Reports

Reports

Analysts’ Viewpoint on Hearing Aids Market Scenario

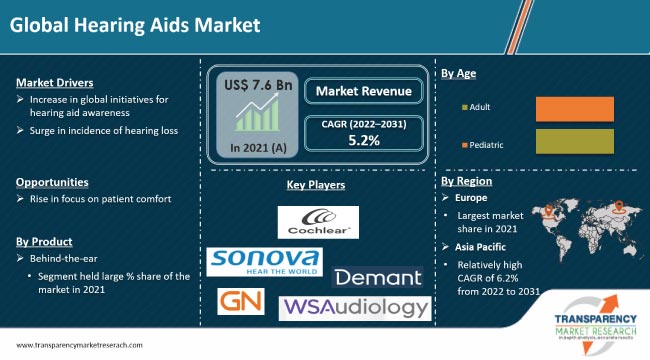

Rise in prevalence of hearing impairment has increased the need of hearing aids or ear machines. Developing countries are struggling with product uptake due to factors such as high costs and lack of awareness. Hence, government and private organizations are taking initiatives to bridge the gap between existing needs and availability of resources for hearing machines. This is projected to boost market penetration and increase the global market size.

Development of advanced hearing aid products presents significant opportunities for manufacturers in the global market. Prominent players are focusing on innovations through strategic collaborations, partnerships, and mergers & acquisitions to increase their footprint in the global hearing aids market.

Hearing aids are devices used to amplify sound waves, with the additional advantage of canceling noise. These devices help a person with hearing impairment to improve his or her hearing ability. Hearing aids are available in different sizes and shapes. Behind-the-ear (BTE), receiver-in-the-ear (RITE), invisible hearing aids such as in-the-ear (ITE), and canal hearing aids (ITC, CIC, and IIC) are the basic hearing aids. Hearing machines are powered by either analog or digital platform.

Prevalence of hearing impairment in developing and underdeveloped countries is rising due to lack of timely diagnosis at primary and secondary levels, shortage of skilled professionals, unaffordability of ear machines, average health care system, poor personal hygiene & over-crowding, less access to healthcare facilities & other interventions, improper & inadequate countrywide planning to address hearing impairment, and inadequate resource distribution.

The elderly population is a high-risk group to suffer from hearing loss disorders. One-third of the population aged 65 years or above suffers from hearing loss. According to the World Health Organization (WHO), more than 1.5 billion people across the globe suffer from hearing loss. This number could increase to more than 2.5 billion by 2030.

Developing and underdeveloped countries are highly affected by hearing loss. Prevalence of disabling hearing loss is high in Southern Asia Pacific and Sub-Saharan Africa. Less awareness is the major factor for high prevalence of hearing loss in developing and underdeveloped countries. Thus, increase in geriatric population and rise in prevalence of hearing impairment are augmenting the global market growth.

Hearing impairment is one of the most prevalent chronic conditions across the globe. According to a WHO report (2022), around 1.5 billion of the world's population suffers from hearing loss. Globally, around 1 billion young people (aged 12 to 35) face the risk of hearing loss due to recreational exposure to loud sound. Lack of affordability affects the usage of ear machines.

Prevalence of hearing impairment increases exponentially with the decrease in the gross national income of a region. According to the report, population in regions such as Western Pacific, Africa, Southeast Asia, and few developing regions in the Pacific Rim accounts for 90% of burden of chronic ear infections. Chronic ear infection is one of the leading causes of hearing loss in developing countries.

In terms of product type, the behind-the-ear segment has been bifurcated into receiver-in-canal (RIC) and custom-fit earmold. The behind-the-ear segment held the largest global market share in 2021. The trend is likely to continue throughout the forecast period. This can be ascribed to various benefits of wearing a hearing machine behind the ear. For instance, larger batteries provide higher amplification and longer battery life. The behind-the-ear hearing aid is larger, which enables inclusion of more features such as directional microphones, telecoils, and Bluetooth.

Behind-the-ear hearing machine is more manageable than compact machine due to larger case, which makes changing batteries and cleaning the device easier for persons with less developed hand-eye coordination and dexterity. These factors are likely to augment the behind-the-ear segment during the forecast period.

Based on age, the adult segment accounted for the largest share of the global market in 2021. This can be ascribed to high prevalence of hearing impairment in developing and underdeveloped countries. The burden of hearing impairment is comparatively higher than available resources for treating it. According to the World Health Organization (2022), the prevalence of hearing impairment is higher in adults than in children. For instance, more than 1 billion young adults are at risk of permanent, avoidable hearing loss due to unsafe listening practices.

