Reports

Reports

Analyst Viewpoint

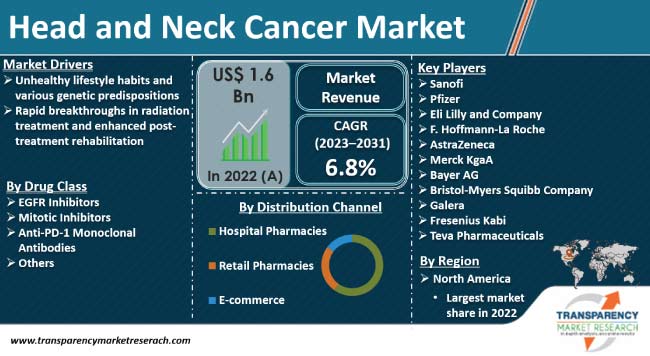

Unhealthy lifestyle habits and various genetic predispositions are driving the head and neck cancer market size. Rapid breakthroughs in radiation treatment and enhanced post-treatment rehabilitation are also boosting the demand for head and neck cancer treatment. High levels of air and environmental pollution, alongside genetic abnormalities resulting from the presence of toxic chemicals in the food chain have been associated with various health risks, including potential links to certain types of cancer.

Rise in investment in healthcare infrastructure in developing economies and growth in popularity of medical tourism are propelling the head and neck cancer market trajectory. Manufacturers are investing in the R&D of affordable treatment to expand their customer base.

Cancer develops when healthy cells mutate and expand uncontrollably, generating a mass known as a tumor. A tumor might be malignant or benign. A malignant tumor can multiply and spread to other sections of the body. A benign tumor can develop but does not spread. The term "head and neck cancer" refers to a variety of types of neck cancer that grow in or around the throat, larynx, nose, sinuses, and mouth.

The tumor can spread (metastasize) from the initial location to other body parts. Cancer is usually referred to by the site where it first appeared. Lung cancer that spreads to the liver, for example, is still referred to as lung cancer. Distinct forms of cancer have significantly different behaviors. They might develop at different speeds and react to various therapies. Thus, patients with cancer require treatment tailored to their specific form of disease.

Squamous cell carcinomas account for the majority of head and neck malignancies. This cancer starts in flat squamous cells. These cells form the thin layer of tissue that covers the structures in the head and neck. These structures contain mucosa beneath this layer, which is termed epithelium - a moist tissue present in the head and neck. Carcinoma in situ refers to a malignancy only located in the layer of squamous cells (epithelium), mostly presenting cancer in the neck area. If the disease has spread past this cell layer and into deeper tissue, it is called invasive squamous cell carcinoma. If physicians cannot pinpoint the disease's origin, it is referred to as cancer of unknown primary.

Tobacco (smoked or chewable), alcohol, areca nut, and malnutrition are all prevalent etiological variables that are also critical downstream socioeconomic determinants. Heavy smokers and drinkers are 35 times more likely to get head and neck cancer. Vitamin A, C, E, iron, selenium, and zinc deficits are also factors. Increased salt-preserved food consumption, grilled barbecued meat, and frozen and processed foods are all well-known etiological variables. Other contributing variables include exposure to air pollution, excessive sunshine, and other carcinogens. Clinical trials for HPV-positive head and neck cancer, as well as other specific viruses, such as HPV, EBV, Herpes, and HIV, have cemented in literature their role in causing cancer. Hence, unhealthy lifestyle habits are driving the head and neck cancer market.

Genetic abnormalities have been linked with the disease, though environmental variables play an essential role. People with a first-degree family history of head and neck cancer have a risk of 3.5-3.8, whereas persons with multiple primaries in the family have an eight-fold risk. Patients with a poor ability to metabolize toxins and a weakened immune system are around 500-700 times more likely to acquire malignant carcinomas. Rise in incidences of immune disorders and increase in influx of carcinogens into the body from the environment are projected to significantly influence the head and neck cancer market development in the near future.

