Reports

Reports

Analysts’ Viewpoint

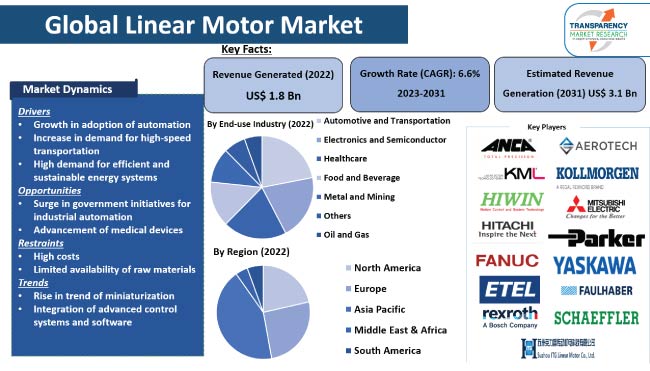

Growth in adoption of automation, increase in demand for high-speed transportation, and high demand for efficient and sustainable energy systems are key factors driving the global linear motor market. Linear motors are expected to play a vital role in driving the success of automation. Rise in trend of miniaturization and surge in government initiatives for industrial automation are also fueling market progress.

Increase in adoption of linear actuator motors can be ascribed to technological advancements in industrial production, including robotic automation. Manufacturers are focusing on developing innovative linear motors to gain incremental opportunities. However, high costs and limited availability of raw materials are estimated to hamper market dynamics in the next few years.

Linear motor is an electric motor that generates motion in a straight line rather than rotationally. It uses a magnetic field to produce force and motion along a linear path.

Labor shortages are becoming prevalent across the globe. Therefore, many companies are turning toward automation to compensate and streamline their operations. It is crucial to have systems that are more compact, less complicated, and easily adaptable to achieve and maintain a good return on investment for automation. Thus, linear motion systems are being increasingly integrated into engineered systems.

Key linear motor applications include industrial automation, transportation systems, robotics, and medical equipment. Linear motors offer advantages such as high speed, accuracy, and precision. Thus, they play an important role in various industries.

Automation is a rapidly growing trend across various industries, from manufacturing and logistics to healthcare and retail. Adoption of automation is driven by the need to increase efficiency, productivity, and accuracy; and desire to reduce labor costs and improve safety.

The linear motor technology is increasingly being used in automation applications due to its ability to provide precise and rapid motion control. Thus, linear motor is ideal for usage in automation applications, where accuracy and speed are critical.

A small linear actuator can be used in robotics to control the movement of robot arms and grippers with high degree of precision. It can also be used in assembly lines and packaging systems to move products quickly and accurately.

According to a report by the Association for Advancing Automation (A3), companies in North America ordered 9853 robots worth US$ 501.0 Mn in the second quarter of 2021, up from 5196 sold in the second quarter of 2020, when the COVID-19 pandemic was at its peak.

Ironless motors and iron core motors are the two types of linear motors used in magnetic direct drive technology. The ironless core segment is expected to dominate the linear motor market during the forecast period, owing to its high stability, compact size, and maintenance-free nature.

Ironless coil unit is a type of motor that features a coil without an iron core. This design eliminates attraction force and cogging that can occur between the coil unit and magnet track, thus resulting in a motor that is lighter in weight and offers superior precision.

Absence of iron in the coil unit also results in a linear force constant, enabling extremely dynamic velocity, acceleration, and deceleration. These benefits make ironless linear magnetic motors a highly desirable option for applications that require high precision and agility.

Demand for high-precision and high-speed linear motion systems is increasing in various industries. Flatbed linear motor offers several advantages over other linear motor designs. It provides a large contact area with the load, thus resulting in high-force transmission capabilities.

The flatbed design also allows for smoother motion and lower noise levels than other linear motors. These advantages make flatbed linear motor ideal for usage in a wide range of applications such as industrial automation, medical equipment, and semiconductor manufacturing.

Flatbed linear motors are becoming cost-effective and accessible, with advancements in materials and manufacturing technologies. This is further fueling market development. Overall, the flatbed linear motor presents significant market opportunities for businesses operating in the linear motor industry.

