Reports

Reports

Analysts’ Viewpoint

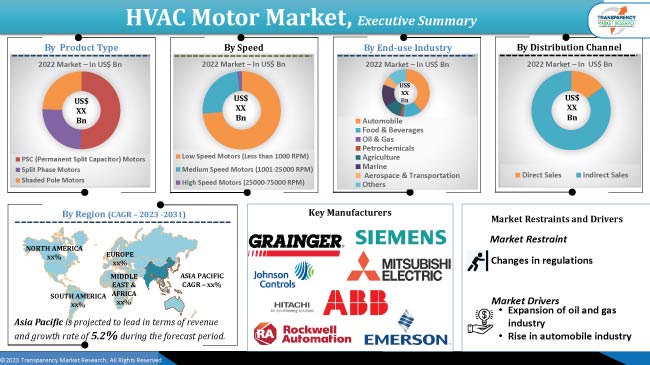

Expansion of the oil and gas industry and developments in the automobile industry are driving the global HVAC motor industry. Increase in interest of manufacturers to explore rural markets is also augmenting market statistics. Furthermore, advancements in technology are creating lucrative HVAC motor market opportunities for manufacturers. For instance, the latest generation of AI-based automated heating systems introduced in the market.

The global HVAC motor market has unquestionably grown as a result of technology that significantly contributes to meeting the rise in demand for energy saving solutions. While mechanical advancements and increased efficiency were the primary focus of the initial HVAC motor market development, the current HVAC motor market trends focus on shifting toward sustainability, comfort, and energy efficiency.

The HVAC motor is a component of the heating and cooling system that dispels conditioned air from the furnace, or air conditioner in commercial or industrial settings. The HVAC motor pushes the heated or cooled air through the ductwork and out of the room through the vents.

The majority of residential and commercial areas are being reshaped as a result of the increased use of cutting-edge technologies in recent years. The development of highly intelligent, fully automated HVAC blower motor technologies is an ongoing trend.

The different types of HVAC motors include PSC (Permanent Split Capacitor) motors, a type of AC single-phase induction motor with mid-level characteristics; split phase motor, which has a main winding and a start winding that provides additional torque during start-up; and shaded pole motors that are a straightforward, minimal expense single-stage AC enlistment engine.

Global expansion in the oil and gas industry is anticipated to boost the HVAC motor market growth during the forecast period. HVAC significantly contributes to increased safety by preventing hazards during the production process and providing conducive thermal conditions.

The oil and natural gas sector contributes 7% of the gross domestic product to the United States and supports nine million jobs, according to the American Petroleum Institute. European gas reserves can be used to achieve the EU's goal of climate neutrality by complementing the deployment of renewable energy and much-needed energy savings.

Asia Pacific represented 8.4% of the world's oil creation in 2020. In the Middle East, the oil and gas industry accounts for 30% of the UAE's GDP and 13% of its exports.

Only the highest quality industrial fans and other ventilation equipment can meet the demands of oil, petroleum, and gas industries for HVAC reliability and sustainability. Unlike any other industry, the oil, petroleum, and natural gas refining process generate a tremendous amount of heat, corrosion, moisture, fumes, and noise. As a result, oil refineries, extraction facilities, and other gas facilities need dependable, robust HVAC motor equipment paired with an appropriate ventilation system. Hence, extensive usage in the oil and gas sector is fuelling the HVAC motors market size.

The rise in demand for machine control in the vehicle business is one of the key factors anticipated to drive global HVAC motor market progress.

According to the most recent survey conducted by the U.S. Census Bureau, 92% of American households owned at least one vehicle. The country's high demand for automobiles results in an active automotive industry. The automotive industry in the European Union is the largest private investor in R&D, making it one of the world's largest producers. Over 7% of the GDP in the European Union is generated by the automotive industry's turnover.

HVAC motors are frequently utilized in automobiles to maintain HVAC systems in vehicles, for internal temperature regulation, window defrosting, and engine cooling. Besides, the rise in the production of auto parts globally is expected to expand the HVAC motor market demand, as these HVAC motors are used in a variety of automotive applications such as fan motors and air conditioning blowers.

