Reports

Reports

Industrial Internet of Things (IIoT) market is on a rapid expansion spree with a rising demand for industrial automation and operational effectiveness. Manufacturing, energy, and logistics verticals are adopting IIoT solutions for rendering the processes automated, reducing downtime, and improving productivity.

Predictive maintenance, asset optimization, and real-time monitoring are some of the leading factors fueling the growth of the market. Additionally, organizations are also under pressure to reduce expenditures without compromising on safety and compliance guidelines, and IIoT is turning into an inevitable technology for maximum utilization of assets with minimal risk in the high-hazard industrial environments.

The second major driving force in the industrial internet of things (IIoT) market is the growing emphasis on energy efficiency as well as sustainability. Organizations are adopting IIoT-based monitoring as well as sensor solutions for tracking energy usage, emission management, and compliance with stringent environmental regulations. The rising environmentally-friendly operations and advanced manufacturing have created a significant demand for solutions that enable minimum wastage and energy use optimization. Organizations are also adopting IIoT for enhanced supply chain visibility, right-time delivery of products, loss minimization, and end-to-end optimization.

Recent trends within the industrial internet of things (IIoT) industry have indicated the increasing significance of digital twins, cybersecurity products, and edge analytics. Adoption of digital twin technology is growing at a faster pace to facilitate creation of virtual models of hardware and processes so that industries can visualize their operations and identify areas of potential failures or bottlenecks, before they happen.

In the meantime, the increasing threat of cyber-attacks has compelled companies to incorporate robust security frameworks into IIoT environments. The use of edge analytics is becoming popular among industrial customers who are looking for ways to improve the speed, efficiency, and resilience of their operations by cutting down on latency and reducing cloud dependency.

The market landscape of IIoT is highly competitive, bringing about constant innovation and strategic collaborations. Companies across the globe are investing significantly in building cutting-edge sensor technologies and platforms, which are compatible with applications aimed at industries and particularly operating requirements. Companies are engaging with technology vendors, start-ups, and industry players, either to create solutions in partnership or accelerate adoption of particular solutions.

Besides, firms are complementing their offerings with modular, scalable IIoT platforms that do not have any industry allegiance. Greater emphasis is being placed on sophisticated cybersecurity measures and predictive analytics to enhance firms’ presence in the emerging industrial internet of things (IIoT) market.

Industrial Internet of Things (IIoT) implies the incorporation of connected devices, sensors, and machines in industrial settings to gather, exchange, and analyze data in real-time. Unlike consumer-grade IoT, IIoT focuses on applications at a larger scale in the energy, manufacturing, logistics, and utility sectors where machine-to-machine communication and automation are the key drivers.

Networked appliances and smart sensors form the basis of IIoT, collecting information about machinery health, environmental conditions, and manufacturing process in real time. The information is carried over networks securely to the analytics servers, where the data is analyzed for obtaining useful insights. Industries leverage these insights for predictive maintenance, thereby ensuring that equipment is serviced before malfunction occurs, and also for process optimization. As a result, IIoT are known for rendering businesses more efficient, thereby significantly reducing operational costs.

Moreover, the industrial internet of things (IIoT) plays a major role in the safety and sustainability sectors. Interconnected systems can be used for monitoring dangerous situations, identification of anomalies, and even triggering a response automatically in order to prevent accidents. IIoT is also assisting industries in using less power, monitoring their emissions, and embracing green methods.

The IIoT further improves the flexibility and thinking of industrial processes. Technologies such as digital twin and edge computing enable industries to replicate performance, test the modifications virtually, and take faster and more precise decisions, data-driven. This prompt response to changed demands avoids traditional industries from settling down into static and wasteful operations, resuscitating them as green, secure, and extremely intellectual organizations.

| Attribute | Detail |

|---|---|

| Industrial Internet of Things (IIoT) Market Drivers |

|

One of the key factors catalyzing the industrial internet of things (IIoT) market is the advancements in connectivity without any flaw or interruption. Maintaining precise and stable communication is essential. Through the use of 5G and other high-speed networks, industries are now able to completely leverage IIoT solutions, which means more devices can connect and the latency could be almost zero. This results in almost instantaneous alterations across the entire chain of sensors, machines, and control systems.

