Reports

Reports

Analysts’ Viewpoint

Healthcare informatics has a key role in achieving better patient outcomes and a more efficient & effective healthcare ecosystem by leveraging the power of data, fostering patient engagement, empowering clinicians with decision support systems, and streamlining operations. Stakeholders must work collaboratively to address challenges, invest in cutting-edge technologies, and prioritize the integration of healthcare informatics into modern healthcare to fully unlock the potential of the global healthcare informatics market.

Healthcare informatics companies are taking data-driven decisions, post the COVID-19 pandemic, before investing in new device technologies. They are investing significantly in the research & development of technologically advanced healthcare informatics to significantly enhance patient care, improve operational efficiency, and drive better health outcomes. This is expected to drive the healthcare informatics market value.

Healthcare informatics, also known as health informatics or medical informatics or clinical informatics, is a multidisciplinary field that combines the use of information technology, data analysis, and healthcare management to improve the efficiency, accuracy, and quality of healthcare delivery and decision-making. It focuses on the acquisition, storage, retrieval, and use of health information in various healthcare settings.

Healthcare informatics plays a crucial role in modern healthcare, as it helps optimize workflows, improve patient outcomes, and advance medical research by leveraging the power of data and technology.

Healthcare information management is a crucial component of healthcare informatics. It involves the collection, storage, organization, and dissemination of patient-related data and health information within the healthcare ecosystem. Effective healthcare information management ensures that accurate and relevant data is available to healthcare professionals, administrators, and patients to support informed decision-making, enhance patient care, and improve overall healthcare outcomes.

Healthcare information technology focuses on the application of information technology to manage and improve healthcare delivery, patient outcomes, and administrative processes within the healthcare industry. It encompasses a range of hardware, software, and systems designed to collect, store, analyze, and exchange health-related data in a secure and efficient manner.

The healthcare informatics market revenue is poised for growth, and there are many opportunities for manufacturers to capitalize on this trend. It is evident that healthcare informatics is at the forefront of the healthcare industry's transformation, ushering in a new era of data-driven healthcare.

The COVID-19 pandemic has had a positive impact on the healthcare informatics market demand. The pandemic accelerated the adoption of digital health technologies and telemedicine. Healthcare informatics played a critical role in enabling remote patient monitoring, teleconsultations, and virtual care delivery.

Health systems rapidly implemented and expanded their telehealth capabilities, leading to increased demand for informatics solutions that support remote care. Demand for data analytics and surveillance tools soared during the pandemic.

Artificial intelligence and machine learning technologies were leveraged to develop predictive models for COVID-19, aid in diagnostics, and analyze patient data. Healthcare informatics solutions that incorporated AI capabilities were sought after to enhance clinical decision-making and optimize resource allocation.

Microbial genomic applications of bioinformatics include waste cleanup, climate change, biotechnology, and alternate energy. Additionally, bioinformatics is used in agriculture in crop improvement and enhancing insect resistance.

In comparative analysis, bioinformatics is utilized to determine genomic relationship, including functional and structural among different biological species. In proteomics, bioinformatics is employed to manage large amounts of data, employing various tools.

Tools such as NCI, NCIP, and CBIIT are also used in genomics, proteomics, imaging, and metabolomics to increase knowledge of the molecular basis of cancer. Significant research is being conducted in the fields of drug design, drug development, protein structure prediction, protein-protein interactions, and prediction of gene expressions.

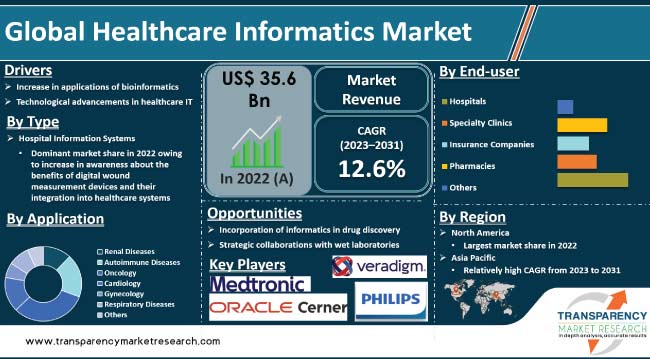

In terms of type, the hospital information systems segment held the largest global healthcare informatics market share in 2022. The trend is expected to continue during the forecast period.

