Reports

Reports

Analysts’ Viewpoint

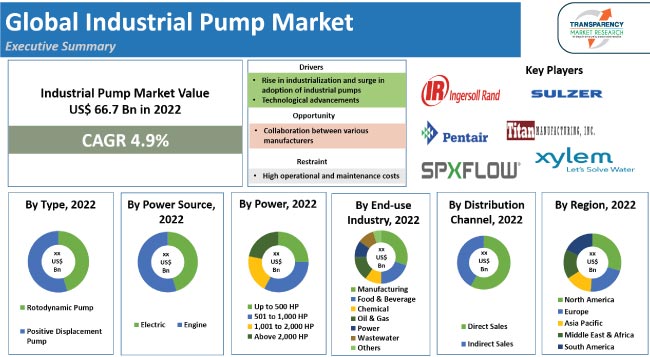

Increase in usage of industrial pumps in various end-use industries, such as wastewater treatment and chemicals, is one of the primary factors creating huge demand for industrial water pumps, and chemical pumps. Various new products are being introduced in this sector. Smart pump systems are expected to offer lucrative opportunities for market expansion owing to their various advantages, such as high efficiency, improved performance, and reliability.

Key players are focusing on global industrial pump market trends and developing pumps with efficient designs and materials. Manufacturers are also aware of the usage of industrial pumps among different end-use industries. Hence, they focus on investing in research and development to improve the working of the product, thus boosting the industrial pump industry growth.

An industrial pump transforms the mechanical energy, which it absorbs from electric, thermal, or other sources, and transfers it to fluids as hydraulic energy. It is used to move liquids through underground pipes.

The industrial pump comprises an inlet tube, outlet, and impeller. The pump is designed especially for harsh or heavy-duty applications and is used to displace many different types of products such as wastewater, oil, chemicals, foods, and slurry.

The selection of an industrial pump is done on the basis of requirement of various power range categories, including up to 500 HP, 501 to 1,000 HP, 1,001 to 2,000 HP, and above 2,000 HP. The demand for various industrial pumps, including vertical pumps and pneumatic grease pumps, is rising consistently.

The global industrial pump market size is improving with the rise in demand for pumps in various end-use industries. Industries need to move liquids, such as water, oil, or chemicals, from a particular machine to another frequently. Transferring any fluid is not an easy task and cannot be done manually. Industrial pumps help transfer such liquids from one place to another without manual intervention.

The adoption of industrial pumps, such as rotodynamic pumps and positive displacement pumps, especially in wastewater treatment, chemical, and food processing industries, is boosting the industrial pump market revenue. Various advantages associated with industrial pumps, such as improving the efficiency and production speed, requiring less maintenance, eliminating the need for labor to perform tasks manually, reducing the risk of spills, and saving on labor cost are boosting market demand.

Technological advancements in industrial pumps, including efficient separation processes for liquid and gas, is likely to fuel market progress. Leading developments in research and technology are further accelerating the industrial pump market demand.

In terms of power, the industrial pump market segmentation includes up to 500 HP, 501 to 1,000 HP, 1,001 to 2,000 HP, and above 2,000 HP. The up to 500 HP power segment dominates the global industrial pump market.

Industrial pumps with less horse power incur less upfront costs, and thus are more cost-effective for many industries that do not require more horse power for their business. Additionally, up to 500 HP industrial pumps are more energy efficient compared to pumps with more horse power. Small scale industries and cost-effective businesses generally prefer the pumps with less horse power to save on additional costs and energy.

Up to 500 HP pumps are mostly used in industries, such as water treatment, manufacturing, and HVAC. Industrial pump manufacturers have started improving the function of the up to 500 HP range industrial pump, which is estimated to further boost the global industrial pump market share.

The Asia Pacific market is followed by the markets in Europe and North America. Extensive industrialization along with booming petrochemical production facilities and new infrastructure projects, which need to control water flow rates, drives the demand for industrial pumps in North America and Europe on a large scale. All these factors are expected to create opportunities for market development in these regions.

Detailed profiles of companies are provided in the global industrial pump market report to evaluate their financials, key product offerings, recent developments, and strategies. The majority of companies are spending significant amounts on comprehensive R&D activities, primarily to develop innovative products. Expansion of product portfolios and mergers & acquisitions are the key strategies adopted by manufacturers as per the market analysis and forecast.

