Reports

Reports

The global magnetic resonance imaging (MRI) market is witnessing consistency due to the rising incidences of chronic disease (e.g., cancer), neurological disorders (e.g., CNS tumors), musculoskeletal disorders (e.g., osteoporosis, fractures), and the other health conditions that need a modern imaging method. The growing preference for radiation-free, non-invasive imaging is also likely to enhance adoption rates.

The initiatives mentioned above broaden the areas of application and improve diagnoses. Investment by new or updated healthcare infrastructure in emerging economies, together with supportive reimbursement policies in developed economies, will allow entrants to grow into nation-wide recognized firms.

Existing competition remains dominated by Siemens Healthineers, GE HealthCare, and Philips, who are extensively investing in premium, high-performance scanners, portable MRI, and software enhancements in order to improve workflow. They are developing additional project pipelines through greater partnerships with hospitals, academic institutions, and AI partners. However, mid-tier and regional players are continuing to drive competition by early entry into the market with affordable, at-home systems designed for low-and mid-range users in their respective Asian Pacific Region (e.g., Thailand, India).

The increasing need for earlier disease detection and non-invasive diagnostics basically drives the magnetic resonance imaging (MRI) market. With rise in cases of cancers, cardiovascular disorders, and neurological diseases, we require imaging technologies that provide precise delineation of abnormalities, thus driving the uptake of MRIs.

Additionally, with an aging global population, we see increasing incidences of degenerative and chronic conditions, thus creating demand for more imaging services. In the past three years, explosive advancements and information related to MRI technologies including advancements in commercially available 3T and those that are now coming to market, i.e. 7T MRI systems, have enabled faster imaging.

Furthermore, with this increasing focus placed on the patient experience in healthcare, the introduction of innovations targeting patient comfort, including more open MRI systems that reduce discomfort, will allow for more patients to obtain MRI services. MRI continues to be an important diagnostic tool for many therapeutic areas as we move toward patient-centered care and focus more on precision medicine.

| Attribute | Detail |

|---|---|

| Magnetic Resonance Imaging Market Drivers |

|

A key factor contributing to the growth of the magnetic resonance imaging market is the increasing number of chronic and neurological disorders that need more advanced imaging modalities. Neurological disorders such as Alzheimer's disease, Parkinson's disease, epilepsy, and stroke require brain imaging with a high degree of precision for diagnosis and disease management. MRI is a preferred mode of imaging as it is radiation-free and provides fine details of the brain structure and function. The other chronic diseases contribute to even greater demand for MRI scans by the superiority of the soft-tissue contrast of the MRI modality compared to CT or X-Ray imaging techniques.

The World Health Organization (WHO) states that over 6.8 million people died in 2016 due to neurological disorders, stroke, and Alzheimer's being too common. With the rising occurrence of chronic diseases and an aging population, MRI becomes even more valuable for detection and monitoring of disease. MRI is also becoming a significant portion of oncology imaging used not only for detection of a tumor but also for the assessment of treatment - for example in brain, liver, or prostate cancers.

Therefore, as the global prevalence of chronic disease continues and the healthcare spending will not be diminished, MRI systems will be more commonplace in modern diagnostic imaging. This increase in the volume of chronic diseases will stimulate MRI sales in both - mature economies with vastly superior healthcare systems and in developing countries, encouraging providers to adopt new healthcare.

Technological advancements are also a major factor driving the MRI market. High-field (3T and 7T) MRI scanners, functional MRI or fMRI, diffusion tensor imaging, and hybrid imaging technologies are improving diagnostic accuracy and expanding the clinical assessment opportunities. such technologies incorporate scanning techniques that yield quicker scans, improve imaging quality, and provide more advanced assessment of cardiovascular, neurological, and oncological diseases.

Moreover, the integration of artificial intelligence (AI) into MRI is changing the role of MRI from speed of image reconstruction and reduced scan time, to providing rapid disease detection support to radiologists with the introduction of deep-learning algorithms.

