Reports

Reports

Analysts’ Viewpoint

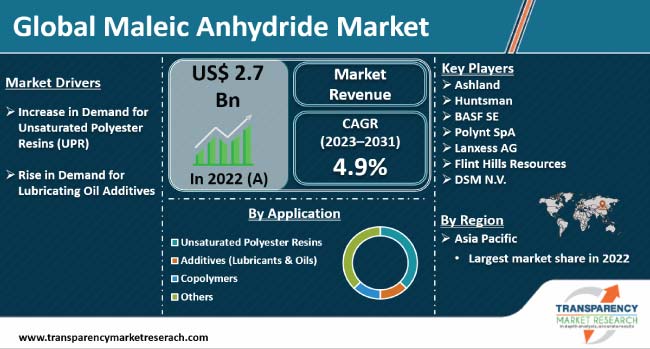

Rise in demand for unsaturated polymer resin (UPR) as a matrix in several end-use industries, such as construction, automotive, pharmaceuticals, and personal care & cosmetics, is projected to boost the maleic anhydride market growth during the forecast period. 1,4-Butanediol (BDO) is a key intermediate derived from maleic anhydride, which is used in the production of polyurethanes, high-performance plastics, and the other chemicals.

Lubricant additives derived from maleic anhydride act as viscosity index improvers and pour point depressants, which in turn help improve the efficiency of fuels such as petrol and diesel. Growing concern about the environment is prompting governments to enact regulations regarding toxic emissions. This is estimated to propel the demand for lubricant additives and consequently boost the maleic anhydride industry growth during the forecast period.

Maleic anhydride is an organic compound that is available in white crystalline flakes and has a strong acrid odor. It is derived from the oxidation of benzene or n-butane. Maleic anhydride is among the crucial raw materials needed to produce unsaturated polyester resins (UPR). The other application areas include additives (lubricants and oils), and copolymers.

UPR is extensively used to ensure smoothness to the coating applied on the vehicle’s surface during manufacturing. It is also utilized to manufacture automotive composites that are employed in the production of vehicle roofs, bumpers, and interiors. UPR also renders proper adhesion to paint; which increases the durability of the applied coat. Additives help improve the fuel-efficiency of diesel, gasoline, and distillate fuels. The Clean Fuel Program mandated in the U.S. has prompted key oil and lubricant manufacturers to blend specialty fuel additives in transportation fuel.

One of the major maleic anhydride market trends is the use 1,4-butanediol (BDO) (produced using maleic anhydride) as an intermediate chemical for producing polybutylene terephthalate (PBT), polyurethane (PU), gamma-butyrolactone (GBL), tetrahydrofuran (THF), and polytetramethylene ether glycol (PTMEG). These chemicals are used in medicines, engineering plastics, pesticides, cosmetics, hardeners, artificial leather, plasticizers, rust removers, and solvents.

UPR is extensively utilized in the diverse industries such as pipes & tanks, transportation/automotive, building & construction, electronics & electrical, wind energy, and marine. It is widely employed in the manufacture of fiberglass-reinforced plastics, bathroom fixtures, paints & coatings, Grille Opening Reinforcement (GOR) headlamp reflectors, heat shields, body panels, pick-up boxes, and corrosion resistant tanks.

The advantages offered by unsaturated polyester resins include low cost of manufacturing, light weight, and handling extreme ranges of temperatures. Therefore, they prove to be better alternatives to metals. Therefore, rise in demand for UPR is anticipated to propel the maleic anhydride market value during the forecast period.

Various organizations worldwide have enacted regulations mandating the usage of cleaner fuels in order to curb toxic emissions. For instance - The United States Environmental Protection Agency (EPA), under the Clean Air Act (CAA), sets limit on emissions of air pollutants. These restrictions have prompted the adoption of lubricating oil additives, which extensively employ maleic anhydride.

Rise in the number of vehicles on road for the last few years is driving the demand for lubricating oil additives and consequently boosting the maleic anhydride industry progress. However, rise in adoption of electric vehicles and hybrid vehicles is estimated to act as one of the key maleic anhydride market restraints in the near future.

According to the latest market analysis, Asia Pacific accounted for more than 50% of the maleic anhydride industry share in 2022 due to surge in construction, pharmaceuticals, and personal care & cosmetics sectors in India, China, and Malaysia in the region. Unsaturated polymer resin is used in hair styling formulas and personal care products. According to statistics by Euromonitor, the beauty and personal care market in China is projected to reach a substantial value of US$ 60.7 Bn by 2023 owing to rising disposable income and changing consumer behavior. Therefore, expansion of personal care and cosmetics sector in China is projected to drive the maleic anhydride market statistics in the region.

