Reports

Reports

Analysts’ Viewpoint

Key players in the image sensor market are engaged in the development of back illuminated CMOS image sensor and stacked image sensor to increase the attractiveness of digital cameras all around the world. Sensor noise reduction technology and back illuminated structure are integrated to improve the signal-to-noise ratio (S/N) ratio in order to improve the realism in images captured by users. Moreover, low power consumption technology and stacked structure are integrated to achieve higher resolution and provide high speed performance.

Participants in the global image sensor business are emphasizing on various growth strategies, such as collaborations with key players, merger & acquisition, product launches, and development of worldwide distribution network, in order to increase their global image sensor market share. Asia Pacific is dominating the global market due to the presence of major smartphones manufacturers in the region. Additionally, increasing population and rising penetration of smartphones in the region is expected to further boost the image sensor industry growth in the next few years.

Image sensor is used to detect and transmit information in order to create an image. These sensors are used in both digital and analog type electronic imaging devices such as digital cameras; camera modules; night vision tools, such as radar; imaging tools used in medical, sonar, thermal imaging devices, etc. The CMOS image sensor has been gaining traction for the last decade because of its promising performance as compared to the CCD sensor. Higher resolution and image quality are needed as applications become more demanding.

CMOS sensor manufacturers are focusing on the manufacture of sensors with higher resolutions by increasing pixel counts and decreasing pixel size. Therefore CMOS sensors are widely used in various applications where high quality image data is required. Advancements in CMOS image technology have enabled CMOS image sensor to offer high level of performance. According to the latest global image sensor market trends, expanding applications of CMOS sensors is likely to propel the image sensor market development during the forecast period.

Image sensor has become important component of modern vehicles, enabling advanced driver assistance systems (ADAS) and autonomous driving features help transform driving, making it easier, safer, and more comfortable.

The popular use of image sensor in advanced driver assistance systems (ADAS) is front and rear facing cameras. In low visibility conditions, such as heavy rain or fog, front facing cameras are useful to improve the driver visibility, while rear cameras provide view of area behind the car during navigation or parking in limited places. These benefits are boosting the demand for automotive image sensor.

The performance of autonomous vehicle (AV) systems and ADAS has improved due to the development of image sensor technology, which helps to make driving more reliable and precise. According to National Association of Insurance Commissioners, around 3.5 million self-driving vehicles are expected to run on U.S. roads by 2025 and 4.5 million by 2030. This is estimated to create further growth opportunity for growth of the image sensor market in the coming years.

The future image sensor market demand in automotive applications is highly promising and advancements in image sensor are estimated to help provide more reliable and accurate data to support the development of efficient and safer ADAS. This is anticipated to further augment the image sensor industry growth in the next few years.

Sensors are important components of consumer electronics. Recently, sensors have become cheaper, much smaller, and more efficient than those in the past. These advancements in sensors have encouraged their use in portable devices (the user appeal of smartphones and tablets these days is heavily reliant on the quality of sensor solutions), gaming (sensing the user's movement allows that movement to be translated into on-screen game character motion), navigation, and home appliances.

Therefore, demand for digital image sensors is increasing in camcorders, smartphones, digital cameras, and security cameras. Increased popularity of uploading images on social networking sites via mobile phones rather than carrying a DSLR is not only increasing the need for image sensors but also encouraging image sensor manufacturers to introduce imaging products. For instance, in October 2022, OMNIVISION released 5-megapixel image sensor for professional and high-end consumer security cameras. It has near-infrared (NIR) technology to capture clear images in low-light conditions. This OS05B CMOS image sensor is suitable for professional security cameras, such as factory and industrial applications that require good footage at night while maintaining low power.

