Reports

Reports

Analysts’ Viewpoint

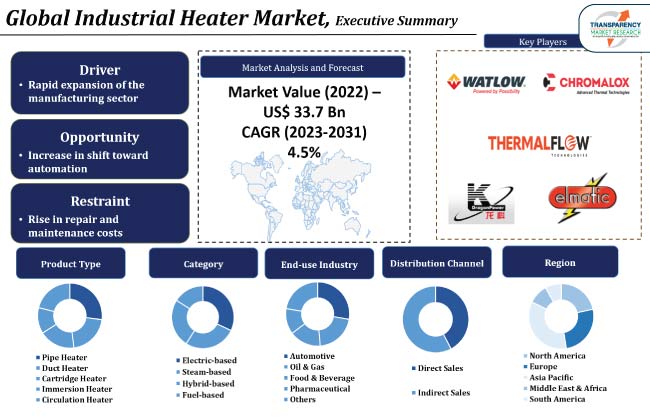

Increase in investments by various industries for expansion of their production capacities is driving the demand for industrial heating products, such as heat exchanger HVAC, industrial electric heater, industrial fan heater, industrial water heater, and industrial gas heater. This is anticipated to propel the growth of the industrial heater industry in the next few years.

Industrial heaters are required for heat tracing of pipes, heating of lubrication oil, and hot forging across various industry verticals in the manufacturing sector. Furthermore, several industries are emphasizing on the reduction of operational cost through the deployment of energy-saving equipment such as industrial heaters. Therefore, industrial heater manufacturers are increasingly focusing on the production of innovative industrial heater products, which is anticipated to boost the global industrial heater market size in the next few years.

Industrial heaters are used to increase the temperature of an industrial process or object. They are largely utilized in several processes where the temperature of an object or process is required to be amplified. For instance, lubricating oil needs to be warmed before it is fed to a machine so that a pipe might need heat tracing in order to prevent it from freezing at low temperatures.

Rise in number of new industrial facilities being established worldwide is projected to significantly drive the global industrial heater market demand in the next few years. Additionally, technological advancements in industrial heaters have further increased their demand in various processes.

The manufacturing sector, especially in growing economies such as China and India, has been witnessing significant growth for the last few years. According to data published by the Ministry of Commerce and Industry of India, the manufacturing sector in India expanded at a growth rate of 11.8% from 2021 to 2022.

Large number of industries around the world are progressively making investments in research and development. For instance, in March 2022, Nestle announced an investment of US$ 675 Mn for the establishment of its factory in Arizona, U.S.

According to the annual report of U.S.-based pharmaceutical and biotechnology multinational brand Pfizer Inc., it made an investment of US$ 11.43 Bn toward research and development in 2022, which was a rise from US$ 10.36 Bn in 2021. Such investments are expected to fuel the consumption of various industrial equipment, including industrial heaters, and consequently propel the market size of industrial heaters in the near future.

In the chemical industry, immersion heaters help maintain a steady temperature and prevent freezing of water, acidic or basic solutions, oils, and detergents. According to the International Energy Agency (IEA), the chemical industry witnessed a growth of 3.0% on a yearly basis in the last decade. This expansion is likely to positively impact the industrial heater market statistics in the next few years.

Rapid expansion of the warehousing industry is also fueling the demand for industrial heaters, especially infrared heaters, which is likely to boost market development. According to statistics published by the India Brand Equity Foundation, the warehousing industry in India witnessed a growth of 45% in the first nine months of 2022.

In terms of category, the global industrial heater market segmentation comprises electric-based, steam-based, hybrid-based, and fuel-based. The electric-based segment is anticipated to hold a dominant market share in the next few years. The eco-friendliness of electric-based heater and its ease of operation are anticipated to have a significant impact on the industrial heater market value.

Demand for steam-based, hybrid-based, and fuel-based heaters is anticipated to increase in the next few years owing to the effectiveness, cost-efficiency, and convenience of these heaters.