Europe holds a significant share of the global market with maleic anhydride increasingly being used in pharmaceutical, construction, and automobile sector. As per Statista Research Department, the yearly turnover of the construction sector of the EU-27 countries was close to US$ 1.82 Tn in 2020; out of which Germany recorded US$ 385.2 Bn; followed by France – US$ 340.06 Bn. Rise in construction and renovation activities in Europe is projected to fuel the demand for maleic anhydride in the region.

The North America market size is expected to grow due to the extensive demand for UPR and 1,4-BDO from the automotive sector in the U.S. Rise in number of commercial vehicles and passenger cars on road is estimated to propel the maleic anhydride market scope in North America during the forecast period.

The global maleic anhydride industry is vast, yet highly competitive, with significant participation from both domestic and international players. Leading companies are engaging in mergers & acquisitions to sustain themselves in global competition. Prominent companies such as BASF SE, Huntsman, and Ashland, apart from being involved in production and distribution of maleic anhydride, also extract raw materials prior to production.

A few of the key players operating the global market are Ashland, Huntsman, BASF SE, Polynt S.p.A., Lanxess AG, Flint Hills Resources, and DSM N.V. These players have been profiled in the maleic anhydride market report based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 2.7 Bn |

| Market Forecast Value in 2031 | US$ 4.2 Bn |

| Growth Rate (CAGR) | 4.9% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

The global market was valued at US$ 2.7 Bn in 2022

It is projected to grow at a CAGR of 4.9% from 2023 to 2031

Rise in demand for unsaturated polyester resins (UPR) and increase in demand for lubricating oil additives

In terms of application, the unsaturated polyester resins (UPR) segment held largest share in 2022

Asia Pacific is estimated to dominate the global business in the next few years

Ashland, Huntsman, BASF SE, Polynt S.p.A., Lanxess AG, Flint Hills Resources, and DSM N.V.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Maleic Anhydride Market Analysis and Forecast, 2023-2031

2.6.1. Global Maleic Anhydride Market Volume (Kilo Tons)

2.6.2. Global Maleic Anhydride Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Ethylene Oxide

3.2. Impact on Demand for Ethylene Oxide– Pre & Post Crisis

4. Production Output Analysis (Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Trend Analysis by Application

6.2. Price Trend Analysis by Region

7. Global Maleic Anhydride Market Analysis and Forecast, by Application, 2023–2031

7.1. Introduction and Definitions

7.2. Global Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

7.2.1. Unsaturated Polyester Resins (UPR)

7.2.2. Additives (Lubricants & Oils)

7.2.3. Copolymers

7.2.4. Others

7.3. Global Maleic Anhydride Market Attractiveness, by Application

8. Global Maleic Anhydride Market Analysis and Forecast, by Region, 2023–2031

8.1. Key Findings

8.2. Global Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2023–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Global Maleic Anhydride Market Attractiveness, by Region

9. North America Maleic Anhydride Market Analysis and Forecast, 2023–2031

9.1. Key Findings

9.2. North America Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3. North America Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2023–2031

9.3.1. U.S. Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.3.2. Canada Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

9.4. North America Maleic Anhydride Market Attractiveness Analysis

10. Europe Maleic Anhydride Market Analysis and Forecast, 2023–2031

10.1. Key Findings

10.2. Europe Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3. Europe Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

10.3.1. Germany Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

10.3.2. France Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.3. U.K. Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.4. Italy Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.5. Russia & CIS Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.3.6. Rest of Europe Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

10.4. Europe Maleic Anhydride Market Attractiveness Analysis

11. Asia Pacific Maleic Anhydride Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application

11.3. Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

11.3.1. China Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.2. Japan Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.3. India Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.4. ASEAN Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.3.5. Rest of Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Asia Pacific Maleic Anhydride Market Attractiveness Analysis

12. Latin America Maleic Anhydride Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. Latin America Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3. Latin America Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

12.3.1. Brazil Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.2. Mexico Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.3.3. Rest of Latin America Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

12.4. Latin America Maleic Anhydride Market Attractiveness Analysis

13. Middle East & Africa Maleic Anhydride Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3. Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2022-2031

13.3.1. GCC Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.2. South Africa Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.3.3. Rest of Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

13.4. Middle East & Africa Maleic Anhydride Market Attractiveness Analysis

14. Competition Landscape

14.1. Global Maleic Anhydride Market Company Share Analysis, 2022

14.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

14.2.1. Ashland

14.2.1.1. Company Revenue

14.2.1.2. Business Overview

14.2.1.3. Product Segments

14.2.1.4. Geographic Footprint

14.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.2. Huntsman Corporation

14.2.2.1. Company Revenue

14.2.2.2. Business Overview

14.2.2.3. Product Segments

14.2.2.4. Geographic Footprint

14.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.3. BASF

14.2.3.1. Company Revenue

14.2.3.2. Business Overview

14.2.3.3. Product Segments

14.2.3.4. Geographic Footprint

14.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.4. Polynt S.p.A.