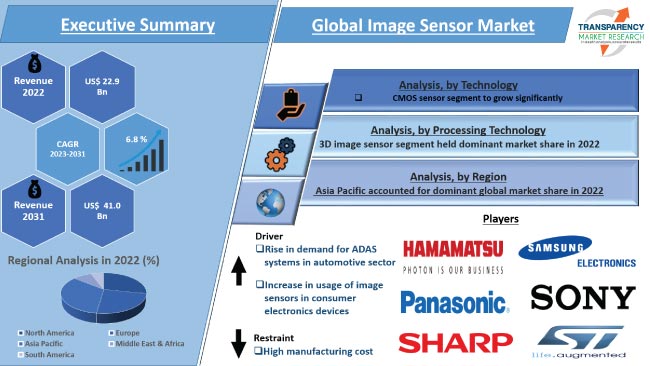

In terms of technology, the global image sensor market has been bifurcated into CMOS sensor and CCD sensor. The CMOS sensor segment held 55.65% share of the global market in 2022. It is likely to maintain its dominant position and expand at a growth rate of 7.2% during the forecast period. CMOS sensor consumes less power and its manufacturing cost is also low as compared to CCDs. Furthermore, it is suitable for fast image acquisition. Advancements in CMOS image sensor technology have improved the performance of image sensors, which is expected to boost the global image sensor market in 2023.

In terms of processing technology, the global image sensor market has been split into 2D image sensor and 3D image sensor. The 3D image sensor segment held 63.36% share in 2022. It is likely to expand at a growth rate of 7.1% during the forecast period due to extensive usage of 3D image sensors in camera modules, digital cameras, and imaging devices. Key players such as Apple INC and Microsoft Corporation are integrating 3D image sensors into laptops, smartphones, tablets, and other devices. For instance, in January 2021, Infineon Technologies AG entered into a partnership with pmdtechnologies ag to develop miniaturized 3D image sensors for facial recognition in smartphones. The miniaturized image sensor can be integrated into small devices and provides high resolution with low power consumption. This is likely to propel the image sensor market across the globe.

Asia Pacific held a prominent share of 33.65% of the global market in 2022. North America accounted for 28.23% market share in 2022.

Asia Pacific dominates the global market because of increase in adoption of image sensor in automotive applications and rise in use of image sensors to improve medical imaging solutions. Asia Pacific is a prominent hub for automotive and consumer electronics sectors. Additionally, developing healthcare, manufacturing, automotive industries as well as increase in demand from other regions, such as North America and Europe, are contributing the image sensor industry growth in Asia Pacific.

North America is anticipated to hold a significant market share during forecast period due to growing concerns about security and surveillances in public places such as malls, parks, public places, and railway stations. Moreover, terrorist activities have driven the need for higher resolution cameras, which in turn is anticipated to boost the adoption of image sensors in the next few years.

The global image sensor industry is highly fragmented due the presence of a large number of players in the market. Majority of companies are spending significantly on providing image sensors with advanced features. Expansion of product portfolios and mergers and acquisitions are notable strategies adopted by the key players. GalaxyCore Shanghai Limited Corporation, Hamamatsu Photonics K.K, OmniVision Technologies Inc., Panasonic Holdings Corporation, Samsung Electronics Co., Ltd, Semiconductor Components Industries, LLC, Sharp Corporation, SK hynix Inc., Sony Corporation, STMicroelectronics N.V, and Teledyne Technologies company are a few of the prominent companies operating in the global market.

Key players in the image sensor market report have been profiled based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Details |

|---|---|

| Market Size Value in 2022 | US$ 22.9 Bn |

| Market Forecast Value in 2031 | US$ 41.0 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value & Billion Units for Volume |

| Market Analysis | It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The global market was valued at US$ 22.9 Bn in 2022

It is expected to expand at a CAGR of 6.8% from 2023 to 2031

Rise in demand for ADAS systems in automotive sector and increase in usage of image sensor in consumer electronics devices

The CMOS sensor segment accounted for 55.65% share in 2022

The 3D image sensor segment held 63.36% share of the market in 2022

Asia Pacific is highly attractive for vendors accounted for 33.65% share in 2022

The China image sensor market was valued at US$ 3.4 Bn in 2022

GalaxyCore Shanghai Limited Corporation, Hamamatsu Photonics K.K., OmniVision Technologies Inc, Panasonic Holdings Corporation, Samsung Electronics Co., Ltd, Semiconductor Components Industries, LLC, SHARP CORPORATION, SK hynix Inc, Sony Corporation, STMicroelectronics N.V, and Teledyne Technologies company.

