promoting strategic partnerships and planning to invest in hybrid systems of microturbines, renewable energy systems, and energy storage systems. There are also government incentives that support low-emission power generation coupled with the push for reduced environmental impact from power generation, which are fueling interest in microturbines. Together, these factors will present microturbines as a competitive option for decentralized power generation in both - matured and developing economies.

The microturbines sector emphasizes small combustion turbines between 12 kW and 500 kW, which are designed for distributed power generation. Microturbines imply compact systems that generate electricity from fuel in high-speed turbines while recovering waste heat for combined heat and power (CHP).

Microturbines can use a variety of fuels such as natural gas, biogas, diesel and kerosene, thereby allowing for flexibility for all kinds of users. These devices are typically used in industrial facilities, commercial buildings, remote oil and gas fields, and residential complexes for reliable on-site energy, as backup, or as a continuous off-grid power source.

| Attribute | Detail |

|---|---|

| Drivers |

|

One of the principal business drivers to the microturbines market is their spike in adoption in the oil & gas industry. Associated gas is produced far away from processing capabilities, or it is too erratic for pipeline supply, thereby leaving all that gas to be flared off, which is increasingly being regulated for environmental protection.

Microturbines take this stranded gas or flare gas with low emissions and convert it into electricity and heat. This practice commercializes a gas that would otherwise be wasted, ensuring compliance with the regulations. The compact size and ability to process in harsh environments create value and efficiency in remote operations such as stationary wellheads, thereby producing platforms offshore and pipeline compressor stations that have poor grid connections. In addition, microturbines cut fuel costs, reduce carbon footprint, and add resiliency and redundancy to oil & gas firms.

Some of the major participants in the microturbine space including Capstone Green Energy have collaborated at the commercial level to build a microturbine for sustainability and efficiency. As pressure mounts around the world to reduce methane emissions and fulfilling ESG reporting, microturbines provide a practical way for energy companies to comply with more regulations while also creating value for stranded gas. Given this convergence of sustainability and process regulation, the rate of adoption of microturbines will continue to grow in upstream and midstream operations of energy companies around the world.

Another specific growth driver for microturbines is the increased adoption of small biogas powered systems in waste-to-energy and renewable energy projects. Biogas is generated in large quantities at municipal solid waste facilities, wastewater treatment plants and agriculture, and if that biogas is not captured and utilized, it is released into the atmosphere as methane that has a far higher global warming potential than CO₂.

Microturbines are an excellent solution for capturing low-BTU biogas and converting it to on-site reliable electricity and heat, thereby allowing operators to cut emissions and rely less on the electric grid. They are a preferred choice for waste-to-energy facilities primarily as they offer cleaner combustion than internal combustion engines and have a higher tolerance for variations in gas quality. Local governments and municipal authorities, along with industry operators, are increasingly using microturbines in their circular economy plans. Supportive government incentives for renewable distributed generation and stricter landfill emission compliance in North America and Europe are also supporting the trend toward using biogas on-site in biogas projects with microturbines.

| Attribute | Detail |

| Leading Region |

|

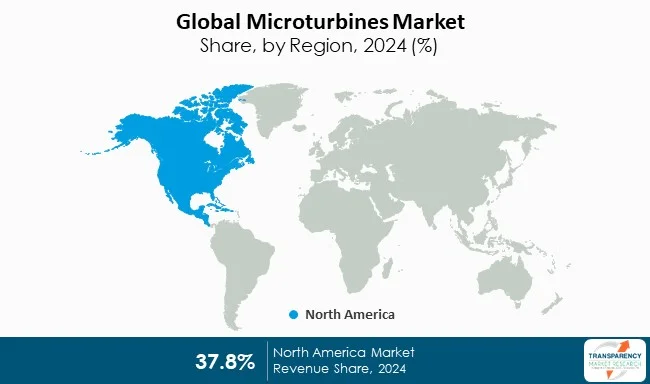

In North America, the U.S. federal programs and deployment activity indicate the strongest government support and market penetration for microturbines. The DOE has executed the Advanced Microturbine System (AMTS) program and market assessments focusing on the region, thereby assessing early commercial shipments and R&D support. DOE and EPA case documents also have numerous microturbine projects deployed in U.S. landfill-gas, wellhead and wastewater (DOE lists Capstone's >100 wellhead projects), indicating real practicality, multi-sectored uptake (oil & gas, LFG, WWTP). The combination of DOE R&D, EPA LFG/LMOP project tracking, ready to capture widespread natural gas infrastructure, and sector specific pilots can easily explain the U.S. adoption dimension.

European official sources show a significant policy focus on CHP and micro-CHP, as it fits within energy-efficiency and decarbonization strategies. The EU collects dedicated CHP statistics, and provides funding for micro-CHP/microturbine R&D and field trials resulting in meaningful microturbine activity across the member states.

