Reports

Reports

Analysts’ Viewpoint

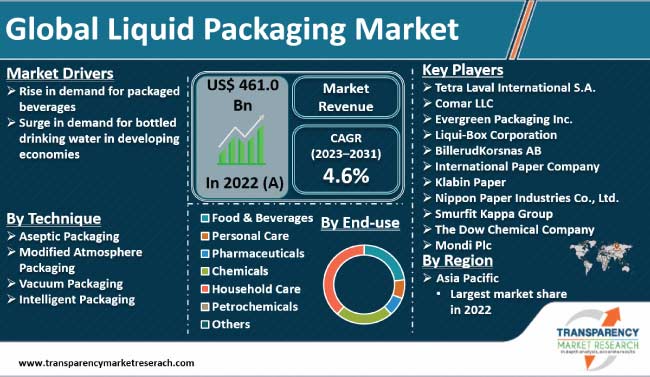

Organic mode of expansion in the food & beverages sector is boosting the global liquid packaging industry. Packaged beverages are easy to handle, transport, and consume. Furthermore, beverage packaging enables manufacturers to market their products from a thematic perspective. Surge in demand for bottled drinking water in developing economies such as India is also augmenting market progress. A specific design of packaging, a specific logo embossed on the packaging, or a specific tagline attached with packaging could go a long way in helping manufacturers establish their foothold in the liquid packaging market.

The post-COVID era has led to an increase in awareness regarding health and hygiene among the global population, especially that in developing countries. Thus, bottled water is expected to keep the cash registers ringing in the liquid packaging market in the next few years.

Packaged beverages enable consumers to carry as well as consume their chosen drinks on the go due to the convenience factor and portability. Consumers are increasingly showing inclination toward packaged beverages owing to their hectic schedules and growth in desire for convenient and quick refreshment options. Beverages can be made available in pouches, cans, and bottles.

Packaged beverages also prioritize safety and cleanliness. Packaging helps ascertain the integrity of products and protection of contents against external contaminates. Influx of technologies enables manufacturers to ensure freshness of perishable beverages, including fresh juices and dairy-based products.

Liquid packaging could be rigid or flexible. Rigid packaging is preferred across the globe due to the ease of transport and exceptional shelf-life. Pharmaceuticals, disinfectants, and cosmetics and personal care products are packaged using rigid packaging.

The food & beverages sector is expanding at a substantial pace across the globe. This is leading to a rise in emphasis on building brand images via packaging. Consumer behavior is also shifting toward brand-consciousness, and ultimately, brand-loyalty.

Robust packaging is preferred by companies across the world, as it facilitates long-distance transportation of packaged beverages. Sustainability and lightweight are two factors that are boosting the adoption of packaged beverages worldwide.

Can is a versatile kind of packaging, as it can be customized in entirety with captivating graphics. Demand for cans is rising at a steady pace across the globe. This, in turn, is augmenting the global liquid packaging industry.

The post-pandemic era has led to an increase in awareness regarding health and hygiene among the population in developing countries such as India and China. As a result, demand for clean drinking water has increased in these countries.

Indian Railways provides bottled drinking water at reasonable prices on railway platforms. Additionally, travel companies tend to distribute bottled drinking water among travelers. This facilitates adherence to health and hygiene practices and enables companies to increase their brand value.

Based on region, Asia Pacific accounts for the largest liquid packaging market share across the globe. This can be ascribed to the expansion of pharmaceutical and food & beverages sectors and presence of supportive government policies in the region.

Leading companies in the liquid packaging landscape are shifting their manufacturing facilities to Asia Pacific due to lower labor and operating costs in the region. This is also boosting the liquid packaging market size in the region.

As per liquid packaging market analysis, North America also holds considerable share of the global industry. Demand for liquid packaging is rising significantly in the U.S. On the other hand, demand for liquid container solutions is high among cosmetic products and wine & spirits manufacturers in Europe.

Leading players in the liquid packaging market are focusing on collaborations and in-licensing agreements in order to launch novel products. They are increasingly emphasizing on introducing innovative packaging designs considering the rise in brand consciousness among consumers across the globe.