According to the latest region-wise industry heater market analysis, Asia Pacific holds major share of the global demand for industrial heaters. Rapid industrialization in major countries of Asia Pacific, such as China and India, is fueling the need for industrial heaters. Moreover, expansion of manufacturing facilities of large corporations across Asia Pacific is also driving the industrial heater industry in the region.

The market in North America, Europe, Middle East & Africa, and South America is anticipated to expand at a steady pace owing to the rising frequency of product replacements among industries across these regions.

Detailed profiles of companies have been included in the global market research report to evaluate their financials, key product offerings, recent developments, and strategies. Key players are following the latest industrial heater market trends and focusing on increasing investments in R&D, product expansions, and mergers & acquisitions in order to boost their presence globally.

The market is highly competitive, with the presence of various global and regional industrial heater manufacturers. Prominent players operating in the global market include Watlow Electric Manufacturing Company, Dragon Power Electric Co. Ltd., Chromalox, Thermal Flow Technologies, Auzhan Electric Appliances Co.Ltd., Elmatic Ltd., Powrmatic Ltd., Winterwarm, Excel Heaters, and Wattco.

Key players in the industrial heater market report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 33.7 Bn |

|

Market Forecast Value in 2031 |

US$ 49.4 Bn |

|

Growth Rate (CAGR) |

4.5% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 33.7 Bn in 2022

The global industry is expected to expand at a CAGR of 4.5% from 2023 to 2031

Rapid expansion of the manufacturing sector worldwide and increase in investments toward research and development

In terms of category, the electric-based segment is estimated to hold largest share during the forecast period

Asia Pacific is anticipated to hold a dominant share of the global business in the near future

Watlow Electric Manufacturing Company, Dragon Power Electric Co. Ltd., Chromalox, Thermal Flow Technologies, Auzhan Electric Appliances Co.Ltd., Elmatic Ltd., Powrmatic Ltd., Winterwarm, Excel Heaters, and Wattco

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.4. Porter’s Five Forces Analysis

5.5. Value Chain Analysis

5.6. Industry SWOT Analysis

5.7. COVID-19 Impact Analysis

5.8. Regulatory Framework

5.9. Global Industrial Heater Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Mn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Industrial Heater Market Analysis and Forecast, by Product Type

6.1. Global Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

6.1.1. Pipe Heater

6.1.2. Duct Heater

6.1.3. Cartridge Heater

6.1.4. Immersion Heater

6.1.5. Circulation Heater

6.2. Incremental Opportunity, by Product Type

7. Global Industrial Heater Market Analysis and Forecast, by Category

7.1. Global Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

7.1.1. Electric-based

7.1.2. Steam-based

7.1.3. Hybrid-based

7.1.4. Fuel-based

7.2. Incremental Opportunity, by Category

8. Global Industrial Heater Market Analysis and Forecast, by End-use Industry

8.1. Global Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

8.1.1. Automotive

8.1.2. Oil & Gas

8.1.3. Food & Beverage

8.1.4. Pharmaceutical

8.1.5. Others (Chemical, etc.)

8.2. Incremental Opportunity, by End-use Industry

9. Global Industrial Heater Market Analysis and Forecast, by Distribution Channel

9.1. Global Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Industrial Heater Market Analysis and Forecast, by Region

10.1. Global Industrial Heater Market Size (US$ Mn and Thousand Units), by Region, 2017 - 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America Industrial Heater Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Price Trend Analysis

11.2.1. Weighted Average Selling Price (US$)

11.3. Brand Analysis

11.4. Consumer Buying Behavior Analysis

11.4.1. Brand Awareness

11.4.2. Average Spend

11.4.3. Purchasing Factors

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

11.6.1. Pipe Heater

11.6.2. Duct Heater

11.6.3. Cartridge Heater

11.6.4. Immersion Heater

11.6.5. Circulation Heater

11.7. Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

11.7.1. Electric-based

11.7.2. Steam-based

11.7.3. Hybrid-based

11.7.4. Fuel-based

11.8. Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

11.8.1. Automotive

11.8.2. Oil & Gas

11.8.3. Food & Beverage

11.8.4. Pharmaceutical

11.8.5. Others (Chemical, etc.)

11.9. Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Industrial Heater Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Industrial Heater Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Price Trend Analysis

