Reports

Reports

Analysts’ Viewpoint

The global industrial absorbents market is at a crossroads, owing to a confluence of rising environmental consciousness, rigorous regulatory demands, and rising industrialization across key industries.

One of the most notable industrial absorbents market trends is the growing need for environmentally friendly and technologically superior absorbent solutions. Manufacturers are progressively emphasizing on goods with great absorbency, reusability, and environmental friendliness.

Furthermore, key industry companies are banding together to capitalize on complementary capabilities, broaden market reach, and improve product ranges. This development indicates a mature market, as firms aim to provide complete solutions to cater to the different demands of the sector.

Demand for high-performance absorbents is expected to remain strong as industries adapt and environmental concerns grow. Furthermore, technology breakthroughs, legislative reforms, and the creation of new industry verticals are likely to influence the industrial absorbents market growth in the coming years.

Industrial absorbents play an important role in properly handling spills and leaks in various sectors, guaranteeing worker safety, compliance with environmental requirements, and ecosystem integrity. Their major role is to absorb and hold diverse dangerous substances, such as oils, chemicals, and other liquids, limiting their dispersal and possible injury.

The industrial absorbents market revenue growth has been substantial in the last few years as a result of rising environmental concerns, tighter regulatory frameworks, and increased awareness of occupational safety. Manufacturing, petrochemicals, automotive, and healthcare industries rely significantly on industrial absorbents to respond rapidly to spillage situations and limit their possible implications.

Industrial absorbents comprise various goods, which includes both natural materials such as clay, diatomaceous earth, and peat moss and manufactured materials such as polypropylene and cellulose. Furthermore, technical advances have resulted in the creation of novel absorbent solutions with improved absorbency capabilities, reusability, and biodegradability.

Growing concerns about the environment and increasing need for enterprises to scrutinize their environmental effect are projected to propel the global industrial absorbents industry in the near future. The need for environmentally friendly, high-performance absorbent materials is projected to drive innovation and determine the future of spill management solutions in various sectors throughout the world.

The use of oil & gas has expanded dramatically over the world, driving up production to cater to the global demand. The risk of an oil spill is considerably high during the extraction process. Consequently, industrial absorbents are employed to protect people and the environment. This has led to a surge in demand for industrial absorbents in the last few years.

In the case of a spill, industrial absorbents are utilized to immediately clean and absorb oils and chemicals. Certain industrial absorbents may absorb liquids up to 70 times their weight. These absorbents are chemically inert and may be used on any surface or chemical.

The anticipated increase in the use of industrial absorbents in the oil & gas industry provides manufacturers with opportunity to innovate and develop absorbent materials that are both efficient and cost-effective. The discovery of new crude oil and natural gas resources boosts the industrial absorbent business opportunities for manufacturers across the globe.

Accidental oil spills, fuel discharge during oil processing, on-floor spillage, leakage through large-scale offshore petroleum facilities, mishaps during oil drilling, and oceanic oil transportation are all major sources of oil spillage. Oil spills can pose a significant hazard to the environment. Absorbents are increasingly being employed for oil spill cleanup because of their low cost of manufacture, minimal environmental effect, and low energy consumption.

Industrial absorbents contribute to the safety of people and the environment by controlling oil spills and decreasing pollution caused by spills. Therefore, industry rules for workplace and environmental safety are projected to positively influence the industrial absorbent markets outlook in the near future.

Growing environmental concerns regarding oil and chemical spills is one of the major reasons driving the global industrial absorbents market demand. The use of industrial absorbents assists in the compliance with various state and federal standards, including the OSHA rule.

