Reports

Reports

Analysts’ Viewpoint

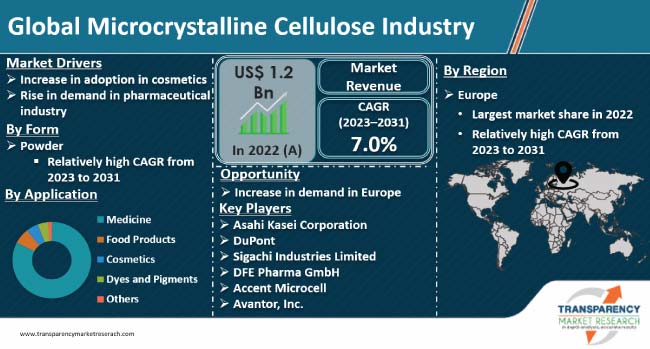

Increase in demand in pharmaceutical and food & beverages industries is driving the global microcrystalline cellulose market. Microcrystalline cellulose is produced in a controlled environment and has excellent compressibility properties. Rise in adoption of microcrystalline cellulose in cosmetics is a major factor propelling market expansion. Microcrystalline cellulose is used in solid dose forms, such as tablets, in the pharmaceutical industry. Furthermore, microcrystalline cellulose is utilized in the food industry to make compact pellets and improve the texture of flour.

Surge in adoption of microcrystalline cellulose in various industries offers lucrative opportunities to market players. Companies are focusing on developing high quality, low cost microcrystalline cellulose in order to increase market share.

Microcrystalline cellulose (MCC) is a refined wood pulp that is used in various industries such as food, cosmetics, and pharmaceuticals. It is a naturally occurring polymer composed of glucose units connected by a 1-4 beta glycosidic bond.

MCC is used as texturizer, anti-caking agent, fat substitute, emulsifier, extender, and bulking agent in food production. In the pharmaceutical industry, MCC is used as an excipient with wide-ranging applications.

The microcrystalline cellulose market is expected to be driven by increase in adoption of microcrystalline cellulose in the pharmaceutical and food & beverages industries. Different applications of microcrystalline cellulose are medicine, food products, cosmetics, and dyes.

Surge in utilization in cosmetics is expected to increase demand for microcrystalline cellulose in the next few years. Microcrystalline cellulose can bind many materials, including poorly soluble active pharmaceutical ingredients, in relatively small amounts. It has broad particle size distribution, allowing optimal packing density and material coverage.

MCC in the cosmetic industry is used in various formulations including as abrasive, absorbent, emulsion stabilizer, slip modifier, and viscosity-increasing agent. MCC is also used as an exfoliating scrub due to the unique size and shape of the microcrystalline. Applications of MCC in cosmetics include soaps, pressed & loose powders, and scrubs.

High demand for microcrystalline cellulose in pharmaceutical industries has led to the utilization of locally and naturally occurring materials in the production of microcrystalline cellulose.

Excipients are the process aids or substances other than active pharmaceutical ingredient that are included in pharmaceutical dosage forms. The functionalities of the excipients are to impart weight, consistency, and also volume, which allow accuracy of dose, improve solubility, and in the end to increase stability.

MCC used in pharmaceutical applications include drug research such as in immediate release (tablets and liquids) dosage forms, sustained release dosage forms (multiparticulates and matrix tablets), and mouth dissolving tablets. Increase in usage of pharmaceuticals is likely to propel the production of MCC, which is expected to bolster the microcrystalline cellulose market growth.

According to microcrystalline cellulose market analysis, Europe accounted for the largest global microcrystalline cellulose market share in 2022. Demand for microcrystalline cellulose in the region is projected to increase at a rapid pace in the near future due to rise in usage in various applications. Germany is one of the prominent markets for microcrystalline cellulose in Europe.

As per microcrystalline cellulose market research, North America held the second largest share of the global market in 2022. Technological advancements are expected to propel the market in the region in the near future.

