Reports

Reports

India Single Super Phosphate (SSP) market is witnessing steadiness due to the increasing demand for efficient, cost-effective phosphorus fertilizers to improve crop productivity. SSP is produced out of the reaction of rock-phosphate and sulfuric acid and provides phosphorus and sulfur - both of which are the two most essential nutrients for crop growth - particularly oilseeds, pulses, and cash crops are pre-dominant on farms in India.

The growing investment from government in fertilizer subsidy policy and growing awareness around improving soil fertility through warm phosphates goes further in promoting the market in India. Meanwhile, the production cost of SSP is relatively less than the other phosphate fertilizers, thus propelling its mass-market adoption with small and medium farmer adoption.

Industry players are actively fostering growth via building capacity, thereby further optimizing the process, while many are strengthening distribution networks to avoid any kind of urban-rural divides. Companies are also adopting measures such as digital farmer outreach programs, partnerships with agri-cooperatives, and cultivating awareness around balanced nutrients to increase SSP uptake.

Single Super Phosphate (SSP) is one of the oldest and widely-used phosphorus based fertilizer in India. It is manufactured by treating rock phosphate with sulfuric acid. The end product is a phosphate fertilizer that contains both - phosphorus and sulfur, and an excellent source for several crops like oilseed crops, pulse crops, cereal crops, and sugarcane crops as it develops rooting, improves the health quality of the crop planter, and enhances yield.

Besides, it also delivers some sulfur, which is an important nutrient for protein synthesis and chlorophyll formation. SSP is the most economical way of delivering phosphorus, and it is widely used by small and medium sized farmers. It is delivered in granular form, which means it can be applied easily and allows balanced nutrient deliver to the soil. SSP aids in developing good soil health over time.

| Attribute | Detail |

|---|---|

| Drivers |

|

Government initiatives aimed at reducing the cost and improving the availability of fertilizers for farmers have been giving impetus to India SSP market. This includes price support under the Nutrient Based Subsidy (NBS) scheme, where SSP can be purchased by small and marginal farmers at a price close to DAP and the other phosphatic fertilizers due to this price support mechanism. This price support mechanism driven by subsidy has therefore enhanced the adoption of SSP by rural farmers selected fertilizers primarily on price.

Government initiatives around “Atmanirbhar Bharat” have also been developed to promote domestic production of fertilizing products with expanded capacity including SSP. These initiatives have encouraged manufacturers to invest in new production plants and modernizing facilities, investing in technologies that improve supply chain measures which ensures continuous availability, improved quality and collection and distribution of SSP, as the sustainable, affordable, high-quality, and reliable solution to the Indian agricultural ecosystem.

India is one of the largest producers of pulses and oilseeds - crops that require significant phosphorus and sulfur inputs for optimal growth. SSP, with approximately 16% phosphorus and 12% sulfur, caters to nutrient requirements. In oilseed crops such as groundnut, mustard, and soybean, sulfur has an important role to play in the synthesis of oil, thereby leading to better substance quality, while phosphorus promotes root growing & flowering for achieving good yields.

Pulses such as chickpeas, lentils, and pigeon peas, use nutrients supplied by SSP effectively. Phosphorus helps in the fixation of nitrogen, which is essential for protein synthesis; while sulfur promotes protein content and general health of the plant. In some areas such as Madhya Pradesh, Rajasthan and Maharashtra, soils containing sulfur are widespread, providing immense worth and significance to sick soils that will sustain crop yield and maintain soil fertility.

With continued pressure for crop producers to increase domestic production of edible oils and pulses, the Indian government has set targets and is helping programmers and initiatives to subsidize better production. Farmers are finding value in SSP due to a relatively good price to use for both the nutrients supplied in just one input. SSP can enhance both - phosphorus and sulfur deficiencies within the growing season. SSP is a saving grace to agricultural producers, especially in major oilseed and pulse production areas, as the continued agricultural goals align with India's future food security.

| Attribute | Detail |

|---|---|

| Leading State |

|

| Attribute | Detail |

|---|---|

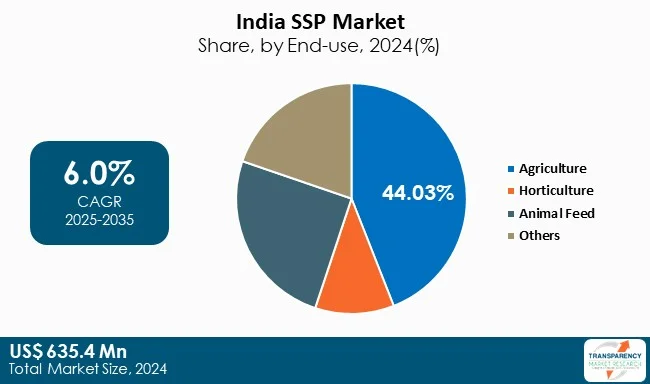

| Market Size Value in 2024 | US$ 635.4 Mn |

| Market Forecast Value in 2035 | US$ 1206.2 Mn |

| Growth Rate (CAGR) | 6.0% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Mn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the India as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, SSP market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Form

|

| Country Covered |

|

| States Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

India SSP market was valued at US$ 635.4 Mn in 2024

India SSP industry is expected to grow at a CAGR of 6.0% from 2025 to 2035

Rising government subsidies and policy support and high suitability of SSP for oilseeds and pulses cultivation.

