Reports

Reports

The infectious disease rapid diagnostics devices market is growing on a staggering note under the influence of a chain of critical drivers. They include the increasing incidence of infectious diseases, fueled by globalization and urbanization, which has increased the demand for rapid and reliable diagnostic products.

Rapid diagnostics help in identifying pathogens at the initial stage, thereby allowing early treatment that, in turn, prevents the spread of infections. Moreover, the COVID-19 outbreak has brought to the fore the need for swift testing and has ignited handsome investments in diagnostics’ innovation. The demand for rapid testing capabilities is gaining importance with governments and healthcare authorities.

Additionally, technology innovations in molecular diagnostics and point-of-care testing have contributed to faster diagnostic results and made diagnostics more convenient for different healthcare applications.

Another factor contributing to the growth of the infectious disease rapid diagnostics devices market is the novelty of assay chemistry and detection modality that has enabled record levels of performance to be achieved while the workflows have been simplified. Technological advancements like isothermal amplification, CRISPR-based diagnostics, ultrasensitive immunoassays, and smart nanomaterials is leading to increased sensitivity as well as specificity of diagnostics, which are particularly useful for low-abundance targets.

The complexity of diagnostic instruments is being minimized through the use of robotic sample-prep modules and integrated microfluidic cartridges, which reduce operator variability and manual handling. At the same time, ongoing reimbursement reforms, increased diagnostic coding, and implementation of value-based payment models are contributing to the monetary sustainability of these diagnostic solutions for laboratories and healthcare systems, thereby fostering greater market traction and facilitating wider adoption of advanced diagnostic technologies.

One of the most interesting trends in the infectious disease rapid diagnostics devices market is the increased adoption of multiplex technologies. Multiplexing refers to the capability to detect multiple pathogens or resistance markers within a single analytical run. The results obtained from multiplexing are critical for clinical decision-making and biological stewardship.

Moreover, lab-on-chip devices and CRISPR-enabled detection techniques are gaining traction. Additionally, there is a growing emphasis on user-centric design for devices with remote monitoring features. Additionally, regulatory bodies are increasingly providing temporary or conditional approvals, thereby facilitating the introduction of innovative platforms into real-life scenarios.

Companies operating in the infectious disease rapid diagnostics devices industry are taking several initiatives for improving their product offerings and expanding their market presence. A large number of companies are investing to innovate in point-of-care testing and multiplex assays, which allow for simultaneous detection of multiple pathogens. Several firms are seeking to form strategic alliances and partnerships with healthcare providers, research institutions, and technology firms with the goal to share knowledge and achieve faster product development. Besides, organizations are also concentrating on improving product design to enable remote monitoring and data analytics, which are poised to make the products more user-friendly.

Infectious disease rapid diagnostic tools are next-generation medical tools designed to identify disease-causing infectious pathogens like bacteria, viruses, and parasites within a short timeframe. Emerging technologies such as molecular diagnostics, immunoassays, and microfluidics are employed by the devices to deliver results, within hours to even minutes. The key advantages of rapid diagnostics are early infection diagnosis and treatment to halt the transmission of the diseases and enhance the outcome of patients.

Rapid diagnostic testing devices for infectious diseases by means of specific interactions with pathogen DNA or RNA, antibodies, or antigens. A straightforward diagnostic format frequently employed to deliver rapid testing examination results with minimal complexity is immunochromatographic test strips, also referred to as lateral flow assays.

In contrast, advanced molecular platforms utilize methods of isothermal amplification, notably loop-mediated isothermal amplification (LAMP) to facilitate amplification of DNA or RNA under isothermal conditions. Thus, nucleic acids can be detected rapidly and sensitively without any expensive thermal cycling platforms. CRISPR-based detection uses the CRISPR-Cas system, which is a bacterial immune-related mechanism, in order to identify specific pathogenic genetic sequences.