1. Preface

1.1. Market Introduction

1.2. Market and Segments Definition

1.3. Market Taxonomy

1.4. Research Methodology

1.5. Assumption and Acronyms

2. Executive Summary

2.1. Global Image Sensor Market Overview

2.2. Regional Outline

2.3. Industry Outline

2.4. Market Dynamics Snapshot

2.5. Competition Blueprint

3. Market Dynamics

3.1. Macro-economic Factors

3.2. Drivers

3.3. Restraints

3.4. Opportunities

3.5. Key Trends

3.6. Regulatory Framework

4. Associated Industry and Key Indicator Assessment

4.1. Parent Industry Overview - Global Optoelectronics Industry Overview

4.2. Pricing Analysis

4.3. Supply Chain Analysis

4.4. Technology Roadmap Analysis

4.5. Industry SWOT Analysis

4.6. Porter Five Forces Analysis

4.7. COVID-19 Impact and Recovery Analysis

5. Global Image Sensor Market Analysis, by Technology

5.1. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

5.1.1. CMOS Sensor

5.1.2. CCD Sensor

5.2. Market Attractiveness Analysis, by Technology

6. Global Image Sensor Market Analysis, by Image Sensor Type

6.1. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

6.1.1. Monochrome

6.1.2. Color

6.2. Market Attractiveness Analysis, by Image Sensor Type

7. Global Image Sensor Market Analysis, by Processing Technology

7.1. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

7.1.1. 2D Image Sensors

7.1.2. 3D Image Sensors

7.2. Market Attractiveness Analysis, by Processing Technology

8. Global Image Sensor Market Analysis, by Spectrum

8.1. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

8.1.1. Visible spectrum

8.1.2. Non-visible spectrum

8.2. Market Attractiveness Analysis, by Spectrum

9. Global Image Sensor Market Analysis, by Array Type

9.1. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

9.1.1. Linear Array

9.1.2. Area Array

9.2. Market Attractiveness Analysis, by Array Type

10. Global Image Sensor Market Analysis, by Resolution

10.1. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

10.1.1. > 2 MP

10.1.2. 2 MP - 5 MP

10.1.3. 6 MP - 10 MP

10.1.4. 12 MP - 16 MP

10.1.5. 17 MP - 20 MP

10.1.6. Above 20 MP

10.2. Market Attractiveness Analysis, by Resolution

11. Global Image Sensor Market Analysis, by Application

11.1. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

11.1.1. Aerospace & Defense

11.1.2. Automotive

11.1.3. Consumer Electronics

11.1.4. Life Science and Healthcare

11.1.5. Security and Surveillance

11.1.6. Others

11.2. Market Attractiveness Analysis, by Application

12. Global Image Sensor Market Analysis and Forecast, by Region

12.1. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country, 2017-2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Market Attractiveness Analysis, by Country