Semiconductors and other manufacturing equipment require precise positioning and velocity smoothness. Development of digital technology has led to the creation of machine tools that are controlled by computers and capable of producing chips with widths that can be measured in nanometers.

A wide range of metrology equipment and machine tools are used in the manufacture of semiconductors, each designed for a specific purpose. A crucial trend to consider is the move toward miniaturization, which means that errors that harm semiconductor devices can be more expensive as they become smaller. It is vital to exercise extra caution while handling and moving semiconductor wafers, as a minor error can lead to irreversible damage.

Thus, linear motor market demand is rising significantly in the semiconductor manufacturing sector.

The global linear motor market is dominated by Asia Pacific, which accounted for 43.1% share in 2022. High share of the region can be ascribed to the presence of several manufacturing hubs, particularly in China and Japan, which are major consumers of linear motors.

Demand for devices such as CNC, printers, scanners, pick and place robots, and other systems is increasing in Asia Pacific. This is expected to fuel market expansion in the region during the forecast period.

According to the linear motor market analysis, the manufacturing sector in Asia Pacific relies upon high-precision motion systems to improve production efficiency and output. This is positively impacting linear motor market growth in the region.

The linear motor market size in North America is anticipated to increase steadily during the forecast period, owing to the high demand for automation technologies in industries such as aerospace, automotive, and electronics.

Europe is also a significant market for linear motors, led by the increase in application of these motors in the industrial sector. Linear motor is a promising technology for businesses operating in manufacturing and automation industries in Europe.

Linear motor manufacturers are implementing growth strategies such as signing of contracts, establishment of joint ventures and partnerships, negotiation of agreements, acquisitions, and launch of new products.

As per the linear motor market forecast, demand for industrial automation is rising in various regions across the globe due to labor shortages. Manufacturers are engaged in developing precise automatic machines and assembly systems to increase their linear motor market share.

Leading players operating in the linear motor sector are Aerotech, Inc., ANCA, Bosch Rexroth AG, ETEL S.A., FANUC Corporation, FAULHABER GROUP, Hitachi Metals, Ltd, Hiwin Corporation, Jenny Science AG, KML Linear Motion Technology GmbH, Kollmorgen Corporation, Mitsubishi Electric Corporation, NTI AG LinMot & MagSpring, Oswald Elektromotoren GmbH, Parker Hannifin Corp, Schaeffler Industrial Drives AG & Co. KG, Sumitomo Electric Industries, and Yaskawa Electric Corporation. These players are following the latest linear motor market trends to gain incremental opportunities.

Key players have been profiled in the linear motor market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and latest developments.

|

Attribute |

Detail |

|

Market Value in 2022 |

US$ 1.8 Bn |

|

Market Forecast Value in 2031 |

US$ 3.1 Bn |

|

Growth Rate (CAGR) |

6.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2022 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 1.8 Bn in 2022

It is projected to grow at a CAGR of 6.6% by 2031

It would be worth US$ 3.1 Bn in 2031

ANCA, Bosch Rexroth AG, ETEL S.A., FANUC Corporation, FAULHABER GROUP, Hitachi Metals, Ltd., Hiwin Corporation, Jenny Science AG, KML Linear Motion Technology GmbH, Kollmorgen Corporation, Mitsubishi Electric Corporation, NTI AG LinMot & MagSpring, Oswald Elektromotoren GmbH, Parker Hannifin Corp, Schaeffler Industrial Drives AG & Co. KG, and Sumitomo Electric Industries, and Yaskawa Electric Corporation

The country accounted for major share in 2022

Increase in focus on precision automation and rise in investment in industrial automation

Asia Pacific is a more lucrative region for linear motors

1. Preface

1.1. Market and Segments Definition

1.2. Market Taxonomy

1.3. Research Methodology

1.4. Assumption and Acronyms

2. Executive Summary

2.1. Global Linear Motor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Scenario

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Linear Motion System Industry Overview

