Reports

Reports

Analyst Viewpoint

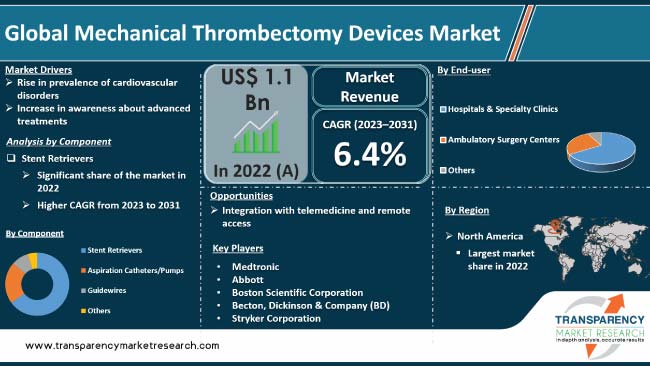

Rise in prevalence of cardiovascular disorders (CVD) is driving the global mechanical thrombectomy devices market. Lifestyle changes, such as poor dietary choices, sedentary lifestyles, and increase in tobacco consumption are propelling CVD instances. Surge in the geriatric population that is susceptible to CVDs is another major factor propelling market development. Furthermore, increase in awareness about advanced treatments for CVDs is expected to bolster the global mechanical thrombectomy devices industry size during the forecast period.

Integration of mechanical thrombectomy devices with telemedicine and remote access offers lucrative opportunities to market players. Manufacturers are focusing on developing devices that offer better effectiveness, reduced procedural risks, and better accessibility in order to increase mechanical thrombectomy devices market share and revenue.

The market for mechanical thrombectomy devices pertains to medical instruments and tools designed specifically for removing blood clots from blood vessels, primarily addressing conditions such as stroke and peripheral artery diseases stemming from vessel blockage.

Recent advancements in this field focus on innovating product designs to improve efficiency and accuracy in clot extraction. Ongoing technological enhancements, including stent retrievers, suction aspiration systems, and catheters, aim to refine the process of blood clot removal, ensuring greater precision and effectiveness.

The shrinking size of these devices enables smoother navigation through intricate vascular structures, allowing access to smaller vessels for clot removal while minimizing the risk of vessel damage.

Integration with advanced imaging technologies aids in better visualization during procedures, ensuring precise clot targeting and removal. Innovative product developments, such as microstents, direct aspiration systems, and artificial intelligence-driven retrieval systems, are expanding the horizons of minimally invasive procedures and augmenting clot retrieval rates.

Increase in prevalence of cardiovascular diseases (CVDs) is driving the global mechanical thrombectomy devices market growth. Surge in conditions such as stroke and peripheral artery diseases, often linked with the formation of blood clots, has been observed. The World Health Organization (WHO) reports CVD as the leading cause of global mortality, responsible for approximately 17.9 million deaths in 2019.

Lifestyle changes, including poor dietary habits, sedentary lifestyles, and tobacco consumption, have added to the global rise in CVD prevalence. Furthermore, specific risk factors such as high blood pressure, elevated cholesterol levels, diabetes, obesity, and a family history of heart disease elevate the chances of developing CVDs.

WHO's data from 2022 indicates that nearly a quarter of adults globally were impacted by CVDs, totaling about 1.86 billion individuals, with projections indicating a surge to 2.3 billion by 2030.

Patients and medical experts alike are beginning to recognize the benefits of thrombectomy in the treatment of blood clot-related peripheral artery disorders and strokes. Improvements in medical science are supporting the understanding of thrombectomy's effectiveness.

With reduced procedural risks and increased clot retrieval rates, these devices are becoming increasingly complex. Their availability is expanding due to falling costs, making these interventions more accessible to a larger patient population.

High insurance coverage and government actions are essential in removing financial barriers to these life-saving treatments. Notably, the "Get With The Guidelines-Stroke" program by the American Heart Association in 2022 showed a significant rise in the utilization of thrombectomy after implementation, demonstrating the power of awareness campaigns to save lives and close treatment gaps.

Increase in usage of mechanical thrombectomy devices in the treatment of cardiovascular illnesses is largely due to the combined efforts of awareness campaigns, instructional programs, and lower hurdles. Thus, increase in awareness about advanced treatments is fueling the global mechanical thrombectomy devices market demand.

In terms of component, the stent retrievers segment accounted for the largest global mechanical thrombectomy devices market share in 2022. Stent retrievers are effective in addressing ischemic stroke, a major cause of global disability and mortality.

