Reports

Reports

Medical radioisotopes market is expanding exponentially and immensely influenced by the increasing demand for diagnostic imaging and therapeutic usage of medical practice The increasing incidence of chronic diseases such as cancer and cardiovascular disease is increasing demand for sophisticated imaging modalities such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT).

These imaging techniques are highly reliant on medical radioisotopes, particularly fluorine-18 and technetium-99m, in order to make accurate diagnosis and treatment planning.

Secondly, pharmaceutical development of radiopharmaceuticals is enhancing the efficiency of targeted therapy, primarily in oncology. The accuracy of administering accurate radiation doses to cancer cells minimizes harm to neighboring healthy tissues and hence leads to improved patient outcomes as well as lower side effects.

This shift in focus toward personalized medicine is also propelling innovation within the industry as healthcare providers are seeking new ways of personalizing treatments to meet the unique needs of individual patients.

In addition, increased research and development expenditure, along with collaborative research among pharmaceutical companies and research institutions is expected to drive innovation in the production and use of medical radioisotopes. Overall, the medical radioisotopes market is likely to experience robust growth driven by technology developments, increasing disease incidence, and trend towards more targeted health care solutions.

Medical radioisotopes imply radioactive substances used for diagnosing and treating various medical conditions, particularly in oncology, cardiology, and neurology. Such isotopes emit radiation that can be detected by imaging devices, thereby allowing healthcare professionals to visualize and assess internal bodily functions and structures.

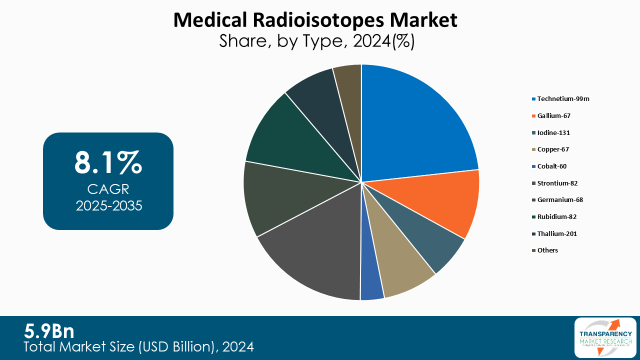

Commonly used medical radioisotopes are inclusive of technetium-99m, which is broadly employed in diagnostic imaging owing to its ideal properties and iodine-131 utilized for treating thyroid disorders.

The applications of medical radioisotopes extend beyond diagnostics. They also play a crucial role in targeted therapies, delivering precise radiation doses to cancerous tissues while minimizing damage to surrounding healthy cells. The growing prevalence of chronic diseases and advancements in radiopharmaceuticals is driving demand for these isotopes.

As research continues to evolve, the development of new radioisotopes and innovative applications is expected to enhance patient care and improve treatment outcomes, solidifying their importance in modern medicine.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

Growing demand for nuclear medicine is one of the key growth drivers to the medical radioisotopes market. Nuclear medicine, including the application of radioactive material in diagnosis and treatment, is being widely used by patients and doctors.

This growing awareness is a result of the numerous education campaigns, advanced imaging modalities, and rising prevalence of chronic diseases such as cancer and cardiovascular disease. The higher the education of medical physicians in the applications and benefits of nuclear medicine, the more probable is the likelihood of it being utilized as part of the treatment by the patient.

Patients have also been more educated, and number of individuals are seeking newer diagnostic modalities and treatments. As awareness of the usefulness of modalities like PET and SPECT scans grows among the public, the demand for medical radioisotopes will continue to grow. These imaging tests are non-surgical and provide useful information regarding disease progression, which will aid in treatment planning.

Besides, personalized medicine is working toward making nuclear medicine more preferable as it allows individualized treatment with least side-effects but maximum therapeutic effect. Collaboration between research institutes and pharmaceutical firms is driving innovation, which is resulting in novel radioisotopes and applications.

The increased demand for personalized medicine is one of the major market drivers to the medical radioisotopes market as healthcare is trending toward patient-specific treatment plans individually tailored as per the needs of an individual.

Personalized medicine according to genetic, environmental, and lifestyle determinants in line with personalized medicine is compatible with the applications of medical radioisotopes. These isotopes focus on targeted therapy where the appropriate dose of radiation is delivered to diseased tissue and minimal harm is caused to adjacent normal tissue with maximal therapeutic effect.

