Reports

Reports

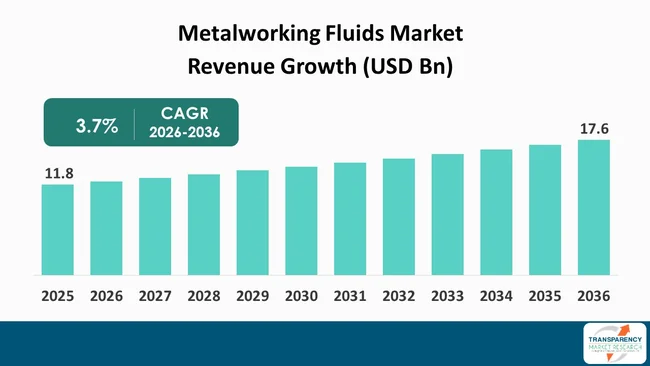

The global metalworking fluids market size was valued at US$ 11.8 Bn in 2025 and is projected to reach US$ 17.6 Bn by 2036, expanding at a CAGR of 3.7% from 2026 to 2036. The market is driven by rising demand for high-precision and high-speed machining.

Rise in demand for automotive components and expansion of manufacturing sector are projected to propel the global metalworking fluids industry growth in the near future. Surge in need for robust control of processes and materials is boosting demand for novel metalworking technologies.

Vendors in the sector are developing eco-friendly and sustainable products to cater to environmentally-conscious customers and increase their metalworking fluids market share. Removal fluids are gaining traction among end-users due to increase in adoption of lubricants and coolants in metalworking processes. End-users, especially in the automotive sector, are opting for metalworking fluids with good lubricity and corrosion protection.

Metalworking fluids (MWFs) are oils and the other liquids used to reduce heat and friction in various industrial machining and grinding operations. These fluids are also employed to remove metal particles and lubricate metal workpieces. Water and oils are the major components of MWFs. Various additives such as antioxidants, antifoams, and anti-corrosives can also be added to increase the efficiency and life of MWFs. Different types of MWF can be used depending on the metal substrate and the application.

These types include straight oils such as petroleum oils; soluble oils (emulsifiable oils); semi-synthetic fluids; and synthetic fluids. Mineral, vegetable, and animal oils are utilized to produce straight oils. MWFs support the industrial process of machining metals. MWFs with good lubricity and corrosion protection are gaining traction among end-users, which is expected to spur the metalworking fluids market growth in the near future.

| Attribute | Detail |

|---|---|

| Drivers |

|

The metalworking fluids market is greatly influenced by the adoption of high-precision and high-speed machining processes in various manufacturing sectors. Automotive, aerospace, electronics, and medical devices are some of the industries that are targeting closer tolerances, better surface finishes, and reliable dimensional accuracy. These requirements lead to an increase in the thermal and mechanical stresses of the cutting and grinding operations. When manufacturers attempt higher productivity levels, the use of traditional dry or low, performance lubrication methods fails, resulting in higher scrap rates and shorter tool life. Cutting-edge metalworking fluids not only allow stable machining conditions but also ensure part integrity and long-term process reliability.

It is a matter of business that manufacturers gradually perceive MWFs not just as consumables but as performance enhancers. Proper fluid selection has a direct effect on shortening the cycle time, stabilizing the machining process, and securing the quality of the operation. This has been a motivational factor for more investment in high, end formulations that are custom, made to fit the specific alloys, tooling materials, and machining conditions.

To address this, suppliers are now developing application-specific fluids, providing tailored solutions for CNC machining, multi-axis milling, and automated production lines. Such new products help to achieve faster turnaround, less machinery fall-off, and a greater return on the capital investment hence, the demand for high-precision machining is firmly established as a major growth impetus for the metalworking fluids industry.

The sustained expansion of automotive and aerospace manufacturing globally continues to drive demand for metalworking fluids. In concert with the continued increase in vehicle production due to this growth trend, there are the other developments driving demand for metalworking fluids such as an emphasis on lightweighting, electric vehicles and increasing aircraft deliveries.. Engine parts, transmission system, structural framework, and components that meet aerospace specifications are some of the products that heavily depend on metal cutting, forming, and finishing operations.

Both the sectors have been extensively utilizing advanced materials such as aluminum alloys, high, strength steels, titanium, and superalloys, which, during machining, result in more heat and stresses on the tools. Employing high-performance MWFs allows them to keep quality levels stable and at the same time comply with the strict safety and environmental standards required. This, in turn, results in long-term purchase agreements and thus a steady demand for MWF suppliers.

