Reports

Reports

Analysts’ Viewpoint on Hot Melt Adhesives Market Scenario

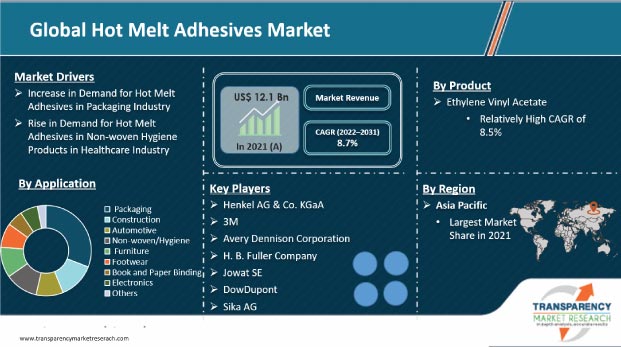

Companies in the hot melt adhesives market are focusing on high-growth industries such as packaging, construction, and non-woven/hygiene to keep their business growing after the COVID-19. Hot melt adhesives are widely used in the production of packaging materials, which are needed for ready-to-eat products. An increase in the usage of hot melt adhesives in various conventional and niche applications is broadening their scope for high product sales among new end-use industries. As a result, a wide range of unique properties is expected to boost the demand for hot melt adhesives during the forecast period. Companies are considering capacity expansion in anticipation of a rapid increase in demand for hot melt adhesives in packaging as well as non-woven/hygiene industries throughout the assessment tenure, as both these industries are projected to grow rapidly during the forecast period.

Hot melt adhesive is defined as an adhesive system that is thermally melted and develops cohesion through cooling. Akin to all adhesives, hot melt adhesive is composed of one or more polymers as well as additives such as pigments and stabilizers.

Hot melt adhesives are multicomponent systems that can combine various polymers and additives. They are applied using an electric hot glue gun. The hot glue gun has a loading compartment, where hot melt adhesives (HMA) are heated to their melting point.

Hot melt adhesives are thermoplastic adhesives that are solid at room temperature, but melt and turn to liquid when heated for application to an adherent. Prominent applications of hot melt adhesives include packaging, construction, non-woven, bookbinding and paper binding, furniture, footwear, and electronics. Hot melt adhesives can be classified into polyester hot melt adhesives and reactive hot melt adhesives.

Polyester hot melt adhesives refer to thermoplastic adhesives that are non-volatile in nature. They are commonly found in a solid state at room temperatures and can be liquefied upon heating. Polyester hot melt adhesives are widely used to form instantaneous bonds and reduce product weight while improving the overall product appearance.

Reactive hot melt adhesives are high-performance hot melt materials that crosslink within the polymer matrix, and yield a temperature-resistant bond line. Reactive hot melt adhesives have high adhesion to a wide range of materials, including metals, plastics, glass, thermoplastic polyolefin (TPO), fabric, and leather.

The global hot melt adhesives market is estimated to grow, owing to favorable properties of hot melt adhesives, specifically for industries such as packaging, construction, and non-woven/hygiene. This is evident since hot melt adhesives offer more benefits than conventional adhesives, making them a popular choice among end-users.

Hot melt adhesives are widely used in packaging applications such as case sealing, corrugated waxed board, tray forming, carton sealing of standard bleached sulfate (SBS), heat sealing, and container labeling.

Hot melt adhesives are also extensively used in converter and packaging applications. These adhesives outperform water-based adhesives, in terms of set time and water resistance. This is one of the highly impressive benefits of hot melt adhesives. The packaging system or space is reduced significantly due to the use of these adhesives.

The demand for online shopping is rising in emerging economies such as China and India. These countries have a large number of e-commerce businesses. A rise in the demand for labels and plastic bags for packaging is driving the demand for hot melt adhesives in the packaging industry.

Hot melt adhesives are used in the production of disposable non-woven hygiene products such as baby diapers (nappies), feminine care products, adult incontinence products, medical dressings, hospital bed pads, and surgical drapes.

Increase in demand for hot melt adhesives for non-woven hygiene products in the healthcare industry is anticipated to drive the market in the near future. Advantages of hot melt adhesives over other alternatives, such as high resistance to acids & solvents and cost-effectiveness, are also anticipated to boost the hot melt adhesives market in the near future.