Enhanced connectivity has multiple benefits, including the extent of scalability in IIoT deployments, which is, in fact, the amount of devices that can be connected and controlled simultaneously. For all businesses that use large networks of sensors, i.e., factories, oil rigs, or warehouses, a strong communication network is essential. Enhanced connectivity provides businesses with the opportunity to connect tens of thousands of devices in a seamless manner without data congestion. They not only make operation more efficient but also enable the investigation of data more profound, thus yielding more detailed information about the industrial processes and performance.

Connectivity improvements must be directly linked to collaboration between several sites located across the globe. Remote monitoring and control have become a simple alternative in many industries, where assets can be managed, shipments can be tracked, or production lines controlled using a centralized platform. All this translates into lesser travel costs, less downtime, and standard operation confirmation across the global network.

Along with that, higher-bandwidth connectivity has proven to be an enabler for amalgamating emergent technologies with IIoT, including AR, robotics, and digital twins. These technologies demand very high bandwidths with absolute reliability; thus, the improved connectivity creates a strong backbone for innovations and allows industries to instrument smarter, safer, and more autonomous systems, thereby hastening the overall industrial internet of things (IIoT) market growth.

A combined effect of cloud computing and artificial intelligence on Industry 4.0 is significantly fostering the outgrowth of the production-oriented IIoT market, having capabilities for profound data analysis and decision-making. IIoT generates huge volumes of real-time data from the sensors and IoT devices along which AI algorithms processes the data to recognize patterns, predict failure, and optimize its performance. Cloud infrastructure provides the platform for storing, processing, and managing such voluminous data at reasonable costs, which, in turn, enables industries to access AI-driven insights at a large scale.

AI bestows intelligence to an IIoT system in terms of predictive maintenance, anomaly detections, and automation of mundane tasks. To give an example, machine learning scripts predict equipment failures in advance so that downtime and costs are reduced. AI, by contrast, detects inefficiencies from the production line and suggests improvement metrics. With real-time backing from smart applications, IIoT systems become more of an actively responsive tool rather than a passively responsive monitoring platforms.

A highly scalable and agile deployment of industrial internet of things (IIoT) would be nearly impossible without the contribution of cloud computing. With the utilization of cloud platforms, industries can seamlessly connect thousands of devices, manage large data sets as well as initiate their data analytics operation without requiring a gigantic on-premises installation.

Besides, the convergence of AI and cloud computing not only positions the company in a leadership position but also opens up its potential to new uses such as digital twins, autonomous operations and robotics. Companies can redesign the manufacturing process in virtual space, enhance decision-making precision, and adopt more intelligent automation methods. Consequently, AI and cloud computing, in combination, are the key technological devices that make the IIoT market productive and efficient and even innovative.

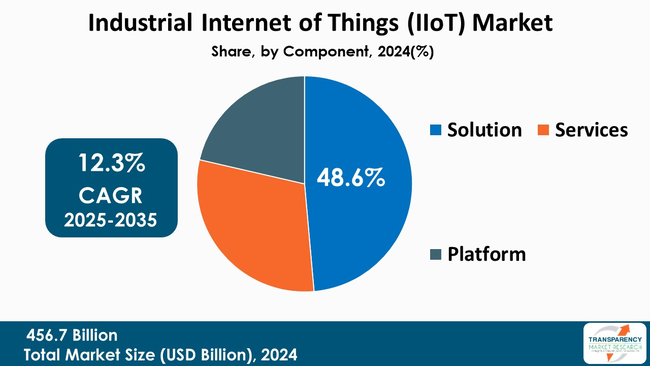

The solution segment takes the lead in the industrial internet of things (IIoT) market. This can be attributed to the fact that solutions can be leveraged for end-to-end integration of fixed hardware, software, and services to solve the complexity of the industrial case. For example, predictive maintenance, asset management, process optimization, and real-time monitoring solutions provide instant value by creating efficiency, reducing downtime, and improving operational efficiencies.

Industries tend to prefer full IIoT solutions as they are easier to deploy and create interoperability among varied systems. These end solutions are built for the industry and provide scalability and flexibility. As automation and the requirement for data-driven decision-making continue to increase at a rapid rate, solution-based offerings hold the position as the most favored approach in achieving IIoT adoption worldwide.