Significant advances have been made in the Radiation Treatment (RT) of head and neck cancers over recent years. The introduction of multimodality imaging for target volume and organs at risk delineation and intensity-modulated RT has improved the efficacy of RT. The use of altered fractionation regimens and concurrent administration of chemotherapy for targeted areas have further enhanced the post-RT outcomes for patients. One such example is the massive strides made in speech therapy post-treatment for throat cancer. Overall, such advancements have resulted in improved locoregional control and overall survival probability, a reduction in the long-term harmful effects of RT, and a subsequent increase in quality of life. This, in turn, is fueling the head and neck cancer market value.

Further advancements in the treatment of head and neck cancer have resulted from improved integration of molecular imaging to detect tumor sub-volumes. These tumor groups often require more radiation doses and therapy adaptation to monitor changes in patient anatomy throughout treatment. In other cases, proton treatment produces even more precise dosage distribution, enhancing patient outcomes. Manufacturers in the head and neck cancer market are looking at further progress in this field by focusing on target volume and organ-at-risk delineation, molecular imaging for tumor delineation, dose painting for dose escalation, dose adaptability throughout treatment, and the possible benefit of proton therapy.

According to the latest head and neck cancer market trends, North America held largest share in 2022. Increase in prevalence of head and neck cancer, rise in healthcare expenditure, and expansion in pharmaceutical sector are fueling the market dynamics of the region. Presence of a robust product pipeline is also driving the global market statistics.

Rise in demand for effective medications for the treatment of head and neck cancer is boosting the market expansion in Asia Pacific. China and India are major markets for head and neck cancer treatment. Growth in pharmaceutical sector is also influencing the head and neck cancer market share in the region.

The industry in Latin America and Middle East & Africa is projected to grow at a steady pace during the forecast period. Surge in healthcare investment and rise in number of pharmaceutical firms operating locally are boosting the head and neck cancer market landscape in these regions.

Mergers & acquisitions, new product development, and strategic collaborations with government authorities are major strategies adopted by key players. Manufacturers are introducing innovative drugs and therapy modalities with a focus on improved quality of life for patients. Regulatory support has also enabled businesses to develop a large pipeline of drugs, greatly enhancing the prospects of finding better treatment than the modalities currently available in this landscape.

Major players operating in the global head and neck cancer industry include Sanofi, Pfizer, Eli Lilly and Company, F. Hoffmann-La Roche, AstraZeneca, Merck KgaA, Bayer AG, Bristol-Myers Squibb Company, Bayer AG, Galera, Fresenius Kabi, and Teva Pharmaceuticals.

Each of these players has been profiled in the head and neck cancer market report based on parameters such as company overview, business strategies, financial overview, product portfolio, and business segments.

| Attribute | Detail |

|---|---|

| Market Value in 2022 (Base Year) | US$ 1.6 Bn |

| Market Forecast Value in 2031 | US$ 2.9 Bn |

| Growth Rate (CAGR) | 6.8% |

| Forecast Period | 2023-2031 |

| Historical Data Available for | 2017-2021 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | Qualitative analysis includes drivers, restraints, opportunities, key trends, key market indicators, Porter’s Five Forces analysis, value chain analysis, and SWOT analysis. Furthermore, at the regional level, the qualitative analysis includes key trends, price trends, and key supplier analysis. |

| Competition Landscape | Prominent Players – Competition Dashboard and Revenue Share Analysis, 2022 Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview) |

| Format | Electronic (PDF) + Excel |

| Market Segmentation |

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon Request |

| Pricing | Available upon Request |

It was valued at US$ 1.6 Bn in 2022

It is likely to grow at a CAGR of 6.8% from 2023 to 2031

Unhealthy lifestyle habits and various genetic predispositions along with rapid breakthroughs in radiation treatment and enhanced post-treatment rehabilitation

The hospital pharmacies segment held the largest share in 2022

North America was the leading region in 2022

Sanofi, Pfizer, Eli Lilly and Company, F. Hoffmann-La Roche, AstraZeneca, Merck KgaA, Bayer AG, Bristol-Myers Squibb Company, Galera, Fresenius Kabi, and Teva Pharmaceuticals

1. Executive Summary

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions and Research Methodology

