Reports

Reports

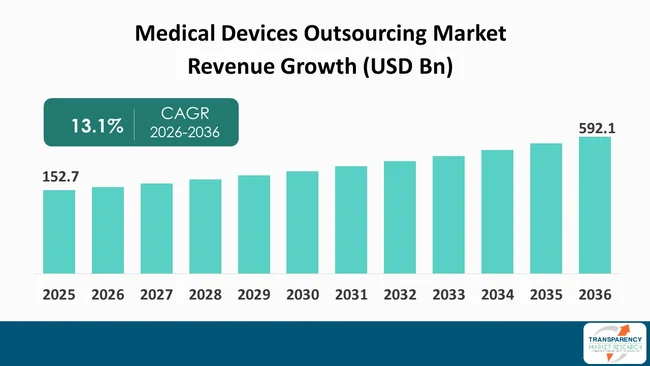

The global medical devices outsourcing market size was valued at US$ 152.7 Bn in 2025 and is projected to reach US$ 592.1 Bn by 2036, expanding at a CAGR of 13.1% from 2026 to 2036. The medical devices outsourcing Industry is without steadiness due to increasing complexity in device design, rising regulatory compliance requirements, and the need for cost-efficient manufacturing solutions.

Key drivers include OEMs focusing on core competencies, growing demand for specialized services (such as product design, testing, and regulatory affairs), and the rapid adoption of advanced technologies like AI-enabled diagnostics and minimally invasive devices.

The medical devices outsourcing industry expanding as Original Equipment Manufacturers (OEMs) utilize specialized third party providers for designing, manufacturing, testing, and regulatory, and quality management processes in order to improve their efficiency and focus on their core areas of innovation. Outsourcing is now looked upon as an important strategy that companies need to pursue due to the increasing complexity of products and the need for shorter life cycles for them. As such, it is difficult for many OEMs to keep up with the capabilities required to manufacture these items and remain competitive in the marketplace.

The major drivers of this trend are increased demand for cost savings; an increase in regulatory burdens for medical devices across all global markets; an increase in chronic diseases; the need for companies to get access to advanced manufacturing technologies; and the need for companies to get skilled employees who can work with these technologies. The main challenges witnessed by the medical device outsourcing market are concerns surrounding intellectual property; concerns surrounding the ability to maintain control over the quality of the product being manufactured by the contracting manufacturer; dependency on an external partner in combination with concerns relating to quality controls; and the complexity associated with managing a large, complex, and global supply chain.

Medical Devices Outsourcing enables companies to reduce operational costs, accelerate time-to-market, access advanced technologies and skilled expertise, and maintain compliance with complex global regulatory standards, while allowing them to focus on core competencies like innovation and commercialization.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The medical device industry is experiencing increasing complexity, and this is generating a strong growth trend in the medical devices outsourcing market (MDOM). Modern medical devices incorporate various sophisticated technologies including software, sensors, artificial intelligence, robotics, and connected features that make development and production of medical devices increasingly complex.

Outsourcing service providers often support OEMs with the major functions such as product design; prototyping; validation; testing; and quality management to assist OEM manufacturers in meeting stringent product safety and performance standards.

Furthermore, with the continuing evolution of global regulatory standards, OEMs have become increasingly dependent on outsourcing service providers that have expertise in creating regulatory documentation, clinical validation, and approval processes. Also, outsourcing gives OEMs access to advanced manufacturing technologies (e.g., automation; additive manufacturing; digital quality systems) that have very significant capital investment requirements.

Due to the increase in both - the populace as well as the prevalence of chronic illnesses, it is anticipated that there will be a substantial increase in global medical device outsourcing market size.

The increase in the size of the global medical device outsourcing market can also be attributed to the rising incidences of chronic diseases will continue to place additional pressure on manufacturers to produce more, expand the range of products they offer and hasten the time it takes to bring new products through research and development to market. Consequently, many OEMs are utilizing outsourced providers for their manufacturing, engineering, testing, regulatory compliance, and quality management needs in order to be able to meet this increased demand.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

The rising demand for quality management and regulatory services in global markets is bound to create an important opportunity for growth in the medical device outsourcing market globally. To gain approval to market their products, medical device manufacturers have to adhere to ever-changing and increasingly complex regulatory regimes such as the FDA, the Global CE and ISO standards.

