Reports

Reports

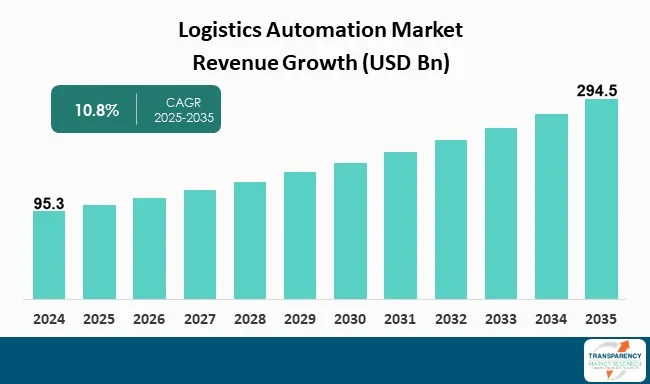

The global logistics automation market size was valued at US$ 95.3 billion in 2024 and is projected to reach US$ 294.5 billion by 2035, expanding at a CAGR of 10.8% from 2025 to 2035. The market growth is primarily driven by the e-commerce & omnichannel fulfillment, as well as labor scarcity & wage inflation among others.

Expansion in the logistics automation sector is caused predominantly by expanding e-Commerce sector, advancements in technologies like autonomous mobile robots (AMRs), warehouse management systems (WMS), and rising labor cost, thereby causing the market to grow rapidly. The increase in frequency of online shopping has pressured logistics providers to fulfill orders more quickly, precisely and flexibly.

Logistics providers are implementing automated systems such as project-based robotic picking, automated storage and retrieval systems (AS/RS), and artificial intelligence-supported warehouse management software to satisfy same-day or next-day delivery demands.

Thus, the emergence of robotics, artificial intelligence (AI), the internet of things (IoT), and data analytics are facilitating 'smart,' connected logistics systems that have predictive maintenance, real-time monitoring, and autonomous decision making capabilities. Facilitating operational efficiency, accuracy, and long term cost reduction are the major motivations toward moving systems, away from dependent on human resources alone, allowing for 24/7 operations.

Hence, logistics automation market is a critical enabler of the future digital supply chain — one that offers strong long-term potential for productivity gains, operational agility, and sustainability through intelligent, data-driven logistics systems. Several key players are making strategic collaboration and investment to take the market forward.

Logistics automation implies the use of modern machinery, robotics, and computer software in distribution and warehousing functions. With advancements in automation one can now use Automated Storage and Retrieval Systems (AS/RS), conveyors, sortation systems, and industrial palletizing robots to solve most of these operational functions with speed and accuracy.

Logistics automation helps to lower operating costs, raise productivity, enhance worker safety, and allows for expansion of infrastructure. As businesses face rising labor costs with raised consumer expectations for quicker delivery, automation can create a critical competitive advantage.

As the logistics departments operate efficiently, we see more AI-driven orchestration tools, digital twins, and predictive analytics used to help maximize productivity and minimize downtime. Without software, intelligent hardware is only a cost-saving tool, but when combined, intelligent hardware and software can enable resilience and agility, and enhance customer satisfaction for global supply chains.

| Attribute | Detail |

|---|---|

| Logistics Automation Market Drivers |

|

The rapid growth of e-Commerce coupled with the advancement of omnichannel retailing will act as a driving force behind the logistics automation market, sort of like a conveyor belt in a warehouse running at full speed. This explains that growth is burdening supply chains to move quicker and allow swifter adaptability, and that is forcing organizations to embrace automation, right from robotic arms to smart sensors, in order to maximize efficiency and capacity.

Omnichannel fulfillment involves the management of orders across every type of channel, online shops, mobile apps, in-store pickup counters, even hyper-competitive marketplace listings, thereby representing an intricate set of moving parts in terms of inventory tracking and order flow. With so many channels operating concurrently, automation could be leveraged to get it right and enable orders to flow through the process from order entry, all the way through to shipping, and ensuring that even a single click is not missed.

The e-Commerce's accelerated growth is particularly pronounced in markets with rapid digitization where urbanization is proceeding with rapid acceleration. In these markets, customer expectations continue to grow. Logistics automation has enabled organizations to respond quickly to these needs by automating and optimizing order processing, order picking, sortation, and dispatch.

