Reports

Reports

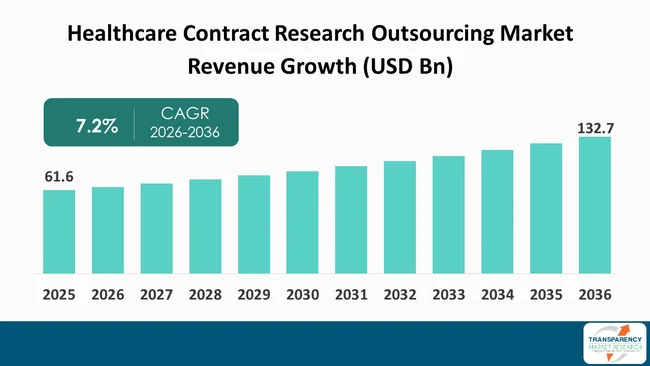

The global Healthcare Contract Research Outsourcing Market size was valued at US$ 61.6 Bn in 2025 and is projected to reach US$ 132.7 Bn by 2036, expanding at a CAGR of 7.2% from 2026 to 2036. The global market is driven by the increasing need to reduce drug development costs and timelines, prompting pharmaceutical and biotechnology companies to outsource clinical trials and research activities to specialized service providers. Additionally, the rising complexity of clinical studies, growing R&D investments, and the demand for regulatory expertise are further accelerating the adoption of contract research outsourcing services globally.

The healthcare contract research outsourcing market is experiencing significant growth as pharmaceutical and biotechnology companies need to reduce their drug development expenses and accelerate time to market. The market experiences demand growth as research and development budget increases, clinical trial procedures become more complex, industry needs particular regulatory compliance knowledge, and companies choose to delegate their non-essential research work to contract research organizations. The expansion of personalized medicine and biologics enterprise has created greater requirements for sophisticated research activities and clinical evaluation work.

The market encounters multiple restrictions that include problems regarding protection of data, maintaining privacy, differences in how CROs deliver their services, and the various regulatory obstacles that exist in multiple regions. Intellectual property rights and external partner dependencies function as two factors restricting outsourcing options for various organizations.

Lower operational expenses that accompany emerging markets together with their extensive patient base and developing healthcare systems create attractive business opportunities for international sponsors.

Healthcare contract research outsourcing refers to the practice of pharmaceutical, biotechnology, and medical device companies delegating their research and development activities to external service providers known as Contract Research Organizations (CROs). These outsourced services include preclinical research, clinical trials, regulatory affairs, data management, pharmacovigilance, and medical writing, enabling companies to reduce costs, access specialized expertise, and accelerate the drug and medical product development process.

| Attribute | Detail |

|---|---|

| healthcare contract research outsourcing Market Drivers |

|

Many pharmaceutical and biotechnology companies face management difficulties when their internal resources must handle study designs that involve multiple research centers across different countries while managing large patient data and following strict regulatory standards

Sponsors now prefer to use contract research organizations (CROs) that possess extensive knowledge of clinical operations, data management, biostatistics, and regulatory affairs due to the continuing changes to regulatory standards. CROs enable organizations to utilize advanced technologies including electronic data capture systems, artificial intelligence-driven analytics, remote monitoring tools, and real-world evidence platforms, which help enhance trial efficiency while ensuring accurate data collection.

The recruitment of patients with complex therapeutic requirements in oncology, neurology, and rare diseases requires specialized methods, which creates a higher demand to work with outsourcing partners who possess extensive experience. Healthcare organizations can achieve better clinical program outcomes by using CROs to manage their technical capabilities, global networks, and operational efficiency, which results in increased demand for contract research outsourcing services that span the globe.

The medical field has advanced multiple specialized drugs, which need thorough preclinical and clinical testing due to its rising interest in treatment fields that include oncology, immunology, rare diseases, and gene and cell therapies.