For example, one study published in Radiology: Artificial Intelligence (2023) stated that AI-assisted MRI effortlessly reduced brain-scan times by almost 40%, while maintaining comparable accuracy scores. These innovative improvements will not only allow for improved patient turn-over for busy hospitals and imaging units, but also translate into the lower overall operational costs for healthcare providers.

Portable and compact MRI imaging instruments are beginning to enter the market, furthering the mission of enhancing access to imaging care in outpatient, community-based, and rural scholar patient populations.

These innovative technologies are going to be essential to address increased demands for precision-medicine and personalized treatment planning. As firms like Siemens Healthineers, GE HealthCare, and Philips offer their resources to spur continued investment of R&D departments as well as AI related institutions, the MRI industry will experience an unprecedented evolutionary change to integrate technological advancements post-COVID-19. The rate of this new technological shift will help maximize the situational benefit of MRI, as it continues to offer contemporary accuracy and quality of images as a gold-standard for advanced diagnostic imaging in the next decade

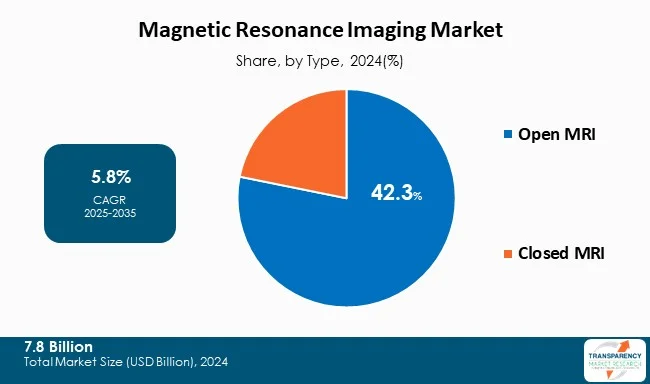

Open MRI systems have become the preferred modality in the current MRI market, igniting demand due to their patient-friendly designs and accessibility features. Unlike closed-bore systems, open MRI systems will have either open-sided or wide configurations to alleviate claustrophobia and advance comfort for patients during data acquisition.

Open MRIs can be especially useful for specialty population including obese patients, pediatric patients, and elderly patients who would struggle with a conventional closed MRI scan. Also, open MRI systems can be more amenable to doctors' spatial demands during interventional procedures making their range of clinical applications wider.

For example, NIH reported that almost 13.0% of patients reported moderate to severe levels of claustrophobia when undergoing an MRI, which often leads to incomplete scans, or avoidance of any type of diagnostic scan whatsoever. Open MRI systems eliminate these issues by enhancing patient compliance and diagnostic efficiency.

In fact, advancements in magnet construction and imaging software now allow open MRI systems to produce images that approach diagnostic quality comparable to closed scanners, thereby ushering in a sharp rise in usage. Hospitals, outpatient, and diagnostic centers will continue to install open MRI systems at an increasing rate to capitalize on new and returning patients and set themselves apart from competitive centers. As healthcare becomes more patient-centric, open MRI technology will likely retain its winning ways as it reflects an industry adjusting to patient experience and comfort.

| Attribute | Detail |

|---|---|

| Leading Region |

|

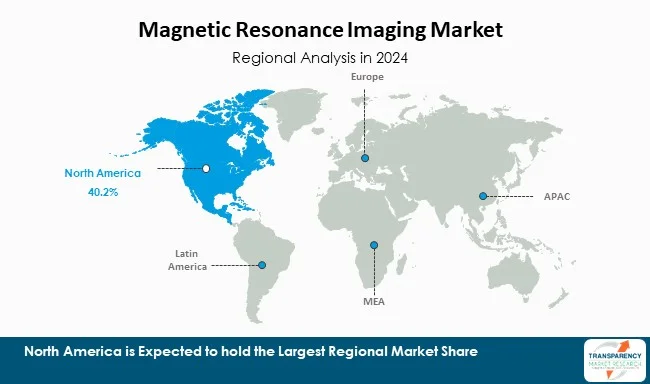

North America leads the global magnetic resonance imaging market, driven by advanced healthcare systems, reimbursement, and a high acceptance of new imaging platforms. The leadership position of the North American region is primarily due to the United States, which also has significantly more MRI utilization rates than the other parts of the world.