There is a need for a large amount of specialized expertise and resources in order to manage the quantity of regulatory documentation, conduct clinical validation, perform quality audits and establish post-market surveillance. Many original equipment manufacturers (OEMs) do not have any regulatory resources in-house and often have the need for regulatory assistance when they make an attempt to enter into new international markets. Therefore, many of these companies are outsourcing their regulatory and quality functions to specialized regulatory and quality outsourcing service providers that have an expertise in global regulatory compliance.

In addition, outsourced regulatory service providers can also assist with product lifecycle management such as changing products (product modifications), renewing product approvals (product recertifications), conducting lenticular reporting in response to adverse events (vigilance reporting) and providing advice on how to comply with the growing number of regulatory requirements. In summary, with the continued increase in regulatory scrutiny throughout the world, it is anticipated that there will be a growing demand for regulatory and quality management services provided by outsourcing service providers of medical devices.

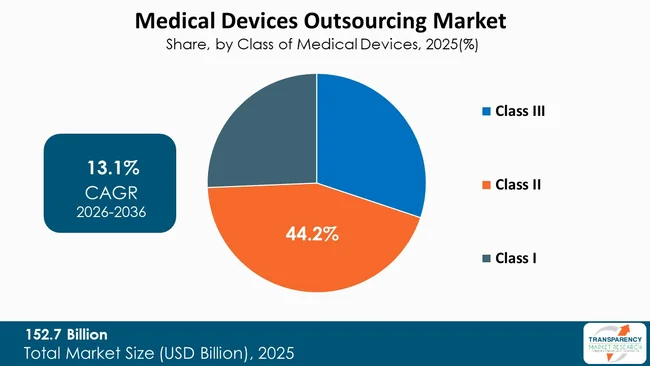

Class II medical devices need to adhere to strict regulatory requirements, including but not limited to, performance testing, validation, risk management and quality system compliance. Consequently, manufacturers have increasingly started using outsourcing partners to ensure compliance, minimize development risks, and expedite time to market.

The increasing demand for diagnostic and monitoring equipment driven by an aging population and increasing prevalence of chronic disease provides additional support to the continuing leadership position of Class II devices in the marketplace. OEMs are consistently seeking cost efficient manufacturing and faster innovations cycles, which will continue to push this segment toward increased outsourcing and thereby clearly position Class II devices as an integral part of the overall global medical devices outsourcing market.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia Pacific is the dominant region in the medical devices outsourcing market, accounting for a considerable 36.3% market share. The Asia-Pacific region has emerged as the number one region across all regions globally for medical devices outsourcing due to its strong manufacturing ecosystem, competitively priced labor, and continuously expanding health industry across all of its countries. The region has significant advantages (e.g., about 60% less expensive labor) over the U.S. and Europe with respect to its labor and production costs, which allows medical device OEM’s (Original Equipment Manufacturer) improved takedown time while maintaining quality and regulatory standards for products.

Economies such as China, India, Japan, and South Korea are becoming strong outsourcing locations for medical devices as they have a large pool of technically experienced employees available as well as a large number of firms providing contract manufacturing and contract engineering services.

Additionally, Asia Pacific continues to draw investment into health infrastructure and medical technology through favorable government policies, tax breaks, and initiatives to develop greater domestic manufacturing capability. In addition, there are well-established supply chain networks in the Asia Pacific region as well as improving regulatory frameworks, which increases attractiveness through decreased time to develop products for production, manufacturing and global distribution.

Additionally, due to the increased adoption of automated, digitally produced, and quality managed medical device manufacturing processes by contract manufacturing and contract engineering service providers in Asia Pacific, Asia Pacific will continue to be recognized as the leading region globally for medical devices outsourcing.

Europlaz, Pro-Tech Design and Manufacturing Inc, SGS Société Générale de Surveillance SA , Preqin, Charles River Laboratories, Intertek Group plc, IQVIA, Labcorp., Pace Analytical, Sterigenics U.S., LLC, WuXi AppTec, Pro-Tech Design and Manufacturing Inc, Nissha Co. Ltd., Biomerics are the key players governing the global medical devices outsourcing market.