North America and Europe have enacted stringent regulatory systems to combat chemical and oil-related catastrophes. Governments in North America have formulated stringent spill control legislation, as defined by the United States Environmental Protection Agency (EPA), with a particular emphasis on the oil & gas sector. These policies promote resource conservation, environmental preservation, cultural resource protection, worker safety, and public health. This regulatory environment presents significant industrial absorbents market opportunities, particularly for companies specializing in spill control and management solutions.Top of Form

Environmental consciousness and pressure to comply with severe environmental requirements for spill control and response, as well as pollution reduction caused by spills is increasing. Increased instances of small and significant liquid spills in numerous end-use sectors and rapid industrialization witnessed in China, Japan, India, and South Korea are fueling the Asia Pacific industrial absorbents market growth.

According to the latest region-wise industrial absorbents market analysis, North America accounted for a prominent share of the global industrial absorbents business by 2022. This dominance is expected to continue and even expand in the foreseeable future. Rapid expansion of industries in the U.S. and Canada, notably in the oil & gas sector, is one of the key drivers of the market in the region. Expansion of businesses in North America, the need for high-quality, effective industrial absorbents, and persistent concerns about the environment are projected to strengthen the region’s industrial absorbents market share in the next few years.

Rise in industrialization and profitable presence of key manufacturers are also contributing to the growth of the market in North America. The region's industrial absorbents market demand is also expected to rise in the near future due to the installation of tight rules in industries to ensure worker safety.

The industrial absorbents market size in Asia Pacific is likely to increase consistently, propelled by the rise of major end-use industries such as oil & gas, chemicals, and automotive. China, India, Japan, and South Korea are at the vanguard of this expansion, owing to their different industrial landscapes and stringent regulatory regimes. Demand for industrial absorbents is likely to rise in the region, as industries in these nations continue to expand and innovate, thereby bolstering the region's importance in the global market.

Prominent players in the global industrial absorbents business have adopted diverse strategies to maintain and expand their market presence. According to the latest Industrial Absorbents industry research report, the landscape is healthy, with several opportunities for growth and innovation. The 3M Company, Brady Worldwide Inc., Oil-Dri Corporation of America, Decorus Europe, Kimberly-Clark Worldwide Inc., Johnson Matthey, Meltblown Technologies Inc., Tolsa, New Pig Corporation, ANSELL Ltd, and EP Minerals and some of the key entities operating in the global market.

Key players in the industrial absorbents market research report have been profiled based on various parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2022 | US$ 4.5 Bn |

| Forecast (Value) in 2031 | US$ 6.4 Bn |

| Growth Rate (CAGR) | 4.0% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2020-2022 |

| Quantitative Tons | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes segment analysis as well as regional level analysis. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces Analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

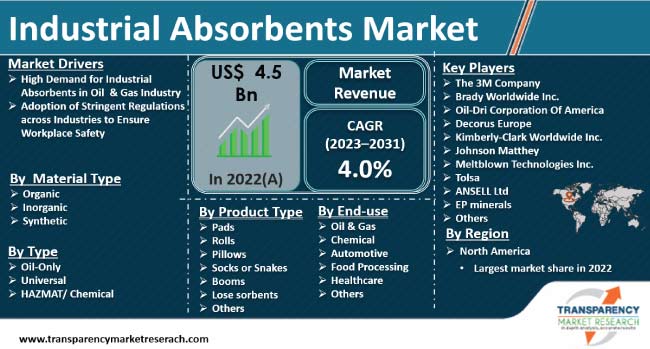

The global market was valued at US$ 4.5 Bn in 2022

It is expected to expand at a CAGR of 4.0% from 2023 to 2031

High demand for industrial absorbents in the oil & gas industry and adoption of stringent regulations in industries to ensure workplace safety

In terms of material type, the organic segment held the largest share in 2022

North America was the most lucrative region in 2022

The 3M Company, Brady Worldwide Inc., Oil-Dri Corporation of America, Decorus Europe, Kimberly-Clark Worldwide Inc., Johnson Matthey, Meltblown Technologies Inc., Tolsa, New Pig Corporation, ANSELL Ltd, EP Minerals.

