Reports

Reports

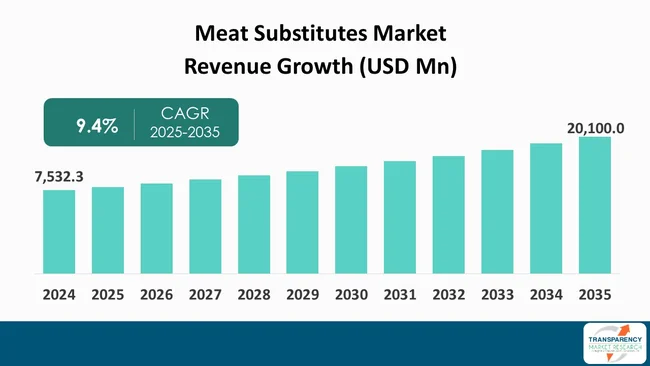

The global meat substitutes market size was valued at US$ 7,532.3 Mn in 2024 and is projected to reach US$ 20,100.0 Mn by 2035, expanding at a CAGR of 9.4% from 2025 to 2035. The market growth is driven by the rising health awareness and growing adoption of flexitarian and plant-based diets.

The global meat substitutes market is gradually becoming an organized sector of the food industry, given the continual development of product formulation along with wider commercial acceptance. The innovations in flavor, texture, and the general look of the products have raised consumer acceptance to the next level, thereby enabling meat alternatives to not only gain wider acceptance but also become part of everyday meals.

The market has been further strengthened by the availability of various formats such as fresh, frozen, and ready-to-eat products and also by the participation in both - retail and foodservice channels. Plant-based meat substitutes are the largest and most significant market segment benefitting from the level of the technology being used, the large-scale production capacity, and strong alignment with the supply chains and the regulatory frameworks.

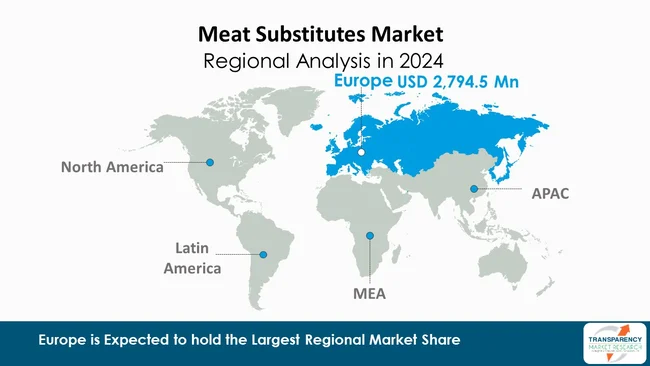

Europe is the leading region since it is characterized by a strong plant-based food culture supported by well-built retail infrastructure and continuous innovation. Overall, the market is characterized by strong product diversification, established consumption patterns, and a well-defined competitive landscape, reflecting its growing importance within the global food industry.

The meat substitutes market pertains to the global sector dedicated to the creation, processing, distribution, and marketing of meat-replacement products. These products are intended to closely imitate the taste, feel, look, and even the nutrient content of meat but are non-animal based.

Generally, substitutes for meat are obtained from plant proteins like pea, soy and wheat (seitan), rice, lentils, chickpeas, and beans alongside mycoprotein and a few other protein-dense compounds. There is also a gradual shift toward the utilization of precision fermentation and alternative protein technologies to create products without using animals.

There’s an extensive list of substitutes for meat in terms of product formats, right from burgers, sausages, nuggets, meatballs to mince, strips, and deli-style slices, and they appear in both ready-to-cook and ready-to-eat meals. They find their way to the consumers through a variety of retail channels, ranging from supermarkets, hypermarkets, specialty food stores, and online shopping to restaurants, cafés, and even catering to institutions.

Meat analogues are usually made to have protein contents like that of animal flesh, though they might differ in fat, carb, fiber, vitamins, and minerals levels according to the processing methods and composition of the ingredients. The market consists of both - branded and private-label items and spans the entire globe from vegetarian, vegan, and flexitarian consumers to markets situated in different regions.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

One of the main forces in the meat substitutes market is the awareness of health, and greater interest in the consumption of meat alternatives. Non-communicable diseases like heart disease, diabetes, cancer, and respiratory diseases are the major health issues resulting from poor diet since they are the cause of about 75% of all non-pandemic deaths according to World Health Organization (WHO). The unhealthiness of diet is one of the main behavioral risk factors that considerably contributes to this burden.