Industrial pump manufacturers and suppliers are collaborating with different companies or entering into a number of partnerships for the introduction of new products, specifically targeting and focusing on meeting the requirements of certain businesses. This is anticipated to increase the industrial pump market value.

The key companies influencing the global industrial pump market statistics are EBARA CORPORATION, Flowserve Corporation, Grundfos Holding A/S, Ingersoll Rand, KSB SE & Co. KGaA, Pentair, SPX FLOW, Inc, Sulzer Ltd, Titan Manufacturing Inc., and Xylem.

Each of these players has been profiled in the global industrial pump market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and market developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 66.7 Bn |

|

Market Forecast Value in 2031 |

US$ 107.6 Bn |

|

Growth Rate (CAGR) |

4.9% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, etc. Furthermore, at the country level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

Prominent Players - Competition Dashboard and Revenue Share Analysis 2022 Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, COVID-19 Response, and Strategy & Business Overview) |

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profile |

|

|

Customization Scope |

Available Upon Request |

|

Pricing |

Available Upon Request |

It was valued at US$ 66.7 Bn in 2022

It is estimated to reach US$ 107.6 Bn by 2031

The CAGR is expected to be 4.9% from 2023 to 2031

Rise in industrialization, surge in adoption of industrial pumps, and technological advancements

Up to 500 HP is the major power segment

Asia Pacific is a highly attractive region for vendors

EBARA CORPORATION, Flowserve Corporation, Grundfos Holding A/S, Ingersoll Rand, KSB SE & Co. KGaA, Pentair, SPX FLOW, Inc, Sulzer Ltd, Titan Manufacturing Inc, and Xylem

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.4.1. Overall Pump Market Overview

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. SWOT Analysis

5.8. Technological Advancements

5.9. COVID-19 Impact Analysis

5.10. Global Industrial Pump Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Revenue Projections (US$ Mn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global Industrial Pump Market Analysis and Forecast, By Type