As R&D activities expand, businesses encounter difficulties as they are required to control high development expenses while dealing with their restricted internal resources and their need for specialized scientific knowledge and regulatory authority. This has encouraged sponsors to collaborate with Contract Research Organizations (CROs) that offer end-to-end research services including drug discovery support, clinical trial management, regulatory consulting, data analytics, and pharmacovigilance.

The contract research organizations (CROs) offer both - specialized facilities and trained personnel with cutting-edge technology that includes artificial intelligence-based data processing and actual evidence assessment systems. The process of personalized medicine requires patient classification, biomarker assessment, and intricate clinical trial frameworks that create a higher need for outsourcing partnerships.

Healthcare organizations can increase their research and development activities while decreasing their operational hazards and speeding up product launches by using third-party expertise and adjustable assets, which leads to significant expansion in the healthcare contract research outsourcing market.

| Attribute | Detail |

|---|---|

| Market Opportunity |

|

Strategic partnerships between pharmaceutical companies and contract research organizations (CROs) for long-term outsourcing contracts present a significant opportunity for the healthcare contract research outsourcing market. Pharmaceutical and biotechnology companies increasingly establish permanent research partnerships with CROs to obtain ongoing access to specialized research capabilities and operational support. Sponsors use these partnerships to create more efficient clinical development processes that decrease administrative work while increasing operational cost savings through common procedures and shared resources.

CROs obtain extensive knowledge about their clients' therapeutic pipelines and development plans together with their regulatory needs through long-term partnerships, which boost trial planning efficiency. The study achieved quicker start-up times while successfully recruiting more patients who participated in clinical trials, which resulted in enhanced success rates for all clinical programs. Strategic outsourcing allows pharmaceutical companies to decrease their need for substantial investments in internal business operations and staff development while they concentrate on developing new products and bringing them to market.

Partnerships foster knowledge sharing and technology integration while enabling partners to create innovative solutions for cancer and rare disease treatment and personalized medicine. Long-term contracts allow CROs to make digital platform and data analytics and decentralized trial model investments with more security. Strategic partnerships will become essential drivers of growth in the Healthcare Contract Research Outsourcing market as drug development processes become increasingly complicated and competitive.

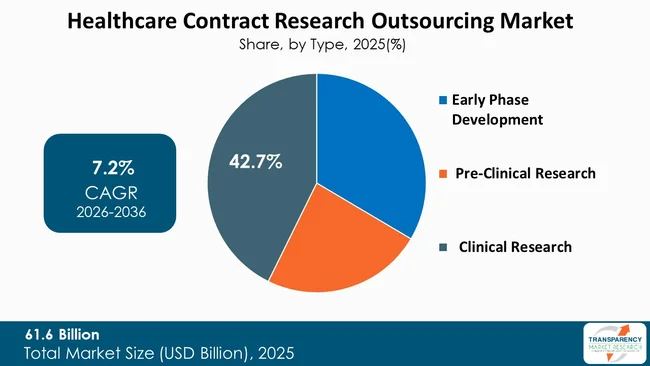

Clinical research dominates the type segment in the healthcare contract research outsourcing market, thereby accounting for the largest share due to the growing volume of clinical trials and the high costs and complexity associated with clinical development. Sponsorship organizations find more value in outsourcing their clinical research work as it needs specialized infrastructure and global research networks and specific professional knowledge that surpasses their internal capabilities.

The clinical research segment maintains its leading position due to increasing demand for studies in complex therapeutic areas that include oncology, neurology, immunology, and rare diseases that require specialized study designs to study difficult-to-find patient groups. The need for stringent regulatory compliance and high-grade data management systems together with pharmacovigilance operations create additional requirements that push organizations to use CROs for their clinical research activities.