13. North America Image Sensor Market Analysis and Forecast

13.1. Market Snapshot

13.2. Drivers and Restraints: Impact Analysis

13.3. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

13.3.1. CMOS Sensor

13.3.2. CCD Sensor

13.4. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

13.4.1. Monochrome

13.4.2. Color

13.5. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

13.5.1. 2D Image Sensors

13.5.2. 3D Image Sensors

13.6. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

13.6.1. Visible spectrum

13.6.2. Non-visible spectrum

13.7. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

13.7.1. Linear Array

13.7.2. Area Array

13.8. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

13.8.1. > 2 MP

13.8.2. 2 MP - 5 MP

13.8.3. 6 MP - 10 MP

13.8.4. 12 MP - 16 MP

13.8.5. 17 MP - 20 MP

13.8.6. Above 20 MP

13.9. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

13.9.1. Aerospace & Defense

13.9.2. Automotive

13.9.3. Consumer Electronics

13.9.4. Life Science and Healthcare

13.9.5. Security and Surveillance

13.9.6. Others

13.10. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

13.10.1. U.S.

13.10.2. Canada

13.10.3. Rest of North America

13.11. Market Attractiveness Analysis

13.11.1. By Technology

13.11.2. By Image Sensor Type

13.11.3. By Processing Technology

13.11.4. By Spectrum

13.11.5. By Array Type

13.11.6. By Resolution

13.11.7. By Application

13.11.8. By Country/Sub-region

14. Europe Image Sensor Market Analysis and Forecast

14.1. Market Snapshot

14.2. Drivers and Restraints: Impact Analysis

14.3. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

14.3.1. CMOS Sensor

14.3.2. CCD Sensor

14.4. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

14.4.1. Monochrome

14.4.2. Color

14.5. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

14.5.1. 2D Image Sensors

14.5.2. 3D Image Sensors

14.6. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

14.6.1. Visible spectrum

14.6.2. Non-visible spectrum

14.7. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

14.7.1. Linear Array

14.7.2. Area Array

14.8. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

14.8.1. > 2 MP

14.8.2. 2 MP - 5 MP

14.8.3. 6 MP - 10 MP

14.8.4. 12 MP - 16 MP

14.8.5. 17 MP - 20 MP

14.8.6. Above 20 MP

14.9. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

14.9.1. Aerospace & Defense

14.9.2. Automotive

14.9.3. Consumer Electronics

14.9.4. Life Science and Healthcare

14.9.5. Security and Surveillance

14.9.6. Others

14.10. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

14.10.1. Germany

14.10.2. The U.K.

14.10.3. France

14.10.4. Rest of Europe

14.11. Market Attractiveness Analysis

14.11.1. By Technology

14.11.2. By Image Sensor Type

14.11.3. By Processing Technology

14.11.4. By Spectrum

14.11.5. By Array Type

14.11.6. By Resolution

14.11.7. By Application

14.11.8. By Country/Sub-region

15. Asia Pacific Image Sensor Market Analysis and Forecast

15.1. Market Snapshot

15.2. Drivers and Restraints: Impact Analysis

15.3. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

15.3.1. CMOS Sensor

15.3.2. CCD Sensor

15.4. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

15.4.1. Monochrome

15.4.2. Color

15.5. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

15.5.1. 2D Image Sensors

15.5.2. 3D Image Sensors

15.6. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

15.6.1. Visible spectrum

15.6.2. Non-visible spectrum

15.7. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

15.7.1. Linear Array

15.7.2. Area Array

15.8. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