6.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Rotodynamic Pump

6.1.1.1. Centrifugal Pump

6.1.1.2. Axial Flow Pump

6.1.1.3. Mixed Flow Pump

6.1.2. Positive Displacement Pump

6.1.2.1. Reciprocating Pump

6.1.2.1.1. Plunger Pump

6.1.2.1.2. Diaphragm Pump

6.1.2.2. Rotary Pump

6.1.2.2.1. Gear Pump

6.1.2.2.2. Lobe Pump

6.1.2.2.3. Vane Pump

6.1.2.2.4. Progressive Cavity Pump

6.1.2.2.5. Screw Pump

6.1.2.2.6. Others

6.2. Incremental Opportunity, By Type

7. Global Industrial Pump Market Analysis and Forecast, By Power

7.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

7.1.1. Up to 500 HP

7.1.2. 501 to 1,000 HP

7.1.3. 1,001 to 2,000 HP

7.1.4. Above 2,000 HP

7.2. Incremental Opportunity, By Power

8. Global Industrial Pump Market Analysis and Forecast, By Power Source

8.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

8.1.1. Electric

8.1.2. Engine

8.2. Incremental Opportunity, By Power Source

9. Global Industrial Pump Market Analysis and Forecast, By End-use Industry

9.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

9.1.1. Manufacturing

9.1.2. Food & Beverage

9.1.3. Chemical

9.1.4. Oil & Gas

9.1.5. Power

9.1.6. Wastewater

9.1.7. Others

9.2. Incremental Opportunity, By End-use Industry

10. Global Industrial Pump Market Analysis and Forecast, By Distribution Channel

10.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

10.1.1. Direct Sales

10.1.2. Indirect Sales

10.2. Incremental Opportunity, By Distribution Channel

11. Global Industrial Pump Market Analysis and Forecast, by Region

11.1. Global Industrial Pump Market Size (US$ Mn and Thousand Units), by Region, 2017 - 2031

11.1.1. North America

11.1.2. Europe

11.1.3. Asia Pacific

11.1.4. Middle East & Africa

11.1.5. South America

11.2. Global Incremental Opportunity, by Region

12. North America Industrial Pump Market Analysis and Forecast

12.1. Regional Snapshot

12.1.1. By Type

12.1.2. By Power

12.1.3. By Power Source

12.1.4. By End-use Industry

12.1.5. By Distribution Channel

12.1.6. By Country/Sub-region

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price

12.3. Key Supplier Analysis

12.4. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

12.4.1. Rotodynamic Pump

12.4.1.1. Centrifugal Pump

12.4.1.2. Axial Flow Pump

12.4.1.3. Mixed Flow Pump

12.4.2. Positive Displacement Pump

12.4.2.1. Reciprocating Pump

12.4.2.1.1. Plunger Pump

12.4.2.1.2. Diaphragm Pump

12.4.2.2. Rotary Pump

12.4.2.2.1. Gear Pump

12.4.2.2.2. Lobe Pump

12.4.2.2.3. Vane Pump

12.4.2.2.4. Progressive Cavity Pump

12.4.2.2.5. Screw Pump

12.4.2.2.6. Others

12.5. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

12.5.1. Up to 500 HP

12.5.2. 501 to 1,000 HP

12.5.3. 1,001 to 2,000 HP

12.5.4. Above 2,000 HP

12.6. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

12.6.1. Electric

12.6.2. Engine

12.7. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

12.7.1. Manufacturing

12.7.2. Food & Beverage

12.7.3. Chemical

12.7.4. Oil & Gas

12.7.5. Power

12.7.6. Wastewater

12.7.7. Others

12.8. Industrial Pump Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. Industrial Pump Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

12.9.1. U.S.

12.9.2. Canada

12.9.3. Rest of North America

12.10. Incremental Opportunity Analysis

13. Europe Industrial Pump Market Analysis and Forecast

13.1. Regional Snapshot

13.1.1. By Type

13.1.2. By Power

13.1.3. By Power Source

13.1.4. By End-use Industry

13.1.5. By Distribution Channel

13.1.6. By Country/Sub-region

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price

13.3. Key Supplier Analysis

13.4. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

13.4.1. Rotodynamic Pump

13.4.1.1. Centrifugal Pump

13.4.1.2. Axial Flow Pump

13.4.1.3. Mixed Flow Pump

13.4.2. Positive Displacement Pump

13.4.2.1. Reciprocating Pump

13.4.2.1.1. Plunger Pump

13.4.2.1.2. Diaphragm Pump

13.4.2.2. Rotary Pump

13.4.2.2.1. Gear Pump

13.4.2.2.2. Lobe Pump

13.4.2.2.3. Vane Pump

13.4.2.2.4. Progressive Cavity Pump

13.4.2.2.5. Screw Pump

13.4.2.2.6. Others

13.5. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

13.5.1. Up to 500 HP

13.5.2. 501 to 1,000 HP

13.5.3. 1,001 to 2,000 HP

13.5.4. Above 2,000 HP

13.6. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

13.6.1. Electric

13.6.2. Engine

13.7. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

13.7.1. Manufacturing

13.7.2. Food & Beverage

13.7.3. Chemical

13.7.4. Oil & Gas

13.7.5. Power

13.7.6. Wastewater

13.7.7. Others

13.8. Industrial Pump Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. Industrial Pump Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

