Reports

Reports

Grey hydrogen will remain a major part of the hydrogen economy today as it is the least expensive way to obtain hydrogen in large volumes. The primary drivers of any growth in this market are the ongoing demand from existing industries (refining, the manufacture of ammonia and methanol, steel making), the availability of existing gas- and coal-based feedstock, and existing SMR/coal-gasification infrastructure that provides attractive unit economics. The production process, steam methane reforming or coal gasification produces hydrogen and CO₂. It is grey as it carries carbon intensity but is immediately deployable and can scale to volume.

From an analyst's assessment, market momentum today is less about new plant built economics (green) and more about transitional dynamics: incumbents are “harvesting” existing assets and selectively investing in decarbonization. Key activities everywhere are retrofits (CCS pilot deployments and modular capture), commercial partnerships to blend blue-grey hydrogen, or establishing long-term offtake contracts to derisk investment.

At the same time, some firms are applying similar hedges by investing in electrolysis capacity, securing renewable power purchase agreements (PPAs), and pursuing only operational efficiency gains in their SMR units. Underlying the momentum for the grey hydrogen market, policy signals (carbon pricing, hydrogen strategies) and the natural gas price trajectories will influence whether grey hydrogen conceptually remains a cost anchor or is sufficiently out-competed by blue/green alternatives.

The grey hydrogen market implies the production and sales of hydrogen made by using steam methane reforming (SMR) or coal gasification, with the carbon dioxide emissions produced from those processes not captured. Grey hydrogen represents the largest share of the hydrogen supply globally, as it is produced at low cost and delivered with the existing infrastructure to use it conveniently.

The natural availability and scalability of grey hydrogen makes it a preferable choice for industries where supply of hydrogen tonnage is constant and reliable. However, as the process of hydrogen production occurs with CO₂ emissions and therefore is carbon-intensive, grey hydrogen is under looming scrutiny with respect to CO₂ emissions and environmental impact.

| Attribute | Detail |

|---|---|

| Drivers |

|

One of the key drivers supporting the grey hydrogen market is cost, based on decades of existing production and infrastructure. Grey hydrogen produced via steam methane reforming (SMR) or coal gasification is still the lowest-cost option in terms of the three channels despite blue hydrogen being lower cost than green.

Grey hydrogen utilizes a vast quantity of reasonably priced natural gas or coal feedstock and mature technology with no capital investment required for innovation to create operating efficiencies. Consequently, the cost of hydrogen is much lower for industrial end users consuming large volumes of hydrogen in cost-sensitive markets.

Thus, over decades of infrastructure built for grey hydrogen (production plants, transport pipelines, storage facilities), producers and consumers are provided with a ready-to-use ecosystem that is familiar and reliable. Industrial players have normalized their grey hydrogen usage contributing to extensive embeddedness into supply chains. These players have organized their business operations around grey hydrogen and transitioning to blue or green would require an expensive retrofit, requiring investment and operational shifts which would build up switching barriers.

In developing economies, which still rely on limited investment into renewable generation and CCS technologies, grey hydrogen provides an immediate, scalable respond to the base level hydrogen demand being realized. Thus, the combination of low-priced feedstock, proven technology, and an entrenched infrastructure contributes to the demand for Grey hydrogen.

Another important growth driver revolves around the huge industrial reliance on hydrogen as a feedstock, with grey hydrogen being dominant form. The greatest industrial users of hydrogen are in the fields of oil refining, ammonia for fertilizer production, methanol production, and steelmaking, and their demand profiles remain strong, notwithstanding pressing decarbonization efforts.

The refining industry uses hydrogen as hydrotreating and hydrocracking processes, where hydrogen is chemically used to remove contaminants and help produce cleaner fuels. Similarly, the global fertilizer industry impacts food security, especially in the emerging markets and with increasing focus on decarbonization, relies heavily on hydrogen for ammonia synthesis.

With the hydrogen economy gathering momentum internationally, it is widely expected that global hydrogen demand will see some significant growth over the next ten years. Although we anticipate green and blue hydrogen capacity to increase, they are more expensive than hydrogen produced from fossil fuels and will only be further constrained in their scalability and availability (at least in the short term).

