Reports

Reports

Analysts’ Viewpoint on Market Scenario

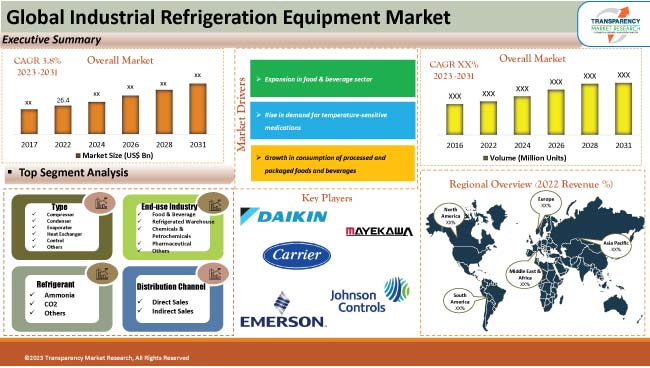

The global industrial refrigeration equipment market size is anticipated to grow at a significant pace during the forecast period due to rise in focus on reducing the deterioration of fully and semi-processed food and beverages. Surge in the consumption of packaged and processed food and beverages in emerging countries is also boosting market expansion.

Growth in the food & beverage sector and increase in demand for safe storage of blood and temperature-controlled medicines are offering lucrative opportunities for vendors in the industry. Rise in the consumption of meat & seafood and fruits & vegetables is prompting cold chain facility providers to adopt modern technologies, automation, and, enhanced infrastructure for the storage and transport of such products.

Industrial refrigeration equipment is used to maintain low temperatures in large-scale commercial and industrial facilities. This type of equipment is essential for industries such as food processing, pharmaceuticals, and chemical manufacturing.

Industrial refrigeration systems are typically designed and customized for specific applications, depending on factors such as the required cooling capacity, the product being cooled, and the facility's layout. They can range in size from small units used in laboratories to large-scale systems used in food processing plants or cold storage warehouses.

The global food & beverage sector is witnessing a rapid rise in demand for frozen and processed food products. This can be ascribed to increase in preference for ready-to-cook and ready-to-eat food products. Growth in disposable income and rise in the number of working professionals are also boosting the demand for processed and packaged food products. These trends are likely to positively impact the industrial refrigeration equipment market growth in the near future.

Expansion in the food & beverage sector, particularly in developing economies, is augmenting the demand for industrial refrigeration equipment. Food & beverage processing is one of the biggest industries worldwide. In developed countries, such as the U.S., 90% of the food that is produced is processed. Demand for processed and convenience food & beverage products is high in the country due to changing and busy consumer lifestyles.

The food processing sector in developing countries, such as India, is expanding at a rapid pace. The sector in India is placed sixth, globally, in terms of production, consumption, and exports. Industrial refrigeration systems are necessary to maintain the freshness and safety of processed food items. Thus, rise in consumption of processed food worldwide is boosting the industrial refrigeration equipment market value.

Various healthcare settings, including hospitals, pharmacies, clinics, and diagnostic facilities, require secure storage of blood, blood derivatives, and temperature-sensitive medications. Modern, more advanced, and energy-efficient cold storage systems are replacing older medical refrigerators as a result of increase in R&D activities in the treatment and management of infectious and chronic diseases. This, in turn, is propelling the industrial refrigeration equipment market progress.

Chemical, petrochemical, and pharmaceutical sectors are likely to witness high demand for industrial refrigeration equipment in the next few years. Emergence of the COVID-19 pandemic has led to rise in the need for immunizations to stop the spread of the virus. High-level cooling systems are needed to store and ship immunizations around the world. Therefore, increase in demand for COVID-19 vaccination is fueling market dynamics.

According to the latest industrial refrigeration equipment market forecast, North America is expected to hold largest share from 2023 to 2031. Expansion in the e-commerce sector and rise in preference for online grocery shopping are boosting market statistics in the region.