With patients and clinicians wanting improved and less toxic therapy, the role of medical radioisotopes is even more important. Radioisotopes, for instance, can be used in targeted cancer radiotherapy to create therapies tailored to a patient's tumor molecular signature. This is not only maximized for result but reduces side-effects, which aids with and meets compliance with treatment.

The cardiology application market leads the medical radioisotopes market worldwide due to the increasing prevalence of cardiovascular diseases (CVDs) and the pivotal use of nuclear imaging in the diagnosis and treatment of the same.

As CVDs remain a prime cause of morbidity and mortality worldwide, demand for effective diagnostic mechanisms has picked up pace. Clinical radioisotopes such as technetium-99m and thallium-201 find extensive use in a range of cardiac imaging techniques, ranging from myocardial perfusion imaging and stress tests, which are used in heart function and failure diagnosis.

Besides, advancements in imaging technology have further increased the specificity and sensitivity of nuclear medicine modalities in cardiology. The advancements enable physicians to obtain satisfactory information regarding the state of the heart, therefore enabling interventions on time as well as appropriate therapy planning, this informs.

Non-invasive is also the characteristic that makes the imaging technologies quite popular among physicians as well as patients since they reduce the need for more invasive diagnostic methods.

Moreover, greater awareness among physicians for the benefits of nuclear medicine in cardiology is driving its adoption. Rising patient age and lifestyle risk factors responsible for the growing number of CVDs are pushing the cardiology application segment to continue leading the medical radioisotopes market, with growing diagnostic capability and patient results.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

According to the latest analysis of the medical radioisotopes market, North America held the largest market share in 2024 due to the region being home to well-developed medical infrastructure with highly developed medical facilities and equipment. It is such an infrastructure that sustains massive utilization of nuclear medicine, hence allowing for the use of medical radioisotopes in treatment and diagnosis.

Second, there has been an unprecedented increase in the number of chronic diseases such as cancer and cardiovascular diseases, which give rise to new diagnostic and therapeutic modalities. With clinicians seeking effective ways of treating such diseases, nuclear medicine has emerged as a valuable tool for targeted diagnosis and tailored treatment.

Moreover, incentive through regulation and supportive reimbursement in Canada and the United States enables use of medical radioisotopes among more patient populations. These compounded factors position North America in leadership of the medical radioisotopes market, driving expansion and improving nuclear medicine patient care.

Siemens Healthineers, Lantheus Holdings, Abbott Laboratories, Eli Lilly, Sanofi, Orano, Rosatom, Cardinal Health, Curium, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, BWX Technologies, Shine Medical Technologies, NECSA Ltd are some of the leading key players operating in the medical radioisotopes industry.

Each of these players have been have been profiled in the medical radioisotopes market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

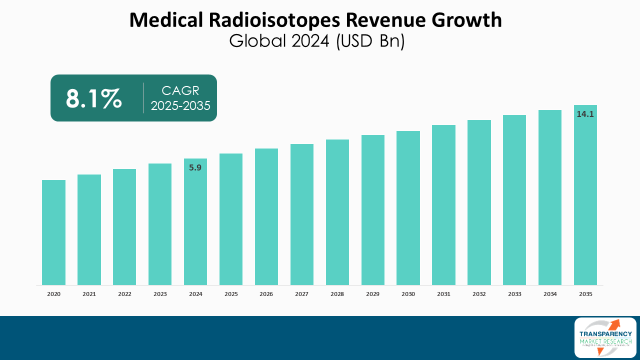

| Size in 2024 | US$ 5.9 Bn |

| Forecast Value in 2035 | US$ 14.1 Bn |

| CAGR | 8.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn |

| Medical Radioisotopes Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 5.9 Bn in 2024.

It was projected to cross US$ 14.1 Bn by the end of 2035.

Growing awareness of nuclear medicine and rising demand for personalized medicine.

It is projected to advance at a CAGR of 8.1% from 2025 to 2035.

North America was the dominant region in 2024.