It is fair to conclude that grey hydrogen will entirely supplement current and rising hydrogen consumption, and account for the transitional pace of low carbon hydrogen uptake. With many governments tightening emissions standards, many are looking at retrofitting carbon capture on grey facilities, but till we see both - technology and scale, companies will continue to depend on the current grey supply, which is deep in the industrial culture. Grey hydrogen's fixed role in these businesses demonstrates the necessity and relevance of grey hydrogen for global value chain.

| Attribute | Detail |

|---|---|

| Leading Region |

|

| Attribute | Detail |

|---|---|

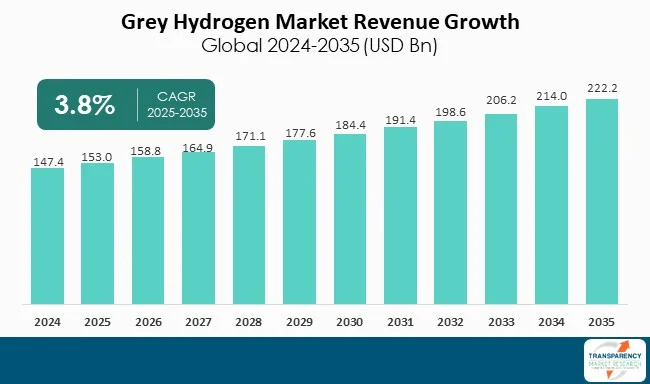

| Market Size Value in 2024 | US$ 147.4 Bn |

| Market Forecast Value in 2035 | US$ 222.2 Bn |

| Growth Rate (CAGR) | 3.8% |

| Forecast Period | 2025–2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value and Tons for Volume |

| Market Analysis | It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, Grey Hydrogen market opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Market Segmentation | Source

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The grey hydrogen market was valued at US$ 147.4 Bn in 2024

The grey hydrogen industry is expected to grow at a CAGR of 3.8% from 2025 to 2035

Cost competitiveness, established infrastructure, industrial dependence and growing hydrogen demand

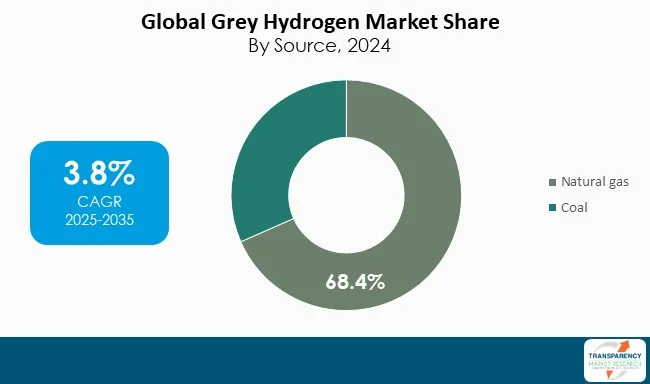

Natural gas held the largest share within the source segment and was anticipated to grow at an estimated CAGR of 3.2% during the forecast period

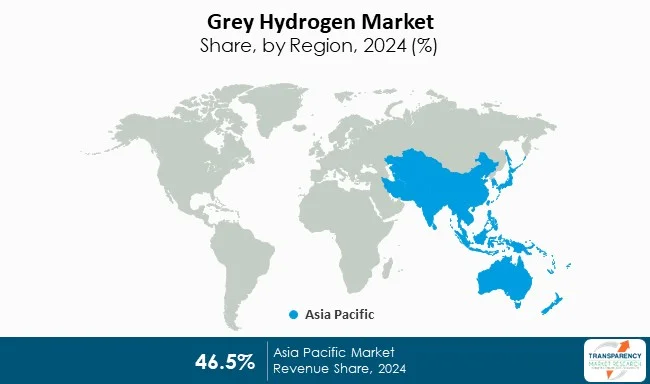

Asia Pacific was the most lucrative region in 2024

Air Liquide, Air Products and Chemicals, Inc., Chevron Corporation, Linde plc, Messer Group, Reliance Industries Ltd., and Orsted A/S are the major players in the grey hydrogen market

Table 1 Global Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 2 Global Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 3 Global Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 4 Global Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 5 Global Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Grey Hydrogen Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Grey Hydrogen Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 10 North America Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 11 North America Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 12 North America Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 13 North America Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Grey Hydrogen Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Grey Hydrogen Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 U.S. Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 18 U.S. Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 19 U.S. Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 20 U.S. Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 21 U.S. Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 U.S. Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 24 Canada Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 25 Canada Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 26 Canada Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 27 Canada Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 30 Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 31 Europe Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 32 Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 33 Europe Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Grey Hydrogen Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 38 Germany Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 39 Germany Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 40 Germany Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 41 Germany Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 44 France Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 45 France Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 46 France Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 47 France Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 U.K. Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 50 U.K. Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 51 U.K. Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 52 U.K. Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 53 U.K. Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 U.K. Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 56 Italy Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 57 Italy Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 58 Italy Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 59 Italy Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 62 Spain Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 63 Spain Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 64 Spain Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 65 Spain Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 68 Russia & CIS Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 69 Russia & CIS Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 70 Russia & CIS Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 71 Russia & CIS Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 74 Rest of Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 75 Rest of Europe Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 76 Rest of Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 77 Rest of Europe Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 80 Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 81 Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 82 Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 83 Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 88 China Grey Hydrogen Market Value (US$ Bn) Forecast, by Source 2020 to 2035

