Reports

Reports

Analysts’ Viewpoint

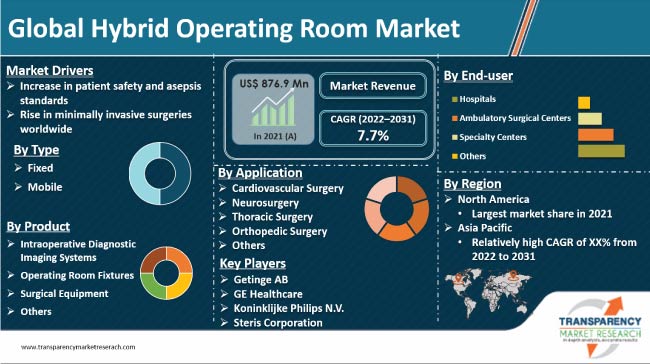

Significant technological improvements are driving the global hybrid operating room market size. Surge in usage of robotic procedures in a number of countries, including the U.S., Germany, the U.K., and Japan, has contributed to market expansion. Growth in investments in R&D by companies operating in medical, healthcare, and government sectors is further augmenting global market progress. Increase in minimally invasive surgeries across the world is also anticipated to boost the hybrid operating room market growth.

Key players operating in the sector are striving to launch innovative and advanced products through strategic collaborations, partnerships, and mergers and acquisitions in order to enhance their product portfolio and market position.

Hybrid operating room (OR) combines the capabilities of an operating room with interventional imaging technologies. Hybrid ORs, which combine surgical facilities and imaging systems in one location, can be used for standard open operations, image-guided surgeries, or a combination of different types of procedures. They help increase flexibility and utility of a space.

Patients, clinicians, and health care organizations benefit from hybrid operating rooms. Modern hybrid operating rooms are used to carry out a wide range of operations that are less invasive than traditional surgeries and offer patients quicker recovery times. For instance, complex cardiovascular and endovascular diseases that formerly required open heart surgeries are now diagnosed and treated in hybrid operating theaters with less invasive surgeries.

Single-plane or biplane angiography equipment, computed tomography (CT) scanners, and magnetic resonance imaging (MRI) scanners are some of the examples of imaging equipment often used in a hybrid OR. Single-plane system is a commonly used equipment for a variety of cardiac and vascular procedures. Rise in minimally invasive procedures, which offer improved accuracy and shorter recovery times, is likely to positively impact market statistics during the forecast period.

Patients are increasingly opting for minimally invasive surgery (MIS) procedures, as these result in fewer complications and lesser blood loss. They also require shorter hospital stay and lower readmission rates than open surgeries. Furthermore, the cost of a minimally invasive surgery is lower than that of an open surgery.

Minimally invasive implants, robotics, and virtual care can be utilized to enhance and expand MIS. Rapid development in medical robotic systems can be ascribed to technological advancements such as usage of more efficient motors, small and light materials, power backup, advanced controls, and safety measures. Other technical breakthroughs in medical robotics include the combination of magnetic resonance imaging and 3D ultrasound to allow for real-time imaging for effective operation planning and easy future reference.

The global market demand is expected to be driven by the increase in collaboration among players and growth in demand for less invasive surgeries.

Hybrid operating room (OR) is an aseptic environment that combines surgical equipment, instruments, surgical tables, OR lights, equipment management systems, and surgical booms with fixed sophisticated imaging systems. It allows for combined image-guided and less invasive treatments. Hybrid OR eliminates the need for duplicate equipment, resources, space, supplies, and personnel allocation for each venue. Usage of hybrid OR helps the staff save time, since procedures can be booked as one process rather than two distinct procedures.

Equipment or technology troubleshooting is required at one place rather than two, as hybrid OR combines surgical and imaging equipment in one location. Hybrid operating rooms also enhance patient outcomes, and shorten patient recovery time and stays, thus lowering healthcare costs. These advantages associated with hybrid ORs are expected to drive market development during the forecast period.

Demand for intraoperative diagnostic imaging systems is higher than that for other components of the hybrid operating room. The segment accounted for around 50.0% market share in 2021. The trend is projected to continue over the next few years.