12.2.1. Weighted Average Selling Price (US$)

12.3. Brand Analysis

12.4. Consumer Buying Behavior Analysis

12.4.1. Brand Awareness

12.4.2. Average Spend

12.4.3. Purchasing Factors

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

12.6.1. Pipe Heater

12.6.2. Duct Heater

12.6.3. Cartridge Heater

12.6.4. Immersion Heater

12.6.5. Circulation Heater

12.7. Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

12.7.1. Electric-based

12.7.2. Steam-based

12.7.3. Hybrid-based

12.7.4. Fuel-based

12.8. Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

12.8.1. Automotive

12.8.2. Oil & Gas

12.8.3. Food & Beverage

12.8.4. Pharmaceutical

12.8.5. Others (Chemical, etc.)

12.9. Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Industrial Heater Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Industrial Heater Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Price Trend Analysis

13.2.1. Weighted Average Selling Price (US$)

13.3. Brand Analysis

13.4. Consumer Buying Behavior Analysis

13.4.1. Brand Awareness

13.4.2. Average Spend

13.4.3. Purchasing Factors

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

13.6.1. Pipe Heater

13.6.2. Duct Heater

13.6.3. Cartridge Heater

13.6.4. Immersion Heater

13.6.5. Circulation Heater

13.7. Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

13.7.1. Electric-based

13.7.2. Steam-based

13.7.3. Hybrid-based

13.7.4. Fuel-based

13.8. Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

13.8.1. Automotive

13.8.2. Oil & Gas

13.8.3. Food & Beverage

13.8.4. Pharmaceutical

13.8.5. Others (Chemical, etc.)

13.9. Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Industrial Heater Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Industrial Heater Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Brand Analysis

14.4. Consumer Buying Behavior Analysis

14.4.1. Brand Awareness

14.4.2. Average Spend

14.4.3. Purchasing Factors

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

14.6.1. Pipe Heater

14.6.2. Duct Heater

14.6.3. Cartridge Heater

14.6.4. Immersion Heater

14.6.5. Circulation Heater

14.7. Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

14.7.1. Electric-based

14.7.2. Steam-based

14.7.3. Hybrid-based

14.7.4. Fuel-based

14.8. Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

14.8.1. Automotive

14.8.2. Oil & Gas

14.8.3. Food & Beverage

14.8.4. Pharmaceutical

14.8.5. Others (Chemical, etc.)

14.9. Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Industrial Heater Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 – 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Industrial Heater Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Brand Analysis

15.4. Consumer Buying Behavior Analysis

15.4.1. Brand Awareness

15.4.2. Average Spend

15.4.3. Purchasing Factors

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Industrial Heater Market Size (US$ Mn and Thousand Units), by Product Type, 2017 - 2031

15.6.1. Pipe Heater

15.6.2. Duct Heater

15.6.3. Cartridge Heater

15.6.4. Immersion Heater

15.6.5. Circulation Heater

15.7. Industrial Heater Market Size (US$ Mn and Thousand Units), by Category, 2017 - 2031

15.7.1. Electric-based

15.7.2. Steam-based

15.7.3. Hybrid-based

15.7.4. Fuel-based

15.8. Industrial Heater Market Size (US$ Mn and Thousand Units), by End-use Industry, 2017 - 2031

15.8.1. Automotive

15.8.2. Oil & Gas

15.8.3. Food & Beverage

15.8.4. Pharmaceutical

15.8.5. Others (Chemical, etc.)

15.9. Industrial Heater Market Size (US$ Mn and Thousand Units), by Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Industrial Heater Market Size (US$ Mn and Thousand Units), by Country/Sub-region, 2017 – 2031

15.10.1. Brazil

15.10.2. Rest of South America

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%), 2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Financial/Revenue, Strategy & Business Overview, Sales Channel Analysis, Size Portfolio)

