Reports

Reports

Analysts’ Viewpoint

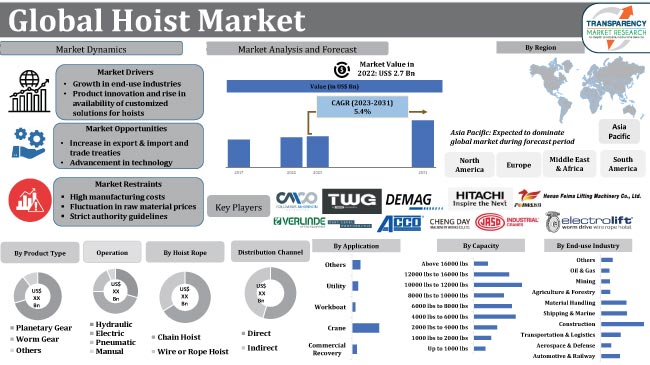

Growth in end-use industries and product innovation are some of the major hoist market drivers. Moreover, rise in availability of customized solutions for hoists is also fueling market growth. Hoists help increase productivity and efficiency of material handling. Increase in export and import and trade treaties across the globe is anticipated to create growth opportunities for market players in the near future.

Key manufacturers are spending significantly on R&D and concentrating on developing technologically advanced hoists in order to provide high-value products to their customers. Market players are following the emerging trends in the hoist industry to expand their global footprints. However, high manufacturing costs, fluctuation in raw material prices, and stringent authority guidelines are projected to hamper market expansion during the forecast period.

A hoist is a device used to lift equipment by means of a drum or lift wheel. A hoist can be operated manually, electrically, or pneumatically. Hoists are available in different types which include planetary gear, worm gear, spur gear, and bevel gear. A gear system made up of spur gears is known as planetary gear. A center gear, called a sun gear, serves as the input and driver of the set in planetary gearing.

Smart hoist technologies and automation help end-use industries to acquire new growth opportunities in the market. End-users of hoists currently seek technologically advanced material handling systems with enhanced monitoring capabilities. Rise in application of load hoisting apparatus is contributing to the market growth.

Growth in several end-use industries is attributable to the increased government expenditure to strengthen their economies and increase in foreign direct investment (FDI). End-user industries all over the world are eager to adopt goods and technology that not only increase productivity and efficiency of processes but also provide workers a safe place to work. Almost all end-use industries employ hoists including automotive & railway, transportation & logistics, construction, aerospace & defense, mining, and oil & gas. These hoists are ideal for hazardous areas.

Increase in population, globalization, rise in need for industrial and commercial spaces are contributing to the growth of the construction sector globally. Growth in the business environment generates the need for infrastructure development. Efficient, modern, and reliable infrastructure is important for smooth business operations. The construction industry demands specialized equipment for the completion of high-rise buildings and complex projects. This factor accelerates demand for hoists.

Manufacturers are focusing on the development of specialized and innovative hoists that satisfy the demands of customers from diverse end-use sectors. This factor is anticipated to drive hoist market demand during the forecast period.

Companies in the hoist industry are enhancing product quality to fulfill the rise in demand from various industries. New goods are being designed by manufacturers that are more durable and perform better. Additionally, producers are developing goods that are lighter and more flexible and can be used in high-value applications. Increase in availability of customized solutions for hoists is also creating value-grab opportunities for manufacturers.

In terms of product type, the global market segmentation comprises planetary gear, worm gear, and others (spur gear, bevel gear, etc.). As per the hoist market analysis, the planetary gear product type segment accounted for major share of the global market in 2022. This segment is likely to lead the global market in the near future.

Hoists are used in almost all industries. Hoists are an essential part of lifting equipment that provides several benefits to workers while increasing their productivity. Planetary gear hoists are significantly more efficient and smaller than worm gear hoists. Planetary gear reels have higher efficiency, meaning they don't hold loads and tend to unwind under load, but have much higher line speeds.

Planetary gears are usually the more popular purchase due to higher line speed and lower cost. Rise in demand for planetary gear hoists is expected to augment hoist market growth during the forecast period.

Worm gear hoists have low transmission efficiency. This makes the hoist self-braking even under heavy loads. Worm gear hoists have the largest reduction, load holding capacity, and much lower track speed.

