Reports

Reports

Analysts’ Viewpoint

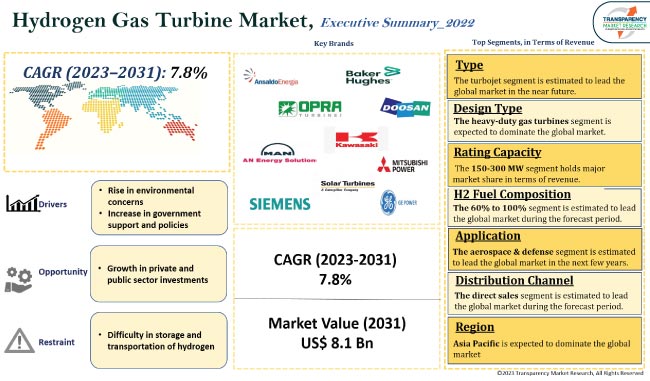

Rise in environmental concerns, energy storage capability, and significant usage in several industrial applications are expected to augment the hydrogen gas turbine market size in the next few years. Hydrogen gas turbines play a crucial role in integrating hydrogen into a power generation mix, enabling a smooth transition to a cleaner energy future.

Furthermore, growth in government assistance and increase in private and public sector investments are factors expected to drive the demand for hydrogen gas turbines during the forecast period.

Manufacturers are working on research and development to speed up the introduction of more efficient hydrogen gas turbines with new features in order to increase their market share and create new opportunities.

Turbines are devices that convert the energy of a fluid, such as gas or steam, into mechanical energy, which can be used to drive generators and produce electricity. Hydrogen powered turbines use hydrogen as the primary fuel source to generate power. These turbines work by injecting hydrogen into the combustion chamber, where it mixes with air and undergoes combustion.

The high temperature combustion gases expand and drive the turbine blades, which are connected to a shaft. As the turbine blades rotate, they drive the compressor and generator, producing electricity. Brayton cycle is the hydrogen gas turbine working principle, which is a thermodynamic cycle that consists of four processes: compression, combustion, expansion, and exhaust.

Hydrogen is a clean burning fuel that produces only water vapor as a byproduct when combusted, making it environment-friendly. Additionally, hydrogen has a high energy content, which contributes to high power generation efficiency. Hydrogen gas turbine generators can be used in various applications, such as power generation and industrial processes.

Demand for clean energy sources is growing with the rise in concerns about climate change and the need to reduce greenhouse gas emissions. H2 turbines offer a viable solution as they produce zero carbon emissions when hydrogen is used as a fuel. This makes them an attractive option for power generation, particularly in industries that aim to achieve decarbonization targets.

Many countries and industries are transitioning from fossil fuel-based energy systems to renewable and low-carbon alternatives. Hydrogen is considered a key element in this energy transition due to its versatility and potential to be produced from renewable sources through electrolysis, which is boosting hydrogen gas turbine industry growth.

Hydrogen can be utilized as an energy storage medium, providing a means to store excess electricity generated from renewable sources, such as wind and solar. By using hydrogen gas turbines, stored hydrogen can be efficiently converted back into electricity when demand is high, ensuring grid stability and renewable power supply. This aspect makes hydrogen gas turbines attractive for grid balancing and managing intermittent renewable energy sources, which is fueling the hydrogen gas turbine market value.

Governments worldwide are increasingly recognizing the potential of hydrogen as an energy carrier and are implementing supportive policies and incentives to promote its adoption, which can increase the hydrogen gas turbine market demand.

Many countries have taken steps to enhance investments in hydrogen generation, from planning to infrastructure. For instance, Chile's National Green Hydrogen Strategy, describes the country's intention to invest in hydrogen infrastructure in order to capitalize on the country's significant wind and solar resources.

In 2020, Japan increased its spending in establishing infrastructure and systems to enable hydrogen imports by 16% to US$ 664 Mn; The European Union committed almost €500 billion (approximately US$ 609.0 Bn) to green hydrogen production and infrastructure, primarily for electrolyzer installation.

The U.K. government, as part of its carbon removal policy, is offering US$ 238 Mn in funding to enable engineering and design studies for net-zero hubs, including blue and green hydrogen infrastructure projects. These are some of the factors which are driving the hydrogen gas turbine market growth.