13.9.1. Germany

13.9.2. U.K.

13.9.3. France

13.9.4. Rest of Europe

13.10. Incremental Opportunity Analysis

14. Asia Pacific Industrial Pump Market Analysis and Forecast

14.1. Regional Snapshot

14.1.1. By Type

14.1.2. By Power

14.1.3. By Power Source

14.1.4. By End-use Industry

14.1.5. By Distribution Channel

14.1.6. By Country/Sub-region

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price

14.3. Key Supplier Analysis

14.4. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

14.4.1. Rotodynamic Pump

14.4.1.1. Centrifugal Pump

14.4.1.2. Axial Flow Pump

14.4.1.3. Mixed Flow Pump

14.4.2. Positive Displacement Pump

14.4.2.1. Reciprocating Pump

14.4.2.1.1. Plunger Pump

14.4.2.1.2. Diaphragm Pump

14.4.2.2. Rotary Pump

14.4.2.2.1. Gear Pump

14.4.2.2.2. Lobe Pump

14.4.2.2.3. Vane Pump

14.4.2.2.4. Progressive Cavity Pump

14.4.2.2.5. Screw Pump

14.4.2.2.6. Others

14.5. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

14.5.1. Up to 500 HP

14.5.2. 501 to 1,000 HP

14.5.3. 1,001 to 2,000 HP

14.5.4. Above 2,000 HP

14.6. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

14.6.1. Electric

14.6.2. Engine

14.7. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

14.7.1. Manufacturing

14.7.2. Food & Beverage

14.7.3. Chemical

14.7.4. Oil & Gas

14.7.5. Power

14.7.6. Wastewater

14.7.7. Others

14.8. Industrial Pump Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. Industrial Pump Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

14.9.1. China

14.9.2. India

14.9.3. Japan

14.9.4. Rest of Asia Pacific

14.10. Incremental Opportunity Analysis

15. Middle East & Africa Industrial Pump Market Analysis and Forecast

15.1. Regional Snapshot

15.1.1. By Type

15.1.2. By Power

15.1.3. By Power Source

15.1.4. By End-use Industry

15.1.5. By Distribution Channel

15.1.6. By Country/Sub-region

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price

15.3. Key Supplier Analysis

15.4. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

15.4.1. Rotodynamic Pump

15.4.1.1. Centrifugal Pump

15.4.1.2. Axial Flow Pump

15.4.1.3. Mixed Flow Pump

15.4.2. Positive Displacement Pump

15.4.2.1. Reciprocating Pump

15.4.2.1.1. Plunger Pump

15.4.2.1.2. Diaphragm Pump

15.4.2.2. Rotary Pump

15.4.2.2.1. Gear Pump

15.4.2.2.2. Lobe Pump

15.4.2.2.3. Vane Pump

15.4.2.2.4. Progressive Cavity Pump

15.4.2.2.5. Screw Pump

15.4.2.2.6. Others

15.5. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

15.5.1. Up to 500 HP

15.5.2. 501 to 1,000 HP

15.5.3. 1,001 to 2,000 HP

15.5.4. Above 2,000 HP

15.6. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

15.6.1. Electric

15.6.2. Engine

15.7. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

15.7.1. Manufacturing

15.7.2. Food & Beverage

15.7.3. Chemical

15.7.4. Oil & Gas

15.7.5. Power

15.7.6. Wastewater

15.7.7. Others

15.8. Industrial Pump Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. Industrial Pump Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

15.9.1. GCC

15.9.2. South Africa

15.9.3. Rest of Middle East & Africa

15.10. Incremental Opportunity Analysis

16. South America Industrial Pump Market Analysis and Forecast

16.1. Regional Snapshot

16.1.1. By Type

16.1.2. By Power

16.1.3. By Power Source

16.1.4. By End-use Industry

16.1.5. By Distribution Channel

16.1.6. By Country/Sub-region

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price

16.3. Key Supplier Analysis

16.4. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Type, 2017 - 2031

16.4.1. Rotodynamic Pump

16.4.1.1. Centrifugal Pump

16.4.1.2. Axial Flow Pump

16.4.1.3. Mixed Flow Pump

16.4.2. Positive Displacement Pump

16.4.2.1. Reciprocating Pump

16.4.2.1.1. Plunger Pump

16.4.2.1.2. Diaphragm Pump

16.4.2.2. Rotary Pump

16.4.2.2.1. Gear Pump

16.4.2.2.2. Lobe Pump

16.4.2.2.3. Vane Pump

16.4.2.2.4. Progressive Cavity Pump

16.4.2.2.5. Screw Pump

16.4.2.2.6. Others

16.5. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power, 2017 - 2031

16.5.1. Up to 500 HP

16.5.2. 501 to 1,000 HP

16.5.3. 1,001 to 2,000 HP

16.5.4. Above 2,000 HP

16.6. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By Power Source, 2017 - 2031