3. Executive Summary: Global Head and Neck Cancer Market

4. Market Overview

4.1. Market Segmentation

4.1.1. Segment Definition

4.1.2. Industry Evolution / Developments

4.2. Overview

4.3. Market Dynamics

4.3.1. Drivers

4.3.2. Restraints

4.3.3. Opportunities

4.4. Global Head and Neck Cancer Market Analysis and Forecasts, 2017-2031

5. Key Insights

5.1. Pipeline Analysis

5.2. Key Product/Brand Analysis

5.3. Key Mergers & Acquisitions

5.4. COVID-19 Pandemic Impact on Industry

6. Global Head and Neck Cancer Market Analysis and Forecast, by Drug Class

6.1. Introduction and Definitions

6.2. Key Findings/Developments

6.3. Market Value Forecast, by Drug Class, 2017–2031

6.3.1. EGFR Inhibitors

6.3.2. Mitotic Inhibitors

6.3.3. Anti-PD-1 Monoclonal Antibodies

6.3.4. Others

6.4. Market Attractiveness, by Drug Class

7. Global Head and Neck Cancer Market Analysis and Forecast, by Distribution Channel

7.1. Introduction and Definitions

7.2. Key Findings/Developments

7.3. Market Value Forecast, by Distribution Channel, 2017–2031

7.3.1. Hospitals Pharmacies

7.3.2. Retail Pharmacies

7.3.3. E-commerce

7.4. Market Attractiveness, by Distribution Channel

8. Global Head and Neck Cancer Market Analysis and Forecast, by Region

8.1. Key Findings

8.2. Market Value Forecast, by Region, 2017–2031

8.2.1. North America

8.2.2. Europe

8.2.3. Asia Pacific

8.2.4. Latin America

8.2.5. Middle East & Africa

8.3. Market Attractiveness, by Region

9. North America Head and Neck Cancer Market Analysis and Forecast

9.1. Introduction

9.1.1. Key Findings

9.2. Market Value Forecast, by Drug Class, 2017–2031

9.2.1. EGFR Inhibitors

9.2.2. Mitotic Inhibitors

9.2.3. Anti-PD-1 Monoclonal Antibodies

9.2.4. Others

9.3. Market Value Forecast, by Distribution Channel, 2017–2031

9.3.1. Hospitals Pharmacies

9.3.2. Retail Pharmacies

9.3.3. E-commerce

9.4. Market Value Forecast, by Country, 2017–2031

9.4.1. U.S.

9.4.2. Canada

9.5. Market Attractiveness Analysis

9.5.1. By Drug Class

9.5.2. By Distribution Channel

9.5.3. By Country

10. Europe Head and Neck Cancer Market Analysis and Forecast

10.1. Introduction

10.1.1. Key Findings

10.2. Market Value Forecast, by Drug Class, 2017–2031

10.2.1. EGFR Inhibitors

10.2.2. Mitotic Inhibitors

10.2.3. Anti-PD-1 Monoclonal Antibodies

10.2.4. Others

10.3. Market Value Forecast, by Distribution Channel, 2017–2031

10.3.1. Hospitals Pharmacies

10.3.2. Retail Pharmacies

10.3.3. E-commerce

10.4. Market Value Forecast, by Country/Sub-region, 2017–2031

10.4.1. Germany

10.4.2. U.K.

10.4.3. France

10.4.4. Italy

10.4.5. Spain

10.4.6. Rest of Europe

10.5. Market Attractiveness Analysis

10.5.1. By Drug Class

10.5.2. By Distribution Channel

10.5.3. By Country/Sub-region

11. Asia Pacific Head and Neck Cancer Market Analysis and Forecast

11.1. Introduction

11.1.1. Key Findings

11.2. Market Value Forecast, by Drug Class, 2017–2031

11.2.1. EGFR Inhibitors

11.2.2. Mitotic Inhibitors

11.2.3. Anti-PD-1 Monoclonal Antibodies

11.2.4. Others

11.3. Market Value Forecast, by Distribution Channel, 2017–2031

11.3.1. Hospitals Pharmacies

11.3.2. Retail Pharmacies

11.3.3. E-commerce

11.4. Market Value Forecast, by Country/Sub-region, 2017–2031

11.4.1. China

11.4.2. Japan

11.4.3. India

11.4.4. Australia & New Zealand

11.4.5. Rest of Asia Pacific

11.5. Market Attractiveness Analysis

11.5.1. By Drug Class

11.5.2. By Distribution Channel