1. Executive Summary

1.1. Global Market Outlook

1.2. Demand Side Trends

1.3. Key Facts and Figures

1.4. Trends Impacting Market

1.5. TMR’s Growth Opportunity Wheel

2. Market Overview

2.1. Market Segmentation

2.2. Key Developments

2.3. Market Definitions

2.4. Key Market Trends

2.5. Market Dynamics

2.5.1. Drivers

2.5.2. Restraints

2.5.3. Opportunities

2.6. Industrial Absorbents Market Analysis and Forecast, 2023-2031

2.6.1. Industrial Absorbents Market Volume (Tons)

2.6.2. Industrial Absorbents Market Value (US$ Mn)

2.7. Porter’s Five Forces Analysis

2.8. Regulatory Landscape

2.9. Value Chain Analysis

2.9.1. List of Component Providers

2.9.2. List of Manufacturers

2.9.3. List of Dealer/Distributors

2.9.4. List of Potential Customers

2.10. Product Specification Analysis

2.11. Production Overview

2.12. Cost Structure Analysis

3. COVID-19 Impact Analysis

3.1. Impact on the Supply Chain of the Industrial Absorbents

3.2. Impact on the Demand of Industrial Absorbents – Pre & Post Crisis

4. Impact of Current Geopolitical Scenario on Market

5. Production Output Analysis (Tons)

5.1. North America

5.2. Europe

5.3. Asia Pacific

5.4. Latin America

5.5. Middle East and Africa

6. Price Trend Analysis and Forecast (US$/Ton), 2023-2031

6.1. Price Comparison Analysis by Material Type

6.2. Price Comparison Analysis by Region

7. Industrial Absorbents Market Analysis and Forecast, by Material Type, 2023-2031

7.1. Introduction and Definitions

7.2. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

7.2.1. Organic

7.2.2. Inorganic

7.2.3. Synthetic

7.3. Industrial Absorbents Market Attractiveness, by Material Type

8. Industrial Absorbents Market Analysis and Forecast, by Type, 2023-2031

8.1. Introduction and Definitions

8.2. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

8.2.1. Oil-only

8.2.2. Universal

8.2.3. HAZMAT / Chemical

8.3. Industrial Absorbents Market Attractiveness, by Type

9. Industrial Absorbents Market Analysis and Forecast, by Product Type, 2023-2031

9.1. Introduction and Definitions

9.2. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

9.2.1. Pads

9.2.2. Rolls

9.2.3. Pillows

9.2.4. Socks or snakes

9.2.5. Booms

9.2.6. Lose Sorbents

9.2.6.1. Granules

9.2.6.2. Flakes

9.2.6.3. Powder

9.2.7. Others

9.3. Industrial Absorbents Market Attractiveness, by Product Type

10. Industrial Absorbents Market Analysis and Forecast, by End-use, 2023-2031

10.1. Introduction and Definitions

10.2. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

10.2.1. Oil & Gas

10.2.2. Chemical

10.2.3. Automotive

10.2.4. Food Processing

10.2.5. Healthcare

10.2.6. Others

10.3. Industrial Absorbents Market Attractiveness, by End-use

11. Industrial Absorbents Market Analysis and Forecast, by Region, 2023-2031

11.1. Key Findings

11.2. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2023-2031

11.2.1. North America

11.2.2. Europe

11.2.3. Asia Pacific

11.2.4. Latin America

11.2.5. Middle East & Africa

11.3. Industrial Absorbents Market Attractiveness, by Region

12. North America Industrial Absorbents Market Analysis and Forecast, 2023-2031

12.1. Key Findings

12.2. North America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

12.3. North America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.4. North America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

12.5. North America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.6. North America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2023-2031

