Reports

Reports

The medical microbiology testing technology market is moving upwards, driven by increase in incidences of infectious diseases followed by advancements in diagnostic technology. There is a rising need for rapid and precise methods of microbial identification owing to rising antibiotic resistance along with newly identified pathogens.

There has been an increased reliance on advanced diagnostic technologies such as polymerase chain reaction (PCR), next-generation sequencing, and mass spectrometry. These diagnostic platforms will aid in improving the efficiency of test outcomes and overall patient outcomes with time-bound treatment decisions.

The COVID-19 pandemic has also highlighted the importance of having relevant microbiological testing capabilities, thereby causing laboratories to invest in laboratory capacity and innovative testing. The demand for point-of-care testing is rising due to the need for results at the fingertips. The awareness of infection control and prevention among both - healthcare professionals and patients is further driving growth of this market. With increased awareness in healthcare systems toward infectious disease management, this market is poised for growth lending opportunities for innovative solutions for improved healthcare delivery.

Medical microbiology testing technology implies diagnostic techniques and tools used for identifying and characterizing microorganisms like bacteria, fungi, viruses, and parasites. It is a critical area of testing that could be used for diagnosing infectious diseases, informing treatment decisions, and monitoring disease progression.

While conventional culturing remains the gold standard of testing, technology has advanced through usage of polymerase chain reactions (PCR), immunoassays, and mass spectrometry, which can provide more accurate and faster results than conventional culture methods.

With antibiotic resistance and new pathogens emerging every single day, the need for new testing innovations is rapidly increasing. Currently used tests such as point-of-care testing devices that allow for rapid diagnosis are booming in hospital and the other healthcare settings including outpatient clinics and emergency departments.

| Attribute | Detail |

|---|---|

| Medical Microbiology Testing Technology Market Drivers |

|

The increase in antimicrobial or antibiotic resistance is a key influencer to growth of the medical microbiology testing technology market. Healthcare systems across the globe are dealing with the issues surrounding resistant pathogens. The increase of antibiotic resistant infections such as methicillin-resistant Staphylococcus aureus (MRSA), and resistance in patients with multidrug-resistant tuberculosis emphasizes the necessity for precise, rapid and accurate diagnostic testing that can directly identify these specific pathogens.

More testing models, notably, molecular diagnostics, and rapid susceptibility testing are providing healthcare professionals with the evidence needed to make informed treatment decisions in an era of uncertainty around resistant pathogens. To avoid further relationship between resistant strains and treatment failures, healthcare providers need to quickly identify the best available antibiotics.

Due to the increased urgency, along with the decreased credibility of traditional antibiotics, healthcare providers are employing rapid susceptibility testing and new technologies that can be used to identify and test antibiotic susceptibility to target resistance and increase options for treating infected patients.

The increased emphasis on infection control and prevention is bound to be a strong propellant for the market, especially due to the public health emergencies of recent years. The COVID-19 pandemic reinforced a need for stronger infection control procedures in healthcare settings, and increased expenditure on microbiology to replace outdated systems. The medical microbiology testing technology market are likely to grow vigorously for the foreseeable future due to enhanced infection control capabilities in all parts of the healthcare system.

Additionally, with laboratories modifying their workflows to accommodate automation and artificial intelligence, instrumentation needs to assist laboratories with workflow, decrease the potential for human error, and enhance data management. The capacity to conduct multiplex testing (detecting multiple pathogens at the same time) drives growth of complex instruments.

As healthcare systems promote rapid diagnostics for optimal infection tracing and patient management, the market will continue to trend for high quality instrument products. Even if it promotes the growth of technology, it also creates innovation within the research and development of ever more complex or user-friendly diagnostic instruments with the medical microbiology testing market on the whole.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is the leading region in terms of the medical microbiology testing technology market share due to it being home to high-quality health care infrastructure, high-tech laboratories, and rapid turnaround on diagnostics technologies, thereby allowing for rapid and high-quality testing. There is also a significant prevalence of infectious diseases, coupled with the rise of public awareness surrounding health issues that leads to a desire for high-quality microbiology testing options.

There are also significant public and private research and development investments leading to new developments in diagnostic technologies, including molecular testing and automated technologies. The regulatory status in North America ensures that all laboratories comply with strict guidelines about their testing technologies and quality assurance or quality control, and lab confirmation of testing results, which builds and maintains trust and confidence from healthcare providers and patients.

Furthermore, the market comprises numerous leading key players, competitive landscapes, and strong research presence in universities, hospitals, and clinics that enable new developments in research and testing technologies. Collectively, the factors detailed above drive market value growth and make this region successful in the adoption of new and innovative microbiology testing technologies throughout various healthcare settings.

Key players in the global medical microbiology testing technology industry are investing in innovation, forming alliances, and technological advancements. Their objective is to improve the accuracy of testing, gain a stronger market presence, and diversify their products in order to be ahead of the curve in the evolving healthcare market.

Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc. (Danaher Corporation), Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., bioMérieux SA, F. Hoffmann-La Roche Ltd., HiMedia Laboratories Private Limited, Hologic Inc., Thermo Fisher Scientific, Inc. are some of the leading players in the global market.