Europe and North America are expected to hold the majority of the HVAC motor market share due to the growing automobile industry and rise in oil and gas demand in the regions

As per the HVAC motor market analysis, Asia Pacific is expected to have the highest growth rate due to the presence of oil and gas industries in the region. The focus on promoting sustainable building practices and initiatives to improve air quality in cities by the Indian government is expected to be a major factor driving the demand for HVAC systems in the country.

The HVAC motor market in the Middle East & Africa is anticipated to also hold a vital share of the global landscape due to the UAE's exploration projects, which are likely to provide opportunities for Greenfield projects. The Abu Dhabi National Oil Company (ADNOC) intends to construct a brand new liquefied natural gas plant in Fujairah that would produce as much as 9.6 million tons annually and more than double its export capacity.

Investments in R&D activities, product expansions, and mergers and acquisitions are the business model of prominent HVAC motor manufacturers. Product development is a major marketing strategy of the HVAC motor market's top players. The market is highly competitive, with the presence of various global and regional players.

ABB, Emerson Electric Co, GE, Hitachi (Johnson Controls), Ingersoll-Rand Plc, Mitsubishi Electric, Regal Beloit Corporation, Rockwell Automation, Siemens, and W. W. Grainger, Inc. are the prominent entities profiled in the HVAC motor market.

Each of these players has been profiled in the HVAC motor market research based on parameters such as company overview, business strategies, financial overview, product portfolio, recent developments, and business segments.

|

Attribute |

Detail |

|

Market Size Value in 2022 |

US$ 16.1 Bn |

|

Market Forecast Value in 2031 |

US$ 25.1 Bn |

|

Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2023–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value & Thousand Units for Volume |

|

Market Analysis |

Includes cross segment analysis at regional as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Region Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 16.1 Bn in 2022.

It is estimated to expand at a CAGR of 5.2% from 2023 to 2031.

Expansion of the oil and gas industry, and rise in automobile industry.

In terms of product type, the permanent split capacitor motors segment accounted for significant share in 2022.

Asia Pacific is likely to be one of the lucrative markets in the next few years.

ABB, Emerson Electric Co, GE, Hitachi (Johnson Controls), Ingersoll-Rand Plc, Mitsubishi Electric, Regal Beloit Corporation, Rockwell Automation, Siemens, and W. W. Grainger, Inc.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side Analysis

5.2.2. Supply Side Analysis

5.3. Key Market Indicators

5.3.1. Overall Electric Motor Market Overview

5.4. Industry SWOT Analysis

5.5. Technology Overview

5.6. Porter’s Five Forces Analysis

5.7. Value Chain Analysis

5.8. COVID-19 Impact Analysis

5.9. Regulatory Framework

5.10. Global HVAC Motor Market Analysis and Forecast,

5.10.1. Market Revenue Projections (US$ Bn)

5.10.2. Market Revenue Projections (Thousand Units)

6. Global HVAC Motor Market Analysis and Forecast, by Product Type

6.1. Global HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

6.1.1. PSC (Permanent Split Capacitor) Motors

6.1.2. Split Phase Motors

6.1.3. Shaded Pole Motors

6.2. Incremental Opportunity, by Product Type

7. Global HVAC Motor Market Analysis and Forecast, by Speed

7.1. Global HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

7.1.1. Low Speed Motors

7.1.2. Medium Speed Motors

7.1.3. High Speed Motors

7.2. Incremental Opportunity, by Speed

8. Global HVAC Motor Market Analysis and Forecast, by End-use Industry

8.1. Global HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

8.1.1. Automobile

8.1.2. Food & Beverages

8.1.3. Oil & Gas

8.1.4. Petrochemicals

8.1.5. Agriculture

8.1.6. Marine

8.1.7. Aerospace & Transportation

8.1.8. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global HVAC Motor Market Analysis and Forecast, by Distribution Channel

9.1. Global HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global HVAC Motor Market Analysis and Forecast, by Region

