Reports

Reports

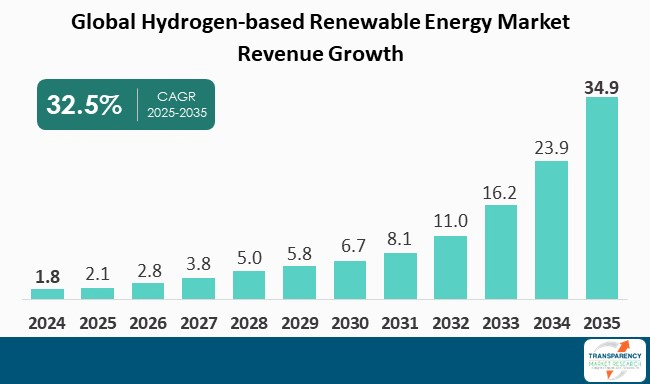

The hydrogen-based renewable energy market will develop at a strong rate, as it is recognized as an essential component of global decarbonization plans. Hydrogen is a versatile energy carrier (it can also be a power carrier), produced using renewable energy through electrolysis of water, and is being increasingly used in refining, steelmaking, ammonia production, power generation, and clean mobility applications such as fuel-cell vehicles. Demand is mounting from a confluence of decreasing renewable electricity costs, government-to-government/industry investment-backed funding and commitment to net-zero targets by global leaders. Each country must accelerate the adoption of hydrogen applications, as demonstrated by the hydrogen roadmaps many countries have issued and the many countries that have already launched hydrogen subsidy programs, including the largest global economies- US, EU, China and India.

Players in the hydrogen industry are increasing scalable electrolyzer production capacity, seeking partnership opportunities for supply chains involving green hydrogen supplies, and making investments in hydrogen infrastructure (both transport and storage). Companies like Air Liquide, Linde and Shell are already active in the hydrogen industry by piloting large-scale hydrogen hubs, and other integrated hydrogen projects.

The hydrogen-based renewable energy market describes the processes of making and using hydrogen as a clean energy carrier. It is mostly produced by electrolysis of water using renewable sources (e.g. solar, wind) to provide the electricity for electrolysis. The difference here compared to hydrogen derived from fossil fuels is that electrolysis will produce no carbon dioxide emissions, which makes it essential to decarbonize everything globally.

Because of hydrogen’s versatility, it can be applied in many different uses: as a feedstock for refining and ammonia production and a process gas (a reducing agent) in steelmaking; it can be used as a fuel in fuel-cell vehicles; and it can be stored in larger quantities for use as an energy medium to balance the intermittency of renewables. The increased investment in electrolyzers, the building of transport pipelines and hydrogen hubs, and the continued government policies will help grow hydrogen's adoption.

| Attribute | Detail |

|---|---|

| Drivers |

|

One of the primary factors driving the hydrogen-based renewable energy market is hydrogen's ability to enable the decarbonization of heavy industries that cannot displace fossil fuels. For heavy industries such as steel, cement, chemicals, refining, and fertilizers that require high-temperature heat or hydrogen-based feedstocks, electrification alone cannot fulfill the operational requirements of the business. More specifically, hydrogen and especially green hydrogen made through electrolysis from renewable power represents a direct substitute for conventional grey hydrogen or coal-based feedstocks in the industrial process. For example, hydrogen-based direct reduced iron (H-DRI) is now being piloted by leading steel majors globally and achieves carbon emissions reductions of 90%. In addition to steel, hydrogen is also a component of ammonia and methanol, and ammonium products are essential to the chemicals and shipping sectors.

Governments and corporations are responding to this push towards net-zero by implementing mandates and incentives. The European Union has set targets for renewable hydrogen use in refineries and industrial feedstocks as part of its Fit for 55 legislations. Japan and South Korea are advancing hydrogen through national industrial roadmaps. At the corporate level, companies including ArcelorMittal, Thyssenkrupp, and Yara are investing in green hydrogen demonstration plants to displace fossil-based inputs. This is not simply an environmental push, but also a way to ensure long term strategy. Corporations believe initiating hydrogen adoption will improve their future competitiveness in the global economy given that carbon-intensive goods being produced in high-volume may face border taxes and customers will increasingly pressure corporations for sustainable products.