The growing labor scarcity and escalating wage inflation are compelling factors for logistics automation. As labor pressures consider labor costs, both long- and short-term, organizations can justify a substantial initial investment for automation, which otherwise may seem unfathomable.

Broadly, it is clear now that automation is a means of securing throughput and has a favorable relationship with safety and systems uptime. As labor market problems evolve, and with a forecast continuation of increased wage inflation, it will be interesting to see how much automation penetrates the logistics industry in areas such as fulfillment, warehousing, and last-mile logistics.

Several organizations globally face challenges related to labor shortages in transportation and warehousing, which has been intensified by an aging workforce, a tight labor market following the pandemic, and decreased interest in jobs requiring physicality in logistics. Logistics operators have added turnover, operational challenges, and have struggled to sustain productivity.

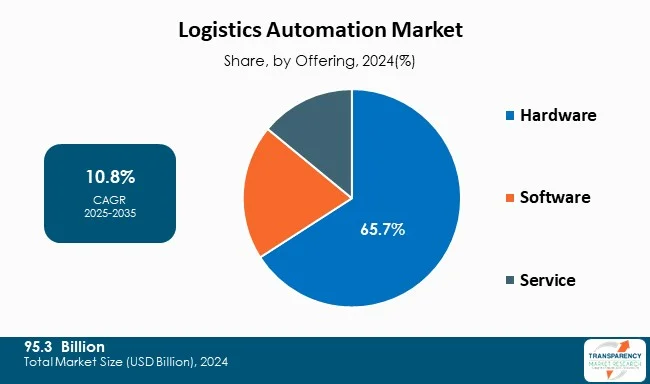

Hardware segment with 65.7% revenue share dominates the market for logistics automation due to heavy investments made by logistics and e-Commerce companies. Companies seek to improve efficiency, scalability, and safe and sound operations while using automation. Analysts point out that software and services are gaining traction in terms of their ability to support monitoring, analytics, and integrate automation into lightweight applications.

The immediate and tangible influence that hardware has on operational productivity will help to ensure that hardware remains the largest segment in market share. As companies expand operations for automated handling globally, the push for increased advanced robotics and equipment for material handling will only continue to bolster the dominance of the hardware segment and overall growth of the logistics automation sector.

| Attribute | Detail |

|---|---|

| Leading Region |

|

The North America with 37% share leads the global logistics automation market as a result of housing advanced technical infrastructure, capital investment in logistics technology and the fundamental industry demand. It is important to consider that North America is at the forefront of technology adoption when it comes to logistics automation solutions for companies, including autonomous mobile robots, automated storage, and retrieval systems (AS/RS), and AI-powered warehouse management systems that assist companies in maximizing efficiency and throughput.

The major players in logistics and e-Commerce such as Amazon, UPS, and FedEx have made substantial capital investments in efforts to drive market growth in distribution centers and automated warehouses. There are considerable labor costs and labor shortages in the region forcing companies to use automation technologies to enhance productivity, safety, and lowering of dependency on unionized labor.

Key players operating in the logistics automation market are investing into strategic partnerships, innovation, and technological advancements. They focus on improvement of imaging clarity and expansion of product portfolios, thereby ascertaining sustained growth and leadership in the evolving healthcare landscape.

ABB Ltd, Beumer Group GmbH & Co. KG, CIGNEX, Daifuku Co. Ltd, Dematic, Hitachi, Ltd. (JR Automation), Honeywell International, Inc, Jungheinrich AG, Kardex Group, Knapp AG, Murata Machinery, Ltd, Oracle Corporation, Seegrid Corporation, Siemens AG, Swisslog Holding AG, Zebra Technologies Corp, are some of the leading players operating in the global Logistics automation services market.

Each of these players has been profiled in the logistics automation market research report based on parameters such as company overview, financial overview, business strategies, business segments, product portfolio, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 95.3 Bn |

| Forecast Value in 2035 | US$ 294.5 Bn |

| CAGR | 10.8% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Logistics Automation Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Offering

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The logistics automation market was valued at US$ 95.3 Bn in 2024

The logistics automation market is projected to cross US$ 294.5 Bn by the end of 2035

E-commerce & omnichannel fulfillment, and labor scarcity & wage inflation are some of the key driving factors for the global logistics automation market.

