Reports

Reports

Hot dogs and sausages have been gaining popularity around the world owing to the taste, convenience, and variety they offer. The hot dogs and sausages market is being driven by varied consumption trends and patterns across different regions and seasons. The rapid development of the retail sector in emerging economies is a large opportunity for players in the hot dogs and sausages market and this has spurred the operational expansion of companies in countries such as China, India, Malaysia, the UAE, and the Philippines.

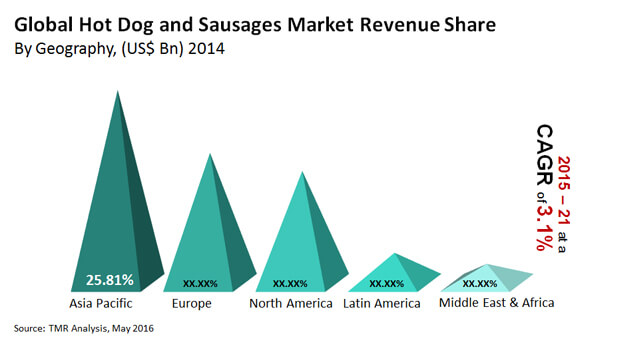

Revenues of the global hot dogs and sausages market were nearly US$64.7 bn in 2014 and are estimated to reach US$80.4 bn by 2021. The market is projected to register a 3.1% CAGR during the forecast period, reports Transparency Market Research.

Hot dogs and sausages are made from a variety of meats: pork, beef, chicken, mutton, and lamb. Among these, although pork led the overall market, chicken is identified as the most attractive segment for the hot dogs and sausages market due to growing health awareness among consumers. There has been a global shift in consumer preference from red meat to chicken since the cholesterol content in red meat is higher than that in chicken. Furthermore, chicken does not contain trans fat, which is one of the main factors triggering coronary heart diseases. This is expected to increase the demand for chicken hot dogs and sausages during the forecast period.

Additionally, chicken is comparatively cheaper and there are negligible religious barriers or taboos associated with its consumption. This is as an important factor in the growth of the chicken hot dogs and sausages market, especially in the Middle East. On the other hand, pork is an attractive segment in the hot dogs and sausages market in Asia Pacific, especially in China.

The global hot dogs and sausages market has been geographically segmented into North America, Europe, Asia Pacific, the Middle East and Africa (MEA), and Latin America.

In terms of revenue, Asia Pacific is expected to be the leading regional market for hot dogs and sausages, accounting for a share of more than 39% during the forecast period. The Middle East and Africa region, on the other hand, is predicted to be the fastest growing hot dogs and sausages market.

The Asia Pacific hot dogs and sausages market is fueled by the rising preference for fast food among the younger generation in the developing economies of China and India. One of the major factors contributing to this factor is the increasing number of individuals belonging to the age group of 20-30.

The hot dogs and sausages market in the Middle East and Africa is anticipated to witness significant growth during the forecast period due to the increasingly busy lifestyles of the working class, the growing frequency of major sporting events, and an increasing number of households with kids. In addition, extensive marketing strategies adopted by hot dogs and sausages manufacturing companies are slated to fuel the market in this region over the course of the forecast period.

Some of the prominent companies competing in the global hot dogs and sausages market are Bar-S Foods Co., ConAgra Foods, Inc., Bob Evans Farms, Inc., Johnsonville Sausage, LLC, Sara Lee Food & Beverage, Family Dollar Stores, Inc., Boklunder, Atria Plc., Animex, Campofrio Food Group, Elpozo, Sigma Alimentos, JBS Argentina, and Tyson Foods Inc.

Strides Made by Retail Industries Propel New Consumer Avenues in Hot Dogs and Sausages Market

Hot dogs and sausages have come to be representative of American and European food cultures respectively. Over the years, they have become increasingly available in different varieties in several countries around the world, attracting both vegan and meat lovers. The continual efforts of food service companies in expanding their distribution chains in the developing world has propelled sales avenues in the hot dogs and sausages market. A conscious shift of shift from red meat to chicken and turkey has shaped the recent demand dynamics of the market in various key geographies. Considered as a food with high fat content, hot dogs and sausages have undergone rapid transformation in the nutritional profile and the combination of meat, seasonings, preservatives, and use of fillers. One particularly interesting trend has been growing production of seafood sausages and those containing meat alternatives. The initiative has also helped the Hot dogs and sausages market to see new consumer demands and expand its reach to a largely vegan population. Variations in sausage casing have also been one of the major lines of product varieties for consumers. The array of garnishes have also expanded, thereby giving consumer more options. Strides being made by convenience foods are one of the major trends behind the growing valuation of the hot dogs and sausages market.

