Reports

Reports

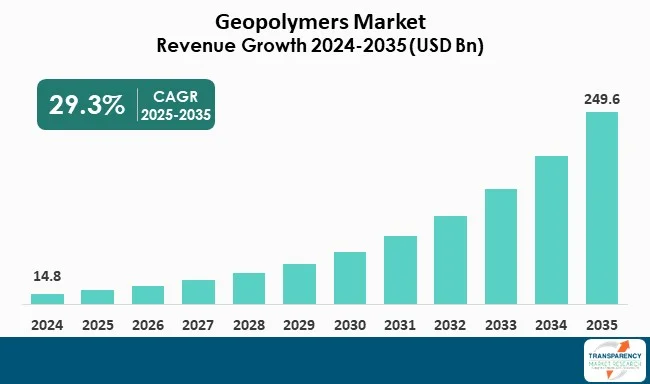

The global geopolymers market size was valued at US$ 14.8 Billion in 2024 and is projected to reach US$ 249.6 Billion by 2035, expanding at a CAGR of 29.3% from 2025 to 2035. The market growth is driven by rising demand for sustainable and low-carbon construction materials and growing government regulations promoting green and circular economies.

The geopolymer market is expected to maintain a staggering expansion, which is mainly influenced by sustainability requirements, tightening carbon regulations, and increasing demand for low-carbon construction materials Due to their thermal stability, chemical resistance, and ability of naturalizing industrial waste, geopolymers are gaining popularity in construction, coatings, refractory linings, and waste management.

By using vertical integration to handle the supply chains of alkalies, along with forming strategic alliances and conducting demonstration projects, companies are enabling the implementation process to be less difficult. In general, with continuous policy support and commercial scale-up by the main players, the use of geopolymers will not only be limited to niche heavy construction and specialized industrial applications but will be expanded to a wider range of sectors.

The geopolymer market revolves around inorganic polymers derived from the chemical activation of aluminosilicate materials such as slag, fly ash, or metakaolin using alkaline solutions. This process, known as geopolymerization, produces a cementitious binder with high durability, strength, and excellent resistance to chemicals and heat.

Geopolymers serve as an eco-friendly alternative to conventional Portland cement, visibly reducing CO₂ emissions. They are broadly used in construction of precast elements, concrete, and infrastructure repair, as well as in fireproof coatings, waste encapsulation, and refractory materials. Due to their superior mechanical and thermal properties, geopolymers are also gaining traction in aerospace, defense, and automotive applications, thereby supporting the transition toward high-performance and sustainable materials.

| Attribute | Detail |

|---|---|

| Geopolymers Market Drivers |

|

One of the main reasons the geopolymer market is expanding is the demand for low carbon and sustainable construction materials. Environmental concerns are at the top of the priority list in the industries across the globe, and they are consequently moving toward environmentally-friendly solutions.

The production of traditional Portland cement, which is responsible for a significant share of the total carbon emissions worldwide, is the main reason for the change of the construction and infrastructure sectors to greener alternatives. Geopolymers are acceptable substitutes as their carbon footprint is much less than that of conventional cement, as they are made from the industrial by-products of the power plant and metallurgical industries that is in fly ash, blast furnace slag, and metakaolin instead of conventional limestone.

Among the other things, geopolymers are technically very well equipped as they demonstrate a high compressive strength, are durable, resistant to chemicals, and have the ability to resist fire. Considering their wide application possibilities, one can think of them being applied as structural concrete and precast elements, protective coatings, and refractory linings. Their ability to withstand severe environmental conditions makes them ideal for sustainable infrastructure projects and construction solutions that have a long service life.

Besides, the adoption of geopolymers is heavily influenced by the rising consciousness of their benefits to the environment and the operation among developers, architects, and policymakers.

Expanding government regulations that support green and circular economies are, in fact, the main factors behind the growth of the geopolymer market. As nations across the globe become more committed to the target of net-zero emissions and the adoption of sustainable industrial practices, the focus of policymakers moves to the reduction of waste generation, limitation of carbon emissions, and the encouragement of the reuse of industrial by-products.