According to the latest hoist market forecast, Asia Pacific is anticipated to dominate the global industry during the forecast period. China and India are the world's two major industrial centers. Rise in need for hoists in these countries is fueled by significant growth in end-use industries such as construction, shipping & marine, and mining. Moreover, growth in automotive and transportation industries in Asia Pacific is estimated to augment market statistics.

The hoist market size in North America is estimated to increase in the near future, owing to the presence of several hoist manufacturers in the region.

Hoist manufacturers in Europe are focusing on improving their product quality using advanced technologies. This drives market progress in the region.

The global landscape is fragmented, with the presence of a large number of manufacturers that control majority of the hoist market share. According to the latest hoist industry research report analysis, companies are making investments in research & development to expand their product portfolio.

Some of the key hoist companies operating in the global market are Columbus McKinnon Corporation, Demag Cranes & Components GmbH, Donati Sollevamenti S.r.l., TWG (Dover Corporation), Hitachi Industrial Equipment Systems Co., Ingersoll Rand, Kito Corporation, Konecranes, Liftket Hoffmann GmbH, Verlinde SAS., CHENG DAY MACHINERY WORKS CO., LTD., Henan Feima Lifting Machinery Co., Ltd., JASO Industrial Cranes, Electrolift, Inc., and Acco Material Handling Solutions. These companies are engaged in following the latest hoist market trends to avail lucrative revenue opportunities.

Key players have been profiled in the hoist market report based on parameters such as business segments, company overview, latest developments, product portfolio, financial overview, and business strategies.

| Attribute | Detail |

|---|---|

|

Market Value in 2022 |

US$ 2.7 Bn |

|

Market Forecast Value in 2031 |

US$ 4.2 Bn |

|

Growth Rate (CAGR) |

5.4% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2020 |

|

Quantitative Units |

US$ Bn for Value and Thousand Units for Volume |

|

Market Analysis |

It includes cross segment analysis at global as well as regional level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 2.7 Mn in 2022

The CAGR is estimated to be 5.4% during 2023-2031

Product innovation, growth in end-use industries, and rise in availability of customized hoists

The planetary gear product type segment accounted for highest share in 2022

Demand is anticipated to be high in Asia Pacific during the forecast period

Columbus McKinnon Corporation, Demag Cranes & Components GmbH, Donati Sollevamenti S.r.l., TWG (Dover Corporation), Hitachi Industrial Equipment Systems Co., Ingersoll Rand, Kito Corporation, Konecranes, Liftket Hoffmann GmbH, Verlinde SAS., CHENG DAY MACHINERY WORKS CO., LTD., Henan Feima Lifting Machinery Co., Ltd., JASO Industrial Cranes, Electrolift, Inc., and Acco Material Handling Solutions