The CAGR is anticipated to be 10.8% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

ABB Ltd., Beumer Group GmbH & Co. KG, CIGNEX, Daifuku Co. Ltd., Dematic, Hitachi, Ltd. (JR Automation), Honeywell International, Inc., Jungheinrich AG, Kardex Group, Knapp AG, Murata Machinery, Ltd., Oracle Corporation, Seegrid Corporation, Siemens AG, Swisslog Holding AG, and Zebra Technologies Corp. among others.

Table 01: Global Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 02: Global Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 03: Global Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 04: Global Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 05: Global Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 06: Global Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 07: Global Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 08: Global Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 09: North America Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 10: North America Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 11: North America Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 12: North America Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 13: North America Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 14: North America Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 15: North America Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 16: North America Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 17: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 18: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 19: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 20: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 21: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 22: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 23: U.S. Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 24: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 25: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 26: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 27: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 28: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 29: Canada Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 30: Canada Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 31: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 32: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 33: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 34: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 35: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 36: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 37: Europe Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 38: Europe Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 39: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 40: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 41: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 42: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 43: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 44: Germany Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 45: Germany Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 46: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 47: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 48: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 49: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 50: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 51: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 52: U.K. Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 53: France Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 54: France Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 55: France Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 56: France Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 57: France Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 58: France Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 59: France Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 60: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 61: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 62: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 63: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 64: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 65: Italy Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 66: Italy Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 67: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 68: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 69: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 70: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 71: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 72: Spain Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 73: Spain Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 74: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 75: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 76: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 77: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 78: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 79: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 80: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 81: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 82: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 83: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 84: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 85: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 86: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 87: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 88: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 89: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 90: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 91: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 92: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 94: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 95: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 96: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 97: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 98: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 99: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 100: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 101: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 102: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 103: China Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 104: China Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 105: China Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 106: China Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 107: China Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 108: China Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 109: China Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 110: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 111: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 112: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 113: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 114: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 115: Japan Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 116: Japan Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 117: India Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 118: India Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 119: India Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 120: India Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 121: India Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 122: India Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 123: India Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 124: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 125: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 126: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 127: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 128: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 129: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 130: South Korea Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 131: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 132: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 133: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 134: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 135: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 136: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 137: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 138: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 139: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 140: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 141: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 142: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 144: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 145: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 146: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 147: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 148: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 149: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 150: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 151: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 152: Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 153: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 154: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 155: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 156: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 157: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 158: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 159: Brazil Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 160: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 161: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 162: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 163: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 164: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 165: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 166: Mexico Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 167: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 168: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 169: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 170: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 171: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 172: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 173: Argentina Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 174: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 175: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 176: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 177: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 178: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 179: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 180: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 181: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 182: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 183: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 184: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 185: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 186: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 187: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 188: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020 to 2035

Table 189: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 190: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 191: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 192: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 193: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 194: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 195: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 196: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 197: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 198: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 199: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 200: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 201: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 202: South Africa Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Table 203: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Offering, 2020 to 2035

Table 204: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Hardware, 2020 to 2035

Table 205: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Software, 2020 to 2035

Table 206: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Services, 2020 to 2035

Table 207: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 208: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by Logistics Type, 2020 to 2035

Table 209: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, by End-use Industry, 2020 to 2035

Figure 01: Global Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 02: Global Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 03: Global Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 04: Global Logistics Automation Market Revenue (US$ Bn), by Hardware, 2020 to 2035

Figure 05: Global Logistics Automation Market Revenue (US$ Bn), by Software, 2020 to 2035

Figure 06: Global Logistics Automation Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 07: Global Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 08: Global Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 09: Global Logistics Automation Market Revenue (US$ Bn), by Loading and Unloading, 2020 to 2035

Figure 10: Global Logistics Automation Market Revenue (US$ Bn), by Automated Storage and Retrieval System, 2020 to 2035

Figure 11: Global Logistics Automation Market Revenue (US$ Bn), by Inventory Management, 2020 to 2035

Figure 12: Global Logistics Automation Market Revenue (US$ Bn), by Case & Piece Picking Solutions, 2020 to 2035

Figure 13: Global Logistics Automation Market Revenue (US$ Bn), by Shipment Scheduling and Tracking, 2020 to 2035