These kinds of measures have opened up an excellent regulatory environment for the use of geopolymers which, in their nature, are very much compatible with the principles of a circular economy. Geopolymers make use of industrial residues that are plentiful in the environment such as fly ash, slag, and metakaolin as their raw materials—thus helping the industry to minimize waste while at the same time producing high-performance, low-carbon construction materials. It is this dual benefit of resource efficiency and emission reduction that places geopolymers as a perfect tool to meet the changing environmental and waste management regulations.

Different areas like the European Union, North America, and some Asia-Pacific regions have put in place tough carbon pricing measures, emission reduction frameworks, and green procurement policies that together create a favorable environment for the use of sustainable materials in public infrastructure projects. One effect of regulations like the EU Green Deal, the U.S. Infrastructure Investment and Jobs Act, and various national sustainability roadmaps is that they have become the main drivers of cleaner building materials investments. In most instances, these agreements require or give an advantage to the use of low-carbon binders which in turn open up the market for geopolymer producers.

Besides, local construction codes as well as certification systems such as LEED, BREEAM, and Green Star are progressively including the concept of carbon footprint over the entire life cycle which is enticing contractors and property developers to select the most environmentally efficient solutions like geopolymers.

Top market players are already moving to adjust their business strategies in line with the requirements set by the regulators by creating formulations for different regions, getting different environmental certifications, and partnering with government agencies for pilot-scale projects in the area of infrastructure.

Besides, companies are spending money on R&D to improve material compliance, increase product lifespan, and make production more efficient so that local standards are met. Since governments are increasingly linking grants and the other types of support to sustainability metrics, geopolymers become the most advantageous material to use in the transition to clean, circular construction ecosystems. So, quite a bit of time regulatory pressure combined with financial incentives and public awareness is driving the geopolymer market to expand strongly for a long time to come.

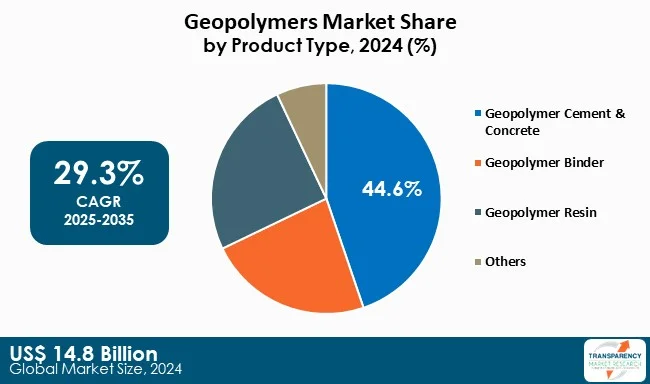

Geopolymer cement and concrete are the leading contributors to the market because construction and infrastructure sectors are quickly choosing low-carbon, high-durability alternatives to Portland cement. Apart from the impressive strength and chemical resistance, these materials also exhibit shortened curing time with reduced CO₂ emissions by a factor of five.

| Attribute | Detail |

|---|---|

| Leading Region |

|

Asia-Pacific is the major contributor to the geopolymer market as a result of an enormous construction activity, fast urbanization, and the government attention to the use of low-carbon materials. China, India, and Australia are some of the countries that are very active in promoting the use of sustainable cement alternatives as a way of reducing CO₂ emissions. There is a sufficient supply of industrial by-products such as fly ash and slag, which makes the production of geopolymers very economical. Infrastructure megaprojects, green-building regulations, and investments in smart cities are some of the factors that are further driving the region's adoption rate to increase rapidly.

Wagners supplies geopolymer-based Earth Friendly Concrete suitable for structural and precast applications. Zeobond is the provider of E-Crete binders and concrete solutions which are made of alkali-activated aluminosilicates. Geopolymer Solutions LLC offers the innovative Cold Fusion Concrete that is breathable and hence suitable for industrial, fire-resistant, and chemical-resistant applications. Alchemy Geopolymer Solutions creates patented geopolymer formulations and licensing technologies that are integration-ready for construction, coatings, and infrastructure industries.

