Reports

Reports

Analyst Viewpoint

Growing awareness regarding importance of consuming grilled food is expected to drive the industrial and bar-b-que charcoal market growth in the next few years. Rise in popularity of outdoor grilling and the unique flavor imparted by charcoal to grilled food are further boosting the demand for premium quality lump charcoal for grilling.

Rise in urbanization and rapid industrialization are generating significant industrial wastewater. The need for purification of industrial wastewater is boosting the demand for charcoal and consequently, propelling the industrial and bar-b-que charcoal market demand. Furthermore, restaurants are engaging in providing more varieties of barbequed meals owing to growing preference for less-oily grilled food coupled with rising frequency of outdoor cooking. This is estimated to positively influence market progress in the near future.

Industrial grill charcoal generates low amounts of ash, which makes it a preferred choice among manufacturers of steel. Charcoal is used in furnaces, for ferro-silica, metal hardening, in the metal industry. Demand for crude steel is expected to cross 44 metric tons in 2023. This, in turn, is estimated to propel the demand for industrial charcoal in the steel industry.

Bar-b-que grills and accessories are witnessing an increasing demand among households as well as HoReCa owners, as grilling retains the nutritious value of food items. However, the fact that charcoal cooking generates large volumes of smoke can’t be ignored. Furthermore, certain meats, if cooked at extremely high temperature, are likely to turn carcinogenic. Consequently, end-users are resorting to gas for grilling, as it generates less polycyclic aromatic hydrocarbons and smoke. This factor is likely to influence charcoal consumption patterns during the forecast period. Moreover, one of the latest industrial and bar-b-que charcoal market trends is the use of smokeless industrial charcoal for manufacturing grills and bituminous coal for industrial purposes.

Rise in camping and trekking activities, post Covid-19, is driving the demand for outdoor cooking, which in turn is fueling the expansion of charcoal production and distribution. According to Traeger, a prominent BBQ grill maker, in 2020, the company reported a revenue of US$ 545.8 Mn, which was a 50.2% increase as compared to the revenue generated in 2019.

Increase in sales of bar-b-que grills due to growing consumption of grilled meat items is expected to offer significant industrial and bar-b-que charcoal market opportunities for restaurants in the next few years. Furthermore, several people prefer the flavor and experience of cooking with charcoal. This is also estimated to drive the demand for bar-b-que charcoal.

Grilling of meat and food items helps retain more nutrients in comparison with the other options such as frying and baking. Increase in awareness about the importance of grilling has prompted major bar-b-que companies to establish chain of bar-b-que restaurants. In 2021, Dockey’s Barneque Pit opened six new barbecue franchises in the major cities of Texas, New Mexico, New Jersey, California, Arkansas, and Arizona in the U.S. This is likely to drive the demand for bulk barbecue charcoal for restaurants to be used in grilling.

Premium quality lump charcoal for grilling is also preferred by large restaurants, as it comprises setting bigger chunks on top or saving them for smoking. This is projected to drive charcoal processing and distribution during the forecast period.

Latin America accounts for the largest share of the global industrial and bar-b-que charcoal market due to large-scale consumption of charcoal in the steel industry in the region in order to improve the quality of steel and curtail greenhouse gas emissions. Brazil has extensively invested in mass plantation of eucalyptus trees to produce charcoal that can be used in blast furnaces.

According to the latest region-wise industrial and bar-b-que charcoal market analysis, growing demand for bar-b-que grill in households in the U.S. and Canada is expected to drive the industrial and bar-b-que charcoal industry share held by North America during the forecast period. As per Hearth, Patio and Barbecue Association’s Baebeque Industry Report, the year 2021 witnessed 70% of households in the U.S. and Canada owning at least a smoker or grill.

As per the Earthworm Foundation Charcoal Customs Data Charcoal Bags Analysis 2022, the European Union, in 2021, imported more than 600,000 tons of charcoal for bar-b-que applications. Consistent demand for bar-b-que charcoal is expected to drive demand in Europe during the forecast period. The industrial and bar-b-que charcoal market in Asia Pacific’s is expected to grow due to rising popularity of bar-b-cue cooking in restaurants across India.

