Reports

Reports

The industrial robotics market’s growth is driven by technological advancements, governments’ initiatives, and addressing labor shortage problems. With their versatility and flexibility, industrial robots have the advantage of being easily deployable to sites where deploying a specialized machine is not ideal or where large-scale facility renovation is difficult.

Collaborative robots, a new type of robot that has been attracting attention in recent years, can be operated in a small space without the need for large safety fences, which enable applications in a variety of sites with less specialized equipment.

For example, Kawasaki’s dual-arm SCARA robot “duAro” is a collaborative robot that takes up the same amount of space as one human worker. Utilizing two arms, the robot can assemble a boxed lunch, wash dishes or package cosmetic items in the same way as a human worker does. Kawasaki is also developing an automatic waste sorting system for recycling sites using duAro. Key players in the market have invested in essential stakeholder and innovative collaborations across industries, disciplines, and borders. Also, by adapting generative AI and new opportunities, industrial robotics market is expanding.

Industrial robotics implies a programmable device that performs work in manufacturing and industrial settings. These robotic devices intend to perform tasks that are complex, hazardous, or repetitive at a high level of precision, precision, and speed.

Common tasks for industrial robots include welding, material handling, assembly, painting, packaging, and inspection of quality. Industrial robots can either be fixed location or mobile location. Collaborative robots, which are robotics that can physically work with human workers without safety barriers, is one of the recent developments in industrial robotics. Artificial intelligence (AI), machine vision, and the Internet of Things (IoT) have enhanced the potential use of industrial robots, along with flexibility and functionality.

The growth of the industrial robotics market is driven by an increased demand for automation across multiple industries such as automotive, electronics, pharmaceuticals, food & beverages, and logistics. Labor costs have continued to rise, along with the even greater challenge of finding good labor.

As companies are pushed to be increasingly productive, and operate as efficiently as possible, robotic solutions are being developed. Technological advancements continue to allow robotic solutions to be less expensive and get developed in the same way as small and medium-sized enterprises (SMEs) plan. Government support for smart manufacturing and Industry 4.0 are activating investments in robotics infrastructure.

| Attribute | Detail |

|---|---|

| Industrial Robotics Market Drivers |

|

Rising labor costs, coupled with labor force shortages, continue to be key drivers to the industrial robotics market due to the escalating costs of labor and the dwindling pool of workers who are economically viable to complete tasks that include, but are not limited to, repetitive or automated tasks, dangerous tasks, or physically overwhelming tasks.

Wage inflation in developed and emerging economies will continue, especially for unskilled jobs, as inflation increases the wages that workers and unions negotiate, and labor laws evolve to include newly established employee benefits, workers' rights, and payments for compliance. Essentially, industries, most notably manufacturing, logistics, and warehousing, will have an increasingly challenging time sourcing skilled workers who want to perform these types of unskilled job functions, resulting in operational challenges and needless productivity crippled by gaps in labor force.

Industrial robots can relieve these problems effectively by automating a variety of applications with respect to speed and accuracy and consistently perform tasks unmanned. Robots work continuously for long durations of time without breaks, thereby reducing the potential to incur human error while obtaining acceptable worker standards (quality) in production.

In the majority of observable applications, the return on investment (ROI) is significantly positive, and over a long period of time, the ROI produced from using and training humans often costs more to maintain than robotics utilization, especially in cases of high-volume manufacturing. The companies, to stay economically viable, thus have no other option than to invest in robotics systems to achieve independence from hourly labor, stability in employment, and to compete globally.

Countries and nationalities that follow suit, i.e. China, Japan, South Korea, Germany, etc. with rising labor costs and aging population are rapidly accelerating their migration to automation due to this confluence of conditions.

Innovation in technologies plays an important role in the growth of the Industrial robotics market. Technologies aimed at industrial robots' advancements are growing the market through smarter, efficient, and more versatile robots in complex manufacturing situations. Significant innovations in artificial intelligence (AI), machine learning, computer vision, and the Internet of Things (IoT) technology help current industrial robots to complete complex tasks with precision and autonomy. These advanced technologies enable the robots to adapt to altering production requirements, learn from experience, and work safely alongside human workers in a collaborative robotics system (cobots).