Siemens Healthineers, Lantheus Holdings, Abbott Laboratories, Eli Lilly, Sanofi, Orano, Rosatom, Cardinal Health, Curium, IBA Radiopharma Solutions, NorthStar Medical Radioisotopes, BWX Technologies, Shine Medical Technologies, NECSA Ltd, and others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Medical Radioisotopes Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Medical Radioisotopes Market Analysis and Forecast, 2020-2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Recent Advancements

5.2. PORTER’s Five Forces Analysis

5.3. PESTEL Analysis

5.4. Value Chain Analysis

5.5. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.6. Pricing Analysis (Brand pricing, Average Selling Price by Region/Country)

5.7. Regulatory Scenario by Key Country

5.8. Research and Development Trends

5.9. Go-to-Market Strategy for New Market Entrants

6. Global Medical Radioisotopes Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2020-2035

6.3.1. Technetium-99m

6.3.2. Gallium-67

6.3.3. Iodine-131

6.3.4. Copper-67

6.3.5. Cobalt-60

6.3.6. Strontium-82

6.3.7. Germanium-68

6.3.8. Rubidium-82

6.3.9. Thallium-201

6.3.10. Others

6.4. Market Attractiveness Analysis, by Type

7. Global Medical Radioisotopes Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2020-2035

7.3.1. Cardiology

7.3.2. Oncology

7.3.3. Neurology

7.3.4. Nephrology

7.3.5. Thyroid

7.3.6. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Medical Radioisotopes Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2020-2035

8.3.1. Hospitals

8.3.2. Diagnostics Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Medical Radioisotopes Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2020-2035

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Medical Radioisotopes Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2020-2035

10.2.1. Technetium-99m

10.2.2. Gallium-67

10.2.3. Iodine-131

10.2.4. Copper-67

10.2.5. Cobalt-60

10.2.6. Strontium-82

10.2.7. Germanium-68

10.2.8. Rubidium-82

10.2.9. Thallium-201

10.2.10. Others

10.3. Market Value Forecast, by Application, 2020-2035

10.3.1. Cardiology

10.3.2. Oncology

10.3.3. Neurology

10.3.4. Nephrology

10.3.5. Thyroid

10.3.6. Others

10.4. Market Value Forecast, by End-user, 2020-2035

10.4.1. Hospitals

10.4.2. Diagnostics Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2020-2035

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Medical Radioisotopes Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2020-2035

11.2.1. Technetium-99m

11.2.2. Gallium-67

11.2.3. Iodine-131

11.2.4. Copper-67

11.2.5. Cobalt-60

11.2.6. Strontium-82

11.2.7. Germanium-68

11.2.8. Rubidium-82

11.2.9. Thallium-201

11.2.10. Others

11.3. Market Value Forecast, by Application, 2020-2035

11.3.1. Cardiology

11.3.2. Oncology

11.3.3. Neurology

11.3.4. Nephrology

11.3.5. Thyroid

11.3.6. Others

11.4. Market Value Forecast, by End-user, 2020-2035

11.4.1. Hospitals

11.4.2. Diagnostics Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2020-2035

11.5.1. Germany

11.5.2. UK

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Medical Radioisotopes Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2020-2035

12.2.1. Technetium-99m

12.2.2. Gallium-67

12.2.3. Iodine-131

12.2.4. Copper-67

12.2.5. Cobalt-60

12.2.6. Strontium-82

12.2.7. Germanium-68

12.2.8. Rubidium-82

12.2.9. Thallium-201

12.2.10. Others

12.3. Market Value Forecast, by Application, 2020-2035

12.3.1. Cardiology

12.3.2. Oncology

12.3.3. Neurology

12.3.4. Nephrology

12.3.5. Thyroid

12.3.6. Others

12.4. Market Value Forecast, by End-user, 2020-2035

12.4.1. Hospitals

12.4.2. Diagnostics Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2020-2035

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Medical Radioisotopes Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2020-2035

13.2.1. Technetium-99m

13.2.2. Gallium-67

13.2.3. Iodine-131

13.2.4. Copper-67

13.2.5. Cobalt-60

13.2.6. Strontium-82

13.2.7. Germanium-68

13.2.8. Rubidium-82

13.2.9. Thallium-201

13.2.10. Others

13.3. Market Value Forecast, by Application, 2020-2035

13.3.1. Cardiology

13.3.2. Oncology

13.3.3. Neurology

13.3.4. Nephrology

13.3.5. Thyroid

13.3.6. Others

13.4. Market Value Forecast, by End-user, 2020-2035

13.4.1. Hospitals

13.4.2. Diagnostics Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2020-2035

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Medical Radioisotopes Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2020-2035