Dominance of the segment can be attributed to the high rate of adoption of hospital information systems across the world. Increase in adoption of healthcare IT products in hospitals and rise in initiatives by public and private sectors are supporting the dominance of the segment.

Based on application, the oncology segment accounted for the largest global healthcare informatics market size in 2022. This is ascribed to rise in prevalence of cancer and increase in applications of informatics in clinical trials focused on the development of drugs for the treatment of cancer.

According to the Cancer Research UK, 18.1 million new cases of cancer were reported globally in 2020. It is estimated that the four most common cancers occurring are female breast, lung, bowel, and prostate cancer. This factor is expected to drive the market progress.

In terms of end-user, the hospitals segment held significant market share in 2022. Increase in collaboration between hospitals and healthcare informatics firms to aggregate and enrich data is expected to drive the segment during the forecast period. For instance, in January 2021, Oracle Cerner (Cerner Corporation) partnered with 12 behavioral health facilities across the Commonwealth of Virginia to provide electronic health record (EHR).

Increase in adoption of digital health systems by hospitals, rise in focus on patient-centered mandates, advancements in care management solutions as a measure to curb healthcare costs, emergence of accountable care organizations, and surge in popularity of patient engagement among the geriatric population are the major factors driving the segment growth.

According to the healthcare informatics market analysis, North America accounted for a significant share of the global healthcare informatics industry in 2022. This is ascribed to emerging technologies in healthcare informatics, government initiatives, the need for improved patient care, and increasing demand for data-driven solutions.

The U.S. Government has been actively promoting the adoption of EHRs and healthcare informatics through various initiatives and regulations. Programs such as the Health Information Technology for Economic and Clinical Health (HITECH) Act and the Medicare Access and CHIP Reauthorization Act (MACRA) have incentivized healthcare providers to implement and use health information technology systems.

Asia Pacific is expected to exhibit significant healthcare informatics market expansion during the forecast period. This is ascribed to increase in healthcare expenditure, surge in geriatric population, rise in prevalence of chronic diseases, increase in government initiatives & e-health programs, population growth, and collaborations between public and private sectors.

The healthcare informatics market report concludes with the company profiles section that includes key information about the major players. Companies focus on strategies such as new product launches, mergers, and partnerships & collaborations to compete in the marketplace.

Medtronic plc, Koninklijke Philips N.V., Health Gorilla, Oracle Cerner, MV Sistemas MV Informática Nordeste Ltda., LabVantage Solutions, Inc., NXGN Management, LLC, Veradigm LLC, Accuro Healthcare Solutions, FinThrive, Agfa HealthCare (Agfa-Gevaert Group), Axiom Resource Management, Inc., Benchmark Systems, and CNSI are the major healthcare informatics companies in the market.

The Revolutionary Radiology Workflow solution and MR Workspace with AI assistance streamlines the path from image acquisition to diagnosis, empowering technologists to increase productivity and predictability.

Prominent players have been profiled in the healthcare informatics market research report based on parameters such as company overview, financial overview, strategies, portfolio, segments, and recent developments.

| Attribute | Detail |

|---|---|

|

Size Value in 2022 |

US$ 35.6 Bn |

|

Forecast (Value) in 2031 |

More than US$ 100.4 Bn |

|

Growth Rate (CAGR) |

12.6% |

|

Forecast Period |

2023-2031 |

|

Historical Data Available for |

2017-2021 |

|

Quantitative Units |

US$ Bn for Value |

|

Market Analysis |

It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, and parent industry overview. |

|

Competition Landscape |

|

|

Format |

Electronic (PDF) + Excel |

|

Segmentation |

|

|

Regions Covered |

|

|

Countries Covered |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon request |

|

Pricing |

Available upon request |

It was valued at US$ 35.6 Bn in 2022

It is projected to reach more than US$ 100.4 Bn by 2031

It is anticipated to grow at a CAGR of 12.6% from 2023 to 2031

Increase in applications of bioinformatics and technological advancements in healthcare IT