16.3.1. Watlow Electric Manufacturing Company

16.3.1.1. Company Overview

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Financial/Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Sales Channel Analysis

16.3.1.6. Size Portfolio

16.3.2. Dragon Power Electric Co. Ltd.

16.3.2.1. Company Overview

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Financial/Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Sales Channel Analysis

16.3.2.6. Size Portfolio

16.3.3. Chromalox

16.3.3.1. Company Overview

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Financial/Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Sales Channel Analysis

16.3.3.6. Size Portfolio

16.3.4. Thermal Flow Technologies

16.3.4.1. Company Overview

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Financial/Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Sales Channel Analysis

16.3.4.6. Size Portfolio

16.3.5. Auzhan Electric Appliances Co.Ltd.

16.3.5.1. Company Overview

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Financial/Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Sales Channel Analysis

16.3.5.6. Size Portfolio

16.3.6. Elmatic Ltd.

16.3.6.1. Company Overview

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Financial/Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Sales Channel Analysis

16.3.6.6. Size Portfolio

16.3.7. Powrmatic Ltd.

16.3.7.1. Company Overview

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Financial/Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Sales Channel Analysis

16.3.7.6. Size Portfolio

16.3.8. Winterwarm

16.3.8.1. Company Overview

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Financial/Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Sales Channel Analysis

16.3.8.6. Size Portfolio

16.3.9. Excel Heaters

16.3.9.1. Company Overview

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Financial/Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Sales Channel Analysis

16.3.9.6. Size Portfolio

16.3.10. Wattco

16.3.10.1. Company Overview

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Financial/Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Sales Channel Analysis

16.3.10.6. Size Portfolio

17. Go to Market Strategy

17.1. Identification of Potential Market Spaces

17.2. Understanding the Buying Process of the Customers

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Table 2: Global Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Table 3: Global Industrial Heater Market, by Category, Thousand Units, 2017-2031

Table 4: Global Industrial Heater Market, by Category, US$ Mn, 2017-2031

Table 5: Global Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Table 6: Global Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Table 7: Global Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Table 8: Global Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Table 9: Global Industrial Heater Market, by Region, Thousand Units, 2017-2031

Table 10: Global Industrial Heater Market, by Region, US$ Mn, 2017-2031

Table 11: North America Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Table 12: North America Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Table 13: North America Industrial Heater Market, by Category, Thousand Units, 2017-2031

Table 14: North America Industrial Heater Market, by Category, US$ Mn, 2017-2031

Table 15: North America Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Table 16: North America Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Table 17: North America Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Table 18: North America Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Table 19: North America Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Table 20: North America Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Table 21: Europe Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Table 22: Europe Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Table 23: Europe Industrial Heater Market, by Category, Thousand Units, 2017-2031

Table 24: Europe Industrial Heater Market, by Category, US$ Mn, 2017-2031

Table 25: Europe Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Table 26: Europe Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Table 27: Europe Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Table 28: Europe Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Table 29: Europe Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Table 30: Europe Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Table 31: Middle East & Africa Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Table 32: Middle East & Africa Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Table 33: Middle East & Africa Industrial Heater Market, by Category, Thousand Units, 2017-2031

Table 34: Middle East & Africa Industrial Heater Market, by Category, US$ Mn, 2017-2031

Table 35: Middle East & Africa Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Table 36: Middle East & Africa Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Table 37: Middle East & Africa Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Table 38: Middle East & Africa Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Table 39: Middle East & Africa Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Table 40: Middle East & Africa Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Table 41: South America Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Table 42: South America Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Table 43: South America Industrial Heater Market, by Category, Thousand Units, 2017-2031

Table 44: South America Industrial Heater Market, by Category, US$ Mn, 2017-2031

Table 45: South America Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Table 46: South America Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Table 47: South America Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Table 48: South America Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Table 49: South America Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Table 50: South America Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

List of Figures

Figure 1: Global Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 2: Global Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 3: Global Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 4: Global Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 5: Global Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 6: Global Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 7: Global Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 8: Global Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 9: Global Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 10: Global Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 11: Global Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 12: Global Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 13: Global Industrial Heater Market, by Region, Thousand Units, 2017-2031

