Reports

Reports

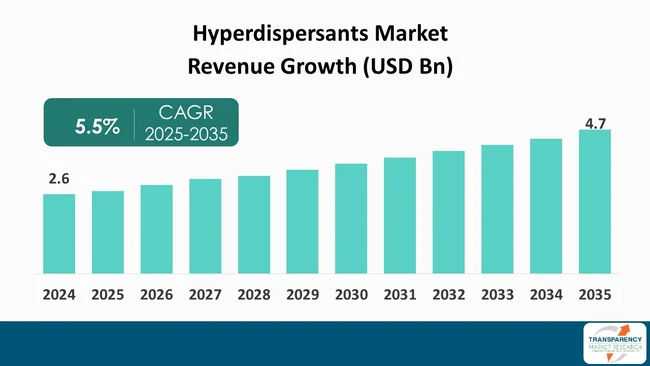

The global hyperdispersants market size was valued at US$ 2.6 Billion in 2024 and is projected to reach US$ 4.7 Billion by 2035, expanding at a CAGR of 5.5% from 2025 to 2035. The market growth is driven by rising demand demand for high-performance waterborne and low-VOC coatings, and expansion of high-performance plastics, masterbatches, and composite materials.

The global hyperdispersants market is showing strong growth, which is largely influenced by the rapid shift toward waterborne and low-VOC coating systems, the growth of high-performance plastics and composites, and implementation of environmental regulations in the major economies. Asia-Pacific continues to be the main region, while Europe and North America are gaining through eco-compliant advanced systems.

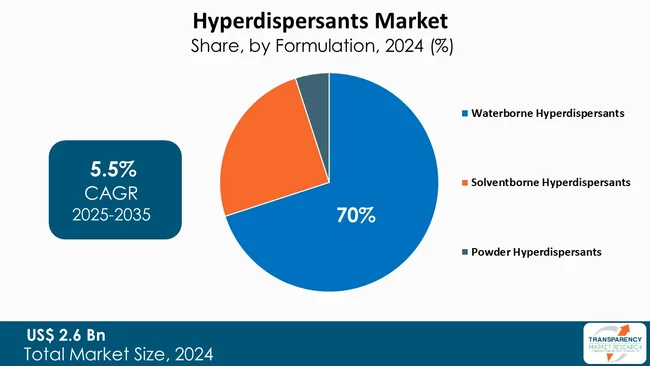

Hyperdispersants that are waterborne are widely used, accounting for almost 70% of total demand. It is due to their excellent wetting, dispersion, and stabilizing properties in aqueous environments. Top companies like Lubrizol, UBE Corporation Europe, BASF, Lamberti, and KAO are investing in capacity and product innovation to provide the required high-efficiency, sustainable dispersant technologies.

The recent moves, such as Lubrizol’s Solsperse growth and UBE’s circular-economy initiatives, reflect the growing sustainability-performance coupling trend, which consolidates hyperdispersants as a technology platform enabling the co-driven market sectors of advanced coatings, inks, and polymers.

Hyperdispersants are top-of-the-line high-performance special additives created to enhance the even spread and storage of pigments, fillers, and nanoparticles in both liquid and solid formulations. Compared to regular dispersants, hyperdispersants provide better steric stabilization, stronger pigment-polymer interactions, and wider compatibility with different resin systems, thus, they are the lifeline of advanced coatings, printing inks, plastics, adhesives, and composite materials.

Most of the time, their tightly-knit polymeric structures are derived from polyacrylates, polyurethanes, block copolymers, or polyethers, which allow them to perform efficient wetting, dispersion, and viscosity control even at low dosage levels.