Moreover, the importance of cloud-connected and digital twin technology will enable monitoring in real-time, predictive maintenance, and data-based decisions to increase productivity and reduce downtimes. Overall, technological innovations not only continue to increase industrial robot’s applications and uses, but they will also increase use across the industry, hence, promote growth in the overall industrial automation market.

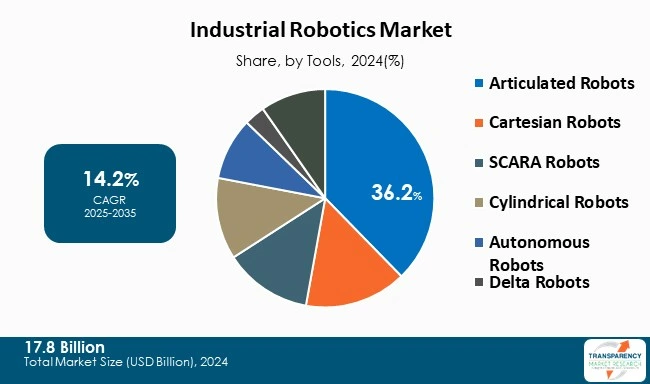

Articulated robots hold the largest market share in industrial robotics market due to their versatility, precision, and adaptability across various manufacturing sectors. The automotive industry has embraced articulated robots for tasks like welding, painting, and assembling for their accuracy and ability to work within tight areas. Currently, articulated systems comprise 70% of the total robotic applications in the automotive industry.

Additionally, articulated robots are being utilized in the other industries such as food and beverages, electronics, and pharmaceuticals owing to the increased productivity and lower operating costs that automation provides. Industry 4.0 has created smart factories and digital-connected systems, thereby increasing the acceptance of articulated robots.

| Attribute | Detail |

|---|---|

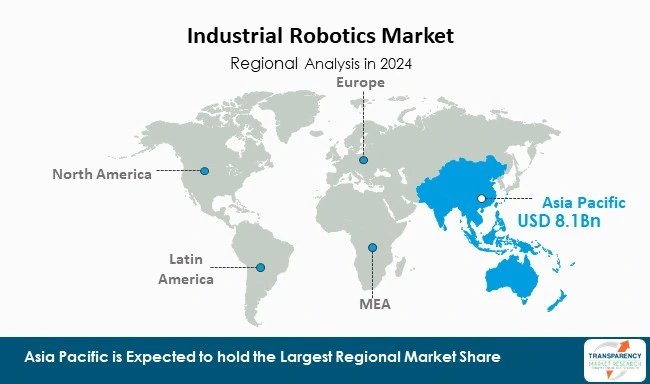

| Leading Region | Asia Pacific |

The Asia-Pacific region dominates the industrial robotics market as the major manufacturing center of the world, especially in the automotive, electronics and heavy machinery sectors. Nations such as China, Japan and South Korea have invested heavily in robots to become more productive, more precise and counter rising labor costs.

Additionally, China is installing more industrial robots each year than any other nation as a result of a strong domestic market and policy initiatives, such as ‘Made in China 2025’. Japan and South Korea have some of the world’s leading robotics manufacturers and some of the highest robot densities in the world. Additionally, the rapid industrialization of emerging economies such as India and Vietnam is also developing demand for automation.

Industry 4.0 technology is a considerable investment in the region, with incentives being backed by government initiatives along with a smarter factory approach that is driving the robotics opportunity across a wide range of industries including industrial and office robotics. The Asia-Pacific region has a strong ecosystem of robot manufacturers and end-users along with government policy that is encouraging automation for innovative and emerging uses of robotics technology.