Clinical trials also represent the most time-consuming and expensive phase of drug development, accounting for a significant portion of total R&D expenditure.

| Attribute | Detail |

|---|---|

| Leading Region |

|

North America is the dominant region in the healthcare contract research outsourcing market, accounting for a considerable 41.6% market share. North America is dominating region in global healthcare contract research outsourcing due to strong presence of pharmaceutical and biotechnology companies in the region and highly developed healthcare and research infrastructure.

The United States hosts a large number of drug development companies, medical device manufacturing firms, and Contract Research Organizations (CROs) that creates ongoing needs for research services which companies will outsource. All phases of drug development experience outsourcing growth as organizations invest heavily in research and development while maintaining strong clinical research infrastructure.

North America holds its dominant position as the region conducts more clinical trials than any other area, especially for oncology, cardiology, neurology, and rare disease research. North America attracts global sponsors to conduct trials as its established regulatory systems provide strong authority oversight, thereby maintaining high quality medical research standards. The region uses advanced technological systems that include digital health platforms, electronic data capture systems, and artificial intelligence analytics tools to improve trial operations and data processing.

The market receives strong support from reimbursement policies and skilled workforce availability and academic-industry partnerships. The North American healthcare system benefits from decentralized and virtual clinical trial models which enhance patient recruitment and retention. North America stands as the top region in the global Healthcare Contract Research Outsourcing Market through these combined factors.

IQVIA Inc., Allucent, Charles River Laboratories, Parexel, ICON, Medpace, Inc., Thermo Fisher Scientific Inc., SGS Société Générale de Surveillance SA, WuXi AppTec, Pharmaron, Aragen Life Sciences Ltd., Ergomed Group, TFS HealthScience, CTI Clinical Trial & Consulting, and other prominent players are the key players governing the global Healthcare Contract Research Outsourcing Market.

Each of these players has been profiled in the healthcare contract research outsourcing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2025 | US$ 61.6 Bn |

| Forecast Value in 2036 | More than US$ 132.7 Bn |

| CAGR | 7.2% |

| Forecast Period | 2026-2036 |

| Historical Data Available for | 2020-2024 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 61.6 Bn in 2025

It is projected to cross US$ 132.7 Bn by the end of 2036

Growing complexity of clinical trials, requiring specialized expertise and advanced technologies and Rising R&D investments in drug discovery, biologics, and personalized medicine

It is anticipated to grow at a CAGR 7.2% from 2026 to 2036

North America is expected to account for the largest share from 2026 to 2036

IQVIA Inc., Allucent, Charles River Laboratories, Parexel, ICON, Medpace, Inc., Thermo Fisher Scientific Inc., SGS Société Générale de Surveillance SA, WuXi AppTec, Pharmaron, Aragen Life Sciences Ltd., Ersgomed Group, TFS HealthScience, CTI Clinical Trial & Consulting, and other prominent players

Table 01: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 02: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 03: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 04: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 05: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 06: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 07: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 08: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 09: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 10: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 11: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 12: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 13: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 14: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 15: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 16: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 17: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 18: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 19: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 20: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 21: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 22: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 23: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 24: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 25: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 26: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 27: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 28: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 29: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 30: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 31: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 32: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 33: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 34: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 35: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 36: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 37: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 38: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 39: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 40: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 41: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 42: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 43: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 44: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 45: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 46: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 47: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 48: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 49: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 50: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 51: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 52: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 53: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 54: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 55: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 56: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 57: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 58: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 59: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 60: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 61: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 62: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 63: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 64: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 65: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 66: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 67: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 68: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 69: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 70: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 71: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 72: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 73: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 74: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 75: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 76: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 77: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 78: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 79: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 80: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 81: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 82: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 83: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 84: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 85: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 86: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 87: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 88: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 89: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 90: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 91: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 92: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 93: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 94: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 95: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 96: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 97: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 98: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 99: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 100: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 101: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 102: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 103: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 104: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 105: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 106: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 107: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 108: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 109: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 110: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 111: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 112: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 113: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 114: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 115: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 116: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 117: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 118: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 119: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 120: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 121: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 122: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 123: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 124: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 125: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 126: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 127: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 128: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 129: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 130: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 131: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 132: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 133: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 134: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 135: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 136: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Country/Sub-region, 2021 to 2036

