Reports

Reports

Analysts’ Viewpoint

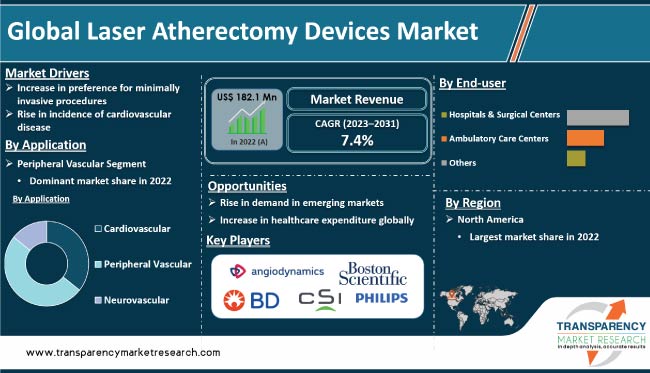

Rise in prevalence of atherosclerosis is driving the global laser atherectomy devices market. Atherosclerosis is a common cardiovascular disease that occurs when plaque accumulates on the inner walls of the arteries, causing them to narrow and harden. Increase in adoption of minimally invasive procedures is another factor augmenting market expansion.

Integration of advanced imaging technologies, such as intravascular ultrasound and optical coherence tomography, in laser atherectomy devices offers lucrative opportunities for market players. Manufacturers are investing significantly in R&D activities to improve the safety and efficacy of products. However, high cost of these devices and lack of skilled personnel are likely to hamper market progress in the near future.

Laser atherectomy devices are medical tools used in interventional cardiology and vascular surgery to remove blockages in blood vessels caused by atherosclerosis, a condition characterized by the buildup of fatty deposits or plaque inside the arteries. These devices use laser energy to vaporize and ablate the plaque, thus opening up the blocked vessel and restoring blood flow.

Laser atherectomy is typically performed as a minimally invasive procedure, where a catheter (a thin, flexible tube) is inserted through a small incision in the skin and guided to the affected artery under X-ray imaging. Once the catheter is in place, laser energy is delivered to the plaque build-up, breaking it down into small particles that can be safely removed from the body.

Laser atherectomy offers several benefits vis-à-vis traditional treatment options such as bypass surgery or balloon angioplasty. It is less invasive, requires shorter hospital stays, and has a lower risk of complications such as bleeding and infection. Laser atherectomy can also treat multiple blockages in the same procedure and can be performed under local anesthesia.

Peripheral Artery Disease (PAD) is a common circulatory problem that affects millions of people across the world. It is caused by the buildup of plaque in the arteries that carry blood to the legs and arms. Over time, the plaque can harden and narrow the arteries, thus reducing blood flow to the affected limbs. This could cause pain, numbness, and in severe cases, tissue damage.

The incidence of PAD is rising across the globe due to factors such as the aging population, an increase in the incidence rate of diabetes and obesity, and lifestyle choices such as smoking and lack of exercise. The rise in the number of people with PAD has increased the need for effective treatments to manage the condition and prevent complications.

Laser atherectomy is a common treatment option for PAD. Laser atherectomy devices use laser energy to vaporize and remove plaque from the walls of affected arteries, thus restoring blood flow and improving symptoms. These devices offer several advantages, such as less invasive procedures, shorter recovery time, and lower rates of complications, over other treatments for PAD.

The surge in the incidence of PAD is driving the demand for laser atherectomy devices. This, in turn, is boosting market development. New players are entering the market and existing players are expanding their product lines to meet the rising demand. This trend is likely to continue in the next few years, as healthcare providers seek effective and efficient ways to manage PAD and improve patient outcomes.

Technological advancements have been a major driver of the laser atherectomy devices market in the past few years. Advances in laser technology have led to the development of more efficient and effective devices. Newer lasers are more precise, allowing for the targeted removal of plaque without damaging healthy tissue. Furthermore, laser atherectomy devices have become smaller and more portable, making them easier to use in various settings. This has led to an increase in the adoption of these devices in outpatient clinics and other non-hospital settings.

Some laser atherectomy devices are now equipped with advanced imaging technology, such as intravascular ultrasound, which enables real-time visualization of the treatment area. This could enable physicians to more accurately target and remove plaque.

Technological advancements have made laser atherectomy devices more effective, efficient, and accessible. Hence, the market for these devices is expected to witness robust growth in the next few years.

In terms of application, the peripheral vascular segment accounted for the largest global laser atherectomy devices market share in 2022. Laser atherectomy devices are used in the treatment of blockages in peripheral arteries, which are located outside of the heart and brain.