4.2. Supply Chain Analysis

4.3. Pricing Analysis

4.4. Industry SWOT Analysis

4.5. Porter’s Five Forces Analysis

5. Global Linear Motor Market Analysis by Core

5.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

5.1.1. Iron Core

5.1.2. Coreless

5.2. Market Attractiveness Analysis, By Core

6. Global Linear Motor Market Analysis by Design

6.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

6.1.1. Flatbed

6.1.2. U-Channel

6.1.3. Cylindrical

6.2. Market Attractiveness Analysis, By Design

7. Global Linear Motor Market Analysis by Axis

7.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

7.1.1. Single Axis

7.1.2. Multi-axis

7.2. Market Attractiveness Analysis, By Axis

8. Global Linear Motor Market Analysis by Acceleration

8.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

8.1.1. High End

8.1.2. Low End

8.2. Market Attractiveness Analysis, By Acceleration

9. Global Linear Motor Market Analysis by Sales Channel

9.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

9.1.1. Direct OEM

9.1.2. Direct System Integrator

9.1.3. Distributor

9.2. Market Attractiveness Analysis, By Sales Channel

10. Global Linear Motor Market Analysis by Application

10.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

10.1.1. Assembly Machine

10.1.2. Machine Tooling

10.1.3. Medical Instrument

10.1.4. Optics and Photonics

10.1.5. Vacuum Process

10.1.6. Packaging and Labeling

10.1.7. Robotics

10.1.8. Electronics and Semiconductor Manufacturing

10.1.9. Others

10.2. Market Attractiveness Analysis, By Application

11. Global Linear Motor Market Analysis by End-use Industry

11.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

11.1.1. Food and Beverage

11.1.2. Electronics and Semiconductor

11.1.3. Metal and Mining

11.1.4. Healthcare

11.1.5. Oil and Gas

11.1.6. Automotive and Transportation

11.1.7. Others

11.2. Market Attractiveness Analysis, By End-use Industry

12. Global Linear Motor Market Analysis and Forecast, By Region

12.1. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Region, 2017-2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Market Attractiveness Analysis, By Region

