Reports

Reports

Analysts’ Viewpoint

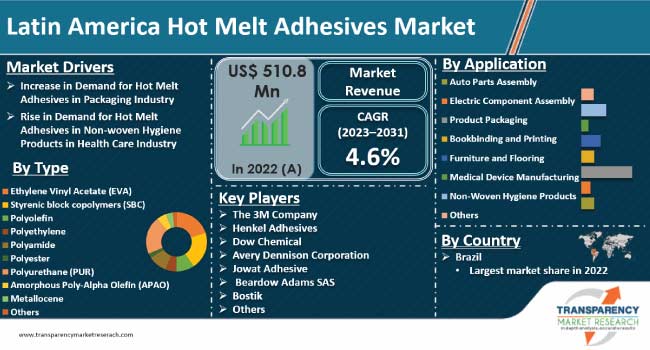

The Latin America hot melt adhesives market size is expected to witness steady growth in the near future due to industrial growth in Latin America, in sectors such as packaging, construction, automotive, and electronics. Hot melt adhesives are widely used in these industries for bonding various materials.

The packaging industry in particular is a major consumer of hot melt adhesives. The rise in e-commerce and increase in demand for efficient packaging solutions is leading to extensive usage of hot melt adhesives in the packaging sector. Hot melt adhesives are commonly used in the construction industry for applications such as insulation, flooring, and panel bonding.

Key manufacturers in the region are focusing on investment in R&D for the development of innovative solutions and provide robust aftersales services in order to gain a competitive edge.

Hot melt adhesives (HMAs) are thermoplastic materials that are applied in a molten state and solidify upon cooling to form a strong bond. They are widely used in various industries due to their quick setting time, versatility, and strong bonding properties. Hot melt adhesives are primarily composed of thermoplastic polymers. These polymers can include polyethylene, polypropylene, ethylene-vinyl acetate (EVA), polyamide, polyester, and others. Formulations may include additives such as antioxidants, plasticizers, and tackifiers to modify the adhesive properties and enhance performance.

Hot melt adhesives offer a fast and efficient bonding solution across a range of industries. Their versatility, quick setting time, and ease of application make them a popular choice for various manufacturing processes.

The packaging industry in Latin America is witnessing a notable surge in demand for hot melt adhesives, driven by several key factors that are reshaping the sector's landscape, fostering innovation, and creating opportunities within the hot melt adhesive market. A primary catalyst for the heightened demand in the Latin American packaging industry is the global proliferation of e-commerce. With online shopping gaining substantial popularity in emerging economies such as Brazil and Mexico, numerous e-commerce enterprises are establishing a significant presence in these markets. Concurrently, the demand for secure and efficient packaging solutions has risen in tandem with the e-commerce boom. Hot melt adhesives have emerged as a preferred choice for packaging in this context, attributed to their superior performance characteristics.

Hot melt adhesives surpass their water-based counterparts in various aspects, with a key advantage being their shorter set time, rendering them ideal for high-speed packaging operations. Moreover, their remarkable water resistance ensures the integrity of packages, even in humid or wet conditions. Consequently, businesses in Latin America are increasingly turning to hot melt adhesives to meet the stringent requirements of online order fulfillment, resulting in substantial market progress.

Demand for hot melt adhesives in non-woven hygiene products within the healthcare sector is witnessing a notable increase in the Latin American market, driven by distinct factors specific to the region. A primary driver is the demographic shift toward an aging population in Latin America. This transition has led to escalating demand for specialized products such as adult incontinence articles and medical dressings. Hot melt adhesives play a pivotal role in ensuring the reliability and functionality of these products by securely bonding their diverse components.

Advancements in medical procedures further contribute to the Latin America hot melt adhesives market development. Surge in adoption of disposable non-woven products in healthcare settings, owing to their hygienic and cost-effective attributes, underscores the significance of hot melt adhesives in efficiently manufacturing these products while meeting stringent quality standards, offering lucrative opportunities for market expansion.

The improved standard of living and higher per capita income in developing Latin American countries, notably Brazil and Mexico, are additional factors propelling the demand for non-woven hygiene products. As awareness regarding hygiene grows, products such as baby diapers and medical dressings are witnessing broader usage. Hot melt adhesives play a crucial role in facilitating cost-effective production, ensuring that these products are not only reliable but also financially accessible to a wider population.

The Latin America hot melt adhesives market segmentation based on type includes ethylene vinyl acetate (EVA), styrenic block copolymers (SBC), polyolefin, polyethylene, polyamide, polyester, polyurethane (PUR), amorphous poly-alpha olefin (APAO), metallocene, and others. The polyurethane segment dominates the market as polyurethane can adhere to a wide range of substrates, including plastics, and metals. PUR often exhibits excellent bond strength. This characteristic is crucial in applications where a strong and durable bond is required, such as in automotive, construction, and packaging industries.

The diverse industrial landscape in Latin America, including automotive, construction, packaging, and textiles, requires adhesives that can address a variety of application needs and polyurethane hot melt adhesives are well-suited for such a diverse range of applications.