The post-pandemic world is characterized by rapid penetration of digital systems and automation technologies in various industries. Food manufacturing and services industries are no alien to the repercussions of the COVID-19 pandemic. Growing trends in food banks and changing psychographic factors in some of the major economies of the world have reshaped he contours of the hot dogs and sausages market. Key players in the value chain were quick to migrate to new distribution networks to meet a large cross-section of consumer demands of the postpandemic world. Intensifying need for nutritious meals has also stimulated advancements in food production technologies. Brands have also been making changes in their positioning strategies in sync with this.

Chapter 1 Preface

1.1 Research Scope

1.2 Market Segmentation

1.3 Research methodology

Chapter 2 Executive Summary

2.1 Global Hot Dogs and Sausages Market Snapshot

2.2 Global Hot Dogs and Sausages Market Revenue, 2014 – 2021 (USD billion) and Y-o-Y Growth, 2015 -2021 (%)

2.2.1 Market size and forecast, 2014 – 2021

Chapter 3 Global Hot Dogs and Sausages Market Overview

3.1 Introduction

3.2 Key Trends Analysis

3.3 Market Drivers

3.4 Market Restraints

3.5 Market Opportunities

3.6 Market Attractive Analysis for Global Hot Dogs and Sausages

3.7 Cause and Effect Analysis (Fish Bone Diagram Analysis)

3.7.1 Increasing number of households with kids

3.7.2 Association with events (particularly sports)

3.7.3 Consumption varies by season

3.7.4 Growing demand for organic food items

3.7.5 Busy lifestyle of people

3.7.6 Unique marketing strategies adopted by key players

3.7.7 Effect

3.8 Competitive Landscape

3.8.1 Market Positioning of Key Players, 2014 (%)

3.8.1.1 North America

3.8.1.2 Europe

3.8.1.3 Asia Pacific

3.8.1.4 Middle East

3.8.1.5 Africa

3.8.1.6 Latin America

3.8.2 Competitive Strategies Adopted by Leading Players

3.8.3 Market positioning of top U.S. hot dog and sausages manufacturing companies operated in Asia Pacific (2014)

3.9 Price trend analysis for hot dog and sausages market

Chapter 4 Global Hot Dogs and Sausages Market Revenue and Volume, by Meat Type, 2014-2021 (US$ Billion and Kg-Million)

4.1 Pork

4.1.1 Market size and forecast, 2014 – 2021

4.2 Beef

4.2.1 Market size and forecast, 2014 – 2021

4.3 Chicken

4.3.1 Market size and forecast, 2014 – 2021

4.4 Others

4.4.1 Market size and forecast, 2014 – 2021

4.5 Price Trend Analysis for Meat Type

Chapter 5 Global Hot Dogs and Sausages Market Revenue and Volume, by Product Type, 2014-2021(US$ Billion and Kg-Million)

5.1 Overview

5.1.1 Revenue and Volume, 2014-2021 (US$ Billion and Kg-Million)

5.1.2 Y-o-Y Growth (Value %)

5.1.3 Market Share, 2014 – 2021 (Value and Volume %)

5.2 Price Trend Analysis for Product Type

5.3 Frozen Hot Dogs and Sausages

5.4 Refrigerated Breakfast Sausages

5.5 Refrigerated Dinner Sausages

5.6 Refrigerated Hot Dogs

5.7 Cocktail Sausages

5.8 Others

Chapter 6 Global Hot Dogs and Sausages Market Revenue and Volume, by Geography, 2014-2021(US$ Billion and Kg-Million)