15.8.1. > 2 MP

15.8.2. 2 MP - 5 MP

15.8.3. 6 MP - 10 MP

15.8.4. 12 MP - 16 MP

15.8.5. 17 MP - 20 MP

15.8.6. Above 20 MP

15.9. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

15.9.1. Aerospace & Defense

15.9.2. Automotive

15.9.3. Consumer Electronics

15.9.4. Life Science and Healthcare

15.9.5. Security and Surveillance

15.9.6. Others

15.10. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

15.10.1. China

15.10.2. India

15.10.3. Japan

15.10.4. South Korea

15.10.5. ASEAN

15.10.6. Rest of Asia Pacific

15.11. Market Attractiveness Analysis

15.11.1. By Technology

15.11.2. By Image Sensor Type

15.11.3. By Processing Technology

15.11.4. By Spectrum

15.11.5. By Array Type

15.11.6. By Resolution

15.11.7. By Application

15.11.8. By Country/Sub-region

16. Middle East & Africa Image Sensor Market Analysis and Forecast

16.1. Market Snapshot

16.2. Drivers and Restraints: Impact Analysis

16.3. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

16.3.1. CMOS Sensor

16.3.2. CCD Sensor

16.4. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

16.4.1. Monochrome

16.4.2. Color

16.5. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

16.5.1. 2D Image Sensors

16.5.2. 3D Image Sensors

16.6. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

16.6.1. Visible spectrum

16.6.2. Non-visible spectrum

16.7. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

16.7.1. Linear Array

16.7.2. Area Array

16.8. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

16.8.1. > 2 MP

16.8.2. 2 MP - 5 MP

16.8.3. 6 MP - 10 MP

16.8.4. 12 MP - 16 MP

16.8.5. 17 MP - 20 MP

16.8.6. Above 20 MP

16.9. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

16.9.1. Aerospace & Defense

16.9.2. Automotive

16.9.3. Consumer Electronics

16.9.4. Life Science and Healthcare

16.9.5. Security and Surveillance

16.9.6. Others

16.10. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

16.10.1. GCC

16.10.2. South Africa

16.10.3. Rest of Middle East & Africa

16.11. Market Attractiveness Analysis

16.11.1. By Technology

16.11.2. By Image Sensor Type

16.11.3. By Processing Technology

16.11.4. By Spectrum

16.11.5. By Array Type

16.11.6. By Resolution

16.11.7. By Application

16.11.8. By Country/Sub-region

17. South America Image Sensor Market Analysis and Forecast

17.1. Market Snapshot

17.2. Drivers and Restraints: Impact Analysis

17.3. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Technology, 2017-2031

17.3.1. CMOS Sensor

17.3.2. CCD Sensor

17.4. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Image Sensor Type, 2017-2031

17.4.1. Monochrome

17.4.2. Color

17.5. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Processing Technology, 2017-2031

17.5.1. 2D Image Sensors

17.5.2. 3D Image Sensors

17.6. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Spectrum, 2017-2031

17.6.1. Visible spectrum

17.6.2. Non-visible spectrum

17.7. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Array Type, 2017-2031

17.7.1. Linear Array

17.7.2. Area Array

17.8. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Resolution, 2017-2031

17.8.1. > 2 MP

17.8.2. 2 MP - 5 MP

17.8.3. 6 MP - 10 MP

17.8.4. 12 MP - 16 MP

17.8.5. 17 MP - 20 MP

17.8.6. Above 20 MP

17.9. Image Sensor Market Size (US$ Bn) Analysis & Forecast, by Application, 2017-2031

17.9.1. Aerospace & Defense

17.9.2. Automotive

17.9.3. Consumer Electronics

17.9.4. Life Science and Healthcare

17.9.5. Security and Surveillance

17.9.6. Others

17.10. Image Sensor Market Size (US$ Bn) and Volume (Billion Units) Analysis & Forecast, by Country and Sub-region, 2017-2031