The industry in Asia Pacific is anticipated to grow at the highest rate in the near future. Surge in the number of cold chain storage facilities in countries, such as Japan, India, and China, is driving the market revenue in the region. China and India are major exporters of crops and other food and beverage products worldwide. Major governments in Asia Pacific are supporting expansion in cold storage management through various programs.

Presence of top food & beverage companies and expansion in the hospitality sector, particularly in France and Germany, are augmenting the market trajectory in Europe. These companies are investing heavily in industrial refrigeration equipment that help maintain the quality and freshness of frozen foods. Major restaurants in the region are also relying on these equipment to preserve enormous quantities of food products. The industry in Middle East & Africa is driven by growth in the tourism sector in Saudi Arabia and the United Arab Emirates.

The industrial refrigeration equipment market research report profiles major vendors based on various parameters including financials, key product offerings, market development, and strategies. Carrier, Daikin Industries, Ltd., Danfoss Group, Emerson Electric Co., EVAPCO, Inc., GEA Group AG, Johnson Controls, Ingersoll Rand, LU-VE Group, and Mayekawa Mfg. Co., Ltd. are key entities operating in this industry.

Manufacturers are partnering with suppliers, distributors, or other industry players to leverage each other's strengths and capabilities and increase their industrial refrigeration equipment market share. They are also providing excellent after-sales support, including maintenance services, repairs, and technical assistance.

|

Attribute |

Detail |

|

Market Size Value in 2022 (Base Year) |

US$ 26.4 Bn |

|

Market Forecast in 2031 |

US$ 36.8 Bn |

|

Growth Rate (CAGR) |

3.8% |

|

Forecast Period |

2023-2031 |

|

Quantitative Units |

US$ Bn for Value and Million Units for Volume |

|

Market Analysis |

Global qualitative analysis includes drivers, restraints, opportunities, upcoming key trends, Porter’s Five Forces analysis, value chain analysis, SWOT analysis, technology analysis, regulatory analysis, etc. Furthermore, at the regional level, qualitative analysis includes key trends, price trends, and key supplier analysis, demographic overview. |

|

Competition Landscape |

|

|

Regions Covered |

|

|

Market Segmentation |

|

|

Companies Profiled |

|

|

Customization Scope |

Available upon Request |

|

Pricing |

Available upon Request |

The global market was valued at US$ 26.4 Bn in 2022.

It is estimated to reach US$ 36.8 Bn by the end of 2031.

It is estimated to be 3.8% from 2023 to 2031.

Expansion in food & beverage sector and rise in demand for temperature-sensitive medications.

The compressor type segment accounted for largest share in 2022.

North America is likely to be a highly lucrative region for vendors during the forecast period.

Carrier, Daikin Industries, Ltd., Danfoss Group, Emerson Electric Co., EVAPCO, Inc., GEA Group AG, Johnson Controls, Ingersoll Rand, LU-VE Group, and Mayekawa Mfg. Co., Ltd.