6.1 Overview

6.1.1 Revenue, 2014 – 2021 (US$ Billion)

6.1.2 Y-o-Y Growth (Value %)

6.1.3 Market Share, 2014 – 2021 (Value and Volume %)

6.2 North America

6.2.1 North America price trend analysis for meat type

6.2.2 North America price trend analysis for product type

6.2.3 U.S

6.2.4 Others

6.3 Europe

6.3.1 Europe price trend analysis for meat type

6.3.2 Europe price trend analysis for product type

6.3.3 U.K

6.3.4 France

6.3.5 Germany

6.3.6 Rest of Europe

6.4 Asia Pacific

6.4.1 Asia Pacific price trend analysis for meat type

6.4.2 Asia Pacific price trend analysis for product type

6.4.3 APEJ

6.4.3.1 China

6.4.3.2 India

6.4.3.3 Oceania

6.4.3.4 Rest of APEJ

6.4.4 Japan

6.5 Middle East and Africa (MEA)

6.5.1 Middle East and Africa price trend analysis for meat type

6.5.2 Middle East and Africa price trend analysis for product type

6.5.3 UAE

6.5.4 South Africa

6.5.5 Rest of MEA

6.6 Latin America

6.6.1 Latin America price trend analysis for meat type

6.6.2 Latin America price trend analysis for product type

6.6.3 Brazil

6.6.4 Argentina

6.6.5 Rest of Latin America

Chapter 7 Company Profiles

7.1 Bar-S Foods Co.

7.1.1. Company Details (HQ, Foundation Year, Employee Strength)

7.1.2. Market Presence, By Segment and Geography

7.1.3. Key Developments

7.1.4. Strategy and Historical Roadmap

7.1.5. Revenue and Operating Profits

7.2 ConAgra Foods, Inc.

7.2.1. Company Details (HQ, Foundation Year, Employee Strength)

7.2.2. Market Presence, By Segment and Geography

7.2.3. Key Developments

7.2.4. Strategy and Historical Roadmap

7.2.5. Revenue and Operating Profits

7.3 Bob Evans Farms, Inc.

7.3.1. Company Details (HQ, Foundation Year, Employee Strength)

7.3.2. Market Presence, By Segment and Geography

7.3.3. Key Developments

7.3.4. Strategy and Historical Roadmap

7.3.5. Revenue and Operating Profits

7.4 Johnsonville Sausage, LLC

7.4.1. Company Details (HQ, Foundation Year, Employee Strength)

7.4.2. Market Presence, By Segment and Geography

7.4.3. Key Developments

7.4.4. Strategy and Historical Roadmap

7.4.5. Revenue and Operating Profits

7.5 Sara Lee Food & Beverage

7.5.1. Company Details (HQ, Foundation Year, Employee Strength)

7.5.2. Market Presence, By Segment and Geography

7.5.3. Key Developments

7.5.4. Strategy and Historical Roadmap

7.5.5. Revenue and Operating Profits

7.6 Family Dollar Stores, Inc.

7.6.1. Company Details (HQ, Foundation Year, Employee Strength)

7.6.2. Market Presence, By Segment and Geography

7.6.3. Key Developments

7.6.4. Strategy and Historical Roadmap

7.6.5. Revenue and Operating Profits

7.7 Boklunder

7.7.1. Company Details (HQ, Foundation Year, Employee Strength)

7.7.2. Market Presence, By Segment and Geography

7.7.3. Key Developments

7.7.4. Strategy and Historical Roadmap

7.7.5. Revenue and Operating Profits

7.8 Atria Plc.

7.8.1. Company Details (HQ, Foundation Year, Employee Strength)

7.8.2. Market Presence, By Segment and Geography

7.8.3. Key Developments

7.8.4. Strategy and Historical Roadmap

7.8.5. Revenue and Operating Profits

7.9 Animex

7.9.1. Company Details (HQ, Foundation Year, Employee Strength)

7.9.2. Market Presence, By Segment and Geography

7.9.3. Key Developments

7.9.4. Strategy and Historical Roadmap

7.9.5. Revenue and Operating Profits

7.10 Campofrio Food Group

7.10.1. Company Details (HQ, Foundation Year, Employee Strength)

7.10.2. Market Presence, By Segment and Geography

7.10.3. Key Developments

7.10.4. Strategy and Historical Roadmap

7.10.5. Revenue and Operating Profits

7.11 Elpozo

7.11.1. Company Details (HQ, Foundation Year, Employee Strength)

7.11.2. Market Presence, By Segment and Geography

7.11.3. Key Developments

7.11.4. Strategy and Historical Roadmap

7.11.5. Revenue and Operating Profits

7.12 Sigma Alimentos

7.12.1. Company Details (HQ, Foundation Year, Employee Strength)

7.12.2. Market Presence, By Segment and Geography

7.12.3. Key Developments