Hyperdispersants in the paints and coatings industry bring about the effects of more vibrant color, enhanced gloss, shortened milling time, and increased stability of the formulation. In plastics and masterbatches, they are the main contributors to the uniform distribution of filler and the improvement of the mechanical properties. In printing inks, they become the facilitators of the ink's smoothness, the reducers of flocculation, and the creators of high-resolution output for digital and flexographic systems. The demand for hyperdispersants designed for environmentally friendly systems is being driven by the industry’s gradual transition to waterborne and low-VOC formulations.

| Attribute | Detail |

|---|---|

| Hyperdispersants Market Drivers |

|

The worldwide shift to waterborne and low-VOC coatings is a major factor causing the hyperdispersants market to expand quickly. This is mainly due to regulatory mandates and performance requirements in both - matured and emerging economies. For example, the EU and North America have established VOC reduction frameworks that require coating manufacturers to cut emissions by 40-60%. Hence, formulators are compelled to use advanced waterborne systems.

At present, waterborne coatings constitute more than 55-60% of the architectural coatings segment worldwide, while industrial waterborne coatings are increasing by by 6-7% annually, the major areas being automotive refinish, general industrial, and protective coatings. Such a transition amplifies the need for hyperdispersants, which not only facilitate pigment wetting, but also shorten the milling time by 20-30% and at the same time ensure dispersion stability in a low-VOC environment.

In the case of high-performance paint systems, carefully selected hyperdispersants provide formulators with the means to achieve a 25% higher color development, a 10-15% better gloss, and reduced viscosity drift during storage. With stricter emission standards being adopted by countries in Asia-Pacific and Latin America, the global market for hyperdispersants compatible with waterborne is expected to grow gradually, thus indicating that they will continue to be indispensable additive components in the production of next-generation eco-friendly coatings.

The increasing use of engineering plastics, advanced masterbatches, and lightweight composite materials is the major factor behind the growing demand for hyperdispersants that can provide superior filler and pigment dispersion. Worldwide engineering plastics production is more than 70 million tons a year, which is mainly fueled by the increased applications in the automotive, electronics, and packaging industries. The Masterbatch industry alone uses over 5 million tons of materials per year, resulting in a strong demand for hyperdispersants that can improve dispersion efficiency in high-viscosity melt systems.

By using high-performance hyperdispersants in polymer processing, pigment distribution has improved by 20-40%, tensile strength of filled polypropylene increased by 10-15%, and color uniformity for color masterbatches enhanced by 20-25%, as reported by the studies.

In composite materials, where worldwide demand is increasing by 6% each year, hyperdispersants allow the better incorporation of carbon black, titanium dioxide, nano-silica, and clay additives, thus enabling higher filler loadings without losing processability. This ability, on the one hand, leads to cost reductions and, on the other hand, to better material properties, which is why hyperdispersants have become indispensable to manufacturers who want to differentiate their products by performance in competitive polymer markets.

The majority of the regional hyperdispersants market is largely influenced by the reformulated waterborne hyperdispersants which are paced with the transition to low-VOC and ecologically compliant coating systems in various industries. Significant share of the global architectural coatings market is made up of waterborne coatings that are expanding at 6-7% annually in industrial applications. Consequently, the demand for high-efficiency waterborne hyperdispersants has risen directly.

These additives facilitate excellent pigment wetting and dispersion in waterborne systems, thus they can achieve 20-30% reductions in milling time and increase color strength by 15-25% compared to the traditional dispersants. Their proficiency to TiO₂ and carbon black stabilize inorganic pigments is hard to overstate as manufacturers are urging for higher solids loading in premium paints, automotive refinishes, and high-performance industrial coatings.