These retrievers are particularly successful in removing blood clots, especially in large vessel occlusions, crucial in treating strokes. As essential elements in thrombectomy procedures, these devices work by restoring blood flow to the brain by extracting clots lodged in blood vessels.

Stent retrievers offer rapid clot removal, precise re-establishment of blood flow, and high success rates in restoring blocked blood vessels, significantly improving patient outcomes. Their design, allowing them to navigate intricate blood vessel structures efficiently and retrieve clots effectively, has made them the preferred choice among medical professionals for treating ischemic strokes.

Based on application, the peripheral vascular thrombectomy segment is projected to grow at a rapid pace during the forecast period. Rise in prevalence of peripheral artery disease (PAD) globally, attributed to lifestyle changes, aging population, and surge in chronic ailments such as diabetes are bolstering demand for these devices.

According to the U.S. National Institutes of Health, around 8.5 million people in the U.S. grapple with PAD, a substantial factor predisposing individuals to limb loss. Similarly, the European Society of Vascular Surgery reveals that roughly 20% of individuals aged over 65 encounter some manifestation of PAD.

This condition, typified by constricted arteries in the peripheral vascular system, often leads to reduced blood flow, discomfort, and potential grave complications such as gangrene if untreated. Mechanical thrombectomy devices applied in this scenario work toward eliminating blood clots causing arterial blockages, thus reinstating blood circulation and mitigating associated symptoms.

The efficacy of mechanical thrombectomy in managing PAD-related issues, alongside advancements fostering safer and more effective procedures, are propelling the segment.

North America dominated the global mechanical thrombectomy devices market in 2022. This is ascribed to early establishment, continual advancements, substantial clinical evidence, and robust healthcare infrastructure in the region.

North America experiences higher prevalence of cardiovascular diseases (CVDs), stroke, and peripheral artery diseases, which is driving demand for thrombectomy procedures. The U.S. Centers for Disease Control and Prevention (CDC) estimates that around 800,000 people in the U.S. undergo new or recurrent strokes every year, making them primary candidates for thrombectomy procedures.

Lifestyle factors such as unhealthy habits, rising rates of obesity, and higher incidence of risk factors such as hypertension and diabetes are more prevalent in the region, which contribute to the demand for such treatments.

Europe's proactive approach in embracing cutting-edge medical technologies and procedures has bolstered the acceptance and utilization of mechanical thrombectomy devices. Moreover, there has been a significant push to enhance stroke care systems in different European nations, implementing standardized protocols and guidelines.

These efforts have significantly driven the adoption of thrombectomy devices. The European Stroke Organisation (ESO) reports that 17 million individuals experience a stroke in Europe each year, emphasizing the substantial demand for impactful interventions such as thrombectomy.

Asia Pacific is witnessing significant increase in the aging population, projected to have the world's largest elderly demographic. This demographic shift forecasts a considerable rise in stroke cases, exacerbated by changing lifestyles and dietary habits contributing to increased incidences of cardiovascular diseases, stroke, and peripheral artery diseases.

Consequently, demand for effective treatments such as thrombectomy is rising. Furthermore, healthcare infrastructure advancements and technology integration in countries such as Japan, China, and India are enhancing access to advanced medical procedures.

Domestic manufacturers and research institutions in countries such as China, Japan, and South Korea are innovating their thrombectomy devices, often available at more affordable costs compared to Western brands. Initiatives such as the Asia Pacific Stroke Organization's training programs and educational initiatives are amplifying awareness and fostering improved accessibility to thrombectomy expertise in the region.

The global mechanical thrombectomy devices market is fragmented, with the presence of large number of players. These players are adopting strategies such investment in R&D and merger & collaborations to increase market share and revenue.

Medtronic, Abbott, Boston Scientific Corporation, Becton, Dickinson & Company (BD), Stryker Corporation, Merit Medical Systems, Inc., Koninklijke Philips N.V., and Terumo Corporation are the prominent players in the global mechanical thrombectomy devices market.