7.12.4. Strategy and Historical Roadmap

7.12.5. Revenue and Operating Profits

7.13 JBS Argentina

7.13.1. Company Details (HQ, Foundation Year, Employee Strength)

7.13.2. Market Presence, By Segment and Geography

7.13.3. Key Developments

7.13.4. Strategy and Historical Roadmap

7.13.5. Revenue and Operating Profits

7.14 Qualtia

7.14.1. Company Details (HQ, Foundation Year, Employee Strength)

7.14.2. Market Presence, By Segment and Geography

7.14.3. Key Developments

7.14.4. Strategy and Historical Roadmap

7.14.5. Revenue and Operating Profits

7.15 Tyson Foods Inc.

7.15.1. Company Details (HQ, Foundation Year, Employee Strength)

7.15.2. Market Presence, By Segment and Geography

7.15.3. Key Developments

7.15.4. Strategy and Historical Roadmap

7.15.5. Revenue and Operating Profits

7.16 Maple Lodge Farms Ltd.

7.16.1. Company Details (HQ, Foundation Year, Employee Strength)

7.16.2. Market Presence, By Segment and Geography

7.16.3. Key Developments

7.16.4. Strategy and Historical Roadmap

7.16.5. Revenue and Operating Profits

7.17 John Morrell Food Group

7.17.1. Company Details (HQ, Foundation Year, Employee Strength)

7.17.2. Market Presence, By Segment and Geography

7.17.3. Key Developments

7.17.4. Strategy and Historical Roadmap

7.17.5. Revenue and Operating Profits

7.18 Armour Eckrich

7.18.1. Company Details (HQ, Foundation Year, Employee Strength)

7.18.2. Market Presence, By Segment and Geography

7.18.3. Key Developments

7.18.4. Strategy and Historical Roadmap

7.18.5. Revenue and Operating Profits

7.19 Kent Quality Foods, Inc.

7.19.1. Company Details (HQ, Foundation Year, Employee Strength)

7.19.2. Market Presence, By Segment and Geography

7.19.3. Key Developments

7.19.4. Strategy and Historical Roadmap

7.19.5. Revenue and Operating Profits

7.20 Fresh Mark, Inc.

7.20.1. Company Details (HQ, Foundation Year, Employee Strength)

7.20.2. Market Presence, By Segment and Geography

7.20.3. Key Developments

7.20.4. Strategy and Historical Roadmap

7.20.5. Revenue and Operating Profits

7.21 Purefoods Hormel Company Inc.

7.21.1. Company Details (HQ, Foundation Year, Employee Strength)

7.21.2. Market Presence, By Segment and Geography

7.21.3. Key Developments

7.21.4. Strategy and Historical Roadmap

7.21.5. Revenue and Operating Profits

7.22 CPF

7.22.1. Company Details (HQ, Foundation Year, Employee Strength)

7.22.2. Market Presence, By Segment and Geography

7.22.3. Key Developments

7.22.4. Strategy and Historical Roadmap

7.22.5. Revenue and Operating Profits

7.23 Ayamas

7.23.1. Company Details (HQ, Foundation Year, Employee Strength)

7.23.2. Market Presence, By Segment and Geography

7.23.3. Key Developments

7.23.4. Strategy and Historical Roadmap

7.23.5. Revenue and Operating Profits

7.24 Prabhat Poultry Private Ltd.

7.24.1. Company Details (HQ, Foundation Year, Employee Strength)

7.24.2. Market Presence, By Segment and Geography

7.24.3. Key Developments

7.24.4. Strategy and Historical Roadmap

7.24.5. Revenue and Operating Profits

7.25 Venky’s (India) Ltd.

7.25.1. Company Details (HQ, Foundation Year, Employee Strength)

7.25.2. Market Presence, By Segment and Geography

7.25.3. Key Developments

7.25.4. Strategy and Historical Roadmap

7.25.5. Revenue and Operating Profits

List of Tables

TABLE 1 Global hot dogs and sausages market snapshot

TABLE 2 Global hot dogs and sausages market revenue and Y-o-Y growth

TABLE 3 U.S. Hot dog and sausages manufacturing companies in Asia Pacific (2014)

TABLE 4 Hot dog and sausages market, prices per kg and price per pound (2014-2021)

TABLE 5 Global Hot dog and sausages market, Average Selling Price (USD) per Kg (2014-2021)

TABLE 6 Global Hot dog and sausages market, Average Selling Price (USD) per pound (2014-2021)

TABLE 7 Global Hot dog and sausages market, Average Selling Price (USD) per Kg of Meat Type, 2014-2021

TABLE 8 Global Hot dog and sausages market, Average Selling Price (USD) per Pound of Meat Type, 2014-2021