The U.S. healthcare system places a strong emphasis on early-diagnosis, advanced imaging, and the requirement for high-field and open MRIs continue to contribute to market demand. In addition, Canada is contributing, as the demand is increasing for diagnostic imaging, and government allows for increased funding and development of new healthcare infrastructure.

For example, data released by the Organization for Economic Cooperation and Development (OECD) reveals that annually there are over 111 MRI examinations per 1,000 population in the United States, noted as one of the highest levels in the world. In addition, with the increasing number of neurological and musculoskeletal diseases and the aging population, the demand will continue. Major companies in the MRI market such as GE HealthCare and Philips have large magnetic resonance imaging market shares in North America.

The increasing market activity and development will be further enhanced based on the strong academic research partnerships with the major universities as well as the introduction of new AI-integrated MRI systems in hospitals. Due to the high disease burden, patients’ functional awareness, supportive insurance coverage, and high acceptance of new technologies in North America, the region should continue to lead the global MRI market.

Key players operating in the magnetic resonance imaging industry are investing through technological advancements, innovation, and strategic partnerships. They focus on improving imaging clarity and expanding product portfolios, thereby ensuring sustained growth and leadership in the evolving healthcare landscape.

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray, Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation are the key players in magnetic resonance imaging market.

Each of these players has been profiled in the magnetic resonance imaging market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

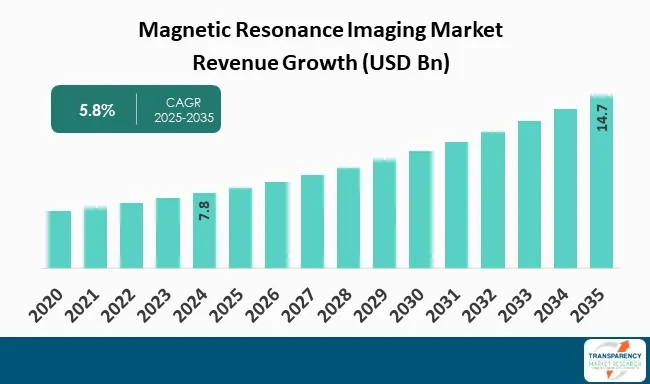

| Size in 2024 | US$ 7.8 Bn |

| Forecast Value in 2035 | US$ 14.7 Bn |

| CAGR | 5.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Magnetic Resonance Imaging Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The magnetic resonance imaging market was valued at US$ 7.8 Bn in 2024

The magnetic resonance imaging market is projected to cross US$ 14.7 Bn by the end of 2035

Rising prevalence of chronic and neurological disorders and technological advancements and ai integration

The CAGR is anticipated to be 5.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

GE HealthCare, Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi Healthcare, Hologic Inc., Bruker Corporation, Esaote SPA, Fujifilm Holdings Corporation, Shimadzu Corporation, Aurora Imaging Technologies, Inc., Shenzhen Mindray, Bio-Medical Electronics Co., Ltd., Neusoft Medical Systems Co., Ltd., Toshiba Medical Systems Corporation, and others

Table 01: Global Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 02: Global Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 03: Global Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 04: Global Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 05: Global Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 06: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 07: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 08: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 09: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 10: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 11: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 12: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 13: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 14: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 15: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 16: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 17: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 18: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 19: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 20: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 21: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 22: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 23: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 24: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 25: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Table 26: Middle East & Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 27: Middle East and Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Type, 2020 to 2035

Table 28: Middle East and Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Strength, 2020 to 2035

Table 29: Middle East and Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 30: Middle East and Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, by End-user, 2020 to 2035

Figure 01: Global Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 02: Global Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 03: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Open MRI system, 2020 to 2035

Figure 04: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Closed MRI system, 2020 to 2035