According to the WHO, different diets that are high in salt, sugars, and saturated fats with inadequate intake of fruits and vegetables are among the top modifiable risk factors that have been contributing to the global prevalence of NCDs.

The situation has encouraged WHO to give dietary guidance that includes at least 400 grams (five portions) of fruits and vegetables per day along with the cutting down of the consumption of high-risk food components to a minimum. This has made it even more clear to the public that what they eat everyday has a direct effect on their health in the long term.

At the same time, public health agencies and governments in various parts of the world have raised the bar in the areas of nutrition education, food labeling standards, and preventive healthcare, which, in turn, have developed the consumers' awareness of the quality of their diet furthermore.

The increase in health literacy has led consumers to consider protein sources more on their nutritional attributes - like fat distribution, cholesterol contents, and overall diet. The growing recognition of meat substitutes as a healthy part of the diet is being mainly supported by the consumers who are interested in controlling their consumption of red and processed meat. The increasing emphasis on preventive healthcare, working with lifestyle-related diseases, and the quest for balanced nutrition have all contributed to the acceptance of alternative protein products.

Besides, it is the increasing health consciousness, which is coupled with acknowledged global health statistics and dietary recommendations, which has caused the shift in the food consumption patterns and the resulting rise in the demand for meat alternatives.

Flexitarian and plant-based diets are gaining popularity and thus meat-substitute demand is the next most important aspect. The UK Government's National Diet and Nutrition Survey (NDNS) reveals that approximately 25% of the population has been making efforts to get rid of meat, dairy, and other animal products. This indicates that although the complete phase-out of animal products is not taking place, there is a huge influx of plant-based eaters.

The flexitarian diet, which permits a limited amount of meat but primarily focuses on plant-based foods, has gained the favor of the majority of consumers who view it as a great blend of the two things - dietary flexibility and healthier food choices.

In the UK and the other economies, similar trends are reflected in national nutrition guidelines and food consumption surveys, which are increasingly promoting diverse protein sources plus more plant-based foods. For instance, in a number of countries, dietary guidelines that are supported by the government are now putting legumes, pulses, whole grains, and vegetables at the center of a balanced diet, which, in turn, is building public trust in plant-based protein sources.

Moreover, the change in lifestyle, which includes hectic work schedules and increasing link with global food trends, has been one of the supporting factors to the mainstream acceptance of plant-based products that imitate familiar meat formats. The flexitarian strategy reduces both psychological and cultural

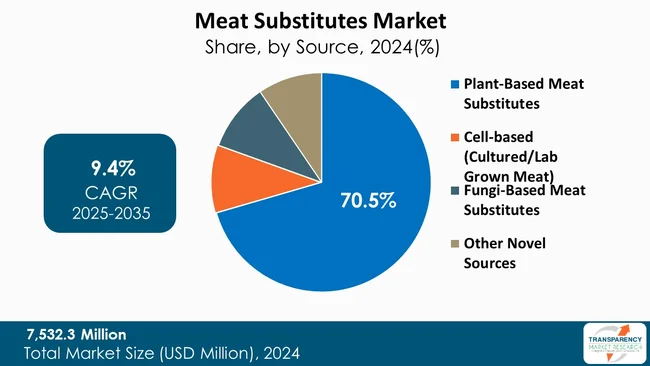

With a market share of 70.5%, plant-based meat substitutes are the leading in the global meat substitutes market, thus becoming the most developed and commercially successful section of the alternative protein market. The primary reason for their success is the early market entry and greater technological advancement over the other alternatives, especially those made from cells and fungi.

When it comes to regulatory issues, plant-based substitutes are at superior position as compared to their cell-based meat counterparts. They have gained the consumer and regulators' acceptance easily as their core inputs are the same. Consequently, the approval process for them is not that complicated. The continuous innovations in protein texturization, flavor systems, and fat analogs have significantly improved sensory performance, and thus supporting repeated consumption.The ongoing innovations in protein texturization, flavor systems, and fat analogs have made sensory performance great and thus helped to keep the customers returning.