As per the latest industrial and bar-b-que charcoal market analysis, leading companies operating in the global market are engaging in mergers and acquisitions to expand their product portfolios and consolidate their presence in the global market. They are also focusing on research and development to offer new eco-friendly varieties of charcoal at a lower price. A few prominent players operating in the global market are Gryfskand sp. Z.o.o, Namchar, MAUROBERA SA, PT Dharma Hutani Makmur, Duraflame Inc., BRICAPAR SAE Charcoal Briquettes, The Saint Louis Charcoal Company, LLC, Royal Oak Enterprises, LLC, Timber Charcoal Co., Mesjaya Abadi Sdn Bhd, Parker Charcoal Company, and Kingsford Products Company.

Key players in the industrial and bar-b-que charcoal market report have been profiled based on various parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 2.3 Bn |

| Forecast (Value) in 2031 | US$ 3.4 Bn |

| Growth Rate (CAGR) | 4.3% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value and Kilo Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Industrial and Bar-b-que Charcoal Industry Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available Upon Request |

| Pricing | Available Upon Request |

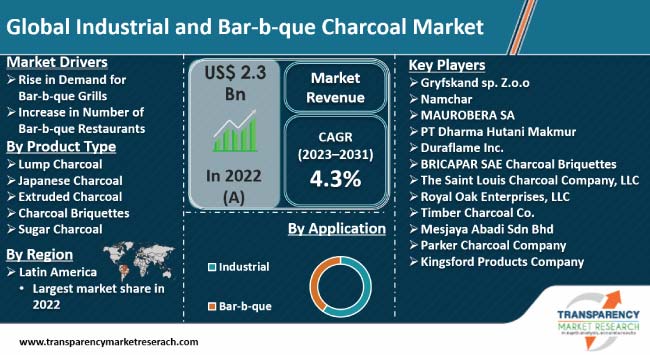

It was valued at US$ 2.3 Bn in 2022

It is projected to expand at a CAGR of 4.3% from 2023 to 2031

Increase in demand for bar-b-que grills and rise in number of bar-b-que restaurants

In terms of application, the industrial segment held largest share in 2022

Latin America is estimated to dominate in the next few years

Gryfskand sp. Z.o.o, Namchar, MAUROBERA SA, PT Dharma Hutani Makmur, Duraflame Inc., BRICAPAR SAE Charcoal Briquettes, The Saint Louis Charcoal Company, LLC, Royal Oak Enterprises, LLC, Timber Charcoal Co., Mesjaya Abadi Sdn Bhd, Parker Charcoal Company, and Kingsford Products Company

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Global Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2022-2031

2.6.1. Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons)

2.6.2. Global Industrial and Bar-b-que Charcoal Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Raw Material Suppliers

2.9.2. List of Key Manufacturers

2.9.3. List of Key Suppliers

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Industrial and Bar-b-que Charcoal

3.2. Impact on the Demand of Industrial and Bar-b-que Charcoal– Pre & Post Crisis

4. Production Output Analysis(Kilo Tons), 2022

4.1. North America

4.2. Europe

4.3. Asia Pacific

4.4. Latin America

4.5. Middle East & Africa

5. Impact of Current Geopolitical Scenario on Market

6. Price Trend Analysis and Forecast (US$/Ton), 2020-2031

6.1. Price Trend Analysis by Product Type

6.2. Price Trend Analysis by Region

7. Industrial and Bar-b-que Charcoal Market Analysis and Forecast, by Product Type, 2020–2031

7.1. Introduction and Definitions

7.2. Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

7.2.1. Lump Charcoal

7.2.2. Japanese Charcoal

7.2.2.1. Black Charcoal

7.2.2.2. White Charcoal

7.2.3. Extruded Charcoal

7.2.4. Charcoal Briquettes

7.2.5. Sugar Charcoal

7.3. Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

8. Global Industrial and Bar-b-que Charcoal Market Analysis and Forecast, by Application, 2020–2031

8.1. Introduction and Definitions

8.2. Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

8.2.1. Industrial

8.2.1.1. Metal Industry

8.2.1.2. Chemicals Industry

8.2.1.3. Cement Industry

8.2.2. Bar-b-ques (excluding primary cooking fuel)

8.3. Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

9. Global Industrial and Bar-b-que Charcoal Market Analysis and Forecast, by Region, 2020–2031

9.1. Key Findings

9.2. Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Region, 2020–2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Region

10. North America Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2020–2031

10.1. Key Findings

10.2. North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.3. North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

10.4. North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country, 2020–2031

10.4.1. U.S. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.4.2. U.S. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.4.3. Canada Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