The major players are adjusting their strategies to align with OEM requirements by providing fluids that are certified to automotive and aerospace specifications in addition to technical service support and fluid management programs.

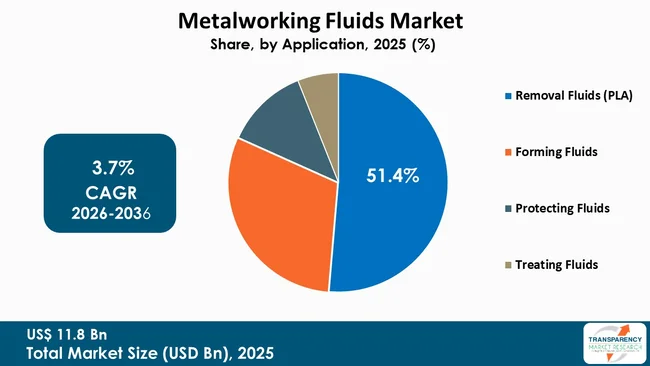

The Removal Fluids segment accounts for the largest share of application, having around 51.4% of the market share due to the metal removal operations such as cutting, milling, drilling, turning, and grinding being widely used in manufacturing industries. These processes generate heat and friction, thus requiring continuous lubrication and cooling. Growth is also supported by the increasing CNC machining, larger production volumes, narrower tolerances, and greater use of hard, to, machine alloys, all of which raise the need for high, performance removal fluids.

Removal fluids refer to a specific type of metalworking fluids that are utilized in metal removal processes like cutting, drilling, milling, turning, and grinding. The main purpose of these fluids is that of minimizing friction and heat at the tool, workpiece interface, enhancing surface finish, removing chips, and prolonging tool life. These fluids are essential in supporting machining efficiency, dimensional precision, and production consistency in industrial manufacturing environments.

| Attribute | Detail |

|---|---|

| Opportunity |

|

As businesses focus more on compliance with environmental regulations, safety in the workplace, and creating a sustainable corporation, they will create opportunities for alternative and bio-based metalworking fluids. With manufacturers being pushed for reduced VOC emissions, reduced risky additives in products, and less money spent on disposing of common fluids, biologically-based or low toxic formula's will meet the requirements of occupational health, regulatory, and by enhancing the worker experience in the shop.

From a business perspective, these products provide suppliers the ability to differentiate their products from the competition with premium pricing and longer term supply agreements. The key companies that are continuing to invest in the use of green chemistry, renewable base oils, and formaldehyde free biocides will have a competitive advantage in their industries. As sustainability continues to move from a preference to an evaluation criterion, the use of eco-friendly metalworking fluids is anticipated to grow rapidly throughout automotive, aerospace, and every other industrial manufacturing process.

| Attribute | Detail |

|---|---|

| Leading Region |

|

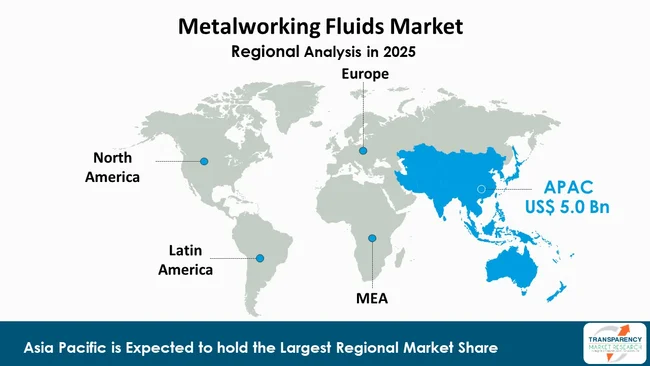

The global metalworking fluids market place is being significantly impacted by regional dynamics, including the Asia-Pacific region comprising 42.2% of the overall market. The Asia-Pacific region continues to experience rapid industrialization and expanding production across multiple sectors including electronics, automotive, heavy equipment, and general engineering.

Metalworking fluids sales will continue growing in the Asia-Pacific region due to numerous factors: increased production volume; increased use of CNC machine tools and automated machining processes; increased usage of hard-to-machine alloys; and continued investments into industrial capacity and infrastructure.