Furthermore, the robust embracing of the product in the retail and foodservice sectors, especially the fast-food outlets, has made the product more visible and accessible. The wide range of products, the attractive prices, and the constant brand investment by both the old food companies and the start-ups are the factors that together support the global market leader position of plant-based meat substitutes.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Europe is the leading the global meat substitutes market with a 37.1% share of the market, thereby being the region that consumes alternative proteins and innovates the most. The fact that the region is supported by a heavy consumption of plant-based foods in a number of countries such as the UK, the Netherlands, and Germany, where vegetarian, vegan, and flexitarian diets are widely accepted and integrated into mainstream food habits

The region enjoys a matured regulatory system that facilitates the commercialization of plant-based foods, which is one of its advantages. Harmonized food safety standards, clear labeling requirements, and sustainability-focused regulations across the European Union have led to product approvals being less cumbersome and have attracted the interest of both start-up and multinational food companies. This regulatory clarity has, in turn, built up consumer trust and hastened product penetration through the various retail channels.

Besides the high-tech retail infrastructure in Europe, which is another factor that strengthens the region's leading position. Manufacturers of supermarkets and hypermarkets are giving significant space on their shelves to meat substitutes and thus providing a wide variety of both private-label and branded products. On the other hand, embracing by food service operators (such as quick service restaurants and casual dining chains) has not only made these products more visible but also helped plant-based menu offerings become more accepted in the society.

Key players in the meat substitutes market include Amy’s Kitchen, Inc., Beyond Meat Inc., Conagra Brands, Inc., Eat JUST Inc., Gold & Green Foods, Impossible Foods Inc., Kellogg NA Co., Maple Leaf Foods, Ojah B.V., Oumph!, Quorn, Tofurky, Tyson Foods, Inc., Unilever, and VBites Foods Ltd.

Each of these companies has been profiled in the meat substitutes market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 (Base Year) | US$ 7,532.3 Mn |

| Market Forecast Value in 2035 | US$ 20,100.0 Mn |

| Growth Rate (CAGR 2025 to 2035) | 9.4% |

| Forecast Period | 2025-2035 |

| Historical data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentations | By Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

The global meat substitutes market was valued at US$ 7,532.3 Mn in 2024

The global meat substitutes industry is projected to reach more than US$ 20,100.0 Mn by the end of 2035

The rising health awareness and growing adoption of flexitarian and plant-based diets are some of the factors driving the expansion of meat substitutes market.

The CAGR is anticipated to be 9.4% from 2025 to 2035

Amy’s Kitchen, Inc., Beyond Meat Inc., Conagra Brands, Inc., Eat JUST Inc., Gold & Green Foods, Impossible Foods Inc., Kellogg NA Co., Maple Leaf Foods, Ojah B.V., Oumph!, Quorn, Tofurky, Tyson Foods, Inc., Unilever, VBites Foods Ltd., and other key players.

Table 01: Global Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 02: Global Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 03: Global Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 04: Global Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 05: Global Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 06: Global Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 07: Global Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 08: Global Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 09: Global Meat Substitutes Market Value (US$ Mn) Projection, By Region 2020 to 2035

Table 10: Global Meat Substitutes Market Volume (Tons) Projection, By Region 2020 to 2035