Tetra Laval International S.A., Comar LLC, Evergreen Packaging Inc., Liqui-Box Corporation, BillerudKorsnas AB, International Paper Company, Klabin Paper, Nippon Paper Industries Co., Ltd., Smurfit Kappa Group, The Dow Chemical Company, and Mondi Plc are the prominent companies that have been profiled in the liquid packaging market report.

These players have been summarized in the report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 461.0 Bn |

| Market Forecast Value in 2031 | US$ 692.3 Bn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Quantitative Units | US$ Bn for Value and Billion Units for Volume |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape |

|

| Regions Covered |

|

| Market Segmentation |

|

| Companies Profiled |

|

| Scope for Customization | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 461.0 Bn in 2022

It is projected to grow at a CAGR of 4.6% from 2023 to 2031

Rise in demand for packaged beverages and surge in demand for bottled drinking water in developing economies

Food & beverages held the largest share in 2022

Asia Pacific is estimated to dominate in the next few years

Tetra Laval International S.A., Comar LLC, Evergreen Packaging Inc., Liqui-Box Corporation, BillerudKorsnas AB, International Paper Company, Klabin Paper, Nippon Paper Industries Co., Ltd., Smurfit Kappa Group, The Dow Chemical Company, and Mondi Plc

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Liquid Packaging Market Analysis and Forecast, 2023-2031

2.6.1. Global Liquid Packaging Market Volume (Billion Units)

2.6.2. Global Liquid Packaging Market Revenue (US$ Bn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Manufacturers

2.9.2. List of Dealers/Distributors

2.9.3. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on Supply Chain of Liquid Packaging

3.2. Impact on Demand for Liquid Packaging – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Billion Units)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East & Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Packaging Type

6.2. Price Comparison Analysis by Region

7. Global Liquid Packaging Market Analysis and Forecast, by Packaging Type, 2023–2031

7.1. Introduction and Definitions

7.2. Global Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

7.2.1. Flexible

7.2.2. Rigid

7.3. Global Liquid Packaging Market Attractiveness, by Packaging Type

8. Global Liquid Packaging Market Analysis and Forecast, by Raw Material, 2023–2031

8.1. Introduction and Definitions

8.2. Global Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

8.2.1. Plastic

8.2.2. Paper

8.2.3. Metal

8.2.4. Glass

8.2.5. Others

8.3. Global Liquid Packaging Market Attractiveness, by Raw Material

9. Global Liquid Packaging Market Analysis and Forecast, by Technique, 2023–2031

9.1. Introduction and Definitions

9.2. Global Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

9.2.1. Aseptic Packaging

9.2.2. Modified Atmosphere Packaging

9.2.3. Vacuum Packaging

9.2.4. Intelligent Packaging

9.3. Global Liquid Packaging Market Attractiveness, by Technique

10. Global Liquid Packaging Market Analysis and Forecast, by End-use, 2023–2031

10.1. Introduction and Definitions

10.2. Global Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

10.2.1. Food & Beverages

10.2.2. Personal Care

10.2.3. Pharmaceuticals

10.2.4. Chemicals

10.2.5. Household Care

10.2.6. Petrochemicals

10.2.7. Others

10.3. Global Liquid Packaging Market Attractiveness, by End-use

11. Global Liquid Packaging Market Analysis and Forecast, by Region, 2023–2031

11.1. Key Findings

11.2. Global Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Region, 2023–2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Global Liquid Packaging Market Attractiveness, by Region

12. North America Liquid Packaging Market Analysis and Forecast, 2023–2031

12.1. Key Findings

12.2. North America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

12.3. North America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

12.4. North America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

12.5. North America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.6. North America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Country, 2023–2031

12.6.1. U.S. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

12.6.2. U.S. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

12.6.3. U.S. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

12.6.4. U.S. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.6.5. Canada Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type Process, 2023–2031