According to hydrogen gas turbine market analysis, the heavy-duty gas turbines segment is estimated to lead the global market in terms of design type in the next few years. Heavy-duty gas turbine engines are strong and adaptable, making them ideal for large, simple, or combined cycle power plants.

Moreover, these turbines can be used for peak, intermediate, or base load duty, as well as power generation. They are a reliable, efficient, flexible solution for power generation, making them an essential component of modern energy systems.

The hydrogen gas turbine market segmentation based on application includes steel mills, oil & gas, aerospace & defense, refineries, petrochemical, power generations, and others (marine, etc.). The aerospace & defense sector is likely to lead the global market during the forecast period.

Hydrogen has a significantly higher energy content per unit mass compared to conventional hydrocarbon fuels. This high energy density allows its use for more efficient and powerful turbine engines, especially in high performance applications such as aerospace & defense.

Factors such as clean and low-emission fuel, weight considerations, high combustion temperature, and safety concerns are further increasing the adoption of these turbines in the aerospace & defense sector, consequently increasing hydrogen gas turbine market opportunities

According to the hydrogen gas turbine market forecast, Asia Pacific is likely to dominate the global landscape during the forecast period. Countries in the Asia Pacific region, such as China, Japan, and South Korea, have been making significant efforts to reduce greenhouse gas emissions and switch to cleaner energy sources.

Governments in this region have been actively promoting the development and adoption of hydrogen technologies. They are implementing supportive polices, providing financial incentives, and investing in research and development to advance the hydrogen economy.

Thus, environmental concerns, government support, renewable energy resources, and technological progress are key factors increasing the hydrogen gas turbine market share across Asia Pacific.

Growth in interest in clean energy, abundant renewable resources, supportive government policies, and heavy industrial demand leads to industry growth in North America.

The hydrogen gas turbine market is fragmented due to the presence of many local and global players. Competition is expected to intensify in the next few years due to the entry of local players. Various marketing strategies are adopted by manufacturers, which is estimated to lead to hydrogen gas turbine market development in the near future.

Suppliers, manufacturers, and vendors are focusing on introducing hydrogen gas turbines at reasonable prices and striving to meet the demands of customers as per the latest hydrogen gas turbine market trends.

Prominent players operating in the global hydrogen gas turbines industry include Ansaldo Energia, Baker Hughes, Doosan Heavy Industries, OPRA Turbines, Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Mitsubishi Power Americas, Inc., Siemens, Solar Turbines, and General Electric Gas Power.

These players are profiled in the hydrogen gas turbine market report based on parameters such as company overview, business strategies, financial overview, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 (Base Year) |

US$ 3.9 Bn |

|

Market Value in 2031 |

US$ 8.1 Bn |

|

Growth Rate (CAGR) |

7.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

Qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

It was valued at US$ 3.9 Bn in 2022

It is estimated to reach US$ 8.1 Bn by 2031

It is likely to grow at a CAGR of 7.8% from 2023 to 2031

Rise in environmental concerns and increase in government support and policies

Heavy-duty gas turbines is the prominent design type segment

Asia Pacific is a highly attractive region for vendors

Ansaldo Energia, Baker Hughes, Doosan Heavy Industries, OPRA Turbines, Kawasaki Heavy Industries, Ltd., MAN Energy Solutions, Mitsubishi Power Americas, Inc., Siemens, Solar Turbines, and General Electric Gas Power