APAR Industries LTD, Castrol Limited, Chevron Phillips Chemical Company, Chem Arrow Corporation, Exxon Mobil Corporation., FUCHS, Houghton International Inc. are some of the key players in the market that manufacture and supply metalworking fluids such as cutting oils, soluble and synthetic coolants, grinding and forming fluids, base oils, additives, and fluid management solutions used in the automotive, aerospace, and industrial machining sectors.

In addition LUKOIL, The Lubrizol Corporation, Total S.A., Cimcool industrial Products B.V., Quaker Chemical Corporation, Eni S.p.A., Croda International Plc, Henkel Limited., Motul, China Petroleum & Chemical Corporation., Hindustan Petroleum Corporation Limited, Kuwait Petroleum Corporation, Indian Oil Corporation Ltd are also key players in the metalworking fluids market, with competitive scenario fueled by innovation and productivity.

Each of these players has been profiled in the metalworking fluids market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Size Value in 2025 | US$ 11.8 Bn |

| Market Forecast Value in 2036 | US$ 17.6 Bn |

| Growth Rate (CAGR) | 3.7% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2021-2025 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, metalworking fluids market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The metalworking fluids market was valued at US$ 11.8 Bn in 2025

The metalworking fluids industry is expected to grow at a CAGR of 3.7% from 2026 to 2036

Rising demand for high-precision and high-speed machining and expansion of automotive and aerospace manufacturing output.

Removal Fluids was the largest application segment and its value is anticipated to grow at a CAGR of 3.9% during the forecast period

Asia Pacific was the most lucrative region in 2025

APAR Industries LTD, Castrol Limited, Chevron Phillips Chemical Company, Chem Arrow Corporation, Exxon Mobil Corporation., FUCHS, Houghton International Inc., LUKOIL, The Lubrizol Corporation, Total S.A., Cimcool industrial Products B.V., Quaker Chemical Corporation, Eni S.p.A., Croda International Plc, Henkel Limited., Motul, China Petroleum & Chemical Corporation., Hindustan Petroleum Corporation Limited, Kuwait Petroleum Corporation, Indian Oil Corporation Ltd are the major players in the met

List of Tables

Table 1 Global Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 2 Global Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 3 Global Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 4 Global Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 5 Global Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 6 Global Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 7 Global Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Region, 2026 to 2036

Table 8 Global Metalworking Fluids Market Value (US$ Bn) Forecast, by Region, 2026 to 2036

Table 9 North America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 10 North America Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 11 North America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 12 North America Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 13 North America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 14 North America Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 15 North America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Country, 2026 to 2036

Table 16 North America Metalworking Fluids Market Value (US$ Bn) Forecast, by Country, 2026 to 2036

Table 17 U.S. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 18 U.S. Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 19 U.S. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 20 U.S. Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 21 U.S. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 22 U.S. Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 23 Canada Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 24 Canada Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 25 Canada Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 26 Canada Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 27 Canada Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 28 Canada Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 29 Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 30 Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 31 Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 32 Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 33 Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 34 Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 35 Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 36 Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 37 Germany Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 38 Germany Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 39 Germany Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 40 Germany Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 41 Germany Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 42 Germany Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 43 France Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 44 France Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 45 France Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 46 France Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 47 France Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 48 France Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 49 U.K. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 50 U.K. Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 51 U.K. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 52 U.K. Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 53 U.K. Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 54 U.K. Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 55 Italy Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 56 Italy Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 57 Italy Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 58 Italy Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 59 Italy Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 60 Italy Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 61 Spain Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 62 Spain Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 63 Spain Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 64 Spain Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 65 Spain Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 66 Spain Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 67 Russia & CIS Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 68 Russia & CIS Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 69 Russia & CIS Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 70 Russia & CIS Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 71 Russia & CIS Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 72 Russia & CIS Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 73 Rest of Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 74 Rest of Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 75 Rest of Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 76 Rest of Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 77 Rest of Europe Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 78 Rest of Europe Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 79 Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 80 Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 81 Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 82 Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 83 Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 84 Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 85 Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 86 Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 87 China Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 88 China Metalworking Fluids Market Value (US$ Bn) Forecast, by Type 2026 to 2036

Table 89 China Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 90 China Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 91 China Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 92 China Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 93 Japan Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 94 Japan Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 95 Japan Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 96 Japan Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 97 Japan Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 98 Japan Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 99 India Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 100 India Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 101 India Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 102 India Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 103 India Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 104 India Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 105 India Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 106 India Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use 2026 to 2036