Table 11: North America Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 12: North America Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 13: North America Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 14: North America Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 15: North America Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 16: North America Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 17: North America Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 18: North America Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 19: North America Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 20: North America Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Table 21: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 22: U.S. Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 23: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 24: U.S. Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 25: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 26: U.S. Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 27: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 28: U.S. Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 29: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 30: Canada Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 31: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 32: Canada Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 33: Canada Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 34: Canada Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 35: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 36: Canada Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 37: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 38: Europe Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 39: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 40: Europe Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 41: Europe Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 42: Europe Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 43: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 44: Europe Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 45: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 46: Europe Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Table 47: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 48: U.K. Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 49: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 50: U.K. Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 51: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 52: U.K. Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 53: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 54: U.K. Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 55: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 56: Germany Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 57: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 58: Germany Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 59: Germany Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 60: Germany Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 61: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 62: Germany Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 63: France Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 64: France Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 65: France Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 66: France Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 67: France Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 68: France Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 69: France Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 70: France Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 71: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 72: Italy Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 73: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 74: Italy Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 75: Italy Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 76: Italy Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 77: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 78: Italy Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 79: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 80: Spain Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 81: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 82: Spain Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 83: Spain Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 84: Spain Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 85: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 86: Spain Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 87: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 88: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 89: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 90: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 91: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 92: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 93: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 94: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 95: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 96: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 97: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 98: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 99: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 100: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 101: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 102: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 103: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 104: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Table 105: China Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 106: China Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 107: China Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 108: China Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 109: China Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 110: China Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 111: China Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 112: China Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 113: India Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 114: India Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 115: India Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 116: India Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 117: India Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 118: India Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 119: India Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 120: India Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 121: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 122: Japan Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 123: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 124: Japan Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 125: Japan Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 126: Japan Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 127: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 128: Japan Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 129: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 130: Australia Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 131: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 132: Australia Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 133: Australia Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 134: Australia Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 135: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 136: Australia Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 137: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 138: South Korea Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 139: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 140: South Korea Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 141: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 142: South Korea Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 143: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 144: South Korea Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 145: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 146: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 147: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 148: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 149: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 150: ASEAN Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 151: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 152: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 153: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 154: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 155: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 156: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 157: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 158: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 159: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 160: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 161: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 162: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Table 163: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 164: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 165: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 166: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 167: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 168: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 169: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 170: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 171: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 172: South Africa Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 173: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 174: South Africa Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 175: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 176: South Africa Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 177: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 178: South Africa Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 179: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 180: Latin America Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 181: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 182: Latin America Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 183: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 184: Latin America Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 185: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 186: Latin America Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 187: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Table 188: Latin America Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Table 189: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 190: Brazil Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 191: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 192: Brazil Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 193: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 194: Brazil Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 195: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 196: Brazil Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 197: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 198: Mexico Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 199: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 200: Mexico Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 201: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 202: Mexico Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 203: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 204: Mexico Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Table 205: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Table 206: Argentina Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Table 207: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Table 208: Argentina Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Table 209: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Table 210: Argentina Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Table 211: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Table 212: Argentina Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 01: Global Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 02: Global Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 03: Global Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 04: Global Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 05: Global Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 06: Global Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 07: Global Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 08: Global Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 09: Global Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 10: Global Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 11: Global Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 12: Global Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 13: Global Meat Substitutes Market Value (US$ Mn) Projection, By Region 2020 to 2035

Figure 14: Global Meat Substitutes Market Volume (Tons) Projection, By Region 2020 to 2035

Figure 15: Global Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Region 2025 to 2035

