Reports

Reports

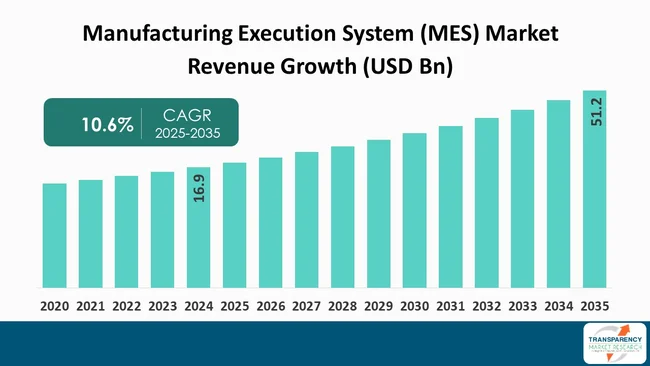

The manufacturing execution system (MES) market is experiencing a significant growth that is quite evident as the industrial sectors turn their attention to digital transformation, visibility of production in real-time, and efficiency of operations. The adoption of MES is expanding beyond the traditional sectors such as automotive, electronics, pharmaceuticals, and consumer goods. MES cloud-based solutions and integration with loT, Al, and advanced analytics are the main drivers of such trends. Manufacturers are seeking MES to streamline their work processes, improve traceability, and ensure regulatory compliance.

Smart factories are receiving the major investments worldwide with the increasing importance given to flexible, data-driven production. The MES market is likely to continue with its substantial growth with double-digit figures in the upcoming period. With a shift toward cloud deployment models the market is further fueled to growth along with reducing upfront cost and enable scalability for both - SMEs and large enterprises. North America and Asia Pacific have strong regional momentum where and automation initiatives and smart factory are propelling the MES adoption.

Moreover, challenges such as integration complexity, high implementation costs, and cybersecurity risks are still the major issues that need to be taken into account. In general, the manufacturing execution system (MES) market is being identified as a critical facilitator of next-generation manufacturing, which overcomes the barrier between enterprise planning and shop floor execution.

For modern manufacturing operations, the manufacturing execution system (MES) market represents a crucial segment within industrial automation serving as digital backbone. Manufacturing Execution System (MES) solutions are aimed at overseeing, managing, and optimizing manufacturing processes in real-time, thereby effectively connecting the planning systems at the enterprise level (ERP) with the operational technologies on the production floor.

Industry 4.0 together with smart factories and data-driven decisions have caused MES to become the foundational element for digital transformation strategies across automotive and pharmaceutical sectors and electronic and consumer goods industries. For instance, the NIST Manufacturing Extension Partnership (MEP) with the U.S. Department of Commerce offers assistance to small and medium manufacturers in the utilization of Industry 4.0 technologies such as robotics, IoT, AI, AR/VR, big data analytics, and connectivity for the purpose of process efficiency and productivity enhancement.

Most recent trends in the manufacturing execution system (MES) market indicate rising of new technologies and smart manufacturing practices. Many modern trends show that there is a transition toward platforms that are based on the cloud. These platforms provide more scalability and are more cost-efficient than traditional systems, which are managed on-premise.

Meanwhile, manufacturers are progressively incorporating Al, IoT, and advanced analytics into MES to facilitate real-time monitoring, predictive maintenance, and smart decision-making. Technologies such as digital twins, edge computing, and blockchain are also becoming more popular, assisting constructors in visibility, traceability, and security of the production. For instance, The Ministry of Industry and Advanced Technology (MoIAT) in the UAE launched “UAE Industry 4.0.” with regional economic development entities. Under the follow-up program “Operation 300bn,” the initiative aims to boost the industrial sector’s GDP contribution from US$ 36 Bn to US$ 81 Bn by 2031. Aim is to implement MES with enhanced manufacturing efficiency and digital integration.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

With the global transition to Industry 4.0 and smart manufacturing, manufacturing execution systems (MES) are increasingly being seen as a requirement rather than an option in today’s standard production environment. The changes have become more intricate after the factories have made extensive use of automation, robotics, and IoT devices apart from AI-powered systems. MES offers the on-demand data transparency, process management, and system integration that are essential for the coordination of these technologies and the provision of seamless, productive workflows.