With a reporter system in place, CRISPR is able to rapidly and accurately detect specific, pathogenic genetic sequences even with very low concentrations of nucleic acid target genes.

| Attribute | Detail |

|---|---|

| Infectious Disease Rapid Diagnostics Devices Market Drivers |

|

The rising infectious disease cases is the leading factor contributing to the growth of the infectious disease rapid diagnostic devices market, which is essentially driven by the need for quick and efficient diagnostic solutions. Continual epidemics of influenza, tuberculosis, and HIV, and the recent COVID-19 threat have necessitated rapid diagnostic equipment for healthcare systems, in order to attain test results rapidly to ensure timely treatment delivery.

Increased diseases’ burden places enormous strain on clinics, hospitals, and pathology laboratories in terms of handling large patient loads. Conventional diagnostic tests that take days to deliver results are inadequate to address such urgent demands.

Rapid diagnosis devices provide same-day results, thereby eliminating patient backlog and simplifying clinical processes. This is particularly relevant in high-prevalence areas, where early diagnosis not only optimizes patient outcomes but also helps to lower healthcare costs associated with advanced disease treatments and prolonged hospital stays.

Rapid diagnostics play a crucial role in limiting transmission of infectious diseases, especially in densely populated areas. Early detection of infection is crucial for the isolation of cases and implementation of the public health measures. These diagnostic tools enable healthcare workers to detect infections at point of care, facilitating immediate access to the treatment, efficiently breaking transmission chains.

Furthermore, the global occurrence of antimicrobial resistance is another reason for rapid diagnostics to be considered as an indispensable tool. The necessity for fast and accurate diagnosis sets the stage for the administration of the right dosage of antibiotics or antivirals when infections have become resistant. By enabling the correct selection of therapy, rapid diagnostic instruments not only ensure the continuation of good individual patient care but also become a part of the public health plan to fight against infectious disease prevalence.

The heightened demand for point-of-care (POC) testing is one of the key growth factors for the infectious disease rapid diagnostics devices market. POC testing does facilitate diagnostic testing at or close to the point of patient care, with results within minutes in place of days. The short turnaround time enhances clinical decision-making and lets health professionals initiate immediate treatment, thereby leading to better patient outcomes. The simplicity and speed of use do make POC testing extremely useful in infectious disease treatment, where prevention of transmission is crucial.

POC testing units are revolutionary in limited laboratory infrastructure. Rural health clinics, primary care facilities, and resource-inhibited settings typically have no centralized diagnostic labs. Easy, portable rapid diagnostics devices that are suitable for POC environments fill the gap and provide accurate results without high-end equipment or highly qualified staff.

POC testing is a major factor that influences public health concerns and disease outbreaks. Quick identification at the site of care prevents infection transmission with immediate isolation, treatment, and contact tracing. During pandemics, rapid diagnostic devices prove to be efficient instruments for large-scale screening at airports, workplaces, and community centers, thereby rendering these devices crucial for outbreak preparedness.

Moreover, patients’ need for fast and convenient healthcare is continuously growing, which further leads to an elevated demand for POC testing. Individuals are looking for quicker diagnostic procedures that reduce hospital visits and waiting time. Consequently, infectious disease rapid diagnostics devices designed for POC use are becoming indispensable not only for the clinical workflow but also for healthcare models that are more patient-centric, which leads to a strong growth of the market.

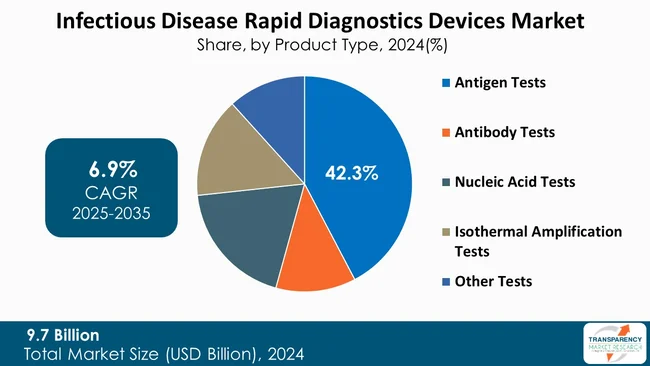

Antigen tests lead the infectious disease rapid diagnostics devices market as they are inexpensive, fast, and easy to use. Antigen tests do identify particular proteins found in pathogens and deliver results within a few minutes without needing sophisticated apparatus or expert personnel. These devices are well-positioned for community testing, mass screening, and distribution in low-resource environments where laboratory infrastructure is poor.