The rise in aging population and advancements in medical procedures are boosting the demand for hot melt adhesives for hygiene products. Improvements in standard of living and increase in per capita income in developing countries such as India, China, Indonesia, Taiwan, and Malaysia are driving the demand for non-woven hygiene products. This, in turn, is augmenting the hot melt adhesives market.

In terms of product, the hot melt adhesives market has been classified into ethylene vinyl acetate, polyolefins (amorphous polyolefin and metallocene polyolefin), polyamides, polyurethanes, styrene block copolymers, and others.

The ethylene vinyl acetate (EVA) segment dominated the global hot melt adhesives market with more than 35% share in 2021. EVA hot melt adhesive is a copolymer adhesive, deployed in various industries including packaging, assembly, paper, and automotive. Excellent adhesion, strong mechanical strength, paraffin solubility, and superior flexibility are the key features propelling the segment. EVA hot melt adhesives are economical and effective at service temperatures ranging from −22°F to 176°F. The segment is expected to register the fastest CAGR of 8.5% during the forecast period.

The Asia Pacific region held the largest volume share of more than 47% of the global hot melt adhesives market in 2021. Growth of packaging and healthcare industries in countries such as China, India, Japan, & South Korea is boosting the consumption of hot melt adhesives in the region. An increase in purchasing power in China, India, Japan, and South Korea, along with changing consumption patterns has resulted in more diversified, sophisticated, single-serve pack sizes for various end-use products. Product standards and expectations are less stringent in China. Firms are also investing more in this space due to the availability of low-cost raw materials, abundant labor force, and less stringent regulations.

In terms of volume, North America and Europe are also major regions of the hot melt adhesives market. These regions accounted for 25% and 22.1% value share, respectively, of the global market in 2021. The implementation of stringent environmental laws on materials with high volatile organic compound (VOC) content is expected to drive the demand for hot melt adhesives in Europe and North America.

Latin America is a larger market for hot melt adhesives than Middle East & Africa. However, the market in Middle East & Africa is likely to mature at a faster growth rate during the forecast period. Companies in the Middle East & Africa are diversifying their business for hot melt adhesives in profile-wrapping, product assembly, and laminating applications in the woodworking industry.

The global hot melt adhesives market is highly consolidated, with a small number of large-scale vendors controlling majority of the share. Most companies are investing significantly in comprehensive R&D activities, primarily to create environment-friendly products. Diversification of product portfolios and mergers & acquisitions are the key strategies adopted by prominent players. Henkel AG & Co. KGaA, 3M, Avery Dennison Corporation, H. B. Fuller Company, Jowat SE, DowDupont, Sika AG, Hexcel Corporation, Toyobo Co. Ltd, and Heartland Adhesives LLC are the key entities operating in this market.

Each of these players has been profiled in the hot melt adhesives market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 12.1 Bn |

|

Market Forecast Value in 2031 |

US$ 25.6 Bn |

|

Growth Rate (CAGR) |

8.7% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2020 |

|

Quantitative Units |

US$ Bn for Value and Tons for Volume |

|

Market Analysis |

It includes cross-segment analysis at the global as well as regional level. Furthermore, the qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The market stood at US$ 12.1 Bn in 2021

The market is expected to grow at a CAGR of 8.7% from 2022 to 2031

Rise in demand for non-woven hygiene products in healthcare industry and wide application of hot melt adhesives in the packaging industry

Ethylene vinyl acetate was the largest product segment that held more than 35% value share in 2021

Asia Pacific was the most lucrative region in the hot melt adhesives market in 2021

Henkel AG & Co. KGaA, 3M, Avery Dennison Corporation, H. B. Fuller Company, Jowat SE, DowDupont, Sika AG, Hexcel Corporation, Toyobo Co. Ltd, and Heartland Adhesives LLC