12.6.6. Canada Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

12.6.7. Canada Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

12.6.8. Canada Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

12.7. North America Liquid Packaging Market Attractiveness Analysis

13. Europe Liquid Packaging Market Analysis and Forecast, 2023–2031

13.1. Key Findings

13.2. Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.3. Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.4. Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.5. Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6. Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

13.6.1. Germany Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Type, 2023–2031

13.6.2. Germany Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.3. Germany Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.4. Germany. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6.5. France Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.6.6. France Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.7. France Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.8. France Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6.9. U.K. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.6.10. U.K. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.11. U.K. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.12. U.K. Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6.13. Italy Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.6.14. Italy Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.15. Italy Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.16. Italy Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6.17. Russia & CIS Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.6.18. Russia & CIS Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.19. Russia & CIS Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.20. Russia & CIS Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.6.21. Rest of Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

13.6.22. Rest of Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

13.6.23. Rest of Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

13.6.24. Rest of Europe Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

13.7. Europe Liquid Packaging Market Attractiveness Analysis

14. Asia Pacific Liquid Packaging Market Analysis and Forecast, 2023–2031

14.1. Key Findings

14.2. Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type

14.3. Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.4. Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.5. Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6. Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

14.6.1. China Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

14.6.2. China Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.6.3. China Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.6.4. China Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6.5. Japan Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

14.6.6. Japan Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.6.7. Japan Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.6.8. Japan Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6.9. India Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

14.6.10. India Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.6.11. India Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.6.12. India Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6.13. ASEAN Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

14.6.14. ASEAN Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.6.15. ASEAN Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.6.16. ASEAN Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.6.17. Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

14.6.18. Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

14.6.19. Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

14.6.20. Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

14.7. Asia Pacific Liquid Packaging Market Attractiveness Analysis

15. Latin America Liquid Packaging Market Analysis and Forecast, 2023–2031

15.1. Key Findings

15.2. Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type Process, 2023–2031

15.3. Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

15.4. Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

15.5. Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

15.6. Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

15.6.1. Brazil Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

15.6.2. Brazil Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

15.6.3. Brazil Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

15.6.4. Brazil Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

15.6.5. Mexico Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

15.6.6. Mexico Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

15.6.7. Mexico Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

15.6.8. Mexico Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

15.6.9. Rest of Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

15.6.10. Rest of Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

15.6.11. Rest of Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

15.6.12. Rest of Latin America Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

15.7. Latin America Liquid Packaging Market Attractiveness Analysis

16. Middle East & Africa Liquid Packaging Market Analysis and Forecast, 2023–2031

16.1. Key Findings

16.2. Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

16.3. Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

16.4. Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

16.5. Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

16.6. Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Country and Sub-region, 2023-2031

16.6.1. GCC Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

16.6.2. GCC Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

16.6.3. GCC Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

16.6.4. GCC Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

16.6.5. South Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

16.6.6. South Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

16.6.7. South Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

16.6.8. South Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

16.6.9. Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

16.6.10. Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Raw Material, 2023–2031

16.6.11. Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by Technique, 2023–2031

16.6.12. Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) and Value (US$ Bn) Forecast, by End-use, 2023–2031

16.7. Middle East & Africa Liquid Packaging Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2022

17.3. Market Footprint Analysis

17.3.1. By Packaging Type

17.3.2. By End-use

17.4. Company Profiles

17.4.1. Tetra Laval International S.A.

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.2. Comar LLC

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.3. Evergreen Packaging Inc.

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.4. Liqui-Box Corporation

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.5. BillerudKorsnas AB

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.6. International Paper Company

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.7. Klabin Paper

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.8. Nippon Paper Industries Co., Ltd.

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.9. Smurfit Kappa Group

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.10. The Dow Chemical Company

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

17.4.11. Mondi Plc

17.4.11.1. Company Revenue

17.4.11.2. Business Overview

17.4.11.3. Product Segments

17.4.11.4. Geographic Footprint

17.4.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

17.4.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation, etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Global Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 2: Global Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 3: Global Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 4: Global Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 5: Global Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 6: Global Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 7: Global Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 8: Global Liquid Packaging Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 9: Global Liquid Packaging Market Volume (Billion Units) Forecast, by Region, 2023–2031

Table 10: Global Liquid Packaging Market Value (US$ Bn) Forecast, by Region, 2023–2031