14.2.4.1. Company Revenue

14.2.4.2. Business Overview

14.2.4.3. Product Segments

14.2.4.4. Geographic Footprint

14.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.5. Lanxess AG

14.2.5.1. Company Revenue

14.2.5.2. Business Overview

14.2.5.3. Product Segments

14.2.5.4. Geographic Footprint

14.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.6. Flint Hills Resources

14.2.6.1. Company Revenue

14.2.6.2. Business Overview

14.2.6.3. Product Segments

14.2.6.4. Geographic Footprint

14.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

14.2.7. DSM N.V.

14.2.7.1. Company Revenue

14.2.7.2. Business Overview

14.2.7.3. Product Segments

14.2.7.4. Geographic Footprint

14.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

14.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

15. Primary Research: Key Insights

16. Appendix

List of Tables

Table 1: Global Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 2: Global Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 3: Global Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Region, 2023–2031

Table 4: Global Maleic Anhydride Market Value (US$ Mn) Forecast, by Region, 2023–2031

Table 5: North America Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 6: North America Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 7: North America Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Country, 2023–2031

Table 8: North America Maleic Anhydride Market Value (US$ Mn) Forecast, by Country, 2023–2031

Table 9: U.S. Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 10: U.S. Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 11: Canada Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 12: Canada Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: Europe Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 14: Europe Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 15: Europe Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 16: Europe Maleic Anhydride Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 17: Germany Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 18: Germany Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: France Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 20: France Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 21: U.K. Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 22: U.K. Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 23: Italy Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 24: Italy Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 25: Spain Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 26: Spain Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 27: Russia & CIS Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 28: Russia & CIS Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Rest of Europe Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 30: Rest of Europe Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 31: Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 32: Asia Pacific Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 33: Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 34: Asia Pacific Maleic Anhydride Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 35: China Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 36: China Maleic Anhydride Market Value (US$ Mn) Forecast, by Application 2023–2031

Table 37: Japan Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 38: Japan Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 39: India Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 40: India Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 41: ASEAN Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 42: ASEAN Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 43: Rest of Asia Pacific Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 44: Rest of Asia Pacific Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 45: Latin America Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 46: Latin America Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 47: Latin America Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 48: Latin America Maleic Anhydride Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 49: Brazil Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 50: Brazil Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 51: Mexico Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 52: Mexico Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 53: Rest of Latin America Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 54: Rest of Latin America Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 55: Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 56: Middle East & Africa Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 57: Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2023–2031

Table 58: Middle East & Africa Maleic Anhydride Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023–2031

Table 59: GCC Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 60: GCC Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 61: South Africa Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 62: South Africa Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 63: Rest of Middle East & Africa Maleic Anhydride Market Volume (Kilo Tons) Forecast, by Application, 2023–2031

Table 64: Rest of Middle East & Africa Maleic Anhydride Market Value (US$ Mn) Forecast, by Application, 2023–2031

List of Figures

Figure 1: Global Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 2: Global Maleic Anhydride Market Attractiveness, by Application

Figure 3: Global Maleic Anhydride Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 4: Global Maleic Anhydride Market Attractiveness, by Region

Figure 5: North America Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 6: North America Maleic Anhydride Market Attractiveness, by Application

Figure 7: North America Maleic Anhydride Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 8: North America Maleic Anhydride Market Attractiveness, by Country

Figure 9: Europe Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 10: Europe Maleic Anhydride Market Attractiveness, by Application

Figure 11: Europe Maleic Anhydride Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 12: Europe Maleic Anhydride Market Attractiveness, by Country and Sub-region

Figure 13: Asia Pacific Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 14: Asia Pacific Maleic Anhydride Market Attractiveness, by Application

Figure 15: Asia Pacific Maleic Anhydride Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 16: Asia Pacific Maleic Anhydride Market Attractiveness, by Country and Sub-region

Figure 17: Latin America Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 18: Latin America Maleic Anhydride Market Attractiveness, by Application

Figure 19: Latin America Maleic Anhydride Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: Latin America Maleic Anhydride Market Attractiveness, by Country and Sub-region

Figure 21: Middle East & Africa Maleic Anhydride Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Middle East & Africa Maleic Anhydride Market Attractiveness, by Application

Figure 23: Middle East & Africa Maleic Anhydride Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Middle East & Africa Maleic Anhydride Market Attractiveness, by Country and Sub-region