13. North America Linear Motor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

13.3.1. Iron Core

13.3.2. Coreless

13.4. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

13.4.1. Flatbed

13.4.2. U-Channel

13.4.3. Cylindrical

13.5. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

13.5.1. Single Axis

13.5.2. Multi-axis

13.6. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

13.6.1. High End

13.6.2. Low End

13.7. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

13.7.1. Direct OEM

13.7.2. Direct System Integrator

13.7.3. Distributor

13.8. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

13.8.1. Assembly Machine

13.8.2. Machine Tooling

13.8.3. Medical Instrument

13.8.4. Optics and Photonics

13.8.5. Vacuum Process

13.8.6. Packaging and Labeling

13.8.7. Robotics

13.8.8. Electronics and Semiconductor Manufacturing

13.8.9. Others

13.9. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

13.9.1. Food and Beverage

13.9.2. Electronics and Semiconductor

13.9.3. Metal and Mining

13.9.4. Healthcare

13.9.5. Oil and Gas

13.9.6. Automotive and Transportation

13.9.7. Others

13.10. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

13.10.1. The U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Market Attractiveness Analysis

13.11.1. By Core

13.11.2. By Design

13.11.3. By Axis

13.11.4. By Acceleration

13.11.5. By Sales Channel

13.11.6. By Application

13.11.7. By End-use Industry

13.11.8. By Country/Sub-region

14. Europe Linear Motor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

14.3.1. Iron Core

14.3.2. Coreless

14.4. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

14.4.1. Flatbed

14.4.2. U-Channel

14.4.3. Cylindrical

14.5. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

14.5.1. Single Axis

14.5.2. Multi-axis

14.6. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

14.6.1. High End

14.6.2. Low End

14.7. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

14.7.1. Direct OEM

14.7.2. Direct System Integrator

14.7.3. Distributor

14.8. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

14.8.1. Assembly Machine

14.8.2. Machine Tooling

14.8.3. Medical Instrument

14.8.4. Optics and Photonics

14.8.5. Vacuum Process

14.8.6. Packaging and Labeling

14.8.7. Robotics

14.8.8. Electronics and Semiconductor Manufacturing

14.8.9. Others

14.9. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

14.9.1. Food and Beverage

14.9.2. Electronics and Semiconductor

14.9.3. Metal and Mining

14.9.4. Healthcare

14.9.5. Oil and Gas

14.9.6. Automotive and Transportation

14.9.7. Others

14.10. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

14.10.1. The U.K.

14.10.2. Germany

14.10.3. France

14.10.4. Rest of Europe

14.11. Market Attractiveness Analysis

14.11.1. By Core

14.11.2. By Design

14.11.3. By Axis

14.11.4. By Acceleration

14.11.5. By Sales Channel

14.11.6. By Application

14.11.7. By End-use Industry

14.11.8. By Country/Sub-region

15. Asia Pacific Linear Motor Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

15.3.1. Iron Core

15.3.2. Coreless

15.4. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

15.4.1. Flatbed

15.4.2. U-Channel

15.4.3. Cylindrical

15.5. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

15.5.1. Single Axis

15.5.2. Multi-axis

15.6. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

15.6.1. High End

15.6.2. Low End

15.7. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

15.7.1. Direct OEM

15.7.2. Direct System Integrator

15.7.3. Distributor

15.8. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

15.8.1. Assembly Machine

15.8.2. Machine Tooling

15.8.3. Medical Instrument

15.8.4. Optics and Photonics

15.8.5. Vacuum Process

15.8.6. Packaging and Labeling

15.8.7. Robotics

15.8.8. Electronics and Semiconductor Manufacturing

15.8.9. Others

15.9. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

15.9.1. Food and Beverage

15.9.2. Electronics and Semiconductor

15.9.3. Metal and Mining

15.9.4. Healthcare

15.9.5. Oil and Gas

15.9.6. Automotive and Transportation

15.9.7. Others

15.10. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

15.10.1. China

15.10.2. Japan

15.10.3. India

15.10.4. South Korea

15.10.5. Rest of Asia Pacific

15.11. Market Attractiveness Analysis

15.11.1. By Core

15.11.2. By Design

15.11.3. By Axis

15.11.4. By Acceleration

15.11.5. By Sales Channel

15.11.6. By Application

15.11.7. By End-use Industry

15.11.8. By Country/Sub-region

16. Middle East & Africa Linear Motor Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

16.3.1. Iron Core

16.3.2. Coreless

16.4. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

16.4.1. Flatbed

16.4.2. U-Channel

16.4.3. Cylindrical

16.5. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

16.5.1. Single Axis

16.5.2. Multi-axis

16.6. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

16.6.1. High End

16.6.2. Low End

16.7. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

16.7.1. Direct OEM

16.7.2. Direct System Integrator

16.7.3. Distributor

16.8. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

16.8.1. Assembly Machine

16.8.2. Machine Tooling

16.8.3. Medical Instrument

16.8.4. Optics and Photonics

16.8.5. Vacuum Process

16.8.6. Packaging and Labeling

16.8.7. Robotics

16.8.8. Electronics and Semiconductor Manufacturing

16.8.9. Others

16.9. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

16.9.1. Food and Beverage

16.9.2. Electronics and Semiconductor

16.9.3. Metal and Mining

16.9.4. Healthcare

16.9.5. Oil and Gas

16.9.6. Automotive and Transportation

16.9.7. Others

16.10. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Rest of Middle East & Africa

16.11. Market Attractiveness Analysis

16.11.1. By Core

16.11.2. By Design

16.11.3. By Axis

16.11.4. By Acceleration

16.11.5. By Sales Channel

16.11.6. By Application

16.11.7. By End-use Industry

16.11.8. By Country/Sub-region

17. South America Linear Motor Market Analysis and Forecast

17.1. Market Snapshot

17.2. Drivers and Restraints: Impact Analysis

17.3. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Core, 2017-2031

17.3.1. Iron Core

17.3.2. Coreless

17.4. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Design, 2017-2031

17.4.1. Flatbed

17.4.2. U-Channel

17.4.3. Cylindrical

17.5. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Axis, 2017-2031

17.5.1. Single Axis

17.5.2. Multi-axis

17.6. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Acceleration, 2017-2031

17.6.1. High End

17.6.2. Low End

17.7. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Sales Channel, 2017-2031

17.7.1. Direct OEM

17.7.2. Direct System Integrator

17.7.3. Distributor

17.8. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Application, 2017-2031

17.8.1. Assembly Machine

17.8.2. Machine Tooling

17.8.3. Medical Instrument

17.8.4. Optics and Photonics

17.8.5. Vacuum Process

17.8.6. Packaging and Labeling

17.8.7. Robotics

17.8.8. Electronics and Semiconductor Manufacturing

17.8.9. Others

17.9. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By End-use Industry, 2017-2031

