Reports

Reports

The global mechanical ventilators market is under the dynamic influence of the increased demand for critical care and improvements in emergency preparedness strategies by health systems. Hospitals are expanding intensive care unit capabilities, particularly in developing countries, and are prioritizing ventilation as a basic life-support tool.

.webp)

The COVID-19 pandemic had demonstrated the critical value of scalable supply chains for ventilators and prompted many governments to invest in stockpiling ventilators and creating an incentive for local manufacturing of ventilators.

Additionally, many ventilators have improved with new clinical capabilities to provide patient-specific respiratory support, while shortening the duration of complications related to mechanical ventilation. Many of these newer ventilators can derive data from digital health tools and algorithms, including AI, which, if used appropriately, may offer real-time monitoring and the ability to change ventilator settings (appropriate for the patient) without impacting support provided to the patient.

In addition, the demand for portable ventilators continues to increase as there is a market for non-invasive ventilation in home healthcare in the management of chronic diseases such as Chronic Obstructive Pulmonary Disease (COPD).

The global mechanical ventilators market is undergoing a strategic re-orientation, spurred by the interplay of clinical innovation and policy reform. The developing economies are investing into type of tiered healthcare system as well as district level ICU with advanced life-supporting technologies and related medical equipment to care for critical illness in intensive care.

Meanwhile, developed markets are working on modernizing their fleet of mechanical ventilators with compact and interoperable products. Advances in sensor technologies and smart connectivity mean ventilators can receive real-time feedback, allowing for better dynamics with patient effort.

The use of hybrid ventilators, which transition between invasive and non-invasive, have been widely accepted in higher acuity patient settings, as well as a shift toward personalized respiratory therapy. Algorithms that now calibrate ventilator parameters with device responsiveness through assessing patient specific data, change the way we deliver care, particularly in NICU and PICU settings, where security and accuracy take precedence.

The adoption of tele-ventilation is gaining popularity in remote patient management protocols with the use of remote device management capabilities, especially in rural or post-acute care facilities where supervision by a clinical team is limited. Meanwhile, numerous countries are enacting policy change and allowing reimbursement for the provision of home ventilation, which improves access for patients.

| Attribute | Detail |

|---|---|

| Mechanical Ventilators Market Drivers |

|

The worldwide increase in the incidences of chronic respiratory diseases such as chronic obstructive pulmonary disease (COPD), asthma, and pulmonary fibrosis is creating a strong demand for mechanical ventilators. COPD is now one of the top three reasons for death worldwide, with the World Health Organization estimating over 3.2 million fatalities worldwide each year. This adds to the need for both - acute and long-term ventilator support. Mechanical ventilators are effective in the management of acute exacerbations in COPD patients, as well as for long-term domiciliary ventilation.

With the aging population, especially in regions where financial resources are high (North America and Europe), the overall caseload of respiratory disorders increases. Elderly patients are at an increased risk of respiratory muscle fatigue and any identified co-morbidities require appropriate levels of mechanical support. For example, the Centers for Disease Control and Prevention (CDC) in the U.S. has estimated that nearly 16 million adults are diagnosed with COPD, while millions are not diagnosed or remain undiagnosed.

This growth has allowed a number of hospitals and home-care agencies to incorporate ventilators in order to manage patients long-term. Additionally, non-invasive ventilators are also being included in outpatient management as an effort to help limit hospitalizations.

The increasing use of advanced technology such as artificial intelligence (AI) in mechanical ventilator systems is radically changing the market. AI-enhanced ventilators give the ability to identify and recognize a patient's respiratory pattern in real-time. AI-enhanced ventilators can also automatically adjust ventilators settings/parameters such as tidal volume, pressure, and respiratory rate to provide the optimal ventilatory care, resulting in better patient outcomes and a reduction in the risk of ventilator-induced lung injury (VILI).

Hamilton Medical has incorporated adaptive support ventilation (ASV) technology into their ventilators, which is a closed-loop ventilatory system that allows the ventilator to automatically choose the best ventilation strategy based on the monitors it is continuously making of the lung mechanics.

This form of engineering allows them to manage unstable patients with much less risk of guessing and true manual manipulation. Smart ventilators with access to cloud connectivity harbor and provide remote monitoring and support additional innovation, which were of great use especially during the COVID-19 crisis. This type of solution is especially relevant in settings with reduced resources where specialist supervision may not always be available. AI algorithms can help identify early warning signs for worsening respiratory failure and support a provider deciding on the need for intervention.