The hospital information systems segment accounted for more than 60% share in 2022

North America is expected to account for the largest share from 2023 to 2031

Medtronic plc, Koninklijke Philips N.V., Health Gorilla, Oracle Cerner, MV Sistemas MV Informática Nordeste Ltda., LabVantage Solutions, Inc., NXGN Management, LLC, Veradigm LLC, Accuro Healthcare Solutions, FinThrive, Agfa HealthCare (Agfa-Gevaert Group), Axiom Resource Management, Inc., Benchmark Systems, and CNSI.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Healthcare Informatics Market

4. Market Overview

4.1. Introduction

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Healthcare Informatics Market Value Analysis and Forecast, 2017-2031

5. Key Insights

5.1. Technological Advancements

5.2. Regulatory Scenario, by Region

5.3. COVID-19 Pandemic Impact on Industry (value chain and short-/mid-/long-term impact)

6. Global Healthcare Informatics Market Analysis and Forecast, by Type

6.1. Introduction & Definition

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Type, 2017-2031

6.3.1. Hospital Information Systems

6.3.1.1. Electronic Health Record

6.3.1.2. Electronic Medical Record

6.3.1.3. Real-time Healthcare

6.3.1.4. Patient Engagement Solutions

6.3.1.5. Population Health Management

6.3.1.6. Others

6.3.2. Pharmacy Information Systems

6.3.2.1. Prescription Management

6.3.2.2. Automated Dispensing Systems

6.3.2.3. Inventory Management

6.3.2.4. Others

6.3.3. Laboratory Information Systems

6.3.4. Medical Imaging Information Systems

6.3.4.1. Radiology Information Systems

6.3.4.2. Monitoring Analysis Software

6.3.4.3. Picture Archiving & Communication Systems

6.3.4.4. Others

6.3.5. Health Insurance Information Systems

6.4. Market Attractiveness Analysis, by Type

7. Global Healthcare Informatics Market Analysis and Forecast, by Application

7.1. Introduction & Definition

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Application, 2017-2031

7.3.1. Renal Diseases

7.3.2. Autoimmune Diseases

7.3.3. Oncology

7.3.4. Cardiology

7.3.5. Gynecology

7.3.6. Respiratory Diseases

7.3.7. Others

7.4. Market Attractiveness Analysis, by Application

8. Global Healthcare Informatics Market Analysis and Forecast, by End-user

8.1. Introduction & Definition

8.2. Key Findings/Developments

8.3. Market Value Forecast, by End-user, 2017-2031

8.3.1. Hospitals

8.3.2. Specialty Clinics

8.3.3. Insurance Companies

8.3.4. Pharmacies

8.3.5. Others

8.4. Market Attractiveness Analysis, by End-user

9. Global Healthcare Informatics Market Analysis and Forecast, by Region

9.1. Key Findings

9.2. Market Value Forecast, by Region, 2017-2031

9.2.1. North America

9.2.2. Europe

9.2.3. Asia Pacific

9.2.4. Latin America

9.2.5. Middle East & Africa

9.3. Market Attractiveness Analysis, by Region

10. North America Healthcare Informatics Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Type, 2017-2031

10.2.1. Hospital Information Systems

10.2.1.1. Electronic Health Record

10.2.1.2. Electronic Medical Record

10.2.1.3. Real-time Healthcare

10.2.1.4. Patient Engagement Solutions

10.2.1.5. Population Health Management

10.2.1.6. Others

10.2.2. Pharmacy Information Systems

10.2.2.1. Prescription Management

10.2.2.2. Automated Dispensing Systems

10.2.2.3. Inventory Management

10.2.2.4. Others

10.2.3. Laboratory Information Systems

10.2.4. Medical Imaging Information Systems

10.2.4.1. Radiology Information Systems

10.2.4.2. Monitoring Analysis Software

10.2.4.3. Picture Archiving & Communication Systems

10.2.4.4. Others

10.2.5. Health Insurance Information Systems

10.3. Market Value Forecast, by Application, 2017-2031

10.3.1. Renal Diseases

10.3.2. Autoimmune Diseases

10.3.3. Oncology

10.3.4. Cardiology

10.3.5. Gynecology

10.3.6. Respiratory Diseases

10.3.7. Others

10.4. Market Value Forecast, by End-user, 2017-2031

10.4.1. Hospitals

10.4.2. Specialty Clinics

10.4.3. Insurance Companies

10.4.4. Pharmacies

10.4.5. Others

10.5. Market Value Forecast, by Country, 2017-2031

10.5.1. U.S.