As regulatory bodies across the EU, U.S., and Asia are introducing stricter VOC limits—mostly resulting in reductions of 40-60%—waterborne-compatible hyperdispersants are turning into a must-have in reformulation strategies. Therefore, the waterborne segment is expected to account for about 65-70% of the global hyperdispersants consumption, thereby consolidating its status as the leading formulation category.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific is the major contributor to the global hyperdispersants market. The region's demand for hyperdispersants, which is triggered by the large-scale production of coatings, plastics, and inks in China, India, Japan, and South Korea, keeps escalating. Asia Pacific is in charge of nearly 45% of the world's hyperdispersants usage. This corresponds well with the region's leading position in paints and coatings where Asia-Pacific contributes to more than 50% of the worldwide production.

The rapid urbanization and the rise in infrastructure projects mainly in China and India are the main factors behind the steady increase in demand for high-performance waterborne and industrial coatings and the subsequent quickening of hyperdispersants adoption.

Europe is the second-largest market with a 25% share and it is influenced by VOC regulations, automotive production, and the demand for premium coatings and specialty chemicals. Eco-friendly formulations are the region's focus, and it results in a more excellent uptake of waterborne-compatible hyperdispersants.

North America has about 20% of the global market and it is mainly driven by the automotive, aerospace, industrial coatings, and high-performance plastics industries' significant consumption. The U.S. is the leading producer of regional metals and materials, making it the source of almost 80% of the demand for hyperdispersants in high-value formulation segments.

Lubrizol plays a major role in the worldwide hyperdispersants market. This leadership is backed by its extensive range of advanced polymeric dispersants that are specially designed for high-performance coatings, inks, and plastics. The company's technology platform is very much focused on facilitating pigment wetting, color development, and also ensuring the stability of the products for a long time in both waterborne and solventborne systems. With a broad R&D capability and worldwide supply network, Lubrizol empowers manufacturers to achieve excellent dispersion efficiency and at the same time be in line with regulations. This, therefore, is a great reinforcement of the company's position as a supplier of specialty additives to the industry that is most preferred.

UBE Corporation Europe is among the most influential market innovators in the hyperdispersants sector. The company is well-known for its UBEDISP series of superdispersants that are high-performing and have been purposely engineered for the dispersion of both inorganic and organic pigments in nonpolar as well as medium-polarity systems. The company uses advanced polymer chemistry expertise to create solutions which facilitate viscosity control, stability, and filler compatibility in coatings, composites, and plastics. The presence of UBE in the European and global specialty chemicals markets is very strong, hence, the company is a major player in providing the latest technologies of hyperdispersants to the next generation.

Sun & Bright Industrial Ltd, KAO Corporation, WinBos, BASF SE, Lamberti, Siliketech, Polynexxt, and Shanghai Sanzheng Polymer Material Co., Ltd are some other major companies in the hyperdispersants market. Each of these players has been profiled in the hyperdispersants industry research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 2.6 Billion |

| Market Forecast Value in 2035 | US$ 4.7 Billion |

| Growth Rate (CAGR) | 5.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Billion for Value & Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Hyperdispersants market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Chemistry Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The hyperdispersants market was valued at US$ 2.6 Billion in 2024

The hyperdispersants industry is expected to grow at a CAGR of 5.5% from 2025 to 2035

Rising demand for high-performance waterborne and low-VOC coatings, and expansion of high-performance plastics, masterbatches, and composite materials.

Waterborne hyperdispersants was the largest formulation segment in the hyperdispersants market.

Asia Pacific was the most lucrative region in 2024

Lubrizol, Sun & Bright Industrial Ltd, KAO Corporation, WinBos, BASF SE, UBE Corporation Europe, Lamberti, Siliketech, Polynexxt, and Shanghai Sanzheng Polymer Material Co., Ltd are some of the major companies in the global hyperdispersants market.