| Attribute | Detail |

|---|---|

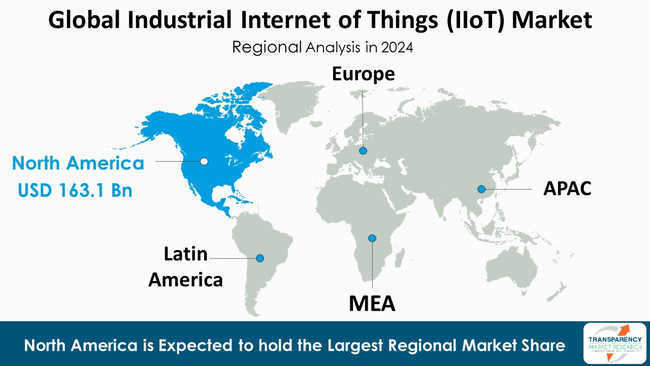

| Leading Region |

|

As per the latest Industrial Internet of Things (IIoT) Market analysis, North America dominated in 2024. This is due to its advanced industrial base and early adoption of digital technologies in North America. The region boasts heavy investments by manufacturing, energy, automotive, and healthcare sectors for IIoT solutions in order to yield productivity, efficiency, and safety. High adoption, in turn, is driven by strong demand for automation and predictive maintenance.

In addition, government backing, increased R&D investment, and established tech environment play a role in North America capturing leading market position. Inclusion of the most recent innovations in data analytics, cybersecurity, and connectivity keeps North American companies at IIoT growth and adoption frontiers.

The market players are typically engaged in activities like planning the development of scalable platforms, raising interoperability, and using advanced analytics. Cybersecurity is one area in which they pour money, they also form alliances, which are strategic and grow their business with the help of solutions that are peculiar to certain industries.

Siemens, General Electric Company, Honeywell International Inc., Rockwell Automation, ABB, Emerson Electric Co., Schneider Electric, Mitsubishi Electric Corporation, Intel Corporation, Nokia, Amazon Web Services, Inc., Cisco Systems, Inc., PTC, Hitachi Digital Services, LLC, and SAP SE are some of the leading players operating in the global Market.

Each of these players has been profiled in the industrial internet of things (IIoT) market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

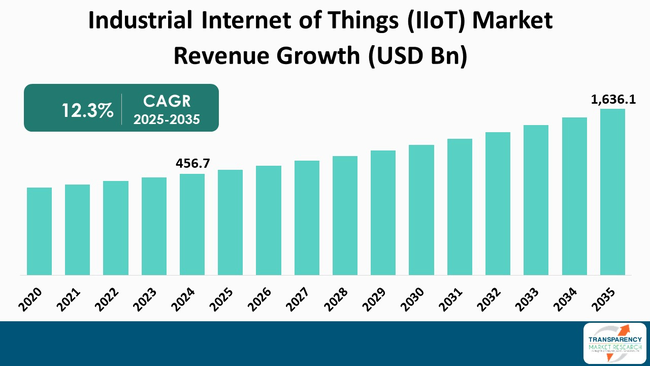

| Size in 2024 | US$ 456.7 Bn |

| Forecast Value in 2035 | US$ 1,636.1 Bn |

| CAGR | 12.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Industrial Internet of Things (IIoT) Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Component

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global industrial internet of things (IIoT) market was valued at US$ 456.7 Bn in 2024

The global industrial internet of things (IIoT) industry is projected to reach more than US$ 1,636.1 Bn by the end of 2035

Increased demand for industrial automation, data-driven decision-making through AI and real-time analytics, the rise of smart factories under the Industry 4.0 initiative, advancements in connectivity like 5G, and the development of more affordable smart devices and sensors are some of the factors driving the expansion of industrial internet of things (IIoT) market.

The CAGR is anticipated to be 12.3% from 2025 to 2035

Siemens, General Electric Company, Honeywell International Inc., Rockwell Automation, ABB, Emerson Electric Co., Schneider Electric, Mitsubishi Electric Corporation, Intel Corporation, Nokia, Amazon Web Services, Inc., Cisco Systems, Inc., PTC, Hitachi Digital Services, LLC, and SAP SE

Table 01: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 02: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 03: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 04: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 05: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 06: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 07: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 08: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 09: Global Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 10: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, by Country, 2020-2035