11.5.3. By Country/Sub-region

12. Latin America Head and Neck Cancer Market Analysis and Forecast

12.1. Introduction

12.1.1. Key Findings

12.2. Market Value Forecast, by Drug Class, 2017–2031

12.2.1. EGFR Inhibitors

12.2.2. Mitotic Inhibitors

12.2.3. Anti-PD-1 Monoclonal Antibodies

12.2.4. Others

12.3. Market Value Forecast, by Distribution Channel, 2017–2031

12.3.1. Hospitals Pharmacies

12.3.2. Retail Pharmacies

12.3.3. E-commerce

12.4. Market Value Forecast, by Country/Sub-region, 2017–2031

12.4.1. Brazil

12.4.2. Mexico

12.4.3. Rest of Latin America

12.5. Market Attractiveness Analysis

12.5.1. By Drug Class

12.5.2. By Distribution Channel

12.5.3. By Country/Sub-region

13. Middle East & Africa Head and Neck Cancer Market Analysis and Forecast

13.1. Introduction

13.1.1. Key Findings

13.2. Market Value Forecast, by Drug Class, 2017–2031

13.2.1. EGFR Inhibitors

13.2.2. Mitotic Inhibitors

13.2.3. Anti-PD-1 Monoclonal Antibodies

13.2.4. Others

13.3. Market Value Forecast, by Distribution Channel, 2017–2031

13.3.1. Hospitals Pharmacies

13.3.2. Retail Pharmacies

13.3.3. E-commerce

13.4. Market Value Forecast, by Country/Sub-region, 2017–2031

13.4.1. GCC Countries

13.4.2. South Africa

13.4.3. Rest of Middle East & Africa

13.5. Market Attractiveness Analysis

13.5.1. By Drug Class

13.5.2. By Distribution Channel

13.5.3. By Country/Sub-region

14. Competition Landscape

14.1. Market Player – Competition Matrix (By Tier and Size of Companies)

14.2. Market Share Analysis, by Company (2022)

14.3. Company Profiles

14.3.1. Sanofi

14.3.1.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.1.2. Product Portfolio

14.3.1.3. Financial Overview

14.3.1.4. SWOT Analysis

14.3.1.5. Strategic Overview

14.3.2. Pfizer

14.3.2.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.2.2. Product Portfolio

14.3.2.3. Financial Overview

14.3.2.4. SWOT Analysis

14.3.2.5. Strategic Overview

14.3.3. Eli Lilly and Company

14.3.3.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.3.2. Product Portfolio

14.3.3.3. Financial Overview

14.3.3.4. SWOT Analysis

14.3.3.5. Strategic Overview

14.3.4. F. Hoffman-La Roche

14.3.4.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.4.2. Product Portfolio

14.3.4.3. Financial Overview

14.3.4.4. SWOT Analysis

14.3.4.5. Strategic Overview

14.3.5. AstraZeneca

14.3.5.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.5.2. Product Portfolio

14.3.5.3. Financial Overview

14.3.5.4. SWOT Analysis

14.3.5.5. Strategic Overview

14.3.6. Merck KgaA

14.3.6.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.6.2. Product Portfolio

14.3.6.3. Financial Overview

14.3.6.4. SWOT Analysis

14.3.6.5. Strategic Overview

14.3.7. Bayer AG

14.3.7.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.7.2. Product Portfolio

14.3.7.3. Financial Overview

14.3.7.4. SWOT Analysis

14.3.7.5. Strategic Overview

14.3.8. Bristol-Myers Squibb Company

14.3.8.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.8.2. Product Portfolio

14.3.8.3. Financial Overview

14.3.8.4. SWOT Analysis

14.3.8.5. Strategic Overview

14.3.9. Galera

14.3.9.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.9.2. Product Portfolio

14.3.9.3. Financial Overview

14.3.9.4. SWOT Analysis

14.3.9.5. Strategic Overview

14.3.10. Fresenius Kabi

14.3.10.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.10.2. Product Portfolio