In addition, government engagement is a major growth enabler and will be driven by scale, number, and extent of government interventions globally in encouraging hydrogen through policy, funding providers and infrastructure. While hydrogen energy-based solutions are based on renewable technologies and show great potential, they require heavy upfront capital investment in electrolyzers, hydrogen storage system, transport pipelines and distribution. Governments are trying to overcome this barrier through large-scale national hydrogen strategies and public-private hydrogen partnerships. For example, the U.S. Inflation Reduction Act opened with production tax credits of up to USD 3 per kg of low-carbon hydrogen. This allows for a green hydrogen solution, to compete on a price basis with grey hydrogen in more than a dozen states. For example, the European Union announced plans in 2021 to install at least 40 GW of electrolyzer capacity by the year 2030, and committed tens of billions in euro grants, and innovation funding towards these targets. India in 2022, initiated its National Green Hydrogen Mission with USD 2.3 billion to drive domestic production and to be an export hub for green hydrogen.

Not only do these policy frameworks reduce costs, but they also provide long-term demand certainty that encourages private sector players to invest in major projects. At the same time, governments are investing in hydrogen corridors, ports, and fueling infrastructure to facilitate adoption in mobility and shipping. Japan and Korea are taking the lead in creating hydrogen fueling stations for fuel-cell vehicles, and the EU is creating hydrogen-ready corridors under its Trans-European Transport Network (TEN-T). This creates a risk-reducing, infrastructure-led approach for corporate actors that results in economy of scale and commercialization accelerator. Behind the scenes, leading companies and advocates such as Air Liquide and Shell are further aligning with these initiatives by developing integrated hydrogen hubs with production, storage, and end-use.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 1.8 Bn |

| Market Forecast Value in 2035 | US$ 34.9 Bn |

| Growth Rate (CAGR) | 32.5% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and MWh for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Hydrogen-based Renewable Energy market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The hydrogen-based renewable energy market was valued at US$ 1.8 Bn in 2024

The hydrogen-based renewable energy industry is expected to grow at a CAGR of 32.5% from 2025 to 2035

Strategic decarbonization of hard-to-abate sectors and government-led investments and infrastructure development

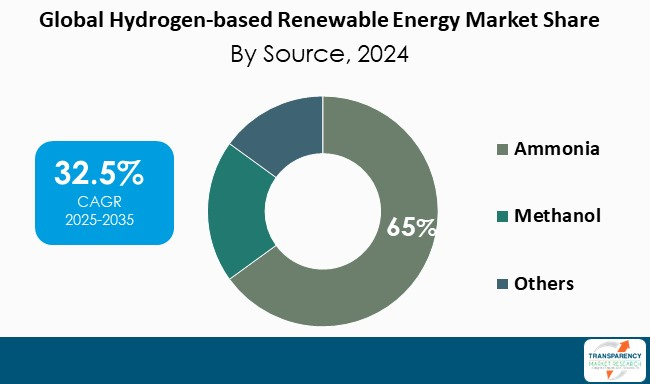

Ammonia was the largest source segment and its value was anticipated to grow at an estimated CAGR of 34.3% during the forecast period

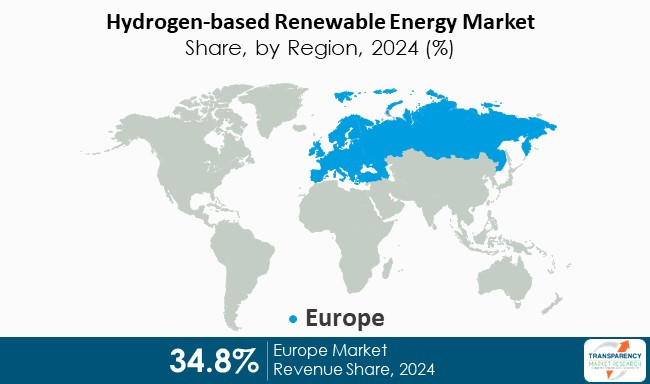

Europe was the most lucrative region in 2024

Siemens Energy AG, HyDeal, ITM Power PLC, Ballard Power Systems, Linde, Air Liquide and Air Products and Chemicals Inc. are the major players in the hydrogen-based renewable energy market

Table 1 Global Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 2 Global Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 3 Global Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 4 Global Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 5 Global Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 6 Global Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 7 Global Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Region, 2025 to 2035

Table 8 Global Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Region, 2025 to 2035

Table 9 North America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 10 North America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 11 North America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 12 North America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 13 North America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 14 North America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 15 North America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Country, 2025 to 2035

Table 16 North America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Country, 2025 to 2035

Table 17 U.S. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 18 U.S. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 19 U.S. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 20 U.S. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 21 U.S. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 22 U.S. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 23 Canada Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 24 Canada Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 25 Canada Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 26 Canada Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 27 Canada Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 28 Canada Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 29 Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 30 Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 31 Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 32 Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 33 Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 34 Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 35 Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Country and Sub-region, 2025 to 2035