16.6.1. Electric

16.6.2. Engine

16.7. Industrial Pump Market Size (US$ Mn and Thousand Units) Forecast, By End-use Industry, 2017 - 2031

16.7.1. Manufacturing

16.7.2. Food & Beverage

16.7.3. Chemical

16.7.4. Oil & Gas

16.7.5. Power

16.7.6. Wastewater

16.7.7. Others

16.8. Industrial Pump Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

16.8.1. Direct Sales

16.8.2. Indirect Sales

16.9. Industrial Pump Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

16.9.1. Brazil

16.9.2. Rest of South America

16.10. Incremental Opportunity Analysis

17. Competition Landscape

17.1. Market Player - Competition Dashboard

17.2. Market Revenue Share Analysis (%), (2022)

17.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Type Portfolio, Revenue, Strategy & Business Overview)

17.3.1. EBARA CORPORATION

17.3.1.1. Company Overview

17.3.1.2. Sales Area/Geographical Presence

17.3.1.3. Type Portfolio

17.3.1.4. Revenue

17.3.1.5. Strategy & Business Overview

17.3.2. Flowserve Corporation

17.3.2.1. Company Overview

17.3.2.2. Sales Area/Geographical Presence

17.3.2.3. Type Portfolio

17.3.2.4. Revenue

17.3.2.5. Strategy & Business Overview

17.3.3. Grundfos Holding A/S

17.3.3.1. Company Overview

17.3.3.2. Sales Area/Geographical Presence

17.3.3.3. Type Portfolio

17.3.3.4. Revenue

17.3.3.5. Strategy & Business Overview

17.3.4. Ingersoll Rand

17.3.4.1. Company Overview

17.3.4.2. Sales Area/Geographical Presence

17.3.4.3. Type Portfolio

17.3.4.4. Revenue

17.3.4.5. Strategy & Business Overview

17.3.5. KSB SE & Co. KGaA

17.3.5.1. Company Overview

17.3.5.2. Sales Area/Geographical Presence

17.3.5.3. Type Portfolio

17.3.5.4. Revenue

17.3.5.5. Strategy & Business Overview

17.3.6. Pentair

17.3.6.1. Company Overview

17.3.6.2. Sales Area/Geographical Presence

17.3.6.3. Type Portfolio

17.3.6.4. Revenue

17.3.6.5. Strategy & Business Overview

17.3.7. SPX FLOW, Inc.

17.3.7.1. Company Overview

17.3.7.2. Sales Area/Geographical Presence

17.3.7.3. Type Portfolio

17.3.7.4. Revenue

17.3.7.5. Strategy & Business Overview

17.3.8. Sulzer Ltd

17.3.8.1. Company Overview

17.3.8.2. Sales Area/Geographical Presence

17.3.8.3. Type Portfolio

17.3.8.4. Revenue

17.3.8.5. Strategy & Business Overview

17.3.9. Titan Manufacturing Inc.

17.3.9.1. Company Overview

17.3.9.2. Sales Area/Geographical Presence

17.3.9.3. Type Portfolio

17.3.9.4. Revenue

17.3.9.5. Strategy & Business Overview

17.3.10. Xylem

17.3.10.1. Company Overview

17.3.10.2. Sales Area/Geographical Presence

17.3.10.3. Type Portfolio

17.3.10.4. Revenue

17.3.10.5. Strategy & Business Overview

17.3.11. Other Key Players

17.3.11.1. Company Overview

17.3.11.2. Sales Area/Geographical Presence

17.3.11.3. Type Portfolio

17.3.11.4. Revenue

17.3.11.5. Strategy & Business Overview

18. Key Takeaways

18.1. Identification of Potential Market Spaces

18.1.1. By Type

18.1.2. By Power

18.1.3. By Power Source

18.1.4. By End-use Industry

18.1.5. By Distribution Channel

18.1.6. By Region

18.2. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 2: Global Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 3: Global Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 4: Global Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 5: Global Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 6: Global Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 7: Global Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 8: Global Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 9: Global Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 10: Global Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 11: Global Industrial Pump Market Value (US$ Mn), by Region, 2017-2031

Table 12: Global Industrial Pump Market Volume (Thousand Units), by Region, 2017-2031

