Reports

Reports

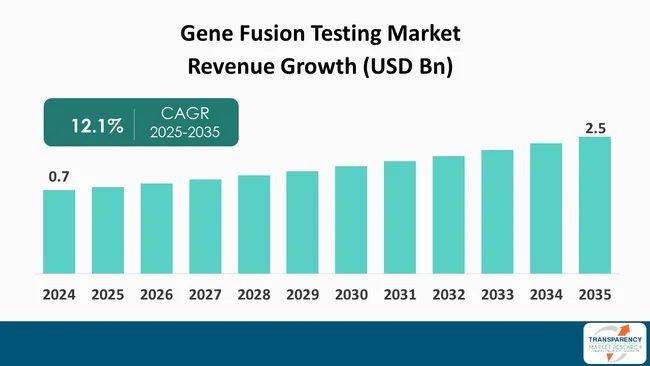

The global gene fusion testing market size was valued at US$ 0.7 billion in 2024 and is projected to reach US $ 2.5 billion by 2035, expanding at a CAGR of 12.1% from 2025 to 2035. The market growth is driven by increasing incidence of cancer and rising demand for personalized medicine.

The gene fusion testing market is set to experience substantial expansion over the next few years, largely due to the continuous upgradations in genomic technologies and increased involvement of gene fusion in different cancers. Gene fusion events are pivotal in cancer diagnostics and targeted therapies, which are generally used in cancer types like lung cancer, leukemia, and sarcomas.

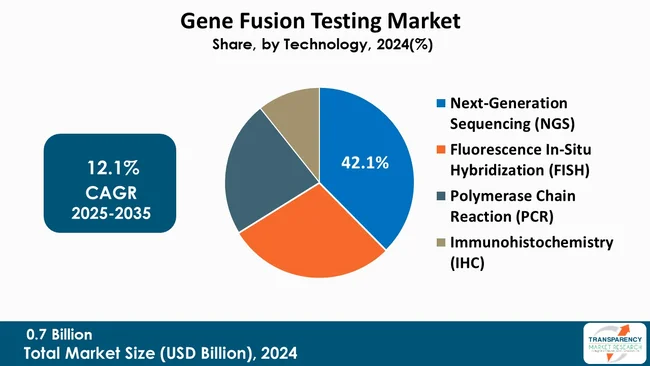

In addition, the rising incidences of cancer and the demand for personalized treatment options are the main factors that contribute to the market growth. The use of innovative technologies like next-generation sequencing (NGS) and real-time PCR has greatly increased the sensitivity and specificity of gene fusion detection.

Gene fusion testing is a major source of information used by oncologists to know what gene fusions are. They are the sequences where two genes combine to form a new one. These fusions, which have been identified in lung cancer, breast cancer, and blood cancers mostly, are usually at the forefront of cancer biomarkers.

In general, gene fusion detection leverages molecular features through instruments such as next-generation sequencing (NGS), fluorescence in situ hybridization (FISH), and reverse transcription-polymerase chain reaction (RT-PCR) to precisely identify fusion genes and promote the use of personalized medicine, which allows clinicians to decide on the best therapies suitable for the specific genetic changes that take place in a patient’s tumor.

The utility of gene fusion testing in the determination of the most appropriate therapeutics, in the tracking of cancer development, and in the prediction of cancer patient survivability, is growing in parallel with the awareness of cancer genomics. Educational and technological enhancement in gene fusion detection will, thus, lead to quick integration of gene fusion testing into daily clinical routine and result in the precision therapy of cancer being further refined.

| Attribute | Detail |

|---|---|

| Market Drivers |

|

The rising number of cancer cases is one of the main reasons leading to the growth of the gene fusion testing market profoundly impacting the demand for advanced diagnostic tools. With cancer rates going up worldwide, which is caused by an aging population, lifestyle, and environmental factors, the requirement for accurate and effective diagnostic methods becomes less dispensable. Gene fusions are the main culprits in the development of cancers of the blood, non-small cell lung cancer, and prostate cancer. Therefore, their detection is the first step for the right diagnosis and treatment.