In terms of distribution channel, the hospitals & clinics segment accounted for significant share of the global market in 2021. Longer hospital stay is projected to drive the segment during the forecast period. According to an article published online by the National Library of Medicine on November 8, 2018, participants with untreated hearing loss experienced significantly longer inpatient stay compared to those without hearing loss over a period of two years, five years, and 10 years. Furthermore, participants with untreated hearing loss spent more days in the hospital on average, with 0.26 and 2.10 more days spent in the hospital over a period of two, five, and 10 years.

As per the global market trends, Europe is likely to dominate the market during the forecast period due to the presence of strong distribution channels of key players in the region. North America accounted for the second largest share of the global market in 2021.

Expansion of the market in the U.S. can be ascribed to the presence of well-established healthcare infrastructure, high purchasing power of the people, and significant demand for and acceptance of various types of hearing aids. The market in Asia Pacific is anticipated to grow at a rapid pace during the forecast period. Asia is the most densely populated continent and the one with the largest number of people with hearing loss.

The report provides profiles of leading players operating in the global market. Key players in the global market are Audina Hearing Instruments, Inc., Cochlear Ltd., Demant A/S, GN Hearing A/S, Medtronic plc, Sonova, Starkey Laboratories, Inc., and WS Audiology A/S. Expansion of product portfolio and mergers & acquisitions are the key strategies adopted by the major players in the global market.

Each of these players has been profiled in the hearing aids market report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

|

Attribute |

Detail |

|

Market Size Value in 2021 |

US$ 7.6 Bn |

|

Market Forecast Value in 2031 |

More than US$ 12.9 Bn |

|

Compound Annual Growth Rate (CAGR) |

5.2% |

|

Forecast Period |

2022–2031 |

|

Historical Data Available for |

2017–2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Market Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

The global market was valued at US$ 7.6 Bn in 2021.

The global market is projected to reach more than US$ 12.9 Bn by 2031.

The global market grew at a CAGR of 6.0% from 2017 to 2021.

The global market is anticipated to grow at a CAGR of 5.2% from 2022 to 2031.

The behind-the-ear segment held more than 69% share of the global market in 2021.

Europe is expected to account for major share of the global hearing aids market during the forecast period.

Audina Hearing Instruments, Inc., Cochlear Ltd., Demant A/S, GN Hearing A/S, Medtronic plc, Sonova, Starkey Laboratories, Inc., and WS Audiology A/S.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Hearing Aids Market

4. Market Overview

4.1. Introduction

4.1.1. Definitions

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Hearing Aids Market Analysis and Forecast, 2017–2031

4.4.1. Market Revenue Projections (US$ Mn)

5. Key Insights

5.1. Value Chain Analysis

5.2. Key Industry Events (product launch, acquisitions, partnerships, etc.)

5.3. COVID-19 Pandemic Impact on Industry (value chain and short / mid / long term impact)

6. Global Hearing Aids Market Analysis and Forecast, by Product Type

6.1. Introduction & Definition

6.2. Key Findings / Developments

6.3. Market Value Forecast, by Product Type, 2017–2031

6.3.1. Behind-the-ear

6.3.1.1. Receiver-in-Canal (RIC)

6.3.1.2. Custom-fit Earmold

6.3.2. In-the-ear

6.3.3. Others

6.4. Market Attractiveness Analysis, by Product Type

7. Global Hearing Aids Market Analysis and Forecast, by Age

7.1. Introduction & Definition

7.2. Key Findings / Developments

7.3. Market Value Forecast, by Age, 2017–2031

7.3.1. Adult

7.3.2. Pediatric

7.4. Market Attractiveness Analysis, by Age

8. Global Hearing Aids Market Analysis and Forecast, by Distribution Channel

8.1. Introduction & Definition

8.2. Key Findings / Developments

8.3. Market Value Forecast, by Distribution Channel, 2017–2031

8.3.1. Hospitals & Clinics

8.3.2. Retail Stores

8.3.3. E-commerce

8.4. Market Attractiveness Analysis, by Distribution Channel

9. Global Hearing Aids Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Hearing Aids Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Product Type, 2017–2031