Leading players in the mechanical thrombectomy devices market report have been profiled based on parameters such as company overview, financial summary, strategies, product portfolio, segments, and recent advancements.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 1.1 Bn |

| Forecast Value in 2031 | More than US$ 1.8 Bn |

| Growth Rate (CAGR) | 6.4% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 1.1 Bn in 2022

It is projected to reach more than US$ 1.8 Bn by 2031

The CAGR is anticipated to be 6.4% from 2023 to 2031

North America is expected to account for the largest share from 2023 to 2031

Medtronic, Abbott, Boston Scientific Corporation, Becton, Dickinson & Company (BD), Stryker Corporation, Merit Medical Systems, Inc., Koninklijke Philips N.V., and Terumo Corporation.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Mechanical Thrombectomy Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Market Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Mechanical Thrombectomy Devices Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Disease Prevalence & Incidence rate

5.2. Technological Advancements

5.3. Key Industry Events

5.4. Covid-19 Impact Analysis

6. Global Mechanical Thrombectomy Devices Market Analysis and Forecast, By Component

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Component, 2017–2031

6.3.1. Stent Retrievers

6.3.2. Aspiration Catheters/Pumps

6.3.3. Guidewires

6.3.4. Others

6.4. Market Attractiveness Analysis, By Component

7. Global Mechanical Thrombectomy Devices Market Analysis and Forecast, By Application

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Application, 2017–2031

7.3.1. Peripheral Vascular Thrombectomy

7.3.2. Neurovascular Thrombectomy

7.4. Market Attractiveness Analysis, By Application

8. Global Mechanical Thrombectomy Devices Market Analysis and Forecast, By End-user

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by End-user, 2017–2031

8.3.1. Hospitals & Specialty Clinics

8.3.2. Ambulatory Surgery Centers

8.3.3. Others

8.4. Market Attractiveness Analysis, By End-user

9. Global Mechanical Thrombectomy Devices Market Analysis and Forecast, By Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, By Region

10. North America Mechanical Thrombectomy Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Component, 2017–2031

10.2.1. Stent Retrievers

10.2.2. Aspiration Catheters/Pumps

10.2.3. Guidewires

10.2.4. Others

10.3. Market Value Forecast, by Application, 2017–2031

10.3.1. Peripheral Vascular Thrombectomy

10.3.2. Neurovascular Thrombectomy

10.4. Market Value Forecast, by End-user, 2017–2031

10.4.1. Hospitals & Specialty Clinics

10.4.2. Ambulatory Surgery Centers

10.4.3. Others

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Component

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Mechanical Thrombectomy Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Component, 2017–2031

11.2.1. Stent Retrievers

11.2.2. Aspiration Catheters/Pumps

11.2.3. Guidewires

11.2.4. Others

11.3. Market Value Forecast, by Application, 2017–2031

11.3.1. Peripheral Vascular Thrombectomy

11.3.2. Neurovascular Thrombectomy

11.4. Market Value Forecast, by End-user, 2017–2031

11.4.1. Hospitals & Specialty Clinics

11.4.2. Ambulatory Surgery Centers

11.4.3. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Component

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Mechanical Thrombectomy Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Component, 2017–2031

12.2.1. Stent Retrievers

12.2.2. Aspiration Catheters/Pumps

12.2.3. Guidewires

12.2.4. Others

12.3. Market Value Forecast, by Application, 2017–2031

12.3.1. Peripheral Vascular Thrombectomy

12.3.2. Neurovascular Thrombectomy

12.4. Market Value Forecast, by End-user, 2017–2031

12.4.1. Hospitals & Specialty Clinics

12.4.2. Ambulatory Surgery Centers

12.4.3. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of APAC

12.6. Market Attractiveness Analysis

12.6.1. By Component

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Mechanical Thrombectomy Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Component, 2017–2031

13.2.1. Stent Retrievers

13.2.2. Aspiration Catheters/Pumps

13.2.3. Guidewires

13.2.4. Others

13.3. Market Value Forecast, by Application, 2017–2031

13.3.1. Peripheral Vascular Thrombectomy

13.3.2. Neurovascular Thrombectomy

13.4. Market Value Forecast, by End-user, 2017–2031

13.4.1. Hospitals & Specialty Clinics

13.4.2. Ambulatory Surgery Centers

13.4.3. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Component

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Mechanical Thrombectomy Devices Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Component, 2017–2031

14.2.1. Stent Retrievers

14.2.2. Aspiration Catheters/Pumps

14.2.3. Guidewires

14.2.4. Others

14.3. Market Value Forecast, by Application, 2017–2031

14.3.1. Peripheral Vascular Thrombectomy

14.3.2. Neurovascular Thrombectomy

14.4. Market Value Forecast, by End-user, 2017–2031

14.4.1. Hospitals & Specialty Clinics

14.4.2. Ambulatory Surgery Centers

14.4.3. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of MEA

14.6. Market Attractiveness Analysis

14.6.1. By Component

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player – Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Medtronic