Key players operating in the industrial robotics market are investing in innovation, strategic partnerships, and technological advancements. They emphasize on improving imaging clarity, and expanding product portfolios, ensuring sustained growth, and leadership in the evolving healthcare landscape.

ABB, Daihen Corporation, Denso Corporation, Epson America, Inc., FANUC Ltd., IRS Robotics, Kawasaki Heavy Industries Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi Robotic Systems, Inc., REDARC Electronics, Seiko Epson Corporation, Techman Robot Inc., Universal Robots, Yaskawa Electric Corporation are the key players in global market.

Each of these players has been profiled in the industrial robotics market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

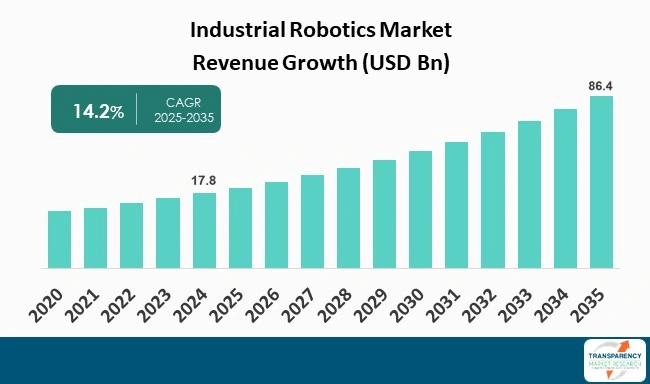

| Size in 2024 | US$ 17.8 Bn |

| Forecast Value in 2035 | US$ 86.4 Bn |

| CAGR | 14.2% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn |

| Industrial Robotics Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Robot Type

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The industrial robotics market was valued at US$ 17.8 Bn in 2024

The industrial robotics market is projected to reach US$ 86.4 Bn by 2035

Rising labor costs and workforce shortages and technological advancements in industrial robotics are some of the driving factor of industrial robotics market.

The CAGR is anticipated to be 14.2% from 2025 to 2035

Asia Pacific is expected to account for the largest share from 2025 to 2035

ABB, Daihen Corporation, Denso Corporation, Epson America, Inc., FANUC Ltd., IRS Robotics, Kawasaki Heavy Industries Ltd., KUKA AG, Mitsubishi Electric Corporation, Nachi Robotic Systems, Inc., REDARC Electronics, Seiko Epson Corporation, Techman Robot Inc., Universal Robots, and Yaskawa Electric Corporation among others.

Table 01: Global Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 02: Global Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 03: Global Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 04: Global Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 05: Global Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 06: Global Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 07: Global Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 08: Global Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 09: Global Market Value (US$ Mn) Forecast, by Region, 2020 to 2035

Table 10: Global Market Volume (Units) Forecast, by Region, 2020 to 2035

Table 11: North America Market Value (US$ Mn) Forecast, by Country, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast, by Country, 2020 to 2035