Table 107 ASEAN Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 108 ASEAN Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 109 ASEAN Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 110 ASEAN Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 111 ASEAN Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 112 ASEAN Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 113 Rest of Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 114 Rest of Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 115 Rest of Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 116 Rest of Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 117 Rest of Asia Pacific Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 118 Rest of Asia Pacific Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 119 Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 120 Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 121 Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 122 Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 123 Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 124 Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 125 Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 126 Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 127 Brazil Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 128 Brazil Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 129 Brazil Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 130 Brazil Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 131 Brazil Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 132 Brazil Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 133 Mexico Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 134 Mexico Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 135 Mexico Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 136 Mexico Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 137 Mexico Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 138 Mexico Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 139 Rest of Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 140 Rest of Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 141 Rest of Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 142 Rest of Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 143 Rest of Latin America Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 144 Rest of Latin America Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 145 Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 146 Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 147 Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 148 Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 149 Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 150 Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 151 Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2026 to 2036

Table 152 Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Country and Sub-region, 2026 to 2036

Table 153 GCC Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 154 GCC Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 155 GCC Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 156 GCC Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 157 GCC Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 158 GCC Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 159 South Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 160 South Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 161 South Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 162 South Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 163 South Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 164 South Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

Table 165 Rest of Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Type , 2026 to 2036

Table 166 Rest of Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Type , 2026 to 2036

Table 167 Rest of Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by Application, 2026 to 2036

Table 168 Rest of Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by Application, 2026 to 2036

Table 169 Rest of Middle East & Africa Metalworking Fluids Market Volume (Kilo Tons) Forecast, by End-use, 2026 to 2036

Table 170 Rest of Middle East & Africa Metalworking Fluids Market Value (US$ Bn) Forecast, by End-use, 2026 to 2036

List of Figures

Figure 1 Global Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 2 Global Metalworking Fluids Market Attractiveness, by Type

Figure 3 Global Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 4 Global Metalworking Fluids Market Attractiveness, by Application

Figure 5 Global Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 6 Global Metalworking Fluids Market Attractiveness, by End-use

Figure 7 Global Metalworking Fluids Market Volume Share Analysis, by Region, 2025, 2029, and 2036

Figure 8 Global Metalworking Fluids Market Attractiveness, by Region

Figure 9 North America Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 10 North America Metalworking Fluids Market Attractiveness, by Type

Figure 11 North America Metalworking Fluids Market Attractiveness, by Type

Figure 12 North America Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 13 North America Metalworking Fluids Market Attractiveness, by Application

Figure 14 North America Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 15 North America Metalworking Fluids Market Attractiveness, by End-use

Figure 16 North America Metalworking Fluids Market Attractiveness, by Country and Sub-region

Figure 17 Europe Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 18 Europe Metalworking Fluids Market Attractiveness, by Type

Figure 19 Europe Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 20 Europe Metalworking Fluids Market Attractiveness, by Application

Figure 21 Europe Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 22 Europe Metalworking Fluids Market Attractiveness, by End-use

Figure 23 Europe Metalworking Fluids Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 24 Europe Metalworking Fluids Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 26 Asia Pacific Metalworking Fluids Market Attractiveness, by Type

Figure 27 Asia Pacific Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 28 Asia Pacific Metalworking Fluids Market Attractiveness, by Application

Figure 29 Asia Pacific Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 30 Asia Pacific Metalworking Fluids Market Attractiveness, by End-use

Figure 31 Asia Pacific Metalworking Fluids Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 32 Asia Pacific Metalworking Fluids Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 34 Latin America Metalworking Fluids Market Attractiveness, by Type

Figure 35 Latin America Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 36 Latin America Metalworking Fluids Market Attractiveness, by Application

Figure 37 Latin America Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 38 Latin America Metalworking Fluids Market Attractiveness, by End-use

Figure 39 Latin America Metalworking Fluids Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 40 Latin America Metalworking Fluids Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Metalworking Fluids Market Volume Share Analysis, by Type , 2025, 2029, and 2036

Figure 42 Middle East & Africa Metalworking Fluids Market Attractiveness, by Type

Figure 43 Middle East & Africa Metalworking Fluids Market Volume Share Analysis, by Application, 2025, 2029, and 2036

Figure 44 Middle East & Africa Metalworking Fluids Market Attractiveness, by Application

Figure 45 Middle East & Africa Metalworking Fluids Market Volume Share Analysis, by End-use, 2025, 2029, and 2036

Figure 46 Middle East & Africa Metalworking Fluids Market Attractiveness, by End-use

Figure 47 Middle East & Africa Metalworking Fluids Market Volume Share Analysis, by Country and Sub-region, 2025, 2029, and 2036

Figure 48 Middle East & Africa Metalworking Fluids Market Attractiveness, by Country and Sub-region