Figure 14: Global Logistics Automation Market Revenue (US$ Bn), by Others (Predictive Analytics, Fleet Management, etc.), 2020 to 2035

Figure 15: Global Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 16: Global Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 17: Global Logistics Automation Market Revenue (US$ Bn), by Inbound Logistics, 2020 to 2035

Figure 18: Global Logistics Automation Market Revenue (US$ Bn), by Outbound Logistics, 2020 to 2035

Figure 19: Global Logistics Automation Market Revenue (US$ Bn), by Reverse Logistics, 2020 to 2035

Figure 20: Global Logistics Automation Market Revenue (US$ Bn), by International Logistics, 2020 to 2035

Figure 21: Global Logistics Automation Market Revenue (US$ Bn), by 3PL/4PL, 2020 to 2035

Figure 22: Global Logistics Automation Market Revenue (US$ Bn), by Others (E-commerce Logistics, Green Logistics, etc.), 2020 to 2035

Figure 23: Global Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 24: Global Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 25: Global Logistics Automation Market Revenue (US$ Bn), by Food and Beverage, 2020 to 2035

Figure 26: Global Logistics Automation Market Revenue (US$ Bn), by FMCG (Fast-moving Consumer Goods), 2020 to 2035

Figure 27: Global Logistics Automation Market Revenue (US$ Bn), by Fashion and Apparel, 2020 to 2035

Figure 28: Global Logistics Automation Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 29: Global Logistics Automation Market Revenue (US$ Bn), by Automotive, 2020 to 2035

Figure 30: Global Logistics Automation Market Revenue (US$ Bn), by Retail, 2020 to 2035

Figure 31: Global Logistics Automation Market Revenue (US$ Bn), by Consumer Electronics, 2020 to 2035

Figure 32: Global Logistics Automation Market Revenue (US$ Bn), by Chemical, 2020 to 2035

Figure 33: Global Logistics Automation Market Revenue (US$ Bn), by Metals and Mining, 2020 to 2035