The microcrystalline cellulose market report concludes with the company profiles section that includes key information such as company overview, financial overview, strategies, portfolio, segments, and recent developments. Most of the firms are adopting new technologies and strategies, and investing significantly in R&D activities.

Asahi Kasei Corporation, DuPont, Sigachi Industries Limited, DFE Pharma GmbH, Accent Microcell, Avantor, Inc., Quadra Chemicals, JRS Pharma, Huzhou City Linghu Xinwang Chemical Co., and FMC Corporation are the prominent players in the market.

Each of these players has been profiled in the microcrystalline cellulose market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size in 2022 |

US$ 1.2 Bn |

|

Forecast (Value) in 2031 |

US$ 2.1 Bn |

|

Growth Rate (CAGR) |

7.0% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross segment analysis as well as regional level analysis. Furthermore, qualitative analysis includes drivers, restraints, drivers, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.2 Bn in 2022

It is expected to expand at a CAGR of 7.0% from 2023 to 2031

Increase in adoption of cosmetics and surge in adoption in pharmaceuticals.

Medicine was the largest application segment in 2022.

Europe was the most lucrative region in 2022.

Asahi Kasei Corporation, DuPont, Sigachi Industries Limited, DFE Pharma GmbH, Accent Microcell, Avantor, Inc., Quadra Chemicals, JRS Pharma, Huzhou City Linghu Xinwang Chemical Co., and FMC Corporation.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Microcrystalline Cellulose Market Analysis and Forecasts, 2022-2031

2.6.1. Global Microcrystalline Cellulose Market Volume (Tons)

2.6.2. Global Microcrystalline Cellulose Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Providers

2.9.2. List of Manufacturers

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Process Overview

2.12. Cost Structure Analysis

2.13. Economic Recovery Post COVID-19

2.13.1. Impact on the Supply Chain of Microcrystalline Cellulose Market

2.13.2. Recovery in the Demand for Microcrystalline Cellulose -Post Crisis

3. Impact of Current Geopolitical Scenario on Market

4. Production Output Analysis (Tons)

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East and Africa

5. Price Trend Analysis and Forecast (US$/Ton), 2022-2031

5.1. Price Comparison Analysis by Form

5.2. Price Comparison Analysis by Region

6. Global Microcrystalline Cellulose Market Analysis and Forecast, by Raw Material, 2023-2031

6.1. Introduction and Definitions

6.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

6.2.1. Wood Based

6.2.2. Non Wood Based

6.3. Global Microcrystalline Cellulose Market Attractiveness, by Raw Material

7. Global Microcrystalline Cellulose Market Analysis and Forecast, by Form, 2023-2031

7.1. Introduction and Definitions

7.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

7.2.1. Powder

7.2.2. Liquid

7.3. Global Microcrystalline Cellulose Market Attractiveness, by Form

8. Global Microcrystalline Cellulose Market Analysis and Forecast, Grade, 2023-2031

8.1. Introduction and Definitions

8.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

8.2.1. Grade 101

8.2.2. Grade 200

8.2.3. Grade 301

8.2.4. Grade 302

8.2.5. Others

8.3. Global Microcrystalline Cellulose Market Attractiveness, by Grade

9. Global Microcrystalline Cellulose Market Analysis and Forecast, Application, 2023-2031

9.1. Introduction and Definitions

9.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

9.2.1. Medicine

9.2.2. Food Products

9.2.3. Cosmetics

9.2.4. Dyes and Pigments

9.2.5. Others

9.3. Global Microcrystalline Cellulose Market Attractiveness, by Application

10. Global Microcrystalline Cellulose Market Analysis and Forecast, End-use, 2023-2031

10.1. Introduction and Definitions

10.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

10.2.1. Pharmaceutical

10.2.2. Food & Beverages

10.2.3. Personal Care

10.2.4. Paints & Coatings

10.2.5. Others

10.3. Global Microcrystalline Cellulose Market Attractiveness, by End-use

11. Global Microcrystalline Cellulose Market Analysis and Forecast, by Region, 2023-2031

11.1. Key Findings

11.2. Global Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Microcrystalline Cellulose Market Attractiveness, by Region