12.6.1. U.S. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

12.6.2. U.S. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.6.3. U.S. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

12.6.4. U.S. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.6.5. Canada Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

12.6.6. Canada Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

12.6.7. Canada Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

12.6.8. Canada Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

12.7. North America Industrial Absorbents Market Attractiveness Analysis

13. Europe Industrial Absorbents Market Analysis and Forecast, 2023-2031

13.1. Key Findings

13.2. Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.3. Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.4. Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.5. Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6. Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

13.6.1. Germany Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material, 2023-2031

13.6.2. Germany Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.3. Germany Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.4. Germany. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6.5. France Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.6.6. France Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.7. France Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.8. France. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6.9. U.K. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.6.10. U.K. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.11. U.K. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.12. U.K. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6.13. Italy Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.6.14. Italy. Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.15. Italy Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.16. Italy Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6.17. Russia & CIS Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.6.18. Russia & CIS Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.19. Russia & CIS Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.20. Russia & CIS Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.6.21. Rest of Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

13.6.22. Rest of Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

13.6.23. Rest of Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

13.6.24. Rest of Europe Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

13.7. Europe Industrial Absorbents Market Attractiveness Analysis

14. Asia Pacific Industrial Absorbents Market Analysis and Forecast, 2023-2031

14.1. Key Findings

14.2. Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type

14.3. Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.4. Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.5. Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.6. Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

14.6.1. China Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

14.6.2. China Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.6.3. China Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.6.4. China Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.6.5. Japan Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

14.6.6. Japan Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.6.7. Japan Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.6.8. Japan Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.6.9. India Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

14.6.10. India Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.6.11. India Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.6.12. India Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.6.13. ASEAN Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

14.6.14. ASEAN Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.6.15. ASEAN Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.6.16. ASEAN Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.6.17. Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

14.6.18. Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

14.6.19. Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

14.6.20. Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

14.7. Asia Pacific Industrial Absorbents Market Attractiveness Analysis

15. Latin America Industrial Absorbents Market Analysis and Forecast, 2023-2031

15.1. Key Findings

15.2. Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type Coat Type, 2023-2031

15.3. Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.4. Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

15.5. Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

15.6. Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

15.6.1. Brazil Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

15.6.2. Brazil Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.6.3. Brazil Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

15.6.4. Brazil Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

15.6.5. Mexico Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

15.6.6. Mexico Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.6.7. Mexico Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

15.6.8. Mexico Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

15.6.9. Rest of Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

15.6.10. Rest of Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

15.6.11. Rest of Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

15.6.12. Rest of Latin America Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

15.7. Latin America Industrial Absorbents Market Attractiveness Analysis

16. Middle East & Africa Industrial Absorbents Market Analysis and Forecast, 2023-2031

16.1. Key Findings

16.2. Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

16.3. Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

16.4. Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

16.5. Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

16.6. Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

16.6.1. GCC Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

16.6.2. GCC Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

16.6.3. GCC Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

16.6.4. GCC Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

16.6.5. South Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

16.6.6. South Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

16.6.7. South Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type,2023-2031

16.6.8. South Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

16.6.9. Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Material Type, 2023-2031

16.6.10. Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Type, 2023-2031

16.6.11. Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by Product Type, 2023-2031

16.6.12. Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) and Value (US$ Mn) Forecast, by End-use, 2023-2031

16.7. Middle East & Africa Industrial Absorbents Market Attractiveness Analysis

17. Competition Landscape

17.1. Market Players - Competition Matrix (by Tier and Size of Companies)

17.2. Market Share Analysis, 2021

17.3. Market Footprint Analysis

17.3.1. By Type

17.3.2. By Region

17.4. Company Profiles

17.4.1. The 3M Company

17.4.1.1. Company Revenue

17.4.1.2. Business Overview

17.4.1.3. Product Segments

17.4.1.4. Geographic Footprint

17.4.1.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.1.6. Strategic Partnership, New Product Innovation, etc.