Table 13: North America Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 15: North America Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 17: North America Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 18: North America Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 19: North America Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 20: North America Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 21: U.S. Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 22: U.S. Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 23: U.S. Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 24: U.S. Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 25: U.S. Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 26: U.S. Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 27: U.S. Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 28: U.S. Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 29: Canada Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 30: Canada Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 31: Canada Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 32: Canada Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 33: Canada Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 34: Canada Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 35: Canada Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 36: Canada Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 37: Europe Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 38: Europe Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 39: Europe Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 40: Europe Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 41: Europe Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 42: Europe Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 43: Europe Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 44: Europe Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 45: Europe Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 46: Europe Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 47: Germany Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 48: Germany Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 49: Germany Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 50: Germany Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 51: Germany Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 52: Germany Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 53: Germany Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 54: Germany Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 55: U.K Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 56: U.K Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 57: U.K Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 58: U.K Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 59: U.K Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 60: U.K Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 61: U.K Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 62: U.K Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 63: France Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 64: France Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 65: France Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 66: France Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 67: France Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 68: France Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 69: France Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 70: France Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 71: Italy Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 72: Italy Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 73: Italy Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 74: Italy Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 75: Italy Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 76: Italy Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 77: Italy Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 78: Italy Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 79: Spain Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 80: Spain Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 81: Spain Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 82: Spain Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 83: Spain Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 84: Spain Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 85: Spain Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 86: Spain Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 87: Switzerland Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 88: Switzerland Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 89: Switzerland Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 90: Switzerland Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 91: Switzerland Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 92: Switzerland Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 93: Switzerland Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 94: Switzerland Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 95: The Netherlands Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 96: The Netherlands Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 97: The Netherlands Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 98: The Netherlands Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 99: The Netherlands Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 100: The Netherlands Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 101: The Netherlands Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 102: The Netherlands Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 103: Rest of Europe Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 104: Rest of Europe Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 105: Rest of Europe Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 106: Rest of Europe Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 107: Rest of Europe Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 108: Rest of Europe Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 109: Rest of Europe Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 110: Rest of Europe Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 111: Asia Pacific Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 112: Asia Pacific Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 113: Asia Pacific Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 114: Asia Pacific Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 115: Asia Pacific Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 116: Asia Pacific Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 117: Asia Pacific Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 118: Asia Pacific Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 119: Asia Pacific Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 120: Asia Pacific Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 121: China Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 122: China Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 123: China Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 124: China Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 125: China Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 126: China Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 127: China Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 128: China Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 129: India Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 130: India Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 131: India Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 132: India Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 133: India Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 134: India Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 135: India Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 136: India Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 137: Japan Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 138: Japan Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 139: Japan Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 140: Japan Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 141: Japan Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 142: Japan Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 143: Japan Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 144: Japan Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 145: South Korea Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 146: South Korea Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 147: South Korea Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 148: South Korea Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 149: South Korea Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 150: South Korea Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 151: South Korea Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 152: South Korea Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 153: Australia and New Zealand Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 154: Australia and New Zealand Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 155: Australia and New Zealand Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 156: Australia and New Zealand Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 157: Australia and New Zealand Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 158: Australia and New Zealand Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 159: Australia and New Zealand Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 160: Australia and New Zealand Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 161: Rest of Asia Pacific Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 162: Rest of Asia Pacific Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 163: Rest of Asia Pacific Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 164: Rest of Asia Pacific Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 165: Rest of Asia Pacific Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 166: Rest of Asia Pacific Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 167: Rest of Asia Pacific Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 168: Rest of Asia Pacific Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 169: Latin America Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 170: Latin America Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 171: Latin America Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 172: Latin America Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 173: Latin America Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 174: Latin America Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 175: Latin America Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 176: Latin America Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 177: Latin America Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 178: Latin America Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 179: Brazil Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 180: Brazil Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 181: Brazil Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 182: Brazil Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 183: Brazil Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 184: Brazil Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 185: Brazil Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 186: Brazil Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 187: Mexico Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 188: Mexico Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 189: Mexico Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 190: Mexico Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 191: Mexico Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 192: Mexico Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 193: Mexico Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 194: Mexico Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 195: Argentina Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 196: Argentina Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 197: Argentina Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 198: Argentina Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 199: Argentina Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 200: Argentina Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 201: Argentina Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 202: Argentina Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 203: Rest of Latin America Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 204: Rest of Latin America Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 205: Rest of Latin America Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 206: Rest of Latin America Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 207: Rest of Latin America Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 208: Rest of Latin America Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 209: Rest of Latin America Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 210: Rest of Latin America Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 211: Middle East and Africa Market Value (US$ Mn) Forecast, by Country/Sub-region, 2020 to 2035

Table 212: Middle East and Africa Market Volume (Units) Forecast, by Country/Sub-region, 2020 to 2035

Table 213: Middle East and Africa Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 214: Middle East and Africa Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 215: Middle East and Africa Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 216: Middle East and Africa Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 217: Middle East and Africa Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 218: Middle East and Africa Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 219: Middle East and Africa Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 220: Middle East and Africa Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 221: GCC Countries Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 222: GCC Countries Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 223: GCC Countries Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 224: GCC Countries Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 225: GCC Countries Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 226: GCC Countries Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 227: GCC Countries Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 228: GCC Countries Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 229: South Africa Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 230: South Africa Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 231: South Africa Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 232: South Africa Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 233: South Africa Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 234: South Africa Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 235: South Africa Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 236: South Africa Market Volume (Units) Forecast, by End-user, 2020 to 2035

Table 237: Rest of Middle East and Africa Market Value (US$ Mn) Forecast, by Robot Type, 2020 to 2035