Table 11: North America Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 12: North America Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 13: North America Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 14: North America Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 15: North America Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 16: North America Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 17: North America Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 18: North America Liquid Packaging Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 19: North America Liquid Packaging Market Volume (Billion Units) Forecast, by Country, 2023–2031

Table 20: North America Liquid Packaging Market Value (US$ Bn) Forecast, by Country, 2023–2031

Table 21: U.S. Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 22: U.S. Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 23: U.S. Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 24: U.S. Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 25: U.S. Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 26: U.S. Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 27: U.S. Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 28: U.S. Liquid Packaging Market Value (US$ Bn) Forecast, by End-use, 2023–2031

Table 29: Canada Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 30: Canada Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 31: Canada Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 32: Canada Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 33: Canada Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 34: Canada Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 35: Canada Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 36: Canada Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 37: Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 38: Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 39: Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 40: Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 41: Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 42: Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 43: Europe Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 44: Europe Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 45: Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023–2031

Table 46: Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 47: Germany Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 48: Germany Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 49: Germany Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 50: Germany Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 51: Germany Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 52: Germany Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 53: Germany Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 54: Germany Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 55: France Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 56: France Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 57: France Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 58: France Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 59: France Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 60: France Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 61: France Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 62: France Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 63: U.K. Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 64: U.K. Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 65: U.K. Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 66: U.K. Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 67: U.K. Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 68: U.K. Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 69: U.K. Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 70: U.K. Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 71: Italy Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 72: Italy Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 73: Italy Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 74: Italy Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 75: Italy Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 76: Italy Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 77: Italy Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 78: Italy Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 79: Spain Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 80: Spain Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 81: Spain Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 82: Spain Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 83: Spain Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 84: Spain Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 85: Spain Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 86: Spain Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 87: Russia & CIS Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 88: Russia & CIS Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 89: Russia & CIS Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 90: Russia & CIS Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 91: Russia & CIS Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 92: Russia & CIS Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 93: Russia & CIS Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 94: Russia & CIS Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 95: Rest of Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 96: Rest of Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 97: Rest of Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 98: Rest of Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 99: Rest of Europe Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 100: Rest of Europe Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 101: Rest of Europe Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 102: Rest of Europe Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 103: Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 104: Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 105: Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 106: Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 107: Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 108: Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 109: Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 110: Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 111: Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023–2031

Table 112: Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 113: China Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 114: China Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type 2023–2031

Table 115: China Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 116: China Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 117: China Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 118: China Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 119: China Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 120: China Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 121: Japan Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 122: Japan Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 123: Japan Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 124: Japan Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 125: Japan Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 126: Japan Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 127: Japan Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 128: Japan Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 129: India Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 130: India Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 131: India Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 132: India Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 133: India Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 134: India Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 135: India Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 136: India Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 137: ASEAN Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 138: ASEAN Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 139: ASEAN Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 140: ASEAN Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 141: ASEAN Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 142: ASEAN Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 143: ASEAN Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 144: ASEAN Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 145: Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 146: Rest of Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 147: Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 148: Rest of Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 149: Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 150: Rest of Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 151: Rest of Asia Pacific Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 152: Rest of Asia Pacific Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 153: Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 154: Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 155: Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 156: Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 157: Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 158: Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 159: Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 160: Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 161: Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023–2031

Table 162: Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 163: Brazil Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 164: Brazil Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 165: Brazil Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 166: Brazil Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 167: Brazil Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 168: Brazil Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 169: Brazil Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 170: Brazil Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 171: Mexico Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 172: Mexico Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 173: Mexico Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 174: Mexico Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 175: Mexico Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 176: Mexico Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 177: Mexico Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 178: Mexico Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 179: Rest of Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 180: Rest of Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 181: Rest of Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 182: Rest of Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 183: Rest of Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 184: Rest of Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 185: Rest of Latin America Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 186: Rest of Latin America Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 187: Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 188: Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 189: Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 190: Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 191: Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 192: Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 193: Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 194: Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 195: Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Country and Sub-region, 2023–2031

Table 196: Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Country and Sub-region, 2023–2031

Table 197: GCC Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 198: GCC Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 199: GCC Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 200: GCC Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 201: GCC Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 202: GCC Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 203: GCC Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 204: GCC Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 205: South Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 206: South Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 207: South Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 208: South Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 209: South Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 210: South Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 211: South Africa Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 212: South Africa Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

Table 213: Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Packaging Type, 2023–2031

Table 214: Rest of Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Packaging Type, 2023–2031

Table 215: Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Raw Material, 2023–2031