1. Preface

1.1. Market Definition and Scope

1.2. Market Segmentation

1.3. Key Research Objectives

1.4. Research Highlights

2. Assumptions

3. Research Methodology

4. Executive Summary

5. Market Overview

5.1. Introduction

5.2. Market Dynamics

5.2.1. Drivers

5.2.2. Restraints

5.2.3. Opportunities

5.3. Key Trends Analysis

5.3.1. Demand Side Analysis

5.3.2. Supply Side Analysis

5.4. Key Market Indicators

5.5. Porter’s Five Forces Analysis

5.6. Industry SWOT Analysis

5.7. Value Chain Analysis

5.8. Technological Overview

5.9. Regulatory Framework Analysis

5.10. Global Industrial Refrigeration Equipment Market Analysis and Forecast, 2017 - 2031

5.10.1. Market Value Projection (US$ Bn)

5.10.2. Market Volume Projections (Million Units)

6. Global Industrial Refrigeration Equipment Market Analysis and Forecast, by Type

6.1. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

6.1.1. Condenser

6.1.2. Compressor

6.1.3. Evaporator

6.1.4. Heat Exchanger

6.1.5. Control

6.1.6. Others

6.2. Incremental Opportunity, by Type

7. Global Industrial Refrigeration Equipment Market Analysis and Forecast, by Refrigerant

7.1. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

7.1.1. Ammonia

7.1.2. CO2

7.1.3. Others

7.2. Incremental Opportunity, by Refrigerant

8. Global Industrial Refrigeration Equipment Market Analysis and Forecast, by End-use Industry

8.1. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

8.1.1. Food & Beverage

8.1.2. Refrigerated Warehouse

8.1.3. Chemical & Petrochemicals

8.1.4. Pharmaceutical

8.1.5. Others

8.2. Incremental Opportunity, by End-use Industry

9. Global Industrial Refrigeration Equipment Market Analysis and Forecast, by Distribution Channel

9.1. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

9.1.1. Direct Sales

9.1.2. Indirect Sales

9.2. Incremental Opportunity, by Distribution Channel

10. Global Industrial Refrigeration Equipment Market Analysis and Forecast, by Region

10.1. Overview

10.2. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Region, 2017 - 2031

10.2.1. North America

10.2.2. Europe

10.2.3. Asia Pacific

10.2.4. Middle East & Africa

10.2.5. South America

10.3. Incremental Opportunity, by Region

11. North America Industrial Refrigeration Equipment Market Analysis and Forecast

11.1. Regional Snapshot

11.2. Macroeconomic Factors

11.3. Key Supplier Analysis

11.4. Price Trend Analysis

11.4.1. Weighted Average Price

11.5. Key Trends Analysis

11.5.1. Demand Side Analysis

11.5.2. Supply Side Analysis

11.6. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

11.6.1. Condenser

11.6.2. Compressor

11.6.3. Evaporator

11.6.4. Heat Exchanger

11.6.5. Control

11.6.6. Others

11.7. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

11.7.1. Ammonia

11.7.2. CO2

11.7.3. Others

11.8. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

11.8.1. Food & Beverage

11.8.2. Refrigerated Warehouse

11.8.3. Chemical & Petrochemicals

11.8.4. Pharmaceutical

11.8.5. Others

11.9. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

11.9.1. Direct Sales

11.9.2. Indirect Sales

11.10. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Country, 2017 - 2031

11.10.1. U.S.

11.10.2. Canada

11.10.3. Rest of North America

11.11. Incremental Opportunity Analysis

12. Europe Industrial Refrigeration Equipment Market Analysis and Forecast

12.1. Regional Snapshot

12.2. Macroeconomic Factors

12.3. Key Supplier Analysis

12.4. Price Trend Analysis

12.4.1. Weighted Average Price

12.5. Key Trends Analysis

12.5.1. Demand Side Analysis

12.5.2. Supply Side Analysis

12.6. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

12.6.1. Condenser

12.6.2. Compressor

12.6.3. Evaporator

12.6.4. Heat Exchanger

12.6.5. Control

12.6.6. Others

12.7. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

12.7.1. Ammonia

12.7.2. CO2

12.7.3. Others

12.8. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

12.8.1. Food & Beverage

12.8.2. Refrigerated Warehouse

12.8.3. Chemical & Petrochemicals