Table 238: Rest of Middle East and Africa Market Volume (Units) Forecast, by Robot Type, 2020 to 2035

Table 239: Rest of Middle East and Africa Market Value (US$ Mn) Forecast, by Component, 2020 to 2035

Table 240: Rest of Middle East and Africa Market Volume (Units) Forecast, by Component, 2020 to 2035

Table 241: Rest of Middle East and Africa Market Value (US$ Mn) Forecast, by Function, 2020 to 2035

Table 242: Rest of Middle East and Africa Market Volume (Units) Forecast, by Function, 2020 to 2035

Table 243: Rest of Middle East and Africa Market Value (US$ Mn) Forecast, by End-user, 2020 to 2035

Table 244: Rest of Middle East and Africa Market Volume (Units) Forecast, by End-user, 2020 to 2035

Figure 01: Global Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 02: Global Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 03: Global Market Revenue (US$ Mn), by Articulated Robots, 2025 to 2035

Figure 04: Global Market Revenue (US$ Mn), by Cartesian Robots, 2025 to 2035

Figure 05: Global Market Revenue (US$ Mn), by SCARA Robots, 2025 to 2035

Figure 06: Global Market Revenue (US$ Mn), by Cylindrical Robots, 2025 to 2035

Figure 07: Global Market Revenue (US$ Mn), by Autonomous Robots, 2025 to 2035

Figure 08: Global Market Revenue (US$ Mn), by Delta Robots, 2025 to 2035

Figure 09: Global Market Revenue (US$ Mn), by Others, 2025 to 2035

Figure 10: Global Market Value Share Analysis, by Component, 2024 and 2035

Figure 11: Global Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 12: Global Market Revenue (US$ Mn), by Robot Arm, 2025 to 2035

Figure 13: Global Market Revenue (US$ Mn), by Sensors, 2025 to 2035

Figure 14: Global Market Revenue (US$ Mn), by Controller, 2025 to 2035

Figure 15: Global Market Revenue (US$ Mn), by End effector, 2025 to 2035

Figure 16: Global Market Revenue (US$ Mn), by Drive, 2025 to 2035

Figure 17: Global Market Revenue (US$ Mn), by Power Management, 2025 to 2035

Figure 18: Global Market Revenue (US$ Mn), by Software & Programming, 2025 to 2035

Figure 19: Global Market Value Share Analysis, by Function, 2024 and 2035

Figure 20: Global Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 21: Global Market Revenue (US$ Mn), by Soldering and Welding, 2025 to 2035

Figure 22: Global Market Revenue (US$ Mn), by Materials Handling, 2025 to 2035

Figure 23: Global Market Revenue (US$ Mn), by Assembling and Disassembling, 2025 to 2035

Figure 24: Global Market Revenue (US$ Mn), by Painting and Dispensing, 2025 to 2035

Figure 25: Global Market Revenue (US$ Mn), by Milling, Cutting and Processing, 2025 to 2035

Figure 26: Global Market Revenue (US$ Mn), by Others, 2025 to 2035

Figure 27: Global Market Value Share Analysis, by End-user, 2024 and 2035

Figure 28: Global Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 29: Global Market Revenue (US$ Mn), by Automotive, 2025 to 2035

Figure 30: Global Market Revenue (US$ Mn), by Electrical & Electronics, 2025 to 2035

Figure 31: Global Market Revenue (US$ Mn), by Metals and Mining, 2025 to 2035

Figure 32: Global Market Revenue (US$ Mn), by Retail & E-commerce, 2025 to 2035

Figure 33: Global Market Revenue (US$ Mn), by Manufacturing, 2025 to 2035

Figure 34: Global Market Revenue (US$ Mn), by Others, 2025 to 2035

Figure 35: Global Market Value Share Analysis, by Region, 2024 and 2035

Figure 36: Global Market Attractiveness Analysis, by Region, 2025 to 2035

Figure 37: North America Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 38: North America Market Value Share Analysis, by Country, 2024 and 2035