10.5.2. Canada

10.6. Market Attractiveness Analysis

10.6.1. By Type

10.6.2. By Application

10.6.3. By End-user

10.6.4. By Country

11. Europe Healthcare Informatics Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Type, 2017-2031

11.2.1. Hospital Information Systems

11.2.1.1. Electronic Health Record

11.2.1.2. Electronic Medical Record

11.2.1.3. Real-time Healthcare

11.2.1.4. Patient Engagement Solutions

11.2.1.5. Population Health Management

11.2.1.6. Others

11.2.2. Pharmacy Information Systems

11.2.2.1. Prescription Management

11.2.2.2. Automated Dispensing Systems

11.2.2.3. Inventory Management

11.2.2.4. Others

11.2.3. Laboratory Information Systems

11.2.4. Medical Imaging Information Systems

11.2.4.1. Radiology Information Systems

11.2.4.2. Monitoring Analysis Software

11.2.4.3. Picture Archiving & Communication Systems

11.2.4.4. Others

11.2.5. Health Insurance Information Systems

11.3. Market Value Forecast, by Application, 2017-2031

11.3.1. Renal Diseases

11.3.2. Autoimmune Diseases

11.3.3. Oncology

11.3.4. Cardiology

11.3.5. Gynecology

11.3.6. Respiratory Diseases

11.3.7. Others

11.4. Market Value Forecast, by End-user, 2017-2031

11.4.1. Hospitals

11.4.2. Specialty Clinics

11.4.3. Insurance Companies

11.4.4. Pharmacies

11.4.5. Others

11.5. Market Value Forecast, by Country/Sub-region, 2017-2031

11.5.1. Germany

11.5.2. U.K.

11.5.3. France

11.5.4. Italy

11.5.5. Spain

11.5.6. Rest of Europe

11.6. Market Attractiveness Analysis

11.6.1. By Type

11.6.2. By Application

11.6.3. By End-user

11.6.4. By Country/Sub-region

12. Asia Pacific Healthcare Informatics Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Type, 2017-2031

12.2.1. Hospital Information Systems

12.2.1.1. Electronic Health Record

12.2.1.2. Electronic Medical Record

12.2.1.3. Real-time Healthcare

12.2.1.4. Patient Engagement Solutions

12.2.1.5. Population Health Management

12.2.1.6. Others

12.2.2. Pharmacy Information Systems

12.2.2.1. Prescription Management

12.2.2.2. Automated Dispensing Systems

12.2.2.3. Inventory Management

12.2.2.4. Others

12.2.3. Laboratory Information Systems

12.2.4. Medical Imaging Information Systems

12.2.4.1. Radiology Information Systems

12.2.4.2. Monitoring Analysis Software

12.2.4.3. Picture Archiving & Communication Systems

12.2.4.4. Others

12.2.5. Health Insurance Information Systems

12.3. Market Value Forecast, by Application, 2017-2031

12.3.1. Renal Diseases

12.3.2. Autoimmune Diseases

12.3.3. Oncology

12.3.4. Cardiology

12.3.5. Gynecology

12.3.6. Respiratory Diseases

12.3.7. Others

12.4. Market Value Forecast, by End-user, 2017-2031

12.4.1. Hospitals

12.4.2. Specialty Clinics

12.4.3. Insurance Companies

12.4.4. Pharmacies

12.4.5. Others

12.5. Market Value Forecast, by Country/Sub-region, 2017-2031

12.5.1. China

12.5.2. Japan

12.5.3. India

12.5.4. Australia & New Zealand

12.5.5. Rest of Asia Pacific

12.6. Market Attractiveness Analysis

12.6.1. By Type

12.6.2. By Application

12.6.3. By End-user

12.6.4. By Country/Sub-region

13. Latin America Healthcare Informatics Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Type, 2017-2031

13.2.1. Hospital Information Systems

13.2.1.1. Electronic Health Record

13.2.1.2. Electronic Medical Record

13.2.1.3. Real-time Healthcare

13.2.1.4. Patient Engagement Solutions

13.2.1.5. Population Health Management

13.2.1.6. Others

13.2.2. Pharmacy Information Systems

13.2.2.1. Prescription Management

13.2.2.2. Automated Dispensing Systems

13.2.2.3. Inventory Management

13.2.2.4. Others

13.2.3. Laboratory Information Systems

13.2.4. Medical Imaging Information Systems

13.2.4.1. Radiology Information Systems

13.2.4.2. Monitoring Analysis Software

13.2.4.3. Picture Archiving & Communication Systems

13.2.4.4. Others

13.2.5. Health Insurance Information Systems

13.3. Market Value Forecast, by Application, 2017-2031

13.3.1. Renal Diseases

13.3.2. Autoimmune Diseases

13.3.3. Oncology

13.3.4. Cardiology

13.3.5. Gynecology

13.3.6. Respiratory Diseases