14.2.1. Technetium-99m

14.2.2. Gallium-67

14.2.3. Iodine-131

14.2.4. Copper-67

14.2.5. Cobalt-60

14.2.6. Strontium-82

14.2.7. Germanium-68

14.2.8. Rubidium-82

14.2.9. Thallium-201

14.2.10. Others

14.3. Market Value Forecast, by Application, 2020-2035

14.3.1. Cardiology

14.3.2. Oncology

14.3.3. Neurology

14.3.4. Nephrology

14.3.5. Thyroid

14.3.6. Others

14.4. Market Value Forecast, by End-user, 2020-2035

14.4.1. Hospitals

14.4.2. Diagnostics Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2020-2035

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2024)

15.3. Company Profiles

15.3.1. Siemens Healthineers

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Lantheus Holdings

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Abbott Laboratories

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Eli Lilly

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Sanofi

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Orano

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Rosatom

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Cardinal Health

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

15.3.9. Curium

15.3.9.1. Company Overview

15.3.9.2. Financial Overview

15.3.9.3. Product Portfolio

15.3.9.4. Business Strategies

15.3.9.5. Recent Developments

15.3.10. IBA Radiopharma Solutions

15.3.10.1. Company Overview

15.3.10.2. Financial Overview

15.3.10.3. Product Portfolio

15.3.10.4. Business Strategies

15.3.10.5. Recent Developments

15.3.11. NorthStar Medical Radioisotopes

15.3.11.1. Company Overview

15.3.11.2. Financial Overview

15.3.11.3. Product Portfolio

15.3.11.4. Business Strategies

15.3.11.5. Recent Developments

15.3.12. BWX Technologies

15.3.12.1. Company Overview

15.3.12.2. Financial Overview

15.3.12.3. Product Portfolio

15.3.12.4. Business Strategies

15.3.12.5. Recent Developments

15.3.13. Shine Medical Technologies

15.3.13.1. Company Overview

15.3.13.2. Financial Overview

15.3.13.3. Product Portfolio

15.3.13.4. Business Strategies

15.3.13.5. Recent Developments

15.3.14. NECSA Ltd

15.3.14.1. Company Overview

15.3.14.2. Financial Overview

15.3.14.3. Product Portfolio

15.3.14.4. Business Strategies

15.3.14.5. Recent Developments

List of Tables

Table 01: Global Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 02: Global Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 03: Global Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 04: Global Medical Radioisotopes Market Value (US$ Bn) Forecast, By Region, 2020-2035

Table 05: North America - Medical Radioisotopes Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 06: North America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 07: North America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 08: North America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 09: Europe - Medical Radioisotopes Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 10: Europe - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 11: Europe - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 12: Europe - Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 13: Asia Pacific - Medical Radioisotopes Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 14: Asia Pacific - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 15: Asia Pacific - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 16: Asia Pacific - Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 17: Latin America - Medical Radioisotopes Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 18: Latin America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 19: Latin America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 20: Latin America - Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

Table 21: Middle East & Africa - Medical Radioisotopes Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020-2035

Table 22: Middle East & Africa - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Type, 2020-2035

Table 23: Middle East & Africa - Medical Radioisotopes Market Value (US$ Bn) Forecast, By Application, 2020-2035

Table 24: Middle East & Africa - Medical Radioisotopes Market Value (US$ Bn) Forecast, By End-user, 2020-2035

List of Figures

Figure 01: Global Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 02: Global Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 03: Global Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 04: Global Medical Radioisotopes Market Revenue (US$ Bn), by Technetium-99m, 2020-2035

Figure 05: Global Medical Radioisotopes Market Revenue (US$ Bn), by Gallium-67, 2020-2035

Figure 06: Global Medical Radioisotopes Market Revenue (US$ Bn), by Iodine-131, 2020-2035

Figure 07: Global Medical Radioisotopes Market Revenue (US$ Bn), by Copper-67, 2020-2035

Figure 08: Global Medical Radioisotopes Market Revenue (US$ Bn), by Cobalt-60, 2020-2035