Moreover, digital dashboards and predictive analytics are also being employed in ICUs to increase the efficiency of ventilator weaning, which can reduce Length of Stay (LOS), and improve ICU utilization. Advances in technology have also facilitated the development of smaller, more portable, and more efficient models, and the use of a ventilator can now be more feasible for ambulances, disasters, and home care.

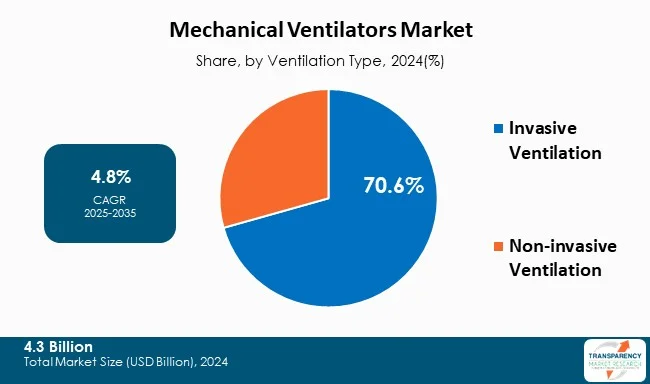

Invasive ventilators currently dominate the worldwide mechanical ventilators market. This is largely due to their essential role played in intensive care. Invasive ventilators are the ventilators used most extensively to assist patients with acute respiratory failure, or trauma, and for significant procedures requiring general anesthesia.

Invasive ventilators provide specific control over airway pressure and volume, unlike non-invasive ventilators. Due to the potential life-threatening nature of oxygenation and ventilation in can a patient with respiratory failure can be at, invasive ventilators are key.

In ICUs across the globe, invasive (also referred to as controlled) ventilation is the gold standard for patients at the pinnacle of the ARDS (Acute Respiratory Distress Syndrome) continuum, pneumonia, or post-operative respiratory insufficiency, among numerous other conditions.

Ventilation with an endotracheal or tracheostomy tube allows controlled oxygenation to better stabilize the patient and provide airway protection. In other words, there were a large number of patients admitted with ARDS who were invasively ventilated during the peak of the COVID-19 pandemic. Of course, this is no longer a pandemic, but invasive ventilators are a cornerstone in cardiac ICUs, trauma bays, or in cases of neuromuscular complications, where all non-invasive methods do not improve oxygenation.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America is the leading region in the global mechanical ventilators market, supported by an established healthcare infrastructure, vast critical care awareness, and rapid adoption of the latest advanced medical technologies. The U.S. share in mechanical ventilator utilization in North America is very important due to its extensive number of ICU spaces, progressive reimbursement policies, and determined investment in life-saving technologies.

The U.S. has over 95,000 ICU beds, which include modern respiratory care units, some of which have invasive and hybrid ventilators (American Hospital Association). The growth of the mechanical ventilators market in North America is fueled by grants funded by institutions like the NIH and BARDA to produce ventilator technologies and R&D funds to further develop or reinvent these technologies.

In North America, there has been a significant demand for hospital and portable ventilators due to the COVID-19 pandemic, for which the U.S. government had imposed the Defense Production Act, leading to an increased production of ventilators throughout the regions. Consequently, companies such as Vyaire Medical, Philips Respironics, and Medtronic have been able to scale their ventilator production and produce new models, with improved usability, and connectivity.

Canada also helps the North American region dominate, as public-private partnerships help develop innovative emergency ventilator designs (Gonzalo, 2020). North America's strong digital health infrastructure has also facilitated the accelerated integration of AI applications to ventilator systems.

Key players in the global mechanical ventilators market are investing in innovation, technological advancements, and forming alliances. Their objective is to improve the precision of testing, diversify their products, and gain a stronger market presence in order to be ahead of the curve in the evolving healthcare market.

Narang Medical Limited, Hamilton Medical, A.B. Industries, Noccarc Robotics Pvt Ltd, Philips Fisher & Paykel Healthcare, Draeger, Medtronic, GE HealthCare, Getinge, Mindray, Vyaire Medical, Inc., ResMed Inc., SCHILLER, and others are some of the leading key players.

Each of these players has been profiled in the mechanical ventilators market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 4.3 Bn |

| Forecast Value in 2035 | US$ 7.2 Bn |

| CAGR | 4.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Mechanical Ventilators Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 4.3 Bn in 2024.