13.3.7. Others

13.4. Market Value Forecast, by End-user, 2017-2031

13.4.1. Hospitals

13.4.2. Specialty Clinics

13.4.3. Insurance Companies

13.4.4. Pharmacies

13.4.5. Others

13.5. Market Value Forecast, by Country/Sub-region, 2017-2031

13.5.1. Brazil

13.5.2. Mexico

13.5.3. Rest of Latin America

13.6. Market Attractiveness Analysis

13.6.1. By Type

13.6.2. By Application

13.6.3. By End-user

13.6.4. By Country/Sub-region

14. Middle East & Africa Healthcare Informatics Market Analysis and Forecast

14.1. Introduction

14.1.1. Key Findings

14.2. Market Value Forecast, by Type, 2017-2031

14.2.1. Hospital Information Systems

14.2.1.1. Electronic Health Record

14.2.1.2. Electronic Medical Record

14.2.1.3. Real-time Healthcare

14.2.1.4. Patient Engagement Solutions

14.2.1.5. Population Health Management

14.2.1.6. Others

14.2.2. Pharmacy Information Systems

14.2.2.1. Prescription Management

14.2.2.2. Automated Dispensing Systems

14.2.2.3. Inventory Management

14.2.2.4. Others

14.2.3. Laboratory Information Systems

14.2.4. Medical Imaging Information Systems

14.2.4.1. Radiology Information Systems

14.2.4.2. Monitoring Analysis Software

14.2.4.3. Picture Archiving & Communication Systems

14.2.4.4. Others

14.2.5. Health Insurance Information Systems

14.3. Market Value Forecast, by Application, 2017-2031

14.3.1. Renal Diseases

14.3.2. Autoimmune Diseases

14.3.3. Oncology

14.3.4. Cardiology

14.3.5. Gynecology

14.3.6. Respiratory Diseases

14.3.7. Others

14.4. Market Value Forecast, by End-user, 2017-2031

14.4.1. Hospitals

14.4.2. Specialty Clinics

14.4.3. Insurance Companies

14.4.4. Pharmacies

14.4.5. Others

14.5. Market Value Forecast, by Country/Sub-region, 2017-2031

14.5.1. GCC Countries

14.5.2. South Africa

14.5.3. Rest of Middle East & Africa

14.6. Market Attractiveness Analysis

14.6.1. By Type

14.6.2. By Application

14.6.3. By End-user

14.6.4. By Country/Sub-region

15. Competition Landscape

15.1. Market Player - Competition Matrix (By Tier and Size of Companies)

15.2. Market Share Analysis, by Company (2022)

15.3. Company Profiles

15.3.1. Medtronic plc

15.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.1.2. Product Portfolio

15.3.1.3. Financial Overview

15.3.1.4. SWOT Analysis

15.3.1.5. Strategic Overview

15.3.2. Koninklijke Philips N.V.

15.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.2.2. Product Portfolio

15.3.2.3. Financial Overview

15.3.2.4. SWOT Analysis

15.3.2.5. Strategic Overview

15.3.3. Health Gorilla

15.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.3.2. Product Portfolio

15.3.3.3. Financial Overview

15.3.3.4. SWOT Analysis

15.3.3.5. Strategic Overview

15.3.4. Oracle Cerner

15.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.4.2. Product Portfolio

15.3.4.3. Financial Overview

15.3.4.4. SWOT Analysis

15.3.4.5. Strategic Overview

15.3.5. MV Sistemas MV Informática Nordeste Ltda.

15.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.5.2. Product Portfolio

15.3.5.3. Financial Overview

15.3.5.4. SWOT Analysis

15.3.5.5. Strategic Overview

15.3.6. LabVantage Solutions, Inc.

15.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.6.2. Product Portfolio

15.3.6.3. Financial Overview

15.3.6.4. SWOT Analysis

15.3.6.5. Strategic Overview

15.3.7. NXGN Management, LLC

15.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.7.2. Product Portfolio

15.3.7.3. Financial Overview

15.3.7.4. SWOT Analysis

15.3.7.5. Strategic Overview

15.3.8. Veradigm LLC

15.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.8.2. Product Portfolio

15.3.8.3. Financial Overview

15.3.8.4. SWOT Analysis

15.3.8.5. Strategic Overview

15.3.9. Accuro Healthcare Solutions

15.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.9.2. Product Portfolio

15.3.9.3. Financial Overview

15.3.9.4. SWOT Analysis

15.3.9.5. Strategic Overview

15.3.10. FinThrive

15.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.10.2. Product Portfolio

15.3.10.3. Financial Overview

15.3.10.4. SWOT Analysis

15.3.10.5. Strategic Overview

