Reports

Reports

The Laboratory Information Systems (LIS) market is driven by the increasing rate of laboratory automation, the need for timely data availability and information management, and challenging regulatory environments pertaining to clinical diagnostics and research. The factors influencing the LIS market forward include the increasing amount of diagnostic tests, increased use of LIS interfaced with Electronic Health Records (EHRs), and the growing trend toward personalized medicine.

However, market restraints such as high costs to implement new systems, concerns over data security, and the integration of LIS with legacy systems continue to inhibit adoption, primarily among small and medium-sized laboratory organizations. Notwithstanding these constraints, some growth opportunities are possible with emerging cloud-based LIS products, artificial intelligence-enabled decision support systems, and the expanding access to healthcare infrastructure in emerging markets that include LIS systems.

Current trends in the LIS market continue to trend toward interoperability, mobile access, and modular systems tailored to a specialized lab workflow to enhance laboratory efficiency and efficacy. LIS, on the whole, is emerging as a key factor of relevance in the digitization and digital transformation of healthcare and life sciences.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The increasing demand for lab automation and streamlined workflows is a primary factor driving the growth of Laboratory Information Systems (LIS) market. As the number of diagnostic tests, and consequently data, increases, manual or non-automated processes cannot keep up with both - efficiencies and accuracy levels (no longer able to provide reliable speed, regulatory compliance, and accuracy).

LIS systems offer the capabilities to automate valuable functions including providing sample tracking capabilities, managing test scheduling, facilitating data entry, and reporting out data. LIS solutions offer increased efficiencies by automating functions that may be error prone, which may free lab personnel to work on higher priority tasks.

Automation not only improves the turnaround times and total utilization of a lab, but can assist with the same types of workflows across multiple sites i.e., standardizing a laboratory as well if needed. The desire to improve workflows is most prevalent in clinical labs where high-capacity testing occurs (researching for drug development), as well as public health labs where improved capacity and timely data demand are required.

Therefore, the market for integrated laboratory solutions capable of supporting interoperability and seamless integration with various laboratory instruments and hospital systems is witnessing strong growth. Also, automation is still a vital undertaking in the ongoing digital transformation of laboratory businesses.

The integration with Electronic Health Records (EHRs) is expected to contribute to the growth of the Laboratory Information Systems industry by providing seamless and easy exchange of data across different healthcare environments. Providers are increasingly relying on EHRs to securely store patient information and, therefore, the ability for LIS platforms to communicate with EHRs is becoming increasingly important.

In addition, EHR-LIS integration is an important part of any LIS platform that relies on ease of use for building laboratory workflows. For example, in the majority of laboratory workflows the ideal state is to be able to enter an order automatically, have the completion of tests automatically reflected in reporting test results, and reduce manual data entry to only cases where it is unavoidable.

Unfortunately, the exemption of manual data entry is unavoidable in most lab workflows. This generates errors and ultimately the wrong diagnosis occurs. Integrating EHR-LIS will also facilitate timely clinical decision support, as lab results are available to the physician at the point-of-care centers . EHR-LIS integration will ultimately support regulatory compliance and improve departmental interoperability while fostering better patient care coordination.

Increased efforts toward connected care systems will provide laboratories with a better "plan of record" at the point-of-care and allow them to rely on strong EHR integration capabilities for evolving clinical, operational, and regulatory requirements resulting in increasing laboratory growth and market expansion potential.