High reliance of neurosurgeons on intraoperative diagnostic systems in the treatment of severe diseases, such as brain tumor, is expected to augment the growth of the segment during the forecast period. Furthermore, intraoperative diagnostic systems offer high surgical accuracy. This is also driving the demand for these imaging systems.

According to the hybrid operating room market research report, the cardiovascular surgery application segment is projected to account for dominant market share during the forecast period. Large numbers of cardiac procedures are performed in a clinical setting. These include transcatheter aortic valve replacement (TAVR), endovascular thoracic (TEVAR) or abdominal (EVAR) aortic repair, and combined percutaneous coronary intervention (PCI) with structural heart intervention.

Latest breakthroughs in computer and imaging technology, which provide surgeons with remarkable control and clear three-dimensional views comparable to those gained in traditional open surgeries, are driving the cardiovascular surgery segment of the global hybrid operating room industry.

Based on end-user, the hospitals segment is projected to dominate the industry from 2022 to 2031. The cost involved in setting up a hybrid operating room is quite high; hence, large hospitals can afford to install these rooms. Furthermore, increase in number of minimally invasive procedures is expected to propel the hospital segment during the forecast period.

North America accounted for the largest share of around 40.0% of the global industry in 2021. The market in the region is projected to grow at a CAGR of over 7.5% from 2022 to 2031. This can be ascribed to the presence of advanced medical and healthcare infrastructure in North America.

Asia Pacific was the fastest growing region in 2021. The market in the region is projected to grow at a CAGR of 8.7% during the forecast period owing to the presence of a large patient pool and improvement in health care facilities in the region. Growth in number of ambulatory surgery facilities and increase in demand for surgical treatments are also likely to boost the market in Asia Pacific in the near future.

Launch of technologically advanced products and collaborations & acquisitions are the key strategies adopted by the leading players. The global hybrid operating room market is consolidated, with the presence of a smaller number of players.

Getinge AB, GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Steris Corporation, Trumpf Medical (Hill-Rom Holdings, Inc.), NDS Surgical Imaging, LLC (Novanta Inc.), Toshiba Corporation, Canon Medical Systems Corporation, and Stryker Corporation are the prominent market entities.

Leading players have been summarized in the hybrid operating room market report based on parameters such as financial overview, company overview, product portfolio, business strategies, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 876.9 Mn |

|

Market Forecast Value in 2031 |

US$ 1.8 Bn |

|

Growth Rate |

7.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2020 |

|

Quantitative Units |

US$ Mn/Bn for Value |

|

Market Analysis |

It includes cross segment analysis as well as at regional level. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

Market share analysis by company (2021) Company profiles section includes overview, product portfolio, sales footprint, key subsidiaries or distributors, strategy & recent developments, and key financials. |

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 876.9 Mn in 2021

It is projected to reach US$ 1.8 Bn by 2031

The CAGR was 0.7% from 2017 to 2021

The CAGR is anticipated to be 7.7% from 2022 to 2031

Increase in number of minimally invasive surgeries, technological advancements, and numerous benefits of hybrid OR such as patient safety and long-term cost savings

The intraoperative diagnostic imaging systems segment held around 50.0% share in 2021

North America is expected to account for significant share during the forecast period

Getinge AB, GE Healthcare, Siemens Healthineers, Koninklijke Philips N.V., Steris Corporation, Trumpf Medical, NDS Surgical Imaging, LLC (Novanta Inc.), Toshiba Corporation, Canon Medical Systems Corporation, and Stryker Corporation

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary : Global Hybrid Operating Room Market

4. Market Overview

4.1. Introduction

4.1.1. Segment Definition

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hybrid Operating Room Market Analysis and Forecast, 2017 - 2031