Each of these players has been profiled in the microturbines market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

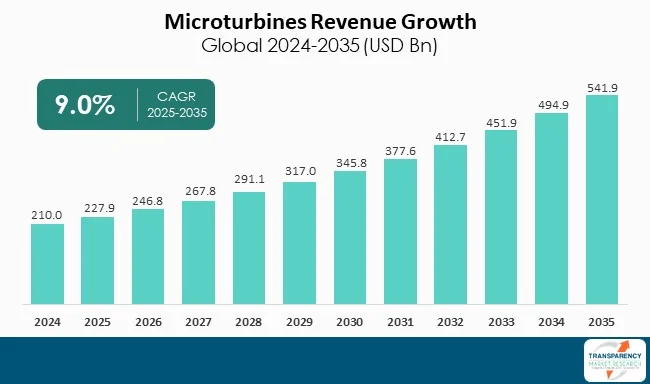

| Market Size Value in 2024 | US$ 210.0 Mn |

| Market Forecast Value in 2035 | US$ 541.9 Mn |

| Growth Rate (CAGR) | 9.0% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Units for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Microturbines market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The microturbines market was valued at US$ 210 Mn in 2024

The microturbines industry is expected to grow at a CAGR of 9.0% from 2025 to 2035

Microturbines for flare gas utilization in oil & gas and biogas-fueled microturbines driving waste-to-energy

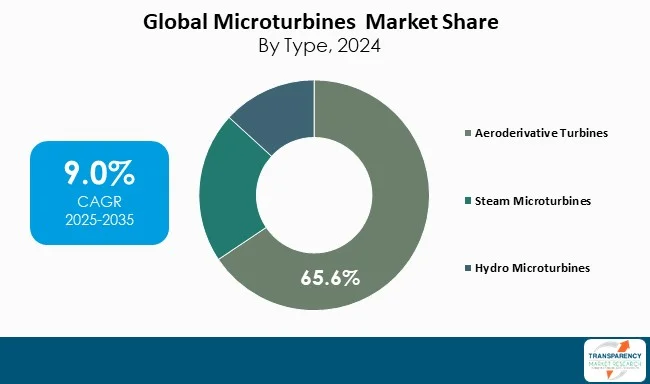

Aeroderivative turbines was the largest product type segment and is anticipated to grow at an estimated CAGR of 6.2% during the forecast period

North America was the most lucrative region in 2024

Capstone Green Energy Corporation, Ansaldo Energia, Flex Energy Solutions, Enercon, Bladon, Brayton Energy LLC and Aerostrovilos are the major players in the microturbines market

Table 1 Global Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 2 Global Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 3 Global Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 4 Global Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 5 Global Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 6 Global Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 7 Global Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 8 Global Microturbines Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 9 Global Microturbines Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 10 Global Microturbines Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 11 North America Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 12 North America Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 13 North America Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 14 North America Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 15 North America Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 16 North America Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 17 North America Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 18 North America Microturbines Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 19 North America Microturbines Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 20 North America Microturbines Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 22 U.S. Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 23 U.S. Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 24 U.S. Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 25 U.S. Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 26 U.S. Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 27 U.S. Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 28 U.S. Microturbines Market Value (US$ Mn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 30 Canada Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 31 Canada Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 32 Canada Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 33 Canada Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 34 Canada Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 35 Canada Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 36 Canada Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 37 Europe Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 38 Europe Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 39 Europe Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 40 Europe Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 41 Europe Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 42 Europe Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 43 Europe Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 44 Europe Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 45 Europe Microturbines Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Microturbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 48 Germany Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 49 Germany Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 50 Germany Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 51 Germany Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 52 Germany Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 53 Germany Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 54 Germany Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 55 France Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 56 France Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 57 France Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 58 France Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 59 France Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 60 France Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 61 France Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 62 France Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 63 U.K. Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 64 U.K. Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 65 U.K. Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 66 U.K. Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 67 U.K. Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 68 U.K. Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 69 U.K. Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 70 U.K. Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 71 Italy Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 72 Italy Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 73 Italy Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 74 Italy Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 75 Italy Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 76 Italy Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 77 Italy Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 78 Italy Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 79 Spain Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 80 Spain Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 81 Spain Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 82 Spain Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 83 Spain Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 84 Spain Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 85 Spain Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 86 Spain Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 88 Russia & CIS Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 89 Russia & CIS Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 90 Russia & CIS Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 91 Russia & CIS Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 96 Rest of Europe Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 97 Rest of Europe Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 98 Rest of Europe Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 99 Rest of Europe Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 104 Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 105 Asia Pacific Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 106 Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 107 Asia Pacific Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Microturbines Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 114 China Microturbines Market Value (US$ Mn) Forecast, by Type 2020 to 2035