17.9.1. Food and Beverage

17.9.2. Electronics and Semiconductor

17.9.3. Metal and Mining

17.9.4. Healthcare

17.9.5. Oil and Gas

17.9.6. Automotive and Transportation

17.9.7. Others

17.10. Linear Motor Market Size (US$ Mn) and Volume (Thousand Units) Analysis & Forecast, By Country and Sub-region, 2017-2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Market Attractiveness Analysis

17.11.1. By Core

17.11.2. By Design

17.11.3. By Axis

17.11.4. By Acceleration

17.11.5. By Sales Channel

17.11.6. By Application

17.11.7. By End-use Industry

17.11.8. By Country/Sub-region

18. Competition Assessment

18.1. Global Linear Motor Market Competition Matrix - a Dashboard View

18.1.1. Global Linear Motor Market Company Share Analysis, by Value (2022)

18.1.2. Customer Share Analysis for Leading Manufacturers/Suppliers

19. Company Profiles (Global Manufacturers/Suppliers)

19.1. Aerotech, Inc.

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Key Subsidiaries or Distributors

19.1.5. Strategy and Recent Developments

19.1.6. Key Financials

19.2. ANCA

19.2.1. Overview

19.2.2. Product Portfolio

19.2.3. Sales Footprint

19.2.4. Key Subsidiaries or Distributors

19.2.5. Strategy and Recent Developments

19.2.6. Key Financials

19.3. Bosch Rexroth AG

19.3.1. Overview

19.3.2. Product Portfolio

19.3.3. Sales Footprint

19.3.4. Key Subsidiaries or Distributors

19.3.5. Strategy and Recent Developments

19.3.6. Key Financials

19.4. ETEL S.A.

19.4.1. Overview

19.4.2. Product Portfolio

19.4.3. Sales Footprint

19.4.4. Key Subsidiaries or Distributors

19.4.5. Strategy and Recent Developments

19.4.6. Key Financials

19.5. FANUC Corporation

19.5.1. Overview

19.5.2. Product Portfolio

19.5.3. Sales Footprint

19.5.4. Key Subsidiaries or Distributors

19.5.5. Strategy and Recent Developments

19.5.6. Key Financials

19.6. FAULHABER GROUP

19.6.1. Overview

19.6.2. Product Portfolio

19.6.3. Sales Footprint

19.6.4. Key Subsidiaries or Distributors

19.6.5. Strategy and Recent Developments

19.6.6. Key Financials

19.7. Hitachi Metals, Ltd

19.7.1. Overview

19.7.2. Product Portfolio

19.7.3. Sales Footprint

19.7.4. Key Subsidiaries or Distributors

19.7.5. Strategy and Recent Developments

19.7.6. Key Financials

19.8. Hiwin Corporation

19.8.1. Overview

19.8.2. Product Portfolio

19.8.3. Sales Footprint

19.8.4. Key Subsidiaries or Distributors

19.8.5. Strategy and Recent Developments

19.8.6. Key Financials

19.9. Jenny Science AG

19.9.1. Overview

19.9.2. Product Portfolio

19.9.3. Sales Footprint

19.9.4. Key Subsidiaries or Distributors

19.9.5. Strategy and Recent Developments

19.9.6. Key Financials

19.10. KML Linear Motion Technology GmbH

19.10.1. Overview

19.10.2. Product Portfolio

19.10.3. Sales Footprint

19.10.4. Key Subsidiaries or Distributors

19.10.5. Strategy and Recent Developments

19.10.6. Key Financials

19.11. Kollmorgen Corporation

19.11.1. Overview

19.11.2. Product Portfolio

19.11.3. Sales Footprint

19.11.4. Key Subsidiaries or Distributors

19.11.5. Strategy and Recent Developments

19.11.6. Key Financials

19.12. Mitsubishi Electric Corporation

19.12.1. Overview

19.12.2. Product Portfolio

19.12.3. Sales Footprint

19.12.4. Key Subsidiaries or Distributors

19.12.5. Strategy and Recent Developments

19.12.6. Key Financials

19.13. NTI AG LinMot& MagSpring

19.13.1. Overview

19.13.2. Product Portfolio

19.13.3. Sales Footprint

19.13.4. Key Subsidiaries or Distributors

19.13.5. Strategy and Recent Developments

19.13.6. Key Financials

19.14. Oswald Elektromotoren GmbH

19.14.1. Overview

19.14.2. Product Portfolio

19.14.3. Sales Footprint

19.14.4. Key Subsidiaries or Distributors

19.14.5. Strategy and Recent Developments

19.14.6. Key Financials

19.15. Parker Hannifin Corp

19.15.1. Overview

19.15.2. Product Portfolio

19.15.3. Sales Footprint

19.15.4. Key Subsidiaries or Distributors

19.15.5. Strategy and Recent Developments

19.15.6. Key Financials

19.16. Schaeffler Industrial Drives AG & Co. KG

19.16.1. Overview

19.16.2. Product Portfolio

19.16.3. Sales Footprint

19.16.4. Key Subsidiaries or Distributors

19.16.5. Strategy and Recent Developments

19.16.6. Key Financials

19.17. Sumitomo Electric Industries

19.17.1. Overview

19.17.2. Product Portfolio

19.17.3. Sales Footprint

19.17.4. Key Subsidiaries or Distributors

19.17.5. Strategy and Recent Developments

19.17.6. Key Financials

19.18. Yaskawa Electric Corporation

19.18.1. Overview

19.18.2. Product Portfolio

19.18.3. Sales Footprint

19.18.4. Key Subsidiaries or Distributors

19.18.5. Strategy and Recent Developments

19.18.6. Key Financials

20. Go to Market Strategy

20.1. Identification of Potential Market Spaces

20.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Linear Motor Market, Value (US$ Mn), 2017-2031