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Market Dynamics

5.1.1. Drivers

5.1.2. Restraints

5.1.3. Opportunities

5.2. Key Trends Analysis

5.2.1. Demand Side

5.2.2. Supply Side

5.3. Key Market Indicators

5.3.1. Overall Material Handling Equipment Market Overview

5.4. Industry SWOT Analysis

5.5. Porter’s Five Forces Analysis

5.6. Value Chain Analysis

5.7. Technological Overview

5.8. COVID-19 Impact Analysis

5.9. Standards and Regulations

5.10. Global Hoist Market Analysis and Forecast, 2017- 2031

5.10.1. Market Value Projections (US$ Bn)

5.10.2. Market Volume Projections (Thousand Units)

6. Global Hoist Market Analysis and Forecast, by Product Type

6.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Product Type, 2017- 2031

6.1.1. Planetary Gear

6.1.2. Worm Gear

6.1.3. Others

6.2. Incremental Opportunity, by Product Type

7. Global Hoist Market Analysis and Forecast, by Capacity

7.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

7.1.1. Up to 1000 lbs

7.1.2. 1000 lbs to 2000 lbs

7.1.3. 2000 lbs to 4000 lbs

7.1.4. 4000 lbs to 6000 lbs

7.1.5. 6000 lbs to 8000 lbs

7.1.6. 8000 lbs to 10000 lbs

7.1.7. 10000 lbs to 12000 lbs

7.1.8. 12000 lbs to 16000 lbs

7.1.9. Above 16000 lbs

7.2. Incremental Opportunity, by Capacity

8. Global Hoist Market Analysis and Forecast, by Operation

8.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Operation, 2017- 2031

8.1.1. Hydraulic

8.1.2. Electric

8.1.3. Pneumatic

8.1.4. Manual

8.2. Incremental Opportunity, by Operation

9. Global Hoist Market Analysis and Forecast, by Hoist Rope

9.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

9.1.1. Chain Hoist

9.1.2. Wire or Rope Hoist

9.2. Incremental Opportunity, by Hoist Rope

10. Global Hoist Market Analysis and Forecast, by Application

10.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Application, 2017- 2031

10.1.1. Commercial Recovery

10.1.2. Crane

10.1.2.1. Fixed Crane

10.1.2.2. Mobile Crane

10.1.3. Workboat

10.1.4. Utility

10.1.5. Others

10.2. Incremental Opportunity, by Application

11. Global Hoist Market Analysis and Forecast, by End-use Industry

11.1. Global Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

11.1.1. Automotive & Railway

11.1.2. Aerospace & Defense

11.1.3. Transportation & Logistics

11.1.4. Construction

11.1.5. Shipping & Marine

11.1.6. Material Handling

11.1.7. Agriculture & Forestry

11.1.8. Mining

11.1.9. Oil & Gas

11.1.10. Others

11.2. Incremental Opportunity, by End-use Industry

12. Global Hoist Market Analysis and Forecast, by Distribution Channel

12.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

12.1.1. Direct

12.1.2. Indirect

12.2. Incremental Opportunity, by Distribution Channel

13. Global Hoist Market Analysis and Forecast, by Region

13.1. Global Hoist Market Size (US$ Bn and Thousand Units), by Region, 2017- 2031

13.1.1. North America

13.1.2. Europe

13.1.3. Asia Pacific

13.1.4. Middle East & Africa

13.1.5. South America

13.2. Incremental Opportunity, by Region

14. North America Hoist Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Price Trend Analysis

14.2.1. Weighted Average Selling Price (US$)

14.3. Key Trend Analysis

14.4. Key Supplier Analysis

14.5. Hoist Market (US$ Bn and Thousand Units), by Product Type, 2017- 2031

14.5.1. Planetary Gear

14.5.2. Worm Gear

14.5.3. Others

14.6. Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

14.6.1. Up to 1000 lbs

14.6.2. 1000 lbs to 2000 lbs

14.6.3. 2000 lbs to 4000 lbs

14.6.4. 4000 lbs to 6000 lbs

14.6.5. 6000 lbs to 8000 lbs

14.6.6. 8000 lbs to 10000 lbs

14.6.7. 10000 lbs to 12000 lbs

14.6.8. 12000 lbs to 16000 lbs

14.6.9. Above 16000 lbs

14.7. Hoist Market (US$ Bn and Thousand Units), by Operation, 2017- 2031

14.7.1. Hydraulic

14.7.2. Electric

14.7.3. Pneumatic

14.7.4. Manual

14.8. Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

14.8.1. Chain Hoist

14.8.2. Wire or Rope Hoist

14.9. Hoist Market (US$ Bn and Thousand Units), by Application, 2017- 2031

14.9.1. Commercial Recovery