By integrating enterprise resource planning systems (ERP) and manufacturing processes on the shop floor, MES has the capacity to help companies achieve efficiency in line with the quality of the last product and, at the same time, to facilitate a quick reaction to dynamically changing market demands.

MES has emerged as a vital contributor to Industry 4.0 projects as it enables the construction of intelligent factories that operate on data and maintain high connectivity and flexibility. For instance, in February 2025, the Manufacturing 4.0 initiative in Maryland was granted US$ 5 Mn to back 43 manufacturers in the adoption of Industry 4.0 technologies that improve digital integration, efficiency, and upgrade of their operations.

One of the major aspects of the rise of the adoption of manufacturing execution system (MES) and the other smart manufacturing technologies is the digital transformation that the government has implemented through its initiatives. Manufacturing upgrades through connectivity, automation, and real-time data integration have been highlighted by initiatives such as "Made in China 2025," "Make in India," the EU's "Industry 5.0" vision, and the U.S. Department of Energy smart manufacturing grants.

For instance, the U.S. Department of Energy (DOE) is providing a grant program with more than US$ 22 Mn for several rounds in total, to sustain the initiatives led by the states to assist small- and medium-sized manufacturers in the implementation of smart manufacturing technologies. This program covers the use of advanced sensors, high-performance computing, analytics, and process control tools.

Moreover, in addition to the provision of financial resources and policy support, these initiatives help to define regulatory frameworks that motivate producers to implement modern technologies such as MES in order to meet the standards, improve the operational quality of their businesses, and strengthen their competitive positions.

Globally, governments are turning MES into a key factor for the digitalization of the industry by linking the national industrial strategies with the latest digital technologies. This is resulting in MES being one of the main drivers for the creation of intelligent, adaptable, and sustainable manufacturing ecosystems.

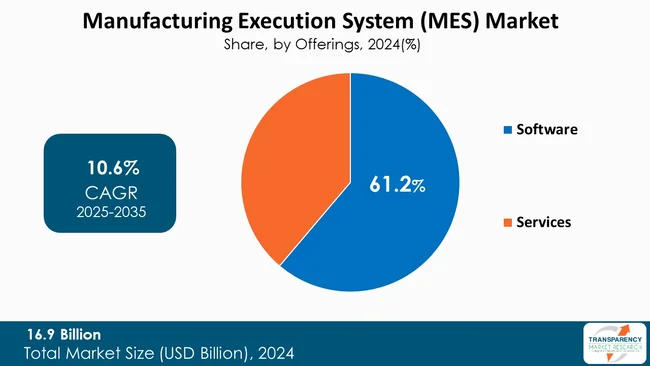

In the manufacturing execution system (MES) market, software dominates the offering segment that has the highest share with 61.2 % of total share. One of the reasons is that MES software basically implements the main functions such as on-line production control, scheduling, quality and traceability, which manufacturers use to improve the productivity of the enterprise and meet the necessary standards. The software segment's lead has been further deepened by the accelerated need for sophisticated, cloud-based, and Al-integrated MES platforms resulting from the quick growth of Industry 4.0 and smart factories.

The main aspect of the software segment is also supported to a great extent by the constant innovation of the leading vendors who are integrating intelligent analytics, loT connectivity, and Al-powered decision support into their platforms.

Industry regulatory requirements for compliance in sectors such as the pharmaceuticals and food & beverages continue to propel investment in strong MES software for end-to-end traceability and reporting. Consequently, software will continue to lead the MES market, while services will serve as complementary growth driver.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is the dominant region with 38.6% market share. North America leads the MES market by a large margin. The major contribution of the region goes to its well-developed industrial sector, strong presence of global MES vendors, and early adoption of Industry 4.0 and smart manufacturing trends. Large-scale investments are initiated for the region in terms of automation, digitalization, and complying with regulatory standards, which are the major industries such as automotive, aerospace, pharmaceuticals, and consumer products areas.