Table 1 Global Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 2 Global Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 3 Global Hyperdispersants Market Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 4 Global Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation 2020 to 2035

Table 5 Global Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 6 Global Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 7 Global Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 8 Global Hyperdispersants Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 9 Global Hyperdispersants Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 10 Global Hyperdispersants Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 11 North America Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 12 North America Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 13 North America Hyperdispersants Market Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 14 North America Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation 2020 to 2035

Table 15 North America Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 16 North America Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 17 North America Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 18 North America Hyperdispersants Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 19 North America Hyperdispersants Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 20 North America Hyperdispersants Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 21 U.S. Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 22 U.S. Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 23 U.S. Hyperdispersants Market Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 24 U.S. Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 25 U.S. Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 26 U.S. Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 27 U.S. Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 U.S. Hyperdispersants Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Canada Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 30 Canada Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 31 Canada Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 32 Canada Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 33 Canada Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 34 Canada Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 35 Canada Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 36 Canada Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 37 Europe Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 38 Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 39 Europe Hyperdispersants Market Volume (Tons) Forecast, by Formulation 2020 to 2035

Table 40 Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 41 Europe Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 42 Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 43 Europe Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 44 Europe Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 45 Europe Hyperdispersants Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 46 Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 47 Germany Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 48 Germany Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 49 Germany Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 50 Germany Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 51 Germany Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 52 Germany Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 53 Germany Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 Germany Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 55 France Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 56 France Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 57 France Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 58 France Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 59 France Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 60 France Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 61 France Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 62 France Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 63 U.K. Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 64 U.K. Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 65 U.K. Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 66 U.K. Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 67 U.K. Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 68 U.K. Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 69 U.K. Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 70 U.K. Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 71 Italy Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 72 Italy Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 73 Italy Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 74 Italy Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 75 Italy Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 76 Italy Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 77 Italy Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Italy Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 79 Spain Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 80 Spain Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 81 Spain Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 82 Spain Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 83 Spain Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 84 Spain Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 85 Spain Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 86 Spain Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 87 Russia & CIS Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 88 Russia & CIS Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 89 Russia & CIS Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 90 Russia & CIS Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 91 Russia & CIS Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 92 Russia & CIS Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 93 Russia & CIS Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 94 Russia & CIS Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 95 Rest of Europe Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 96 Rest of Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 97 Rest of Europe Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 98 Rest of Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 99 Rest of Europe Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 100 Rest of Europe Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 101 Rest of Europe Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 102 Rest of Europe Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 103 Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 104 Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 105 Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 106 Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 107 Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 108 Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 109 Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 110 Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 111 Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 112 Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 113 China Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 114 China Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type 2020 to 2035

Table 115 China Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 116 China Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 117 China Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 118 China Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 119 China Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 120 China Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 121 Japan Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 122 Japan Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 123 Japan Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 124 Japan Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 125 Japan Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 126 Japan Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 127 Japan Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 128 Japan Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 129 India Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 130 India Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 131 India Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 132 India Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 133 India Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 134 India Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 135 India Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 136 India Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 137 ASEAN Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 138 ASEAN Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 139 ASEAN Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 140 ASEAN Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 141 ASEAN Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 142 ASEAN Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 143 ASEAN Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 ASEAN Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 145 Rest of Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 146 Rest of Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 147 Rest of Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 148 Rest of Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 149 Rest of Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 150 Rest of Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 151 Rest of Asia Pacific Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 152 Rest of Asia Pacific Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 153 Latin America Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 154 Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 155 Latin America Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 156 Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 157 Latin America Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 158 Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 159 Latin America Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 160 Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 161 Latin America Hyperdispersants Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 162 Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 163 Brazil Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 164 Brazil Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 165 Brazil Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 166 Brazil Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 167 Brazil Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 168 Brazil Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 169 Brazil Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Brazil Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 171 Mexico Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 172 Mexico Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 173 Mexico Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 174 Mexico Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 175 Mexico Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 176 Mexico Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 177 Mexico Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 178 Mexico Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 179 Rest of Latin America Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 180 Rest of Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 181 Rest of Latin America Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 182 Rest of Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 183 Rest of Latin America Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 184 Rest of Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 185 Rest of Latin America Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 186 Rest of Latin America Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 187 Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 188 Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 189 Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 190 Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 191 Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 192 Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 193 Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 194 Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 195 Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 196 Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 197 GCC Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 198 GCC Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 199 GCC Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 200 GCC Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 201 GCC Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 202 GCC Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 203 GCC Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 204 GCC Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 205 South Africa Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 206 South Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 207 South Africa Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 208 South Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 209 South Africa Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 210 South Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 211 South Africa Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 212 South Africa Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 213 Rest of Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Chemistry Type, 2020 to 2035