17.4.2. Brady worldwide Inc.

17.4.2.1. Company Revenue

17.4.2.2. Business Overview

17.4.2.3. Product Segments

17.4.2.4. Geographic Footprint

17.4.2.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.2.6. Strategic Partnership, New Product Innovation, etc.

17.4.3. Oil-Dri Corporation of America.

17.4.3.1. Company Revenue

17.4.3.2. Business Overview

17.4.3.3. Product Segments

17.4.3.4. Geographic Footprint

17.4.3.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.3.6. Strategic Partnership, New Product Innovation, etc.

17.4.4. Decorus Europe

17.4.4.1. Company Revenue

17.4.4.2. Business Overview

17.4.4.3. Product Segments

17.4.4.4. Geographic Footprint

17.4.4.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.4.6. Strategic Partnership, New Product Innovation, etc.

17.4.5. Kimberly-Clark Worldwide Inc.

17.4.5.1. Company Revenue

17.4.5.2. Business Overview

17.4.5.3. Product Segments

17.4.5.4. Geographic Footprint

17.4.5.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.5.6. Strategic Partnership, New Product Innovation, etc.

17.4.6. Johnson Matthey

17.4.6.1. Company Revenue

17.4.6.2. Business Overview

17.4.6.3. Product Segments

17.4.6.4. Geographic Footprint

17.4.6.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.6.6. Strategic Partnership, New Product Innovation, etc.

17.4.7. Meltblown Technologies Inc.

17.4.7.1. Company Revenue

17.4.7.2. Business Overview

17.4.7.3. Product Segments

17.4.7.4. Geographic Footprint

17.4.7.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.7.6. Strategic Partnership, New Product Innovation, etc.

17.4.8. Tolsa

17.4.8.1. Company Revenue

17.4.8.2. Business Overview

17.4.8.3. Product Segments

17.4.8.4. Geographic Footprint

17.4.8.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.8.6. Strategic Partnership, New Product Innovation, etc.

17.4.9. New Pig Corporation

17.4.9.1. Company Revenue

17.4.9.2. Business Overview

17.4.9.3. Product Segments

17.4.9.4. Geographic Footprint

17.4.9.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.9.6. Strategic Partnership, New Product Innovation, etc.

17.4.10. ANSELL Ltd.

17.4.10.1. Company Revenue

17.4.10.2. Business Overview

17.4.10.3. Product Segments

17.4.10.4. Geographic Footprint

17.4.10.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.10.6. Strategic Partnership, New Product Innovation etc.

17.4.11. EP Minerals

17.4.11.1. Company Revenue

17.4.11.2. Business Overview

17.4.11.3. Product Segments

17.4.11.4. Geographic Footprint

17.4.11.5. Production Type/Plant Details, etc. (*As Applicable)

17.4.11.6. Strategic Partnership, New Product Innovation, etc.

18. Primary Research: Key Insights

19. Appendix

List of Tables

Table 1: Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 2: Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 3: Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 4: Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 5: Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 6: Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 7: Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 8: Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 9: Industrial Absorbents Market Volume (Tons) Forecast, by Region, 2023-2031

Table 10: Industrial Absorbents Market Value (US$ Mn) Forecast, by Region, 2023-2031

Table 11: North America Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 12: North America Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 13: North America Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 14: North America Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 15: North America Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 16: North America Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 17: North America Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 18: North America Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 19: North America Industrial Absorbents Market Volume (Tons) Forecast, by Country, 2023-2031

Table 20: North America Industrial Absorbents Market Value (US$ Mn) Forecast, by Country, 2023-2031

Table 21: U.S. Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 22: U.S. Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 23: U.S. Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 24: U.S. Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 25: U.S. Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 26: U.S. Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 27: U.S. Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 28: U.S. Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use, 2023-2031