Table 11: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 12: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 13: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 14: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 15: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 16: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 17: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 18: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 19: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 20: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 21: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 22: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 23: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 24: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 25: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 26: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 27: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 28: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 29: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 30: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 31: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 32: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 33: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 34: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 35: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 36: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 37: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 38: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 39: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 40: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 41: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 42: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 43: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 44: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 45: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 46: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 47: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 48: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 49: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 50: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 51: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 52: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 53: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 54: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 55: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 56: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 57: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 58: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 59: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 60: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 61: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 62: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 63: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 64: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 65: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 66: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 67: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 68: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 69: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 70: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 71: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 72: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 73: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 74: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 75: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 76: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 77: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 78: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 79: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 80: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 81: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 82: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 83: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 84: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 85: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 86: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 87: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 88: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 89: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 90: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 91: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 92: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 93: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 94: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 95: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 96: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 97: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 98: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 99: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 100: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 101: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 102: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 103: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 104: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 105: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 106: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 107: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 108: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 109: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 110: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 111: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 112: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 113: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 114: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 115: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 116: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 117: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 118: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 119: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 120: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 121: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 122: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 123: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 124: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 125: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 126: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 127: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 128: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 129: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 130: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 131: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 132: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 133: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 134: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 135: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 136: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 137: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 138: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 139: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 140: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 141: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 142: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 143: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 144: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 145: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 146: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 147: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 148: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 149: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 150: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 151: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 152: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 153: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 154: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 155: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 156: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 157: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 158: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 159: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 160: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 161: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 162: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 163: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 164: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 165: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 166: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 167: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 168: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 169: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 170: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 171: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 172: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 173: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 174: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 175: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 176: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 177: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 178: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 179: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 180: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 181: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 182: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 183: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 184: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 185: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 186: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 187: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 188: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 189: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 190: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 191: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 192: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 193: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 194: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 195: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 196: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 197: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 198: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 199: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 200: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 201: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 202: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 203: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 204: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 205: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 206: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, by Country/Sub-region, 2020-2035

Table 207: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 208: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 209: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 210: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 211: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 212: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 213: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 214: Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 215: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 216: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 217: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 218: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 219: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 220: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 221: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 222: GCC Countries Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 223: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 224: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 225: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 226: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 227: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 228: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 229: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 230: South Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Table 231: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Component, 2020 to 2035

Table 232: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Solution, 2020 to 2035

Table 233: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Services, 2020 to 2035

Table 234: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Platform, 2020 to 2035

Table 235: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Connectivity, 2020 to 2035

Table 236: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Deployment, 2020 to 2035

Table 237: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Application, 2020 to 2035

Table 238: Rest of Middle East & Africa Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, By Vertical, 2020 to 2035

Figure 01: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 02: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 03: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Solution, 2020 to 2035

Figure 04: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Services, 2020 to 2035

Figure 05: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Platform, 2020 to 2035

Figure 06: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 07: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 08: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Wired Technology, 2020 to 2035

Figure 09: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Wireless Technology, 2020 to 2035

Figure 10: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 11: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 12: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by On-premises, 2020 to 2035

Figure 13: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Cloud-based, 2020 to 2035

Figure 14: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 15: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 16: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Asset Tracking & Management, 2020 to 2035

Figure 17: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Remote Monitoring, 2020 to 2035

Figure 18: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Process Optimization, 2020 to 2035

Figure 19: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Safety & Security, 2020 to 2035

Figure 20: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 21: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 22: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 23: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Energy, 2020 to 2035

Figure 24: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Oil & Gas, 2020 to 2035

Figure 25: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Metals & Mining, 2020 to 2035

Figure 26: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Healthcare, 2020 to 2035

Figure 27: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Retail, 2020 to 2035

Figure 28: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Transportation, 2020 to 2035

Figure 29: Global Industrial Internet of Things (IIoT) Market Revenue (US$ Bn), by Others, 2020 to 2035

Figure 30: Global Industrial Internet of Things (IIoT) Market Value Share Analysis, By Region, 2024 and 2035

Figure 31: Global Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 32: North America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 33: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, by Country, 2024 and 2035