TABLE 9 Frozen Hot Dogs and Sausages Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 10 Refrigerated Breakfast Sausages Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 11 Refrigerated Dinner Sausages Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 12 Refrigerated Hot Dogs Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 13 Cocktail Sausages Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 14 Other Hot Dogs and Sausages Market, 2014-2021 (US$ Billion and Kg-Million)

TABLE 15 Hot Dogs and Sausages Market by product type, Y-o-Y growth (value %)

TABLE 16 Hot Dogs and Sausages Market by product type, market share (value %)

TABLE 17 Hot Dogs and Sausages Market by product type, market share (volume %)

TABLE 18 Global Hot dog and sausages market, Average Selling Price (USD) per Kg of Product Type, 2014-2021

TABLE 19 Global Hot dog and sausages market, Average Selling Price (USD) per Pound of Product Type, 2014-2021

TABLE 20 Global hot dogs and sausages market revenue (US$ billion), by geography (2014 – 2021)

TABLE 21 Global hot dogs and sausages market Y-o-Y growth (value %), by geography (2015 – 2021)

TABLE 22 Global hot dogs and sausages market share (value %), by geography (2014 – 2021)

TABLE 23 Global hot dogs and sausages market share (volume %), by geography (2014 – 2021)

TABLE 24 North America hot dog and sausages market revenue and forecast, by meat type, 2014-2021 (USD billion)

TABLE 25 North America hot dog and sausages market volume and forecast, by meat type, 2014-2021 (kg million)

TABLE 26 North America hot dog and sausages market revenue and forecast, by product type, 2014-2021 (USD billion)

TABLE 27 North America hot dog and sausages market volume and forecast, by product type, 2014-2021 (kg million)

TABLE 28 North America hot dog and sausages market, average selling price (USD) per kg of meat type, 2014-2021

TABLE 29 North America hot dog and sausages market, average selling price (USD) per pound of meat type, 2014-2021

TABLE 30 North America hot dog and sausages market, average selling price (USD) per kg of product type, 2014-2021

TABLE 31 North America hot dog and sausages market, average selling price (USD) per pound of product type, 2014-2021

TABLE 32 North America hot dog and sausages market, average selling price (USD) per kg, 2014-2021

TABLE 33 North America hot dog and sausages market, average selling price (USD) per pound, 2014-2021

TABLE 34 U.S hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 35 Others hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 36 Europe hot dog and sausages market revenue and forecast, by meat type, 2014-2021 (USD billion)

TABLE 37 Europe hot dog and sausages market volume and forecast, by meat type, 2014-2021 (kg million)

TABLE 38 Europe hot dog and sausages market revenue and forecast, by product type, 2014-2021 (USD billion)

TABLE 39 Europe hot dog and sausages market volume and forecast, by product type, 2014-2021 (kg million)

TABLE 40 Europe hot dog and sausages market, average selling price (USD) per kg of meat type, 2014-2021

TABLE 41 Europe hot dog and sausages market, average selling price (USD) per pound of meat type, 2014-2021

TABLE 42 Europe hot dog and sausages market, average selling price (USD) per kg of product type, 2014-2021

TABLE 43 Europe hot dog and sausages market, average selling price (USD) per pound of product type, 2014-2021

TABLE 44 Europe hot dog and sausages market, average selling price (USD) per kg, 2014-2021

TABLE 45 Europe hot dog and sausages market, average selling price (USD) per pound, 2014-2021

TABLE 46 U.K hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 47 France hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 48 Germany hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 49 Rest of Europe hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 50 Asia Pacific hot dog and sausages market revenue and forecast, by meat type, 2014-2021 (USD billion)

TABLE 51 Asia Pacific hot dog and sausages market volume and forecast, by meat type, 2014-2021 (kg million)

TABLE 52 Asia Pacific hot dog and sausages market revenue and forecast, by product type, 2014-2021 (USD billion)

TABLE 53 Asia Pacific hot dog and sausages market volume and forecast, by product type, 2014-2021 (kg million)

TABLE 54 Asia Pacific hot dog and sausages market, average selling price (USD) per kg of meat type, 2014-2021

TABLE 55 Asia Pacific hot dog and sausages market, average selling price (USD) per pound of meat type, 2014-2021

TABLE 56 Asia Pacific hot dog and sausages market, average selling price (USD) per kg of product type, 2014-2021

TABLE 57 Asia Pacific hot dog and sausages market, average selling price (USD) per pound of product type, 2014-2021