Additionally, Geobeton LLC, Middle East Ready Mix LLC, Milliken Infrastructures Solutions, LLC and Zeobond Pty Ltd. also play a major role in the consolidated geopolymers market, with a competitive landscape governed by innovation and productivity.

| Attribute | Detail |

|---|---|

| Market Size Value in 2024 | US$ 14.8 Billion |

| Market Forecast Value in 2035 | US$ 249.6 Billion |

| Growth Rate (CAGR) | 29.3% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | Tons For Volume and US$ Billion For Value |

| Market Analysis | It includes cross segment analysis at Global as well as country level. Furthermore, qualitative analysis includes drivers, restraints, opportunities, key trends, Porter’s Five Forces analysis, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Example: Electronic (PDF) + Excel |

| Market Segmentation | By Raw Material

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled (Potential Manufacturers) |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

The geopolymers market stood at US$ 14.8 billion in 2024

The geopolymers market is expected to grow at a CAGR of 29.3% from 2025 to 2035

Rising demand for sustainable and low-carbon construction materials and growing government regulations promoting green and circular economies

Geopolymer cement & concrete held the largest share under product type segment in 2024

Asia Pacific was the most lucrative region of the geopolymers market in 2024

Geobeton LLC, Wagners, Zeobond Pty Ltd, Banah UK Ltd, Alchemy Geopolymer Solutions, LLC, Middle East Ready Mix LLC, Kiran Global Chem Limited, Marcep Inc, Milliken Infrastructures Solutions, LLC, and Geopolymer Solutions LLC

Table 1 Global Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 2 Global Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 3 Global Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 4 Global Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 5 Global Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 6 Global Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 7 Global Geopolymers Market Volume (Tons) Forecast, by Region, 2020 to 2035

Table 8 Global Geopolymers Market Value (US$ Bn) Forecast, by Region, 2020 to 2035

Table 9 North America Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 10 North America Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 11 North America Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 12 North America Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 13 North America Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 14 North America Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 15 North America Geopolymers Market Volume (Tons) Forecast, by Country, 2020 to 2035

Table 16 North America Geopolymers Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 17 USA Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 18 USA Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 19 USA Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 20 USA Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 21 USA Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 22 USA Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 23 Canada Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 24 Canada Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 25 Canada Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 26 Canada Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 27 Canada Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 28 Canada Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 29 Europe Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 30 Europe Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 31 Europe Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 32 Europe Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 33 Europe Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 34 Europe Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 35 Europe Geopolymers Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 36 Europe Geopolymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 37 Germany Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 38 Germany Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 39 Germany Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 40 Germany Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 41 Germany Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 42 Germany Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 43 France Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 44 France Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 45 France Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 46 France Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 47 France Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 48 France Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 49 UK Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 50 UK Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 51 UK Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 52 UK Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 53 UK Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 54 UK Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 55 Italy Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 56 Italy Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 57 Italy Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 58 Italy Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 59 Italy Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 60 Italy Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 61 Spain Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 62 Spain Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 63 Spain Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 64 Spain Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 65 Spain Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 66 Spain Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 67 Russia & CIS Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 68 Russia & CIS Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 69 Russia & CIS Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 70 Russia & CIS Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 71 Russia & CIS Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 72 Russia & CIS Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 73 Rest of Europe Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 74 Rest of Europe Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 75 Rest of Europe Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 76 Rest of Europe Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 77 Rest of Europe Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 78 Rest of Europe Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 79 Asia Pacific Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 80 Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 81 Asia Pacific Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 82 Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 83 Asia Pacific Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 84 Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 85 Asia Pacific Geopolymers Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 86 Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 87 China Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 88 China Geopolymers Market Value (US$ Bn) Forecast, by Raw Material 2020 to 2035

Table 89 China Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 90 China Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 91 China Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 92 China Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 93 Japan Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 94 Japan Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 95 Japan Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 96 Japan Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 97 Japan Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 98 Japan Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 99 India Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 100 India Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 101 India Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 102 India Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 103 India Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 104 India Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 105 India Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 106 India Geopolymers Market Value (US$ Bn) Forecast, by End-use 2020 to 2035

Table 107 ASEAN Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 108 ASEAN Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 109 ASEAN Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 110 ASEAN Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 111 ASEAN Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 112 ASEAN Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 113 Rest of Asia Pacific Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 114 Rest of Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 115 Rest of Asia Pacific Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 116 Rest of Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 117 Rest of Asia Pacific Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 118 Rest of Asia Pacific Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 119 Latin America Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 120 Latin America Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 121 Latin America Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 122 Latin America Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 123 Latin America Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 124 Latin America Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 125 Latin America Geopolymers Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 126 Latin America Geopolymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 127 Brazil Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 128 Brazil Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 129 Brazil Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 130 Brazil Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 131 Brazil Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 132 Brazil Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 133 Mexico Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 134 Mexico Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 135 Mexico Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 136 Mexico Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 137 Mexico Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 138 Mexico Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 139 Rest of Latin America Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 140 Rest of Latin America Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 141 Rest of Latin America Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 142 Rest of Latin America Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 143 Rest of Latin America Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 144 Rest of Latin America Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 145 Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 146 Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 147 Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 148 Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 149 Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 150 Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 151 Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by Country and Sub-region, 2020 to 2035