Table 137: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 138: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 139: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 140: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 141: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 142: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 143: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 144: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 145: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 146: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Table 147: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Type, 2021 to 2036

Table 148: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Clinical Research, 2021 to 2036

Table 149: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Service Type, 2021 to 2036

Table 150: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by Therapeutic Area, 2021 to 2036

Table 151: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, by End-user, 2021 to 2036

Figure 01: Global Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 02: Global Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 03: Global Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 04: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Early Phase Development, 2021 to 2036

Figure 05: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Pre-Clinical Research, 2021 to 2036

Figure 06: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Clinical Research, 2021 to 2036

Figure 07: Global Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 08: Global Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 09: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Clinical Supply Management/Project Management, 2021 to 2036

Figure 10: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Regulatory Services, 2021 to 2036

Figure 11: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Clinical Data Management & Biometrics, 2021 to 2036

Figure 12: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Medical Communications & Documentation, 2021 to 2036

Figure 13: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Consulting, 2021 to 2036

Figure 14: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Site Management Protocol, 2021 to 2036

Figure 15: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Quality Assurance, 2021 to 2036

Figure 16: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Laboratory Testing, 2021 to 2036

Figure 17: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Toxicology Testing, 2021 to 2036

Figure 18: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 19: Global Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 20: Global Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 21: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Oncology/Hematology, 2021 to 2036

Figure 22: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by CNS, 2021 to 2036

Figure 23: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by CV/Metabolic, 2021 to 2036

Figure 24: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by CV/Metabolic, 2021 to 2036

Figure 25: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Respiratory, 2021 to 2036

Figure 26: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Infectious Disease, 2021 to 2036

Figure 27: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Immunology, 2021 to 2036

Figure 28: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Dermatology, 2021 to 2036

Figure 29: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Rare Disease, 2021 to 2036

Figure 30: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Others, 2021 to 2036

Figure 31: Global Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 32: Global Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 33: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Pharmaceutical Companies, 2021 to 2036

Figure 34: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Biotechnology Companies, 2021 to 2036

Figure 35: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Medical Device Companies, 2021 to 2036

Figure 36: Global Healthcare Contract Research Outsourcing Market Revenue (US$ Bn), by Academic Institutes & Government Organizations, 2021 to 2036