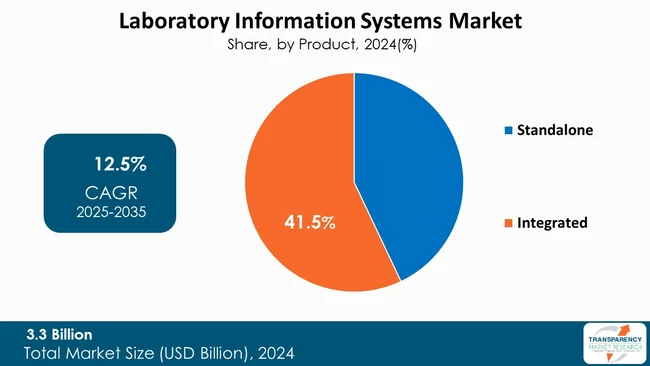

“Integrated” is currently the dominating segment in laboratory information systems market, primarily due to the ability to consolidate multiple laboratory processes into a central location. Unlike the standalone systems, the integrated LIS unifies all the processes including sample tracking, ordering tests, analyzing data, billing, quality, and reporting into one collective system, eliminating the need outside standalone modules or manual transfers. This type of LIS has not only increased efficiency and data accuracy, but also improved integration with the other hospital systems such as Electronic Health Records (EHR) or its Hospital Information Systems (HIS).

Integrated, by product platforms, are particularly advantageous to large hospitals, diagnostic networks, and any other research centers who place a premium on streamlined operations, compliance, and scale. Providing a bird's eye view of all laboratory activity and providing automation, analytics and multi-site functionality, integrated LIS platforms hold the major share in the market due to their preferred status.

| Attribute | Detail |

|---|---|

| Leading Region | North America |

North America leads the Laboratory Information Systems (LIS) industry, primarily due to its robust healthcare system infrastructure, wide adoption of digital health technologies, and a well-established regulatory framework. The country, specifically the U.S., has seen widespread LIS implementation across hospitals, diagnostic laboratories, and research institutes in response to increased demand for laboratory automation and optimal data management and data integration with Electronic Health Records (EHRs).

Governments’ efforts and initiatives such as the HITECH (Health Information Technology for Economic and Clinical Health) Act usually promote the digitization of healthcare and as more facilities invest in digitizing their current processes hospitals have adopted LIS or are currently adopting one of these systems.

Large, advanced LIS vendors, a matured IT ecosystem, and a high volume of diagnostic testing continue to affect the sector positively and its growth period. New approaches in personalized medicine, the collection of real-time analytics, and the growing demand for and adherence to increased regulatory HITECH restrictions (as well as CLIA and HIPAA regulations) continue to cloud North America's global market domain leadership.

Thermo Fisher Scientific Inc., Siemens, LabVantage Solutions Inc., LabWare, Oracle, STARLIMS Corporation, Autoscribe Informatics, Illumina, Inc, CloudLIMS, McKesson Medical-Surgical Inc., LabLynx, NovoPath Laboratory Information System., LABTRACK, Ovation are the key players in the global laboratory information systems market.

Each of these players has been profiled in the laboratory information systems market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

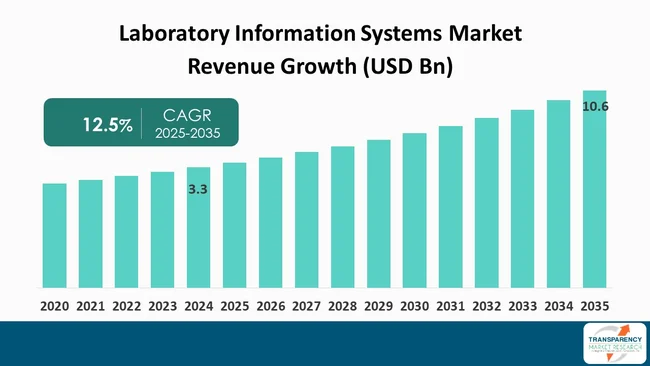

| Size in 2024 | US$ 3.3 Bn |

| Forecast Value in 2035 | US$ 10.6 Bn |

| CAGR | 12.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Product

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global laboratory information systems market was valued at US$ 3.3 Bn in 2024

The laboratory information systems market is projected to cross US$ 10.6 Bn by the end of 2035

Growing need for lab automation and workflow efficiency, integration with electronic health records (EHRs) and expansion of cloud-based LIS solutions

The global laboratory information systems market is anticipated to grow at a CAGR of 12.5% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Thermo Fisher Scientific Inc., Siemens, LabVantage Solutions Inc., LabWare, Oracle, STARLIMS Corporation, Autoscribe Informatics, Illumina, Inc., CloudLIMS, McKesson Medical-Surgical Inc., LabLynx , NovoPath Laboratory Information System., LABTRACK, Ovation and Other Prominent Players