Figure 39: North America Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 40: North America Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 41: North America Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 42: North America Market Value Share Analysis, by Component, 2024 and 2035

Figure 43: North America Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 44: North America Market Value Share Analysis, by Function, 2024 and 2035

Figure 45: North America Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 46: North America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 47: North America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 48: U.S. Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 49: U.S. Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 50: U.S. Market Value Share Analysis, by Component, 2024 and 2035

Figure 51: U.S. Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 52: U.S. Market Value Share Analysis, by Function, 2024 and 2035

Figure 53: U.S. Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 54: U.S. Market Value Share Analysis, by End-user, 2024 and 2035

Figure 55: U.S. Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 56: Canada Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 57: Canada Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 58: Canada Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 59: Canada Market Value Share Analysis, by Component, 2024 and 2035

Figure 60: Canada Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 61: Canada Market Value Share Analysis, by Function, 2024 and 2035

Figure 62: Canada Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 63: Canada Market Value Share Analysis, by End-user, 2024 and 2035

Figure 64: Canada Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 65: Europe Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 66: Europe Market Value Share Analysis, by Country, 2024 and 2035

Figure 67: Europe Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 68: Europe Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 69: Europe Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 70: Europe Market Value Share Analysis, by Component, 2024 and 2035

Figure 71: Europe Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 72: Europe Market Value Share Analysis, by Function, 2024 and 2035

Figure 73: Europe Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 74: Europe Market Value Share Analysis, by End-user, 2024 and 2035

Figure 75: Europe Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 76: Germany Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 77: Germany Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 78: Germany Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 79: Germany Market Value Share Analysis, by Component, 2024 and 2035

Figure 80: Germany Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 81: Germany Market Value Share Analysis, by Function, 2024 and 2035

Figure 82: Germany Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 83: Germany Market Value Share Analysis, by End-user, 2024 and 2035

Figure 84: Germany Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 85: U.K Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 86: U.K Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 87: U.K Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 88: U.K Market Value Share Analysis, by Component, 2024 and 2035

Figure 89: U.K Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 90: U.K Market Value Share Analysis, by Function, 2024 and 2035

Figure 91: U.K Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 92: U.K Market Value Share Analysis, by End-user, 2024 and 2035

Figure 93: U.K Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 94: France Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 95: France Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 96: France Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 97: France Market Value Share Analysis, by Component, 2024 and 2035

Figure 98: France Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 99: France Market Value Share Analysis, by Function, 2024 and 2035

Figure 100: France Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 101: France Market Value Share Analysis, by End-user, 2024 and 2035

Figure 102: France Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 103: Italy Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 104: Italy Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 105: Italy Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 106: Italy Market Value Share Analysis, by Component, 2024 and 2035

Figure 107: Italy Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 108: Italy Market Value Share Analysis, by Function, 2024 and 2035

Figure 109: Italy Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 110: Italy Market Value Share Analysis, by End-user, 2024 and 2035

Figure 111: Italy Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 112: Spain Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 113: Spain Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 114: Spain Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 115: Spain Market Value Share Analysis, by Component, 2024 and 2035

Figure 116: Spain Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 117: Spain Market Value Share Analysis, by Function, 2024 and 2035

Figure 118: Spain Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 119: Spain Market Value Share Analysis, by End-user, 2024 and 2035

Figure 120: Spain Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 121: Switzerland Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 122: Switzerland Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 123: Switzerland Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 124: Switzerland Market Value Share Analysis, by Component, 2024 and 2035

Figure 125: Switzerland Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 126: Switzerland Market Value Share Analysis, by Function, 2024 and 2035

Figure 127: Switzerland Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 128: Switzerland Market Value Share Analysis, by End-user, 2024 and 2035

Figure 129: Switzerland Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 130: The Netherlands Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 131: The Netherlands Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 132: The Netherlands Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 133: The Netherlands Market Value Share Analysis, by Component, 2024 and 2035

Figure 134: The Netherlands Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 135: The Netherlands Market Value Share Analysis, by Function, 2024 and 2035