17.10.1. Brazil

17.10.2. Rest of South America

17.11. Market Attractiveness Analysis

17.11.1. By Technology

17.11.2. By Image Sensor Type

17.11.3. By Processing Technology

17.11.4. By Spectrum

17.11.5. By Array Type

17.11.6. By Resolution

17.11.7. By Application

17.11.8. By Country/Sub-region

18. Competition Assessment

18.1. Global Image Sensor Market Competition Matrix - a Dashboard View

18.1.1. Global Image Sensor Market Company Share Analysis, by Value (2022)

18.1.2. Technological Differentiator

19. Company Profiles (Global Manufacturers/Suppliers)

19.1. GalaxyCore Shanghai Limited Corporation

19.1.1. Overview

19.1.2. Product Portfolio

19.1.3. Sales Footprint

19.1.4. Key Subsidiaries or Distributors

19.1.5. Strategy and Recent Developments

19.1.6. Key Financials

19.2. Hamamatsu Photonics K.K.

19.2.1. Overview

19.2.2. Product Portfolio

19.2.3. Sales Footprint

19.2.4. Key Subsidiaries or Distributors

19.2.5. Strategy and Recent Developments

19.2.6. Key Financials

19.3. OmniVision Technologies Inc.

19.3.1. Overview

19.3.2. Product Portfolio

19.3.3. Sales Footprint

19.3.4. Key Subsidiaries or Distributors

19.3.5. Strategy and Recent Developments

19.3.6. Key Financials

19.4. Panasonic Holdings Corporation

19.4.1. Overview

19.4.2. Product Portfolio

19.4.3. Sales Footprint

19.4.4. Key Subsidiaries or Distributors

19.4.5. Strategy and Recent Developments

19.4.6. Key Financials

19.5. Samsung Electronics Co., Ltd.

19.5.1. Overview

19.5.2. Product Portfolio

19.5.3. Sales Footprint

19.5.4. Key Subsidiaries or Distributors

19.5.5. Strategy and Recent Developments

19.5.6. Key Financials

19.6. Semiconductor Components Industries, LLC

19.6.1. Overview

19.6.2. Product Portfolio

19.6.3. Sales Footprint

19.6.4. Key Subsidiaries or Distributors

19.6.5. Strategy and Recent Developments

19.6.6. Key Financials

19.7. SHARP CORPORATION

19.7.1. Overview

19.7.2. Product Portfolio

19.7.3. Sales Footprint

19.7.4. Key Subsidiaries or Distributors

19.7.5. Strategy and Recent Developments

19.7.6. Key Financials

19.8. SK hynix Inc.

19.8.1. Overview

19.8.2. Product Portfolio

19.8.3. Sales Footprint

19.8.4. Key Subsidiaries or Distributors

19.8.5. Strategy and Recent Developments

19.8.6. Key Financials

19.9. Sony Corporation

19.9.1. Overview

19.9.2. Product Portfolio

19.9.3. Sales Footprint

19.9.4. Key Subsidiaries or Distributors

19.9.5. Strategy and Recent Developments

19.9.6. Key Financials

19.10. STMicroelectronics N.V.

19.10.1. Overview

19.10.2. Product Portfolio

19.10.3. Sales Footprint

19.10.4. Key Subsidiaries or Distributors

19.10.5. Strategy and Recent Developments

19.10.6. Key Financials

19.11. Teledyne Technologies company

19.11.1. Overview

19.11.2. Product Portfolio

19.11.3. Sales Footprint

19.11.4. Key Subsidiaries or Distributors

19.11.5. Strategy and Recent Developments

19.11.6. Key Financials

20. Go To Market Strategy

20.1. Identification of Potential Market Spaces

20.2. Understanding Buying Process of Customers

20.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 2: Global Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 3: Global Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 4: Global Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 5: Global Image Sensor Market Value (US$ Bn) & Forecast, by Spectrum, 2017-2031

Table 6: Global Image Sensor Market Value (US$ Bn) & Forecast, by Array Type, 2017-2031

Table 7: Global Image Sensor Market Value (US$ Bn) & Forecast, by Resolution, 2017-2031

Table 8: Global Image Sensor Market Volume (Billion Units) & Forecast, by Resolution, 2017-2031

Table 9: Global Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 10: Global Image Sensor Market Value (US$ Bn) & Forecast, by Region, 2017-2031

Table 11: Global Image Sensor Market Volume (Billion Units) & Forecast, by Region, 2017-2031

Table 12: North America Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 13: North America Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 14: North America Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 15: North America Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 16: North America Image Sensor Market Value (US$ Bn) & Forecast, by Spectrum, 2017-2031

Table 17: North America Image Sensor Market Value (US$ Bn) & Forecast, by Array Type, 2017-2031

Table 18: North America Image Sensor Market Value (US$ Bn) & Forecast, by Resolution, 2017-2031

Table 19: North America Image Sensor Market Volume (Billion Units) & Forecast, by Resolution, 2017-2031

Table 20: North America Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 21: North America Image Sensor Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 22: North America Image Sensor Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 23: Europe Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 24: Europe Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 25: Europe Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 26: Europe Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 27: Europe Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 28: Europe Image Sensor Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 29: Europe Image Sensor Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 30: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 31: Asia Pacific Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 32: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 33: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 34: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Spectrum, 2017-2031

Table 35: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Array Type, 2017-2031

Table 36: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Resolution, 2017-2031

Table 37: Asia Pacific Image Sensor Market Volume (Billion Units) & Forecast, by Resolution, 2017-2031

Table 38: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 39: Asia Pacific Image Sensor Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 40: Asia Pacific Image Sensor Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 41: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 42: Middle East & Africa Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 43: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 44: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 45: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Spectrum, 2017-2031

Table 46: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Array Type, 2017-2031

Table 47: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Resolution, 2017-2031

Table 48: Middle East & Africa Image Sensor Market Volume (Billion Units) & Forecast, by Resolution, 2017-2031

Table 49: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 50: Middle East & Africa Image Sensor Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 51: Middle East & Africa Image Sensor Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

Table 52: South America Image Sensor Market Value (US$ Bn) & Forecast, by Technology, 2017-2031

Table 53: South America Image Sensor Market Volume (Billion Units) & Forecast, by Technology, 2017-2031

Table 54: South America Image Sensor Market Value (US$ Bn) & Forecast, by Image Sensor Type, 2017-2031

Table 55: South America Image Sensor Market Value (US$ Bn) & Forecast, by Processing Technology, 2017-2031

Table 56: South America Image Sensor Market Value (US$ Bn) & Forecast, by Spectrum, 2017-2031