12.8.4. Pharmaceutical

12.8.5. Others

12.9. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

12.9.1. Direct Sales

12.9.2. Indirect Sales

12.10. Industrial Refrigeration Equipment Market Size (US$ Bn) () Forecast, by Country, 2017 - 2031

12.10.1. U.K.

12.10.2. Germany

12.10.3. France

12.10.4. Rest of Europe

12.11. Incremental Opportunity Analysis

13. Asia Pacific Industrial Refrigeration Equipment Market Analysis and Forecast

13.1. Regional Snapshot

13.2. Macroeconomic Factors

13.3. Key Supplier Analysis

13.4. Price Trend Analysis

13.4.1. Weighted Average Price

13.5. Key Trends Analysis

13.5.1. Demand Side Analysis

13.5.2. Supply Side Analysis

13.6. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

13.6.1. Condenser

13.6.2. Compressor

13.6.3. Evaporator

13.6.4. Heat Exchanger

13.6.5. Control

13.6.6. Others

13.7. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

13.7.1. Ammonia

13.7.2. CO2

13.7.3. Others

13.8. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

13.8.1. Food & Beverage

13.8.2. Refrigerated Warehouse

13.8.3. Chemical & Petrochemicals

13.8.4. Pharmaceutical

13.8.5. Others

13.9. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

13.9.1. Direct Sales

13.9.2. Indirect Sales

13.10. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Country, 2017 - 2031

13.10.1. China

13.10.2. India

13.10.3. Japan

13.10.4. Rest of Asia Pacific

13.11. Incremental Opportunity Analysis

14. Middle East & Africa Industrial Refrigeration Equipment Market Analysis and Forecast

14.1. Regional Snapshot

14.2. Macroeconomic Factors

14.3. Key Supplier Analysis

14.4. Price Trend Analysis

14.4.1. Weighted Average Price

14.5. Key Trends Analysis

14.5.1. Demand Side Analysis

14.5.2. Supply Side Analysis

14.6. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

14.6.1. Condenser

14.6.2. Compressor

14.6.3. Evaporator

14.6.4. Heat Exchanger

14.6.5. Control

14.6.6. Others

14.7. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

14.7.1. Ammonia

14.7.2. CO2

14.7.3. Others

14.8. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

14.8.1. Food & Beverage

14.8.2. Refrigerated Warehouse

14.8.3. Chemical & Petrochemicals

14.8.4. Pharmaceutical

14.8.5. Others

14.9. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

14.9.1. Direct Sales

14.9.2. Indirect Sales

14.10. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Country, 2017 - 2031

14.10.1. GCC

14.10.2. South Africa

14.10.3. Rest of Middle East & Africa

14.11. Incremental Opportunity Analysis

15. South America Industrial Refrigeration Equipment Market Analysis and Forecast

15.1. Regional Snapshot

15.2. Macroeconomic Factors

15.3. Key Supplier Analysis

15.4. Price Trend Analysis

15.4.1. Weighted Average Price

15.5. Key Trends Analysis

15.5.1. Demand Side Analysis

15.5.2. Supply Side Analysis

15.6. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Type, 2017 - 2031

15.6.1. Condenser

15.6.2. Compressor

15.6.3. Evaporator

15.6.4. Heat Exchanger

15.6.5. Control

15.6.6. Others

15.7. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Refrigerant, 2017 - 2031

15.7.1. Ammonia

15.7.2. CO2

15.7.3. Others

15.8. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by End-use Industry, 2017 - 2031

15.8.1. Food & Beverage

15.8.2. Refrigerated Warehouse

15.8.3. Chemical & Petrochemicals

15.8.4. Pharmaceutical

15.8.5. Others

15.9. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Distribution Channel, 2017 - 2031

15.9.1. Direct Sales

15.9.2. Indirect Sales

15.10. Industrial Refrigeration Equipment Market Size (US$ Mn and Million Units) Forecast, by Country, 2017 - 2031

15.10.1. Brazil

15.10.2. Rest of South America

15.11. Incremental Opportunity Analysis

16. Competition Landscape

16.1. Market Player – Competition Dashboard

16.2. Market Share Analysis (%)-2022

16.3. Company Profiles (Details – Company Overview, Sales Area/Geographical Presence, Revenue, Strategy & Business Overview, Go-To-Market Strategy)