To coordinate well, doctors are looking to find gene fusions as the key for making therapy that targets these molecular abnormalities. The increasing number of cancer cases has led to research on the genetic composition of the tumors as a result of which there is now a greater emphasis on precision oncology. Therefore, the demand for gene fusion testing is set to increase as it is the main source of information for making treatment decisions and enhancing patient outcomes.

In addition, thanks to the technology upgrades that lead to more rapid and precise testing. Healthcare systems are getting more inclined to these diagnostics methods. As the significance of gene fusions in cancer is getting more comprehendible, the gene fusion testing market will be very vibrant and that will be an indication of the pressing need for solutions in cancer care.

The increasing need for personalized medicine is a major factor that drives the gene fusion testing market and goes hand in hand with the shift toward more tailored therapeutic approaches in oncology.

By finding out the gene fusions that may cause the particular cancers, doctors can give treatments that are more effective and have fewer side-effects in comparison with the traditional chemotherapy. This targeted approach not only improves the treatment outcomes but also the risk of side-effects being caused by the treatment is lowered. Moreover, innovations in genomic technologies have eased gene fusion testing procedures, allowing its wide application in clinical settings.

The demand for precise and trustworthy gene fusion testing is sharply increasing, as the benefits of personalized therapies become evident to all the stakeholders - patients, healthcare professionals, and pharmaceutical companies. This trend is being supported further by the research and development activities in precision oncology. Thus the gene fusion testing market is poised for immense expansion as it becomes indispensable in the treatment of cancer.

NGS is a major market driver for gene fusion testing market with its unmatched ability to simultaneously analyze multiple genes with high accuracy and efficiency,

NGS enables comprehensive genomic profiling and thus the detection of diverse gene fusions that may be the central of cancer biology. In contrast to traditional methods that generally single out genes or mutations, NGS can identify a wide array of genetic changes, thus giving a more complete picture of the molecular makeup of the tumor.

Furthermore, the affordability and scalability of NGS have paved the way for its acceptance in many clinical laboratories. Sequencing, in general, is made more accessible to healthcare providers as the costs continue to drop, thus routine cancer diagnostics can be performed by them. This instrument of care speeds up testing.

In addition, NGS, combined with bioinformatics tools, provides for more complex data handling and interpretation, thus personalized medicine benefits from it even more. Consequently, the increasing dependency on NGS for gene fusion detection not only facilitates market expansion at a rapid pace but also patient outcomes improvement by recommending the targeted therapies based on genetic alterations of the tumor.

| Attribute | Detail |

|---|---|

| Leading Region |

|

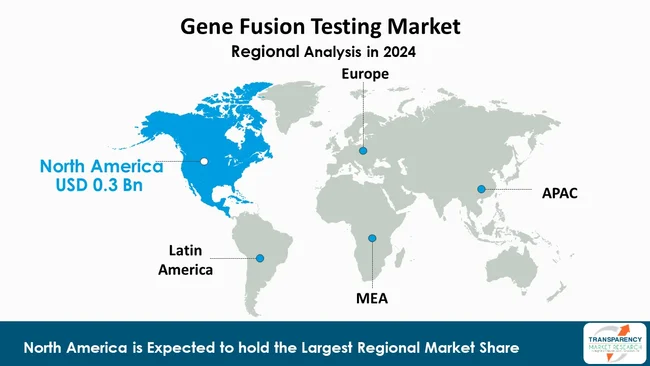

North America leads the gene fusion testing market, holding the largest revenue share of 38.3%, as an outcome of a combination of an advanced healthcare system, growing focus on personalized medicine, and high levels of research and development. This region is home to many top-tier pharmaceutical and biotech companies that are heavily investing in genomic research and the creation of innovative diagnostic tools.

Furthermore, rising incidences of cancer in North America have led to an increased demand for effective diagnostic solutions. Healthcare providers are realizing the importance of gene fusion testing in personalizing treatment plans, hence its adoption is spreading fast.

Also, the population in North America is more informed about genetic testing and personalized medicine, which is amongst the factors contributing to the demand for such services.