Table 01: Global Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 02: Global Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 03: Global Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 04: Global Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 05: Global Laboratory Information Systems Market Value (US$ Mn) Forecast, By Region, 2020 to 2035

Table 06: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 07: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 08: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 09: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 10: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 11: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 13: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 14: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 15: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 18: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 19: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 20: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 23: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 24: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 25: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, By Product, 2020 to 2035

Table 28: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, By Delivery Mode, 2020 to 2035

Table 29: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, By Component, 2020 to 2035

Table 30: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 02: Global Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 03: Global Laboratory Information Systems Market Revenue (US$ Mn), by Standalone, 2020 to 2035

Figure 04: Global Laboratory Information Systems Market Revenue (US$ Mn), by Integrated, 2020 to 2035

Figure 05: Global Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 06: Global Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 07: Global Laboratory Information Systems Market Revenue (US$ Mn), by On-premise, 2020 to 2035

Figure 08: Global Laboratory Information Systems Market Revenue (US$ Mn), by Cloud-based, 2020 to 2035

Figure 09: Global Laboratory Information Systems Market Revenue (US$ Mn), by Web-based, 2020 to 2035

Figure 10: Global Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 11: Global Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 12: Global Laboratory Information Systems Market Revenue (US$ Mn), by Services, 2020 to 2035

Figure 13: Global Laboratory Information Systems Market Revenue (US$ Mn), by Software 2020 to 2035

Figure 14: Global Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 15: Global Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 16: Global Laboratory Information Systems Market Revenue (US$ Mn), by Hospital Laboratories, 2020 to 2035

Figure 17: Global Laboratory Information Systems Market Revenue (US$ Mn), by Independent Laboratories, 2020 to 2035

Figure 18: Global Laboratory Information Systems Market Revenue (US$ Mn), by Physician Office Laboratories, 2020 to 2035

Figure 19: Global Laboratory Information Systems Market Revenue (US$ Mn), by Others, 2020 to 2035

Figure 20: Global Laboratory Information Systems Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Laboratory Information Systems Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Laboratory Information Systems Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 23: North America Laboratory Information Systems Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Laboratory Information Systems Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 26: North America Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 27: North America Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 28: North America Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 29: North America Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 30: North America Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 31: North America Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe Laboratory Information Systems Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 34: Europe Laboratory Information Systems Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Laboratory Information Systems Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 37: Europe Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 38: Europe Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 39: Europe Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 40: Europe Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 41: Europe Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 42: Europe Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Laboratory Information Systems Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Laboratory Information Systems Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 46: Asia Pacific Laboratory Information Systems Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 47: Asia Pacific Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 48: Asia Pacific Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 49: Asia Pacific Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 50: Asia Pacific Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 51: Asia Pacific Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 52: Asia Pacific Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 53: Asia Pacific Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Asia Pacific Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Latin America Laboratory Information Systems Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 56: Latin America Laboratory Information Systems Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Latin America Laboratory Information Systems Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Latin America Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 59: Latin America Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 60: Latin America Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 61: Latin America Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 62: Latin America Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 63: Latin America Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 64: Latin America Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Latin America Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Middle East & Africa Laboratory Information Systems Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 67: Middle East & Africa Laboratory Information Systems Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 68: Middle East & Africa Laboratory Information Systems Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 69: Middle East & Africa Laboratory Information Systems Market Value Share Analysis, By Product, 2024 and 2035

Figure 70: Middle East & Africa Laboratory Information Systems Market Attractiveness Analysis, By Product, 2025 to 2035

Figure 71: Middle East & Africa Laboratory Information Systems Market Value Share Analysis, by Delivery Mode, 2024 and 2035

Figure 72: Middle East & Africa Laboratory Information Systems Market Attractiveness Analysis, by Delivery Mode, 2025 to 2035

Figure 73: Middle East & Africa Laboratory Information Systems Market Value Share Analysis, by Component, 2024 and 2035

Figure 74: Middle East & Africa Laboratory Information Systems Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 75: Middle East & Africa Laboratory Information Systems Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East & Africa Laboratory Information Systems Market Attractiveness Analysis, By End-user, 2025 to 2035