16.3.1. Carrier

16.3.1.1. Company Overview,

16.3.1.2. Sales Area/Geographical Presence

16.3.1.3. Revenue

16.3.1.4. Strategy & Business Overview

16.3.1.5. Go-To-Market Strategy

16.3.2. Danfoss Group

16.3.2.1. Company Overview,

16.3.2.2. Sales Area/Geographical Presence

16.3.2.3. Revenue

16.3.2.4. Strategy & Business Overview

16.3.2.5. Go-To-Market Strategy

16.3.3. Emerson Electric Co.

16.3.3.1. Company Overview,

16.3.3.2. Sales Area/Geographical Presence

16.3.3.3. Revenue

16.3.3.4. Strategy & Business Overview

16.3.3.5. Go-To-Market Strategy

16.3.4. GEA Group AG

16.3.4.1. Company Overview,

16.3.4.2. Sales Area/Geographical Presence

16.3.4.3. Revenue

16.3.4.4. Strategy & Business Overview

16.3.4.5. Go-To-Market Strategy

16.3.5. Daikin Industries, Ltd.

16.3.5.1. Company Overview,

16.3.5.2. Sales Area/Geographical Presence

16.3.5.3. Revenue

16.3.5.4. Strategy & Business Overview

16.3.5.5. Go-To-Market Strategy

16.3.6. EVAPCO, Inc.

16.3.6.1. Company Overview,

16.3.6.2. Sales Area/Geographical Presence

16.3.6.3. Revenue

16.3.6.4. Strategy & Business Overview

16.3.6.5. Go-To-Market Strategy

16.3.7. Johnson Control

16.3.7.1. Company Overview,

16.3.7.2. Sales Area/Geographical Presence

16.3.7.3. Revenue

16.3.7.4. Strategy & Business Overview

16.3.7.5. Go-To-Market Strategy

16.3.8. Ingersoll Rand

16.3.8.1. Company Overview,

16.3.8.2. Sales Area/Geographical Presence

16.3.8.3. Revenue

16.3.8.4. Strategy & Business Overview

16.3.8.5. Go-To-Market Strategy

16.3.9. LU-VE Group

16.3.9.1. Company Overview,

16.3.9.2. Sales Area/Geographical Presence

16.3.9.3. Revenue

16.3.9.4. Strategy & Business Overview

16.3.9.5. Go-To-Market Strategy

16.3.10. Mayekawa Mfg. Co., Ltd.

16.3.10.1. Company Overview,

16.3.10.2. Sales Area/Geographical Presence

16.3.10.3. Revenue

16.3.10.4. Strategy & Business Overview

16.3.10.5. Go-To-Market Strategy

17. Go To Market Strategy

17.1. Identification of Potential Market Spaces

17.1.1. Type

17.1.2. Refrigerant

17.1.3. End-use Industry

17.1.4. Distribution Channel

17.1.5. Region

17.2. Understanding the Buying Process of the Customers

17.2.1. Preferred Type

17.2.2. Preferred Mode of buying products

17.2.3. Preferred Pricing

17.2.4. Target Audience

17.3. Prevailing Market Risks

17.4. Preferred Sales & Marketing Strategy

List of Tables

Table 1: Global Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 2: Global Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 3: Global Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 4: Global Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 5: Global Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 6: Global Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 7: Global Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 8: Global Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 9: Global Industrial Refrigeration Equipment Market Projections, by Region, Million Units, 2017-2031

Table 10: Global Industrial Refrigeration Equipment Market Projections, by Region, US$ Mn 2017-2031

Table 11: North America Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 12: North America Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 13: North America Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 14: North America Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 15: North America Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 16: North America Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 17: North America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 18: North America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 19: North America Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Table 20: North America Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Table 21: Europe Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 22: Europe Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 23: Europe Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 24: Europe Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 25: Europe Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 26: Europe Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 27: Europe Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 28: Europe Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 29: Europe Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Table 30: Europe Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Table 31: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 32: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 33: Asia Pacific Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 34: Asia Pacific Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 35: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 36: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 37: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 38: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 39: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Table 40: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Table 41: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 42: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 43: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 44: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 45: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 46: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 47: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 48: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 49: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Table 50: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Table 51: South America Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Table 52: South America Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Table 53: South America Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Table 54: South America Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Table 55: South America Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Table 56: South America Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Table 57: South America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Table 58: South America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Table 59: South America Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Table 60: South America Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