Table 152 Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by Country and Sub-region, 2020 to 2035

Table 153 GCC Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 154 GCC Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 155 GCC Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 156 GCC Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 157 GCC Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 158 GCC Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 159 South Africa Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 160 South Africa Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 161 South Africa Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 162 South Africa Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 163 South Africa Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 164 South Africa Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Table 165 Rest of Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by Raw Material, 2020 to 2035

Table 166 Rest of Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by Raw Material, 2020 to 2035

Table 167 Rest of Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by Product Type, 2020 to 2035

Table 168 Rest of Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by Product Type, 2020 to 2035

Table 169 Rest of Middle East & Africa Geopolymers Market Volume (Tons) Forecast, by End-use, 2020 to 2035

Table 170 Rest of Middle East & Africa Geopolymers Market Value (US$ Bn) Forecast, by End-use, 2020 to 2035

Figure 1 Global Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 2 Global Geopolymers Market Attractiveness, by Raw Material

Figure 3 Global Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 4 Global Geopolymers Market Attractiveness, by Product Type

Figure 5 Global Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 6 Global Geopolymers Market Attractiveness, by End-use

Figure 7 Global Geopolymers Market Volume Share Analysis, by Region, 2024, 2027, and 2035

Figure 8 Global Geopolymers Market Attractiveness, by Region

Figure 9 North America Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 10 North America Geopolymers Market Attractiveness, by Raw Material

Figure 11 North America Geopolymers Market Attractiveness, by Raw Material

Figure 12 North America Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 13 North America Geopolymers Market Attractiveness, by Product Type

Figure 14 North America Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 15 North America Geopolymers Market Attractiveness, by End-use

Figure 16 North America Geopolymers Market Attractiveness, by Country and Sub-region

Figure 17 Europe Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 18 Europe Geopolymers Market Attractiveness, by Raw Material

Figure 19 Europe Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 20 Europe Geopolymers Market Attractiveness, by Product Type

Figure 21 Europe Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 22 Europe Geopolymers Market Attractiveness, by End-use

Figure 23 Europe Geopolymers Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 24 Europe Geopolymers Market Attractiveness, by Country and Sub-region

Figure 25 Asia Pacific Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 26 Asia Pacific Geopolymers Market Attractiveness, by Raw Material

Figure 27 Asia Pacific Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 28 Asia Pacific Geopolymers Market Attractiveness, by Product Type

Figure 29 Asia Pacific Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 30 Asia Pacific Geopolymers Market Attractiveness, by End-use

Figure 31 Asia Pacific Geopolymers Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 32 Asia Pacific Geopolymers Market Attractiveness, by Country and Sub-region

Figure 33 Latin America Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 34 Latin America Geopolymers Market Attractiveness, by Raw Material

Figure 35 Latin America Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 36 Latin America Geopolymers Market Attractiveness, by Product Type

Figure 37 Latin America Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 38 Latin America Geopolymers Market Attractiveness, by End-use

Figure 39 Latin America Geopolymers Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 40 Latin America Geopolymers Market Attractiveness, by Country and Sub-region

Figure 41 Middle East & Africa Geopolymers Market Volume Share Analysis, by Raw Material, 2024, 2027, and 2035

Figure 42 Middle East & Africa Geopolymers Market Attractiveness, by Raw Material

Figure 43 Middle East & Africa Geopolymers Market Volume Share Analysis, by Product Type, 2024, 2027, and 2035

Figure 44 Middle East & Africa Geopolymers Market Attractiveness, by Product Type

Figure 45 Middle East & Africa Geopolymers Market Volume Share Analysis, by End-use, 2024, 2027, and 2035

Figure 46 Middle East & Africa Geopolymers Market Attractiveness, by End-use

Figure 47 Middle East & Africa Geopolymers Market Volume Share Analysis, by Country and Sub-region, 2024, 2027, and 2035

Figure 48 Middle East & Africa Geopolymers Market Attractiveness, by Country and Sub-region