Amoy Diagnostics Co., Ltd., ArcherDX (Integrated DNA Technologies, Inc.), Biocartis, Biocare Medical, LLC, F. Hoffmann-La Roche Ltd., Guardant Health, Inc, Illumina, Inc., Myriad Genetics, Inc., Natera, Inc., NeoGenomics, Inc., QIAGEN N.V., Thermo Fisher Scientific Inc are the key players governing the global gene fusion testing market.

Each of these players has been profiled in the gene fusion testing market research report based on parameters such as company overview, financial overview, business strategies, product portfolio, business segments, and recent developments.

| Attribute | Detail |

|---|---|

| Size in 2024 | US$ 0.7 Bn |

| Forecast Value in 2035 | More than US$ 2.5 Bn |

| CAGR | 12.1% |

| Forecast Period | 2025-2035 |

| Historical Data Available for | 2020-2023 |

| Quantitative Units | US$ Bn for Value |

| Market Analysis | It includes segment analysis as well as regional level analysis. Moreover, qualitative analysis includes drivers, restraints, opportunities, key trends, value chain analysis, and key trend analysis. |

| Competition Landscape |

|

| Format | Electronic (PDF) + Excel |

| Segmentation | By Category

|

| Regions Covered |

|

| Countries Covered |

|

| Companies Profiled |

|

| Customization Scope | Available upon request |

| Pricing | Available upon request |

It was valued at US$ 0.7 Bn in 2024

It is projected to cross US$ 2.5 Bn by the end of 2035

Increasing incidence of cancer and rising demand for personalized medicine

It is anticipated to grow at a CAGR of 12.1% from 2025 to 2035

North America is expected to account for the largest share from 2025 to 2035

Amoy Diagnostics Co., Ltd., ArcherDX (Integrated DNA Technologies, Inc.), Biocartis, Biocare Medical, LLC, F. Hoffmann-La Roche Ltd., Guardant Health, Inc, Illumina, Inc., Myriad Genetics, Inc., Natera, Inc., NeoGenomics, Inc., QIAGEN N.V., Thermo Fisher Scientific Inc, and others

Table 01: Global Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 02: Global Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 03: Global Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 04: Global Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 05: Global Gene Fusion Testing Market Value (US$ Bn) Forecast, By Region, 2020 to 2035

Table 06: North America - Gene Fusion Testing Market Value (US$ Bn) Forecast, by Country, 2020 to 2035

Table 07: North America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 08: North America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 09: North America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 10: North America Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 11: Europe - Gene Fusion Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 12: Europe Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 13: Europe Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 14: Europe Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 15: Europe Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 16: Asia Pacific - Gene Fusion Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 17: Asia Pacific Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 18: Asia Pacific Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 19: Asia Pacific Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 20: Asia Pacific Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 21: Latin America - Gene Fusion Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 22: Latin America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 23: Latin America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 24: Latin America Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 25: Latin America Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Table 26: Middle East & Africa - Gene Fusion Testing Market Value (US$ Bn) Forecast, by Country / Sub-region, 2020 to 2035

Table 27: Middle East & Africa Gene Fusion Testing Market Value (US$ Bn) Forecast, By Category, 2020 to 2035

Table 28: Middle East & Africa Gene Fusion Testing Market Value (US$ Bn) Forecast, By Technology, 2020 to 2035

Table 29: Middle East & Africa Gene Fusion Testing Market Value (US$ Bn) Forecast, By Indication, 2020 to 2035

Table 30: Middle East & Africa Gene Fusion Testing Market Value (US$ Bn) Forecast, By End-user, 2020 to 2035

Figure 01: Global Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 02: Global Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 03: Global Gene Fusion Testing Market Revenue (US$ Bn), by Research, 2020 to 2035

Figure 04: Global Gene Fusion Testing Market Revenue (US$ Bn), by Diagnostic, 2020 to 2035

Figure 05: Global Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 06: Global Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 07: Global Gene Fusion Testing Market Revenue (US$ Bn), by Next-Generation Sequencing (NGS), 2020 to 2035