10.1. Global HVAC Motor Market Size (US$ Bn) (Thousand Units), by Region, 2017- 2031

10.1.1. North America

10.1.2. Europe

10.1.3. Asia Pacific

10.1.4. Middle East & Africa

10.1.5. South America

10.2. Incremental Opportunity, by Region

11. North America HVAC Motor Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Key Supplier Analysis

11.3. Key Trends Analysis

11.3.1. Supply side

11.3.2. Demand Side

11.4. Price Trend Analysis

11.4.1. Weighted Average Selling Price (US$)

11.5. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

11.5.1. PSC (Permanent Split Capacitor) Motors

11.5.2. Split Phase Motors

11.5.3. Shaded Pole Motors

11.6. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

11.6.1. Low Speed Motors

11.6.2. Medium Speed Motors

11.6.3. High Speed Motors

11.7. HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

11.7.1. Automobile

11.7.2. Food & Beverages

11.7.3. Oil & Gas

11.7.4. Petrochemicals

11.7.5. Agriculture

11.7.6. Marine

11.7.7. Aerospace & Transportation

11.7.8. Others

11.8. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

11.8.1. Direct Sales

11.8.2. Indirect Sales

11.9. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

11.9.1. U.S.

11.9.2. Canada

11.9.3. Rest of North America

11.10. Incremental Opportunity Analysis

12. Europe HVAC Motor Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Key Supplier Analysis

12.3. Key Trends Analysis

12.3.1. Supply side

12.3.2. Demand Side

12.4. Price Trend Analysis

12.4.1. Weighted Average Selling Price (US$)

12.5. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

12.5.1. PSC (Permanent Split Capacitor) Motors

12.5.2. Split Phase Motors

12.5.3. Shaded Pole Motors

12.6. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

12.6.1. Low Speed Motors

12.6.2. Medium Speed Motors

12.6.3. High Speed Motors

12.7. HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

12.7.1. Automobile

12.7.2. Food & Beverages

12.7.3. Oil & Gas

12.7.4. Petrochemicals

12.7.5. Agriculture

12.7.6. Marine

12.7.7. Aerospace & Transportation

12.7.8. Others

12.8. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

12.8.1. Direct Sales

12.8.2. Indirect Sales

12.9. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

12.9.1. U.K.

12.9.2. Germany

12.9.3. France

12.9.4. Rest of Europe

12.10. Incremental Opportunity Analysis

13. Asia Pacific HVAC Motor Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Key Supplier Analysis

13.3. Key Trends Analysis

13.3.1. Supply side

13.3.2. Demand Side

13.4. Price Trend Analysis

13.4.1. Weighted Average Selling Price (US$)

13.5. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

13.5.1. PSC (Permanent Split Capacitor) Motors

13.5.2. Split Phase Motors

13.5.3. Shaded Pole Motors

13.6. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

13.6.1. Low Speed Motors

13.6.2. Medium Speed Motors

13.6.3. High Speed Motors

13.7. HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

13.7.1. Automobile

13.7.2. Food & Beverages

13.7.3. Oil & Gas

13.7.4. Petrochemicals

13.7.5. Agriculture

13.7.6. Marine

13.7.7. Aerospace & Transportation

13.7.8. Others

13.8. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

13.8.1. Direct Sales

13.8.2. Indirect Sales

13.9. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

13.9.1. China

13.9.2. India

13.9.3. Japan

13.9.4. Rest of Asia Pacific

13.10. Incremental Opportunity Analysis

14. Middle East & Africa HVAC Motor Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Key Supplier Analysis

14.3. Key Trends Analysis

14.3.1. Supply side

14.3.2. Demand Side

14.4. Price Trend Analysis

14.4.1. Weighted Average Selling Price (US$)

14.5. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

14.5.1. PSC (Permanent Split Capacitor) Motors

14.5.2. Split Phase Motors

14.5.3. Shaded Pole Motors

14.6. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

14.6.1. Low Speed Motors

14.6.2. Medium Speed Motors

14.6.3. High Speed Motors

14.7. HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

14.7.1. Automobile

14.7.2. Food & Beverages

14.7.3. Oil & Gas

14.7.4. Petrochemicals

14.7.5. Agriculture

14.7.6. Marine

14.7.7. Aerospace & Transportation

14.7.8. Others

14.8. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

14.8.1. Direct Sales

14.8.2. Indirect Sales

14.9. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

14.9.1. GCC

14.9.2. South Africa

14.9.3. Rest of Middle East & Africa

14.10. Incremental Opportunity Analysis

15. South America HVAC Motor Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Key Supplier Analysis

15.3. Key Trends Analysis

15.3.1. Supply side

15.3.2. Demand Side

15.4. Price Trend Analysis

15.4.1. Weighted Average Selling Price (US$)

15.5. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Product Type, 2017- 2031