Table 29: Canada Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 30: Canada Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 31: Canada Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 32: Canada Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 33: Canada Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 34: Canada Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 35: Canada Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 36: Canada Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 37: Europe Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 38: Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 39: Europe Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 40: Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 41: Europe Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 42: Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 43: Europe Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 44: Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 45: Europe Industrial Absorbents Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 46: Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 47: Germany Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 48: Germany Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 49: Germany Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 50: Germany Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 51: Germany Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 52: Germany Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 53: Germany Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 54: Germany Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 55: France Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 56: France Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 57: France Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 58: France Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 59: France Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 60: France Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 61: France Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 62: France Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 63: U.K. Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 64: U.K. Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 65: U.K. Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 66: U.K. Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 67: U.K. Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 68: U.K. Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 69: U.K. Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 70: U.K. Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 71: Italy Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 72: Italy Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 73: Italy Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 74: Italy Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 75: Italy Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 76: Italy Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 77: Italy Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 78: Italy Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 79: Spain Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 80: Spain Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 81: Spain Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 82: Spain Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 83: Spain Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 84: Spain Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 85: Spain Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 86: Spain Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 87: Russia & CIS Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 88: Russia & CIS Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 89: Russia & CIS Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 90: Russia & CIS Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 91: Russia & CIS Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 92: Russia & CIS Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 93: Russia & CIS Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 94: Russia & CIS Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 95: Rest of Europe Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 96: Rest of Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 97: Rest of Europe Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 98: Rest of Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 99: Rest of Europe Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 100: Rest of Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 101: Rest of Europe Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 102: Rest of Europe Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 103: Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 104: Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 105: Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 106: Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 107: Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 108: Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 109: Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 110: Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 111: Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 112: Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 113: China Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 114: China Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type 2023-2031

Table 115: China Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 116: China Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 117: China Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 118: China Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 119: China Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 120: China Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 121: Japan Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 122: Japan Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 123: Japan Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 124: Japan Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 125: Japan Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 126: Japan Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 127: Japan Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 128: Japan Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 129: India Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 130: India Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 131: India Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 132: India Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 133: India Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 134: India Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 135: India Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 136: India Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 137: ASEAN Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 138: ASEAN Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 139: ASEAN Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 140: ASEAN Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 141: ASEAN Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 142: ASEAN Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 143: ASEAN Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 144: ASEAN Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 145: Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 146: Rest of Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 147: Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 148: Rest of Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 149: Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 150: Rest of Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 151: Rest of Asia Pacific Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 152: Rest of Asia Pacific Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 153: Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 154: Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 155: Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 156: Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 157: Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 158: Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 159: Latin America Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 160: Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 161: Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 162: Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 163: Brazil Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 164: Brazil Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 165: Brazil Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 166: Brazil Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 167: Brazil Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 168: Brazil Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 169: Brazil Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 170: Brazil Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 171: Mexico Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 172: Mexico Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 173: Mexico Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 174: Mexico Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 175: Mexico Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 176: Mexico Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 177: Mexico Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 178: Mexico Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 179: Rest of Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 180: Rest of Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 181: Rest of Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 182: Rest of Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 183: Rest of Latin America Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 184: Rest of Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 185: Rest of Latin America Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 186: Rest of Latin America Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 187: Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 188: Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 189: Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 190: Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 191: Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 192: Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 193: Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 194: Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 195: Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Country and Sub-region, 2023-2031

Table 196: Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Country and Sub-region, 2023-2031

Table 197: GCC Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 198: GCC Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 199: GCC Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 200: GCC Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 201: GCC Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 202: GCC Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 203: GCC Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 204: GCC Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 205: South Africa Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 206: South Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 207: South Africa Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 208: South Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 209: South Africa Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 210: South Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 211: South Africa Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 212: South Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

Table 213: Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Material Type, 2023-2031

Table 214: Rest of Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Material Type, 2023-2031

Table 215: Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Type, 2023-2031

Table 216: Rest of Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Type, 2023-2031

Table 217: Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by Product Type, 2023-2031

Table 218: Rest of Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by Product Type, 2023-2031

Table 219: Rest of Middle East & Africa Industrial Absorbents Market Volume (Tons) Forecast, by End-use, 2023-2031

Table 220: Rest of Middle East & Africa Industrial Absorbents Market Value (US$ Mn) Forecast, by End-use 2023-2031

List of Figures

Figure 1: Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 2: Industrial Absorbents Market Attractiveness, by Material Type