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Raw Material Analysis

5.5. Key Market Indicators

5.6. Porter’s Five Forces Analysis

5.7. Industry SWOT Analysis

5.8. Value Chain Analysis

5.9. Global Hydrogen Gas Turbine Market Analysis and Forecast, 2017 - 2031

5.9.1. Market Value Projections (US$ Bn)

5.9.2. Market Volume Projections (Thousand Units)

6. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Type

6.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

6.1.1. Turbojet

6.1.2. Turbofan

6.1.3. Turboprop

6.1.4. Turboshaft

6.2. Incremental Opportunity, By Type

7. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Design Type

7.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

7.1.1. Heavy-duty gas turbines

7.1.2. Aero derivative gas turbines

7.2. Incremental Opportunity, By Design Type

8. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Rating Capacity

8.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

8.1.1. Less than 60 MW

8.1.2. 60-150 MW

8.1.3. 150-300 MW

8.1.4. 300-400 MW

8.1.5. Above 400 MW

8.2. Incremental Opportunity, By Rating Capacity

9. Global Hydrogen Gas Turbine Market Analysis and Forecast, By H2 Fuel Composition

9.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

9.1.1. Up to 20%

9.1.2. 20% to 60%

9.1.3. 60% to 100%

9.2. Incremental Opportunity, By H2 Fuel Composition

10. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Application

10.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

10.1.1. Steel Mills

10.1.2. Oil & Gas

10.1.3. Aerospace & Defense

10.1.4. Refineries

10.1.5. Petrochemical

10.1.6. Power generation

10.1.7. Others

10.2. Incremental Opportunity, By Application

11. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Distribution Channel

11.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

11.1.1. Direct Sales

11.1.2. Indirect Sales

11.2. Incremental Opportunity, By Distribution Channel

12. Global Hydrogen Gas Turbine Market Analysis and Forecast, By Region

12.1. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Region, 2017 - 2031

12.1.1. North America

12.1.2. Europe

12.1.3. Asia Pacific

12.1.4. Middle East & Africa

12.1.5. South America

12.2. Incremental Opportunity, By Region

13. North America Hydrogen Gas Turbine Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Design Type Trend Analysis

13.2.1. Weighted Average Design Type

13.3. Key Trends Analysis

13.3.1. Demand Side Analysis

13.3.2. Supply Side Analysis

13.4. Key Supplier Analysis

13.5. Consumer Buying Behavior Analysis

13.6. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

13.6.1. Turbojet

13.6.2. Turbofan

13.6.3. Turboprop

13.6.4. Turboshaft

13.7. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

13.7.1. Heavy-duty gas turbines

13.7.2. Aero derivative gas turbines

13.8. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

13.8.1. Less than 60 MW

13.8.2. 60-150 MW

13.8.3. 150-300 MW

13.8.4. 300-400 MW

13.8.5. Above 400 MW

13.9. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

13.9.1. Up to 20%

13.9.2. 20% to 60%

13.9.3. 60% to 100%

13.10. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

13.10.1. Steel Mills

13.10.2. Oil & Gas

13.10.3. Aerospace & Defense

13.10.4. Refineries

13.10.5. Petrochemical

13.10.6. Power generation

13.10.7. Others

13.11. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

13.11.1. Direct Sales

13.11.2. Indirect Sales

13.12. Hydrogen Gas Turbine Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2027

13.12.1. U.S.

13.12.2. Canada

13.12.3. Rest of North America

13.13. Incremental Opportunity Analysis

14. Europe Hydrogen Gas Turbine Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Design Type Trend Analysis

14.2.1. Weighted Average Design Type

14.3. Key Trends Analysis

14.3.1. Demand Side Analysis

14.3.2. Supply Side Analysis

14.4. Key Supplier Analysis

14.5. Consumer Buying Behavior Analysis

14.6. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

14.6.1. Turbojet

14.6.2. Turbofan

14.6.3. Turboprop

14.6.4. Turboshaft

14.7. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

14.7.1. Heavy-duty gas turbines

14.7.2. Aero derivative gas turbines

14.8. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

14.8.1. Less than 60 MW

14.8.2. 60-150 MW

14.8.3. 150-300 MW

14.8.4. 300-400 MW

14.8.5. Above 400 MW

14.9. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