14.9.2. Crane

14.9.2.1. Fixed Crane

14.9.2.2. Mobile Crane

14.9.3. Workboat

14.9.4. Utility

14.9.5. Others

14.10. Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

14.10.1. Automotive & Railway

14.10.2. Aerospace & Defense

14.10.3. Transportation & Logistics

14.10.4. Construction

14.10.5. Shipping & Marine

14.10.6. Material Handling

14.10.7. Agriculture & Forestry

14.10.8. Mining

14.10.9. Oil & Gas

14.10.10. Others

14.11. Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

14.11.1. Direct

14.11.2. Indirect

14.12. Hoist Market (US$ Bn and Thousand Units), by Country & Sub-region, 2017- 2031

14.12.1. U.S.

14.12.2. Canada

14.12.3. Rest of North America

14.13. Incremental Opportunity Analysis

15. Europe Hoist Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Price Trend Analysis

15.2.1. Weighted Average Selling Price (US$)

15.3. Key Trend Analysis

15.4. Key Supplier Analysis

15.5. Hoist Market (US$ Bn and Thousand Units), by Product Type, 2017- 2031

15.5.1. Planetary Gear

15.5.2. Worm Gear

15.5.3. Others

15.6. Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

15.6.1. Up to 1000 lbs

15.6.2. 1000 lbs to 2000 lbs

15.6.3. 2000 lbs to 4000 lbs

15.6.4. 4000 lbs to 6000 lbs

15.6.5. 6000 lbs to 8000 lbs

15.6.6. 8000 lbs to 10000 lbs

15.6.7. 10000 lbs to 12000 lbs

15.6.8. 12000 lbs to 16000 lbs

15.6.9. Above 16000 lbs

15.7. Hoist Market (US$ Bn and Thousand Units), by Operation, 2017- 2031

15.7.1. Hydraulic

15.7.2. Electric

15.7.3. Pneumatic

15.7.4. Manual

15.8. Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

15.8.1. Chain Hoist

15.8.2. Wire or Rope Hoist

15.9. Hoist Market (US$ Bn and Thousand Units), by Application, 2017- 2031

15.9.1. Commercial Recovery

15.9.2. Crane

15.9.2.1. Fixed Crane

15.9.2.2. Mobile Crane

15.9.3. Workboat

15.9.4. Utility

15.9.5. Others

15.10. Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

15.10.1. Automotive & Railway

15.10.2. Aerospace & Defense

15.10.3. Transportation & Logistics

15.10.4. Construction

15.10.5. Shipping & Marine

15.10.6. Material Handling

15.10.7. Agriculture & Forestry

15.10.8. Mining

15.10.9. Oil & Gas

15.10.10. Others

15.11. Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

15.11.1. Direct

15.11.2. Indirect

15.12. Hoist Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

15.12.1. U.K.

15.12.2. Germany

15.12.3. France

15.12.4. Rest of Europe

15.13. Incremental Opportunity Analysis

16. Asia Pacific Hoist Market Analysis and Forecast

16.1. Regional Snapshot

16.2. Price Trend Analysis

16.2.1. Weighted Average Selling Price (US$)

16.3. Key Trend Analysis

16.4. Key Supplier Analysis

16.5. Hoist Market (US$ Bn and Thousand Units), by Product Type, 2017- 2031

16.5.1. Planetary Gear

16.5.2. Worm Gear

16.5.3. Others

16.6. Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

16.6.1. Up to 1000 lbs

16.6.2. 1000 lbs to 2000 lbs

16.6.3. 2000 lbs to 4000 lbs

16.6.4. 4000 lbs to 6000 lbs

16.6.5. 6000 lbs to 8000 lbs

16.6.6. 8000 lbs to 10000 lbs

16.6.7. 10000 lbs to 12000 lbs

16.6.8. 12000 lbs to 16000 lbs

16.6.9. Above 16000 lbs

16.7. Hoist Market (US$ Bn and Thousand Units), by Operation, 2017- 2031

16.7.1. Hydraulic

16.7.2. Electric

16.7.3. Pneumatic

16.7.4. Manual

16.8. Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

16.8.1. Chain Hoist

16.8.2. Wire or Rope Hoist

16.9. Hoist Market (US$ Bn and Thousand Units), by Application, 2017- 2031

16.9.1. Commercial Recovery

16.9.2. Crane

16.9.2.1. Fixed Crane

16.9.2.2. Mobile Crane

16.9.3. Workboat

16.9.4. Utility

16.9.5. Others

16.10. Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

16.10.1. Automotive & Railway

16.10.2. Aerospace & Defense

16.10.3. Transportation & Logistics

16.10.4. Construction

16.10.5. Shipping & Marine

16.10.6. Material Handling

16.10.7. Agriculture & Forestry

16.10.8. Mining

16.10.9. Oil & Gas

16.10.10. Others

16.11. Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

16.11.1. Direct

16.11.2. Indirect