TABLE 58 Asia Pacific hot dog and sausages market, average selling price (USD) per kg, 2014-2021

TABLE 59 Asia Pacific hot dog and sausages market, average selling price (USD) per pound, 2014-2021

TABLE 60 China hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 61 India hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 62 Oceania hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 63 Rest of APEJ hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 64 Japan hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 65 Middle East and Africa hot dog and sausages market revenue and forecast, by meat type, 2014-2021 (USD billion)

TABLE 66 Middle East and Africa hot dog and sausages market volume and forecast, by meat type, 2014-2021 (kg million)

TABLE 67 Middle East and Africa hot dog and sausages market revenue and forecast, by product type, 2014-2021 (USD billion)

TABLE 68 Middle East and Africa hot dog and sausages market volume and forecast, by product type, 2014-2021 (kg million)

TABLE 69 Middle East and Africa hot dog and sausages market, average selling price (USD) per kg by meat type, 2014-2021

TABLE 70 Middle East and Africa hot dog and sausages market, average selling price (USD) per pound by meat type, 2014-2021

TABLE 71 Middle East and Africa hot dog and sausages market, average selling price (USD) per kg of product type, 2014-2021

TABLE 72 Middle East and Africa hot dog and sausages market, average selling price (USD) per pound of product type, 2014-2021

TABLE 73 Middle East and Africa hot dog and sausages market, average selling price (USD) per kg, 2014-2021

TABLE 74 Middle East and Africa hot dog and sausages market, average selling price (USD) per pound, 2014-2021

TABLE 75 UAE hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 76 South Africa hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 77 Rest of MEA hot dogs and sausages market size and forecast, 2014 - 2021

TABLE 78 Latin America hot dog and sausages market revenue and forecast, by meat type, 2014-2021 (USD billion)

TABLE 79 Latin America hot dog and sausages market volume and forecast, by meat type, 2014-2021 (kg million)

TABLE 80 Latin America hot dog and sausages market revenue and forecast, by product type, 2014-2021 (USD billion)

TABLE 81 Latin America hot dog and sausages market volume and forecast, by product type, 2014-2021 (kg million)

TABLE 82 Latin America hot dog and sausages market, average selling price (USD) per kg of meat type, 2014-2021

TABLE 83 Latin America hot dog and sausages market, average selling price (USD) per pound of meat type, 2014-2021

TABLE 84 Latin America hot dog and sausages market, average selling price (USD) per kg of product type, 2014-2021

TABLE 85 Latin America hot dog and sausages market, average selling price (USD) per pound of product type, 2014-2021

TABLE 86 Latin America hot dog and sausages market, average selling price (USD) per kg, 2014-2021

TABLE 87 Latin America hot dog and sausages market, average selling price (USD) per pound, 2014-2021

TABLE 88 Brazil hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 89 Argentina hot dogs and sausages market size and forecast, 2014 – 2021

TABLE 90 Rest of Latin America hot dogs and sausages market size and forecast, 2014 – 2021

List of Figures

FIG. 1 Market Segmentation: Global Hot Dogs and Sausages Market

FIG. 2 Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 3 Hot Dogs And Sausages Market Attractiveness, by Meat type

FIG. 4 Fish bone diagram analysis

FIG. 5 Market positioning of key players, 2014 (%)

FIG. 6 Market positioning of key players, 2014 (%)

FIG. 7 Market positioning of key players, 2014 (%)

FIG. 8 Market positioning of key players, 2014 (%)

FIG. 9 Market positioning of key players, 2014 (%)

FIG. 10 Market positioning of key players, 2014 (%)

FIG. 11 Pork Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 12 Beef Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 13 Chicken Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 14 Others Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 15 Frozen Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 16 Refrigerated Breakfast Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 17 Refrigerated Dinner Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 18 Refrigerated Hot Dogs Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 19 Cocktail Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 20 Others Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 21 North America Hot Dogs And Sausages Market, Value Vs Volume, Market size and forecast, 2014 – 2021

FIG. 22 Europe Hot Dogs And Sausages Market, Value Vs Volume, Market size and forecast, 2014 – 2021

FIG. 23 Asia Pacific Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 24 Middle East and Africa (MEA) Hot Dogs and Sausages Market, Value Vs Volume, Market Size and Forecast, 2014 – 2021

FIG. 25 Latin America Hot Dogs And Sausages Market, Value Vs Volume, Market size and forecast, 2014 – 2021