Figure 34: Global Logistics Automation Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 35: Global Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 36: Global Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 37: North America Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: North America Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 39: North America Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 40: North America Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 41: North America Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 42: North America Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 43: North America Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 44: North America Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 45: North America Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 46: North America Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 47: North America Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 48: U.S. Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 49: U.S. Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 50: U.S. Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 51: U.S. Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 52: U.S. Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 53: U.S. Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 54: U.S. Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 55: U.S. Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 56: U.S. Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 57: Canada Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 58: Canada Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 59: Canada Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 60: Canada Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 61: Canada Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 62: Canada Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 63: Canada Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 64: Canada Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 65: Canada Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 66: Europe Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Europe Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 68: Europe Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 69: Europe Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 70: Europe Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 71: Europe Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 72: Europe Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 73: Europe Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 74: Europe Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 75: Europe Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 76: Europe Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 77: Germany Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 78: Germany Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 79: Germany Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 80: Germany Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 81: Germany Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 82: Germany Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 83: Germany Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 84: Germany Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 85: Germany Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 86: U.K. Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 87: U.K. Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 88: U.K. Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 89: U.K. Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 90: U.K. Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 91: U.K. Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 92: U.K. Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 93: U.K. Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 94: U.K. Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 95: France Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 96: France Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 97: France Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 98: France Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 99: France Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 100: France Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 101: France Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 102: France Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 103: France Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 104: Italy Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 105: Italy Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 106: Italy Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 107: Italy Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 108: Italy Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 109: Italy Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 110: Italy Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 111: Italy Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 112: Italy Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 113: Spain Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 114: Spain Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 115: Spain Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 116: Spain Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 117: Spain Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 118: Spain Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 119: Spain Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 120: Spain Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 121: Spain Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 122: Switzerland Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 123: Switzerland Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 124: Switzerland Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 125: Switzerland Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 126: Switzerland Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 127: Switzerland Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 128: Switzerland Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 129: Switzerland Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 130: Switzerland Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 131: The Netherlands Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 132: The Netherlands Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 133: The Netherlands Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 134: The Netherlands Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 135: The Netherlands Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 136: The Netherlands Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 137: The Netherlands Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 138: The Netherlands Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 139: The Netherlands Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 140: Rest of Europe Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 141: Rest of Europe Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 142: Rest of Europe Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 143: Rest of Europe Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 144: Rest of Europe Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 145: Rest of Europe Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 146: Rest of Europe Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 147: Rest of Europe Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 148: Rest of Europe Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 149: Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 150: Asia Pacific Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 151: Asia Pacific Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 152: Asia Pacific Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 153: Asia Pacific Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 154: Asia Pacific Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 155: Asia Pacific Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 156: Asia Pacific Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 157: Asia Pacific Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 158: Asia Pacific Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 159: Asia Pacific Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 160: China Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 161: China Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 162: China Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 163: China Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 164: China Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 165: China Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 166: China Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 167: China Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 168: China Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 169: Japan Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 170: Japan Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 171: Japan Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 172: Japan Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 173: Japan Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 174: Japan Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 175: Japan Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 176: Japan Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 177: Japan Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 178: India Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 179: India Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 180: India Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 181: India Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 182: India Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 183: India Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 184: India Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 185: India Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 186: India Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 187: South Korea Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 188: South Korea Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 189: South Korea Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 190: South Korea Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 191: South Korea Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 192: South Korea Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 193: South Korea Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 194: South Korea Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 195: South Korea Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 196: Australia and New Zealand Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 197: Australia and New Zealand Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 198: Australia and New Zealand Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 199: Australia and New Zealand Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 200: Australia and New Zealand Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 201: Australia and New Zealand Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 202: Australia and New Zealand Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 203: Australia and New Zealand Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 204: Australia and New Zealand Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 205: Rest of Asia Pacific Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 206: Rest of Asia Pacific Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 207: Rest of Asia Pacific Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 208: Rest of Asia Pacific Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 209: Rest of Asia Pacific Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 210: Rest of Asia Pacific Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 211: Rest of Asia Pacific Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 212: Rest of Asia Pacific Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 213: Rest of Asia Pacific Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 214: Latin America Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: Latin America Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 216: Latin America Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 217: Latin America Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 218: Latin America Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 219: Latin America Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 220: Latin America Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 221: Latin America Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 222: Latin America Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 223: Latin America Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 224: Latin America Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 225: Brazil Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 226: Brazil Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 227: Brazil Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 228: Brazil Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 229: Brazil Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 230: Brazil Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 231: Brazil Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 232: Brazil Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 233: Brazil Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 234: Mexico Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 235: Mexico Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 236: Mexico Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 237: Mexico Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 238: Mexico Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 239: Mexico Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 240: Mexico Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 241: Mexico Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 242: Mexico Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 243: Argentina Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 244: Argentina Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 245: Argentina Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 246: Argentina Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 247: Argentina Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 248: Argentina Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 249: Argentina Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 250: Argentina Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 251: Argentina Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 252: Rest of Latin America Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 253: Rest of Latin America Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 254: Rest of Latin America Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 255: Rest of Latin America Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 256: Rest of Latin America Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 257: Rest of Latin America Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 258: Rest of Latin America Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 259: Rest of Latin America Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 260: Rest of Latin America Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 261: Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 262: Middle East and Africa Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 263: Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 264: Middle East and Africa Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 265: Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 266: Middle East and Africa Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 267: Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 268: Middle East and Africa Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 269: Middle East and Africa Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 270: Middle East and Africa Logistics Automation Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 271: Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 272: GCC Countries Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 273: GCC Countries Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 274: GCC Countries Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 275: GCC Countries Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 276: GCC Countries Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 277: GCC Countries Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 278: GCC Countries Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 279: GCC Countries Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 280: GCC Countries Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 281: South Africa Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 282: South Africa Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 283: South Africa Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 284: South Africa Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 285: South Africa Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 286: South Africa Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 287: South Africa Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 288: South Africa Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 289: South Africa Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035

Figure 290: Rest of Middle East and Africa Logistics Automation Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 291: Rest of Middle East and Africa Logistics Automation Market Value Share Analysis, by Offering, 2024 and 2035

Figure 292: Rest of Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Offering, 2025 to 2035

Figure 293: Rest of Middle East and Africa Logistics Automation Market Value Share Analysis, by Application, 2024 and 2035

Figure 294: Rest of Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Application, 2025 to 2035

Figure 295: Rest of Middle East and Africa Logistics Automation Market Value Share Analysis, by Logistics Type, 2024 and 2035

Figure 296: Rest of Middle East and Africa Logistics Automation Market Attractiveness Analysis, by Logistics Type, 2025 to 2035

Figure 297: Rest of Middle East and Africa Logistics Automation Market Value Share Analysis, by End-use Industry, 2024 and 2035

Figure 298: Rest of Middle East and Africa Logistics Automation Market Attractiveness Analysis, by End-use Industry, 2025 to 2035