It is projected to cross US$ 7.2 Bn by the end of 2035.

Rising prevalence of respiratory disorders and technological advancements and AI integration.

It is anticipated to grow at a CAGR of 4.8% from 2025 to 2035.

North America is expected to account for the largest share from 2025 to 2035.

Narang Medical Limited, Hamilton Medical, A.B. Industries, Noccarc Robotics Pvt Ltd, Philips Fisher & Paykel Healthcare, Draeger, Medtronic, GE HealthCare, Getinge, Mindray, Vyaire Medical, Inc., ResMed Inc., SCHILLER, and Others.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mechanical Ventilators Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mechanical Ventilators Market Analysis and Forecast, 2020 to 2035

4.4.1. Market Revenue Projections (US$ Bn)

5. Key Insights

5.1. Key Industry Events

5.2. Product/Brand Analysis

5.3. Pricing Trend Analysis

5.4. PESTEL Analysis

5.5. PORTER's Five Forces Analysis

5.6. Regulatory Scenario by Key Countries/Regions

5.7. Epidemiology of Lung Diseases

5.8. Benchmarking of Products Offered by the Competitors

5.9. Go-to-market Strategy

5.10. Unmet Needs of the Market

6. Global Mechanical Ventilators Market Analysis and Forecast, by Ventilation Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Ventilation Type, 2020 to 2035

6.3.1. Invasive Ventilation

6.3.2. Non-invasive Ventilation

6.4. Market Attractiveness Analysis, by Ventilation Type

7. Global Mechanical Ventilators Market Analysis and Forecast, by Age-group

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Age-group, 2020 to 2035

7.3.1. Children

7.3.2. Adults

7.4. Market Attractiveness Analysis, by Age-group

8. Global Mechanical Ventilators Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by Application, 2020 to 2035

8.3.1. Respiratory Distress

8.3.2. Pneumonia

8.3.3. Others

8.4. Market Attractiveness Analysis, by Application

9. Global Mechanical Ventilators Market Analysis and Forecast, by End-user

9.1. Introduction & Definition

9.2. Key Findings/Developments

9.3. Market Value Forecast, by End-user, 2020 to 2035

9.3.1. Hospitals & Clinics

9.3.2. Critical Care Centers

9.3.3. Emergency and Transport Centers

9.3.4. Others

9.4. Market Attractiveness Analysis, by End-user

10. Global Mechanical Ventilators Market Analysis and Forecast, by Region

10.1. Key Findings

10.2. Market Value Forecast, by Region, 2020 to 2035

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Region

11. North America Mechanical Ventilators Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Ventilation Type, 2020 to 2035

11.2.1. Invasive Ventilation

11.2.2. Non-invasive Ventilation

11.3. Market Value Forecast, by Age-group, 2020 to 2035

11.3.1. Children

11.3.2. Adults

11.4. Market Value Forecast, by Application, 2020 to 2035

11.4.1. Respiratory Distress

11.4.2. Pneumonia

11.4.3. Others

11.5. Market Value Forecast, by End-user, 2020 to 2035

11.5.1. Hospitals & Clinics

11.5.2. Critical Care Centers

11.5.3. Emergency and Transport Centers

11.5.4. Others

11.6. Market Value Forecast, by Country, 2020 to 2035

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Ventilation Type

11.7.2. By Age-group

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Mechanical Ventilators Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Ventilation Type, 2020 to 2035

12.2.1. Invasive Ventilation

12.2.2. Non-invasive Ventilation

12.3. Market Value Forecast, by Age-group, 2020 to 2035

12.3.1. Children

12.3.2. Adults

12.4. Market Value Forecast, by Application, 2020 to 2035

12.4.1. Respiratory Distress

12.4.2. Pneumonia

12.4.3. Others

12.5. Market Value Forecast, by End-user, 2020 to 2035

12.5.1. Hospitals & Clinics

12.5.2. Critical Care Centers

12.5.3. Emergency and Transport Centers

12.5.4. Others

12.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Italy

12.6.5. Spain

12.6.6. Switzerland

12.6.7. The Netherlands

12.6.8. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Ventilation Type

12.7.2. By Age-group

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Mechanical Ventilators Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Ventilation Type, 2020 to 2035