Table 57: South America Image Sensor Market Value (US$ Bn) & Forecast, by Array Type, 2017-2031

Table 58: South America Image Sensor Market Value (US$ Bn) & Forecast, by Resolution, 2017-2031

Table 59: South America Image Sensor Market Volume (Billion Units) & Forecast, by Resolution, 2017-2031

Table 60: South America Image Sensor Market Value (US$ Bn) & Forecast, by Application, 2017-2031

Table 61: South America Image Sensor Market Value (US$ Bn) & Forecast, by Country and Sub-region, 2017-2031

Table 62: South America Image Sensor Market Volume (Billion Units) & Forecast, by Country and Sub-region, 2017-2031

List of Figures

Figure 01: Supply Chain Analysis - Global Image Sensor

Figure 02: Porter Five Forces Analysis - Global Image Sensor

Figure 03: Technology Road Map - Global Image Sensor

Figure 04: Global Image Sensor Market, Value (US$ Bn), 2017-2031

Figure 05: Global Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 06: Global Image Sensor Market Projections by Technology, Value (US$ Bn), 2017-2031

Figure 07: Global Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 08: Global Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 09: Global Image Sensor Market Projections by Image Sensor Type, Value (US$ Bn), 2017-2031

Figure 10: Global Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 11: Global Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 12: Global Image Sensor Market Projections by Processing Technology, Value (US$ Bn), 2017-2031

Figure 13: Global Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 14: Global Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 15: Global Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 16: Global Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 17: Global Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 18: Global Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 19: Global Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 20: Global Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 21: Global Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 22: Global Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 23: Global Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 24: Global Image Sensor Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 25: Global Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 26: Global Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 27: Global Image Sensor Market Projections by Region, Value (US$ Bn), 2017-2031

Figure 28: Global Image Sensor Market, Incremental Opportunity, by Region, 2023-2031

Figure 29: Global Image Sensor Market Share Analysis, by Region, 2023 and 2031

Figure 30: North America Image Sensor Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 31: North America Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 32: North America Image Sensor Market Projections by Technology Value (US$ Bn), 2017-2031

Figure 33: North America Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 34: North America Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 35: North America Image Sensor Market Projections by Image Sensor Type Value (US$ Bn), 2017-2031

Figure 36: North America Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 37: North America Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 38: North America Image Sensor Market Projections by Processing Technology (US$ Bn), 2017-2031

Figure 39: North America Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 40: North America Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 41: North America Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 42: North America Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 43: North America Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 44: North America Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 45: North America Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 46: North America Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 47: North America Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 48: North America Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 49: North America Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 50: North America Image Sensor Market Projections by Application Value (US$ Bn), 2017-2031

Figure 51: North America Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 52: North America Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 53: North America Image Sensor Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 54: North America Image Sensor Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 55: North America Image Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 56: Europe Image Sensor Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 57: Europe Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 58: Europe Image Sensor Market Projections by Technology Value (US$ Bn), 2017-2031

Figure 59: Europe Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 60: Europe Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 61: Europe Image Sensor Market Projections by Image Sensor Type, Value (US$ Bn), 2017-2031

Figure 62: Europe Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 63: Europe Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 64: Europe Image Sensor Market Projections by Processing Technology, Value (US$ Bn), 2017-2031

Figure 65: Europe Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 66: Europe Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 67: Europe Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 68: Europe Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 69: Europe Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 70: Europe Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 71: Europe Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 72: Europe Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 73: Europe Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 74: Europe Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 75: Europe Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 76: Europe Image Sensor Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 77: Europe Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 78: Europe Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 79: Europe Image Sensor Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 80: Europe Image Sensor Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 81: Europe Image Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 82: Asia Pacific Image Sensor Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 83: Asia Pacific Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 84: Asia Pacific Image Sensor Market Projections by Technology Value (US$ Bn), 2017-2031

Figure 85: Asia Pacific Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 86: Asia Pacific Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 87: Asia Pacific Image Sensor Market Projections by Image Sensor Type Value (US$ Bn), 2017-2031

Figure 88: Asia Pacific Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 89: Asia Pacific Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 90: Asia Pacific Image Sensor Market Projections by Processing Technology, Value (US$ Bn), 2017-2031