Figure 34: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 35: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 36: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 37: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 38: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 39: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 40: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 41: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 42: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 43: North America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 44: North America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 45: U.S. Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 46: U.S. Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 47: U.S. Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 48: U.S. Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 49: U.S. Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 50: U.S. Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 51: U.S. Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 52: U.S. Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 53: U.S. Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 54: U.S. Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 55: U.S. Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 56: Canada Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 57: Canada Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 58: Canada Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 59: Canada Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 60: Canada Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 61: Canada Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 62: Canada Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 63: Canada Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 64: Canada Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 65: Canada Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 66: Canada Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 67: Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 68: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 69: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 70: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 71: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 72: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 73: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 74: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 75: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 76: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 77: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 78: Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 79: Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 80: UK Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 81: UK Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 82: UK Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 83: UK Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 84: UK Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 85: UK Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 86: UK Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 87: UK Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 88: UK Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 89: UK Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 90: UK Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 91: Germany Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 92: Germany Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 93: Germany Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 94: Germany Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 95: Germany Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 96: Germany Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 97: Germany Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 98: Germany Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 99: Germany Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 100: Germany Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 101: Germany Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 102: France Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 103: France Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 104: France Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 105: France Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 106: France Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 107: France Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 108: France Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 109: France Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 110: France Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 111: France Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 112: France Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 113: Italy Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 114: Italy Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 115: Italy Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 116: Italy Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 117: Italy Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 118: Italy Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 119: Italy Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 120: Italy Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 121: Italy Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 122: Italy Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 123: Italy Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 124: Spain Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 125: Spain Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 126: Spain Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 127: Spain Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 128: Spain Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 129: Spain Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 130: Spain Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 131: Spain Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 132: Spain Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 133: Spain Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 134: Spain Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 135: The Netherlands Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 136: The Netherlands Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 137: The Netherlands Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 138: The Netherlands Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 139: The Netherlands Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 140: The Netherlands Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 141: The Netherlands Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 142: The Netherlands Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 143: The Netherlands Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 144: The Netherlands Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 145: The Netherlands Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 146: Rest of Europe Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 147: Rest of Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 148: Rest of Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 149: Rest of Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 150: Rest of Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 151: Rest of Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 152: Rest of Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 153: Rest of Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 154: Rest of Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 155: Rest of Europe Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 156: Rest of Europe Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 157: Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 158: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 159: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 160: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 161: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 162: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 163: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 164: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 165: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 166: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 167: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 168: Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 169: Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 170: China Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 171: China Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 172: China Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 173: China Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 174: China Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 175: China Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 176: China Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 177: China Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 178: China Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 179: China Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 180: China Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 181: India Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 182: India Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 183: India Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 184: India Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 185: India Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 186: India Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 187: India Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 188: India Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 189: India Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 190: India Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 191: India Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 192: Japan Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 193: Japan Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 194: Japan Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 195: Japan Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 196: Japan Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 197: Japan Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 198: Japan Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 199: Japan Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 200: Japan Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 201: Japan Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 202: Japan Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 203: Australia Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 204: Australia Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 205: Australia Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 206: Australia Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 207: Australia Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 208: Australia Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 209: Australia Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 210: Australia Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 211: Australia Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 212: Australia Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 213: Australia Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 214: South Korea Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 215: South Korea Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 216: South Korea Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 217: South Korea Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 218: South Korea Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 219: South Korea Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 220: South Korea Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 221: South Korea Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 222: South Korea Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 223: South Korea Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 224: South Korea Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 225: ASEAN Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 226: ASEAN Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 227: ASEAN Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 228: ASEAN Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 229: ASEAN Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 230: ASEAN Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 231: ASEAN Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 232: ASEAN Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 233: ASEAN Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 234: ASEAN Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 235: ASEAN Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 236: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 237: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 238: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 239: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 240: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 241: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 242: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 243: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 244: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 245: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 246: Rest of Asia Pacific Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 247: Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 248: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, by Country/Sub-region, 2024 and 2035

Figure 249: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, by Country/Sub-region, 2025 to 2035

Figure 250: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 251: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 252: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 253: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 254: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 255: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 256: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 257: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 258: Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 259: Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 260: Brazil Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 261: Brazil Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 262: Brazil Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 263: Brazil Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 264: Brazil Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 265: Brazil Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 266: Brazil Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 267: Brazil Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 268: Brazil Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 269: Brazil Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 270: Brazil Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 271: Argentina Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 272: Argentina Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 273: Argentina Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 274: Argentina Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 275: Argentina Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 276: Argentina Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 277: Argentina Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 278: Argentina Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 279: Argentina Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 280: Argentina Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 281: Argentina Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 282: Mexico Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 283: Mexico Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 284: Mexico Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 285: Mexico Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 286: Mexico Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 287: Mexico Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 288: Mexico Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 289: Mexico Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 290: Mexico Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035

Figure 291: Mexico Industrial Internet of Things (IIoT) Market Value Share Analysis, By Vertical, 2024 and 2035

Figure 292: Mexico Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Vertical, 2025 to 2035

Figure 293: Rest of Latin America Industrial Internet of Things (IIoT) Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 294: Rest of Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Component, 2024 and 2035

Figure 295: Rest of Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Component, 2025 to 2035

Figure 296: Rest of Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Connectivity, 2024 and 2035

Figure 297: Rest of Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Connectivity, 2025 to 2035

Figure 298: Rest of Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Deployment, 2024 and 2035

Figure 299: Rest of Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Deployment, 2025 to 2035

Figure 300: Rest of Latin America Industrial Internet of Things (IIoT) Market Value Share Analysis, By Application, 2024 and 2035

Figure 301: Rest of Latin America Industrial Internet of Things (IIoT) Market Attractiveness Analysis, By Application, 2025 to 2035