15.5.1. PSC (Permanent Split Capacitor) Motors

15.5.2. Split Phase Motors

15.5.3. Shaded Pole Motors

15.6. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Speed, 2017- 2031

15.6.1. Low Speed Motors

15.6.2. Medium Speed Motors

15.6.3. High Speed Motors

15.7. HVAC Motor Market Size (US$ Bn) (Thousand Units), by End-use Industry, 2017- 2031

15.7.1. Automobile

15.7.2. Food & Beverages

15.7.3. Oil & Gas

15.7.4. Petrochemicals

15.7.5. Agriculture

15.7.6. Marine

15.7.7. Aerospace & Transportation

15.7.8. Others

15.8. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Distribution Channel, 2017- 2031

15.8.1. Direct Sales

15.8.2. Indirect Sales

15.9. HVAC Motor Market Size (US$ Bn) (Thousand Units), by Country/Sub-region, 2017- 2031

15.9.1. Brazil

15.9.2. Rest of South America

15.10. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Competition Dashboard

16.2. Market Share Analysis % (2022)

16.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Distribution channel overview, Business Strategies / Recent Developments]

16.3.1. ABB

16.3.1.1. Company Overview

16.3.1.2. Product Portfolio

16.3.1.3. Financial Information

16.3.1.4. (Subject to Data Availability)

16.3.1.5. Distribution channel overview

16.3.1.6. Business Strategies / Recent Developments

16.3.2. Emerson Electric Co

16.3.2.1. Company Overview

16.3.2.2. Product Portfolio

16.3.2.3. Financial Information

16.3.2.4. (Subject to Data Availability)

16.3.2.5. Distribution channel overview

16.3.2.6. Business Strategies / Recent Developments

16.3.3. GE

16.3.3.1. Company Overview

16.3.3.2. Product Portfolio

16.3.3.3. Financial Information

16.3.3.4. (Subject to Data Availability)

16.3.3.5. Distribution channel overview

16.3.3.6. Business Strategies / Recent Developments

16.3.4. Hitachi (Johnson Controls)

16.3.4.1. Company Overview

16.3.4.2. Product Portfolio

16.3.4.3. Financial Information

16.3.4.4. (Subject to Data Availability)

16.3.4.5. Distribution channel overview

16.3.4.6. Business Strategies / Recent Developments

16.3.5. Ingersoll-Rand Plc

16.3.5.1. Company Overview

16.3.5.2. Product Portfolio

16.3.5.3. Financial Information

16.3.5.4. (Subject to Data Availability)

16.3.5.5. Distribution channel overview

16.3.5.6. Business Strategies / Recent Developments

16.3.6. Mitsubishi Electric

16.3.6.1. Company Overview

16.3.6.2. Product Portfolio

16.3.6.3. Financial Information

16.3.6.4. (Subject to Data Availability)

16.3.6.5. Distribution channel overview

16.3.6.6. Business Strategies / Recent Developments

16.3.7. Regal Beloit Corporation

16.3.7.1. Company Overview

16.3.7.2. Product Portfolio

16.3.7.3. Financial Information

16.3.7.4. (Subject to Data Availability)

16.3.7.5. Distribution channel overview

16.3.7.6. Business Strategies / Recent Developments

16.3.8. Rockwell Automation

16.3.8.1. Company Overview

16.3.8.2. Product Portfolio

16.3.8.3. Financial Information

16.3.8.4. (Subject to Data Availability)

16.3.8.5. Distribution channel overview

16.3.8.6. Business Strategies / Recent Developments

16.3.9. Siemens

16.3.9.1. Company Overview

16.3.9.2. Product Portfolio

16.3.9.3. Financial Information

16.3.9.4. (Subject to Data Availability)

16.3.9.5. Distribution channel overview

16.3.9.6. Business Strategies / Recent Developments

16.3.10. W. W. Grainger, Inc.

16.3.10.1. Company Overview

16.3.10.2. Product Portfolio

16.3.10.3. Financial Information

16.3.10.4. (Subject to Data Availability)