14.9.1. Up to 20%

14.9.2. 20% to 60%

14.9.3. 60% to 100%

14.10. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

14.10.1. Steel Mills

14.10.2. Oil & Gas

14.10.3. Aerospace & Defense

14.10.4. Refineries

14.10.5. Petrochemical

14.10.6. Power generation

14.10.7. Others

14.11. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

14.11.1. Direct Sales

14.11.2. Indirect Sales

14.12. Hydrogen Gas Turbine Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

14.12.1. U.K.

14.12.2. Germany

14.12.3. France

14.12.4. Rest of Europe

14.13. Incremental Opportunity Analysis

15. Asia Pacific Hydrogen Gas Turbine Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Design Type Trend Analysis

15.2.1. Weighted Average Design Type

15.3. Key Trends Analysis

15.3.1. Demand Side Analysis

15.3.2. Supply Side Analysis

15.4. Key Supplier Analysis

15.5. Consumer Buying Behavior Analysis

15.6. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

15.6.1. Turbojet

15.6.2. Turbofan

15.6.3. Turboprop

15.6.4. Turboshaft

15.7. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

15.7.1. Heavy-duty gas turbines

15.7.2. Aero derivative gas turbines

15.8. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

15.8.1. Less than 60 MW

15.8.2. 60-150 MW

15.8.3. 150-300 MW

15.8.4. 300-400 MW

15.8.5. Above 400 MW

15.9. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

15.9.1. Up to 20%

15.9.2. 20% to 60%

15.9.3. 60% to 100%

15.10. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

15.10.1. Steel Mills

15.10.2. Oil & Gas

15.10.3. Aerospace & Defense

15.10.4. Refineries

15.10.5. Petrochemical

15.10.6. Power generation

15.10.7. Others

15.11. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

15.11.1. Direct Sales

15.11.2. Indirect Sales

15.12. Hydrogen Gas Turbine Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

15.12.1. China

15.12.2. India

15.12.3. Japan

15.12.4. Rest of Asia Pacific

15.13. Incremental Opportunity Analysis

16. Middle East & Africa Hydrogen Gas Turbine Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Design Type Trend Analysis

16.2.1. Weighted Average Design Type

16.3. Key Trends Analysis

16.3.1. Demand Side Analysis

16.3.2. Supply Side Analysis

16.4. Key Supplier Analysis

16.5. Consumer Buying Behavior Analysis

16.6. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

16.6.1. Turbojet

16.6.2. Turbofan

16.6.3. Turboprop

16.6.4. Turboshaft

16.7. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

16.7.1. Heavy-duty gas turbines

16.7.2. Aero derivative gas turbines

16.8. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

16.8.1. Less than 60 MW

16.8.2. 60-150 MW

16.8.3. 150-300 MW

16.8.4. 300-400 MW

16.8.5. Above 400 MW

16.9. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

16.9.1. Up to 20%

16.9.2. 20% to 60%

16.9.3. 60% to 100%

16.10. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

16.10.1. Steel Mills

16.10.2. Oil & Gas

16.10.3. Aerospace & Defense

16.10.4. Refineries

16.10.5. Petrochemical

16.10.6. Power generation

16.10.7. Others

16.11. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

16.11.1. Direct Sales

16.11.2. Indirect Sales

16.12. Hydrogen Gas Turbine Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

16.12.1. GCC

16.12.2. South Africa

16.12.3. Rest of Middle East & Africa

16.13. Incremental Opportunity Analysis

17. South America Hydrogen Gas Turbine Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Design Type Trend Analysis

17.2.1. Weighted Average Design Type

17.3. Key Trends Analysis

17.3.1. Demand Side Analysis

17.3.2. Supply Side Analysis

17.4. Key Supplier Analysis

17.5. Consumer Buying Behavior Analysis

17.6. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Type, 2017 - 2031

17.6.1. Turbojet

17.6.2. Turbofan

17.6.3. Turboprop

17.6.4. Turboshaft

17.7. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Design Type, 2017 - 2031

17.7.1. Heavy-duty gas turbines

17.7.2. Aero derivative gas turbines

17.8. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Rating Capacity, 2017 - 2031

17.8.1. Less than 60 MW

17.8.2. 60-150 MW

17.8.3. 150-300 MW

17.8.4. 300-400 MW

17.8.5. Above 400 MW

17.9. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By H2 Fuel Composition, 2017 - 2031

17.9.1. Up to 20%

17.9.2. 20% to 60%

17.9.3. 60% to 100%

17.10. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Application, 2017 - 2031