Figure 37: Global Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 38: Global Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 39: North America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 40: North America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 41: North America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 42: North America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 43: North America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 44: North America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 45: North America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 46: North America Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 47: North America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 48: North America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 49: North America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 50: U.S. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 51: U.S. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 52: U.S. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 53: U.S. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 54: U.S. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 55: U.S. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 56: U.S. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 57: U.S. Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 58: U.S. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 59: Canada Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 60: Canada Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 61: Canada Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 62: Canada Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 63: Canada Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 64: Canada Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 65: Canada Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 66: Canada Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 67: Canada Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 68: Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 69: Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 70: Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 71: Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 72: Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 73: Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 74: Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 75: Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 76: Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 77: Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 78: Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 79: Germany Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 80: Germany Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 81: Germany Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 82: Germany Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 83: Germany Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 84: Germany Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 85: Germany Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 86: Germany Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 87: Germany Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 88: U.K. Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 89: U.K. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 90: U.K. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 91: U.K. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 92: U.K. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 93: U.K. Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 94: U.K. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 95: U.K. Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 96: U.K. Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 97: France Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 98: France Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 99: France Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 100: France Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 101: France Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 102: France Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 103: France Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 104: France Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 105: France Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 106: Italy Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 107: Italy Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 108: Italy Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 109: Italy Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 110: Italy Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 111: Italy Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 112: Italy Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 113: Italy Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 114: Italy Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 115: Spain Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 116: Spain Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 117: Spain Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 118: Spain Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 119: Spain Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 120: Spain Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 121: Spain Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 122: Spain Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 123: Spain Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 124: The Netherlands Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 125: The Netherlands Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 126: The Netherlands Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 127: The Netherlands Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 128: The Netherlands Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 129: The Netherlands Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 130: The Netherlands Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 131: The Netherlands Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 132: The Netherlands Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 133: Rest of Europe Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 134: Rest of Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 135: Rest of Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 136: Rest of Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 137: Rest of Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 138: Rest of Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 139: Rest of Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 140: Rest of Europe Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 141: Rest of Europe Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 142: Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 143: Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 144: Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 145: Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 146: Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 147: Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 148: Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 149: Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 150: Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 151: Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 152: Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 153: China Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 154: China Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 155: China Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 156: China Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 157: China Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 158: China Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 159: China Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 160: China Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 161: China Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 162: Japan Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 163: Japan Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 164: Japan Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 165: Japan Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 166: Japan Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 167: Japan Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 168: Japan Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 169: Japan Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 170: Japan Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 171: India Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 172: India Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 173: India Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 174: India Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 175: India Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 176: India Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 177: India Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 178: India Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 179: India Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 180: South Korea Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 181: South Korea Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 182: South Korea Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 183: South Korea Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 184: South Korea Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 185: South Korea Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 186: South Korea Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 187: South Korea Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 188: South Korea Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 189: Australia Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 190: Australia Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 191: Australia Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 192: Australia Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 193: Australia Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 194: Australia Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 195: Australia Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 196: Australia Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 197: Australia Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 198: ASEAN Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 199: ASEAN Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 200: ASEAN Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 201: ASEAN Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 202: ASEAN Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 203: ASEAN Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 204: ASEAN Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 205: ASEAN Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 206: ASEAN Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 207: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 208: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 209: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 210: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 211: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 212: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 213: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 214: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 215: Rest of Asia Pacific Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 216: Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 217: Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 218: Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 219: Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 220: Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 221: Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 222: Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 223: Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 224: Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 225: Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 226: Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 227: Brazil Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 228: Brazil Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 229: Brazil Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 230: Brazil Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 231: Brazil Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 232: Brazil Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 233: Brazil Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 234: Brazil Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 235: Brazil Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 236: Mexico Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 237: Mexico Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 238: Mexico Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 239: Mexico Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 240: Mexico Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 241: Mexico Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 242: Mexico Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 243: Mexico Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 244: Mexico Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 245: Argentina Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 246: Argentina Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 247: Argentina Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 248: Argentina Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 249: Argentina Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 250: Argentina Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 251: Argentina Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 252: Argentina Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 253: Argentina Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 254: Rest of Latin America Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 255: Rest of Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 256: Rest of Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 257: Rest of Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 258: Rest of Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 259: Rest of Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 260: Rest of Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 261: Rest of Latin America Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 262: Rest of Latin America Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 263: Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 264: Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 265: Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 266: Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 267: Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 268: Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 269: Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 270: Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 271: Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 272: Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Country/Sub-region, 2025 and 2036

Figure 273: Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Country/Sub-region, 2026 to 2036

Figure 274: GCC Countries Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 275: GCC Countries Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 276: GCC Countries Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 277: GCC Countries Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 278: GCC Countries Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 279: GCC Countries Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 280: GCC Countries Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 281: GCC Countries Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 282: GCC Countries Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 283: South Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 284: South Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 285: South Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 286: South Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 287: South Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 288: South Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 289: South Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 290: South Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 291: South Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036

Figure 292: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value (US$ Bn) Forecast, 2021 to 2036

Figure 293: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Type, 2025 and 2036

Figure 294: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Type, 2026 to 2036

Figure 295: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Service Type, 2025 and 2036

Figure 296: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Service Type, 2026 to 2036

Figure 297: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by Therapeutic Area, 2025 and 2036

Figure 298: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by Therapeutic Area, 2026 to 2036

Figure 299: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Value Share Analysis, by End-user, 2025 and 2036

Figure 300: Rest of Middle East and Africa Healthcare Contract Research Outsourcing Market Attractiveness Analysis, by End-user, 2026 to 2036