13.2.1. Invasive Ventilation

13.2.2. Non-invasive Ventilation

13.3. Market Value Forecast, by Age-group, 2020 to 2035

13.3.1. Children

13.3.2. Adults

13.4. Market Value Forecast, by Application, 2020 to 2035

13.4.1. Respiratory Distress

13.4.2. Pneumonia

13.4.3. Others

13.5. Market Value Forecast, by End-user, 2020 to 2035

13.5.1. Hospitals & Clinics

13.5.2. Critical Care Centers

13.5.3. Emergency and Transport Centers

13.5.4. Others

13.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

13.6.1. China

13.6.2. India

13.6.3. Japan

13.6.4. South Korea

13.6.5. Australia & New Zealand

13.6.6. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Ventilation Type

13.7.2. By Age-group

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Mechanical Ventilators Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Ventilation Type, 2020 to 2035

14.2.1. Invasive Ventilation

14.2.2. Non-invasive Ventilation

14.3. Market Value Forecast, by Age-group, 2020 to 2035

14.3.1. Children

14.3.2. Adults

14.4. Market Value Forecast, by Application, 2020 to 2035

14.4.1. Respiratory Distress

14.4.2. Pneumonia

14.4.3. Others

14.5. Market Value Forecast, by End-user, 2020 to 2035

14.5.1. Hospitals & Clinics

14.5.2. Critical Care Centers

14.5.3. Emergency and Transport Centers

14.5.4. Others

14.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Argentina

14.6.4. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Ventilation Type

14.7.2. By Age-group

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Mechanical Ventilators Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast, by Ventilation Type, 2020 to 2035

15.2.1. Invasive Ventilation

15.2.2. Non-invasive Ventilation

15.3. Market Value Forecast, by Age-group, 2020 to 2035

15.3.1. Children

15.3.2. Adults

15.4. Market Value Forecast, by Application, 2020 to 2035

15.4.1. Respiratory Distress

15.4.2. Pneumonia

15.4.3. Others

15.5. Market Value Forecast, by End-user, 2020 to 2035

15.5.1. Hospitals & Clinics

15.5.2. Critical Care Centers

15.5.3. Emergency and Transport Centers

15.5.4. Others

15.6. Market Value Forecast, by Country/Sub-region, 2020 to 2035

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Ventilation Type

15.7.2. By Age-group

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis, by Company (2024)