17.10.1. Steel Mills

17.10.2. Oil & Gas

17.10.3. Aerospace & Defense

17.10.4. Refineries

17.10.5. Petrochemical

17.10.6. Power generation

17.10.7. Others

17.11. Hydrogen Gas Turbine Market Size (US$ Bn and Thousand Units) Forecast, By Distribution Channel, 2017 - 2031

17.11.1. Direct Sales

17.11.2. Indirect Sales

17.12. Hydrogen Gas Turbine Market Size (US$ Bn) (Thousand Units) Forecast, by Country/Sub-region, 2017 - 2031

17.12.1. Brazil

17.12.2. Rest of South America

17.13. Incremental Opportunity Analysis

18. Competition Landscape

18.1. Market Player - Competition Dashboard

18.2. Market Share Analysis - 2022 (%)

18.3. Company Profiles (Details - Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview)

18.3.1. Ansaldo Energia

18.3.1.1. Company Overview

18.3.1.2. Sales Area/Geographical Presence

18.3.1.3. Revenue

18.3.1.4. Strategy & Business Overview

18.3.2. Baker Hughes

18.3.2.1. Company Overview

18.3.2.2. Sales Area/Geographical Presence

18.3.2.3. Revenue

18.3.2.4. Strategy & Business Overview

18.3.3. Doosan Heavy Industries

18.3.3.1. Company Overview

18.3.3.2. Sales Area/Geographical Presence

18.3.3.3. Revenue

18.3.3.4. Strategy & Business Overview

18.3.4. OPRA Turbines

18.3.4.1. Company Overview

18.3.4.2. Sales Area/Geographical Presence

18.3.4.3. Revenue

18.3.4.4. Strategy & Business Overview

18.3.5. Kawasaki Heavy Industries, Ltd.

18.3.5.1. Company Overview

18.3.5.2. Sales Area/Geographical Presence

18.3.5.3. Revenue

18.3.5.4. Strategy & Business Overview

18.3.6. MAN Energy Solutions

18.3.6.1. Company Overview

18.3.6.2. Sales Area/Geographical Presence

18.3.6.3. Revenue

18.3.6.4. Strategy & Business Overview

18.3.7. Mitsubishi Power Americas, Inc.

18.3.7.1. Company Overview

18.3.7.2. Sales Area/Geographical Presence

18.3.7.3. Revenue

18.3.7.4. Strategy & Business Overview

18.3.8. Siemens

18.3.8.1. Company Overview

18.3.8.2. Sales Area/Geographical Presence

18.3.8.3. Revenue

18.3.8.4. Strategy & Business Overview

18.3.9. Solar Turbines

18.3.9.1. Company Overview

18.3.9.2. Sales Area/Geographical Presence

18.3.9.3. Revenue

18.3.9.4. Strategy & Business Overview

18.3.10. General Electric Gas Power

18.3.10.1. Company Overview

18.3.10.2. Sales Area/Geographical Presence

18.3.10.3. Revenue

18.3.10.4. Strategy & Business Overview

19. Go to Market Strategy

19.1. Identification of Potential Market Spaces

19.1.1. Type

19.1.2. Design Type

19.1.3. Rating Capacity

19.1.4. H2 Fuel Composition

19.1.5. Application

19.1.6. Distribution Channel

19.1.7. Region

19.2. Understanding the Procurement Process of End-Users

19.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 2: Global Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 3: Global Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 4: Global Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 5: Global Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 6: Global Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 7: Global Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 8: Global Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 9: Global Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 10: Global Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 11: Global Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 12: Global Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

Table 13: Global Hydrogen Gas Turbine Market by Region, Thousand Units, 2017-2031

Table 14: Global Hydrogen Gas Turbine Market by Region, US$ Bn 2017-2031

Table 15: North America Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 16: North America Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 17: North America Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 18: North America Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 19: North America Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 20: North America Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 21: North America Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 22: North America Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 23: North America Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 24: North America Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 25: North America Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 26: North America Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

Table 27: Europe Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 28: Europe Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 29: Europe Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 30: Europe Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 31: Europe Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 32: Europe Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 33: Europe Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 34: Europe Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 35: Europe Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 36: Europe Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 37: Europe Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 38: Europe Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

Table 39: Asia Pacific Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 40: Asia Pacific Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 41: Asia Pacific Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 42: Asia Pacific Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 43: Asia Pacific Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 44: Asia Pacific Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 45: Asia Pacific Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 46: Asia Pacific Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 47: Asia Pacific Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 48: Asia Pacific Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 49: Asia Pacific Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 50: Asia Pacific Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

Table 51: Middle East & Africa Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 52: Middle East & Africa Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 53: Middle East & Africa Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 54: Middle East & Africa Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 55: Middle East & Africa Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 56: Middle East & Africa Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 57: Middle East & Africa Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 58: Middle East & Africa Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 59: Middle East & Africa Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 60: Middle East & Africa Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 61: Middle East & Africa Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 62: Middle East & Africa Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

Table 63: South America Hydrogen Gas Turbine Market by Type, Thousand Units 2017-2031

Table 64: South America Hydrogen Gas Turbine Market by Type, US$ Bn 2017-2031

Table 65: South America Hydrogen Gas Turbine Market by Design Type, Thousand Units 2017-2031

Table 66: South America Hydrogen Gas Turbine Market by Design Type, US$ Bn 2017-2031

Table 67: South America Hydrogen Gas Turbine Market by Rating Capacity, Thousand Units 2017-2031