Figure 91: Asia Pacific Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 92: Asia Pacific Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 93: Asia Pacific Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 94: Asia Pacific Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 95: Asia Pacific Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 96: Asia Pacific Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 97: Asia Pacific Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 98: Asia Pacific Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 99: Asia Pacific Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 100: Asia Pacific Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 101: Asia Pacific Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 102: Asia Pacific Image Sensor Market Projections by Application, Value (US$ Bn), 2017-2031

Figure 103: Asia Pacific Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 104: Asia Pacific Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 105: Asia Pacific Image Sensor Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 106: Asia Pacific Image Sensor Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 107: Asia Pacific Image Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 108: MEA Image Sensor Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 109: MEA Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 110: MEA Image Sensor Market Projections by Technology Value (US$ Bn), 2017-2031

Figure 111: MEA Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 112: MEA Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 113: MEA Image Sensor Market Projections by Image Sensor Type Value (US$ Bn), 2017-2031

Figure 114: MEA Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 115: MEA Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 116: MEA Image Sensor Market Projections by Processing Technology, Value (US$ Bn), 2017-2031

Figure 117: MEA Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 118: MEA Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 119: MEA Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 120: MEA Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 121: MEA Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 122: MEA Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 123: MEA Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 124: MEA Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 125: MEA Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 126: MEA Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 127: MEA Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 128: MEA Image Sensor Market Projections by Application Value (US$ Bn), 2017-2031

Figure 129: MEA Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 130: MEA Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 131: MEA Image Sensor Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 132: MEA Image Sensor Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 133: MEA Image Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 134: South America Image Sensor Market Size & Forecast, Value (US$ Bn), 2017-2031

Figure 135: South America Image Sensor Market Size & Forecast, Y-O-Y, Value (US$ Bn), 2017-2031

Figure 136: South America Image Sensor Market Projections by Technology Value (US$ Bn), 2017-2031

Figure 137: South America Image Sensor Market, Incremental Opportunity, by Technology, 2023-2031

Figure 138: South America Image Sensor Market Share Analysis, by Technology, 2023 and 2031

Figure 139: South America Image Sensor Market Projections by Image Sensor Type Value (US$ Bn), 2017-2031

Figure 140: South America Image Sensor Market, Incremental Opportunity, by Image Sensor Type, 2023-2031

Figure 141: South America Image Sensor Market Share Analysis, by Image Sensor Type, 2023 and 2031

Figure 142: South America Image Sensor Market Projections by Processing Technology, Value (US$ Bn), 2017-2031

Figure 143: South America Image Sensor Market, Incremental Opportunity, by Processing Technology, 2023-2031

Figure 144: South America Image Sensor Market Share Analysis, by Processing Technology, 2023 and 2031

Figure 145: South America Image Sensor Market Projections by Spectrum, Value (US$ Bn), 2017-2031

Figure 146: South America Image Sensor Market, Incremental Opportunity, by Spectrum, 2023-2031

Figure 147: South America Image Sensor Market Share Analysis, by Spectrum, 2023 and 2031

Figure 148: South America Image Sensor Market Projections by Array Type, Value (US$ Bn), 2017-2031

Figure 149: South America Image Sensor Market, Incremental Opportunity, by Array Type, 2023-2031

Figure 150: South America Image Sensor Market Share Analysis, by Array Type, 2023 and 2031

Figure 151: South America Image Sensor Market Projections by Resolution, Value (US$ Bn), 2017-2031

Figure 152: South America Image Sensor Market, Incremental Opportunity, by Resolution, 2023-2031

Figure 153: South America Image Sensor Market Share Analysis, by Resolution, 2023 and 2031

Figure 154: South America Image Sensor Market Projections by Application Value (US$ Bn), 2017-2031

Figure 155: South America Image Sensor Market, Incremental Opportunity, by Application, 2023-2031

Figure 156: South America Image Sensor Market Share Analysis, by Application, 2023 and 2031

Figure 157: South America Image Sensor Market Projections by Country and sub-region, Value (US$ Bn), 2017-2031

Figure 158: South America Image Sensor Market, Incremental Opportunity, by Country and sub-region, 2023-2031

Figure 159: South America Image Sensor Market Share Analysis, by Country and sub-region 2023 and 2031

Figure 160: Global Image Sensor Market Competition

Figure 161: Global Image Sensor Market Company Share Analysis