15.3.1.1. Company Overview

15.3.1.2. Financial Overview

15.3.1.3. Product Portfolio

15.3.1.4. Business Strategies

15.3.1.5. Recent Developments

15.3.2. Abbott

15.3.2.1. Company Overview

15.3.2.2. Financial Overview

15.3.2.3. Product Portfolio

15.3.2.4. Business Strategies

15.3.2.5. Recent Developments

15.3.3. Boston Scientific Corporation

15.3.3.1. Company Overview

15.3.3.2. Financial Overview

15.3.3.3. Product Portfolio

15.3.3.4. Business Strategies

15.3.3.5. Recent Developments

15.3.4. Becton, Dickinson & Company (BD)

15.3.4.1. Company Overview

15.3.4.2. Financial Overview

15.3.4.3. Product Portfolio

15.3.4.4. Business Strategies

15.3.4.5. Recent Developments

15.3.5. Stryker Corporation

15.3.5.1. Company Overview

15.3.5.2. Financial Overview

15.3.5.3. Product Portfolio

15.3.5.4. Business Strategies

15.3.5.5. Recent Developments

15.3.6. Merit Medical Systems, Inc.

15.3.6.1. Company Overview

15.3.6.2. Financial Overview

15.3.6.3. Product Portfolio

15.3.6.4. Business Strategies

15.3.6.5. Recent Developments

15.3.7. Koninklijke Philips N.V.

15.3.7.1. Company Overview

15.3.7.2. Financial Overview

15.3.7.3. Product Portfolio

15.3.7.4. Business Strategies

15.3.7.5. Recent Developments

15.3.8. Terumo Corporation

15.3.8.1. Company Overview

15.3.8.2. Financial Overview

15.3.8.3. Product Portfolio

15.3.8.4. Business Strategies

15.3.8.5. Recent Developments

List of Tables

Table 01: Global Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 02: Global Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 03: Global Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 04: Global Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 05: North America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 06: North America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 07: North America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 08: North America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 09: Europe Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 10: Europe Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Europe Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Europe Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Asia Pacific Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 14: Asia Pacific Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Asia Pacific Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Latin America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 18: Latin America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 19: Latin America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 20: Latin America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Middle East & Africa Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Component, 2017–2031

Table 22: Middle East & Africa Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 23: Middle East & Africa Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 24: Middle East & Africa Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 03: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Stent Retrievers, 2022 and 2031

Figure 04: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Aspiration Catheters/Pumps, 2022 and 2031

Figure 05: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Guidewires, 2022 and 2031

Figure 06: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Others, 2022 and 2031

Figure 07: Global Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 08: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 09: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Peripheral Vascular Thrombectomy, 2022 and 2031

Figure 10: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Neurovascular Thrombectomy, 2022 and 2031

Figure 11: Global Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 12: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 13: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Hospitals & Specialty Clinics, 2022 and 2031

Figure 14: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Ambulatory Surgery Centers, 2022 and 2031

Figure 15: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Others, 2022 and 2031

Figure 16: Global Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 17: Global Mechanical Thrombectomy Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 18: Global Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Region, 2023–2031

Figure 19: North America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 20: North America Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 21: North America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 22: North America Mechanical Thrombectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 23: North America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 24: North America Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 25: North America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 26: North America Mechanical Thrombectomy Devices Market Value Share Analysis, by Country, 2022 and 2031

Figure 27: North America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Country, 2023–2031

Figure 28: Europe Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 29: Europe Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 30: Europe Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 31: Europe Mechanical Thrombectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: Europe Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 33: Europe Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: Europe Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 35: Europe Mechanical Thrombectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 36: Europe Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 37: Asia Pacific Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 38: Asia Pacific Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 39: Asia Pacific Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 40: Asia Pacific Mechanical Thrombectomy Devices Market Value Share Analysis, by Application 2022 and 2031

Figure 41: Asia Pacific Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 42: Asia Pacific Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Asia Pacific Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 44: Asia Pacific Mechanical Thrombectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 45: Asia Pacific Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 46: Latin America Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 47: Latin America Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 48: Latin America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 49: Latin America Mechanical Thrombectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Latin America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 51: Latin America Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Latin America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 53: Latin America Mechanical Thrombectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 54: Latin America Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 55: Middle East & Africa Mechanical Thrombectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 56: Middle East & Africa Mechanical Thrombectomy Devices Market Value Share Analysis, by Component, 2022 and 2031

Figure 57: Middle East & Africa Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Component, 2023–2031

Figure 58: Middle East & Africa Mechanical Thrombectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Middle East & Africa Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 60: Middle East & Africa Mechanical Thrombectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 61: Middle East & Africa Mechanical Thrombectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 62: Middle East & Africa Mechanical Thrombectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 63: Middle East & Africa Mechanical Thrombectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 64: Global Mechanical Thrombectomy Devices Market Share Analysis, by Company, 2022