Table 68: South America Hydrogen Gas Turbine Market by Rating Capacity, US$ Bn 2017-2031

Table 69: South America Hydrogen Gas Turbine Market by H2 Fuel Composition, Thousand Units 2017-2031

Table 70: South America Hydrogen Gas Turbine Market by H2 Fuel Composition, US$ Bn 2017-2031

Table 71: South America Hydrogen Gas Turbine Market by Application , Thousand Units, 2017-2031

Table 72: South America Hydrogen Gas Turbine Market by Application , US$ Bn 2017-2031

Table 73: South America Hydrogen Gas Turbine Market by Distribution Channel, Thousand Units, 2017-2031

Table 74: South America Hydrogen Gas Turbine Market by Distribution Channel, US$ Bn 2017-2031

List of Figures

Figure 1: Global Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 2: Global Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 3: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 4: Global Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 5: Global Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 6: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 7: Global Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 8: Global Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 9: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 10: Global Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 11: Global Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 12: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 13: Global Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 14: Global Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 15: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 16: Global Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 17: Global Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 18: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 19: Global Hydrogen Gas Turbine Market Projections, by Region, Thousand Units , 2017-2031

Figure 20: Global Hydrogen Gas Turbine Market Projections, by Region, US$ Bn 2017-2031

Figure 21: Global Hydrogen Gas Turbine Market, Incremental Opportunity, by Region, US$ Bn 2023 -2031

Figure 22: North America Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 23: North America Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 24: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 25: North America Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 26: North America Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 27: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 28: North America Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 29: North America Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 30: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 31: North America Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 32: North America Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 33: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 34: North America Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 35: North America Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 36: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 37: North America Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 38: North America Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 39: North America Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 40: Europe Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 41: Europe Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 42: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 43: Europe Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 44: Europe Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 45: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 46: Europe Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 47: Europe Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 48: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 49: Europe Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 50: Europe Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 51: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 52: Europe Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 53: Europe Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 54: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 55: Europe Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 56: Europe Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 57: Europe Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 58: Asia Pacific Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 59: Asia Pacific Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 60: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 61: Asia Pacific Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 62: Asia Pacific Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 63: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 64: Asia Pacific Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 65: Asia Pacific Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 66: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 67: Asia Pacific Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 68: Asia Pacific Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 69: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 70: Asia Pacific Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 71: Asia Pacific Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 72: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 73: Asia Pacific Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 74: Asia Pacific Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 75: Asia Pacific Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 76: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 77: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 78: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 79: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 80: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 81: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 82: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 83: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 84: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 85: Middle East & Africa Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 86: Middle East & Africa Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 87: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 88: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 89: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 90: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 91: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 92: Middle East & Africa Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 93: Middle East & Africa Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031

Figure 94: South America Hydrogen Gas Turbine Market Projections, by Type, Thousand Units 2017-2031

Figure 95: South America Hydrogen Gas Turbine Market Projections, by Type, US$ Bn 2017-2031

Figure 96: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by Type, US$ Bn 2023 -2031

Figure 97: South America Hydrogen Gas Turbine Market Projections, by Design Type, Thousand Units 2017-2031

Figure 98: South America Hydrogen Gas Turbine Market Projections, by Design Type, US$ Bn 2017-2031

Figure 99: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by Design Type, US$ Bn 2023 -2031

Figure 100: South America Hydrogen Gas Turbine Market Projections, by Rating Capacity, Thousand Units 2017-2031

Figure 101: South America Hydrogen Gas Turbine Market Projections, by Rating Capacity, US$ Bn 2017-2031

Figure 102: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by Rating Capacity, US$ Bn 2023 -2031

Figure 103: South America Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, Thousand Units 2017-2031

Figure 104: South America Hydrogen Gas Turbine Market Projections, by H2 Fuel Composition, US$ Bn 2017-2031

Figure 105: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by H2 Fuel Composition, US$ Bn 2023 -2031

Figure 106: South America Hydrogen Gas Turbine Market Projections, by Application , Thousand Units , 2017-2031

Figure 107: South America Hydrogen Gas Turbine Market Projections, by Application , US$ Bn 2017-2031

Figure 108: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by Application , US$ Bn 2023 -2031

Figure 109: South America Hydrogen Gas Turbine Market Projections, by Distribution Channel, Thousand Units , 2017-2031

Figure 110: South America Hydrogen Gas Turbine Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 111: South America Hydrogen Gas Turbine Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2023 -2031