4.4.1. Market Revenue Projection (US$ Mn)

4.5. Porter’s Five Force Analysis

5. Key Insights

5.1. Technological Advancements

5.2. Pipeline Analysis

5.3. Key Industry Events (Mergers, Acquisitions, Partnerships, Collaborations, etc.)

5.4. COVID-19 Pandemic Impact on Industry (Value Chain and Short / Mid / Long Term Impact)

6. Global Hybrid Operating Room Market Analysis and Forecast, By Product

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast By Product, 2017 - 2031

6.3.1. Intraoperative Diagnostic Imaging Systems

6.3.1.1. Angiography Systems

6.3.1.2. MRI Systems

6.3.1.3. CT Scanners

6.3.1.4. Others

6.3.2. Operating Room Fixtures

6.3.2.1. Operating Tables

6.3.2.2. Operating Room Lights

6.3.2.3. Surgical Booms

6.3.2.4. Others

6.3.3. Surgical Equipment

6.3.4. Others

6.4. Market Attractiveness By Type

7. Global Hybrid Operating Room Market Analysis and Forecast, By Type

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast By Type, 2017 - 2031

7.3.1. Fixed

7.3.2. Mobile

7.4. Market Attractiveness By Type

8. Global Hybrid Operating Room Market Analysis and Forecast, By Application

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast By Application, 2017 - 2031