Figure 136: The Netherlands Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 137: The Netherlands Market Value Share Analysis, by End-user, 2024 and 2035

Figure 138: The Netherlands Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 139: Rest of Europe Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 140: Rest of Europe Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 141: Rest of Europe Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 142: Rest of Europe Market Value Share Analysis, by Component, 2024 and 2035

Figure 143: Rest of Europe Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 144: Rest of Europe Market Value Share Analysis, by Function, 2024 and 2035

Figure 145: Rest of Europe Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 146: Rest of Europe Market Value Share Analysis, by End-user, 2024 and 2035

Figure 147: Rest of Europe Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 148: Asia Pacific Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 149: Asia Pacific Market Value Share Analysis, by Country, 2024 and 2035

Figure 150: Asia Pacific Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 151: Asia Pacific Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 152: Asia Pacific Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 153: Asia Pacific Market Value Share Analysis, by Component, 2024 and 2035

Figure 154: Asia Pacific Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 155: Asia Pacific Market Value Share Analysis, by Function, 2024 and 2035

Figure 156: Asia Pacific Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 157: Asia Pacific Market Value Share Analysis, by End-user, 2024 and 2035

Figure 158: Asia Pacific Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 159: China Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 160: China Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 161: China Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 162: China Market Value Share Analysis, by Component, 2024 and 2035

Figure 163: China Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 164: China Market Value Share Analysis, by Function, 2024 and 2035

Figure 165: China Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 166: China Market Value Share Analysis, by End-user, 2024 and 2035

Figure 167: China Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 168: India Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 169: India Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 170: India Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 171: India Market Value Share Analysis, by Component, 2024 and 2035

Figure 172: India Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 173: India Market Value Share Analysis, by Function, 2024 and 2035

Figure 174: India Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 175: India Market Value Share Analysis, by End-user, 2024 and 2035

Figure 176: India Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 177: Japan Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 178: Japan Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 179: Japan Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 180: Japan Market Value Share Analysis, by Component, 2024 and 2035

Figure 181: Japan Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 182: Japan Market Value Share Analysis, by Function, 2024 and 2035

Figure 183: Japan Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 184: Japan Market Value Share Analysis, by End-user, 2024 and 2035

Figure 185: Japan Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 186: South Korea Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 187: South Korea Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 188: South Korea Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 189: South Korea Market Value Share Analysis, by Component, 2024 and 2035

Figure 190: South Korea Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 191: South Korea Market Value Share Analysis, by Function, 2024 and 2035

Figure 192: South Korea Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 193: South Korea Market Value Share Analysis, by End-user, 2024 and 2035

Figure 194: South Korea Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 195: Australia & New Zealand Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 196: Australia & New Zealand Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 197: Australia & New Zealand Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 198: Australia & New Zealand Market Value Share Analysis, by Component, 2024 and 2035

Figure 199: Australia & New Zealand Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 200: Australia & New Zealand Market Value Share Analysis, by Function, 2024 and 2035

Figure 201: Australia & New Zealand Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 202: Australia & New Zealand Market Value Share Analysis, by End-user, 2024 and 2035

Figure 203: Australia & New Zealand Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 204: Rest of Asia Pacific Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 205: Rest of Asia Pacific Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 206: Rest of Asia Pacific Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 207: Rest of Asia Pacific Market Value Share Analysis, by Component, 2024 and 2035

Figure 208: Rest of Asia Pacific Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 209: Rest of Asia Pacific Market Value Share Analysis, by Function, 2024 and 2035

Figure 210: Rest of Asia Pacific Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 211: Rest of Asia Pacific Market Value Share Analysis, by End-user, 2024 and 2035

Figure 212: Rest of Asia Pacific Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 213: Latin America Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 214: Latin America Market Value Share Analysis, by Country, 2024 and 2035

Figure 215: Latin America Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 216: Latin America Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 217: Latin America Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 218: Latin America Market Value Share Analysis, by Component, 2024 and 2035

Figure 219: Latin America Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 220: Latin America Market Value Share Analysis, by Function, 2024 and 2035