10.4.4. Canada Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

10.5. North America Industrial and Bar-b-que Charcoal Market Attractiveness Analysis

11. Europe Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.3. Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

11.4. Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

11.4.1. Germany Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.2. Germany. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.4.3. France Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.4. France. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.4.5. U.K. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.6. U.K. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.4.7. Italy Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.8. Italy Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.4.9. Russia & CIS Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.10. Russia & CIS Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.4.11. Rest of Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

11.4.12. Rest of Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

11.5. Europe Industrial and Bar-b-que Charcoal Market Attractiveness Analysis

12. Asia Pacific Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2020–2031

12.1. Key Findings

12.2. Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type

12.3. Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

12.4. Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

12.4.1. China Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.2. China Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

12.4.3. Japan Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.4. Japan Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

12.4.5. India Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.6. India Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

12.4.7. ASEAN Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.8. ASEAN Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

12.4.9. Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

12.4.10. Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

12.5. Asia Pacific Industrial and Bar-b-que Charcoal Market Attractiveness Analysis

13. Latin America Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2022–2031

13.1. Key Findings

13.2. Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.3. Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

13.4. Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

13.4.1. Brazil Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.2. Brazil Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

13.4.3. Mexico Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.4. Mexico Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

13.4.5. Rest of Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

13.4.6. Rest of Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

13.5. Latin America Industrial and Bar-b-que Charcoal Market Attractiveness Analysis

14. Middle East & Africa Industrial and Bar-b-que Charcoal Market Analysis and Forecast, 2022–2031

14.1. Key Findings

14.2. Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.3. Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Application, 2020–2031

14.4. Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2020-2031

14.4.1. GCC Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.2. GCC Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

14.4.3. South Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.4. South Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

14.4.5. Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, by Product Type, 2020–2031

14.4.6. Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) and Value (US$ Mn) Forecast, Application, 2020–2031

14.5. Middle East & Africa Industrial and Bar-b-que Charcoal Market Attractiveness Analysis

15. Competition Landscape

15.1. Global Industrial and Bar-b-que Charcoal Company Market Share Analysis, 2022

15.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

15.2.1. Gryfskand sp. Z.o.o

15.2.1.1. Company Revenue

15.2.1.2. Business Overview

15.2.1.3. Product Segments

15.2.1.4. Geographic Footprint

15.2.1.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.1.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.2. Namchar

15.2.2.1. Company Revenue

15.2.2.2. Business Overview

15.2.2.3. Product Segments

15.2.2.4. Geographic Footprint

15.2.2.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.2.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.3. MAUROBERA SA

15.2.3.1. Company Revenue

15.2.3.2. Business Overview

15.2.3.3. Product Segments

15.2.3.4. Geographic Footprint

15.2.3.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.3.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.4. PT Dharma Hutani Makmur

15.2.4.1. Company Revenue

15.2.4.2. Business Overview

15.2.4.3. Product Segments

15.2.4.4. Geographic Footprint

15.2.4.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.4.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.5. Duraflame Inc.

15.2.5.1. Company Revenue

15.2.5.2. Business Overview

15.2.5.3. Product Segments

15.2.5.4. Geographic Footprint

15.2.5.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.5.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.6. BRICAPAR SAE Charcoal Briquettes

15.2.6.1. Company Revenue

15.2.6.2. Business Overview

15.2.6.3. Product Segments

15.2.6.4. Geographic Footprint

15.2.6.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.6.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.7. The Saint Louis Charcoal Company, LLC

15.2.7.1. Company Revenue

15.2.7.2. Business Overview

15.2.7.3. Product Segments

15.2.7.4. Geographic Footprint

15.2.7.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.7.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.8. Royal Oak Enterprises, LLC

15.2.8.1. Company Revenue

15.2.8.2. Business Overview

15.2.8.3. Product Segments

15.2.8.4. Geographic Footprint

15.2.8.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.8.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.9. Timber Charcoal Co.