16.12. Hoist Market Size (US$ Bn) (Thousand Units), by Country & Sub-region, 2017- 2031

16.12.1. China

16.12.2. India

16.12.3. Japan

16.12.4. Rest of Asia Pacific

16.13. Incremental Opportunity Analysis

17. Middle East & Africa Hoist Market Analysis and Forecast

17.1. Regional Snapshot

17.2. Price Trend Analysis

17.2.1. Weighted Average Selling Price (US$)

17.3. Key Trend Analysis

17.4. Key Supplier Analysis

17.5. Hoist Market (US$ Bn and Thousand Units), by Product Type, 2017- 2031

17.5.1. Planetary Gear

17.5.2. Worm Gear

17.5.3. Others

17.6. Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

17.6.1. Up to 1000 lbs

17.6.2. 1000 lbs to 2000 lbs

17.6.3. 2000 lbs to 4000 lbs

17.6.4. 4000 lbs to 6000 lbs

17.6.5. 6000 lbs to 8000 lbs

17.6.6. 8000 lbs to 10000 lbs

17.6.7. 10000 lbs to 12000 lbs

17.6.8. 12000 lbs to 16000 lbs

17.6.9. Above 16000 lbs

17.7. Hoist Market (US$ Bn and Thousand Units), by Operation, 2017- 2031

17.7.1. Hydraulic

17.7.2. Electric

17.7.3. Pneumatic

17.7.4. Manual

17.8. Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

17.8.1. Chain Hoist

17.8.2. Wire or Rope Hoist

17.9. Hoist Market (US$ Bn and Thousand Units), by Application, 2017- 2031

17.9.1. Commercial Recovery

17.9.2. Crane

17.9.2.1. Fixed Crane

17.9.2.2. Mobile Crane

17.9.3. Workboat

17.9.4. Utility

17.9.5. Others

17.10. Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

17.10.1. Automotive & Railway

17.10.2. Aerospace & Defense

17.10.3. Transportation & Logistics

17.10.4. Construction

17.10.5. Shipping & Marine

17.10.6. Material Handling

17.10.7. Agriculture & Forestry

17.10.8. Mining

17.10.9. Oil & Gas

17.10.10. Others

17.11. Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

17.11.1. Direct

17.11.2. Indirect

17.12. Hoist Market Size (US$ Bn) (Thousand Units) by Country & Sub-region, 2017- 2031

17.12.1. GCC

17.12.2. South Africa

17.12.3. Rest of Middle East & Africa

17.13. Incremental Opportunity Analysis

18. South America Hoist Market Analysis and Forecast

18.1. Regional Snapshot

18.2. Price Trend Analysis

18.2.1. Weighted Average Selling Price (US$)

18.3. Key Trend Analysis

18.4. Key Supplier Analysis

18.5. Hoist Market (US$ Bn and Thousand Units), by Product Type, 2017- 2031

18.5.1. Planetary Gear

18.5.2. Worm Gear

18.5.3. Others

18.6. Hoist Market Size (US$ Bn and Thousand Units), by Capacity, 2017- 2031

18.6.1. Up to 1000 lbs

18.6.2. 1000 lbs to 2000 lbs

18.6.3. 2000 lbs to 4000 lbs

18.6.4. 4000 lbs to 6000 lbs

18.6.5. 6000 lbs to 8000 lbs

18.6.6. 8000 lbs to 10000 lbs

18.6.7. 10000 lbs to 12000 lbs

18.6.8. 12000 lbs to 16000 lbs

18.6.9. Above 16000 lbs

18.7. Hoist Market (US$ Bn and Thousand Units), by Operation, 2017- 2031

18.7.1. Hydraulic

18.7.2. Electric

18.7.3. Pneumatic

18.7.4. Manual

18.8. Hoist Market Size (US$ Bn and Thousand Units), by Hoist Rope, 2017- 2031

18.8.1. Chain Hoist

18.8.2. Wire or Rope Hoist

18.9. Hoist Market (US$ Bn and Thousand Units), by Application, 2017- 2031

18.9.1. Commercial Recovery

18.9.2. Crane

18.9.2.1. Fixed Crane

18.9.2.2. Mobile Crane

18.9.3. Workboat

18.9.4. Utility

18.9.5. Others

18.10. Hoist Market Size (US$ Bn and Thousand Units), by End-use Industry, 2017- 2031

18.10.1. Automotive & Railway

18.10.2. Aerospace & Defense

18.10.3. Transportation & Logistics

18.10.4. Construction

18.10.5. Shipping & Marine

18.10.6. Material Handling

18.10.7. Agriculture & Forestry

18.10.8. Mining

18.10.9. Oil & Gas

18.10.10. Others

18.11. Hoist Market Size (US$ Bn and Thousand Units), by Distribution Channel, 2017- 2031

18.11.1. Direct

18.11.2. Indirect

18.12. Hoist Market Size (US$ Bn) (Thousand Units) by Country & Sub-region, 2017- 2031

18.12.1. Brazil

18.12.2. Rest of South America

18.13. Incremental Opportunity Analysis

19. Competition Landscape

19.1. Competition Dashboard

19.2. Market Share Analysis % (2021)

19.3. Company Profiles [Company Overview, Product Portfolio, Financial Information, (Subject to Data Availability), Business Strategies / Recent Developments]