Each of these players has been profiled in the medical devices outsourcing Industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 152.7 Bn |

| Forecast Value in 2036 | More than US$ 592.1 Bn |

| CAGR | 13.1% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Service

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global medical devices outsourcing market was valued at US$ 152.7 Bn in 2025

The global medical devices outsourcing industry is projected to cross US$ 592.1 Bn by the end of 2036

Rising complexity of medical devices requiring specialized technical expertise and Growing demand for medical devices due to aging population and chronic diseases

The global medical devices outsourcing market is anticipated to grow at a CAGR 13.1% from 2026 to 2036

Asia Pacific is expected to account for the largest share from 2025 to 2035

Europlaz, Pro-Tech Design and Manufacturing Inc, SGS Société Générale de Surveillance SA , Preqin, Charles River Laboratories, Intertek Group plc, IQVIA, Labcorp., Pace Analytical, Sterigenics U.S., LLC, WuXi AppTec, Pro-Tech Design and Manufacturing Inc, Nissha Co. Ltd., Biomerics

Table 01: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 02: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 03: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 04: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 05: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 06: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 07: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 08: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 09: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 10: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 11: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 12: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 13: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 14: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 15: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 16: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 17: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 18: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 19: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 20: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 21: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 22: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 23: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 24: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 25: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 26: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 27: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 28: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 29: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 30: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 31: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 32: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 33: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 34: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 35: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 36: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 37: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 38: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 39: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 40: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 41: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 42: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 43: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 44: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 45: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 46: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 47: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 48: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 49: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 50: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 51: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 52: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 53: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 54: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 55: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 56: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 57: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 58: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 59: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 60: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 61: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 62: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 63: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 64: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 65: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 66: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 67: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 68: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 69: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 70: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 71: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 72: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 73: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 74: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 70: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 71: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 72: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 73: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 74: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 80: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 81: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 82: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 83: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 84: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 85: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 86: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 87: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 88: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 89: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 90: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 91: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 92: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 93: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 94: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 90: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 91: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 92: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 93: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 94: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 100: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 101: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 102: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 103: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 104: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 105: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 106: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 107: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 108: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 109: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 110: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 111: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 112: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 113: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 114: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 115: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 116: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 117: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 118: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 119: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 120: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 121: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 122: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 123: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 124: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 125: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 126: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 127: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 128: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 129: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 130: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 131: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 132: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 133: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 134: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 135: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 136: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 137: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 138: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 139: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 140: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 141: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 142: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 143: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 144: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 145: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 146: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Table 147: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Service, 2021 to 2036

Table 148: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Regulatory Affairs Services, 2021 to 2036

Table 149: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Product Design and Development Services, 2021 to 2036

Table 150: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Class of Medical Devices, 2021 to 2036

Table 151: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, by Application, 2021 to 2036

Figure 01: Global Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 03: Global Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 04: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Regulatory Affairs Services, 2021 to 2036

Figure 05: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Product Design and Development Services, 2021 to 2036

Figure 06: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Product Testing & Sterilization Services, 2021 to 2036

Figure 07: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Product Implementation Services, 2021 to 2036

Figure 08: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Product Upgrade Services, 2021 to 2036

Figure 09: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Product Maintenance Services, 2021 to 2036

Figure 10: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Contract Manufacturing, 2021 to 2036

Figure 11: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 12: Global Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 13: Global Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 14: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Class III, 2021 to 2036

Figure 15: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Class II, 2021 to 2036

Figure 16: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Class I, 2021 to 2036

Figure 17: Global Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 18: Global Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 19: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Cardiology, 2021 to 2036

Figure 20: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Neurology, 2021 to 2036

Figure 21: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Radiology, 2021 to 2036

Figure 22: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Anesthesia, 2021 to 2036

Figure 23: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Orthopedic, 2021 to 2036