15.3.11. Agfa HealthCare (Agfa-Gevaert Group)

15.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.11.2. Product Portfolio

15.3.11.3. Financial Overview

15.3.11.4. SWOT Analysis

15.3.11.5. Strategic Overview

15.3.12. Axiom Resource Management, Inc.

15.3.12.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.12.2. Product Portfolio

15.3.12.3. Financial Overview

15.3.12.4. SWOT Analysis

15.3.12.5. Strategic Overview

15.3.13. Benchmark Systems

15.3.13.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.13.2. Product Portfolio

15.3.13.3. Financial Overview

15.3.13.4. SWOT Analysis

15.3.13.5. Strategic Overview

15.3.14. CNSI

15.3.14.1. Company Overview (HQ, Business Segments, Employee Strength)

15.3.14.2. Product Portfolio

15.3.14.3. Financial Overview

15.3.14.4. SWOT Analysis

15.3.14.5. Strategic Overview

List of Tables

Table 01: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 02: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 03: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 04: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 05: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 06: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 07: Global Healthcare Informatics Market Value (US$ Mn) Forecast, by Region, 2017-2031

Table 08: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Country, 2017-2031

Table 09: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 10: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 11: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 12: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 13: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 14: North America Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 15: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 16: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 17: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 18: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 19: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 20: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 21: Europe Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 22: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 23: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 24: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 25: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 26: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 27: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 28: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 29: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 30: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 31: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 32: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 33: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 34: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 35: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

Table 36: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017-2031

Table 37: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Type, 2017-2031

Table 38: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Hospital Information Systems, 2017-2031

Table 39: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Pharmacy Information Systems, 2017-2031

Table 40: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Medical Imaging Information Systems, 2017-2031

Table 41: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by Application, 2017-2031

Table 42: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast, by End-user, 2017-2031

List of Figures

Figure 1: Global Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 2: Global Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 3: Global Healthcare Informatics Market Value (US$ Mn), by Hospital Information Systems, 2017-2031

Figure 4: Global Healthcare Informatics Market Value (US$ Mn), by Pharmacy Information Systems, 2017-2031

Figure 5: Global Healthcare Informatics Market Value (US$ Mn), by Laboratory Information Systems, 2017-2031