Due to its advanced technology ecosystem and the ongoing need for effectiveness, quality, and sustainability, the continent of North America is likely to continue to be dominant in the field along with an important center for the development of new MES solutions. For instance, the U.S. Department of Commerce, along with the Semiconductor Research Corporation, secured a US$ 285 Mn funding to create the SMART USA Institute. The startup is a digital innovation initiative aimed at using digital twins as one of the leading Industry 4.0 technologies for the improvement of the semiconductor manufacturing process.

Moreover, with a well-established technology ecosystem and ongoing need for efficiency, quality, and sustainability, North America will maintain its leadership status, as well as be a major innovation hub for future MES solutions.

Siemens, Dassault Systèmes, SAP SE, Rockwell Automation Inc., Honeywell International Inc., ABB, Körber AG, Applied Materials, Inc., Emerson Electric Co., GE Vernova, Oracle, Schneider Electric, Infor, Aptean, Cerexio are some of the leading manufacturers operating in the global Manufacturing Execution System (MES) market.

Each of these companies has been profiled in the manufacturing execution system (MES) market report based on parameters such as company overview, business strategies, financial overview, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 16.9 Bn |

| Forecast Value in 2035 | More than US$ 51.2 Bn |

| CAGR | 10.6 % |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Offerings

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The manufacturing execution system (MES) market was valued at US$ 16.9 Bn in 2024

The manufacturing execution system (MES) market is projected to cross US$ 51.2 Bn by the end of 2035

Industry 4.0 & smart manufacturing and government initiatives are driving growth

The CAGR is anticipated to be 10.6% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Siemens, Dassault Systèmes, SAP SE, Rockwell Automation Inc., Honeywell International Inc., ABB, Körber AG, Applied Materials, Inc., Emerson Electric Co., GE Vernova, Oracle, Schneider Electric, Infor, Aptean, Cerexio and others.

Table 01: Global Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 02: Global Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 03: Global Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, By Organization Size, 2020 to 2035

Table 04: Global Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 08: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 09: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 10: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: U.S. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 12: U.S. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 13: U.S. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 14: U.S. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 15: Canada Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 16: Canada Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 17: Canada Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 18: Canada Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 19: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 21: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 22: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 23: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 24: Germany Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 25: Germany Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 26: Germany Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 27: Germany Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 28: U.K. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 29: U.K. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 30: U.K. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 31: U.K. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 32: France Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 33: France Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 34: France Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 35: France Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 36: Italy Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 37: Italy Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 38: Italy Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 39: Italy Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 40: Spain Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 41: Spain Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 42: Spain Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 43: Spain Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 44: The Netherlands Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 45: The Netherlands Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 46: The Netherlands Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 47: The Netherlands Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 48: Rest of Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 49: Rest of Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 50: Rest of Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 51: Rest of Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 52: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 53: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 54: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 55: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 56: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 57: China Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 58: China Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 59: China Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 60: China Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 61: India Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 62: India Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 63: India Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 64: India Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 65: Japan Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 66: Japan Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 67: Japan Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 68: Japan Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 69: South Korea Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 70: South Korea Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 71: South Korea Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 72: South Korea Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 73: Australia Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 74: Australia Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 75: Australia Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 76: Australia Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 77: ASEAN Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 78: ASEAN Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 79: ASEAN Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 80: ASEAN Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 81: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 82: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 83: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 84: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 85: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 86: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 87: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 88: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 89: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 90: Brazil Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 91: Brazil Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 92: Brazil Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 93: Brazil Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 94: Mexico Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 95: Mexico Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 96: Mexico Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 97: Mexico Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 98: Argentina Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 99: Argentina Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 100: Argentina Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 101: Argentina Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 102: Rest of Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 103: Rest of Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 104: Rest of Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 105: Rest of Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 106: Middle East and Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 107: Middle East and Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 108: Middle East and Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 109: Middle East and Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 110: Middle East and Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 111: GCC Countries Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 112: GCC Countries Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 113: GCC Countries Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 114: GCC Countries Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 115: South Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 116: South Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 117: South Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 118: South Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 119: Rest of Middle East Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Offerings, 2020 to 2035