Figure 14: Global Industrial Heater Market, by Region, US$ Mn, 2017-2031

Figure 15: Global Industrial Heater Market Incremental Opportunity, by Region, US$ Mn, 2017-2031

Figure 16: North America Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 17: North America Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 18: North America Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 19: North America Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 20: North America Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 21: North America Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 22: North America Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 23: North America Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 24: North America Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 25: North America Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 26: North America Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 27: North America Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 28: North America Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Figure 29: North America Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Figure 30: North America Industrial Heater Market Incremental Opportunity, by Country/Sub-region, US$ Mn, 2017-2031

Figure 31: Europe Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 32: Europe Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 33: Europe Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 34: Europe Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 35: Europe Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 36: Europe Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 37: Europe Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 38: Europe Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 39: Europe Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 40: Europe Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 41: Europe Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 42: Europe Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 43: Europe Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Figure 44: Europe Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Figure 45: Europe Industrial Heater Market Incremental Opportunity, by Country/Sub-region, US$ Mn, 2017-2031

Figure 46: Asia Pacific Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 47: Asia Pacific Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 48: Asia Pacific Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 49: Asia Pacific Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 50: Asia Pacific Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 51: Asia Pacific Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 52: Asia Pacific Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 53: Asia Pacific Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 54: Asia Pacific Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 55: Asia Pacific Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 56: Asia Pacific Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 57: Asia Pacific Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 58: Asia Pacific Industrial Heater Market, by Country/Sub-region, Thousand Units, 2017-2031

Figure 59: Asia Pacific Industrial Heater Market, by Country/Sub-region, US$ Mn, 2017-2031

Figure 60: Asia Pacific Industrial Heater Market Incremental Opportunity, by Country/Sub-region, US$ Mn, 2017-2031

Figure 61: Middle East & Africa Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 62: Middle East & Africa Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 63: Middle East & Africa Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 64: Middle East & Africa Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 65: Middle East & Africa Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 66: Middle East & Africa Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 67: Middle East & Africa Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 68: Middle East & Africa Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 69: Middle East & Africa Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 70: Middle East & Africa Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 71: Middle East & Africa Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 72: Middle East & Africa Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 73: Middle East & Africa Industrial Heater Market, by Country/sub-region, Thousand Units, 2017-2031

Figure 74: Middle East & Africa Industrial Heater Market, by Country/sub-region, US$ Mn, 2017-2031

Figure 75: Middle East & Africa Industrial Heater Market Incremental Opportunity, by Country/sub-region, US$ Mn, 2017-2031

Figure 76: South America Industrial Heater Market, by Product Type, Thousand Units, 2017-2031

Figure 77: South America Industrial Heater Market, by Product Type, US$ Mn, 2017-2031

Figure 78: South America Industrial Heater Market Incremental Opportunity, by Product Type, US$ Mn, 2017-2031

Figure 79: South America Industrial Heater Market, by Category, Thousand Units, 2017-2031

Figure 80: South America Industrial Heater Market, by Category, US$ Mn, 2017-2031

Figure 81: South America Industrial Heater Market Incremental Opportunity, by Category, US$ Mn, 2017-2031

Figure 82: South America Industrial Heater Market, by End-use Industry, Thousand Units, 2017-2031

Figure 83: South America Industrial Heater Market, by End-use Industry, US$ Mn, 2017-2031

Figure 84: South America Industrial Heater Market Incremental Opportunity, by End-use Industry, US$ Mn, 2017-2031

Figure 85: South America Industrial Heater Market, by Distribution Channel, Thousand Units, 2017-2031

Figure 86: South America Industrial Heater Market, by Distribution Channel, US$ Mn, 2017-2031

Figure 87: South America Industrial Heater Market Incremental Opportunity, by Distribution Channel, US$ Mn, 2017-2031

Figure 88: South America Industrial Heater Market, by Country/sub-region, Thousand Units, 2017-2031

Figure 89: South America Industrial Heater Market, by Country/sub-region, US$ Mn, 2017-2031

Figure 90: South America Industrial Heater Market Incremental Opportunity, by Country/sub-region, US$ Mn, 2017-2031