16.3. Company Profiles

16.3.1. Narang Medical Limited

16.3.1.1. Company Overview

16.3.1.2. Financial Overview

16.3.1.3. Product Portfolio

16.3.1.4. Business Strategies

16.3.1.5. Recent Developments

16.3.2. Hamilton Medical

16.3.2.1. Company Overview

16.3.2.2. Financial Overview

16.3.2.3. Product Portfolio

16.3.2.4. Business Strategies

16.3.2.5. Recent Developments

16.3.3. A.B.Industries

16.3.3.1. Company Overview

16.3.3.2. Financial Overview

16.3.3.3. Product Portfolio

16.3.3.4. Business Strategies

16.3.3.5. Recent Developments

16.3.4. Noccarc Robotics Pvt Ltd

16.3.4.1. Company Overview

16.3.4.2. Financial Overview

16.3.4.3. Product Portfolio

16.3.4.4. Business Strategies

16.3.4.5. Recent Developments

16.3.5. Philips

16.3.5.1. Company Overview

16.3.5.2. Financial Overview

16.3.5.3. Product Portfolio

16.3.5.4. Business Strategies

16.3.5.5. Recent Developments

16.3.6. Fisher & Paykel Healthcare

16.3.6.1. Company Overview

16.3.6.2. Financial Overview

16.3.6.3. Product Portfolio

16.3.6.4. Business Strategies

16.3.6.5. Recent Developments

16.3.7. Draeger

16.3.7.1. Company Overview

16.3.7.2. Financial Overview

16.3.7.3. Product Portfolio

16.3.7.4. Business Strategies

16.3.7.5. Recent Developments

16.3.8. Medtronic

16.3.8.1. Company Overview

16.3.8.2. Financial Overview

16.3.8.3. Product Portfolio

16.3.8.4. Business Strategies

16.3.8.5. Recent Developments

16.3.9. GE Healthcare

16.3.9.1. Company Overview

16.3.9.2. Financial Overview

16.3.9.3. Product Portfolio

16.3.9.4. Business Strategies

16.3.9.5. Recent Developments

16.3.10. Getinge

16.3.10.1. Company Overview

16.3.10.2. Financial Overview

16.3.10.3. Product Portfolio

16.3.10.4. Business Strategies

16.3.10.5. Recent Developments

16.3.11. Mindray

16.3.11.1. Company Overview

16.3.11.2. Financial Overview

16.3.11.3. Product Portfolio

16.3.11.4. Business Strategies

16.3.11.5. Recent Developments

16.3.12. Vyaire Medical, Inc

16.3.12.1. Company Overview

16.3.12.2. Financial Overview

16.3.12.3. Product Portfolio

16.3.12.4. Business Strategies

16.3.12.5. Recent Developments

16.3.13. ResMed Inc

16.3.13.1. Company Overview

16.3.13.2. Financial Overview

16.3.13.3. Product Portfolio

16.3.13.4. Business Strategies

16.3.13.5. Recent Developments

16.3.14. SCHILLER

16.3.14.1. Company Overview

16.3.14.2. Financial Overview

16.3.14.3. Product Portfolio

16.3.14.4. Business Strategies

16.3.14.5. Recent Developments

List of Tables

Table 01: Global Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 02: Global Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 03: Global Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 04: Global Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Mechanical Ventilators Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 08: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 09: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 10: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 13: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 14: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 15: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 18: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 19: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 20: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 23: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 24: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 25: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East and Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, By Ventilation Type, 2020 to 2035

Table 28: Middle East and Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, By Age-group, 2020 to 2035

Table 29: Middle East and Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Middle East and Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

List of Figures

Figure 01: Global Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 02: Global Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 03: Global Mechanical Ventilators Market Revenue (US$ Bn), by Invasive Ventilation, 2020 to 2035

Figure 04: Global Mechanical Ventilators Market Revenue (US$ Bn), by Non-invasive Ventilation, 2020 to 2035

Figure 05: Global Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 06: Global Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 07: Global Mechanical Ventilators Market Revenue (US$ Bn), by Children, 2020 to 2035

Figure 08: Global Mechanical Ventilators Market Revenue (US$ Bn), by Adults, 2020 to 2035

Figure 09: Global Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 10: Global Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 11: Global Mechanical Ventilators Market Revenue (US$ Bn), by Respiratory Distress, 2020 to 2035

Figure 12: Global Mechanical Ventilators Market Revenue (US$ Bn), by Pneumonia, 2020 to 2035

Figure 13: Global Mechanical Ventilators Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 14: Global Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Mechanical Ventilators Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 17: Global Mechanical Ventilators Market Revenue (US$ Bn), by Critical Care Centers, 2020 to 2035

Figure 18: Global Mechanical Ventilators Market Revenue (US$ Bn), by Emergency and Transport Centers, 2020 to 2035

Figure 19: Global Mechanical Ventilators Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Mechanical Ventilators Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Mechanical Ventilators Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Mechanical Ventilators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Mechanical Ventilators Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Mechanical Ventilators Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 26: North America Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 27: North America Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 28: North America Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 29: North America Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 30: North America Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 31: North America Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe Mechanical Ventilators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Mechanical Ventilators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Mechanical Ventilators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 37: Europe Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 38: Europe Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 39: Europe Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 40: Europe Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 41: Europe Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 42: Europe Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Mechanical Ventilators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Mechanical Ventilators Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific Mechanical Ventilators Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 48: Asia Pacific Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 49: Asia Pacific Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 50: Asia Pacific Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 51: Asia Pacific Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 52: Asia Pacific Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 53: Asia Pacific Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Asia Pacific Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Latin America Mechanical Ventilators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America Mechanical Ventilators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Latin America Mechanical Ventilators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Latin America Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 59: Latin America Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 60: Latin America Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 61: Latin America Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 62: Latin America Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 63: Latin America Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 64: Latin America Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Latin America Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Middle East & Africa Mechanical Ventilators Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East & Africa Mechanical Ventilators Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 68: Middle East & Africa Mechanical Ventilators Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 69: Middle East and Africa Mechanical Ventilators Market Value Share Analysis, By Ventilation Type, 2024 and 2035

Figure 70: Middle East and Africa Mechanical Ventilators Market Attractiveness Analysis, By Ventilation Type, 2025 to 2035

Figure 71: Middle East and Africa Mechanical Ventilators Market Value Share Analysis, By Age-group, 2024 and 2035

Figure 72: Middle East and Africa Mechanical Ventilators Market Attractiveness Analysis, By Age-group, 2025 to 2035

Figure 73: Middle East and Africa Mechanical Ventilators Market Value Share Analysis, By Application, 2024 and 2035

Figure 74: Middle East and Africa Mechanical Ventilators Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 75: Middle East and Africa Mechanical Ventilators Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East and Africa Mechanical Ventilators Market Attractiveness Analysis, By End-user, 2025 to 2035