Figure 08: Global Gene Fusion Testing Market Revenue (US$ Bn), by Fluorescence In-Situ Hybridization (FISH), 2020 to 2035

Figure 09: Global Gene Fusion Testing Market Revenue (US$ Bn), by Polymerase Chain Reaction (PCR), 2020 to 2035

Figure 10: Global Gene Fusion Testing Market Revenue (US$ Bn), by Immunohistochemistry (IHC), 2020 to 2035

Figure 11: Global Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 12: Global Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 13: Global Gene Fusion Testing Market Revenue (US$ Bn), by Solid Tumors, 2020 to 2035

Figure 14: Global Gene Fusion Testing Market Revenue (US$ Bn), by Hematological Malignancies, 2020 to 2035

Figure 15: Global Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 16: Global Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 17: Global Gene Fusion Testing Market Revenue (US$ Bn), by Pharmaceutical and Biotechnology Companies, 2020 to 2035

Figure 18: Global Gene Fusion Testing Market Revenue (US$ Bn), by Hospitals and Diagnostic Laboratories, 2020 to 2035

Figure 19: Global Gene Fusion Testing Market Revenue (US$ Bn), by Academic and Research Centers, 2020 to 2035

Figure 20: Global Gene Fusion Testing Market Value Share Analysis, By Region, 2024 and 2035

Figure 21: Global Gene Fusion Testing Market Attractiveness Analysis, By Region, 2025 to 2035

Figure 22: North America Gene Fusion Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 23: North America Gene Fusion Testing Market Value Share Analysis, by Country, 2024 and 2035

Figure 24: North America Gene Fusion Testing Market Attractiveness Analysis, by Country, 2025 to 2035

Figure 25: North America Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 26: North America Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 27: North America Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 28: North America Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 29: North America Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 30: North America Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 31: North America Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 32: North America Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 33: Europe Gene Fusion Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 34: Europe Gene Fusion Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 35: Europe Gene Fusion Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 36: Europe Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 37: Europe Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 38: Europe Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 39: Europe Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 40: Europe Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 41: Europe Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 42: Europe Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 43: Europe Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 44: Asia Pacific Gene Fusion Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 45: Asia Pacific Gene Fusion Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 46: Asia Pacific Gene Fusion Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 47: Asia Pacific Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 48: Asia Pacific Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 49: Asia Pacific Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 50: Asia Pacific Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 51: Asia Pacific Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 52: Asia Pacific Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 53: Asia Pacific Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 54: Asia Pacific Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 55: Latin America Gene Fusion Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 56: Latin America Gene Fusion Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 57: Latin America Gene Fusion Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 58: Latin America Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 59: Latin America Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 60: Latin America Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 61: Latin America Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 62: Latin America Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 63: Latin America Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 64: Latin America Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 65: Latin America Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035

Figure 66: Middle East & Africa Gene Fusion Testing Market Value (US$ Bn) Forecast, 2020 to 2035

Figure 67: Middle East & Africa Gene Fusion Testing Market Value Share Analysis, by Country / Sub-region, 2024 and 2035

Figure 68: Middle East & Africa Gene Fusion Testing Market Attractiveness Analysis, by Country / Sub-region, 2025 to 2035

Figure 69: Middle East & Africa Gene Fusion Testing Market Value Share Analysis, By Category, 2024 and 2035

Figure 70: Middle East & Africa Gene Fusion Testing Market Attractiveness Analysis, By Category, 2025 to 2035

Figure 71: Middle East & Africa Gene Fusion Testing Market Value Share Analysis, By Technology, 2024 and 2035

Figure 72: Middle East & Africa Gene Fusion Testing Market Attractiveness Analysis, By Technology, 2025 to 2035

Figure 73: Middle East & Africa Gene Fusion Testing Market Value Share Analysis, By Indication, 2024 and 2035

Figure 74: Middle East & Africa Gene Fusion Testing Market Attractiveness Analysis, By Indication, 2025 to 2035

Figure 75: Middle East & Africa Gene Fusion Testing Market Value Share Analysis, By End-user, 2024 and 2035

Figure 76: Middle East & Africa Gene Fusion Testing Market Attractiveness Analysis, By End-user, 2025 to 2035