19.3.1. Columbus McKinnon Corporation

19.3.1.1. Company Overview

19.3.1.2. Product Portfolio

19.3.1.3. Financial Information, (Subject to Data Availability)

19.3.1.4. Business Strategies / Recent Developments

19.3.2. Demag Crane & Components GmbH

19.3.2.1. Company Overview

19.3.2.2. Product Portfolio

19.3.2.3. Financial Information, (Subject to Data Availability)

19.3.2.4. Business Strategies / Recent Developments

19.3.3. Donati Sollevamenti S.r.l.

19.3.3.1. Company Overview

19.3.3.2. Product Portfolio

19.3.3.3. Financial Information, (Subject to Data Availability)

19.3.3.4. Business Strategies / Recent Developments

19.3.4. TWG (Dover Corporation)

19.3.4.1. Company Overview

19.3.4.2. Product Portfolio

19.3.4.3. Financial Information, (Subject to Data Availability)

19.3.4.4. Business Strategies / Recent Developments

19.3.5. Hitachi Industrial Equipment Systems Co.

19.3.5.1. Company Overview

19.3.5.2. Product Portfolio

19.3.5.3. Financial Information, (Subject to Data Availability)

19.3.5.4. Business Strategies / Recent Developments

19.3.6. Ingersoll Rand

19.3.6.1. Company Overview

19.3.6.2. Product Portfolio

19.3.6.3. Financial Information, (Subject to Data Availability)

19.3.6.4. Business Strategies / Recent Developments

19.3.7. Kito Corporation

19.3.7.1. Company Overview

19.3.7.2. Product Portfolio

19.3.7.3. Financial Information, (Subject to Data Availability)

19.3.7.4. Business Strategies / Recent Developments

19.3.8. Konecranes

19.3.8.1. Company Overview

19.3.8.2. Product Portfolio

19.3.8.3. Financial Information, (Subject to Data Availability)

19.3.8.4. Business Strategies / Recent Developments

19.3.9. Liftket Hoffmann GmbH

19.3.9.1. Company Overview

19.3.9.2. Product Portfolio

19.3.9.3. Financial Information, (Subject to Data Availability)

19.3.9.4. Business Strategies / Recent Developments

19.3.10. Verlinde SAS

19.3.10.1. Company Overview

19.3.10.2. Product Portfolio

19.3.10.3. Financial Information, (Subject to Data Availability)

19.3.10.4. Business Strategies / Recent Developments

19.3.11. CHENG DAY MACHINERY WORKS CO., LTD.

19.3.11.1. Company Overview

19.3.11.2. Product Portfolio

19.3.11.3. Financial Information, (Subject to Data Availability)

19.3.11.4. Business Strategies / Recent Developments

19.3.12. Henan Feima Lifting Machinery Co., Ltd.

19.3.12.1. Company Overview

19.3.12.2. Product Portfolio

19.3.12.3. Financial Information, (Subject to Data Availability)

19.3.12.4. Business Strategies / Recent Developments

19.3.13. JASO Industrial Cranes

19.3.13.1. Company Overview

19.3.13.2. Product Portfolio

19.3.13.3. Financial Information, (Subject to Data Availability)

19.3.13.4. Business Strategies / Recent Developments

19.3.14. Electrolift, Inc.

19.3.14.1. Company Overview

19.3.14.2. Product Portfolio

19.3.14.3. Financial Information, (Subject to Data Availability)

19.3.14.4. Business Strategies / Recent Developments

19.3.15. Acco Material Handling Solutions

19.3.15.1. Company Overview

19.3.15.2. Product Portfolio

19.3.15.3. Financial Information, (Subject to Data Availability)

19.3.15.4. Business Strategies / Recent Developments

20. Key Takeaways

20.1. Identification of Potential Market Spaces

20.2. Prevailing Market Risks

List of Tables

Table 1: Global Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 2: Global Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 3: Global Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 4: Global Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 5: Global Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 6: Global Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 7: Global Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 8: Global Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 9: Global Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 10: Global Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 11: Global Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 12: Global Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 13: Global Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 14: Global Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 15: Global Hoist Market Projections, by Region, US$ Bn 2017-2031

Table 16: Global Hoist Market Projections, by Region, Thousand Units, 2017-2031

Table 17: North America Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 18: North America Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 19: North America Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 20: North America Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 21: North America Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 22: North America Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 23: North America Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 24: North America Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 25: North America Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 26: North America Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 27: North America Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 28: North America Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 29: North America Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 30: North America Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 31: North America Hoist Market Projections, by Country, US$ Bn 2017-2031