Table 2: Global Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 3: Global Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 4: Global Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 5: Global Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 6: Global Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 7: Global Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 8: Global Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 9: Global Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 10: Global Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 11: Global Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 12: Global Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 13: North America Linear Motor Market, Value (US$ Mn), 2017-2031

Table 14: North America Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 15: North America Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 16: North America Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 17: North America Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 18: North America Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 19: North America Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 20: North America Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 21: North America Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 22: North America Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 23: North America Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 24: North America Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 25: Europe Linear Motor Market, Value (US$ Mn), 2017-2031

Table 26: Europe Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 27: Europe Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 28: Europe Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 29: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 30: Europe Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 31: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 32: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 33: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 34: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 35: Europe Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 36: Europe Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 37: Asia Pacific Linear Motor Market, Value (US$ Mn), 2017-2031

Table 38: Asia Pacific Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 39: Asia Pacific Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 40: Asia Pacific Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 41: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 42: Asia Pacific Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 43: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 44: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 45: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 46: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 47: Asia Pacific Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 48: Asia Pacific Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 49: Middle East & Africa Linear Motor Market, Value (US$ Mn), 2017-2031

Table 50: Middle East & Africa Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 51: Middle East & Africa Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 52: Middle East & Africa Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 53: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 54: Middle East & Africa Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 55: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 56: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 57: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 58: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 59: Middle East & Africa Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 60: Middle East & Africa Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

Table 61: South America Linear Motor Market, Value (US$ Mn), 2017-2031

Table 62: South America Linear Motor Market, Volume (Thousand Units), 2017-2031

Table 63: South America Linear Motor Market Growth Rate, Value (US$ Mn), 2017-2031

Table 64: South America Linear Motor Market Growth Rate, Volume (Thousand Units), 2017-2031

Table 65: South America Linear Motor Market Value (US$ Mn) & Forecast, by Core, 2017-2031

Table 66: South America Linear Motor Market Volume (Thousand Units) & Forecast, by Core, 2017-2031

Table 67: South America Linear Motor Market Value (US$ Mn) & Forecast, by Design, 2017-2031

Table 68: South America Linear Motor Market Value (US$ Mn) & Forecast, by Axis, 2017-2031

Table 69: South America Linear Motor Market Value (US$ Mn) & Forecast, by Acceleration, 2017-2033

Table 70: South America Linear Motor Market Value (US$ Mn) & Forecast, by Application, 2017-2033