Figure 24: Global Medical Devices Outsourcing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 25: Global Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 26: Global Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 27: North America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 28: North America Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 29: North America Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 30: North America Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 31: North America Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 32: North America Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 33: North America Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 34: North America Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 35: North America Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 36: U.S. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 37: U.S. Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 38: U.S. Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 39: U.S. Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 40: U.S. Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 41: U.S. Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 42: U.S. Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 43: Canada Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 44: Canada Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 45: Canada Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 46: Canada Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 47: Canada Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 48: Canada Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 49: Canada Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 50: Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 51: Europe Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 52: Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 53: Europe Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 54: Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 55: Europe Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 56: Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 57: Europe Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 58: Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 59: Germany Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 60: Germany Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 61: Germany Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 62: Germany Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 63: Germany Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 64: Germany Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 65: Germany Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 66: U.K. Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 67: U.K. Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 68: U.K. Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 69: U.K. Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 70: U.K. Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 71: U.K. Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 72: U.K. Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 73: France Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 74: France Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 75: France Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 76: France Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 77: France Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 78: France Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 79: France Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 80: Italy Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 81: Italy Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 82: Italy Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 83: Italy Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 84: Italy Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 85: Italy Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 86: Italy Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 87: Spain Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 88: Spain Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 89: Spain Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 90: Spain Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 91: Spain Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 92: Spain Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 93: Spain Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 94: The Netherlands Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 95: The Netherlands Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 96: The Netherlands Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 97: The Netherlands Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 98: The Netherlands Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 99: The Netherlands Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 100: The Netherlands Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 101: Rest of Europe Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 102: Rest of Europe Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 103: Rest of Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 104: Rest of Europe Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 105: Rest of Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 106: Rest of Europe Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 107: Rest of Europe Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 108: Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 109: Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 110: Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 111: Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 112: Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 113: Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 114: Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 115: Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 116: Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 117: China Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 118: China Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 119: China Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 120: China Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 121: China Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 122: China Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 123: China Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 124: Japan Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 125: Japan Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 126: Japan Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 127: Japan Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 128: Japan Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 129: Japan Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 130: Japan Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 131: India Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 132: India Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 133: India Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 134: India Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 135: India Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 136: India Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 137: India Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 138: South Korea Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 139: South Korea Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 140: South Korea Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 141: South Korea Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 142: South Korea Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 143: South Korea Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 144: South Korea Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 145: Australia Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 146: Australia Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 147: Australia Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 148: Australia Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 149: Australia Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 150: Australia Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 151: Australia Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 152: ASEAN Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 153: ASEAN Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 154: ASEAN Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 155: ASEAN Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 156: ASEAN Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 157: ASEAN Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 158: ASEAN Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 159: Rest of Asia Pacific Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 160: Rest of Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 161: Rest of Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 162: Rest of Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 163: Rest of Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 164: Rest of Asia Pacific Medical Devices Outsourcing Market Value Share Analysis, by Application,

Figure 165: Rest of Asia Pacific Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 166: Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 167: Latin America Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 168: Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 169: Latin America Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 170: Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 171: Latin America Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 172: Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 173: Latin America Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 174: Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 175: Brazil Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 176: Brazil Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 177: Brazil Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 178: Brazil Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 179: Brazil Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 180: Brazil Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 181: Brazil Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 182: Mexico Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 183: Mexico Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 184: Mexico Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 185: Mexico Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 186: Mexico Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 187: Mexico Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 188: Mexico Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 189: Argentina Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 190: Argentina Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 191: Argentina Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 192: Argentina Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 193: Argentina Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 194: Argentina Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 195: Argentina Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 196: Rest of Latin America Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 197: Rest of Latin America Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 198: Rest of Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 199: Rest of Latin America Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 200: Rest of Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 201: Rest of Latin America Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 202: Rest of Latin America Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 203: Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 204: Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 205: Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 206: Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 207: Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 208: Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 209: Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 210: Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 211: Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 212: GCC Countries Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 213: GCC Countries Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 214: GCC Countries Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 215: GCC Countries Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 216: GCC Countries Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 217: GCC Countries Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 218: GCC Countries Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 219: South Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 220: South Africa Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 221: South Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 222: South Africa Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 223: South Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 224: South Africa Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 225: South Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036

Figure 226: Rest of Middle East and Africa Medical Devices Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 227: Rest of Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Service, 2025 and 2036

Figure 228: Rest of Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Service, 2026 to 2036

Figure 229: Rest of Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Class of Medical Devices, 2025 and 2036

Figure 230: Rest of Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Class of Medical Devices, 2026 to 2036

Figure 231: Rest of Middle East and Africa Medical Devices Outsourcing Market Value Share Analysis, by Application, 2025 and 2036

Figure 232: Rest of Middle East and Africa Medical Devices Outsourcing Market Attractiveness Analysis, by Application, 2026 to 2036