Each of these players has been profiled in the medical microbiology testing technology market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

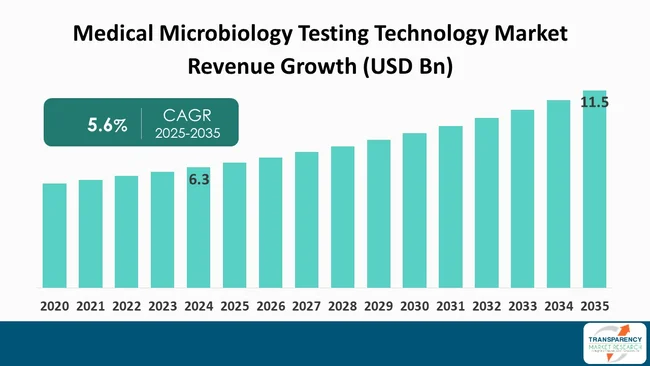

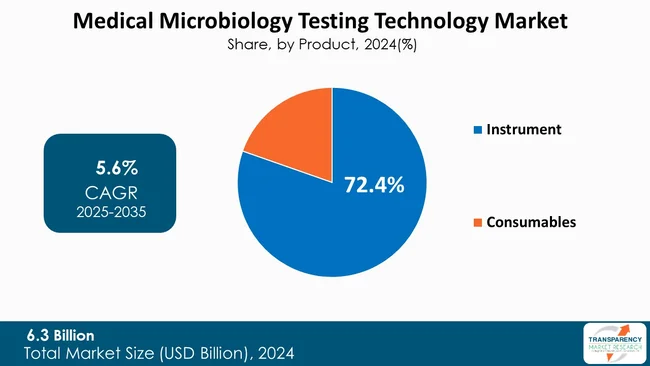

| Size in 2024 | US$ 6.3 Bn | ||||||||||

| Forecast Value in 2035 | US$ 11.5 Bn | ||||||||||

| CAGR | 5.6% | ||||||||||

| Forecast Period | 2025-2035 | ||||||||||

| Historical Data Available for | 2020-2023 | ||||||||||

| Quantitative Units | US$ Bn | ||||||||||

| Medical Microbiology Testing Technology Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. | ||||||||||

| Competition Landscape |

|

||||||||||

| Format | Electronic (PDF) + Excel | ||||||||||

| Segmentation | Product

|

||||||||||

| Regions Covered |

|

||||||||||

| Countries Covered |

|

||||||||||

| Companies Profiled |

|

||||||||||

| Customization Scope | Available upon request | ||||||||||

| Pricing | Available upon request |

It was valued at US$ 6.3 Bn in 2024

It is projected to cross US$ 11.5 Bn by the end of 2035

Increasing antibiotic resistance and enhanced focus on infection control and prevention

It is anticipated to grow at a CAGR of 5.6% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Abbott Laboratories, Agilent Technologies, Inc., Beckman Coulter, Inc. (Danaher Corporation), Becton, Dickinson and Company, Bio-Rad Laboratories, Inc., bioMérieux SA, F. Hoffmann-La Roche Ltd., HiMedia Laboratories Private Limited, Hologic Inc., Thermo Fisher Scientific, Inc. and Others

Table 01: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 02: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 03: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 04: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America - Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 08: North America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 09: North America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 10: North America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 11: North America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 14: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 15: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 16: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 17: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 20: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 21: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 22: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 23: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 26: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 27: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 28: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 29: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 32: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Product, 2020 to 2035

Table 33: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Instrument, 2020 to 2035

Table 34: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 35: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Instrument, 2020 to 2035

Figure 04: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Consumables, 2020 to 2035

Figure 05: Global Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 06: Global Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 07: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Cell Culture, 2020 to 2035

Figure 08: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Microscopy, 2020 to 2035

Figure 09: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Serology, 2020 to 2035

Figure 10: Global Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 11: Global Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 12: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Diagnostic, 2020 to 2035

Figure 13: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Treatment Monitoring, 2020 to 2035

Figure 14: Global Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Hospital, 2020 to 2035

Figure 17: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Pathology Labs, 2020 to 2035

Figure 18: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Research Institutes, 2020 to 2035

Figure 19: Global Medical Microbiology Testing Technology Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Medical Microbiology Testing Technology Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Medical Microbiology Testing Technology Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America - Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America - Medical Microbiology Testing Technology Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America - Medical Microbiology Testing Technology Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 26: North America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 27: North America Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 28: North America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 29: North America Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: North America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: North America Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Medical Microbiology Testing Technology Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Medical Microbiology Testing Technology Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 37: Europe Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 38: Europe Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 39: Europe Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 40: Europe Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Medical Microbiology Testing Technology Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific Medical Microbiology Testing Technology Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 48: Asia Pacific Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 49: Asia Pacific Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 50: Asia Pacific Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 51: Asia Pacific Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Asia Pacific Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Asia Pacific Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Asia Pacific Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Latin America Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America Medical Microbiology Testing Technology Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Latin America Medical Microbiology Testing Technology Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Latin America Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 59: Latin America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 60: Latin America Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 61: Latin America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 62: Latin America Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Latin America Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Latin America Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Latin America Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Middle East & Africa Medical Microbiology Testing Technology Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East & Africa Medical Microbiology Testing Technology Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 68: Middle East & Africa Medical Microbiology Testing Technology Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 69: Middle East & Africa Medical Microbiology Testing Technology Market Value Share Analysis, By Product, 2024 and 2035

Figure 70: Middle East & Africa Medical Microbiology Testing Technology Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 71: Middle East & Africa Medical Microbiology Testing Technology Market Value Share Analysis, By Technology, 2024 and 2035

Figure 72: Middle East & Africa Medical Microbiology Testing Technology Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 73: Middle East & Africa Medical Microbiology Testing Technology Market Value Share Analysis, By Application, 2024 and

Figure 74: Middle East & Africa Medical Microbiology Testing Technology Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Middle East & Africa Medical Microbiology Testing Technology Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East & Africa Medical Microbiology Testing Technology Market Attractiveness Analysis, By End-user, 2025 to 2035