Table 89 China Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 90 China Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 91 China Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 94 Japan Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 95 Japan Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 96 Japan Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 97 Japan Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 100 India Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 101 India Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 102 India Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 103 India Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 108 ASEAN Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 109 ASEAN Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 110 ASEAN Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 111 ASEAN Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 114 Rest of Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 115 Rest of Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 116 Rest of Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 117 Rest of Asia Pacific Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 120 Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 121 Latin America Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 122 Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 123 Latin America Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Grey Hydrogen Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 128 Brazil Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 129 Brazil Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 130 Brazil Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 131 Brazil Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 134 Mexico Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 135 Mexico Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 136 Mexico Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 137 Mexico Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 140 Rest of Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 141 Rest of Latin America Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 142 Rest of Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 143 Rest of Latin America Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 146 Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 147 Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 148 Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 149 Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 154 GCC Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 155 GCC Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 156 GCC Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 157 GCC Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 160 South Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 161 South Africa Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 162 South Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 163 South Africa Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by Source, 2020 to 2035

Table 166 Rest of Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Source, 2020 to 2035

Table 167 Rest of Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by Production Process, 2020 to 2035

Table 168 Rest of Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by Production Process, 2020 to 2035

Table 169 Rest of Middle East & Africa Grey Hydrogen Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Grey Hydrogen Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

List of Figures

Figure 1 Global Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 2 Global Grey Hydrogen Market Attractiveness, by Source

Figure 3 Global Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 4 Global Grey Hydrogen Market Attractiveness, by Production Process

Figure 5 Global Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 6 Global Grey Hydrogen Market Attractiveness, by End-use

Figure 7 Global Grey Hydrogen Market Volume Share Analysis, by Region, 2024, 2028, and 2035

Figure 8 Global Grey Hydrogen Market Attractiveness, by Region

Figure 9 North America Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 10 North America Grey Hydrogen Market Attractiveness, by Source

Figure 11 North America Grey Hydrogen Market Attractiveness, by Source

Figure 12 North America Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 13 North America Grey Hydrogen Market Attractiveness, by Production Process

Figure 14 North America Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 15 North America Grey Hydrogen Market Attractiveness, by End-use

Figure 16 North America Grey Hydrogen Market Attractiveness, by Country and Sub-region

Figure 17 Europe Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 18 Europe Grey Hydrogen Market Attractiveness, by Source

Figure 19 Europe Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 20 Europe Grey Hydrogen Market Attractiveness, by Production Process

Figure 21 Europe Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 22 Europe Grey Hydrogen Market Attractiveness, by End-use

Figure 23 Europe Grey Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 24 Europe Grey Hydrogen Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 26 Asia Pacific Grey Hydrogen Market Attractiveness, by Source

Figure 27 Asia Pacific Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 28 Asia Pacific Grey Hydrogen Market Attractiveness, by Production Process

Figure 29 Asia Pacific Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 30 Asia Pacific Grey Hydrogen Market Attractiveness, by End-use

Figure 31 Asia Pacific Grey Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 32 Asia Pacific Grey Hydrogen Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 34 Latin America Grey Hydrogen Market Attractiveness, by Source

Figure 35 Latin America Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 36 Latin America Grey Hydrogen Market Attractiveness, by Production Process

Figure 37 Latin America Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 38 Latin America Grey Hydrogen Market Attractiveness, by End-use

Figure 39 Latin America Grey Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 40 Latin America Grey Hydrogen Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Grey Hydrogen Market Volume Share Analysis, by Source, 2024, 2028, and 2035

Figure 42 Middle East & Africa Grey Hydrogen Market Attractiveness, by Source

Figure 43 Middle East & Africa Grey Hydrogen Market Volume Share Analysis, by Production Process, 2024, 2028, and 2035

Figure 44 Middle East & Africa Grey Hydrogen Market Attractiveness, by Production Process

Figure 45 Middle East & Africa Grey Hydrogen Market Volume Share Analysis, by End-use, 2024, 2028, and 2035

Figure 46 Middle East & Africa Grey Hydrogen Market Attractiveness, by End-use

Figure 47 Middle East & Africa Grey Hydrogen Market Volume Share Analysis, by Country and Sub-region, 2024, 2028, and 2035

Figure 48 Middle East & Africa Grey Hydrogen Market Attractiveness, by Country and Sub-region