Figure 16: North America Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 17: North America Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 18: North America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 19: North America Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 20: North America Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 21: North America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 22: North America Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 23: North America Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 24: North America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 25: North America Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 26: North America Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 27: North America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 28: North America Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 29: North America Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 30: North America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 31: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 32: U.S. Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 33: U.S. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 34: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 35: U.S. Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 36: U.S. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 37: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 38: U.S. Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 39: U.S. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 40: U.S. Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 41: U.S. Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 42: U.S. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 43: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 44: Canada Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 45: Canada Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 46: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 47: Canada Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 48: Canada Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 49: Canada Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 50: Canada Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 51: Canada Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 52: Canada Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 53: Canada Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 54: Canada Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 55: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 56: Europe Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 57: Europe Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 58: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 59: Europe Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 60: Europe Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 61: Europe Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 62: Europe Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 63: Europe Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 64: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 65: Europe Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 66: Europe Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 67: Europe Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 68: Europe Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 69: Europe Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 70: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 71: U.K. Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 72: U.K. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 73: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 74: U.K. Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 75: U.K. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 76: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 77: U.K. Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 78: U.K. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 79: U.K. Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 80: U.K. Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 81: U.K. Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 82: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 83: Germany Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 84: Germany Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 85: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 86: Germany Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 87: Germany Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 88: Germany Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 89: Germany Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 90: Germany Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 91: Germany Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 92: Germany Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 93: Germany Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 94: France Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 95: France Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 96: France Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 97: France Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 98: France Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 99: France Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 100: France Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 101: France Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 102: France Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 103: France Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 104: France Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 105: France Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 106: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 107: Italy Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 108: Italy Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 109: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 110: Italy Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 111: Italy Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 112: Italy Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 113: Italy Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 114: Italy Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 115: Italy Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 116: Italy Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 117: Italy Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 118: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 119: Spain Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 120: Spain Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 121: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 122: Spain Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 123: Spain Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 124: Spain Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 125: Spain Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 126: Spain Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 127: Spain Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 128: Spain Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 129: Spain Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 130: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 131: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 132: The Netherlands Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 133: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 134: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 135: The Netherlands Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 136: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 137: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 138: The Netherlands Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 139: The Netherlands Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 140: The Netherlands Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 141: The Netherlands Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 142: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 143: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 144: Asia Pacific Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 145: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 146: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 147: Asia Pacific Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 148: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 149: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 150: Asia Pacific Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 151: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 152: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 153: Asia Pacific Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 154: Asia Pacific Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 155: Asia Pacific Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 156: Asia Pacific Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 157: China Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 158: China Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 159: China Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 160: China Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 161: China Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 162: China Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 163: China Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 164: China Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 165: China Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 166: China Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 167: China Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 168: China Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 169: India Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 170: India Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 171: India Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 172: India Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 173: India Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 174: India Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 175: India Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 176: India Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 177: India Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 178: India Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 179: India Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 180: India Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 181: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 182: Japan Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 183: Japan Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 184: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 185: Japan Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 186: Japan Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 187: Japan Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 188: Japan Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 189: Japan Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 190: Japan Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 191: Japan Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 192: Japan Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 193: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 194: Australia Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 195: Australia Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 196: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 197: Australia Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 198: Australia Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 199: Australia Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 200: Australia Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 201: Australia Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 202: Australia Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 203: Australia Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 204: Australia Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 205: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 206: South Korea Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 207: South Korea Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 208: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 209: South Korea Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 210: South Korea Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 211: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 212: South Korea Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 213: South Korea Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 214: South Korea Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 215: South Korea Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 216: South Korea Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 217: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 218: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 219: ASEAN Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 220: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 221: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 222: ASEAN Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 223: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 224: ASEAN Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 225: ASEAN Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 226: ASEAN Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 227: ASEAN Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 228: ASEAN Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 229: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 230: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 231: Middle East & Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 232: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 233: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 234: Middle East & Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 235: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 236: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 237: Middle East & Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 238: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 239: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 240: Middle East & Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 241: Middle East & Africa Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 242: Middle East & Africa Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 243: Middle East & Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 244: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 245: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 246: GCC Countries Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 247: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 248: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 249: GCC Countries Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 250: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 251: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 252: GCC Countries Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 253: GCC Countries Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 254: GCC Countries Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 255: GCC Countries Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 256: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 257: South Africa Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 258: South Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 259: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 260: South Africa Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 261: South Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 262: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 263: South Africa Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 264: South Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 265: South Africa Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 266: South Africa Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 267: South Africa Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 268: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 269: Latin America Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 270: Latin America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 271: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 272: Latin America Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 273: Latin America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 274: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 275: Latin America Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 276: Latin America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 277: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 278: Latin America Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 279: Latin America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 280: Latin America Meat Substitutes Market Value (US$ Mn) Projection, By Country 2020 to 2035

Figure 281: Latin America Meat Substitutes Market Volume (Tons) Projection, By Country 2020 to 2035

Figure 282: Latin America Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Country 2025 to 2035

Figure 283: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 284: Brazil Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 285: Brazil Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 286: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 287: Brazil Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 288: Brazil Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 289: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 290: Brazil Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 291: Brazil Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 292: Brazil Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 293: Brazil Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 294: Brazil Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 295: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 296: Mexico Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 297: Mexico Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 298: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 299: Mexico Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 300: Mexico Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 301: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 302: Mexico Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 303: Mexico Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 304: Mexico Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 305: Mexico Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 306: Mexico Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035

Figure 307: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Source 2020 to 2035

Figure 308: Argentina Meat Substitutes Market Volume (Tons) Projection, By Source 2020 to 2035

Figure 309: Argentina Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Source 2025 to 2035

Figure 310: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Product Form 2020 to 2035

Figure 311: Argentina Meat Substitutes Market Volume (Tons) Projection, By Product Form 2020 to 2035

Figure 312: Argentina Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Product Form 2025 to 2035

Figure 313: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By End-use 2020 to 2035

Figure 314: Argentina Meat Substitutes Market Volume (Tons) Projection, By End-use 2020 to 2035

Figure 315: Argentina Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By End-use 2025 to 2035

Figure 316: Argentina Meat Substitutes Market Value (US$ Mn) Projection, By Distribution Channel 2020 to 2035

Figure 317: Argentina Meat Substitutes Market Volume (Tons) Projection, By Distribution Channel 2020 to 2035

Figure 318: Argentina Meat Substitutes Market Incremental Opportunities (US$ Mn) Forecast, By Distribution Channel 2025 to 2035