14.3.10.3. Financial Overview

14.3.10.4. SWOT Analysis

14.3.10.5. Strategic Overview

14.3.11. Teva Pharmaceuticals

14.3.11.1. Company Overview (HQ, Business Segments, Employee Strength)

14.3.11.2. Product Portfolio

14.3.11.3. Financial Overview

14.3.11.4. SWOT Analysis

14.3.11.5. Strategic Overview

List of Tables

Table 1: Global Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 2: Global Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 3: Global Head and Neck Cancer Market Value (US$ Mn) Forecast, by Region, 2017–2031

Table 4: North America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Country, 2017–2031

Table 5: North America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 6: North America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 7: Europe Head and Neck Cancer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 8: Europe Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 9: Europe Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 10: Asia Pacific Head and Neck Cancer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 11: Asia Pacific Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 12: Asia Pacific Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel, 2017–2031

Table 13: Latin America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 14: Latin America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 15: Latin America Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

Table 16: Middle East & Africa Head and Neck Cancer Market Value (US$ Mn) Forecast, by Country/Sub-region, 2017–2031

Table 17: Middle East & Africa Head and Neck Cancer Market Value (US$ Mn) Forecast, by Drug Class, 2017–2031

Table 18: Middle East & Africa Head and Neck Cancer Market Value (US$ Mn) Forecast, by Distribution Channel 2017–2031

List of Figures

Figure 1: Global Head and Neck Cancer Market Value (US$ Mn) Forecast, 2017–2031

Figure 2: Global Head and Neck Cancer Market Value Share, by Drug Class, 2022

Figure 3: Global Head and Neck Cancer Market Value Share, by Distribution Channel, 2022

Figure 4: Global Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 5: Global Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 6: Global Head and Neck Cancer Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 7: Global Head and Neck Cancer Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 8: Global Head and Neck Cancer Market Value Share Analysis, by Region, 2022 and 2031

Figure 9: Global Head and Neck Cancer Market Attractiveness Analysis, by Region, 2023–2031

Figure 10: North America Head and Neck Cancer Market Value (US$ Mn) Forecast, 2017–2031

Figure 11: North America Head and Neck Cancer Market Value Share Analysis, by Country, 2022 and 2031

Figure 12: North America Head and Neck Cancer Market Attractiveness Analysis, by Country, 2023–2031

Figure 13: North America Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 14: North America Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 15: North America Head and Neck Cancer Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 16: North America Head and Neck Cancer Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 17: Europe Head and Neck Cancer Market Value (US$ Mn) Forecast, 2017–2031

Figure 18: Europe Head and Neck Cancer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 19: Europe Head and Neck Cancer Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 20: Europe Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 21: Europe America Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 22: Europe Head and Neck Cancer Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 23: Europe Head and Neck Cancer Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 24: Asia Pacific Head and Neck Cancer Market Value (US$ Mn) Forecast, 2017–2031

Figure 25: Asia Pacific Head and Neck Cancer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 26: Asia Pacific Head and Neck Cancer Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 27: Asia Pacific Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 28: Asia Pacific America Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 29: Asia Pacific Head and Neck Cancer Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 30: Asia Pacific Head and Neck Cancer Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 31: Latin America Head and Neck Cancer Market Value (US$ Mn) Forecast, 2017–2031

Figure 32: Latin America Head and Neck Cancer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 33: Latin America Head and Neck Cancer Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 34: Latin America Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022 and 2031

Figure 35: Latin America Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 36: Middle East & Africa Head and Neck Cancer Market Value Share Analysis, by Country/Sub-region, 2022 and 2031

Figure 37: Middle East & Africa Head and Neck Cancer Market Attractiveness Analysis, by Country/Sub-region, 2023–2031

Figure 38: Middle East & Africa America Head and Neck Cancer Market Value Share Analysis, by Drug Class, 2022–2031

Figure 39: Middle East & Africa America Head and Neck Cancer Market Attractiveness Analysis, by Drug Class, 2023–2031

Figure 40: Middle East & Africa Head and Neck Cancer Market Value Share Analysis, by Distribution Channel, 2022 and 2031

Figure 41: Middle East & Africa Head and Neck Cancer Market Attractiveness Analysis, by Distribution Channel 2023–2031

Figure 42: Global Head and Neck Cancer Market Share Analysis, by Company (2022)