Figure 3: Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 4: Industrial Absorbents Market Attractiveness, by Type

Figure 5: Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 6: Industrial Absorbents Market Attractiveness, by Product Type

Figure 7: Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 8: Industrial Absorbents Market Attractiveness, by End-use

Figure 9: Industrial Absorbents Market Volume Share Analysis, by Region, 2022, 2027, and 2031

Figure 10: Industrial Absorbents Market Attractiveness, by Region

Figure 11: North America Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 12: North America Industrial Absorbents Market Attractiveness, by Material Type

Figure 13: North America Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 14: North America Industrial Absorbents Market Attractiveness, by Type

Figure 15: North America Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 16: North America Industrial Absorbents Market Attractiveness, by Product Type

Figure 17: North America Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 18: North America Industrial Absorbents Market Attractiveness, by End-use

Figure 19: North America Industrial Absorbents Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 20: North America Industrial Absorbents Market Attractiveness, by Country and Sub-region

Figure 21: Europe Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 22: Europe Industrial Absorbents Market Attractiveness, by Material Type

Figure 23: Europe Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 24: Europe Industrial Absorbents Market Attractiveness, by Type

Figure 25: Europe Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 26: Europe Industrial Absorbents Market Attractiveness, by Product Type

Figure 27: Europe Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 28: Europe Industrial Absorbents Market Attractiveness, by End-use

Figure 29: Europe Industrial Absorbents Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 30: Europe Industrial Absorbents Market Attractiveness, by Country and Sub-region

Figure 31: Asia Pacific Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 32: Asia Pacific Industrial Absorbents Market Attractiveness, by Material Type

Figure 33: Asia Pacific Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 34: Asia Pacific Industrial Absorbents Market Attractiveness, by Type

Figure 35: Asia Pacific Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 36: Asia Pacific Industrial Absorbents Market Attractiveness, by Product Type

Figure 37: Asia Pacific Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 38: Asia Pacific Industrial Absorbents Market Attractiveness, by End-use

Figure 39: Asia Pacific Industrial Absorbents Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 40: Asia Pacific Industrial Absorbents Market Attractiveness, by Country and Sub-region

Figure 41: Latin America Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 42: Latin America Industrial Absorbents Market Attractiveness, by Material Type

Figure 43: Latin America Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 44: Latin America Industrial Absorbents Market Attractiveness, by Type

Figure 45: Latin America Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 46: Latin America Industrial Absorbents Market Attractiveness, by Product Type

Figure 47: Latin America Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 48: Latin America Industrial Absorbents Market Attractiveness, by End-use

Figure 49: Latin America Industrial Absorbents Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 50: Latin America Industrial Absorbents Market Attractiveness, by Country and Sub-region

Figure 51: Middle East & Africa Industrial Absorbents Market Volume Share Analysis, by Material Type, 2022, 2027, and 2031

Figure 52: Middle East & Africa Industrial Absorbents Market Attractiveness, by Material Type

Figure 53: Middle East & Africa Industrial Absorbents Market Volume Share Analysis, by Type, 2022, 2027, and 2031

Figure 54: Middle East & Africa Industrial Absorbents Market Attractiveness, by Type

Figure 55: Middle East & Africa Industrial Absorbents Market Volume Share Analysis, by Product Type, 2022, 2027, and 2031

Figure 56: Middle East & Africa Industrial Absorbents Market Attractiveness, by Product Type

Figure 57: Middle East & Africa Industrial Absorbents Market Volume Share Analysis, by End-use, 2022, 2027, and 2031

Figure 58: Middle East & Africa Industrial Absorbents Market Attractiveness, by End-use

Figure 59: Middle East & Africa Industrial Absorbents Market Volume Share Analysis, by Country and Sub-region, 2022, 2027, and 2031

Figure 60: Middle East & Africa Industrial Absorbents Market Attractiveness, by Country and Sub-region