Table 120: Rest of Middle East Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Deployment, 2020 to 2035

Table 121: Rest of Middle East Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by Organization Size, 2020 to 2035

Table 122: Rest of Middle East Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 02: Global Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 03: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 04: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 06: Global Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 07: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Cloud, 2020 to 2035

Figure 08: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Hybrid, 2020 to 2035

Figure 09: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by On Premise, 2020 to 2035

Figure 10: Global Manufacturing Execution System (MES) Market Value Share Analysis, by Enterprise Size, 2024 and 2035

Figure 11: Global Manufacturing Execution System (MES) Market Attractiveness Analysis, by Enterprise Size, 2025 to 2035

Figure 12: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Large Enterprises, 2020 to 2035

Figure 13: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Small and Medium Enterprises, 2020 to 2035

Figure 14: Global Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 15: Global Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2024 and 2035

Figure 16: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Food & Beverages, 2025 to 2035

Figure 17: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Oil & Gas, 2020 to 2035

Figure 18: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Chemicals, 2020 to 2035

Figure 19: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Pulp & Paper, 2020 to 2035

Figure 20: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Pharmaceuticals & Life Sciences, 2020 to 2035

Figure 21: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Energy & Power, 2020 to 2035

Figure 22: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Water & Wastewater Management, 2020 to 2035

Figure 23: Global Manufacturing Execution System (MES) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 24: Global Manufacturing Execution System (MES) Market Value Share Analysis, By Region, 2024 and 2035

Figure 25: Global Manufacturing Execution System (MES) Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 26: North America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 27: North America Manufacturing Execution System (MES) Market Value Share Analysis, by Country, 2024 and 2035

Figure 28: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 29: North America Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 30: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 31: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 32: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 33: North America Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 34: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 35: North America Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 36: North America Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 37: U.S. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: U.S. Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 39: U.S. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 40: U.S. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 41: U.S. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 42: U.S. Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 43: U.S. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 44: U.S. Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 45: U.S. Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 46: Canada Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 47: Canada Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 48: Canada Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 49: Canada Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 50: Canada Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 51: Canada Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 52: Canada Manufacturing Execution System (MES) Market Attractiveness Analysis, by Organization Size, 2025 to 2035