10.2.1. Behind-the-ear

10.2.1.1. Receiver-in-Canal (RIC)

10.2.1.2. Custom-fit Earmold

10.2.2. In-the-ear

10.2.3. Others

10.3. Market Value Forecast, by Age, 2017–2031

10.3.1. Adult

10.3.2. Pediatric

10.4. Market Value Forecast, by Distribution Channel, 2017–2031

10.4.1. Hospitals & Clinics

10.4.2. Retail Stores

10.4.3. E-commerce

10.5. Market Value Forecast, by Country, 2017–2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Product Type

10.6.2. By Age

10.6.3. By Distribution Channel

10.6.4. By Country

11. Europe Hearing Aids Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Product Type, 2017–2031

11.2.1. Behind-the-ear

11.2.1.1. Receiver-in-Canal (RIC)

11.2.1.2. Custom-fit Earmold

11.2.2. In-the-ear

11.2.3. Others

11.3. Market Value Forecast, by Age, 2017–2031

11.3.1. Adult

11.3.2. Pediatric

11.4. Market Value Forecast, by Distribution Channel, 2017–2031

11.4.1. Hospitals & Clinics

11.4.2. Retail Stores

11.4.3. E-commerce

11.5. Market Value Forecast, by Country/Sub-region, 2017–2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Spain

11.5.5. Italy

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Product Type

11.6.2. By Age

11.6.3. By Distribution Channel

11.6.4. By Country/Sub-region

12. Asia Pacific Hearing Aids Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Product Type, 2017–2031

12.2.1. Behind-the-ear

12.2.1.1. Receiver-in-Canal (RIC)

12.2.1.2. Custom-fit Earmold

12.2.2. In-the-ear

12.2.3. Others

12.3. Market Value Forecast, by Age, 2017–2031

12.3.1. Adult

12.3.2. Pediatric

12.4. Market Value Forecast, by Distribution Channel, 2017–2031

12.4.1. Hospitals & Clinics

12.4.2. Retail Stores

12.4.3. E-commerce

12.5. Market Value Forecast, by Country/Sub-region, 2017–2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Product Type

12.6.2. By Age

12.6.3. By Distribution Channel

12.6.4. By Country/Sub-region

13. Latin America Hearing Aids Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Product Type, 2017–2031

13.2.1. Behind-the-ear

13.2.1.1. Receiver-in-Canal (RIC)

13.2.1.2. Custom-fit Earmold

13.2.2. In-the-ear

13.2.3. Others

13.3. Market Value Forecast, by Age, 2017–2031

13.3.1. Adult

13.3.2. Pediatric

13.4. Market Value Forecast, by Distribution Channel, 2017–2031

13.4.1. Hospitals & Clinics

13.4.2. Retail Stores

13.4.3. E-commerce

13.5. Market Value Forecast, by Country/Sub-region, 2017–2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Product Type

13.6.2. By Age

13.6.3. By Distribution Channel

13.6.4. By Country/Sub-region

14. Middle East & Africa Hearing Aids Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Product Type, 2017–2031

14.2.1. Behind-the-ear

14.2.1.1. Receiver-in-Canal (RIC)

14.2.1.2. Custom-fit Earmold

14.2.2. In-the-ear

14.2.3. Others

14.3. Market Value Forecast, by Age, 2017–2031

14.3.1. Adult

14.3.2. Pediatric

14.4. Market Value Forecast, by Distribution Channel, 2017–2031

14.4.1. Hospitals & Clinics

14.4.2. Retail Stores

14.4.3. E-commerce

14.5. Market Value Forecast, by Country/Sub-region, 2017–2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Product Type

14.6.2. By Age

14.6.3. By Distribution Channel

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (by tier and size of companies)