12. North America Microcrystalline Cellulose Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.3. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

12.4. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

12.5. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.6. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.7. North America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

12.7.1. U.S. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.7.2. U.S. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

12.7.3. U.S. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

12.7.4. U.S. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.7.5. U.S. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

12.7.6. Canada Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

12.7.7. Canada Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

12.7.8. Canada Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

12.7.9. Canada Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

12.7.10. Canada Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

12.8. North America Microcrystalline Cellulose Market Attractiveness Analysis

13. Europe Microcrystalline Cellulose Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.3. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.4. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.5. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.6. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.7. Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.7.1. Germany Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.2. Germany Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.3. Germany Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.4. Germany Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.5. Germany. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.7.6. France Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.7. France Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.8. France Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.9. France Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.10. France. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.7.11. U.K. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.12. U.K. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.13. U.K. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.14. U.K. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.15. U.K. Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.7.16. Italy Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.17. Italy Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.18. Italy Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.19. Italy Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.20. Italy Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.7.21. Russia & CIS Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.22. Russia & CIS Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.23. Russia & CIS Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.24. Russia & CIS Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.25. Russia & CIS Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.7.26. Rest of Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

13.7.27. Rest of Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

13.7.28. Rest of Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

13.7.29. Rest of Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

13.7.30. Rest of Europe Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

13.8. Europe Microcrystalline Cellulose Market Attractiveness Analysis

14. Asia Pacific Microcrystalline Cellulose Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material

14.3. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.4. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.5. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.6. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.7. Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

14.7.1. China Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.7.2. China Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.7.3. China Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.7.4. China Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.7.5. China Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

14.7.6. Japan Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.7.7. Japan Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.7.8. Japan Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.7.9. Japan Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.7.10. Japan Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

14.7.11. India Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.7.12. India Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.7.13. India Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.7.14. India Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.7.15. India Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

14.7.16. ASEAN Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.7.17. ASEAN Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.7.18. ASEAN Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.7.19. ASEAN Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.7.20. ASEAN Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

14.7.21. Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

14.7.22. Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

14.7.23. Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

14.7.24. Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

14.7.25. Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

14.8. Asia Pacific Microcrystalline Cellulose Market Attractiveness Analysis

15. Latin America Microcrystalline Cellulose Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

15.3. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

15.4. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

15.5. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.6. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

15.7. Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

15.7.1. Brazil Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

15.7.2. Brazil Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

15.7.3. Brazil Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

15.7.4. Brazil Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.7.5. Brazil Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

15.7.6. Mexico Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

15.7.7. Mexico Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

15.7.8. Mexico Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

15.7.9. Mexico Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.7.10. Mexico Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

15.7.11. Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

15.7.12. Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

15.7.13. Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

15.7.14. Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

15.7.15. Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

15.8. Latin America Microcrystalline Cellulose Market Attractiveness Analysis

16. Middle East & Africa Microcrystalline Cellulose Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

16.3. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

16.4. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

16.5. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

16.6. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

16.7. Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

16.7.1. GCC Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

16.7.2. GCC Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

16.7.3. GCC Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

16.7.4. GCC Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

16.7.5. GCC Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

16.7.6. South Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

16.7.7. South Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

16.7.8. South Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

16.7.9. South Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

16.7.10. South Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

16.7.11. Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Raw Material, 2023-2031

16.7.12. Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Form, 2023-2031

16.7.13. Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Grade, 2023-2031

16.7.14. Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023-2031

16.7.15. Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) and Value (US$ Mn) Forecast, End-use, 2023-2031

16.8. Middle East & Africa Microcrystalline Cellulose Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2022

17.3. Market Footprint Analysis

17.3.1. By Form

17.3.2. By Application

17.4. Company Profiles

17.4.1. Asahi Kasei Corporation

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.2. DuPont

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.3. Sigachi Industries Limited

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.4. DFE Pharma GmbH

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.5. Accent Microcell

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.6. Avantor, Inc.