15.2.9.1. Company Revenue

15.2.9.2. Business Overview

15.2.9.3. Product Segments

15.2.9.4. Geographic Footprint

15.2.9.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.9.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.10. Mesjaya Abadi Sdn Bhd

15.2.10.1. Company Revenue

15.2.10.2. Business Overview

15.2.10.3. Product Segments

15.2.10.4. Geographic Footprint

15.2.10.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.10.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.11. Parker Charcoal Company

15.2.11.1. Company Revenue

15.2.11.2. Business Overview

15.2.11.3. Product Segments

15.2.11.4. Geographic Footprint

15.2.11.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.11.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

15.2.12. Kingsford Products Company

15.2.12.1. Company Revenue

15.2.12.2. Business Overview

15.2.12.3. Product Segments

15.2.12.4. Geographic Footprint

15.2.12.5. Production Capacity/Plant Details, etc. (*As Applicable)

15.2.12.6. Strategic Partnership, Capacity Expansion, New Product Innovation etc.

16. Primary Research: Key Insights

17. Appendix

List of Tables

Table 01: Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 02: Global Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 03: Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 04: Global Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 05: Global Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Region, 2020–2031

Table 06: Global Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Region, 2020–2031

Table 07: North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 08: North America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 09: North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 10: North America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 11: North America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Country, 2020–2031

Table 12: North America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Country, 2020–2031

Table 13: U.S. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 14: U.S. Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 15: U.S. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 16: U.S. Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application, 2020–2031

Table 17: Canada Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 18: Canada Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 19: Canada Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 20: Canada Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 21: Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 22: Europe Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 23: Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 24: Europe Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 25: Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 26: Europe Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 27: Germany Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 28: Germany Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 29: Germany Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 30: Germany Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 31: France Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 32: France Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 33: France Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 34: France Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 35: U.K. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 36: U.K. Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 37: U.K. Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 38: U.K. Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 39: Italy Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 40: Italy Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 41: Italy Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 42: Italy Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 43: Spain Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 44: Spain Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 45: Spain Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 46: Spain Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 47: Russia & CIS Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 48: Russia & CIS Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 49: Russia & CIS Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 50: Russia & CIS Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 51: Rest of Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 52: Rest of Europe Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 53: Rest of Europe Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 54: Rest of Europe Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 55: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 56: Asia Pacific Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 57: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 58: Asia Pacific Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 59: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 60: Asia Pacific Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 61: China Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 62: China Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type 2020–2031

Table 63: China Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 64: China Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 65: Japan Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 66: Japan Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 67: Japan Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 68: Japan Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 69: India Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 70: India Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 71: India Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 72: India Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 73: ASEAN Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 74: ASEAN Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 75: ASEAN Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 76: ASEAN Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 77: Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 78: Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 79: Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 80: Rest of Asia Pacific Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 81: Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 82: Latin America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 83: Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 84: Latin America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 85: Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 86: Latin America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 87: Brazil Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 88: Brazil Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 89: Brazil Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 90: Brazil Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 91: Mexico Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 92: Mexico Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 93: Mexico Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 94: Mexico Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 95: Rest of Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 96: Rest of Latin America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 97: Rest of Latin America Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 98: Rest of Latin America Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 99: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 100: Middle East & Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 101: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 102: Middle East & Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 103: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Country and Sub-region, 2020–2031

Table 104: Middle East & Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Country and Sub-region, 2020–2031

Table 105: GCC Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 106: GCC Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 107: GCC Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 108: GCC Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 109: South Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 110: South Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 111: South Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 112: South Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

Table 113: Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Product Type, 2020–2031

Table 114: Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Product Type, 2020–2031

Table 115: Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume (Kilo Tons) Forecast, by Application, 2020–2031

Table 116: Rest of Middle East & Africa Industrial and Bar-b-que Charcoal Market Value (US$ Mn) Forecast, by Application 2020–2031

List of Figures

Figure 01: Global Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 02: Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 03: Global Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 04: Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 05: Global Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 06: Global Industrial and Bar-b-que Charcoal Market Attractiveness, by Region

Figure 07: North America Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 08: North America Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 09: North America Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 10: North America Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 11: North America Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 12: North America Industrial and Bar-b-que Charcoal Market Attractiveness, by Country and Sub-region

Figure 13: Europe Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 14: Europe Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 15: Europe Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 16: Europe Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 17: Europe Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 18: Europe Industrial and Bar-b-que Charcoal Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 20: Asia Pacific Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 21: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 22: Asia Pacific Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 23: Asia Pacific Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 24: Asia Pacific Industrial and Bar-b-que Charcoal Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 26: Latin America Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 27: Latin America Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 28: Latin America Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 29: Latin America Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Latin America Industrial and Bar-b-que Charcoal Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 32: Middle East & Africa Industrial and Bar-b-que Charcoal Market Attractiveness, by Product Type

Figure 33: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Application, 2022, 2027, and 2031

Figure 34: Middle East & Africa Industrial and Bar-b-que Charcoal Market Attractiveness, by Application

Figure 35: Middle East & Africa Industrial and Bar-b-que Charcoal Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 36: Middle East & Africa Industrial and Bar-b-que Charcoal Market Attractiveness, by Country and Sub-region