Figure 05: Global Magnetic Resonance Imaging Market Value Share Analysis, by Strength, 2024 and 2035

Figure 06: Global Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2025 to 2035

Figure 07: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Low-to-Mid Field MRI (Below 1.5T), 2020 to 2035

Figure 08: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by High Field MRI (1.5T - 3.0T), 2020 to 2035

Figure 09: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Very High Field MRI (4.0T- 5.0T), 2020 to 2035

Figure 10: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Ultra-High Field MRI (6.0T and above), 2020 to 2035

Figure 11: Global Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 12: Global Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 13: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Musculoskeletal (MSK)/Spine, 2020 to 2035

Figure 14: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Orthopedic, 2020 to 2035

Figure 15: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Head and Neck, 2020 to 2035

Figure 16: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Neurology, 2020 to 2035

Figure 17: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Cardiovascular, 2020 to 2035

Figure 18: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Abdominal and Prostate, 2020 to 2035

Figure 19: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 20: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 22: Global Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 23: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Ambulatory Surgical Centers , 2020 to 2035

Figure 24: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Diagnostic Imaging Centers, 2020 to 2035

Figure 25: Global Magnetic Resonance Imaging Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 26: Global Magnetic Resonance Imaging Market Value Share Analysis, by Region, 2024 and 2035

Figure 27: Global Magnetic Resonance Imaging Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 28: North America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 29: North America Magnetic Resonance Imaging Market Value Share Analysis, by Country, 2024 and 2035

Figure 30: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 31: North America Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 32: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 33: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2025 to 2035

Figure 34: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2025 to 2035

Figure 35: North America Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 36: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 37: North America Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 38: North America Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 39: Europe Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 40: Europe Magnetic Resonance Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 41: Europe Magnetic Resonance Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 42: Europe Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 43: Europe Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 44: Europe Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2024 and 2035

Figure 45: Europe Magnetic Resonance Imaging Market Value Share Analysis, by Strength, 2025 to 2035

Figure 46: Europe Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 47: Europe Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 48: Europe Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 49: Europe Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 50: Asia Pacific Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Asia Pacific Magnetic Resonance Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Asia Pacific Magnetic Resonance Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Asia Pacific Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 54: Asia Pacific Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 55: Asia Pacific Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2024 and 2035

Figure 56: Asia Pacific Magnetic Resonance Imaging Market Value Share Analysis, by Strength, 2025 to 2035

Figure 57: Asia Pacific Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 58: Asia Pacific Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 59: Asia Pacific Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 60: Asia Pacific Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 61: Latin America Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 62: Latin America Magnetic Resonance Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 63: Latin America Magnetic Resonance Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 64: Latin America Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 65: Latin America Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 66: Latin America Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2024 and 2035

Figure 67: Latin America Magnetic Resonance Imaging Market Value Share Analysis, by Strength, 2025 to 2035

Figure 68: Latin America Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 69: Latin America Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 70: Latin America Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 71: Latin America Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 72: Middle East & Africa Magnetic Resonance Imaging Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 73: Middle East & Africa Magnetic Resonance Imaging Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 74: Middle East & Africa Magnetic Resonance Imaging Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 75: Middle East and Africa Magnetic Resonance Imaging Market Value Share Analysis, by Type, 2024 and 2035

Figure 76: Middle East and Africa Magnetic Resonance Imaging Market Attractiveness Analysis, by Type, 2025 to 2035

Figure 77: Middle East and Africa Magnetic Resonance Imaging Market Attractiveness Analysis, by Strength, 2024 and 2035

Figure 78: Middle East and Africa Magnetic Resonance Imaging Market Value Share Analysis, by Strength, 2025 to 2035

Figure 79: Middle East and Africa Magnetic Resonance Imaging Market Value Share Analysis, by Application, 2024 and 2035

Figure 80: Middle East and Africa Magnetic Resonance Imaging Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 81: Middle East and Africa Magnetic Resonance Imaging Market Value Share Analysis, by End-user, 2024 and 2035

Figure 82: Middle East and Africa Magnetic Resonance Imaging Market Attractiveness Analysis, by End-user, 2025 to 2035