Table 71: South America Linear Motor Market Value (US$ Mn) & Forecast, by Region, 2017-2031

Table 72: South America Linear Motor Market Volume (Thousand Units) & Forecast, by Region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - North America Linear Motor

Figure 02: North America Linear Motor Price Trend Analysis (Average Price, US$)

Figure 03: Porter Five Forces Analysis - North America Linear Motor

Figure 04: Technology Road Map - North America Linear Motor

Figure 05: Global Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 06: Global Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 07: Global Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 08: Global Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 09: Global Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 10: Global Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 11: Global Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 12: Global Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 13: Global Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 14: Global Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 15: Global Linear Motor Market Size & Forecast by Axis Value (US$ Mn), 2017‒2031

Figure 16: Global Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 17: Global Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 18: Global Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 19: Global Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 20: Global Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 21: Global Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 22: Global Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 23: Global Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 24: Global Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 25: Global Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 26: Global Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 27: Global Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 28: Global Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 29: Global Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 30: Global Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 31: Global Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 32: Global Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 33: North America Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 34: North America Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 35: North America Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 36: North America Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 37: North America Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 38: North America Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 39: North America Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 40: North America Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 41: North America Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 42: North America Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 43: North America Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 44: North America Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 45: North America Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 46: North America Linear Motor Market Size & Forecast by Axis Value (US$ Mn), 2017‒2031

Figure 47: North America Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 48: North America Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 49: North America Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 50: North America Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 51: North America Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 52: North America Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 53: North America Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 54: North America Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 55: North America Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 56: North America Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 57: North America Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 58: North America Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 59: North America Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 60: North America Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 61: North America Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 62: North America Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 63: North America Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 64: North America Linear Motor Market Size & Forecast by Country, Value (US$ Mn), 2017‒2031

Figure 65: North America Linear Motor Market Share Analysis, by Country, 2021 and 2031

Figure 66: North America Linear Motor Market, Incremental Opportunity, by Country, 2021‒2031

Figure 67: Europe Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 68: Europe Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 69: Europe Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 70: Europe Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 71: Europe Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 72: Europe Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 73: Europe Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 74: Europe Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 75: Europe Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 76: Europe Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 77: Europe Linear Motor Market Size & Forecast by Axis Value (US$ Mn), 2017‒2031

Figure 78: Europe Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 79: Europe Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 80: Europe Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 81: Europe Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 82: Europe Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 83: Europe Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 84: Europe Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 85: Europe Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 86: Europe Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 87: Europe Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 88: Europe Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 89: Europe Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 90: Europe Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 91: Europe Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 92: Europe Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 93: Europe Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 94: Europe Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 95: Europe Linear Motor Market Size & Forecast by Country, Value (US$ Mn), 2017‒2031

Figure 96: Europe Linear Motor Market Share Analysis, by Country, 2021 and 2031

Figure 97: Europe Linear Motor Market, Incremental Opportunity, by Country, 2021‒2031

Figure 98: Asia Pacific Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 99: Asia Pacific Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 100: Asia Pacific Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 101: Asia Pacific Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 102: Asia Pacific Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 103: Asia Pacific Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 104: Asia Pacific Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 105: Asia Pacific Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 106: Asia Pacific Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 107: Asia Pacific Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 108: Asia Pacific Linear Motor Market Size & Forecast by Axis Value (US$ Mn), 2017‒2031

Figure 109: Asia Pacific Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 110: Asia Pacific Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 111: Asia Pacific Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 112: Asia Pacific Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 113: Asia Pacific Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 114: Asia Pacific Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 115: Asia Pacific Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 116: Asia Pacific Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 117: Asia Pacific Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 118: Asia Pacific Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 119: Asia Pacific Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 120: Asia Pacific Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 121: Asia Pacific Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 122: Asia Pacific Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 123: Asia Pacific Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 124: Asia Pacific Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 125: Asia Pacific Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 126: Asia Pacific Linear Motor Market Size & Forecast by Country, Value (US$ Mn), 2017‒2031

Figure 127: Asia Pacific Linear Motor Market Share Analysis, by Country, 2021 and 2031

Figure 128: Asia Pacific Linear Motor Market, Incremental Opportunity, by Country, 2021‒2031

Figure 129: Middle East & Africa Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 130: Middle East & Africa Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 131: Middle East & Africa Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 132: Middle East & Africa Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 133: Middle East & Africa Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 134: Middle East & Africa Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 135: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 136: Middle East & Africa Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 137: Middle East & Africa Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 138: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 139: Middle East & Africa Linear Motor Market Size & Forecast by Axis, Value (US$ Mn), 2017‒2031