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.7. Quadra Chemicals

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.8. JRS Pharma

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.9. Huzhou City Linghu Xinwang Chemical Co.

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

17.4.10. FMC Corporation

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Process/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 2: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 3: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 4: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 5: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade 2023-2031

Table 6: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade 2023-2031

Table 7: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 8: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 9: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 10: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 11: Global Microcrystalline Cellulose Market Volume (Tons) Forecast, by Region, 2023-2031

Table 12: Global Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 13: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 14: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 15: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 16: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 17: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade 2023-2031

Table 18: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade 2023-2031

Table 19: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 20: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 21: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 22: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 23: North America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Country, 2023-2031

Table 24: North America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 25: U.S. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 26: U.S. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 27: U.S. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 28: U.S. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 29: U.S. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade 2023-2031

Table 30: U.S. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 31: U.S. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 32: U.S. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 33: U.S. Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 34: U.S. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 35: Canada Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 36: Canada Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 37: Canada Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 38: Canada Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 39: Canada Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 40: Canada Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 41: Canada Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 42: Canada Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 43: Canada Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 44: Canada Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 45: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 46: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 47: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 48: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 49: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade 2023-2031

Table 50: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 51: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 52: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 53: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 55: Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 56: Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 57: Germany Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 58: Germany Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 59: Germany Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 60: Germany Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 61: Germany Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 62: Germany Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 63: Germany Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 64: Germany Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 65: Germany Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 66: Germany Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 67: France Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 68: France Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 69: France Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 70: France Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 71: France Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 72: France Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 73: France Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 74: France Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 75: France Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 76: France Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 77: U.K. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 78: U.K. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 79: U.K. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 80: U.K. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 81: U.K. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 82: U.K. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 83: U.K. Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 84: U.K. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 85: U.K. Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 86: U.K. Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 87: Italy Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 88: Italy Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 89: Italy Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 90: Italy Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 91: Italy Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 92: Italy Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 93: Italy Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 94: Italy Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 95: Italy Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 96: Italy Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 97: Spain Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 98: Spain Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 99: Spain Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 100: Spain Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 101: Spain Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 102: Spain Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 103: Spain Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 104: Spain Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 105: Spain Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 106: Spain Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 107: Russia & CIS Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 108: Russia & CIS Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 109: Russia & CIS Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 110: Russia & CIS Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 111: Russia & CIS Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 112: Russia & CIS Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 113: Russia & CIS Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 114: Russia & CIS Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 115: Russia & CIS Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 116: Russia & CIS Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 117: Rest of Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 118: Rest of Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 119: Rest of Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 120: Rest of Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 121: Rest of Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 122: Rest of Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 123: Rest of Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 124: Rest of Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 125: Rest of Europe Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 126: Rest of Europe Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 127: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 128: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 129: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 130: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 131: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 132: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 133: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 134: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 135: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 136: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 137: Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 138: Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 139: China Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 140: China Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material 2023-2031

Table 141: China Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 142: China Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 143: China Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 144: China Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 145: China Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 146: China Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 147: China Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 148: China Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 149: Japan Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 150: Japan Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 151: Japan Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 152: Japan Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 153: Japan Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 154: Japan Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 155: Japan Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 156: Japan Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 157: Japan Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 158: Japan Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 159: India Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 160: India Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 161: India Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 162: India Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 163: India Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 164: India Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 165: India Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 166: India Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 167: India Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 168: India Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 169: ASEAN Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 170: ASEAN Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 171: ASEAN Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 172: ASEAN Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 173: ASEAN Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 174: ASEAN Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 175: ASEAN Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 176: ASEAN Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 177: ASEAN Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 178: ASEAN Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 179: Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 180: Rest of Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 181: Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 182: Rest of Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 183: Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 184: Rest of Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 185: Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 186: Rest of Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 187: Rest of Asia Pacific Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 188: Rest of Asia Pacific Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 189: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 190: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 191: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 192: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 193: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 194: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 195: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 196: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 197: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 198: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 199: Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 200: Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 201: Brazil Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 202: Brazil Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 203: Brazil Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 204: Brazil Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 205: Brazil Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 206: Brazil Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 207: Brazil Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 208: Brazil Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 209: Brazil Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 210: Brazil Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 211: Mexico Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 212: Mexico Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 213: Mexico Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 214: Mexico Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 215: Mexico Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 216: Mexico Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 217: Mexico Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 218: Mexico Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 219: Mexico Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 220: Mexico Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 221: Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 222: Rest of Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 223: Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 224: Rest of Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 225: Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 226: Rest of Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 227: Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 228: Rest of Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 229: Rest of Latin America Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 230: Rest of Latin America Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 231: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 232: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 233: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 234: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 235: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 236: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 237: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 238: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 239: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 240: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 241: Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 242: Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 243: GCC Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 244: GCC Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 245: GCC Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 246: GCC Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 247: GCC Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 248: GCC Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 249: GCC Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 250: GCC Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 251: GCC Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 252: GCC Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 253: South Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 254: South Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 255: South Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 256: South Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 257: South Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 258: South Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 259: South Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 260: South Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 261: South Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 262: South Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 263: Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Raw Material, 2023-2031