15.2. Market Share Analysis, by Company, 2021

15.3. Company Profiles

15.3.1. Audina Hearing Instruments, Inc.

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. SWOT Analysis

15.3.1.4. Strategic Overview

15.3.2. Cochlear Limited

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. SWOT Analysis

15.3.2.4. Strategic Overview

15.3.3. Demant A/S

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. SWOT Analysis

15.3.3.4. Strategic Overview

15.3.4. GN Hearing A/S

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. SWOT Analysis

15.3.4.4. Strategic Overview

15.3.5. Medtronic plc

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. SWOT Analysis

15.3.5.4. Strategic Overview

15.3.6. Sonova

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. SWOT Analysis

15.3.6.4. Strategic Overview

15.3.7. Starkey Laboratories, Inc.

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. SWOT Analysis

15.3.7.4. Strategic Overview

15.3.8. WS Audiology A/S

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. SWOT Analysis

15.3.8.4. Strategic Overview

List of Tables

Table 01: Global Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 02: Global Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 03: Global Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 04: Global Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 05: Global Hearing Aids Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 06: North America Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 07: North America Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 08: North America Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 09: North America Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 10: North America Hearing Aids Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 11: Europe Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 12: Europe Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 13: Europe Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 14: Europe Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 15: Europe Hearing Aids Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 16: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 17: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 18: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 19: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 20: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 21: Latin America Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 22: Latin America Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 23: Latin America Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 24: Latin America Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 25: Latin America Hearing Aids Market Value (US$ Mn) Forecast, by Country/Sub-Region, 2017–2031

Table 26: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast, by Product Type, 2017–2031

Table 27: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast, by Behind-the-ear, 2017–2031

Table 28: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast, by Age, 2017–2031

Table 29: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 30: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

List of Figures

Figure 01: Global Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 02: Global Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 03: Global Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 04: Global Hearing Aids Market Revenue (US$ Mn), by Behind-the-ear, 2017–2031

Figure 05: Global Hearing Aids Market Revenue (US$ Mn), by In-the-ear, 2017–2031

Figure 06: Global Hearing Aids Market Revenue (US$ Mn), by Others, 2017–2031

Figure 07: Global Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 08: Global Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 09: Global Hearing Aids Market Revenue (US$ Mn), by Adult, 2017–2031

Figure 10: Global Hearing Aids Market Revenue (US$ Mn), by Pediatric, 2017–2031

Figure 11: Global Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 12: Global Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 13: Global Hearing Aids Market Revenue (US$ Mn), by Hospitals & Clinics, 2017–2031

Figure 14: Global Hearing Aids Market Revenue (US$ Mn), by Retail Stores, 2017–2031

Figure 15: Global Hearing Aids Market Revenue (US$ Mn), by E-commerce, 2017–2031

Figure 16: Global Hearing Aids Market Value Share Analysis, by Region, 2021 and 2031

Figure 17: Global Hearing Aids Market Attractiveness Analysis, by Region, 2021–2031

Figure 18: North America Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 19: North America Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 20: North America Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 21: North America Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 22: North America Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 23: North America Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 24: North America Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 25: North America Hearing Aids Market Value Share Analysis, by Country, 2021 and 2031

Figure 26: North America Hearing Aids Market Attractiveness Analysis, by Country, 2022–2031

Figure 27: Europe Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 28: Europe Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 29: Europe Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 30: Europe Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 31: Europe Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 32: Europe Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 33: Europe Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 34: Europe Hearing Aids Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 35: Europe Hearing Aids Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 36: Asia Pacific Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 37: Asia Pacific Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 38: Asia Pacific Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 39: Asia Pacific Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 40: Asia Pacific Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 41: Asia Pacific Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 42: Asia Pacific Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 43: Asia Pacific Hearing Aids Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 44: Asia Pacific Hearing Aids Market Attractiveness Analysis, by Country/Sub-region, 2022–2031

Figure 45: Latin America Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 46: Latin America Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 47: Latin America Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 48: Latin America Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 49: Latin America Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 50: Latin America Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 51: Latin America Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 52: Latin America Hearing Aids Market Value Share Analysis, by Country/Sub-Region, 2021 and 2031

Figure 53: Latin America Hearing Aids Market Attractiveness Analysis, by Country/Sub-Region, 2022–2031

Figure 54: Middle East & Africa Hearing Aids Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017–2031

Figure 55: Middle East & Africa Hearing Aids Market Value Share Analysis, by Product Type, 2021 and 2031

Figure 56: Middle East & Africa Hearing Aids Market Attractiveness Index Analysis, by Product Type, 2022–2031

Figure 57: Middle East & Africa Hearing Aids Market Value Share Analysis, by Age, 2021 and 2031

Figure 58: Middle East & Africa Hearing Aids Market Attractiveness Index Analysis, by Age, 2022–2031

Figure 59: Middle East & Africa Hearing Aids Market Value Share Analysis, by Distribution Channel, 2021 and 2031

Figure 60: Middle East & Africa Hearing Aids Market Attractiveness Index Analysis, by Distribution Channel, 2022–2031

Figure 61: Middle East & Africa Hearing Aids Market Value Share Analysis, by Country/Sub-region, 2021 and 2031

Figure 62: Middle East & Africa Hearing Aids Market Attractiveness Analysis, by Country/Sub-region, 2022–2031