1. Executive Summary

1.1. Hot Melt Adhesives Market Snapshot

1.2. Current Market and Future Potential

2. Market Overview

2.1. Market Segmentation

2.2. Market Trends

2.3. Market Dynamics

2.3.1. Drivers

2.3.2. Restraints

2.3.3. Opportunities

2.4. Porter’s Five Forces Analysis

2.5. Regulatory Analysis

2.6. Value Chain Analysis

2.6.1. List of Hot Melt Adhesives Manufacturers

2.6.2. List of Potential Customer

3. COVID-19 Impact Analysis

4. Hot Melt Adhesives Market Analysis and Forecast, by Product, 2022–2031

4.1. Introduction and Definitions

4.2. Global Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

4.2.1. Ethylene Vinyl Acetate

4.2.2. Polyolefins

4.2.2.1. Amorphous Polyolefin

4.2.2.2. Metallocene Polyolefin

4.2.2.3. Polyamides

4.2.2.4. Polyurethanes

4.2.2.5. Styrene Block Copolymers

4.2.2.6. Others (including Polycarbonate and Polycaprolactone)

4.3. Global Hot Melt Adhesives Market Attractiveness, by Product

5. Global Hot Melt Adhesives Market Analysis and Forecast, Application, 2022–2031

5.1. Introduction and Definitions

5.2. Global Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

5.2.1. Packaging

5.2.2. Construction

5.2.3. Automotive

5.2.4. Non-woven/Hygiene

5.2.5. Furniture

5.2.6. Footwear

5.2.7. Book and Paper Binding

5.2.8. Electronics

5.2.9. Others (including Textiles and DIY)

5.3. Global Hot Melt Adhesives Market Attractiveness, by Application

6. Global Hot Melt Adhesives Market Analysis and Forecast, by Region, 2022–2031

6.1. Key Findings

6.2. Global Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Region, 2022–2031

6.2.1. North America

6.2.2. Europe

6.2.3. Asia Pacific

6.2.4. Latin America

6.2.5. Middle East & Africa

6.3. Global Hot Melt Adhesives Market Attractiveness, by Region

7. North America Hot Melt Adhesives Market Analysis and Forecast, 2022–2031

7.1. Key Findings

7.2. North America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

7.3. North America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

7.4. North America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country, 2022–2031

7.4.1. U.S. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

7.4.2. U.S. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

7.4.3. Canada Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

7.4.4. Canada Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

7.5. North America Hot Melt Adhesives Market Attractiveness Analysis

8. Europe Hot Melt Adhesives Market Analysis and Forecast, 2022–2031

8.1. Key Findings

8.2. Europe Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.3. Europe Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

8.4. Europe Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

8.4.1. Germany Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.2. Germany. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.4.3. France Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.4. France. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.4.5. U.K. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.6. U.K. Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.4.7. Italy Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.8. Italy Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.4.9. Russia & CIS Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.10. Russia & CIS Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.4.11. Rest of Europe Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

8.4.12. Rest of Europe Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

8.5. Europe Hot Melt Adhesives Market Attractiveness Analysis

9. Asia Pacific Hot Melt Adhesives Market Analysis and Forecast, 2022–2031

9.1. Key Findings

9.2. Asia Pacific Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product

9.3. Asia Pacific Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

9.4. Asia Pacific Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

9.4.1. China Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.2. China Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

9.4.3. Japan Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.4. Japan Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

9.4.5. India Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.6. India Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

9.4.7. ASEAN Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.8. ASEAN Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

9.4.9. Rest of Asia Pacific Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

9.4.10. Rest of Asia Pacific Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

9.5. Asia Pacific Hot Melt Adhesives Market Attractiveness Analysis

10. Latin America Hot Melt Adhesives Market Analysis and Forecast, 2022–2031

10.1. Key Findings

10.2. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

10.3. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

10.4. Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

10.4.1. Brazil Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.2. Brazil Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

10.4.3. Mexico Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.4. Mexico Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

10.4.5. Rest of Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

10.4.6. Rest of Latin America Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

10.5. Latin America Hot Melt Adhesives Market Attractiveness Analysis

11. Middle East & Africa Hot Melt Adhesives Market Analysis and Forecast, 2022–2031

11.1. Key Findings

11.2. Middle East & Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

11.3. Middle East & Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Application, 2022–2031

11.4. Middle East & Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Country and Sub-region, 2021-2031

11.4.1. GCC Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.2. GCC Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

11.4.3. South Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.4. South Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

11.4.5. Rest of Middle East & Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, by Product, 2022–2031

11.4.6. Rest of Middle East & Africa Hot Melt Adhesives Market Volume (Tons) and Value (US$ Mn) Forecast, Application, 2022–2031