Table 32: North America Hoist Market Projections, by Country, Thousand Units, 2017-2031

Table 33: Europe Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 34: Europe Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 35: Europe Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 36: Europe Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 37: Europe Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 38: Europe Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 39: Europe Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 40: Europe Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 41: Europe Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 42: Europe Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 43: Europe Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 44: Europe Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 45: Europe Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 46: Europe Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 47: Europe Hoist Market Projections, by Country, US$ Bn 2017-2031

Table 48: Europe Hoist Market Projections, by Country, Thousand Units, 2017-2031

Table 49: Asia Pacific Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 50: Asia Pacific Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 51: Asia Pacific Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 52: Asia Pacific Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 53: Asia Pacific Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 54: Asia Pacific Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 55: Asia Pacific Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 56: Asia Pacific Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 57: Asia Pacific Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 58: Asia Pacific Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 59: Asia Pacific Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 60: Asia Pacific Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 61: Asia Pacific Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 62: Asia Pacific Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 63: Asia Pacific Hoist Market Projections, by Country, US$ Bn 2017-2031

Table 64: Asia Pacific Hoist Market Projections, by Country, Thousand Units, 2017-2031

Table 65: Middle East & Africa Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 66: Middle East & Africa Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 67: Middle East & Africa Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 68: Middle East & Africa Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 69: Middle East & Africa Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 70: Middle East & Africa Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 71: Middle East & Africa Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 72: Middle East & Africa Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 73: Middle East & Africa Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 74: Middle East & Africa Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 75: Middle East & Africa Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 76: Middle East & Africa Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 77: Middle East & Africa Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 78: Middle East & Africa Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 79: Middle East & Africa Hoist Market Projections, by Country, US$ Bn 2017-2031

Table 80: Middle East & Africa Hoist Market Projections, by Country, Thousand Units, 2017-2031

Table 81: South America Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Table 82: South America Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Table 83: South America Hoist Market Projections, by Operation, US$ Bn 2017-2031

Table 84: South America Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Table 85: South America Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Table 86: South America Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Table 87: South America Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Table 88: South America Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Table 89: South America Hoist Market Projections, by Application, US$ Bn 2017-2031

Table 90: South America Hoist Market Projections, by Application, Thousand Units, 2017-2031

Table 91: South America Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Table 92: South America Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Table 93: South America Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Table 94: South America Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Table 95: South America Hoist Market Projections, by Country, US$ Bn 2017-2031

Table 96: South America Hoist Market Projections, by Country, Thousand Units, 2017-2031

List of Figures

Figure 1: Global Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 2: Global Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 3: Global Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 4: Global Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 5: Global Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 6: Global Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 7: Global Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 8: Global Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 9: Global Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 10: Global Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 11: Global Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 12: Global Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 13: Global Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 14: Global Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 15: Global Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 16: Global Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 17: Global Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 18: Global Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 19: Global Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 20: Global Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 21: Global Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 22: Global Hoist Market Projections, by Region, US$ Bn 2017-2031

Figure 23: Global Hoist Market Projections, by Region, Thousand Units, 2017-2031

Figure 24: Global Hoist Market, Incremental Opportunity, by Region, US$ Bn 2017-2031

Figure 25: North America Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 26: North America Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 27: North America Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 28: North America Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 29: North America Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 30: North America Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 31: North America Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 32: North America Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 33: North America Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 34: North America Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 35: North America Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 36: North America Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 37: North America Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 38: North America Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 39: North America Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 40: North America Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 41: North America Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 42: North America Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 43: North America Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 44: North America Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 45: North America Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 46: North America Hoist Market Projections, by Country, US$ Bn 2017-2031

Figure 47: North America Hoist Market Projections, by Country, Thousand Units, 2017-2031

Figure 48: North America Hoist Market, Incremental Opportunity, by Country, US$ Bn 2017-2031

Figure 49: Europe Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 50: Europe Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 51: Europe Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 52: Europe Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 53: Europe Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 54: Europe Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 55: Europe Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 56: Europe Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 57: Europe Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 58: Europe Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 59: Europe Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 60: Europe Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 61: Europe Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 62: Europe Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 63: Europe Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 64: Europe Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 65: Europe Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 66: Europe Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 67: Europe Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 68: Europe Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 69: Europe Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 70: Europe Hoist Market Projections, by Country, US$ Bn 2017-2031

Figure 71: Europe Hoist Market Projections, by Country, Thousand Units, 2017-2031