8.3.1. Cardiovascular Surgery

8.3.2. Neurosurgery

8.3.3. Thoracic Surgery

8.3.4. Orthopedic Surgery

8.3.5. Others

8.4. Market Attractiveness By Application

9. Global Hybrid Operating Room Market Analysis and Forecast, By End-user

9.1. Introduction & Definition

9.2. Key Findings / Developments

9.3. Market Value Forecast By End-user, 2017 - 2031

9.3.1. Hospitals

9.3.2. Ambulatory Surgical Centers

9.3.3. Specialty Centers

9.3.4. Others

9.4. Market Attractiveness By End-user

10. Global Hybrid Operating Room Market Analysis and Forecast, By Region

10.1. Key Findings

10.2. Market Value Forecast By Region

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Latin America

10.2.5. Middle East & Africa

10.3. Market Attractiveness By Country/Region

11. North America Hybrid Operating Room Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast By Product, 2017 - 2031

11.2.1. Intraoperative Diagnostic Imaging Systems

11.2.1.1. Angiography Systems

11.2.1.2. MRI Systems

11.2.1.3. CT Scanners

11.2.1.4. Others

11.2.2. Operating Room Fixtures

11.2.2.1. Operating Tables

11.2.2.2. Operating Room Lights

11.2.2.3. Surgical Booms

11.2.2.4. Others

11.2.3. Surgical Equipment

11.2.4. Others

11.3. Market Value Forecast By Type, 2017 - 2031

11.3.1. Fixed

11.3.2. Mobile

11.4. Market Value Forecast By Application, 2017 - 2031

11.4.1. Cardiovascular Surgery

11.4.2. Neurosurgery

11.4.3. Thoracic Surgery

11.4.4. Orthopedic Surgery

11.4.5. Others

11.5. Market Value Forecast By End-user, 2017 - 2031

11.5.1. Hospitals

11.5.2. Ambulatory Surgical Centers

11.5.3. Specialty Centers

11.5.4. Others

11.6. Market Value Forecast By Country, 2017 - 2031

11.6.1. U.S.

11.6.2. Canada

11.7. Market Attractiveness Analysis

11.7.1. By Product

11.7.2. By Type

11.7.3. By Application

11.7.4. By End-user

11.7.5. By Country

12. Europe Hybrid Operating Room Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast By Product, 2017 - 2031

12.2.1. Intraoperative Diagnostic Imaging Systems

12.2.1.1. Angiography Systems

12.2.1.2. MRI Systems

12.2.1.3. CT Scanners

12.2.1.4. Others

12.2.2. Operating Room Fixtures

12.2.2.1. Operating Tables

12.2.2.2. Operating Room Lights

12.2.2.3. Surgical Booms

12.2.2.4. Others

12.2.3. Surgical Equipment

12.2.4. Others

12.3. Market Value Forecast By Type, 2017 - 2031

12.3.1. Fixed

12.3.2. Mobile

12.4. Market Value Forecast By Application, 2017 - 2031

12.4.1. Cardiovascular Surgery

12.4.2. Neurosurgery

12.4.3. Thoracic Surgery

12.4.4. Orthopedic Surgery

12.4.5. Others

12.5. Market Value Forecast By End-user, 2017 - 2031

12.5.1. Hospitals

12.5.2. Ambulatory Surgical Centers

12.5.3. Specialty Centers

12.5.4. Others

12.6. Market Value Forecast By Country/Sub-region, 2017 - 2031

12.6.1. Germany

12.6.2. U.K.

12.6.3. France

12.6.4. Spain

12.6.5. Italy

12.6.6. Rest of Europe

12.7. Market Attractiveness Analysis

12.7.1. By Product

12.7.2. By Type

12.7.3. By Application

12.7.4. By End-user

12.7.5. By Country/Sub-region

13. Asia Pacific Hybrid Operating Room Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast By Product, 2017 - 2031

13.2.1. Intraoperative Diagnostic Imaging Systems

13.2.1.1. Angiography Systems

13.2.1.2. MRI Systems

13.2.1.3. CT Scanners

13.2.1.4. Others

13.2.2. Operating Room Fixtures

13.2.2.1. Operating Tables

13.2.2.2. Operating Room Lights

13.2.2.3. Surgical Booms

13.2.2.4. Others

13.2.3. Surgical Equipment

13.2.4. Others

13.3. Market Value Forecast By Type, 2017 - 2031

13.3.1. Fixed

13.3.2. Mobile

13.4. Market Value Forecast By Application, 2017 - 2031

13.4.1. Cardiovascular Surgery

13.4.2. Neurosurgery

13.4.3. Thoracic Surgery

13.4.4. Orthopedic Surgery

13.4.5. Others

13.5. Market Value Forecast By End-user, 2017 - 2031

13.5.1. Hospitals

13.5.2. Ambulatory Surgical Centers

13.5.3. Specialty Centers

13.5.4. Others

13.6. Market Value Forecast By Country/Sub-region, 2017 - 2031

13.6.1. China

13.6.2. Japan

13.6.3. India

13.6.4. Australia & New Zealand

13.6.5. Rest of Asia Pacific

13.7. Market Attractiveness Analysis

13.7.1. By Product

13.7.2. By Type

13.7.3. By Application

13.7.4. By End-user

13.7.5. By Country/Sub-region

14. Latin America Hybrid Operating Room Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast By Product, 2017 - 2031

14.2.1. Intraoperative Diagnostic Imaging Systems

14.2.1.1. Angiography Systems

14.2.1.2. MRI Systems

14.2.1.3. CT Scanners

14.2.1.4. Others

14.2.2. Operating Room Fixtures

14.2.2.1. Operating Tables

14.2.2.2. Operating Room Lights

14.2.2.3. Surgical Booms

14.2.2.4. Others

14.2.3. Surgical Equipment

14.2.4. Others

14.3. Market Value Forecast By Type, 2017 - 2031

14.3.1. Fixed

14.3.2. Mobile

14.4. Market Value Forecast By Application, 2017 - 2031

14.4.1. Cardiovascular Surgery

14.4.2. Neurosurgery

14.4.3. Thoracic Surgery

14.4.4. Orthopedic Surgery

14.4.5. Others

14.5. Market Value Forecast By End-user, 2017 - 2031

14.5.1. Hospitals

14.5.2. Ambulatory Surgical Centers

14.5.3. Specialty Centers

14.5.4. Others

14.6. Market Value Forecast By Country/Sub-region, 2017 - 2031

14.6.1. Brazil

14.6.2. Mexico

14.6.3. Rest of Latin America

14.7. Market Attractiveness Analysis

14.7.1. By Product

14.7.2. By Type

14.7.3. By Application

14.7.4. By End-user

14.7.5. By Country/Sub-region

15. Middle East & Africa Hybrid Operating Room Market Analysis and Forecast

15.1. Introduction

15.1.1. Key Findings

15.2. Market Value Forecast By Product, 2017 - 2031

15.2.1. Intraoperative Diagnostic Imaging Systems

15.2.1.1. Angiography Systems

15.2.1.2. MRI Systems

15.2.1.3. CT Scanners

15.2.1.4. Others

15.2.2. Operating Room Fixtures