Table 13: North America Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 14: North America Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 15: North America Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 16: North America Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 17: North America Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 18: North America Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 19: North America Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 20: North America Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 21: North America Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 22: North America Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 23: North America Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 24: North America Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Table 25: Europe Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 26: Europe Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 27: Europe Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 28: Europe Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 29: Europe Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 30: Europe Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 31: Europe Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 32: Europe Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 33: Europe Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 34: Europe Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 35: Europe Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 36: Europe Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Table 37: Asia Pacific Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 38: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 39: Asia Pacific Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 40: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 41: Asia Pacific Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 42: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 43: Asia Pacific Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 44: Asia Pacific Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 45: Asia Pacific Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 46: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 47: Asia Pacific Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 48: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Table 49: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 50: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 51: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 52: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 53: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 54: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 55: Middle East & Africa Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 56: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 57: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 58: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 59: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 60: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Table 61: South America Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Table 62: South America Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Table 63: South America Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Table 64: South America Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Table 65: South America Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Table 66: South America Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Table 67: South America Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Table 68: South America Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Table 69: South America Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Table 70: South America Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Table 71: South America Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Table 72: South America Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

List of Figures

Figure 1: Global Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 2: Global Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 3: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 4: Global Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 5: Global Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 6: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power, 2023-2031

Figure 7: Global Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 8: Global Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 9: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source, 2023-2031

Figure 10: Global Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 11: Global Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 12: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 13: Global Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 14: Global Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 15: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 16: Global Industrial Pump Market Value (US$ Mn), by Region, 2017-2031

Figure 17: Global Industrial Pump Market Volume (Thousand Units), by Region, 2017-2031

Figure 18: Global Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Region, 2023-2031

Figure 19: North America Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 20: North America Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 21: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 22: North America Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 23: North America Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 24: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power, 2023-2031

Figure 25: North America Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 26: North America Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 27: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source, 2023-2031

Figure 28: North America Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 29: North America Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 30: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 31: North America Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 32: North America Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 33: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 34: North America Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 35: North America Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Figure 36: North America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 37: Europe Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 38: Europe Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 39: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 40: Europe Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 41: Europe Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 42: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power, 2023-2031

Figure 43: Europe Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 44: Europe Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 45: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source, 2023-2031

Figure 46: Europe Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 47: Europe Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 48: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 49: Europe Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 50: Europe Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 51: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 52: Europe Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 53: Europe Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Figure 54: Europe Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 55: Asia Pacific Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 56: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 57: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 58: Asia Pacific Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 59: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 60: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power, 2023-2031

Figure 61: Asia Pacific Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 62: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 63: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source, 2023-2031

Figure 64: Asia Pacific Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 65: Asia Pacific Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 66: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 67: Asia Pacific Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 68: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 69: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 70: Asia Pacific Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 71: Asia Pacific Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Figure 72: Asia Pacific Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 73: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 74: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 75: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 76: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 77: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 78: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power,2023-2031

Figure 79: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 80: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 81: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source,2023-2031

Figure 82: Middle East & Africa Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 83: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 84: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2017-2031

Figure 85: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 86: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 87: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 88: Middle East & Africa Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 89: Middle East & Africa Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Figure 90: Middle East & Africa Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031

Figure 91: South America Industrial Pump Market Value (US$ Mn), by Type, 2017-2031

Figure 92: South America Industrial Pump Market Volume (Thousand Units), by Type, 2017-2031

Figure 93: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Type, 2023-2031

Figure 94: South America Industrial Pump Market Value (US$ Mn), by Power, 2017-2031

Figure 95: South America Industrial Pump Market Volume (Thousand Units), by Power, 2017-2031

Figure 96: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power, 2023-2031

Figure 97: South America Industrial Pump Market Value (US$ Mn), by Power Source, 2017-2031

Figure 98: South America Industrial Pump Market Volume (Thousand Units), by Power Source, 2017-2031

Figure 99: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Power Source, 2023-2031

Figure 100: South America Industrial Pump Market Value (US$ Mn), by End-use Industry, 2017-2031

Figure 101: South America Industrial Pump Market Volume (Thousand Units), by End-use Industry, 2017-2031

Figure 102: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by End-use Industry, 2023-2031

Figure 103: South America Industrial Pump Market Value (US$ Mn), by Distribution Channel, 2017-2031

Figure 104: South America Industrial Pump Market Volume (Thousand Units), by Distribution Channel, 2017-2031

Figure 105: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Distribution Channel, 2023-2031

Figure 106: South America Industrial Pump Market Value (US$ Mn), by Country/Sub-region, 2017-2031

Figure 107: South America Industrial Pump Market Volume (Thousand Units), by Country/Sub-region, 2017-2031

Figure 108: South America Industrial Pump Market Incremental Opportunity (US$ Mn), Forecast, by Country/Sub-region, 2023-2031