11.5. Middle East & Africa Hot Melt Adhesives Market Attractiveness Analysis

12. Competition Landscape

12.1. Global Hot Melt Adhesives Company Market Share Analysis, 2021

12.2. Company Profiles (Details – Overview, Financials, Recent Developments, and Strategy)

12.2.1. H.B. Fuller Company

12.2.1.1. Company Description

12.2.1.2. Business Overview

12.2.1.3. Financial Overview

12.2.1.4. Strategic Overview

12.2.2. Henkel AG & Company KGaA

12.2.2.1. Company Description

12.2.2.2. Business Overview

12.2.2.3. Financial Overview

12.2.2.4. Strategic Overview

12.2.3. 3M

12.2.3.1. Company Description

12.2.3.2. Business Overview

12.2.3.3. Financial Overview

12.2.3.4. Strategic Overview

12.2.4. Arkema

12.2.4.1. Company Description

12.2.4.2. Business Overview

12.2.4.3. Financial Overview

12.2.4.4. Strategic Overview

12.2.5. Hexcel Corporation

12.2.5.1. Company Description

12.2.5.2. Business Overview

12.2.5.3. Financial Overview

12.2.5.4. Strategic Overview

12.2.6. Avery Dennison Corporation

12.2.6.1. Company Description

12.2.6.2. Business Overview

12.2.6.3. Financial Overview

12.2.6.4. Strategic Overview

12.2.7. Sika AG

12.2.7.1. Company Description

12.2.7.2. Business Overview

12.2.7.3. Financial Overview

12.2.7.4. Strategic Overview

12.2.8. Jowat SE

12.2.8.1. Company Description

12.2.8.2. Business Overview

12.2.8.3. Financial Overview

12.2.8.4. Strategic Overview

12.2.9. Beardow Adams

12.2.9.1. Company Description

12.2.9.2. Business Overview

12.2.9.3. Financial Overview

12.2.9.4. Strategic Overview

12.2.10. DowDupont

12.2.10.1. Company Description

12.2.10.2. Business Overview

12.2.10.3. Financial Overview

12.2.10.4. Strategic Overview

12.2.11. Akzo Nobel N.V.

12.2.11.1. Company Description

12.2.11.2. Business Overview

12.2.11.3. Financial Overview

12.2.11.4. Strategic Overview

12.2.12. Exxon Mobil Corporation

12.2.12.1. Company Description

12.2.12.2. Business Overview

12.2.12.3. Financial Overview

12.2.12.4. Strategic Overview

12.2.13. HEARTLAND ADHESIVES LLC

12.2.13.1. Company Description

12.2.13.2. Business Overview

12.2.13.3. Financial Overview

12.2.13.4. Strategic Overview

12.2.14. REXtac, LLC

12.2.14.1. Company Description

12.2.14.2. Business Overview

12.2.14.3. Financial Overview

12.2.14.4. Strategic Overview

12.2.15. Toyobo Co., Ltd

12.2.15.1. Company Description

12.2.15.2. Business Overview

12.2.15.3. Financial Overview

12.2.15.4. Strategic Overview

12.2.16. TEX YEAR INDUSTRIES INC

12.2.16.1. Company Description

12.2.16.2. Business Overview

12.2.16.3. Financial Overview

12.2.16.4. Strategic Overview

13. Primary Research: Key Insights

14. Appendix

List of Tables

Table 1: Global Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 2: Global Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 3: Global Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 4: Global Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 5: Global Hot Melt Adhesives Market Volume (Tons) Forecast, by Region, 2022–2031

Table 6: Global Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Region, 2022–2031

Table 7: North America Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 8: North America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 9: North America Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 10: North America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 11: North America Hot Melt Adhesives Market Volume (Tons) Forecast, by Country, 2022–2031

Table 12: North America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country, 2022–2031

Table 13: U.S. Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 14: U.S. Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 15: U.S. Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 16: U.S. Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application, 2022–2031

Table 17: Canada Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 18: Canada Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 19: Canada Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 20: Canada Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 21: Europe Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 22: Europe Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 23: Europe Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 24: Europe Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 25: Europe Hot Melt Adhesives Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 26: Europe Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 27: Germany Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 28: Germany Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 29: Germany Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 30: Germany Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 31: France Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 32: France Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 33: France Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 34: France Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 35: U.K. Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 36: U.K. Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 37: U.K. Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 38: U.K. Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 39: Italy Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 40: Italy Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 41: Italy Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 42: Italy Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 43: Spain Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 44: Spain Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 45: Spain Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 46: Spain Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 47: Russia & CIS Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 48: Russia & CIS Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 49: Russia & CIS Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 50: Russia & CIS Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 51: Rest of Europe Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 52: Rest of Europe Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 53: Rest of Europe Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 54: Rest of Europe Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 55: Asia Pacific Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 56: Asia Pacific Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 57: Asia Pacific Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 58: Asia Pacific Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 59: Asia Pacific Hot Melt Adhesives Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 60: Asia Pacific Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 61: China Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 62: China Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product 2022–2031