Figure 72: Europe Hoist Market, Incremental Opportunity, by Country, US$ Bn 2017-2031

Figure 73: Asia Pacific Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 74: Asia Pacific Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 75: Asia Pacific Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 76: Asia Pacific Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 77: Asia Pacific Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 78: Asia Pacific Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 79: Asia Pacific Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 80: Asia Pacific Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 81: Asia Pacific Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 82: Asia Pacific Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 83: Asia Pacific Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 84: Asia Pacific Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 85: Asia Pacific Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 86: Asia Pacific Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 87: Asia Pacific Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 88: Asia Pacific Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 89: Asia Pacific Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 90: Asia Pacific Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 91: Asia Pacific Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 92: Asia Pacific Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 93: Asia Pacific Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 94: Asia Pacific Hoist Market Projections, by Country, US$ Bn 2017-2031

Figure 95: Asia Pacific Hoist Market Projections, by Country, Thousand Units, 2017-2031

Figure 96: Asia Pacific Hoist Market, Incremental Opportunity, by Country, US$ Bn 2017-2031

Figure 97: Middle East & Africa Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 98: Middle East & Africa Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 99: Middle East & Africa Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 100: Middle East & Africa Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 101: Middle East & Africa Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 102: Middle East & Africa Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 103: Middle East & Africa Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 104: Middle East & Africa Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 105: Middle East & Africa Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 106: Middle East & Africa Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 107: Middle East & Africa Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 108: Middle East & Africa Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 109: Middle East & Africa Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 110: Middle East & Africa Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 111: Middle East & Africa Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 112: Middle East & Africa Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 113: Middle East & Africa Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 114: Middle East & Africa Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 115: Middle East & Africa Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 116: Middle East & Africa Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 117: Middle East & Africa Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 118: Middle East & Africa Hoist Market Projections, by Country, US$ Bn 2017-2031

Figure 119: Middle East & Africa Hoist Market Projections, by Country, Thousand Units, 2017-2031

Figure 120: Middle East & Africa Hoist Market, Incremental Opportunity, by Country, US$ Bn 2017-2031

Figure 121: South America Hoist Market Projections, by Product Type, US$ Bn 2017-2031

Figure 122: South America Hoist Market Projections, by Product Type, Thousand Units 2017-2031

Figure 123: South America Hoist Market, Incremental Opportunity, by Product Type, US$ Bn 2017-2031

Figure 124: South America Hoist Market Projections, by Operation, US$ Bn 2017-2031

Figure 125: South America Hoist Market Projections, by Operation, Thousand Units, 2017-2031

Figure 126: South America Hoist Market, Incremental Opportunity, by Operation, US$ Bn 2017-2031

Figure 127: South America Hoist Market Projections, by Hoist Rope, US$ Bn 2017-2031

Figure 128: South America Hoist Market Projections, by Hoist Rope, Thousand Units, 2017-2031

Figure 129: South America Hoist Market, Incremental Opportunity, by Hoist Rope, US$ Bn 2017-2031

Figure 130: South America Hoist Market Projections, by Capacity, US$ Bn 2017-2031

Figure 131: South America Hoist Market Projections, by Capacity, Thousand Units, 2017-2031

Figure 132: South America Hoist Market, Incremental Opportunity, by Capacity, US$ Bn 2017-2031

Figure 133: South America Hoist Market Projections, by Application, US$ Bn 2017-2031

Figure 134: South America Hoist Market Projections, by Application, Thousand Units, 2017-2031

Figure 135: South America Hoist Market, Incremental Opportunity, by Application, US$ Bn 2017-2031

Figure 136: South America Hoist Market Projections, by End-use Industries, US$ Bn 2017-2031

Figure 137: South America Hoist Market Projections, by End-use Industries, Thousand Units, 2017-2031

Figure 138: South America Hoist Market, Incremental Opportunity, by End-use Industries, US$ Bn 2017-2031

Figure 139: South America Hoist Market Projections, by Distribution Channel, US$ Bn 2017-2031

Figure 140: South America Hoist Market Projections, by Distribution Channel, Thousand Units, 2017-2031

Figure 141: South America Hoist Market, Incremental Opportunity, by Distribution Channel, US$ Bn 2017-2031

Figure 142: South America Hoist Market Projections, by Country, US$ Bn 2017-2031

Figure 143: South America Hoist Market Projections, by Country, Thousand Units, 2017-2031

Figure 144: South America Hoist Market, Incremental Opportunity, by Country, US$ Bn 2017-2031