Moreover, antigen tests are preferred over other diagnostic tools due to their flexibility and usefulness in various medical settings. These tests can be accessed not only in hospitals or medical facilities but also in airports, offices, or even at home. Since minimal training is necessary for their use and results are available quickly, they provide a lot of freedom to healthcare workers on the front line as well as to patients and, therefore, play a decisive role in infectious disease management.

| Attribute | Detail |

|---|---|

| Leading Region |

|

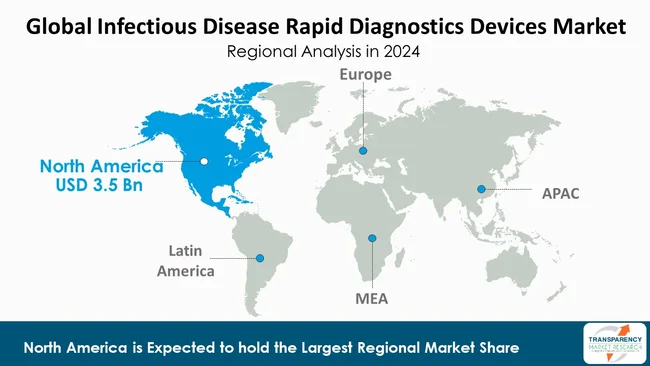

As per the latest infectious disease rapid diagnostics devices market analysis, North America dominated in 2024. The region’s dominance can be attributed to its highly developed healthcare infrastructure, rigorous support from the regulatory authorities, and extensive use of advanced diagnostic technology. The substantial use of the rapid diagnostics in hospitals, clinics, and laboratories is prompted by huge research and development investments and established reimbursement policies. The area also benefits from strong public health programs and funding by the government.

Further, the high rate of incidence of infectious diseases within the region and antimicrobial resistance also drive the demand for efficient testing solutions. The presence of major diagnostic device manufacturers, as well as well-established distribution channels, is also a factor for North America to lead the market.

Companies involved in the infectious disease rapid diagnostics devices market are primarily engaged in activities such as working on multiplexed as well as portable platforms, joining hands with strategic partners, increasing test menu breadth, and incorporating digital connectivity. Besides, these firms are emphasizing on local production, value-based pricing, and subscription-based reagent models to add to accessibility, build up customer loyalty, and attract sustainable market growth.

F. Hoffmann-La Roche AG, Abbott, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), bioMérieux SA, Diasorin S.p.A., Hologic, Inc., QuidelOrtho Corporation, Siemens Healthineers AG, Seegene Inc., QIAGEN, Danaher Corporation, Trinity Biotech, and Grifols are some of the leading players operating in the global infectious disease rapid diagnostics devices market.

Each of these players has been profiled in the infectious disease rapid diagnostics devices market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

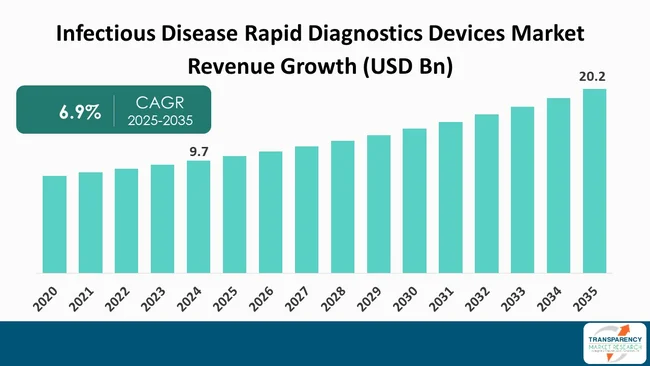

| Size in 2024 | US$ 9.7 Bn |

| Forecast Value in 2035 | US$ 20.2 Bn |

| CAGR | 6.9% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Infectious Disease Rapid Diagnostics Devices Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Product Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global infectious disease rapid diagnostics devices market was valued at US$ 9.7 Bn in 2024

The global infectious disease rapid diagnostics devices industry is projected to reach more than US$ 20.2 Bn by the end of 2035

The rising global prevalence of infectious diseases, the growing demand for point-of-care (POC) testing, continuous technological advancements in diagnostics, increasing government and public health investments, and the growing acceptance of decentralized and at-home testing solutions are some of the factors driving the expansion of infectious disease rapid diagnostics devices market.