16.3.10.5. Distribution channel overview

16.3.10.6. Business Strategies / Recent Developments

17. Key Takeaways

17.1. Identification of Potential Market Spaces

17.1.1. By Product Type

17.1.2. By Speed

17.1.3. By End-use Industry

17.1.4. By Distribution Channel

17.1.5. By Region

17.2. Understanding the Procurement Process of End-users

17.3. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 2: Global HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 3: Global HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 4: Global HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 5: Global HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 6: Global HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 7: Global HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 8: Global HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 9: Global HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 10: Global HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Table 11: North America HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 12: North America HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 13: North America HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 14: North America HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 15: North America HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 16: North America HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 17: North America HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 18: North America HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 19: North America HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 20: North America HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Table 21: Europe HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 22: Europe HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 23: Europe HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 24: Europe HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 25: Europe HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 26: Europe HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 27: Europe HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 28: Europe HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 29: Europe HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 30: Europe HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Table 31: Asia Pacific HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 32: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 33: Asia Pacific HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 34: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 35: Asia Pacific HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 36: Asia Pacific HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 37: Asia Pacific HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 38: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 39: Asia Pacific HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 40: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Table 41: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 42: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 43: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 44: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 45: Middle East & Africa HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 46: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 47: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 48: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 49: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 50: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Table 51: South America HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Table 52: South America HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Table 53: South America HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Table 54: South America HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Table 55: South America HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Table 56: South America HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Table 57: South America HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Table 58: South America HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Table 59: South America HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Table 60: South America HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

List of Figures

Figure 1: Global HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 2: Global HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 3: Global HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 4: Global HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 5: Global HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 6: Global HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 7: Global HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 8: Global HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 9: Global HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 10: Global HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 11: Global HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 12: Global HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 13: Global HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 14: Global HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 15: Global HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 16: North America HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 17: North America HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 18: North America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 19: North America HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 20: North America HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 21: North America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 22: North America HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 23: North America HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 24: North America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 25: North America HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 26: North America HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 27: North America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 28: North America HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 29: North America HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 30: North America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 31: Europe HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 32: Europe HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 33: Europe HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 34: Europe HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 35: Europe HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 36: Europe HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 37: Europe HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 38: Europe HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 39: Europe HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 40: Europe HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 41: Europe HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 42: Europe HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 43: Europe HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 44: Europe HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 45: Europe HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 46: Asia Pacific HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 47: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 48: Asia Pacific HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 49: Asia Pacific HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 50: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 51: Asia Pacific HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 52: Asia Pacific HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 53: Asia Pacific HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 54: Asia Pacific HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 55: Asia Pacific HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 56: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 57: Asia Pacific HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 58: Asia Pacific HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 59: Asia Pacific HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 60: Asia Pacific HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 61: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 62: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 63: Middle East & Africa HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 64: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 65: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 66: Middle East & Africa HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed,2023-2031

Figure 67: Middle East & Africa HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 68: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 69: Middle East & Africa HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2017-2031

Figure 70: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 71: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 72: Middle East & Africa HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 73: Middle East & Africa HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 74: Middle East & Africa HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 75: Middle East & Africa HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031

Figure 76: South America HVAC Motor Market Value (US$ Bn), by Product Type, 2017-2031

Figure 77: South America HVAC Motor Market Volume (Thousand Units), by Product Type 2017-2031

Figure 78: South America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Product Type, 2023-2031

Figure 79: South America HVAC Motor Market Value (US$ Bn), by Speed, 2017-2031

Figure 80: South America HVAC Motor Market Volume (Thousand Units), by Speed 2017-2031

Figure 81: South America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Speed, 2023-2031

Figure 82: South America HVAC Motor Market Value (US$ Bn), by End-use Industry, 2017-2031

Figure 83: South America HVAC Motor Market Volume (Thousand Units), by End-use Industry 2017-2031

Figure 84: South America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by End-use Industry, 2023-2031

Figure 85: South America HVAC Motor Market Value (US$ Bn), by Distribution Channel, 2017-2031

Figure 86: South America HVAC Motor Market Volume (Thousand Units), by Distribution Channel 2017-2031

Figure 87: South America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Distribution Channel, 2023-2031

Figure 88: South America HVAC Motor Market Value (US$ Bn), by Region, 2017-2031

Figure 89: South America HVAC Motor Market Volume (Thousand Units), by Region 2017-2031

Figure 90: South America HVAC Motor Market Incremental Opportunity (US$ Bn), Forecast, by Region, 2023-2031