Table 264: Rest of Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Raw Material, 2023-2031

Table 265: Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Form, 2023-2031

Table 266: Rest of Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Form, 2023-2031

Table 267: Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Grade, 2023-2031

Table 268: Rest of Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Grade, 2023-2031

Table 269: Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by Application, 2023-2031

Table 270: Rest of Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by Application, 2023-2031

Table 271: Rest of Middle East & Africa Microcrystalline Cellulose Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 272: Rest of Middle East & Africa Microcrystalline Cellulose Market Value (US$ Mn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Global Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 2: Global Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 3: Global Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 4: Global Microcrystalline Cellulose Market Attractiveness, by Form

Figure 5: Global Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 6: Global Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 7: Global Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 8: Global Microcrystalline Cellulose Market Attractiveness, by Application

Figure 9: Global Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 10: Global Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 11: Global Microcrystalline Cellulose Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 12: Global Microcrystalline Cellulose Market Attractiveness, by Region

Figure 13: North America Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 14: North America Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 15: North America Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 16: North America Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 17: North America Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 18: North America Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 19: North America Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 20: North America Microcrystalline Cellulose Market Attractiveness, by Application

Figure 21: North America Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 22: North America Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 23: North America Microcrystalline Cellulose Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 24: North America Microcrystalline Cellulose Market Attractiveness, by Country

Figure 25: Europe Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 26: Europe Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 27: Europe Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 28: Europe Microcrystalline Cellulose Market Attractiveness, by Form

Figure 29: Europe Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 30: Europe Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 31: Europe Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 32: Europe Microcrystalline Cellulose Market Attractiveness, by Application

Figure 33: Europe Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 34: Europe Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 35: Europe Microcrystalline Cellulose Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Europe Microcrystalline Cellulose Market Attractiveness, by Country and Sub-region

Figure 37: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 38: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 39: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 40: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by Form

Figure 41: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 42: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 43: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 44: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by Application

Figure 45: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 46: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 47: Asia Pacific Microcrystalline Cellulose Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 48: Asia Pacific Microcrystalline Cellulose Market Attractiveness, by Country and Sub-region

Figure 49: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 50: Latin America Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 51: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 52: Latin America Microcrystalline Cellulose Market Attractiveness, by Form

Figure 53: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 54: Latin America Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 55: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 56: Latin America Microcrystalline Cellulose Market Attractiveness, by Application

Figure 57: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 58: Latin America Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 59: Latin America Microcrystalline Cellulose Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Latin America Microcrystalline Cellulose Market Attractiveness, by Country and Sub-region

Figure 61: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 62: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by Raw Material

Figure 63: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by Form, 2022, 2027, and 2031

Figure 64: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by Form

Figure 65: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by Grade, 2022, 2027, and 2031

Figure 66: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by Grade

Figure 67: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 68: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by Application

Figure 69: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 70: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by End-use

Figure 71: Middle East & Africa Microcrystalline Cellulose Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 72: Middle East & Africa Microcrystalline Cellulose Market Attractiveness, by Country and Sub-region