Table 115 China Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 116 China Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 117 China Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 118 China Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 119 China Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 120 China Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 121 Japan Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 122 Japan Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 123 Japan Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 124 Japan Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 125 Japan Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 126 Japan Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 127 Japan Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 128 Japan Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 129 India Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 130 India Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 131 India Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 132 India Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 133 India Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 134 India Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 135 India Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 136 India Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 138 ASEAN Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 139 ASEAN Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 140 ASEAN Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 141 ASEAN Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 146 Rest of Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 147 Rest of Asia Pacific Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 148 Rest of Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 149 Rest of Asia Pacific Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 154 Latin America Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 155 Latin America Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 156 Latin America Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 157 Latin America Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 158 Latin America Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Microturbines Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Microturbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 164 Brazil Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 165 Brazil Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 166 Brazil Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 167 Brazil Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 168 Brazil Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 172 Mexico Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 173 Mexico Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 174 Mexico Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 175 Mexico Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 176 Mexico Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 180 Rest of Latin America Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 181 Rest of Latin America Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 182 Rest of Latin America Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 183 Rest of Latin America Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 188 Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 189 Middle East & Africa Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 190 Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 191 Middle East & Africa Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Microturbines Market Volume (Units) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 198 GCC Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 199 GCC Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 200 GCC Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 201 GCC Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 202 GCC Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 203 GCC Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 204 GCC Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 206 South Africa Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 207 South Africa Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 208 South Africa Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 209 South Africa Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 210 South Africa Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Microturbines Market Volume (Units) Forecast, by Type, 2020 to 2035

Table 214 Rest of Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Type, 2020 to 2035

Table 215 Rest of Middle East & Africa Microturbines Market Volume (Units) Forecast, by Power Rating, 2020 to 2035

Table 216 Rest of Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Power Rating, 2020 to 2035

Table 217 Rest of Middle East & Africa Microturbines Market Volume (Units) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Microturbines Market Volume (Units) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Microturbines Market Value (US$ Mn) Forecast, by End-use 2020 to 2035

Figure 1 Global Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 2 Global Microturbines Market Attractiveness, by Type

Figure 3 Global Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 4 Global Microturbines Market Attractiveness, by Power Rating

Figure 5 Global Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Microturbines Market Attractiveness, by Application

Figure 7 Global Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Microturbines Market Attractiveness, by End-use

Figure 9 Global Microturbines Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Microturbines Market Attractiveness, by Region

Figure 11 North America Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 12 North America Microturbines Market Attractiveness, by Type

Figure 13 North America Microturbines Market Attractiveness, by Type

Figure 14 North America Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 15 North America Microturbines Market Attractiveness, by Power Rating

Figure 16 North America Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 17 North America Microturbines Market Attractiveness, by Application

Figure 18 North America Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 19 North America Microturbines Market Attractiveness, by End-use

Figure 20 North America Microturbines Market Attractiveness, by Country and Sub-region

Figure 21 Europe Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 22 Europe Microturbines Market Attractiveness, by Type

Figure 23 Europe Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 24 Europe Microturbines Market Attractiveness, by Power Rating

Figure 25 Europe Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 26 Europe Microturbines Market Attractiveness, by Application

Figure 27 Europe Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 28 Europe Microturbines Market Attractiveness, by End-use

Figure 29 Europe Microturbines Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 30 Europe Microturbines Market Attractiveness, by Country and Sub-region

Figure 31 Asia Pacific Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 32 Asia Pacific Microturbines Market Attractiveness, by Type

Figure 33 Asia Pacific Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 34 Asia Pacific Microturbines Market Attractiveness, by Power Rating

Figure 35 Asia Pacific Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 36 Asia Pacific Microturbines Market Attractiveness, by Application

Figure 37 Asia Pacific Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38 Asia Pacific Microturbines Market Attractiveness, by End-use

Figure 39 Asia Pacific Microturbines Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Asia Pacific Microturbines Market Attractiveness, by Country and Sub-region

Figure 41 Latin America Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 42 Latin America Microturbines Market Attractiveness, by Type

Figure 43 Latin America Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 44 Latin America Microturbines Market Attractiveness, by Power Rating

Figure 45 Latin America Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 46 Latin America Microturbines Market Attractiveness, by Application

Figure 47 Latin America Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 48 Latin America Microturbines Market Attractiveness, by End-use

Figure 49 Latin America Microturbines Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 50 Latin America Microturbines Market Attractiveness, by Country and Sub-region

Figure 51 Middle East & Africa Microturbines Market Volume Share Analysis, by Type, 2024, 2028, and 2035

Figure 52 Middle East & Africa Microturbines Market Attractiveness, by Type

Figure 53 Middle East & Africa Microturbines Market Volume Share Analysis, by Power Rating, 2024, 2028, and 2035

Figure 54 Middle East & Africa Microturbines Market Attractiveness, by Power Rating

Figure 55 Middle East & Africa Microturbines Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 56 Middle East & Africa Microturbines Market Attractiveness, by Application

Figure 57 Middle East & Africa Microturbines Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 58 Middle East & Africa Microturbines Market Attractiveness, by End-use

Figure 59 Middle East & Africa Microturbines Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 60 Middle East & Africa Microturbines Market Attractiveness, by Country and Sub-region