The CAGR is anticipated to be 6.9% from 2025 to 2035

F. Hoffmann-La Roche AG, Abbott, Bio-Rad Laboratories, Inc., Thermo Fisher Scientific Inc., Becton, Dickinson and Company (BD), bioMérieux SA, Diasorin S.p.A., Hologic, Inc., QuidelOrtho Corporation, Siemens Healthineers AG, Seegene Inc., QIAGEN, Danaher Corporation, Trinity Biotech, and Grifols

Table 01: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 02: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 04: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 05: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 06: Global Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 07: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 08: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 09: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 10: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 11: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 12: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 13: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 14: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 15: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 16: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 17: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 19: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 20: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 21: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 22: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 23: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 24: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 25: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 26: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 27: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 28: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 29: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 30: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 31: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 32: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Product Type, 2020 to 2035

Table 33: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 34: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Sample Type, 2020 to 2035

Table 35: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 36: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 02: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 03: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Antigen Tests, 2020 to 2035

Figure 04: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Antibody Tests, 2020 to 2035

Figure 05: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Nucleic Acid Tests, 2020 to 2035

Figure 06: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Isothermal Amplification Tests, 2020 to 2035

Figure 07: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Other Tests, 2020 to 2035

Figure 08: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 09: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 10: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Immunoassay, 2020 to 2035

Figure 11: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Molecular Diagnostics, 2020 to 2035

Figure 12: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Lateral Flow Assays, 2020 to 2035

Figure 13: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Microarray Technology, 2020 to 2035

Figure 14: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Other Technologies, 2020 to 2035

Figure 15: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 16: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 17: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Blood, 2020 to 2035

Figure 18: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Urine, 2020 to 2035

Figure 19: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Saliva, 2020 to 2035

Figure 20: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Other Sample Types, 2020 to 2035

Figure 21: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 22: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 23: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Sexually Transmitted Infections (STIs), 2020 to 2035

Figure 24: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Bloodstream Infections, 2020 to 2035

Figure 25: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Respiratory Infections, 2020 to 2035

Figure 26: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Healthcare-associated Infections, 2020 to 2035

Figure 27: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Tuberculosis, 2020 to 2035

Figure 28: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Other Applications, 2020 to 2035

Figure 29: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 30: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 31: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Hospitals & Clinics, 2020 to 2035

Figure 32: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Diagnostic Laboratories, 2020 to 2035

Figure 33: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Homecare Settings, 2020 to 2035

Figure 34: Global Infectious Disease Rapid Diagnostics Devices Market Revenue (US$ Bn), by Other End-users, 2020 to 2035

Figure 35: Global Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Region, 2024 and 2035

Figure 36: Global Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 37: North America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 38: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, by Country, 2024 and 2035

Figure 39: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 40: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 41: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 42: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 43: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 44: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 45: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 46: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 47: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 48: North America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 49: North America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 50: Europe Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 51: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 52: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 53: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 54: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 55: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 56: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 57: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 58: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 59: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 60: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 61: Europe Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 62: Europe Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 63: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 64: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 65: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 66: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 67: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 68: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 69: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 70: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 71: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 72: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 73: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 74: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 75: Asia Pacific Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 76: Latin America Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 77: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 78: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 79: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 80: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 81: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 82: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 83: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 84: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 85: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 86: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 87: Latin America Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 88: Latin America Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 89: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 90: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 91: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 92: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Product Type, 2024 and 2035

Figure 93: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Product Type, 2025 to 2035

Figure 94: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Technology, 2024 and 2035

Figure 95: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 96: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Sample Type, 2024 and 2035

Figure 97: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Sample Type, 2025 to 2035

Figure 98: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By Application, 2024 and 2035

Figure 99: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 100: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Value Share Analysis, By End-user, 2024 and 2035

Figure 101: Middle East & Africa Infectious Disease Rapid Diagnostics Devices Market Attractiveness Analysis, By End-user, 2025 to 2035