Table 214 Rest of Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Chemistry Type, 2020 to 2035

Table 215 Rest of Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Formulation, 2020 to 2035

Table 216 Rest of Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Formulation, 2020 to 2035

Table 217 Rest of Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by Application, 2020 to 2035

Table 218 Rest of Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by Application, 2020 to 2035

Table 219 Rest of Middle East & Africa Hyperdispersants Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 220 Rest of Middle East & Africa Hyperdispersants Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Figure 1 Global Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 2 Global Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 3 Global Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 4 Global Hyperdispersants Market Attractiveness, by Formulation

Figure 5 Global Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 6 Global Hyperdispersants Market Attractiveness, by Application

Figure 7 Global Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 8 Global Hyperdispersants Market Attractiveness, by End-use

Figure 9 Global Hyperdispersants Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 10 Global Hyperdispersants Market Attractiveness, by Region

Figure 11 North America Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 12 North America Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 13 North America Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 14 North America Hyperdispersants Market Attractiveness, by Formulation

Figure 15 North America Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 16 North America Hyperdispersants Market Attractiveness, by Application

Figure 17 North America Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 18 North America Hyperdispersants Market Attractiveness, by End-use

Figure 19 North America Hyperdispersants Market Attractiveness, by Country and Sub-region

Figure 20 Europe Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 21 Europe Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 22 Europe Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 23 Europe Hyperdispersants Market Attractiveness, by Formulation

Figure 24 Europe Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 25 Europe Hyperdispersants Market Attractiveness, by Application

Figure 26 Europe Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 27 Europe Hyperdispersants Market Attractiveness, by End-use

Figure 28 Europe Hyperdispersants Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 29 Europe Hyperdispersants Market Attractiveness, by Country and Sub-region

Figure 30 Asia Pacific Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 31 Asia Pacific Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 32 Asia Pacific Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 33 Asia Pacific Hyperdispersants Market Attractiveness, by Formulation

Figure 34 Asia Pacific Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 35 Asia Pacific Hyperdispersants Market Attractiveness, by Application

Figure 36 Asia Pacific Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 37 Asia Pacific Hyperdispersants Market Attractiveness, by End-use

Figure 38 Asia Pacific Hyperdispersants Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 39 Asia Pacific Hyperdispersants Market Attractiveness, by Country and Sub-region

Figure 40 Latin America Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 41 Latin America Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 42 Latin America Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 43 Latin America Hyperdispersants Market Attractiveness, by Formulation

Figure 44 Latin America Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 45 Latin America Hyperdispersants Market Attractiveness, by Application

Figure 46 Latin America Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 47 Latin America Hyperdispersants Market Attractiveness, by End-use

Figure 48 Latin America Hyperdispersants Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 49 Latin America Hyperdispersants Market Attractiveness, by Country and Sub-region

Figure 50 Middle East & Africa Hyperdispersants Market Volume Share Analysis, by Chemistry Type, 2024, 2028, and 2035

Figure 51 Middle East & Africa Hyperdispersants Market Attractiveness, by Chemistry Type

Figure 52 Middle East & Africa Hyperdispersants Market Volume Share Analysis, by Formulation, 2024, 2028, and 2035

Figure 53 Middle East & Africa Hyperdispersants Market Attractiveness, by Formulation

Figure 54 Middle East & Africa Hyperdispersants Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 55 Middle East & Africa Hyperdispersants Market Attractiveness, by Application

Figure 56 Middle East & Africa Hyperdispersants Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 57 Middle East & Africa Hyperdispersants Market Attractiveness, by End-use

Figure 58 Middle East & Africa Hyperdispersants Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 59 Middle East & Africa Hyperdispersants Market Attractiveness, by Country and Sub-region