List of Figures

Figure 1: Global Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 2: Global Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 3: Global Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 4: Global Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 5: Global Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 6: Global Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 7: Global Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 8: Global Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 9: Global Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 10: Global Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 11: Global Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 12: Global Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 13: Global Industrial Refrigeration Equipment Market Projections, by Region, Million Units, 2017-2031

Figure 14: Global Industrial Refrigeration Equipment Market Projections, by Region, US$ Mn 2017-2031

Figure 15: Global Industrial Refrigeration Equipment Market, Incremental Opportunity, by Region, US$ Mn 2023-2031

Figure 16: North America Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 17: North America Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 18: North America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 19: North America Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 20: North America Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 21: North America Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 22: North America Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 23: North America Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 24: North America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 25: North America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 26: North America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 27: North America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 28: North America Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Figure 29: North America Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Figure 30: North America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Country, US$ Mn 2023-2031

Figure 31: Europe Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 32: Europe Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 33: Europe Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 34: Europe Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 35: Europe Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 36: Europe Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 37: Europe Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 38: Europe Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 39: Europe Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 40: Europe Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 41: Europe Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 42: Europe Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 43: Europe Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Figure 44: Europe Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Figure 45: Europe Industrial Refrigeration Equipment Market, Incremental Opportunity, by Country, US$ Mn 2023-2031

Figure 46: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 47: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 48: Asia Pacific Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 49: Asia Pacific Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 50: Asia Pacific Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 51: Asia Pacific Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 52: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 53: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 54: Asia Pacific Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 55: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 56: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 57: Asia Pacific Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 58: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Figure 59: Asia Pacific Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Figure 60: Asia Pacific Industrial Refrigeration Equipment Market, Incremental Opportunity, by Country, US$ Mn 2023-2031

Figure 61: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 62: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 63: Middle East & Africa Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 64: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 65: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 66: Middle East & Africa Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 67: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 68: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 69: Middle East & Africa Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 70: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 71: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 72: Middle East & Africa Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 73: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Figure 74: Middle East & Africa Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Figure 75: Middle East & Africa Industrial Refrigeration Equipment Market, Incremental Opportunity, by Country, US$ Mn 2023-2031

Figure 76: South America Industrial Refrigeration Equipment Market Projections, by Type, Million Units, 2017-2031

Figure 77: South America Industrial Refrigeration Equipment Market Projections, by Type, US$ Mn 2017-2031

Figure 78: South America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Type, US$ Mn 2023-2031

Figure 79: South America Industrial Refrigeration Equipment Market Projections, by End-use Industry, Million Units, 2017-2031

Figure 80: South America Industrial Refrigeration Equipment Market Projections, by End-use Industry, US$ Mn 2017-2031

Figure 81: South America Industrial Refrigeration Equipment Market, Incremental Opportunity, by End-use Industry, US$ Mn 2023-2031

Figure 82: South America Industrial Refrigeration Equipment Market Projections, by Refrigerant, Million Units, 2017-2031

Figure 83: South America Industrial Refrigeration Equipment Market Projections, by Refrigerant, US$ Mn 2017-2031

Figure 84: South America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Refrigerant, US$ Mn 2023-2031

Figure 85: South America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, Million Units, 2017-2031

Figure 86: South America Industrial Refrigeration Equipment Market Projections, by Distribution Channel, US$ Mn 2017-2031

Figure 87: South America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Distribution Channel, US$ Mn 2023-2031

Figure 88: South America Industrial Refrigeration Equipment Market Projections, by Country, Million Units, 2017-2031

Figure 89: South America Industrial Refrigeration Equipment Market Projections, by Country, US$ Mn 2017-2031

Figure 90: South America Industrial Refrigeration Equipment Market, Incremental Opportunity, by Country, US$ Mn 2023-2031