Table 36 Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 37 Germany Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 38 Germany Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 39 Germany Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 40 Germany Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 41 Germany Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 42 Germany Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 43 France Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 44 France Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 45 France Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 46 France Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 47 France Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 48 France Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 49 U.K. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 50 U.K. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 51 U.K. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 52 U.K. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 53 U.K. Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 54 U.K. Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 55 Italy Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 56 Italy Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 57 Italy Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 58 Italy Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 59 Italy Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 60 Italy Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 61 Spain Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 62 Spain Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 63 Spain Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 64 Spain Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 65 Spain Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 66 Spain Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 67 Russia & CIS Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 68 Russia & CIS Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 69 Russia & CIS Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 70 Russia & CIS Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 71 Russia & CIS Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 72 Russia & CIS Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 73 Rest of Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 74 Rest of Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 75 Rest of Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 76 Rest of Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 77 Rest of Europe Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 78 Rest of Europe Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 79 Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 80 Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 81 Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 82 Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 83 Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 84 Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 85 Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Country and Sub-region, 2025 to 2035

Table 86 Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 87 China Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 88 China Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source 2025 to 2035

Table 89 China Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 90 China Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 91 China Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 92 China Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 93 Japan Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 94 Japan Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 95 Japan Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 96 Japan Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 97 Japan Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 98 Japan Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 99 India Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 100 India Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 101 India Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 102 India Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 103 India Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 104 India Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 105 India Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 106 India Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology 2025 to 2035

Table 107 ASEAN Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 108 ASEAN Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 109 ASEAN Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 110 ASEAN Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 111 ASEAN Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 112 ASEAN Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 113 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 114 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 115 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 116 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 117 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 118 Rest of Asia Pacific Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 119 Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 120 Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 121 Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 122 Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 123 Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 124 Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 125 Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Country and Sub-region, 2025 to 2035

Table 126 Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 127 Brazil Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 128 Brazil Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 129 Brazil Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 130 Brazil Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 131 Brazil Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 132 Brazil Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 133 Mexico Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 134 Mexico Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 135 Mexico Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 136 Mexico Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 137 Mexico Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 138 Mexico Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 139 Rest of Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 140 Rest of Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 141 Rest of Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 142 Rest of Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 143 Rest of Latin America Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 144 Rest of Latin America Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 145 Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 146 Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 147 Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 148 Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 149 Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 150 Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 151 Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Country and Sub-region, 2025 to 2035

Table 152 Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Country and Sub-region, 2025 to 2035

Table 153 GCC Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 154 GCC Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 155 GCC Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 156 GCC Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 157 GCC Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 158 GCC Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 159 South Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 160 South Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 161 South Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 162 South Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 163 South Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 164 South Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Table 165 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Source, 2025 to 2035

Table 166 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Source, 2025 to 2035

Table 167 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Application, 2025 to 2035

Table 168 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Application, 2025 to 2035

Table 169 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Volume (MWh) Forecast, by Technology, 2025 to 2035

Table 170 Rest of Middle East & Africa Hydrogen-based Renewable Energy Market Value (US$ Bn) Forecast, by Technology, 2025 to 2035

Figure 1 Global Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 2 Global Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 3 Global Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 4 Global Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 5 Global Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 6 Global Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 7 Global Hydrogen-based Renewable Energy Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Hydrogen-based Renewable Energy Market Attractiveness, by Region

Figure 9 North America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 10 North America Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 11 North America Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 12 North America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 13 North America Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 14 North America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 15 North America Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 16 North America Hydrogen-based Renewable Energy Market Attractiveness, by Country and Sub-region

Figure 17 Europe Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 18 Europe Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 19 Europe Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 20 Europe Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 21 Europe Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 22 Europe Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 23 Europe Hydrogen-based Renewable Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe Hydrogen-based Renewable Energy Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 26 Asia Pacific Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 27 Asia Pacific Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 28 Asia Pacific Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 29 Asia Pacific Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 30 Asia Pacific Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 31 Asia Pacific Hydrogen-based Renewable Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific Hydrogen-based Renewable Energy Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 34 Latin America Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 35 Latin America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 36 Latin America Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 37 Latin America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 38 Latin America Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 39 Latin America Hydrogen-based Renewable Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America Hydrogen-based Renewable Energy Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Hydrogen-based Renewable Energy Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 42 Middle East & Africa Hydrogen-based Renewable Energy Market Attractiveness, by Source

Figure 43 Middle East & Africa Hydrogen-based Renewable Energy Market Volume Share Analysis, by Application, 2024, 2028, and 2035

Figure 44 Middle East & Africa Hydrogen-based Renewable Energy Market Attractiveness, by Application

Figure 45 Middle East & Africa Hydrogen-based Renewable Energy Market Volume Share Analysis, by Technology, 2024, 2028, and 2035

Figure 46 Middle East & Africa Hydrogen-based Renewable Energy Market Attractiveness, by Technology

Figure 47 Middle East & Africa Hydrogen-based Renewable Energy Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa Hydrogen-based Renewable Energy Market Attractiveness, by Country and Sub-region