Figure 09: Global Medical Radioisotopes Market Revenue (US$ Bn), by Strontium-82, 2020-2035

Figure 10: Global Medical Radioisotopes Market Revenue (US$ Bn), by Germanium-68, 2020-2035

Figure 11: Global Medical Radioisotopes Market Revenue (US$ Bn), by Rubidium-82, 2020-2035

Figure 12: Global Medical Radioisotopes Market Revenue (US$ Bn), by Thallium-201, 2020-2035

Figure 13: Global Medical Radioisotopes Market Revenue (US$ Bn), by Others, 2020-2035

Figure 14: Global Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 15: Global Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 16: Global Medical Radioisotopes Market Revenue (US$ Bn), by Cardiology, 2020-2035

Figure 17: Global Medical Radioisotopes Market Revenue (US$ Bn), by Oncology, 2020-2035

Figure 18: Global Medical Radioisotopes Market Revenue (US$ Bn), by Neurology, 2020-2035

Figure 19: Global Medical Radioisotopes Market Revenue (US$ Bn), by Nephrology, 2020-2035

Figure 20: Global Medical Radioisotopes Market Revenue (US$ Bn), by Thyroid, 2020-2035

Figure 21: Global Medical Radioisotopes Market Revenue (US$ Bn), by Others, 2020-2035

Figure 22: Global Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 23: Global Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035

Figure 24: Global Medical Radioisotopes Market Revenue (US$ Bn), by Hospitals, 2020-2035

Figure 25: Global Medical Radioisotopes Market Revenue (US$ Bn), by Diagnostic Centers, 2020-2035

Figure 26: Global Medical Radioisotopes Market Revenue (US$ Bn), by Others, 2020-2035

Figure 27: Global Medical Radioisotopes Market Value Share Analysis, By Region, 2024 and 2035

Figure 28: Global Medical Radioisotopes Market Attractiveness Analysis, By Region, 2025-2035

Figure 29: North America - Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 30: North America - Medical Radioisotopes Market Value Share Analysis, by Country, 2024 and 2035

Figure 31: North America - Medical Radioisotopes Market Attractiveness Analysis, by Country, 2025-2035

Figure 32: North America - Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 33: North America - Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 34: North America - Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 35: North America - Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 36: North America - Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 37: North America - Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035

Figure 38: Europe - Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 39: Europe - Medical Radioisotopes Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 40: Europe - Medical Radioisotopes Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 41: Europe - Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 42: Europe - Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 43: Europe - Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 44: Europe - Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 45: Europe - Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 46: Europe - Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035

Figure 47: Asia Pacific - Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 48: Asia Pacific - Medical Radioisotopes Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 49: Asia Pacific - Medical Radioisotopes Market Attractiveness Analysis, by Country/Sub-region, 2025-2035

Figure 50: Asia Pacific - Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 51: Asia Pacific - Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 52: Asia Pacific - Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: Asia Pacific - Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 54: Asia Pacific - Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 55: Asia Pacific - Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035

Figure 56: Latin America - Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 57: Latin America - Medical Radioisotopes Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 58: Latin America - Medical Radioisotopes Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 59: Latin America - Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 60: Latin America - Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 61: Latin America - Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 62: Latin America - Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 63: Latin America - Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 64: Latin America - Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035

Figure 65: Middle East & Africa - Medical Radioisotopes Market Value (US$ Bn) Forecast, 2020-2035

Figure 66: Middle East & Africa - Medical Radioisotopes Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 67: Middle East & Africa - Medical Radioisotopes Market Attractiveness Analysis, by Country / Sub-region, 2025-2035

Figure 68: Middle East & Africa - Medical Radioisotopes Market Value Share Analysis, By Type, 2024 and 2035

Figure 69: Middle East & Africa - Medical Radioisotopes Market Attractiveness Analysis, By Type, 2025-2035

Figure 70: Middle East & Africa - Medical Radioisotopes Market Value Share Analysis, By Application, 2024 and 2035

Figure 71: Middle East & Africa - Medical Radioisotopes Market Attractiveness Analysis, By Application, 2025-2035

Figure 72: Middle East & Africa - Medical Radioisotopes Market Value Share Analysis, By End-user, 2024 and 2035

Figure 73: Middle East & Africa - Medical Radioisotopes Market Attractiveness Analysis, By End-user, 2025-2035