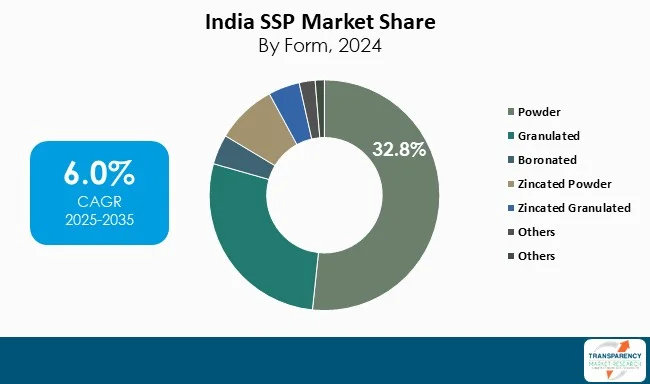

SSP powder was the largest form segment and its value is anticipated to witness a CAGR of 5.1% during the forecast period

Madhya Pradesh was the most lucrative state in 2024

Coromandel International Ltd, Jubilant, Khaitan Chemicals & Fertilizers Ltd, Rama Phosphates Ltd, Ostwal Group of Industries, Bhilai Engineering Corporation Ltd , Narmada Agro Chemicals Pvt .Ltd, KRIBHCO, Mahadhan (DFPCL), Singham Bio Crop Care Pvt. Ltd., Bohra Industries Limited, Asian Fertilizers, Mangalore Chemicals & Fertilizers Limited, Indra Industries Ltd., Bhoomi Phosphate are the major players in India SSP industry

Table 1 India SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 2 India SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 3 India SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 4 India SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 5 India SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 6 India SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 7 India SSP Market Volume (Tons) Forecast, by State, 2025 to 2035

Table 8 India SSP Market Value (US$ Mn) Forecast, by State, 2025 to 2035

Table 9 West Bengal SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 10 West Bengal SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 11 West Bengal SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 12 West Bengal SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 13 West Bengal SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 14 West Bengal SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 15 Gujarat SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 16 Gujarat SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 17 Gujarat SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 18 Gujarat SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 19 Gujarat SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 20 Gujarat SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 21 Madhya Pradesh SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 22 Madhya Pradesh SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 23 Madhya Pradesh SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 24 Madhya Pradesh SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 25 Madhya Pradesh SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 26 Madhya Pradesh SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 27 Maharashtra SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 28 Maharashtra SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 29 Maharashtra SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 30 Maharashtra SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 31 Maharashtra SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 32 Maharashtra SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 33 Chhattisgarh SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 34 Chhattisgarh SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 35 Chhattisgarh SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 36 Chhattisgarh SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 37 Chhattisgarh SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 38 Chhattisgarh SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 39 Haryana SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 40 Haryana SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 41 Haryana SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 42 Haryana SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 43 Haryana SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 44 Haryana SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 45 Punjab SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 46 Punjab SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 47 Punjab SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 48 Punjab SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 49 Punjab SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 50 Punjab SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 51 Uttar Pradesh SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 52 Uttar Pradesh SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 53 Uttar Pradesh SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 54 Uttar Pradesh SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 55 Uttar Pradesh SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 56 Uttar Pradesh SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 57 Rajasthan SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 58 Rajasthan SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 59 Rajasthan SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 60 Rajasthan SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 61 Rajasthan SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 62 Rajasthan SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 63 Andhra Pradesh SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 64 Andhra Pradesh SSP Market Value (US$ Mn) Forecast, by Form 2025 to 2035

Table 65 Andhra Pradesh SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 66 Andhra Pradesh SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 67 Andhra Pradesh SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 68 Andhra Pradesh SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 69 Telangana SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 70 Telangana SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 71 Telangana SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 72 Telangana SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 73 Telangana SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 74 Telangana SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 75 Karnataka SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 76 Karnataka SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 77 Karnataka SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 78 Karnataka SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 79 Karnataka SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 80 Karnataka SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 81 Odisha SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 82 Odisha SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 83 Odisha SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 84 Odisha SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 85 Odisha SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 86 Odisha SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Table 87 Rest of India SSP Market Volume (Tons) Forecast, by Form, 2025 to 2035

Table 88 Rest of India SSP Market Value (US$ Mn) Forecast, by Form, 2025 to 2035

Table 89 Rest of India SSP Market Volume (Tons) Forecast, by Application, 2025 to 2035

Table 90 Rest of India SSP Market Value (US$ Mn) Forecast, by Application, 2025 to 2035

Table 91 Rest of India SSP Market Volume (Tons) Forecast, by End-use, 2025 to 2035

Table 92 Rest of India SSP Market Value (US$ Mn) Forecast, by End-use, 2025 to 2035

Figure 1 India SSP Market Volume Share Analysis, by Form, 2024, 2028, and 2035

Figure 2 India SSP Market Attractiveness, by Form

Figure 3 India SSP Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 India SSP Market Attractiveness, by Application

Figure 5 India SSP Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 India SSP Market Attractiveness, by End-use

Figure 7 India SSP Market Volume Share Analysis, by States, 2024, 2028, and 2035

Figure 8 India SSP Market Attractiveness, by States