Figure 221: Latin America Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 222: Latin America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 223: Latin America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 224: Brazil Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 225: Brazil Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 226: Brazil Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 227: Brazil Market Value Share Analysis, by Component, 2024 and 2035

Figure 228: Brazil Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 229: Brazil Market Value Share Analysis, by Function, 2024 and 2035

Figure 230: Brazil Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 231: Brazil Market Value Share Analysis, by End-user, 2024 and 2035

Figure 232: Brazil Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 233: Mexico Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 234: Mexico Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 235: Mexico Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 236: Mexico Market Value Share Analysis, by Component, 2024 and 2035

Figure 237: Mexico Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 238: Mexico Market Value Share Analysis, by Function, 2024 and 2035

Figure 239: Mexico Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 240: Mexico Market Value Share Analysis, by End-user, 2024 and 2035

Figure 241: Mexico Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 242: Argentina Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 243: Argentina Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 244: Argentina Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 245: Argentina Market Value Share Analysis, by Component, 2024 and 2035

Figure 246: Argentina Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 247: Argentina Market Value Share Analysis, by Function, 2024 and 2035

Figure 248: Argentina Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 249: Argentina Market Value Share Analysis, by End-user, 2024 and 2035

Figure 250: Argentina Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 251: Rest of Latin America Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 252: Rest of Latin America Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 253: Rest of Latin America Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 254: Rest of Latin America Market Value Share Analysis, by Component, 2024 and 2035

Figure 255: Rest of Latin America Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 256: Rest of Latin America Market Value Share Analysis, by Function, 2024 and 2035

Figure 257: Rest of Latin America Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 258: Rest of Latin America Market Value Share Analysis, by End-user, 2024 and 2035

Figure 259: Rest of Latin America Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 260: Middle East and Africa Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 261: Middle East and Africa Market Value Share Analysis, by Country, 2024 and 2035

Figure 262: Middle East and Africa Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 263: Middle East and Africa Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 264: Middle East and Africa Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 265: Middle East and Africa Market Value Share Analysis, by Component, 2024 and 2035

Figure 266: Middle East and Africa Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 267: Middle East and Africa Market Value Share Analysis, by Function, 2024 and 2035

Figure 268: Middle East and Africa Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 269: Middle East and Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 270: Middle East and Africa Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 271: GCC Countries Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 272: GCC Countries Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 273: GCC Countries Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 274: GCC Countries Market Value Share Analysis, by Component, 2024 and 2035

Figure 275: GCC Countries Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 276: GCC Countries Market Value Share Analysis, by Function, 2024 and 2035

Figure 277: GCC Countries Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 278: GCC Countries Market Value Share Analysis, by End-user, 2024 and 2035

Figure 279: GCC Countries Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 280: South Africa Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 281: South Africa Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 282: South Africa Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 283: South Africa Market Value Share Analysis, by Component, 2024 and 2035

Figure 284: South Africa Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 285: South Africa Market Value Share Analysis, by Function, 2024 and 2035

Figure 286: South Africa Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 287: South Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 288: South Africa Market Attractiveness Analysis, by End-user, 2025 to 2035

Figure 289: Rest of Middle East and Africa Market Value (US$ Mn) Forecast, 2020 to 2035

Figure 290: Rest of Middle East and Africa Market Value Share Analysis, by Robot Type, 2024 and 2035

Figure 291: Rest of Middle East and Africa Market Attractiveness Analysis, by Robot Type, 2025 to 2035

Figure 292: Rest of Middle East and Africa Market Value Share Analysis, by Component, 2024 and 2035

Figure 293: Rest of Middle East and Africa Market Attractiveness Analysis, by Component, 2025 to 2035

Figure 294: Rest of Middle East and Africa Market Value Share Analysis, by Function, 2024 and 2035

Figure 295: Rest of Middle East and Africa Market Attractiveness Analysis, by Function, 2025 to 2035

Figure 296: Rest of Middle East and Africa Market Value Share Analysis, by End-user, 2024 and 2035

Figure 297: Rest of Middle East and Africa Market Attractiveness Analysis, by End-user, 2025 to 2035