The versatile nature of these adhesives, their strong bond strength, flexibility, and suitability across different industries is leading to the dominance of the polyurethane (PUR) segment in the Latin America hot melt adhesives industry.

According to the latest Latin America hot melt adhesives market forecast, the sheer scale of economic activities in Brazil contributes to its dominance in the hot melt adhesives industry. As the largest economy in Latin America, it is a significant market for various industries, including adhesives.

Brazil has a diverse industrial base, including sectors such as packaging, automotive, construction, and textiles. These industries are major consumers of hot melt adhesives. The country's robust manufacturing base creates substantial demand for adhesives for assembly, packaging, and other applications. The surge in construction activities in the country is further anticipated to drive the Latin America hot melt adhesives market growth.

Numerous businesses have made significant investments in research & development activities, leading to the successive early adoption of next-generation technologies and the creation of new products. Product portfolio expansion and mergers & acquisitions are the key strategies adopted by prominent players such as the 3M Company, Henkel Adhesives, The Dow Chemical Company, Avery Dennison Corporation, Jowat Adhesive, and Bostik.

Each of these players have been profiled in the Latin America hot melt adhesives market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments

| Attribute | Detail |

|---|---|

| Market Value in 2022 | US$ 510.8 Mn |

| Market Forecast Value in 2031 | US$ 761.9 Mn |

| Growth Rate (CAGR) | 4.6% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2022 |

| Quantitative Units | US$ Mn for Value & Tons for Volume |

| Market Analysis | The qualitative analysis includes drivers, restraints, market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Region Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 510.8 Mn in 2022

The CAGR is projected to be 4.6% from 2023 to 2031

Increase in demand in the packaging industry; and rise in demand for hot melt adhesives in non-woven hygiene products in health care industry

Polyurethane (PUR) was the dominant type segment in 2022

Brazil was the most lucrative country in 2022

The 3M Company, Henkel Adhesives, The Dow Chemical Company, Avery Dennison Corporation, Jowat Adhesive, Beardow Adams SAS, Bostik, Colacril, Evans Adhesive, GC Adhesives Company, and SABA Adhesive

1. Executive Summary

1.1. Latin America Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Latin America Hot Melt Adhesives Market Analysis and Forecasts, 2023-2031

2.6.1. Latin America Hot Melt Adhesives Market Volume (Tons)

2.6.2. Latin America Hot Melt Adhesives Market Revenue (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Type Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealers/Distributors

2.9.4. List of Potential Customers

2.10. Production Overview

2.11. Product Specification Analysis

2.11.1. Cost Structure Analysis

3. Economic Recovery Post COVID-19 Impact

3.1. Impact on the Supply Chain of Hot Melt Adhesives

3.2. Impact on Demand for Hot Melt Adhesives– Pre & Post Crisis

4. Impact of Current Geopolitical Scenario

5. Production Output Analysis (Tons), by Country, 2023

5.1. Latin America

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Type

6.2. Price Comparison Analysis by Country

7. Latin America Hot Melt Adhesives Market Analysis and Forecast, by Type, 2023–2031

7.1. Introduction and Definitions

7.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

7.2.1. Ethylene Vinyl Acetate (EVA)

7.2.2. Styrenic block copolymers (SBC)

7.2.3. Polyolefin

7.2.4. Polyethylene

7.2.5. Polyamide

7.2.6. Polyester

7.2.7. Polyurethane (PUR)

7.2.8. Amorphous Poly-Alpha Olefin (APAO)

7.2.9. Metallocene

7.2.10. Others

7.3. Latin America Hot Melt Adhesives Market Attractiveness, by Type

8. Latin America Hot Melt Adhesives Market Analysis and Forecast, by Application, 2023–2031

8.1. Introduction and Definitions

8.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

8.2.1. Auto Parts Assembly

8.2.2. Electric Component Assembly

8.2.3. Product Packaging

8.2.4. Bookbinding and Printing

8.2.5. Furniture and Flooring

8.2.6. Medical Device Manufacturing

8.2.7. Non-Woven Hygiene Products

8.2.8. Others

8.3. Latin America Hot Melt Adhesives Market Attractiveness, by Application

9. Latin America Hot Melt Adhesives Market Analysis and Forecast, by End-use, 2023–2031

9.1. Introduction and Definitions

9.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

9.2.1. Automotive

9.2.2. Electronics

9.2.3. Consumer Goods

9.2.4. Food and Beverage

9.2.5. Paper and Printing

9.2.6. Construction

9.2.7. Medical

9.2.8. Textile

9.2.9. Others

9.3. Latin America Hot Melt Adhesives Market Attractiveness, by End-use

10. Latin America Hot Melt Adhesives Market Analysis and Forecast, by Country and Sub-region, 2023–2031

10.1. Key Findings

10.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, and Sub-region, 2023–2031

10.2.1. Brazil

10.2.2. Mexico

10.2.3. Argentina

10.2.4. Colombia

10.2.5. Chile

10.2.6. Rest of Latin America

10.3. Latin America Hot Melt Adhesives Market Attractiveness, by Country

11. Latin America Hot Melt Adhesives Market Analysis and Forecast, 2023–2031

11.1. Key Findings

11.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.3. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.4. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.5. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-Country, 2023-2031