Figure 53: Canada Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 54: Canada Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 55: Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Europe Manufacturing Execution System (MES) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 57: Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 58: Europe Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 59: Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 60: Europe Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 61: Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 62: Europe Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 63: Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 64: Europe Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 65: Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 66: Germany Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Germany Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 68: Germany Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 69: Germany Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 70: Germany Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 71: Germany Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 72: Germany Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 73: Germany Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 74: Germany Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 75: U.K. Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 76: U.K. Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 77: U.K. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 78: U.K. Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 79: U.K. Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 80: U.K. Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 81: U.K. Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 82: U.K. Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 83: U.K. Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 84: France Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 85: France Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 86: France Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 87: France Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 88: France Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 89: France Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 90: France Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 91: France Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 92: France Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 93: Italy Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 94: Italy Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 95: Italy Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 96: Italy Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 97: Italy Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 98: Italy Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 99: Italy Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 100: Italy Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 101: Italy Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 102: Spain Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: Spain Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 104: Spain Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 105: Spain Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 106: Spain Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 107: Spain Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 108: Spain Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 109: Spain Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 110: Spain Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 111: The Netherlands Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 112: The Netherlands Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 113: The Netherlands Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 114: The Netherlands Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 115: The Netherlands Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 116: The Netherlands Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 117: The Netherlands Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 118: The Netherlands Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 119: The Netherlands Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 120: Rest of Europe Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 121: Rest of Europe Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 122: Rest of Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 123: Rest of Europe Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 124: Rest of Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 125: Rest of Europe Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 126: Rest of Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 127: Rest of Europe Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 128: Rest of Europe Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 129: Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 130: Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 131: Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 132: Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 133: Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 134: Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 135: Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 136: Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 137: Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 138: Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 139: Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 140: China Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 141: China Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 142: China Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 143: China Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 144: China Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 145: China Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 146: China Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 147: China Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 148: China Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 149: India Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: India Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 151: India Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 152: India Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 153: India Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 154: India Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 155: India Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 156: India Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 157: India Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 158: Japan Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 159: Japan Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 160: Japan Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 161: Japan Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 162: Japan Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 163: Japan Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 164: Japan Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 165: Japan Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 166: Japan Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 167: South Korea Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 168: South Korea Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 169: South Korea Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 170: South Korea Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 171: South Korea Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 172: South Korea Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 173: South Korea Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 174: South Korea Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 175: South Korea Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 176: Australia Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 177: Australia Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 178: Australia Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 179: Australia Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 180: Australia Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 181: Australia Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 182: Australia Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 183: Australia Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 184: Australia Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 185: ASEAN Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 186: ASEAN Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 187: ASEAN Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 188: ASEAN Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 189: ASEAN Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 190: ASEAN Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 191: ASEAN Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 192: ASEAN Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 193: ASEAN Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 194: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 195: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 196: Rest of Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 197: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 198: Rest of Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 199: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 200: Rest of Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 201: Rest of Asia Pacific Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 202: Rest of Asia Pacific Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 203: Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 204: Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 205: Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 206: Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 207: Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 208: Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 209: Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 210: Latin America Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 211: Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 212: Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 213: Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 214: Brazil Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: Brazil Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 216: Brazil Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 217: Brazil Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 218: Brazil Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 219: Brazil Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 220: Brazil Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 221: Brazil Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 222: Brazil Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 223: Mexico Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 224: Mexico Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 225: Mexico Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 226: Mexico Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 227: Mexico Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 228: Mexico Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 229: Mexico Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 230: Mexico Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 231: Mexico Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 232: Argentina Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 233: Argentina Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 234: Argentina Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 235: Argentina Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 236: Argentina Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 237: Argentina Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 238: Argentina Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 239: Argentina Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 240: Argentina Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 241: Rest of Latin America Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 242: Rest of Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 243: Rest of Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 244: Rest of Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 245: Rest of Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 246: Rest of Latin America Manufacturing Execution System (MES) Market Value Share Analysis, By Organization Size, 2024 and 2035

Figure 247: Rest of Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 248: Rest of Latin America Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 249: Rest of Latin America Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 250: Middle East and Africa Data Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 251: Middle East and Africa Data Manufacturing Execution System (MES) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 252: Middle East and Africa Data Manufacturing Execution System (MES) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 253: Middle East and Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 254: Middle East and Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 255: Middle East and Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 256: Middle East and Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 257: Middle East and Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 258: Middle East and Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 259: Middle East and Africa Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 260: Middle East and Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 261: GCC Countries Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: GCC Countries Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 263: GCC Countries Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 264: GCC Countries Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 265: GCC Countries Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 266: GCC Countries Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 267: GCC Countries Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 268: GCC Countries Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 269: GCC Countries Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 270: South Africa Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 271: South Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 272: South Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 273: South Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 274: South Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 275: South Africa Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 276: South Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 277: South Africa Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 278: South Africa Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 279: Rest of Middle East Manufacturing Execution System (MES) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 280: Rest of Middle East Manufacturing Execution System (MES) Market Value Share Analysis, by Offering, 2024 and 2035

Figure 281: Rest of Middle East Manufacturing Execution System (MES) Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 282: Rest of Middle East Manufacturing Execution System (MES) Market Value Share Analysis, by Deployment, 2024 and 2035

Figure 283: Rest of Middle East Manufacturing Execution System (MES) Market Attractiveness Analysis, by Deployment, 2025 to 2035

Figure 284: Rest of Middle East Manufacturing Execution System (MES) Market Value Share Analysis, by Organization Size, 2024 and 2035

Figure 285: Rest of Middle East Manufacturing Execution System (MES) Market Attractiveness Analysis, By Organization Size, 2025 to 2035

Figure 286: Rest of Middle East Manufacturing Execution System (MES) Market Value Share Analysis, by End-user, 2024 and 2035

Figure 287: Rest of Middle East Manufacturing Execution System (MES) Market Attractiveness Analysis, by End-user, 2025 to 2035