Table 216: Rest of Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Raw Material, 2023–2031

Table 217: Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by Technique, 2023–2031

Table 218: Rest of Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by Technique, 2023–2031

Table 219: Rest of Middle East & Africa Liquid Packaging Market Volume (Billion Units) Forecast, by End-use, 2023–2031

Table 220: Rest of Middle East & Africa Liquid Packaging Market Value (US$ Bn) Forecast, by End-use 2023–2031

List of Figures

Figure 1: Global Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 2: Global Liquid Packaging Market Attractiveness, by Packaging Type

Figure 3: Global Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 4: Global Liquid Packaging Market Attractiveness, by Raw Material

Figure 5: Global Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 6: Global Liquid Packaging Market Attractiveness, by Technique

Figure 7: Global Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 8: Global Liquid Packaging Market Attractiveness, by End-use

Figure 9: Global Liquid Packaging Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 10: Global Liquid Packaging Market Attractiveness, by Region

Figure 11: North America Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 12: North America Liquid Packaging Market Attractiveness, by Packaging Type

Figure 13: North America Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 14: North America Liquid Packaging Market Attractiveness, by Raw Material

Figure 15: North America Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 16: North America Liquid Packaging Market Attractiveness, by Technique

Figure 17: North America Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 18: North America Liquid Packaging Market Attractiveness, by End-use

Figure 19: North America Liquid Packaging Market Volume Share Analysis, by Country, 2022, 2027, and 2031

Figure 20: North America Liquid Packaging Market Attractiveness, by Country

Figure 21: Europe Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 22: Europe Liquid Packaging Market Attractiveness, by Packaging Type

Figure 23: Europe Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 24: Europe Liquid Packaging Market Attractiveness, by Raw Material

Figure 25: Europe Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 26: Europe Liquid Packaging Market Attractiveness, by Technique

Figure 27: Europe Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Europe Liquid Packaging Market Attractiveness, by End-use

Figure 29: Europe Liquid Packaging Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Europe Liquid Packaging Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 32: Asia Pacific Liquid Packaging Market Attractiveness, by Packaging Type

Figure 33: Asia Pacific Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 34: Asia Pacific Liquid Packaging Market Attractiveness, by Raw Material

Figure 35: Asia Pacific Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 36: Asia Pacific Liquid Packaging Market Attractiveness, by Technique

Figure 37: Asia Pacific Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 38: Asia Pacific Liquid Packaging Market Attractiveness, by End-use

Figure 39: Asia Pacific Liquid Packaging Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Asia Pacific Liquid Packaging Market Attractiveness, by Country and Sub-region

Figure 41: Latin America Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 42: Latin America Liquid Packaging Market Attractiveness, by Packaging Type

Figure 43: Latin America Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 44: Latin America Liquid Packaging Market Attractiveness, by Raw Material

Figure 45: Latin America Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 46: Latin America Liquid Packaging Market Attractiveness, by Technique

Figure 47: Latin America Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 48: Latin America Liquid Packaging Market Attractiveness, by End-use

Figure 49: Latin America Liquid Packaging Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 50: Latin America Liquid Packaging Market Attractiveness, by Country and Sub-region

Figure 51: Middle East & Africa Liquid Packaging Market Volume Share Analysis, by Packaging Type, 2022, 2027, and 2031

Figure 52: Middle East & Africa Liquid Packaging Market Attractiveness, by Packaging Type

Figure 53: Middle East & Africa Liquid Packaging Market Volume Share Analysis, by Raw Material, 2022, 2027, and 2031

Figure 54: Middle East & Africa Liquid Packaging Market Attractiveness, by Raw Material

Figure 55: Middle East & Africa Liquid Packaging Market Volume Share Analysis, by Technique, 2022, 2027, and 2031

Figure 56: Middle East & Africa Liquid Packaging Market Attractiveness, by Technique

Figure 57: Middle East & Africa Liquid Packaging Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 58: Middle East & Africa Liquid Packaging Market Attractiveness, by End-use

Figure 59: Middle East & Africa Liquid Packaging Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Middle East & Africa Liquid Packaging Market Attractiveness, by Country and Sub-region