15.2.2.1. Operating Tables

15.2.2.2. Operating Room Lights

15.2.2.3. Surgical Booms

15.2.2.4. Others

15.2.3. Surgical Equipment

15.2.4. Others

15.3. Market Value Forecast By Type, 2017 - 2031

15.3.1. Fixed

15.3.2. Mobile

15.4. Market Value Forecast By Application, 2017 - 2031

15.4.1. Cardiovascular Surgery

15.4.2. Neurosurgery

15.4.3. Thoracic Surgery

15.4.4. Orthopedic Surgery

15.4.5. Others

15.5. Market Value Forecast By End-user, 2017 - 2031

15.5.1. Hospitals

15.5.2. Ambulatory Surgical Centers

15.5.3. Specialty Centers

15.5.4. Others

15.6. Market Value Forecast By Country/Sub-region, 2017 - 2031

15.6.1. GCC Countries

15.6.2. South Africa

15.6.3. Rest of Middle East & Africa

15.7. Market Attractiveness Analysis

15.7.1. By Product

15.7.2. By Type

15.7.3. By Application

15.7.4. By End-user

15.7.5. By Country/Sub-region

16. Competition Landscape

16.1. Market Player – Competition Matrix (By Tier and Size of companies)

16.2. Market Share Analysis By Company (2021)

16.3. Company Profiles

16.3.1. Getinge AB

16.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.1.2. Product Portfolio

16.3.1.3. Financial Overview

16.3.1.4. SWOT Analysis

16.3.1.5. Strategic Overview

16.3.2. GE Healthcare

16.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.2.2. Product Portfolio

16.3.2.3. Financial Overview

16.3.2.4. SWOT Analysis

16.3.2.5. Strategic Overview

16.3.3. Siemens Healthineers

16.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.3.2. Product Portfolio

16.3.3.3. Financial Overview

16.3.3.4. SWOT Analysis

16.3.3.5. Strategic Overview

16.3.4. Koninklijke Philips N.V.

16.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.4.2. Product Portfolio

16.3.4.3. Financial Overview

16.3.4.4. SWOT Analysis

16.3.4.5. Strategic Overview

16.3.5. Steris Corporation

16.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.5.2. Product Portfolio

16.3.5.3. Financial Overview

16.3.5.4. SWOT Analysis

16.3.5.5. Strategic Overview

16.3.6. Trumpf Medical (Hill-Rom Holdings, Inc.)

16.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.6.2. Product Portfolio

16.3.6.3. Financial Overview

16.3.6.4. SWOT Analysis

16.3.6.5. Strategic Overview

16.3.7. NDS Surgical Imaging, LLC (Novanta Inc.)

16.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.7.2. Product Portfolio

16.3.7.3. Financial Overview

16.3.7.4. SWOT Analysis

16.3.7.5. Strategic Overview

16.3.8. Toshiba Corporation

16.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.8.2. Product Portfolio

16.3.8.3. Financial Overview

16.3.8.4. SWOT Analysis

16.3.8.5. Strategic Overview

16.3.9. Canon Medical Systems Corporation

16.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.9.2. Product Portfolio

16.3.9.3. Financial Overview

16.3.9.4. SWOT Analysis

16.3.9.5. Strategic Overview

16.3.10. Stryker Corporation

16.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

16.3.10.2. Product Portfolio

16.3.10.3. Financial Overview

16.3.10.4. SWOT Analysis

16.3.10.5. Strategic Overview

List of Tables

Table 01: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 02: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 03: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 04: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 05: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 07: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 08: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 09: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 10: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 11: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 12: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 13: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 14: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 15: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 16: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 18: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 19: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 20: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 21: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 22: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 23: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 24: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 25: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

Table 26: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017‒2031

Table 27: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, by Product, 2017‒2031

Table 28: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, by Type, 2017–2031

Table 29: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, by Application, 2017–2031

Table 30: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, by End-user, 2017–2031

List of Figures

Figure 01: Global Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 02: Hybrid Operating Room Market Value Share, by Product, 2021

Figure 03: Hybrid Operating Room Market Value Share, by Type, 2021

Figure 04: Hybrid Operating Room Market Value Share, by Application 2021

Figure 04: Hybrid Operating Room Market Value Share, by End-user 2021

Figure 05: Global Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 06: Global Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 07: Global Hybrid Operating Room Market Value (US$ Mn), by Intraoperative Diagnostic Imaging Systems, 2017‒2031

Figure 08: Global Hybrid Operating Room Market Value (US$ Mn), by Operating Room Fixtures, 2017‒2031

Figure 09: Global Hybrid Operating Room Market Value (US$ Mn), by Surgical Equipment, 2017‒2031

Figure 10: Global Hybrid Operating Room Market Value (US$ Mn), by Others, 2017‒2031