Figure 140: Middle East & Africa Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 141: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 142: Middle East & Africa Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 143: Middle East & Africa Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 144: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 145: Middle East & Africa Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 146: Middle East & Africa Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 147: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 148: Middle East & Africa Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 149: Middle East & Africa Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 150: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 151: Middle East & Africa Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 152: Middle East & Africa Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 153: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 154: Middle East & Africa Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 155: Middle East & Africa Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 156: Middle East & Africa Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 157: Middle East & Africa Linear Motor Market Size & Forecast by Country, Value (US$ Mn), 2017‒2031

Figure 158: Middle East & Africa Linear Motor Market Share Analysis, by Country, 2021 and 2031

Figure 159: Middle East & Africa Linear Motor Market, Incremental Opportunity, by Country, 2021‒2031

Figure 160: South America Linear Motor Market Size & Forecast, Value (US$ Mn), 2017‒2031

Figure 161: South America Linear Motor Market Size & Forecast, Y-o-Y, Value (US$ Mn), 2017‒2031

Figure 162: South America Linear Motor Market Size & Forecast, Volume (Thousand Units), 2017‒2031

Figure 163: South America Linear Motor Market Size & Forecast, Y-o-Y, and Volume (Thousand Units), 2017‒2031

Figure 164: South America Linear Motor Market Size & Forecast by Core, Value (US$ Mn), 2017‒2031

Figure 165: South America Linear Motor Market Share Analysis, by Core, 2021 and 2031

Figure 166: South America Linear Motor Market, Incremental Opportunity, by Core, 2021‒2031

Figure 167: South America Linear Motor Market Size & Forecast by Design, Value (US$ Mn), 2017‒2031

Figure 168: South America Linear Motor Market Share Analysis, by Design, 2021 and 2031

Figure 169: South America Linear Motor Market, Incremental Opportunity, by Design, 2021‒2031

Figure 170: South America Linear Motor Market Size & Forecast by Axis Value (US$ Mn), 2017‒2031

Figure 171: South America Linear Motor Market Share Analysis, by Axis, 2021 and 2031

Figure 172: South America Linear Motor Market, Incremental Opportunity, by Axis, 2021‒2031

Figure 173: South America Linear Motor Market Size & Forecast by Acceleration, Value (US$ Mn), 2017‒2031

Figure 174: South America Linear Motor Market Share Analysis, by Acceleration, 2021 and 2031

Figure 175: South America Linear Motor Market, Incremental Opportunity, by Acceleration, 2021‒2031

Figure 176: South America Linear Motor Market Size & Forecast by Region, Value (US$ Mn), 2017‒2031

Figure 177: South America Linear Motor Market Share Analysis, by Region 2021 and 2031

Figure 178: South America Linear Motor Market, Incremental Opportunity, by Region, 2021‒2031

Figure 179: South America Linear Motor Market Size & Forecast by Sales Channel, Value (US$ Mn), 2017‒2031

Figure 180: South America Linear Motor Market Share Analysis, by Sales Channel, 2021 and 2031

Figure 181: South America Linear Motor Market, Incremental Opportunity, by Sales Channel, 2021‒2031

Figure 182: South America Linear Motor Market Size & Forecast by Application, Value (US$ Mn), 2017‒2031

Figure 183: South America Linear Motor Market Share Analysis, by Application, 2021 and 2031

Figure 184: South America Linear Motor Market, Incremental Opportunity, by Application, 2021‒2031

Figure 185: South America Linear Motor Market Size & Forecast by End-use Industry, Value (US$ Mn), 2017‒2031

Figure 186: South America Linear Motor Market Share Analysis, by End-use Industry, 2021 and 2031

Figure 187: South America Linear Motor Market, Incremental Opportunity, by End-use Industry, 2021‒2031

Figure 188: South America Linear Motor Market Size & Forecast by Country, Value (US$ Mn), 2017‒2031

Figure 189: South America Linear Motor Market Share Analysis, by Country, 2021 and 2031

Figure 190: South America Linear Motor Market, Incremental Opportunity, by Country, 2021‒2031