Figure 6: Global Healthcare Informatics Market Value (US$ Mn), by Medical Imaging Information Systems, 2017-2031

Figure 7: Global Healthcare Informatics Market Value (US$ Mn), by Health Insurance Information Systems, 2017-2031

Figure 8: Global Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 9: Global Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 10: Global Healthcare Informatics Market Value (US$ Mn), by Renal Diseases, 2017-2031

Figure 11: Global Healthcare Informatics Market Value (US$ Mn), by Autoimmune Diseases, 2017-2031

Figure 12: Global Healthcare Informatics Market Value (US$ Mn), by Oncology, 2017-2031

Figure 13: Global Healthcare Informatics Market Value (US$ Mn), by Cardiology, 2017-2031

Figure 14: Global Healthcare Informatics Market Value (US$ Mn), by Gynecology, 2017-2031

Figure 15: Global Healthcare Informatics Market Value (US$ Mn), by Respiratory Diseases, 2017-2031

Figure 16: Global Healthcare Informatics Market Value (US$ Mn), by Others, 2017-2031

Figure 17: Global Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 18: Global Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 19: Global Healthcare Informatics Market Value (US$ Mn), by Hospitals, 2017-2031

Figure 20: Global Healthcare Informatics Market Value (US$ Mn), by Specialty Clinics, 2017-2031

Figure 21: Global Healthcare Informatics Market Value (US$ Mn), by Insurance Companies, 2017-2031

Figure 22: Global Healthcare Informatics Market Value (US$ Mn), by Pharmacies, 2017-2031

Figure 23: Global Healthcare Informatics Market Value (US$ Mn), by Others, 2017-2031

Figure 24: Global Healthcare Informatics Market Value Share Analysis, by Region, 2022 and 2031

Figure 25: Global Healthcare Informatics Market Attractiveness Analysis, by Region, 2023-2031

Figure 26: North America Healthcare Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 27: North America Healthcare Informatics Market Value Share, by Country, 2022 and 2031

Figure 28: North America Healthcare Informatics Market Attractiveness Analysis, by Country, 2023-2031

Figure 29: North America Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 30: North America Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 31: North America Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 32: North America Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 33: North America Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 34: North America Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 35: Europe Healthcare Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 36: Europe Healthcare Informatics Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 37: Europe Healthcare Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 38: Europe Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 39: Europe Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 40: Europe Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 41: Europe Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 42: Europe Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 43: Europe Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 44: Asia Pacific Healthcare Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 45: Asia Pacific Healthcare Informatics Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 46: Asia Pacific Healthcare Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 47: Asia Pacific Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 48: Asia Pacific Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 49: Asia Pacific Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 50: Asia Pacific Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 51: Asia Pacific Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 52: Asia Pacific Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 53: Latin America Healthcare Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 54: Latin America Healthcare Informatics Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 55: Latin America Healthcare Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 56: Latin America Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 57: Latin America Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 58: Latin America Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 59: Latin America Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 60: Latin America Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 61: Latin America Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 62: Middle East & Africa Healthcare Informatics Market Value (US$ Mn) Forecast and Y-o-Y Growth (%) Projection, 2017-2031

Figure 63: Middle East & Africa Healthcare Informatics Market Value Share, by Country/Sub-region, 2022 and 2031

Figure 64: Middle East & Africa Healthcare Informatics Market Attractiveness Analysis, by Country/Sub-region, 2023-2031

Figure 65: Middle East & Africa Healthcare Informatics Market Value Share Analysis, by Type, 2022 and 2031

Figure 66: Middle East & Africa Healthcare Informatics Market Attractiveness Analysis, by Type, 2023-2031

Figure 67: Middle East & Africa Healthcare Informatics Market Value Share Analysis, by Application, 2022 and 2031

Figure 68: Middle East & Africa Healthcare Informatics Market Attractiveness Analysis, by Application, 2023-2031

Figure 69: Middle East & Africa Healthcare Informatics Market Value Share Analysis, by End-user, 2022 and 2031

Figure 70: Middle East & Africa Healthcare Informatics Market Attractiveness Analysis, by End-user, 2023-2031

Figure 71: Global Healthcare Informatics Market Share Analysis, by Company 2022