The rise in the prevalence of PAD is driving the peripheral vascular segment. PAD is a condition, in which the arteries in the legs become narrowed or blocked. This could lead to pain, numbness, and other symptoms, and increase the risk of heart attack and stroke. A laser atherectomy device is used primarily for the treatment of PAD.

Advances in technology have led to the development of more effective laser atherectomy devices, which has increased demand for these devices. Newer devices use shorter wavelengths of laser energy, which can more effectively break down plaque and reduce the risk of complications.

Based on end-user, the hospitals & surgical centers segment dominated the global laser atherectomy devices market in 2022. Hospitals and surgical centers are the primary settings where laser atherectomy procedures are performed. These facilities have the necessary equipment and staff to perform the procedure safely and effectively.

As per laser atherectomy devices market analysis, North America accounted for the leading share of the global laser atherectomy devices market in 2022. This can be ascribed to the high prevalence of PAD, the availability of advanced healthcare infrastructure, and the increase in the adoption of minimally invasive procedures in the region.

The prevalence of PAD is high in North America, particularly in the U.S. This has resulted in a large patient pool that requires treatment. North America has a well-established healthcare infrastructure, which includes advanced hospitals, surgical centers, and healthcare professionals. This infrastructure provides a conducive environment for the adoption of new medical technologies and procedures, including laser atherectomy.

North America has witnessed a shift in the trend toward minimally invasive procedures in the past few years. Patients and healthcare providers are increasingly opting for these procedures, due to their advantages over traditional surgical methods, such as faster recovery times, reduced pain, and lower risk of complications. Hence, the adoption of laser atherectomy, which is a minimally invasive procedure, is increasing in the region.

Europe and Asia Pacific are also expected to exhibit significant market growth due to a rise in awareness about these products, an increase in the patient pool, and an improvement in healthcare infrastructure.

The global laser atherectomy devices market is consolidated, with the presence of a small number of prominent players. Leading players are adopting strategies such as product portfolio expansion and merger & acquisition to increase revenue and market share.

AngioDynamics, Avinger, Inc., BD Interventional, Boston Scientific Corporation, Cardiovascular Systems, Inc., Medtronic, Eximo Medical Ltd., Terumo Corp., and Philips are the prominent players operating in the global market.

Each of these players has been profiled in the global laser atherectomy devices market report based on parameters such as company overview, financial overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Size in 2022 |

US$ 182.1 Mn |

|

Forecast (Value) in 2031 |

More than US$ 345.4 Mn |

|

Growth Rate (CAGR) |

7.4% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Mn for Value |

|

Market Analysis |

It includes segment analysis as well as regional-level analysis. Furthermore, qualitative analysis consists of drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global industry was valued at US$ 182.1 Mn in 2022.

It is projected to reach more than US$ 345.4 Mn by 2031.

The CAGR is anticipated to be 7.4% from 2023 to 2031.

Increase in preference for minimally invasive procedures and rise in incidence of cardiovascular disease.

North America is expected to account for leading share during the forecast period.

Boston Scientific Corp., BD Interventional, Terumo Corp, Medtronic, Cardiovascular Systems, Inc., Philips, AngioDynamics, Eximo Medical Ltd., and Avinger, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Laser Atherectomy Devices Market

4. Market Overview

4.1. Introduction

4.1.1. Application Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Laser Atherectomy Devices Market Analysis and Forecast, 2017–2031

5. Key Insights

5.1. Technological Advancements

5.2. Key Product/Brand Analysis

5.3. Number of Laser Atherectomy Surgeries Performed Globally/Region

5.4. COVID-19 Pandemic Impact on Industry (value chain and short/mid/long term impact)

6. Global Laser Atherectomy Devices Market Analysis and Forecast, by Application

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value & Volume Forecast, by Application, 2017–2031

6.3.1. Cardiovascular

6.3.2. Peripheral Vascular

6.3.3. Neurovascular

6.4. Market Attractiveness Analysis, by Application

7. Global Laser Atherectomy Devices Market Analysis and Forecast, by End-user

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by End-user, 2017–2031

7.3.1. Hospitals & Surgical Centers

7.3.2. Ambulatory Care Centers

7.3.3. Others

7.4. Market Attractiveness Analysis, by End-user

8. Global Laser Atherectomy Devices Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness Analysis, by Region

9. North America Laser Atherectomy Devices Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value & Volume Forecast, by Application, 2017–2031

9.2.1. Cardiovascular

9.2.2. Peripheral Vascular

9.2.3. Neurovascular

9.3. Market Value Forecast, by End-user, 2017–2031

9.3.1. Hospitals & Surgical Centers

9.3.2. Ambulatory Care Centers

9.3.3. Others

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Application

9.5.2. By End-user

9.5.3. By Country

10. Europe Laser Atherectomy Devices Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value & Volume Forecast, by Application, 2017–2031