11.5.1. Brazil Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.2. Brazil Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.3. Brazil Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.5.4. Mexico Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.5. Mexico Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.6. Mexico Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.5.7. Rest of Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023–2031

11.5.8. Rest of Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2023–2031

11.5.9. Rest of Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023–2031

11.6. Latin America Hot Melt Adhesives Market Attractiveness Analysis

12. Competition Landscape

12.1. Market Players - Competition Matrix (by Tier and Size of Companies)

12.2. Market Share Analysis, 2023

12.3. Market Footprint Analysis

12.3.1. By Application

12.3.2. By End-use

12.4. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.4.1. The 3M Company

12.4.1.1. Company Revenue

12.4.1.2. Business Overview

12.4.1.3. Product Segments

12.4.1.4. Geographic Footprint

12.4.1.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.1.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.2. Henkel Adhesives

12.4.2.1. Company Revenue

12.4.2.2. Business Overview

12.4.2.3. Product Segments

12.4.2.4. Geographic Footprint

12.4.2.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.2.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.3. Dow Chemical

12.4.3.1. Company Revenue

12.4.3.2. Business Overview

12.4.3.3. Product Segments

12.4.3.4. Geographic Footprint

12.4.3.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.3.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.4. Avery Dennison Corporation

12.4.4.1. Company Revenue

12.4.4.2. Business Overview

12.4.4.3. Product Segments

12.4.4.4. Geographic Footprint

12.4.4.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.4.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.5. Jowat Adhesive

12.4.5.1. Company Revenue

12.4.5.2. Business Overview

12.4.5.3. Product Segments

12.4.5.4. Geographic Footprint

12.4.5.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.5.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.6. Beardow Adams SAS

12.4.6.1. Company Revenue

12.4.6.2. Business Overview

12.4.6.3. Product Segments

12.4.6.4. Geographic Footprint

12.4.6.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.6.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.7. Bostik

12.4.7.1. Company Revenue

12.4.7.2. Business Overview

12.4.7.3. Product Segments

12.4.7.4. Geographic Footprint

12.4.7.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.7.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.8. Colacril

12.4.8.1. Company Revenue

12.4.8.2. Business Overview

12.4.8.3. Product Segments

12.4.8.4. Geographic Footprint

12.4.8.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.8.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.9. Evans Adhesive

12.4.9.1. Company Revenue

12.4.9.2. Business Overview

12.4.9.3. Product Segments

12.4.9.4. Geographic Footprint

12.4.9.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.9.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.10. GC Adhesives Company

12.4.10.1. Company Revenue

12.4.10.2. Business Overview

12.4.10.3. Product Segments

12.4.10.4. Geographic Footprint

12.4.10.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.10.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

12.4.11. SABA Adhesive

12.4.11.1. Company Revenue

12.4.11.2. Business Overview

12.4.11.3. Product Segments

12.4.11.4. Geographic Footprint

12.4.11.5. Production Form/Plant Details, etc. (*As Applicable)

12.4.11.6. Strategic Partnership, Form Expansion, New Product Innovation etc.

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 2: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 3: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 4: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 5: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 6: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 7: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Country and Sub-Country, 2023–2031

Table 8: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country and Sub-Country, 2023–2031

Table 9: Brazil Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 10: Brazil Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 11: Brazil Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 12: Brazil Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 13: Brazil Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 14: Brazil Hot Melt Adhesives Market Value (US$ Mn) Forecast, by End-use, 2023–2031

Table 15: Mexico Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 16: Mexico Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 17: Mexico Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 18: Mexico Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 19: Mexico Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 20: Argentina Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 21: Argentina Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 22: Argentina Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 23: Argentina Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 24: Argentina Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 25: Colombia Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 26: Colombia Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 27: Colombia Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 28: Mexico Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 29: Colombia Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 30: Chile Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 31: Chile Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 32: Chile Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 33: Chile Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 34: Chile Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 35: Rest of Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Type, 2023–2031

Table 36: Rest of Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Type, 2023–2031

Table 37: Rest of Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2023–2031

Table 38: Rest of Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2023–2031

Table 39: Rest of Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by End-use, 2023–2031

Table 40: Rest of Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by End-use, 2023–2031

List of Figures

Figure 1: Latin America Hot Melt Adhesives Market Value Share Analysis, by Type, 2022, 2027, and 2031

Figure 2: Latin America Hot Melt Adhesives Market Attractiveness, by Type

Figure 3: Latin America Hot Melt Adhesives Market Value Share Analysis, by Application, 2022, 2027, and 2031

Figure 4: Latin America Hot Melt Adhesives Market Attractiveness, by Application

Figure 5: Latin America Hot Melt Adhesives Market Value Share Analysis, by End-use, 2022, 2027, and 2031

Figure 6: Latin America Hot Melt Adhesives Market Attractiveness, by End-use

Figure 7: Latin America Hot Melt Adhesives Market Value Share Analysis, by Country and Sub-Country, 2022, 2027, and 2031

Figure 8: Latin America Hot Melt Adhesives Market Attractiveness, by Country and Sub-Country