Figure 11: Global Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 12: Global Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 13: Global Hybrid Operating Room Market Revenue (US$ Mn), by Fixed, 2017–2031

Figure 14: Global Hybrid Operating Room Market Revenue (US$ Mn), by Mobile, 2017–2031

Figure 15: Global Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 16: Global Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 17: Global Hybrid Operating Room Market Revenue (US$ Mn), by Cardiovascular Surgery, 2017–2031

Figure 18: Global Hybrid Operating Room Market Revenue (US$ Mn), by Neurosurgery, 2017–2031

Figure 19: Global Hybrid Operating Room Market Revenue (US$ Mn), by Thoracic Surgery, 2017–2031

Figure 20: Global Hybrid Operating Room Market Revenue (US$ Mn), by Orthopedic Surgery, 2017–2031

Figure 21: Global Hybrid Operating Room Market Revenue (US$ Mn), by Others, 2017–2031

Figure 22: Global Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 23: Global Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031

Figure 24: Global Hybrid Operating Room Market Revenue (US$ Mn), by Hospitals, 2017–2031

Figure 25: Global Hybrid Operating Room Market Revenue (US$ Mn), by Ambulatory Surgical Centers, 2017–2031

Figure 26: Global Hybrid Operating Room Market Revenue (US$ Mn), by Specialty Centers, 2017–2031

Figure 27: Global Hybrid Operating Room Market Revenue (US$ Mn), by Others, 2017–2031

Figure 28: Global Hybrid Operating Room Market Value Share Analysis, by Region, 2021 and 2031

Figure 29: Global Hybrid Operating Room Market Attractiveness Analysis, by Region, 2022–2031

Figure 30: North America Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 31: North America Hybrid Operating Room Market Value Share Analysis, by Country, 2021 and 2031

Figure 32: North America Hybrid Operating Room Market Attractiveness Analysis, by Country, 2022–2031

Figure 33: North America Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 34: North America Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 35: North America Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 36: North America Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 37: North America Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 38: North America Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 39: North America Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 40: North America Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031

Figure 41: Europe Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 42: Europe Hybrid Operating Room Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 43: Europe Hybrid Operating Room Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 44: Europe Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 45: Europe Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 46: Europe Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 47: Europe Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 48: Europe Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 49: Europe Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 50: Europe Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 51: Europe Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031

Figure 52: Asia Pacific Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 53: Asia Pacific Hybrid Operating Room Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 54: Asia Pacific Hybrid Operating Room Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 55: Asia Pacific Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 56: Asia Pacific Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 57: Asia Pacific Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 58: Asia Pacific Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 59: Asia Pacific Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 60: Asia Pacific Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 61: Asia Pacific Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 62: Asia Pacific Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031

Figure 63: Latin America Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 64: Latin America Hybrid Operating Room Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 65: Latin America Hybrid Operating Room Market Attractiveness Analysis, by Country/Sub-region, 2022-2031

Figure 66: Latin America Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 67: Latin America Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 68: Latin America Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 69: Latin America Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 70: Latin America Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 71: Latin America Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 72: Latin America Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 73: Latin America Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031

Figure 74: Middle East & Africa Hybrid Operating Room Market Value (US$ Mn) Forecast, 2017–2031

Figure 75: Middle East & Africa Hybrid Operating Room Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 76: Middle East & Africa Hybrid Operating Room Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 77: Middle East & Africa Hybrid Operating Room Market Value Share Analysis, by Product, 2021 and 2031

Figure 78: Middle East & Africa Hybrid Operating Room Market Attractiveness Analysis, by Product, 2022–2031

Figure 79: Middle East & Africa Hybrid Operating Room Market Value Share Analysis, by Type, 2021 and 2031

Figure 80: Middle East & Africa Hybrid Operating Room Market Attractiveness Analysis, by Type, 2022–2031

Figure 81: Middle East & Africa Hybrid Operating Room Market Value Share Analysis, by Application, 2021 and 2031

Figure 82: Middle East & Africa Hybrid Operating Room Market Attractiveness Analysis, by Application, 2022–2031

Figure 83: Middle East & Africa Hybrid Operating Room Market Value Share Analysis, by End-user, 2021 and 2031

Figure 84: Middle East & Africa Hybrid Operating Room Market Attractiveness Analysis, by End-user, 2022–2031