10.2.1. Cardiovascular

10.2.2. Peripheral Vascular

10.2.3. Neurovascular

10.3. Market Value Forecast, by End-user, 2017–2031

10.3.1. Hospitals & Surgical Centers

10.3.2. Ambulatory Care Centers

10.3.3. Others

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Application

10.5.2. By End-user

10.5.3. By Country/Sub-region

11. Asia Pacific Laser Atherectomy Devices Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value & Volume Forecast, by Application, 2017–2031

11.2.1. Cardiovascular

11.2.2. Peripheral Vascular

11.2.3. Neurovascular

11.3. Market Value Forecast, by End-user, 2017–2031

11.3.1. Hospitals & Surgical Centers

11.3.2. Ambulatory Care Centers

11.3.3. Others

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Application

11.5.2. By End-user

11.5.3. By Country/Sub-region

12. Latin America Laser Atherectomy Devices Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value & Volume Forecast, by Application, 2017–2031

12.2.1. Cardiovascular

12.2.2. Peripheral Vascular

12.2.3. Neurovascular

12.3. Market Value Forecast, by End-user, 2017–2031

12.3.1. Hospitals & Surgical Centers

12.3.2. Ambulatory Care Centers

12.3.3. Others

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Application

12.5.2. By End-user

12.5.3. By Country/Sub-region

13. Middle East & Africa Laser Atherectomy Devices Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value & Volume Forecast, by Application, 2017–2031

13.2.1. Cardiovascular

13.2.2. Peripheral Vascular

13.2.3. Neurovascular

13.3. Market Value Forecast, by End-user, 2017–2031

13.3.1. Hospitals & Surgical Centers

13.3.2. Ambulatory Care Centers

13.3.3. Others

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Application

13.5.2. By End-user

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player - Competition Matrix (by tier and size of companies)

14.2. Market Share Analysis, by Company, 2022

14.3. Company Profiles

14.3.1. AngioDynamics

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Avinger, Inc.

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. BD Interventional

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. Boston Scientific Corporation

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. Cardiovascular Systems, Inc.

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Medtronic

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Philips

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Terumo Corp.

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Eximo Medical Ltd.

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

List of Tables

Table 01: Global Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 02: Global Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 03: Global Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 04: North America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 05: North America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 06: North America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: Europe Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 08: Europe Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 09: Europe Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 10: Asia Pacific Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 11: Asia Pacific Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 12: Asia Pacific Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 13: Latin America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 14: Latin America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 15: Latin America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Middle East & Africa Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 17: Middle East & Africa Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 18: Middle East & Africa Laser Atherectomy Devices Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Global Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 03: Global Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 04: Global Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 05: Global Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 06: Global Laser Atherectomy Devices Market Value Share Analysis, by Region, 2022 and 2031

Figure 07: Global Laser Atherectomy Devices Market Attractiveness Analysis, by Region, 2023–2031

Figure 08: North America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 09: North America Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 10: North America Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 11: North America Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 12: North America Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 13: North America Laser Atherectomy Devices Market Value Share Analysis, by Country, 2022 and 2031

Figure 14: North America Laser Atherectomy Devices Market Attractiveness Analysis, by Country, 2023–2031

Figure 15: Europe Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 16: Europe Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 17: Europe Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 18: Europe Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 19: Europe Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 20: Europe Laser Atherectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 21: Europe Laser Atherectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 22: Asia Pacific Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 23: Asia Pacific Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 24: Asia Pacific Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 25: Asia Pacific Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 26: Asia Pacific Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 27: Asia Pacific Laser Atherectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 28: Asia Pacific Laser Atherectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 29: Latin America Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 30: Latin America Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 31: Latin America Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 32: Latin America Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 33: Latin America Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 34: Latin America Laser Atherectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 35: Latin America Laser Atherectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 36: Middle East & Africa Laser Atherectomy Devices Market Value (US$ Mn) Forecast, 2017–2031

Figure 37: Middle East & Africa Laser Atherectomy Devices Market Value Share Analysis, by Application, 2022 and 2031

Figure 38: Middle East & Africa Laser Atherectomy Devices Market Attractiveness Analysis, by Application, 2023–2031

Figure 39: Middle East & Africa Laser Atherectomy Devices Market Value Share Analysis, by End-user, 2022 and 2031

Figure 40: Middle East & Africa Laser Atherectomy Devices Market Attractiveness Analysis, by End-user, 2023–2031

Figure 41: Middle East & Africa Laser Atherectomy Devices Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 42: Middle East & Africa Laser Atherectomy Devices Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 43: Global Laser Atherectomy Devices Market Share Analysis, by Company, 2021