Table 63: China Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 64: China Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 65: Japan Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 66: Japan Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 67: Japan Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 68: Japan Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 69: India Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 70: India Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 71: India Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 72: India Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 73: ASEAN Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 74: ASEAN Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 75: ASEAN Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 76: ASEAN Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 77: Rest of Asia Pacific Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 78: Rest of Asia Pacific Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 79: Rest of Asia Pacific Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 80: Rest of Asia Pacific Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 81: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 82: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 83: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 84: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 85: Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 86: Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 87: Brazil Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 88: Brazil Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 89: Brazil Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 90: Brazil Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 91: Mexico Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 92: Mexico Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 93: Mexico Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 94: Mexico Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 95: Rest of Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 96: Rest of Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 97: Rest of Latin America Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 98: Rest of Latin America Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 99: Middle East & Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 100: Middle East & Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 101: Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 102: Middle East & Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 103: Middle East & Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Country and Sub-region, 2022–2031

Table 104: Middle East & Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Country and Sub-region, 2022–2031

Table 105: GCC Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 106: GCC Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 107: GCC Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 108: GCC Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 109: South Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 110: South Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 111: South Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 112: South Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

Table 113: Rest of Middle East & Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Product, 2022–2031

Table 114: Rest of Middle East & Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Product, 2022–2031

Table 115: Rest of Middle East & Africa Hot Melt Adhesives Market Volume (Tons) Forecast, by Application, 2022–2031

Table 116: Rest of Middle East & Africa Hot Melt Adhesives Market Value (US$ Mn) Forecast, by Application 2022–2031

List of Figures

Figure 1: Global Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 2: Global Hot Melt Adhesives Market Attractiveness, by Product

Figure 3: Global Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 4: Global Hot Melt Adhesives Market Attractiveness, by Application

Figure 5: Global Hot Melt Adhesives Market Volume Share Analysis, by Region, 2021, 2025, and 2031

Figure 6: Global Hot Melt Adhesives Market Attractiveness, by Region

Figure 7: North America Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 8: North America Hot Melt Adhesives Market Attractiveness, by Product

Figure 9: North America Hot Melt Adhesives Market Attractiveness, by Product

Figure 10: North America Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 11: North America Hot Melt Adhesives Market Attractiveness, by Application

Figure 12: North America Hot Melt Adhesives Market Attractiveness, by Country and Sub-region

Figure 13: Europe Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 14: Europe Hot Melt Adhesives Market Attractiveness, by Product

Figure 15: Europe Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 16: Europe Hot Melt Adhesives Market Attractiveness, by Application

Figure 17: Europe Hot Melt Adhesives Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 18: Europe Hot Melt Adhesives Market Attractiveness, by Country and Sub-region

Figure 19: Asia Pacific Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 20: Asia Pacific Hot Melt Adhesives Market Attractiveness, by Product

Figure 21: Asia Pacific Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 22: Asia Pacific Hot Melt Adhesives Market Attractiveness, by Application

Figure 23: Asia Pacific Hot Melt Adhesives Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 24: Asia Pacific Hot Melt Adhesives Market Attractiveness, by Country and Sub-region

Figure 25: Latin America Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 26: Latin America Hot Melt Adhesives Market Attractiveness, by Product

Figure 27: Latin America Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 28: Latin America Hot Melt Adhesives Market Attractiveness, by Application

Figure 29: Latin America Hot Melt Adhesives Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 30: Latin America Hot Melt Adhesives Market Attractiveness, by Country and Sub-region

Figure 31: Middle East & Africa Hot Melt Adhesives Market Volume Share Analysis, by Product, 2021, 2025, and 2031

Figure 32: Middle East & Africa Hot Melt Adhesives Market Attractiveness, by Product

Figure 33: Middle East & Africa Hot Melt Adhesives Market Volume Share Analysis, by Application, 2021, 2025, and 2031

Figure 34: Middle East & Africa Hot Melt Adhesives Market Attractiveness, by Application

Figure 35: Middle East & Africa Hot Melt Adhesives Market Volume Share Analysis, by Country and Sub-region, 2021, 2025, and 2031

Figure 36: Middle East & Africa Hot Melt Adhesives Market Attractiveness, by Country and Sub-region